Gold Continues Short Term Uptrend📊 Market Overview:

💬Gold is currently trading around $3,340 – $3,352/oz, down slightly (~0.25%) on the day but still consolidating near recent highs around $3,500.

🌍 Geopolitical tensions (trade wars, Middle East conflicts) and strong central bank gold purchases continue to support long-term demand.

📅Markets are awaiting key U.S. inflation data and Fed signals, which may trigger volatility in the short term.

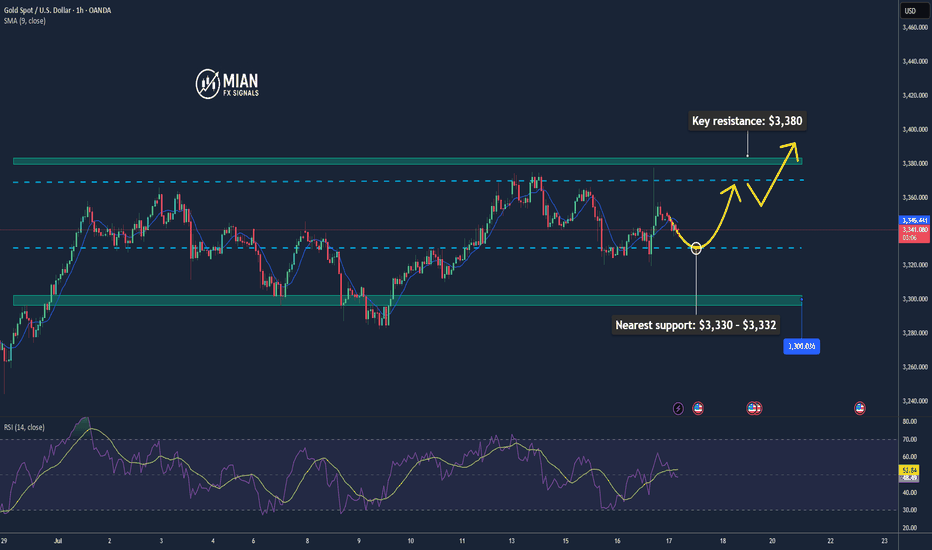

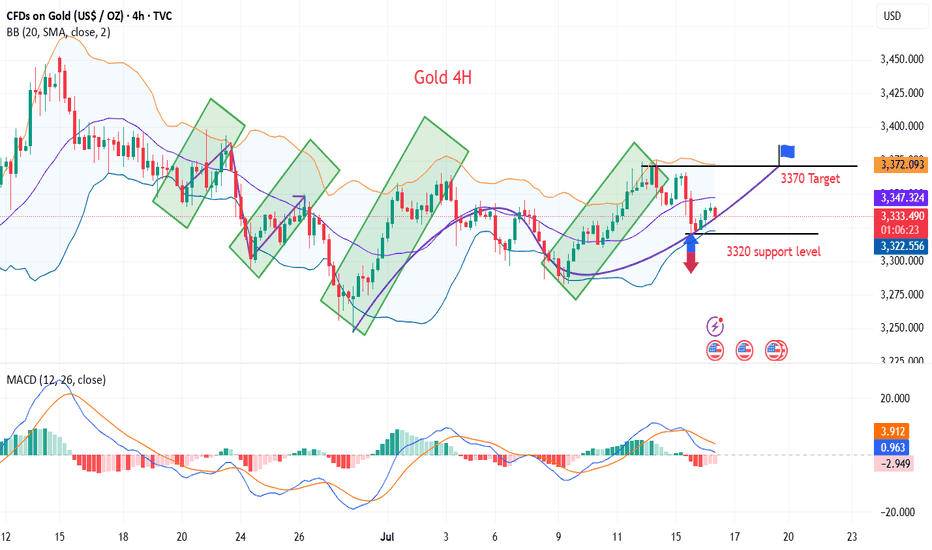

📉 Technical Analysis:

🔺Key resistance: $3,360 – $3,380, with the psychological zone at $3,400–$3,420.

🔻Nearest support: $3,330 – $3,332, followed by a firmer zone at $3,300–$3,326 (based on Fibonacci and moving averages).

• EMA/MA:

✅ Price is trading above the 50-day MA ($2,862), confirming a medium-term uptrend.

⚠️ While no specific EMA 09 data is noted, current price action suggests bullish momentum.

• Momentum / Candlestick / Volume:

📏RSI (14) is near 50–55, signaling positive momentum without being overbought.

🔄MACD is slightly negative but the overall structure remains bullish.

📌 Outlook:

Gold may continue to rise in the short term if it holds above the $3,330–$3,332 support zone, with potential to test resistance at $3,360–$3,380 and possibly revisit the $3,400 level.

A break below $3,330 could open the path toward deeper support around $3,300.

💡 Suggested Trading Strategy:

SELL XAU/USD: 3,367–3,370

🎯 TP: 40/80/200 pips

❌ SL: 3,374

BUY XAU/USD: 3,330–3,333

🎯 TP: 40/80/200 pips

❌ SL: 3,326

Goldinvesting

Gold pullback bulls are a winning streak strategy

💡Message Strategy

Gold prices experienced a roller coaster ride on Wednesday, mainly due to a Bloomberg report that Trump was considering firing Federal Reserve Chairman Powell (Trump wants to cut interest rates as soon as possible and the Fed is cautious). This quickly ignited the market's risk aversion sentiment, pushing gold prices up quickly by $50. However, after the rise, gold soon encountered resistance and gave up nearly $40 in gains, as Trump quickly denied the plan and the market's risk aversion sentiment cooled.

