XAUUSD Daily Trading Plan - Sniper EntriesXAUUSD Daily Trading Plan - Sniper Entries 🚀

🔹 Price Action Overview:

Trend: Bullish (H1, H4, M15)

Current Price: ~3,217

Market Sentiment: Positive, with strong bullish momentum, consolidating after breaking recent highs.

Key News: Core PPI (m/m) and Prelim UoM Consumer Sentiment due today, watch for volatility during the New York session.

🚨 Potential Sniper Entry Zones:

1st Buy Entry Zone 📈

Price Range: 3,172 – 3,175

Why: Strong Order Block (OB) on M15 & M5, CHoCH confirming trend reversal with a clear liquidity grab.

Confirmation: Expect a bounce from support as price retraces into the zone, offering favorable risk/reward for a buy continuation.

Stop Loss (SL): 3,160 (tight risk management)

Take Profit (TP):

TP1: 3,200

TP2: 3,220

TP3: 3,240

2nd Buy Entry Zone 🛒

Price Range: 3,200 – 3,205

Why: Minor support with the market showing consistent bullish action around this zone.

Confirmation: Watch for market structure to hold; this will be a second-tier entry in case of shallow retracements.

Stop Loss (SL): 3,190

Take Profit (TP):

TP1: 3,220

TP2: 3,240

TP3: 3,260

1st Sell Entry Zone 🔻

Price Range: 3,220 – 3,230

Why: Possible Premium zone as the price tests recent highs, near overbought conditions. Look for rejections here.

Confirmation: Watch for FVG & Price Action rejection signals.

Stop Loss (SL): 3,240

Take Profit (TP):

TP1: 3,200

TP2: 3,180

TP3: 3,150

2nd Sell Entry Zone 🔻

Price Range: 3,240 – 3,250

Why: Testing the Premium area near previous highs; watch for signs of a strong reversal.

Confirmation: Look for Bearish Divergence or Order Block Rejections.

Stop Loss (SL): 3,260

Take Profit (TP):

TP1: 3,220

TP2: 3,200

TP3: 3,180

⏰ Key Trading Hours:

New York Session (14:30 – 22:00 UTC+2): Pay attention to Core PPI data and Prelim UoM Consumer Sentiment for volatility. Watch for price reaction during these times to align with the entry zones.

🔑 Summary & Final Notes:

Buy Bias is dominant in this market given the recent strong bullish momentum. However, be mindful of resistance zones as price approaches key levels.

Ensure Risk-to-Reward is always favorable before entering.

Monitor key news events around 3:30 PM UTC for potential market reactions.

💬 Let's trade smart! Drop a comment below if you like the setup! 🔥 Follow and subscribe for more analysis!

Goldintraday

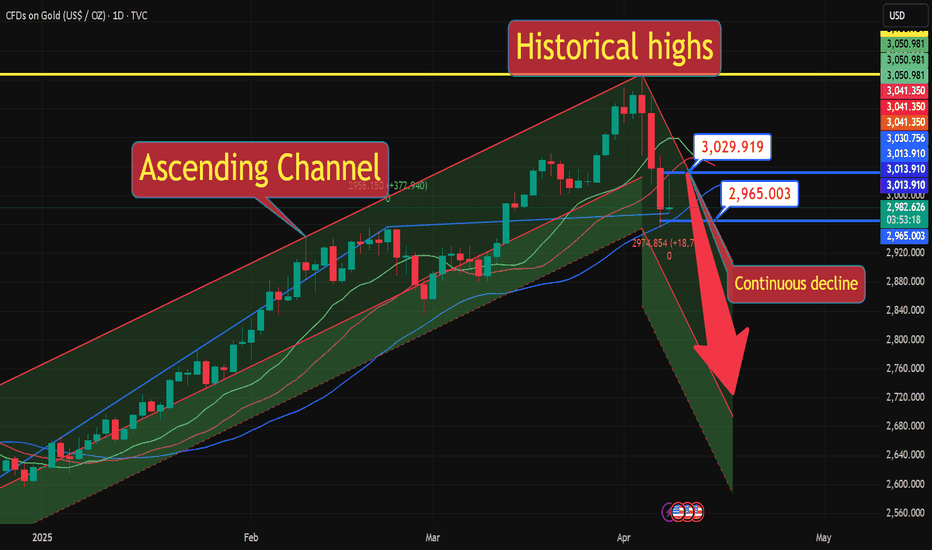

4.11 Interpretation of gold technical ideas4.11 Interpretation of gold operation ideas: Gold prices rose sharply to a new high. How to trade next?

