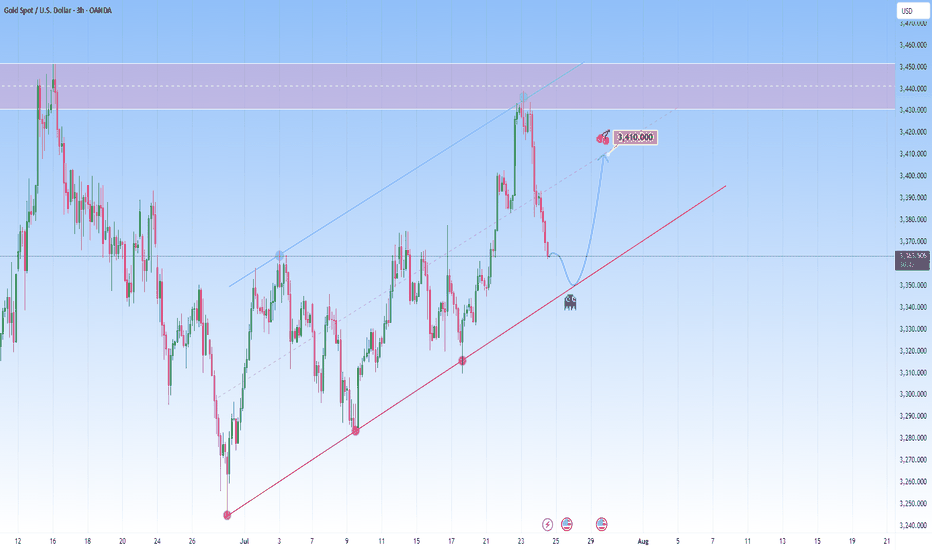

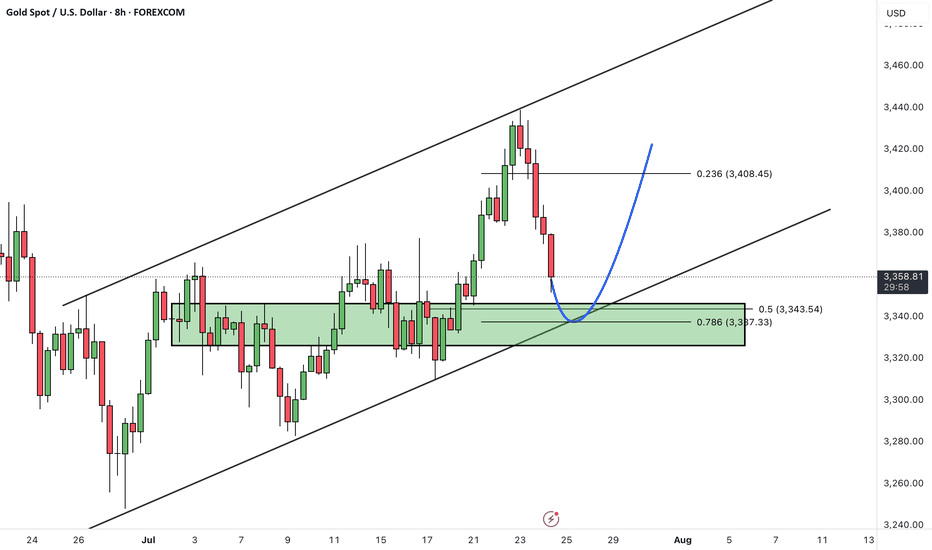

GOLD Reawakened: Corrects firmly but conditions remain bullishFrom a technical perspective Gold is climbing in a parallel channel, clearly bullish with a rhythm that’s hard to ignore. Price just bounced off the resistance with force, a classic overextension flush.

And the market is now approaching the lower boundary of this projected channel. This confluence of technical support is likely to attract renewed buying interest.

I expect it to bounce back toward 3,410, somewhere around the middle of the channel. The move up may not be determined right away. It could be consolitaing, fake dips first, or sudden acceleration.