Gold prices fluctuated and fell on Thursday as Trump denied plans to fire Powell. Due to the rise in US CPI data released earlier, investors' expectations for the Fed's interest rate cuts cooled, which began to affect the market again. Looking ahead, investors still need to pay attention to the impact of Trump's tariff remarks and the Fed's monetary policy outlook on gold prices.

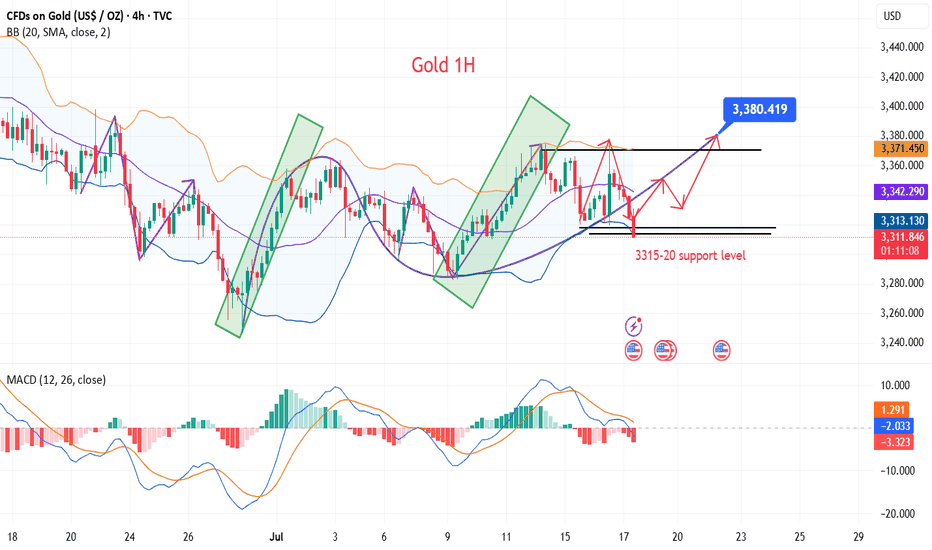

📊Technical aspects

After hitting a three-week high, gold prices fell back and continued to fluctuate in a wide range.

Gold is still in a bullish pattern. The support below focuses on Tuesday's low of $3,320, which is near the position where gold prices stabilized and rose in the Asian and European sessions on Wednesday, and near the position where gold prices fell and stabilized and rose in the US session on Wednesday. This is also the core position of our trading this week.

Gold's upper pressure focuses on the downward breakthrough of gold prices in the Asian and European sessions at $3,345, which is also the low point where gold prices quickly fell after rising on Wednesday. Secondly, focus on the intraday high of $3,375. The 5-day moving average slowed down after a slight golden cross, the MACD indicator slightly crossed upward, and the KDJ and RSI indicators formed a dead cross. The short-term technical aspect suggests that gold prices have a short-term upward trend.

💰Strategy Package

Long Position:3300-3315,SL:3280,Target: 3360-3370

Powell's stay or departure affects the market, and gold is unlik

Yesterday, the Trump and Powell incident caused gold to rise strongly to around 3377. The rise of gold was just a moment. In the end, the gold daily line closed positive, but closed with a super long upper shadow line. In the end, the gold price quickly rose and broke through the 3377 mark, and then fell under pressure and fell into a shock closing. The daily K line closed high and fell back and fluctuated in the middle of the positive. Although the overall gold price repeatedly fluctuated and washed the market under the stimulation of the news, it ultimately failed to break through the recent large box shock range. Today we continue to pay attention to the support line of 3318-25 below. We will continue to go long if it falls back!

From the 4-hour analysis, today's short-term support below continues to focus on the vicinity of 3318-25, the short-term pressure above focuses on the 3340-45 line, and the key pressure above focuses on the 3380 line. The overall support range still maintains the main tone of high-altitude low-multiple cycle participation. In the middle position, watch more and do less, and follow orders cautiously, and wait patiently for key points to enter the market.

Gold operation strategy:

Gold falls back to the 3318-25 line and goes long, stop loss 3312, target 3340-45 line, and continues to hold if it breaks;

TACO trading reappears. Gold is down.The news that Trump intends to fire Powell caused a decline in US stocks and bonds, and gold prices soared in response. But then Trump denied the news, and the market subsequently fell back to stabilize.

On Wednesday, the Asian market began to fluctuate and rise in the early trading. It rose to a high of 3343 in the European market and then fell to 3319 in the US market. Then it rose sharply due to the news. It rose to a high of 3377 and then fell to 3336. It fluctuated around 3350 in the late trading. The daily line closed with a positive line with an upper shadow line.