The daily line closed with a big positive line, and the closing price was far away from the previous high. This is a truly effective breakthrough!

There are two types of breakthroughs: 1. The amplitude and strength of the breakthrough! 2. The closing price after the breakthrough!

At present, the intraday pattern of gold prices is unbalanced. The rise and fall depends entirely on the international situation. The US dollar has fallen below 100 points, which has led to panic selling by investors and a sharp rise in gold prices. Therefore, if the situation eases, we must be wary of a rapid decline in gold prices. After a wave of accelerated rises in the morning, today's main focus is on the trend of the afternoon and US markets.

At present, the price of gold is hovering in the 3210 range. If it falls back, it is expected to rebound in the 3200-3190 range. If the European market breaks through the high for the second time and continues to strengthen during the day, then the US stock market will usher in a bullish opportunity again.

The market is always full of opportunities! The above strategies are for reference only, and personal opinions are for reference only. The specific operation is subject to real-time operation. If you want to obtain core member signals and increase account profits, please contact Ailen❤️❤️❤️

GOLD WEEKLY CHART MID/LONG RANGE ROUTE MAP UPDATEDWeekly GOLD Analysis: 17th February 2025

Hello Traders,

Here’s a weekly chart analysis of GOLD, offering an in-depth look at recent market trends and future outlook. Since October 2023, our consistent tracking has achieved 100% target accuracy, as shown by the Golden Circle markers on the charts. Let’s break down the highlights and what’s next.

Recap of Last Week’s Successes

Weekly Chart Highlights:

* EMA5 crossed and settled above Entry ✅ 2735 reached

* Bullish Target TP1: 2877 ✅ Achieved

* GoldTurn Levels at 2875 activated twice ✅ Reached

What’s Next for GOLD? Bullish or Bearish?

After hitting ENTRY LEVELS at 2735 and TP1 2877, we saw a small close above 2877 last week, leaving 3018 open as a potential target. We mentioned that an EMA5 lock would confirm this movement.

While EMA5 hasn’t locked yet, the close from last week provided a solid push upward, gaining over 500 pips. The long-term gap remains open, with more movement likely after last week’s candle body close.

Key Level: 2735 remains a critical zone.

GoldTurn Levels at 2875 and 2735 are active, and the price may revisit these levels before bouncing back to reach TP1 and beyond.

Recommendations & Strategy:

* Focus on EMA5: Watch its behavior around 2877 for key signals on short- and long-term trades.

* Support Levels: GoldTurn levels at 2875 and 2735 are vital for identifying reversal points and prime dip-buying opportunities.

* FVG Support: A range between 2835 and 2850 is also supportive.

For precise entry and exit points, check our daily, 12H, 4H, and 1H analyses for clearer market guidance.

We’ll continue to provide daily updates, insights, and strategies on our TradingView and YouTube channels every Sunday. Don’t forget to like, comment, and share to support our work and help others benefit!

The Quantum Trading Mastery

GOLD WEEKLY CHART MID/LONG RANGE ROUTE MAP UPDATEDWeekly GOLD Analysis: 24th February 2025

Hello Traders,

Here’s a weekly chart analysis of GOLD, offering an in-depth look at recent market trends and future outlook. Since October 2023, our consistent tracking has achieved 100% target accuracy, as shown by the Golden Circle markers on the charts. Let’s break down the highlights and what’s next.

Gold reached an all-time high of $2,954.80 last week. As previously noted, close attention to the movement of the 5-day Exponential Moving Average (EMA5) was advised. The anticipated Fair Value Gap (FVG) provided strong support at $2,850, with the EMA5 approaching the first take-profit (TP1) level at $2,877, leading to a bullish surge that touched the all-time high. However, the EMA5 has yet to cross and stabilize above $2,877.