Goldlong

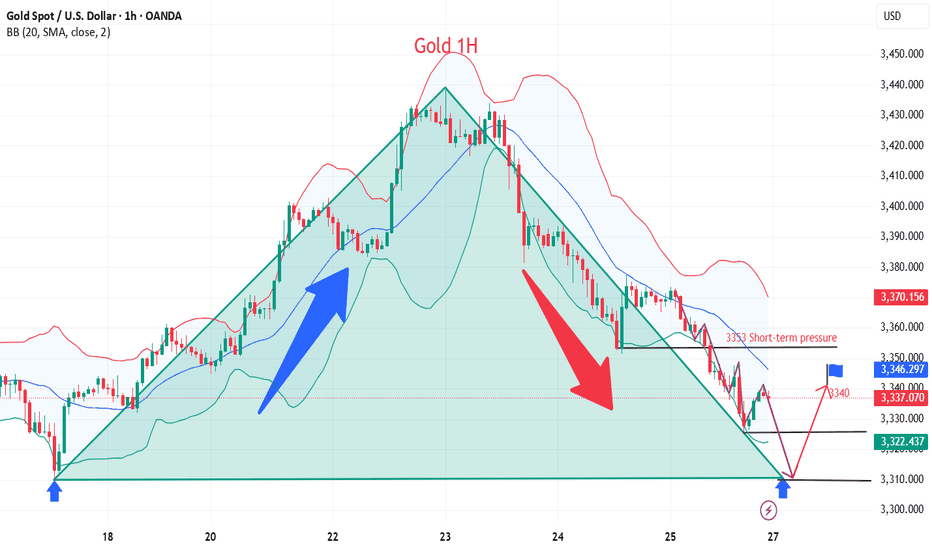

The correction is quite surprise. What direction for GOLD price?✏️Quite surprised with the adjustment of gold at the end of the previous trading week. The rising price channel is still holding around the lower border of the price channel around 3316. A liquidity sweep and candle wick removal in this area is considered a good buying opportunity.

If h1 closes below this border, limit trading BUY signals until the bottom support of 3286. When the price can close the candle below 3316, gold will trade in a wide range and there is no main trend dominating the market.

📉 Key Levels

Support: 3316-3286

Resistance: 3372-3400-3418

Buy trigger: Reject and Trading above 3316

BUY DCA Break 3372

Target: 3400

SELL Trigger: Break bellow and Retest 3416

Leave your comments on the idea. I am happy to read your views.

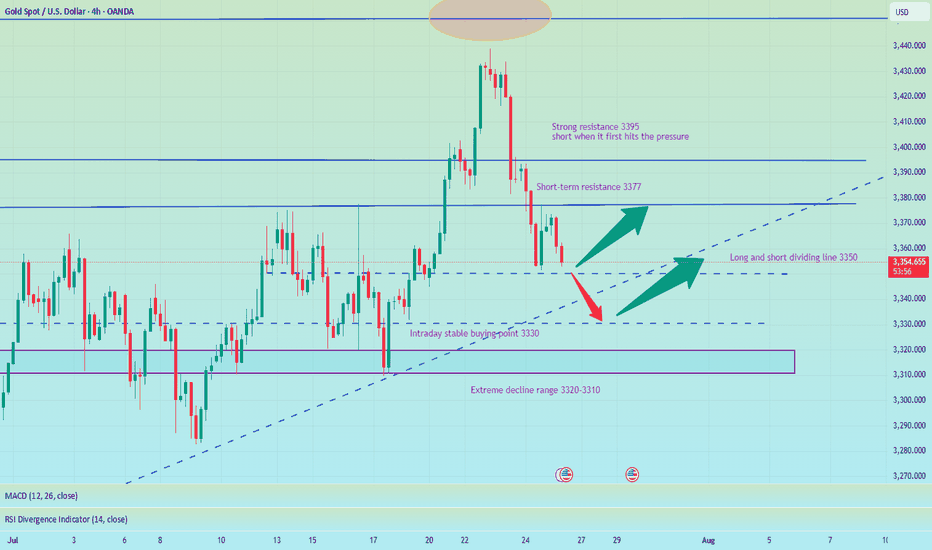

Gold short-term rise waiting for breakthrough

💡Message Strategy

During the Asian trading session, gold prices rebounded slightly from $3,320, filling the short gap at the start of the new week. As investors chose to stay on the sidelines before the Fed's two-day monetary policy meeting, the bullish force of the US dollar temporarily weakened, providing support for gold, an interest-free asset.

However, with the 15% tariff agreement between the United States and Europe and the positive progress of trade easing between the United States, Japan and the United States, market risk appetite has rebounded, weakening the appeal of gold as a safe-haven asset.

According to market surveys, "The current optimistic atmosphere of trade has weakened the safe-haven demand for gold, while the weakening of the US dollar has provided support for gold prices. The two forces offset each other, causing gold to fluctuate."

Investors are focusing on the FOMC meeting to be held on Tuesday. Although Trump continues to pressure the Fed to cut interest rates, the market generally expects that the interest rate will remain unchanged at this meeting because the US labor market remains strong.