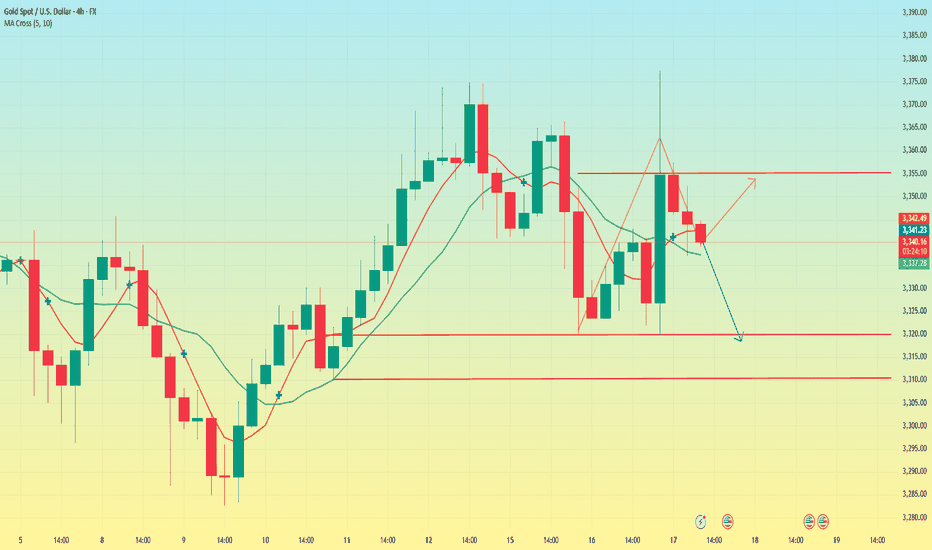

The recent market trend fluctuated violently. Since last Wednesday, there have been three consecutive positive rises. This week, there have been two consecutive negative declines on Monday and Tuesday. On Wednesday, it closed positive after washing up and down. At present, the MA5 and 10-day moving averages have formed a golden cross, but the direction is unclear. The Asian market opened above the moving average on Thursday. The overall pattern needs to pay attention to the breakthrough of the key points of long and short positions.

Today, the focus below is on the support near the low point of 3320, followed by the support near 3315 and 3310. This position is the trend line support formed by the previous low point connection. If it breaks down, we need to pay attention to the position of 3280. The upper resistance level is mainly concerned with the resistance near 3355, which is the rebound high point after the US market hit 3377.

Today, the operation needs to adjust the strategy according to the breakthrough of key points. In the volatile market, we need to be vigilant about the sudden fluctuations caused by the news. After breaking the key support or resistance, the trend direction may be further clarified.

Gold Holds Key Support Zone📊 Market Summary

– Gold is currently trading at $3,338/oz, hovering near a key technical support level.

– US Treasury yields remain elevated and the USD is strong, both pressuring gold; however, ongoing concerns over US–EU/Mexico trade tensions continue to support safe-haven demand.

– The market is awaiting the upcoming US PPI data to determine the next directional move.

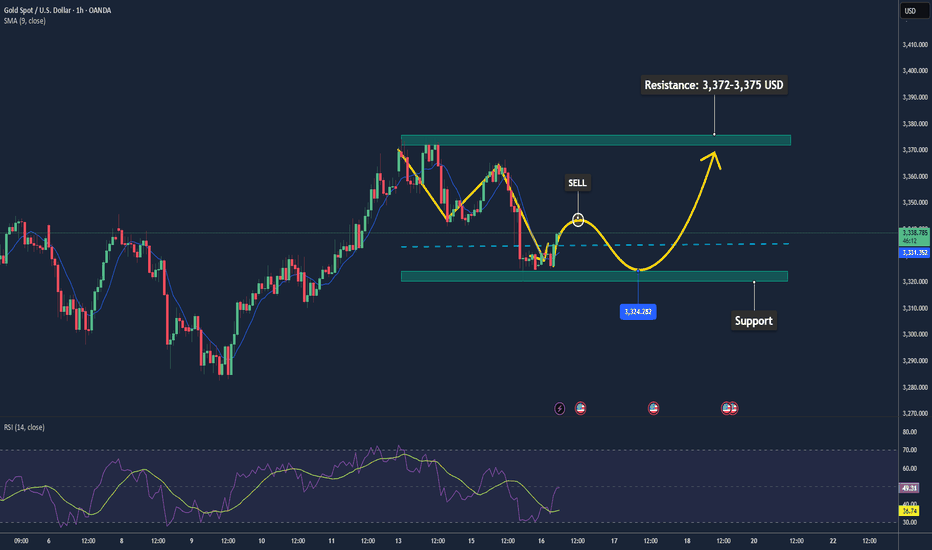

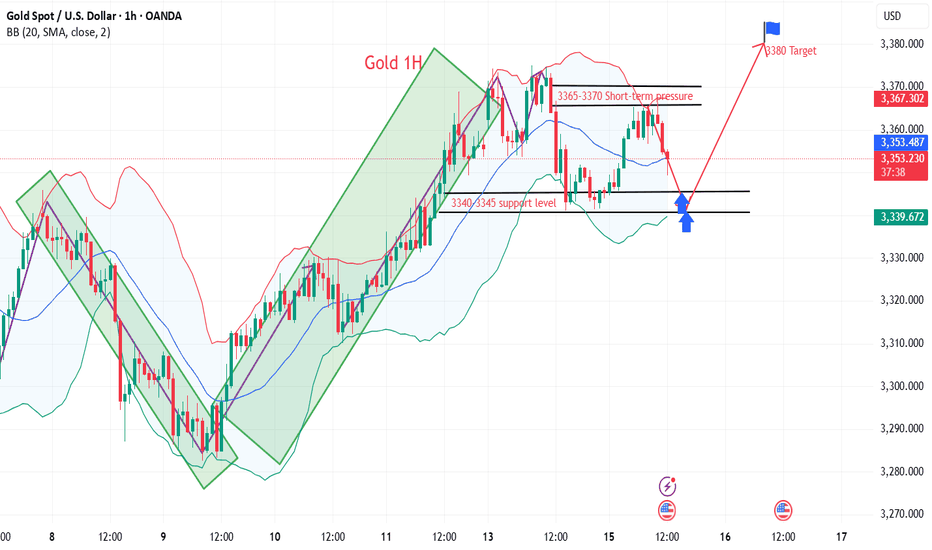

📉 Technical Analysis

• Key Resistance: $3,372 – $3,375 (23.6% Fibonacci zone – short-term ceiling)