This situation persists, with the EMA5 still not locked above $2,877, which is necessary for further bullish confirmation. If the EMA5 fails to cross and hold above this level, the price may reverse to test the GoldTurn level at $2,875 before potentially bouncing back upward.

The key level at $2,735 remains a critical zone. Active GoldTurn levels at $2,875 and $2,735 suggest that the price may revisit these areas before advancing to TP1 and beyond.

Recommendations & Strategy:

* Focus on EMA5: Watch its behavior around 2877 for key signals on short- and long-term trades.

* Support Levels: GoldTurn levels at 2875 and 2735 are vital for identifying reversal points and prime dip-buying opportunities.

* EMA5 detachment is still due on weekly chart.

For precise entry and exit points, check our daily, 12H, 4H, and 1H analyses for clearer market guidance.

We’ll continue to provide daily updates, insights, and strategies on our TradingView and YouTube channels every Sunday. Don’t forget to like, comment, and share to support our work and help others benefit!

The Quantum Trading Mastery

Gold: Sell@3188-3200Gold has continued its strong rally, hitting a new all-time high, with bullish sentiment running extremely hot.

However, we must approach this rationally — every new high is usually followed by a technical pullback.

Currently, the 3200 level is a significant psychological resistance, as well as a key threshold for short-term bullish momentum.

From a technical perspective, the sharp recent rally has shown signs of momentum exhaustion, with clear overbought signals emerging.

📌 Strategy Suggestion:

Consider building short positions around the 3188–3200 zone

If 3137 is broken, further downside could extend to 3112–3090

⚠️ Risk Management Notes:

The larger the rally, the stronger the pullback potential

Avoid chasing long positions at these levels to prevent getting trapped at the top

Keep position sizes under control and set stop-losses to guard against sudden volatility

Wishing everyone smooth trades and solid profits!

Gold V-shaped reversal breaks through new highs to usher in a buFundamental analysis:

The erratic tariff plans of the US administration have shaken the entire global market, with market participants scrambling for direction and certainty. This is usually supportive for gold, which has risen 18% so far this year. Gold has also been boosted by expectations of further monetary easing by the Federal Reserve and central bank purchases.

Technical interpretation:

From the 4-hour chart, spot gold has completed a typical V-shaped reversal pattern, rebounding strongly after a deep correction. After hitting a low of $2,956.67, gold prices launched a counterattack, breaking through the suppression of multiple moving averages in one fell swoop, and finally stood firm at the key resistance level of $3,100. It is worth noting that gold prices are currently running above the rising trend line, which indicates that the short-term trend has clearly turned bullish.

The MACD indicator shows a strong bullish signal, with the DIFF line and the DEA line forming a golden cross, and the DIFF value is 13.58 and the DEA value is -1.55, indicating that the upward momentum is accumulating at an accelerated rate. At the same time, the MACD bar chart continues to expand, further confirming the strengthening of bullish power.

Although the daily MACD indicator temporarily shows signs of high divergence, the DIFF value is 35.22 and the DEA value is 40.67, but both are at high levels, indicating that the medium- and long-term momentum is still strong. The daily RSI is 62.58, which is in a moderately strong area and does not show obvious overbought. The daily CCI is 74.30, which also shows that the medium-term upward momentum is still continuing.

Analysis of short-term operation ideas:

After the gold price broke through the key resistance of $3,100, the technical side showed a clear trend of strengthening. If it can stand firm at this level, the next target will point to the historical high of $3,167.60, and a new round of upside will be opened after the breakthrough. In terms of support, $3,060.00 (previous breakthrough position) will provide effective support. If it fails, it may pull back to the lower track of the rising channel near $2,968.00. Recent US inflation data and trade situation developments will become key catalysts for short-term trends.

Gold continues to strengthen and fluctuates widely in the short Gold stabilized near the 200-period moving average at the beginning of this week, and the current upward trend is supported by the daily chart oscillator indicators. Both the daily RSI and MACD remain in the bullish range, with obvious momentum;

The upper target is concentrated in the 3167-3168 US dollar line, which is the historical high set at the beginning of this month; if it successfully breaks through this area, the gold price may enter a new upward channel.