In addition to the interest rate decision, this week will also usher in the US second quarter GDP estimate, PCE price index and non-farm payrolls report, all of which may have a significant impact on gold.

📊Technical aspects

From the technical trend, gold triggered a rapid correction after breaking below the lower edge of the short-term rising channel and the 50% Fibonacci retracement level last week. The current gold price stabilized in the $3,320 area and received some buying at the 61.8% Fibonacci support.

However, it is worth noting that the 200-period moving average on the 4-hour chart is at $3,350, which constitutes an important technical resistance for a short-term rebound. On the contrary, if gold breaks through the $3,350 level, gold will continue to develop a bullish pattern.

From the technical trend, gold triggered a rapid correction after falling below the lower edge of the short-term rising channel and the 50% Fibonacci retracement level last week. The current gold price stabilized in the $3,320 area and received some buying at the 61.8% Fibonacci support.

However, it is worth noting that the 200-period moving average on the 4-hour chart is at $3,350, which constitutes an important technical resistance for a short-term rebound.

On the contrary, if gold breaks through the $3,350 line, it will be expected to attack the $3,371-3,373 area in the short term, and further look to the key pressure levels of $3,400 and $3,440.

💰Strategy Package

Long Position:3320-3325,SL:3300,Target: 3350

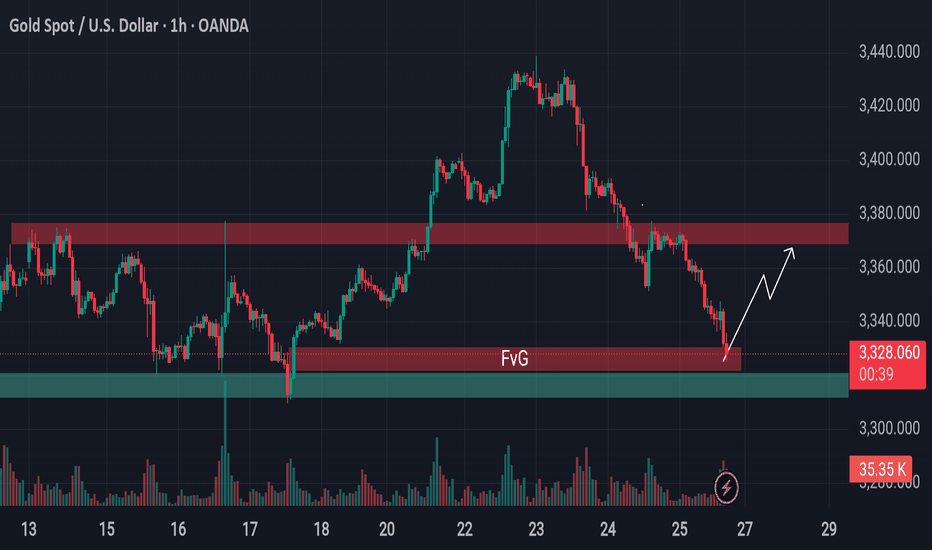

Still a chance for gold bulls?

💡Message Strategy

The gold market was volatile this week, and gold prices ultimately closed lower for the week.

Gold prices have failed to stabilize above $3,400 an ounce after a bullish breakout. The technical outlook highlights the recent indecision of gold bulls. Looking ahead to next week, the Fed's policy statement and US-China trade talks could trigger the next big move for gold.

These important factors may trigger the market next week

1. The Fed will announce its monetary policy decision after its policy meeting on July 29-30.

Before the Fed meeting, the U.S. Bureau of Economic Analysis will release its first estimate of annualized growth in gross domestic product (GDP) in the second quarter.

2. Next Friday, the U.S. Bureau of Labor Statistics will release the July employment report.

If the non-farm payrolls (NFP) increase by more than 100,000, it may indicate that the labor market is in good enough condition for the Fed to prioritize controlling inflation and support the dollar when making policies.

If the new non-farm payrolls data reaches or falls below 70,000, the dollar may find it difficult to find demand before the end of next week and help gold gain bullish momentum.

3. Market participants will be closely watching the headlines of the US-China negotiations.

If the two sides make further progress in trade and economic relations, risk flows may dominate the actions of financial markets, making it difficult for gold to find demand.

📊Technical aspects

The short-term technical outlook highlights the hesitation among gold buyers. The daily chart shows that the relative strength index (RSI) remains just below 50, and gold is struggling to move away from both the 20-day simple moving average (SMA) and the 50-day SMA after breaking above both levels earlier this week.