• Nearest Support: $3,338 – $3,330 (tested and bounced at 3,338 per Oanda); deeper support at $3,325 – $3,320 if broken

• EMA 9: Price is below the MA20/50/100 but above MA200 (H1); EMA9 is flat, suggesting a sideways/consolidation trend

• Momentum / Indicators:

• RSI around 44–52 – neutral to slightly bullish

• MACD slightly positive; Stochastic above 50, hinting at short-term overbought conditions

📌 Outlook

– Gold is holding above the 3,338–3,330 support zone. If this level holds and rate-cut expectations strengthen, the price may rebound toward 3,372–3,375.

– However, if the USD continues to strengthen and PPI/CPI data surprises to the upside, gold could break support and head lower toward 3,325–3,320.

💡 Trade Strategy Proposal

🟣 SELL XAU/USD at 3,372 – 3,375

🎯 TP: ~ 40 / 80 / 200 pips

❌ SL: ~ 3,378

🟢 BUY XAU/USD at 3,330 – 3,333

🎯 TP: ~ 40 / 80 / 200 pips

❌ SL: ~ 3,327

As risk aversion wavers, will gold rise or fall?

💡Message Strategy

After falling for two consecutive days, gold (XAU/USD) rebounded slightly in the Asian session on Wednesday, stabilizing above $3,320, attracting some bargain-hunting buyers. The market has paid close attention to the tariff policy that US President Trump continues to increase, and the rising risk aversion has become the core factor supporting gold prices.

The US CPI data for June showed that overall prices rose by 0.3% month-on-month, the largest increase in five months, and the core CPI rose to 2.9% year-on-year, both higher than expected. This has caused the market to worry that tariffs are gradually pushing up inflation, prompting the Federal Reserve to extend the high interest rate policy cycle.

📊Technical aspects

The current trend of gold is constrained by both fundamentals and technical factors.

On the one hand, Trump's tariff policy has pushed up inflation expectations, triggering risk aversion and rethinking of the Fed's policy path, providing support for gold;

On the other hand, the Fed's tone of "maintaining high interest rates for longer" has limited the room for gold prices to rebound.

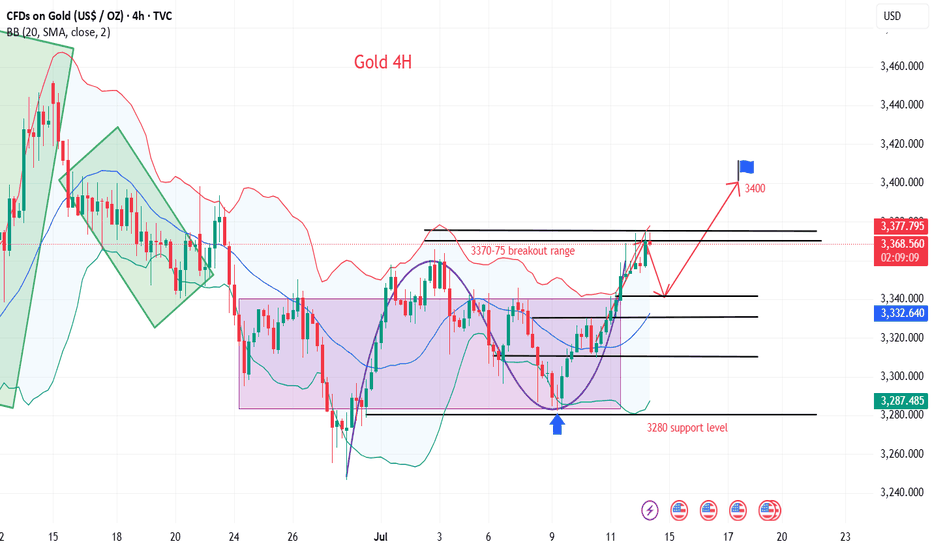

From the 4-hour chart, gold prices found support near the 100-period SMA (about $3,320) on Tuesday, stopping the decline from the three-week high. In the short term, if it can stand above the 3340-3345 resistance band, it may test the 3365-3370 area again, and the further target is the 3400-dollar round mark.

💰Strategy Package

Long Position:3320-3330,SL:3305,Target: 3365-3370

Will CPI data boost gold to 3,400?

💡Message Strategy

Gold prices rebounded modestly in the Asian session, supported by a weaker dollar and safe-haven demand. The market is currently focusing on the upcoming June CPI data from the United States, and investors are reassessing whether the Federal Reserve may start a rate cut cycle this year.

The overall CPI (year-on-year) is expected to grow by 2.7%, and the core CPI may reach 3.0%. If the data is lower than expected, it will strengthen the market's bet on a rate cut in September, which is bearish for the dollar and bullish for gold.

The current market has expected that the probability of the Federal Reserve cutting interest rates in September is about 60%, and the probability of a 50 basis point rate cut before the end of the year is about 50%.