In the short term, the support level below $3100 is concentrated in the 3065-3060 US dollar range, and a break below it will open a downward channel to $3000. The $3000 mark coincides with the 200-period moving average of the 4-hour chart, which is the key long-short dividing point;

If it falls below this point, it means that gold has entered the correction stage, and bulls need to remain vigilant; but the current fundamentals and market sentiment still strongly support the gold price to maintain high volatility.

Gold trading ideas April 9th ahead of FOMC MinutesAll entries demand confirmation on M5 or M15;

Snipers don't chase—they wait for the market to come to their scope;

You’re not “late,” you’re loading up for a legendary entry.

🔻 SELL ZONE

📍 3045–3055

🛑 SL: 3065

Why: M15–H1 OB + imbalance fill from previous BOS

Liquidity grab probability during London

🎯 TP1: 3015 | TP2: 2971 | TP3: 2943

🔻 SELL ZONE

📍 3094–3109

🛑 SL: 3122

Why: D1/H4 OB + unmitigated FVG + resting equal highs

Textbook supply raid + swing short

🎯 TP1: 3055 | TP2: 3015 | TP3: 2965

🟢 BUY ZONE

📍 2965–2950

🛑 SL: 2948

Why: H1 demand + FVG + trendline bounce

RSI recovery + bullish CHoCH M15

🎯 TP1: 2990 | TP2: 3022 | TP3: 3044

🟢 BUY ZONE

📍 2922–2904

🛑 SL: 2890

Why: Unmitigated Daily OB + final imbalance

Psychological trap zone if swept

🎯 TP1: 2943 | TP2: 2982 | TP3: 3022

🟢 BUY ZONE

📍 2885–2894

🛑 SL: 2870

Why: Breaker + extreme OB + fib 0.786

Liquidity grab scenario with high RR

🎯 TP1: 2950 | TP2: 3000 | TP3: 3050

📌 Bonus Notes

🔐 Watch 3060–3080 – strong base area.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

📣 If this strategy sparked clarity, hit that like button and follow. 💛

Gold bulls are in the driver's seat, beware of a pullback!Fundamental analysis:

A new round of tariff shocks has become a core factor affecting the trend of gold prices. "The rebound in gold reflects the market's growing concerns about tariff threats and the possible reshaping of global trade norms."

Technical interpretation:

The 4-hour chart shows that gold prices have now formed a clear upward channel, with support and resistance lines connecting lows and highs respectively. Recently, the price came near the MA200 moving average, and at the same time found buying near the key support level of $3015.00. From the MACD indicator, the DIFF line (0.41) and the DEA line (-8.65) have formed a golden cross, and the bar chart has turned red and the volume has increased, suggesting that upward momentum is accumulating. The RSI indicator is at the 60.47 level, close to but not yet in the overbought area, indicating that there is still room for upward movement. The CCI indicator is at 150.94. Although it is in the overbought area, the trend is strong and no obvious top divergence has yet to appear. It is worth noting that the recent price has not fallen below the lower track of the rising channel during the decline, indicating that bulls are still dominant.

Operational analysis:

The gold price is currently at a key technical position and has just retested the support level near MA55. If it can stand firm at this position, it is expected to retest the resistance level of $3090.00, and further breakthroughs may challenge the previous high of $3167.60. The short-term MACD golden cross signal strengthens the bullish expectations, but if the support of $3015.00 cannot be maintained, it may fall back to $2980.00. The lower track of the rising channel will be the key line of defense for the long-short boundary.

Technical analysis of short-term operations in the US market on 4,9 US trading operation interpretation ideas:

Today, there was a bottoming out and rebound. In the morning, it first went south and then north. It fell sharply to 2970 and then quickly counterattacked 3000 after entering the Asian session! I emphasized in the morning that the gold short may be coming to an end! It will enter a short-term sharp decline and then rebound! But the current trend is obvious that today's increase has exceeded expectations!

We must beware of the possibility of a V-reversal in the US market! Although the large-scale purchase of gold caused by the selling of US bonds is still difficult to confirm the long position in the US market!

The intraday increase is close to 90 points! There may be two emotions.

1: The market impact after the tariffs are implemented has not been eliminated

2: If the bullish trend continues in the US market, it may retreat to around 3045 in the future, and continue to be bullish later!

Short-term support: 3045---3030----3000

Pressure level: 3075---3080---3100---3135

4.9 Gold price trend after the Fed meetingIn the early European session, spot gold maintained its amazing intraday gains, and the current price is around $3046/oz, up $64 on the day.

Gold's latest technical trading analysis:

Gold's recent sharp decline from its all-time high has stalled near the 61.8% Fibonacci retracement level of the February-April rally. The support level is around the $2957-2956/oz area, or the multi-week low hit on Monday, followed by the 50-day moving average (currently around $2952/oz). If gold falls below the latter, it will be seen as a new trigger by bearish traders and drag gold to the next important support level around $2920/oz, and then all the way down to $2900/oz.

On the other hand, the momentum of gold breaking through the overnight high (around the $3023/oz area) could push gold prices to the $3055-3056/oz barrier. Some follow-up buying should pave the way for gold to return to the $3,100/oz mark, with some intermediate barriers around $3,075-3,080/oz.

Support: 3,030 3,018 3,000

Resistance: 3,045 3,068 3,080

We will update regularly every day to introduce how we manage active thinking and settings. Thank you for your likes, comments and attention. Thank you very much

4.9 Technical analysis of short-term gold operations!Gold market analysis

Gold idea: We need to pay attention to whether the daily line will rise after reaching a low. The daily line is hovering at the bottom. In a volatile market, we must find a range of volatility. Finding the rhythm is the most important thing. Yesterday, the daily line formed a cross star again. Today, the white market is expected to fluctuate. In addition, there are many fundamentals in the near future. The market has been led by the rhythm. Gold rose well before. The sharp drop was also due to Trump’s tariff policy. The global tariff war is inevitable in the future. It will support the US dollar in the long term and suppress gold. The short-term top of the weekly line may be a long-term top.

Today’s idea: Let’s focus on the 2969-3022 volatility range. If the white market rebounds first and approaches 3022, go short first. On the contrary, if gold breaks and stands on 3022, it will also fluctuate, but the center of gravity of the volatility will rise to the 3000-3055 range. The volatility requires patience to wait for the position, and waiting is also part of the transaction.

Support level: 2990-2969,

Pressure: 3022 3035

After a brief rebound, gold continues to be short-sellingThe gold 1-hour moving average is still in a downward dead cross short arrangement, and the gold short strength is still there. The gold moving average resistance has now moved down to around 3002. After gold fell below 3000, gold accelerated its decline again, indicating that gold is still at an important level around 3000. The volatility of gold has only increased recently, so don't think that the market has reversed because it seems to have rebounded a lot. The recent fluctuations of tens of dollars in the gold market are normal.

Trading ideas: short gold around 3000, stop loss 3010, target 2970

4.9 gold rebound increases resistance level and continues shortiFundamentals:

On Tuesday (April 8), the price of gold fluctuated slightly higher in the early US trading. The market is currently expecting a continuous decline, and at the same time paying attention to the logic of short selling at resistance points. After briefly hitting a four-week low on Monday, the price of gold rebounded quickly and rebounded strongly to above $3,000 in the Asian and European trading on Tuesday.

Against this background, gold, as the ultimate safe-haven asset with "zero credit risk", has once again become the main allocation target of market funds. Every macro policy imbalance and external shock will bring cyclical buying to gold, and this time the intensity may be stronger. The current gold price has stabilized at the psychological level of $3,000 and is showing a short-term rising structure. From a technical perspective, the gold price in the daily chart quickly rose after stepping back on the Fibonacci 61.8% retracement level ($2,956), showing the resilience of buying. If the gold price breaks through the short-term resistance of $3,020, the upward target will be the $3,055 and $3,080 areas, and further may rise to the $3,100 mark. The key support level below is still around $2956. If it fails, it may test the 50-day moving average support (about $2947). Once this level is lost, it may trigger more technical selling pressure. The biggest variable facing the current market is no longer inflation data, but the destructive impact of Trump's tariff increase on the global trade pattern. The Fed's policy space is opening up rapidly. Driven by the expectation of interest rate cuts and risk aversion demand, gold not only stabilizes the $3,000 mark, but is also likely to re-enter the main upward trend.