📊Technical aspects

Gold price (XAU/USD) maintains a bullish structure as a whole and is currently testing the key resistance level of $3365. If it can effectively break through this area, it will open up the upside, with the target pointing to $3400 or even $3435.

On the daily chart, MACD maintains a positive opening, and the momentum indicator shows that buying is still active, and the short-term trend is to continue to rise. On the contrary, if the gold price is blocked near 3365-3370, it may fall back to the support area of 3340 US dollars. Further support is near 3326 and 3300 US dollars, which is still regarded as a potential area for bargain hunting.

💰Strategy Package

Long Position:3345-3355,SL:3335,Target: 3380-3400

Gold bulls explode to new highs

💡Message Strategy

Gold prices hit a three-week high near $3,375 an ounce in early trading on Monday before retreating. Gold prices are under selling pressure again as buyers failed to sustain higher levels hit earlier on Monday.

Gold prices hit a three-week high in early Asian trading on Monday, supported by safe-haven demand after U.S. President Trump threatened to impose 30% tariffs on imports from the European Union and Mexico.

Gold prices encountered resistance just below the 23.6% Fibonacci retracement of April’s record rally at $3,377 an ounce in early Asian trading on Monday.

Despite the pullback, the 14-day relative strength index (RSI) continues to show additional upside as the indicator is well above its midline, currently near 54.20.

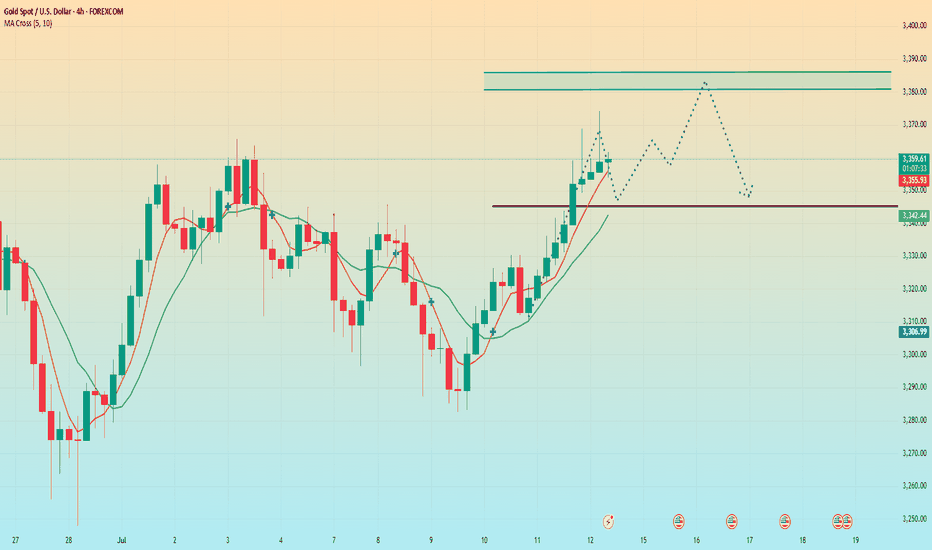

📊Technical aspects

Gold 4H chart. From the perspective of the morphological structure, gold has recently been rising in lows, and has been oscillating upward along the rising trend line, moving out of the standard rising trend wave rhythm. On Friday night, the bulls once again made a strong effort to break through the key pressure level of 3345.0, further opening up the bullish upside space, and the market outlook continues to see the bullish continuation of the market.

According to the comprehensive MACD indicator, the fast and slow lines are running above the 0 axis, indicating that the bullish power dominates the market trend. In terms of strategy, it is recommended to follow the bullish rebound wave trend to find support levels and ambush long orders.

💰Strategy Package

Long Position:3335-3340,SL:3320,Target: 3390-3400

Affected by tariffs, gold rose again.On Saturday, Trump announced that he would impose a 30% tariff on goods imported from the European Union and Mexico from August 1. This news triggered a rise in risk aversion in the market. As a traditional safe-haven asset, gold was once again sought after. The price continued the rise on Friday and continued to open high in the early Asian session. As of now, the highest price reached around 3373.

From the current market point of view, after breaking through the triangle pattern last Friday, there was a sharp rise. The price successfully stood on the short-term moving average, showing an overall bullish trend. However, it should be noted that the short-term moving average has not yet formed an upward cross, which means that there is a high possibility of a confirmation process in the future. Looking back at the trend in the past two months, gold rarely opens high and then continues to rise. Most of them open high and go low. Therefore, under the current situation, although it is bullish overall, it is not advisable to blindly chase more. It is more suitable to wait for a decline before arranging more orders. The key lies in grasping the decline position.

From the perspective of pressure level, 3380-3385 is the first pressure level, and the second pressure level is 3395-3400. The support level below is around 3345, which is also the pressure level that has been emphasized in the early stage, and the top and bottom conversion position. For today's operation, Quaid recommends low-to-long.

Operation strategy:

Short near 3380, stop loss 3390, profit range 3360-3345

Long near 3345, stop loss 3335, profit range 3360-3380

Gold rises after brief recovery

Let’s review the gold price for next week from July 14, 2025 to July 18, 2025

⭐️Gold Information:

Gold prices surged nearly 1% on Friday as sentiment soured over U.S. President Donald Trump’s controversial trade policy targeting Canada, while hinting at broader tariffs on other countries and copper. At the time of writing, XAU/USD was trading at $3,354, rebounding from an intraday low of $3,322.

On Thursday, Trump announced a 35% tariff on Canadian imports, but goods eligible under the 2020 USMCA trade agreement remain duty-free. He also expressed his intention to extend tariffs to most trading partners, proposing a basket of rates ranging from 15% to 20%.

With a light U.S. economic calendar, attention turns to comments from the Federal Reserve. Chicago Fed President Austan Goolsbee dismissed calls for rate cuts aimed at reducing government borrowing costs, stressing that the central bank's focus remains firmly on employment and price stability.

⭐️Personal Comment:

Growth with the trend, maintaining the accumulation price zone above 3300

🔥 Technical:

Based on the resistance and support levels of gold prices on the 4-hour chart, NOVA has identified the following important key areas:

Resistance: $3392, $3447

Support: $3330, $3308, $3246

Gold trend analysis: long positions are still the general trend

After opening on Friday morning, it started to rise directly. The opening was the low of the day and continued into the European session, reaching the highest point near 3340-45, which was also close to the previous high point. After touching this position, the bears also ushered in a symbolic correction and tried to test the position above 30 many times. However, it finally catered to the strength of the bulls and began to break through in the US session, reaching the highest point near 3369, and also pierced the previous high of 3365 for the first time, and then retreated and corrected again. The daily line also closed in the form of a large positive line with an upper lead. The gold hourly line continued to diverge from the golden cross upward bullish arrangement. The gold bullish strength is still there, and the gold moving average support has also moved up to around 3320-25. After gold broke through the 3345 line on Friday, it rose all the way, reaching the highest point of 3369. We continue to be bullish on gold when it falls back to the 3320-25 line next week. The short-term 3320-25 line of gold has formed a strong support, and gold will continue to buy on dips when it falls back next week. If your current gold operation is not ideal, I hope Yulia can make your investment smooth. Welcome to communicate with us!

From the 4-hour analysis, the support below is around 3320-25, and the short-term bullish strong dividing line is around 3365-3370. The overall low-multiple bullish rhythm remains unchanged. Before the daily level falls below the 3300 mark, any retracement is a long opportunity. Be cautious about short positions against the trend.

Gold operation strategy:

Gold retracement 3320-25 line long, stop loss 3313, target 3365-70 line, break and continue to hold

Gold breaks through. Will it continue?After breaking through the position predicted by Quaid on Friday, gold rose strongly and finally maintained the fluctuation range of 3345-3360 that I predicted. Gold bulls are now strong. If there is no major change in the news over the weekend, the price will likely continue to rise after a slight decline at the beginning of next week. I think we can still follow the strategy of Dutou.

The 1-hour moving average of gold continues to diverge with a golden cross and upward bullish arrangement, and the bullish momentum of gold is still there. The current strong support level of gold has also moved up to around 3330. After gold broke through 3330 over the weekend, the price fell back to 3330 and stabilized and rose twice. In the short term, this position has formed a strong support.

There is a high probability that the price will have a small correction at the beginning of next week. We can continue the bullish strategy after the price falls back.

Market transactions should abandon personal preferences. Preconceived subjective consciousness will eventually be taught a lesson by the market. The market is always right. We should follow the fluctuations of the market. Instead of having a head full of random thoughts. There are always traces of market changes, and you need to have the ability to discover them or follow those who have the ability. The market changes rapidly, so pay attention to more timely changes.

Gold price rises as expected, is 3400 far behind?

💡Message Strategy

Trump announced on Friday that he would impose a 35% comprehensive tariff on Canadian imports, which will take effect on August 1, which caused a market shock. As Canada's largest trading partner, the United States accounts for 76% of Canada's exports in 2024. This move will undoubtedly have a profound impact on the global supply chain and trade pattern.

In addition, Trump's tariff policies on copper and Brazil have further exacerbated market uncertainty, pushing gold prices to break through key technical resistance levels and move towards the $3,400 mark.

The Fed's policy moves also have an important impact on market sentiment. The minutes of the June meeting released on Wednesday showed that the Fed's internal concerns about tariffs potentially pushing up inflation are growing. The minutes pointed out that "most participants emphasized that tariffs could have a more lasting impact on inflation."

Despite this, the Fed reiterated that it would remain on the sidelines and wait for further clarity on inflation and economic activity. At present, according to the market forecast of the CME FedWatch tool, the probability of a 25 basis point rate cut in September has risen to 62.9%, reflecting investors' expectations that the Fed may ease early.

📊Technical aspects

Yesterday’s strategic recommendations mentioned that the effective support level for gold was in the 3280-3285 range. Today, gold fell back to the 3280 level, stabilized, and began to rise, perfectly reaching the target.

From a technical perspective, gold has shown significant upward momentum this week. The daily chart shows that the price of gold has successfully broken through the symmetrical triangle resistance and touched the 20-day simple moving average (SMA) of $3,339.97.

This breakthrough marks a strengthening of the short-term technical pattern, showing that bulls have the upper hand. The relative strength index (RSI) has rebounded to around 55 on the daily chart and is trending upward, indicating that there is slight bullish momentum in the market.

However, in the short term, the upside of gold may be limited by the 23.6% Fibonacci retracement level ($3,370). If this level can be effectively broken, the psychological level of $3,400 and the June high of $3,452 will become the next target.