Personal operation analysis:

Trend: shock trend

Support: 3000----2983------2965

Resistance: 3008-----3030-------3050

Strategy:

Viewpoint logic:

Short view near 3030, stop loss 3036, take profit near 3000----2970, and track stop loss 300 points.

4.8 Gold continues to run at a low point!Gold stabilized and rebounded on Tuesday (April 8), with an intraday increase of nearly 1%, successfully recovering the losses of the previous trading day. The rebound ended the three-day correction trend, and the gold price rebounded significantly from the key support level of $2,955. The current market focus is on the evolution of the Fed's policy path and the geopolitical trade situation. Under the interweaving of long and short factors, the short-term volatility of gold has risen significantly.

Fundamentals: The struggle between risk aversion and interest rate expectations

The rebound of gold at the beginning of this week was mainly driven by two factors:

1. The escalation of geopolitical trade risks

US President Trump's recent remarks on tariffs have triggered market concerns about the renewed tension in the global trade system.

2. The Fed's interest rate expectations fluctuated sharply

The interest rate futures market has undergone dramatic changes this week: On Monday, the market once bet that the Fed would cut interest rates five times in 2025, a significant shift from the expectation of "one or no interest rate cut" a week ago.

3. The coordination of the US dollar and capital flows

The US dollar index weakened slightly on Tuesday, reducing the cost of holding gold for non-US investors.

Technical aspect: Attack and defense of key support level

From the perspective of the market structure, the trend of gold this week showed typical "sharp drop and slow rise" characteristics:

Support confirmation: On Monday, the gold price accurately tested the support of $2955 and then rebounded. This position corresponds to the neckline of the platform that broke through in mid-March, and formed a double defense line with the 55-day moving average (US$2930). The intraday lows were densely bought, indicating that medium- and long-term investors viewed the correction as an opportunity to build positions.

Resistance distribution: The first resistance above is at US$3040 (daily line R1), and after breaking through, it may test US$3057 (March 20 pivot point) and US$3097 (R2). The historical high of US$3167 is still a psychological barrier, but it is difficult to challenge it directly in the short term.

In the short term, the trend of gold will depend on two major catalysts: 1. The minutes of the Fed's March meeting on Wednesday: If the minutes suggest an open attitude towards rate cuts, it may push gold prices to test the $3,050-3,070 range; conversely, if the emphasis is on inflation stickiness, it may trigger long profit-taking. 2. Progress in trade negotiations: Any substantive implementation or easing of tariff policies may trigger fluctuations of more than 5% in gold prices. In the medium term, the upward trend of gold has not been broken. Institutional research reports show that the current global central bank's demand for gold purchases is still at a historical high, and in the downward cycle of interest rates, the relative attractiveness of interest-free assets will continue to stand out. If the technical side breaks through $3,057, it will open up space for the impact of the previous high; the defense strength of the $2,950-2,930 area needs to be closely monitored below.

4.8 Technical analysis of short-term gold operations!Spot gold rebounded slightly during the Asian session on Tuesday (April 8), once rising above the 3,000 mark, and is currently trading around $2,995.51 per ounce. Spot gold may rebound to $3,049 per ounce, as the price has previously completed a five-wave cycle starting from $3,168.

Analysts pointed out that the peak of wave d is around $3,049, which can be used as a rebound target. It is still difficult to judge whether this cycle is an impulse wave cycle or a correction wave cycle.

If it is an impulse wave cycle, it means that the downward trend will extend to well below $2,950. The correction wave cycle shows that despite the sharp drop from $3,168, the upward trend from $2,831 remains intact.

The information shown on the daily chart is very clear. The sharp drop in the past few days seems to be driven by wave (4), which may end near the strong support level of $2,970. The next wave (5) will push the upward trend above $3167.

Resistance level: 3015----3038-----3050

Pressure level: 3000---29833-----2970

Gold's decline is not over yet, go short on the rebound!The gold 1-hour moving average continues to cross the downward short arrangement, the momentum of gold shorts is still there, and gold rebounds and continues to short. Of course, gold has been falling sharply in the past few days, and the market may gradually begin to recover. You must wait patiently for opportunities to rebound, and do not chase short positions easily.

Trading ideas: short gold near 3017, stop loss 3027, target 2090

The above is purely a sharing of personal opinions and does not constitute trading advice. Investments are risky and you are responsible for your profits and losses.

4.8 Interpretation of gold short-term operation ideasGold price has fallen below the previous row support band in the daily trend. The K-line continues to be under pressure from the short-term moving average and maintains a weaker trend of shock. In the short term, pay attention to the pressure band around 3030. In the 4-hour level trend, the K-line is currently under pressure from the short-term moving average and is maintaining a low-level shock repair. The strength and continuation of the intraday rebound are not too large. Pay attention to the continued downward trend after a small break in the 4-hour level trend. At present, after continuous shocks in the small-level cycle trend, the technical pattern has begun to gradually adjust. The K-line has begun to slowly stand on the short-term moving average and tends to have a certain rebound space in the short-term trend. Pay attention to the short-term adjustment.

Operational suggestions:

Short near 3017-8, stop loss 3023.9, or long near 2945-6, stop loss 2939.1.

Real-time market intraday guidance.

We will update regularly every day to introduce to you how we manage active ideas and settings. Thank you for your likes, comments and attention. Thank you very much

4.8 Gold Bollinger Bands bearish signal appearsRecently, the spot gold price once fell below the psychological barrier of $3,000, triggering technical concerns in the market about whether the gold bull market has reached its peak. On Monday (April 7) in the North American session, spot gold is currently trying to recover to around $3,030, but the technical indicators have shown obvious divergence.

Fundamental analysis

The market's concerns about US inflation continue to ferment, and the intensification of global trade frictions is driving the market's concerns about economic stagflation. The Fed's policy stance has also undergone subtle changes. The market has begun to price in five possible interest rate cuts this year. The CME FedWatch tool shows that the probability of the Fed's interest rate cut in May has soared from 33.3% last Friday to 49.3%.

At present, traders are turning their attention to the US inflation data to be released this week, which will provide important clues for assessing the US economic situation.

Technical analysts' interpretation:

Bollinger band breakthrough signal indicates a short-term correction

On the daily chart, gold prices have formed a clear upward channel since mid-March, but recently touched the upper track of the Bollinger band and began to fall. It is worth noting that the middle track of the Bollinger Band 3006.13 has become a key support level. After breaking through the historical high of 3167.60, the price has shown a typical upward exhaustion pattern. The MACD indicator shows DIFF: 43.46, DEA: 48.65, MACD: -10.39, and the green kinetic energy column has begun to expand, indicating that the short-term downward momentum is accumulating.

RSI indicator shows overbought correction

The 120-minute chart shows that the RSI indicator has fallen from the overbought area to a neutral level of 40.37. At the same time, the CCI indicator has dropped to -45.05, further confirming the trend of short-term overbought correction.

Key support and resistance level analysis

The current gold price faces multiple technical resistances, among which 3055.00 and 3085.00 constitute the main resistance range for short-term rebound. The lower support levels are mainly concentrated at $3005.00 and $2971.31, and these two levels will determine whether the gold price can remain above the psychological level of $3,000. In particular, the $2971.31 level, as a recent low, may trigger a deeper adjustment if it is lost.

From the long-term daily chart, gold prices formed an accelerated upward channel after breaking through $2950.00. The recent high of $3167.60 is just at the upper track of the channel. This trend of peaking and falling is in line with the classic channel trading theory.

Outlook

Bull Outlook: If the US inflation data exceeds expectations, the market's expectations for a more aggressive rate cut by the Federal Reserve will be further strengthened, and gold prices are expected to re-challenge the high of $3167.60 after a correction. Technically, gold prices need to return to above $3055.00 to reactivate upward momentum. The widening of the Bollinger Band width indicates that volatility is increasing, which provides potential trading opportunities for bulls.

Bear Outlook: In the short term, the downward divergence of the upper track of the Bollinger Band indicates that gold prices may face further corrections. The MACD histogram turned green and continued to expand, suggesting that downward momentum is accumulating. If the gold price falls below the key support of $2,971.31, it may trigger a deeper adjustment, and the next target will be $2,950.00 or even $2,920.00.

4.7 Interpretation of gold short-term operation ideas! US market4.7 Interpretation of gold late trading operation ideas:

Falling more than 70 points in the morning, it quickly rebounded and reversed! How will gold evolve tonight?