💰Strategy Package

Long Position:3335-3340,SL:3320,Target: 3370-3400

Trump's tariff news stimulates gold to explode!

📌 Driving Events

Gold prices rose for the third consecutive day and are expected to close higher this week. The trend turned in favor of gold buyers as tariff tensions intensified. US President Trump announced new tariffs, exacerbating concerns about a trade war.

📊Personal Comments:

Signs of instability in Trump's trade policy have once again hit investor confidence, reviving safe-haven demand for gold. In the absence of any top US economic data, the market will continue to focus on trade headlines. Weekend fund flows may also drive gold price movements.

⭐️Set Gold Price:

🔥Sell Gold Area: 3360-3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose a lot size that matches your funds

Gold prices are faking declines but rising, so beware

💡Message Strategy

As trade uncertainty heats up, gold welcomes safe-haven buying

After the Trump administration issued a series of tariff notices against many countries around the world, market risk aversion has intensified. The US President announced on Wednesday that a new 50% tariff on copper imports will be imposed from August 1, and reiterated that "the deadline will not be extended for countries that have received the notice, and any retaliatory measures will be responded to by tax increases."

This move has triggered market concerns about the slowdown in global economic growth, and traditional safe-haven assets such as gold have been sought after. The current gold price has rebounded significantly from the one-and-a-half-week low hit the previous day.

According to market surveys, safe-haven funds are being reconfigured, especially in the context of the unclear Fed policy and the direction of the US dollar, gold has become a non-yielding asset preferred in the short term.

📊Technical aspects

From the 1H chart, the gold price has approached the 100-period simple moving average (SMA), which is currently located around 3,335, forming an initial resistance. If the price effectively breaks through this area, the next resistance level will be in the 3,345-3,350 range. Once it breaks through, it may trigger a short-covering market, pushing the gold price back to the 3,400 integer mark.

If gold breaks above 3,360, it will confirm the short-term bottom and open the door to re-challenging the high point of the year. On the contrary, if the gold price falls below 3,300 again, it may retest the 3,280 support, and further downside space will extend to the July low of 3,247.

For now, the performance of gold bulls is relatively prominent, and it is recommended to do more on the pullback.

💰Strategy Package

Long Position:3300-3310,SL:3285,Target: 3340-3350

Gold in Equilibrium, Possible Minor Pullback📊 Market Overview:

• Spot gold currently trades around 3,332–3,333 USD/oz

• A slightly weaker US dollar and declining Treasury yields are supporting gold

• Yet strong US jobs data and delayed Fed rate cuts are limiting gold’s upside

• Escalating trade tensions and new tariffs keep safe-haven demand intact

📉 Technical Analysis:

• Resistance: 3,345–3,350 USD, repeatedly tested zone

• Support: 3,316–3,322 USD, strong bottom near 3,310 USD

• EMA 9: Price hovering around it—no clear trend direction

• Momentum/RSI: RSI fading from overbought, momentum weakening

• Candle Patterns/Volume: Narrow consolidation, forming pennant structure

📌 Outlook:

Gold is likely to remain range-bound or dip slightly if USD strengthens. Conversely, renewed economic headwinds or Fed dovishness could push gold higher, especially on a break above 3,345 USD.

💡 Suggested Trade Strategy:

SELL XAU/USD : 3.347–3.350

🎯 TP: 40/80/200 pips

❌ SL: 3.355

BUY XAU/USD : 3.316–3.319

🎯 TP: 40/80/200 pips

❌ SL: 3.310

The price fell back. Watch out for a breakthrough.After reaching the resistance position near 3345 predicted by Quaid, the price fell back slightly, and the price fluctuated around 3335 so far.

From the hourly chart, before the price stabilizes at 3345, it is likely to maintain a range of 3330-3345. 3330-3345 is a temporary range. If it stands firm and breaks above 3345 again, the fluctuation range will become 3345-3360.

On the contrary, if it falls below 3330, the range may drop to 3320-3330. However, as long as the downward trend does not fall below 3320, gold will still maintain a bullish trend. If the price breaks down below 3320, today’s trend will be reversed.

As long as it is above 3320, gold will maintain a bullish trend today.

On the last trading day of this week, I wish all traders a good harvest.

Gold is fluctuating. Can it break through?Since the price of gold rose to 3500 on April 22 and encountered resistance and fell back, it has shown a triangular convergence and fluctuation trend so far. From the short-term trend, after the decline adjustment on Tuesday, it bottomed out and rebounded on Wednesday to close with a positive line, and on Thursday it completed the shock consolidation with a small positive line. The current moving average system is in an intertwined state, and the short-term market tends to fluctuate.

Today, we need to pay attention to the resistance of the 3340-3345 range. This position is a high point concentration area that has suppressed the upward movement of gold prices many times in the early stage. If the gold price breaks through this range, the bullish trend is expected to continue.

From the current trend, after the gold price bottomed out and rebounded, it formed a short-term support at 3310. Secondly, we need to pay attention to the support strength near the low point of 3282 on Tuesday. In terms of operation, it is still necessary to operate around the range.

Operation strategy:

Short when the price rebounds to around 3345, stop loss at 3355, profit range 3320-3300

Long when the price falls back to around 3310, stop loss at 3300, profit range 3320-3340

Gold Rejected at 3329.5, Profit-Taking Pressure Rises📊 Market Overview:

Gold surged to 3329.5, approaching key resistance, but quickly dropped to 3319.8 due to strong selling pressure, signaling short-term profit-taking. It’s now slightly recovering and trading around 3321.