This V-reversal market frequently appears in these three trading days. It is difficult for us to encounter it once or twice a month. This increases the risk of trading. Once you make a mistake, it will be a reversal of dozens of points! When trading, you must strictly use the "stop loss".

We note that the three V-reversals in this stage have common characteristics. The stop in the last trading intensive period means that "3130" can be used as a reference for stage support and pressure. Then these three are: 3130, 3050, 2970---2980

The decline caused by the backlog of sell orders and insufficient liquidity! For gold, it will cause multiple stimulations, panic selling, and funds leaving the market for a short time to avoid risks. Selling gold to fill the gap in other markets and many other factors, and the central banks around the world that intend to reserve gold will not wait! They will still buy strategically, so the trend determines that the decline is limited.

2880 and 2630 are the two main observation positions.

After the small-cycle funds rebounded in the morning, the market entered a triangular consolidation state, the highs were gradually decreasing, and the lows were flattening. This is an obvious sign of market wait-and-see sentiment. The probability of a V-reversal phase or a continuous unilateral trend in the evening increased! If you follow this logic, gold should be under pressure around 3035-3038 during the rebound phase of 16-18 points!

And then continue to fall. Of course, if the EU further expresses its tariffs! It may cause the short-term volatility of the market to intensify!

Any unilateral trend needs to be confirmed in the US market. In the evening, whether it is a V-reversal from north to south or a continuation of the Asian and European market, it is normal. The overall framework will not deviate from the framework of 3130, 3050, 2980!

We will update regularly every day to introduce to you how we manage active ideas and settings. Thank you for your likes, comments and attention. Thank you very much

XAU/USD 07 April 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 04 April 2025.

Since last analysis price has printed a bearish CHoCH which is the first indication, but not confirmation of bearish pullback phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,187,835

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price has printed as per last Friday's analysis by targeting weak internal low and printing a bearish iBOS.

Price has subsequently printed a bullish iBOS indicating bullish phase initiation.

Price is now trading within an established internal range.

Intraday Expectation:

Price to continue bullish, react at either premium of internal 50% EQ, or M15/H4 nested supply zone before targeting weak internal low priced at 2,970.215

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

Trump's tariff announcement will most likely cause considerably increased volatility and whipsaws.

M15 Chart:

GOLD Price Analysis: Key Insights for Next Week Trading DecisionThe price of gold (XAUUSD) surged to a new all-time high last week following former President Trump’s announcement of reciprocal tariffs, only to face a strong retracement that plunged it to a 7-day low of around $3,015. The market then saw a recovery after Fed Chair Jerome Powell hinted that inflation could reaccelerate due to the economic impact of tariffs.

In this video, I break down:

✨ Gold price action and how markets are reacting to significant headlines

📉 A complete technical analysis of XAUUSD

📍 Key price levels, the current trend, and market structure

💡 Potential trade setups for the week ahead

We’re standing at a critical juncture in the gold market—and how traders respond could shape the next major move.

#XAUUSD #GoldAnalysis #GoldPrice #TechnicalAnalysis #ForexTrading #GoldForecast #FOMC #JeromePowell #TrumpTariffs #InflationData #MarketUpdate

Disclaimer:

Forex and other market trading involve high risk and may not be for everyone. This content is educational only—not financial advice. Always assess your situation and consult a professional before investing. Past performance doesn’t guarantee future results.

4.7 Gold short-term operation technical strategyLast week, gold and Dow Jones started to plummet across the board, and the short-selling of the band was a carnival. First of all, our initial short-selling target of 38,500 under the Dow Jones 45,000 has been completed. The only key support is the 36,300 line, and gold has also fallen to the 2970 line. There is no bottom at present, but there is a rebound in the key support level, so don't chase the low in the morning! From the closing point of view, the weekly line finally closed with a long upper shadow line and a quasi-inverted hammer pattern. After the end of this pattern, the market has been in the short stage this week. The intraday rebound is still mainly high-altitude. The market has a large amplitude, and the small stop loss has lost its meaning. At this time, the entry position is very important. In terms of points, the intraday rebound 3045-55 area continues to be high-altitude.

Short-term support: 3038, 3018, 2980, 2960

Do a good job of pushing the position protection! ! !