📉 Technical Analysis:

• Key Resistance: 3329 – 3335

• Nearest Support: 3308 – 3285

• EMA 09: Price remains above EMA 09 → uptrend still intact.

• Candlestick / Volume / Momentum: H1 candle shows long upper wick at resistance. High volume at the top suggests profit-taking activity.

📌 Outlook:

Gold may continue a short-term correction if it fails to break above 3330 decisively. Bulls need to hold 3308 to maintain the upward structure.

💡 Suggested Trading Strategy:

🔻 SELL XAU/USD : 3330 – 3333

🎯 TP: 40/80/200 pips

❌ SL: 3336

🔺 BUY XAU/USD at: 3302 – 3305

🎯 TP: 40/80/200 pips

❌ SL: 3399

Gold continues to short

Life is like a thread. As long as today continues and as long as there is hope for tomorrow, we will always be at the starting point and on the road to running. Don't be afraid of the long road, don't complain about the lack of scenery on the roadside, don't despair at any time, just keep running, the bumps under your feet are the cornerstones of our life, and perhaps the turning point is just around the next corner!

Gold, on the eve of the US market yesterday, the shorts repeatedly touched the lower support of 3282, but ultimately lacked the momentum to make a final push, which led to a reverse reversal in the US market and a continuous rebound effect. As of the morning of the day, the highest reached near 3326, and the daily line also closed at the bald small positive line of the lower lead. The current upper pressure is maintained at the previous 3330 line. This position will also be related to the continuity of the long and short positions in the later period, and the highest in the morning will also be maintained near this position. For the European market, this position is even more important. Once it continues to break through, the US market will likely continue to rise, and it can also be used as the position of the long and short watershed in the short term, and the recent trend continuity is extremely high. , most of them are maintained in the range of shock operation, and the support below will be maintained at 3310, which is also the key defensive point of the European session. Although the daily line is currently closed at a small positive line, it is still obviously insufficient in power, and the multi-hour line is also maintained in the downward channel without a breakthrough. In the short term, it is still in a bearish situation overall. If there is no breakthrough for a long time, it may continue to fall in the later period. If gold rebounds near the morning high, it can continue to short. If the European session breaks through strongly, it needs to adjust its direction before the US session. If gold rebounds near 3325-26, it can be shorted. The target is around 3310-00, and the loss is 3335!

Gold rebounds near 3325-26 during the day, and the target is around 3310-00, and the loss is 3335.

Trump blasted Powell again. Interest rates remain unchanged.Information summary:

Trump blasted Powell on Wednesday, saying that the current interest rate is "at least 3 percentage points higher" and once again accused Fed Chairman Powell of "making the United States pay an extra $360 billion in refinancing costs each year." He also said that "there is no inflation" and that companies "are pouring into the United States," and urged the Fed to "cut interest rates."

During the U.S. trading session, gold also showed a significant rebound momentum, rebounding from a low of 3285 to above 3310 in one fell swoop. As of now, gold has stood above 3320.

Market analysis:

From the daily chart:

It can be seen that the first suppression position above gold is currently at 3325, followed by around 3345. Gold did not close above 3320 on Wednesday, which means that even if gold is currently above 3320, as long as today's daily line closes below 3320, it is still in a bearish trend. On the contrary, if the closing price today is above 3320, then the subsequent test of the suppression position near 3345 may be further carried out.

Secondly, from the 4-hour chart, the current suppression position above 4 hours is around 3330-3335. Therefore, today we should focus on this position. If we cannot stand firm and break through the range suppression here in the 4-hour chart, we may retreat again in the future. The key support position below is around 3310, which is the opening price today. If the price is to retreat, it is likely to fall below 3310. But it may also remain above 3310 for consolidation.

However, as long as it falls below 3310, I think the low point near 3285 may be refreshed, so pay attention to this.

Operation strategy:

Steady trading waits for 3310 to fall and break through to short, and the profit range is 3385 or even lower.

Aggressive trading can short near 3340, with a stop loss of 3350.

Gold rose. Trend reversed.Gold rose slightly in early Asian trading on Wednesday, but fell under pressure near 3308. It fluctuated in the European trading range of 3296-3282. It broke through the US trading range and rose to around 3317 in the late trading. The daily line closed with a positive line with a lower shadow.

After a sharp drop on Tuesday, gold showed a downward recovery trend on Wednesday and closed positive. It rose slightly in early Asian trading today. From the daily level, in the short term, we should first pay attention to the resistance near 3325-3330. This area brings together the current positions of the 5-day moving average, the 10-day moving average and the 60-day moving average, which is an important gateway for the game between long and short forces in the short term. If the gold price continues to be under pressure in this area, it means that the short-term upward momentum is insufficient, and we need to be alert to the risk of a market decline.

If the above resistance area can be broken and the price continues to rise strongly, the next target will be the resistance near 3345, which is not only the high point on Tuesday, but also the current location of the 20-day moving average and the 30-day moving average, which has a strong technical resistance significance.

In terms of support below, first pay attention to the support near 3280, which is the current support level of the trend line formed by the low points of May 15 and June 30, which provides certain support for the gold price.

Operation strategy:

Short at price rebound near 3345, stop loss at 3355, profit range 3320-3300

Long at price drop near 3315, stop loss at 3305, profit range 3320-3340