If the price of gold falls to the key support level of $3,310 and fails to break down (trend line support/Fibonacci 61.8% retracement level), it will force a large number of shorts to exit the market and may further test the $3,340 range (psychological level/Fibonacci 76.4% retracement level).

Combined with the current trend, the downward momentum of gold has weakened, and it is seeking support to restart the long position

💰Strategy Package

Long Position:3310-3320,SL:3290,Target: 3340

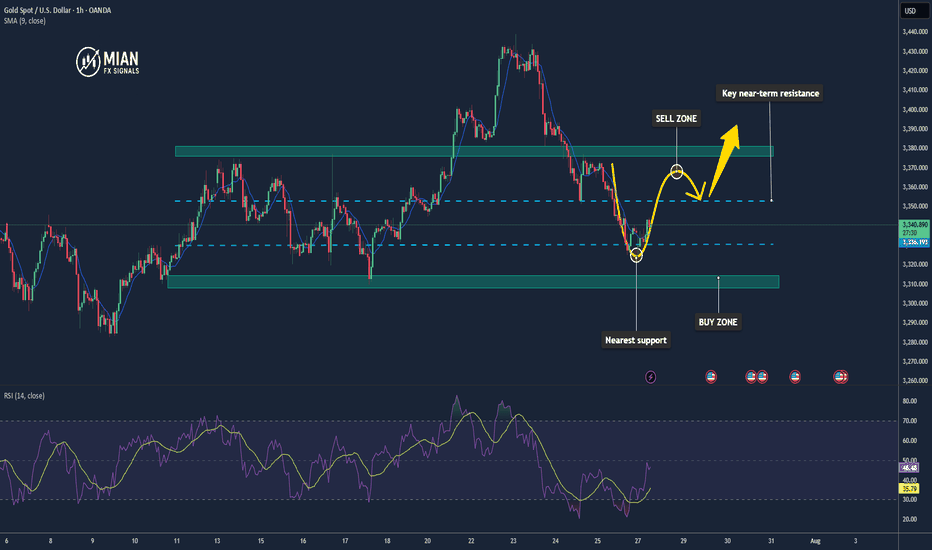

Gold Continues Mild Uptrend – Watching for Reaction at $3351📊 Market Overview:

Gold maintained its bullish momentum during the Asian–European session, rising from $3330 to $3344. A slightly weaker USD and safe-haven demand supported prices. However, price is now approaching a key resistance zone, where technical rejection may occur in the U.S. session.

________________________________________

📉 Technical Analysis:

• Key near-term resistance: $3345 – $3351

• Stronger resistance (higher zone): $3360 – $3366 and $3374

• Nearest support: $3335 – $3332

• Stronger support (lower zone): $3322 – $3315

• EMA 09 (H1): Price is above EMA09 → confirms short-term uptrend

• Candlestick / Volume / Momentum:

• Price is consolidating in an ascending triangle

• A breakout above $3345 may target $3360+

• RSI remains below overbought; volume is stable → room for continuation

________________________________________

📌 Outlook:

If gold holds above $3335 and breaks above $3351, the uptrend could extend toward the $3366–$3374 zone. However, failure to break $3351 followed by a drop below $3332 could lead to a deeper pullback toward $3315.

💡 Recommended Trading Strategies:

BUY XAU/USD: $3318 – $3315

🎯 TP: 40/80/200 PIPS

❌ SL: $3321

SELL XAU/USD: $3360 – $3363

🎯 TP: 40/80/200 PIPS

❌ SL: $3357

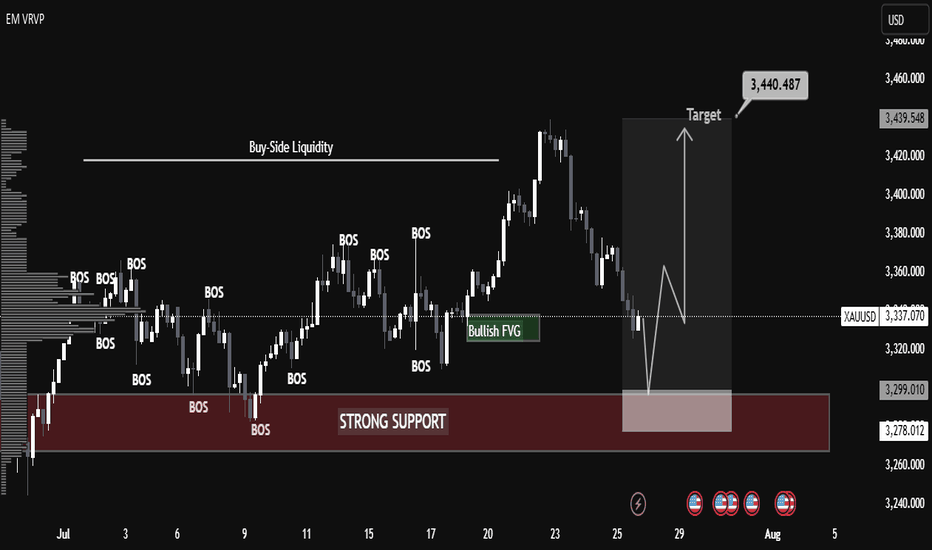

XAUUSD Technical Analysis – Educational Insight Key Observations:

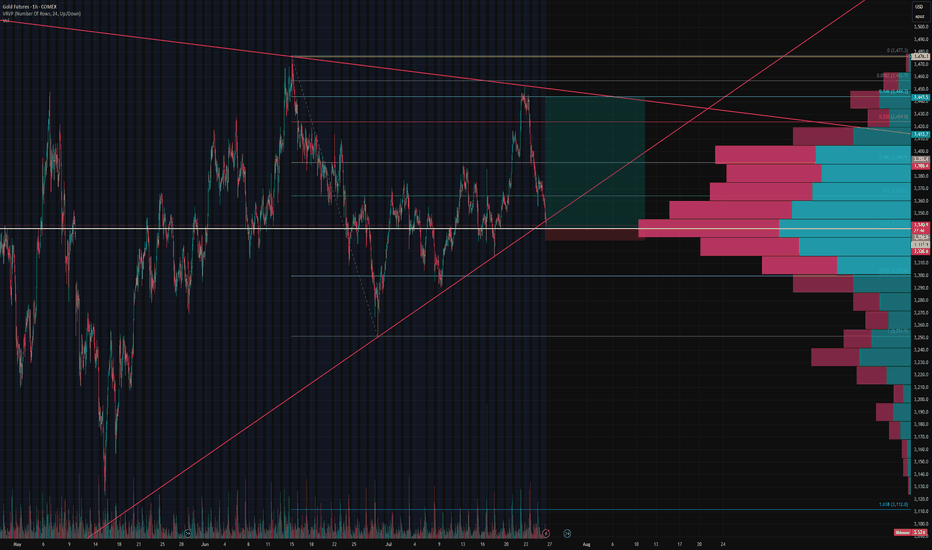

🔴 Strong Support Zone (3,278 – 3,299 USD)

This zone has been highlighted as a key institutional level where buyers have consistently stepped in.

It aligns with previous Breaks of Structure (BOS), confirming its historical significance.

📉 Recent Price Action:

Price is retracing from the highs of around 3,439 USD and is approaching the strong support zone again.

A possible liquidity grab near the support is anticipated before a bullish reversal.

🔄 Break of Structure (BOS):

Multiple BOS marked indicate shifts in market direction and the presence of aggressive buying/selling phases.

These BOS events help identify trend continuation or reversal points.

🟢 Bullish Fair Value Gap (FVG):

A bullish FVG is present, indicating imbalance in price movement where institutions may look to fill orders.

Price previously reacted positively to this zone, indicating unfilled demand.

📈 Target Area:

A clearly marked target at 3,440.487 USD, which aligns with Buy-Side Liquidity, suggests a potential liquidity run.

This implies smart money may drive price upwards after collecting liquidity below support.

Volume Profile (VRVP):

The horizontal volume bars show the highest traded volume areas, providing confirmation for key support zones and BOS reactions.

🧠 Educational Insights:

BOS (Break of Structure) is used by institutional traders to spot shifts in trend. It typically signals continuation or reversal when aligned with liquidity concepts.

Liquidity Zones (like buy-side or sell-side liquidity) often serve as magnets for price; smart money aims to trigger orders and trap retail traders.

Fair Value Gaps represent imbalances where price moved too fast; institutions may return to these zones to execute pending orders.

Volume Profile Analysis helps in understanding where the most buying/selling occurred—confirming support and resistance zones.

📌 Strategy Suggestion (For Learning Only):

Entry Idea: Wait for price to tap the strong support (ideally sweep liquidity slightly below).

Confirmation: Look for bullish engulfing or BOS on lower timeframe to confirm reversal.

Target: 3,440 area where buy-side liquidity resides.

Stop Loss: Below the strong support (near 3,270 level) to protect against deeper liquidity grabs.

📢 Disclaimer (Educational Use Only):

This analysis is for educational purposes and not financial advice. Trading involves significant risk; always do your own research or consult a financial advisor.

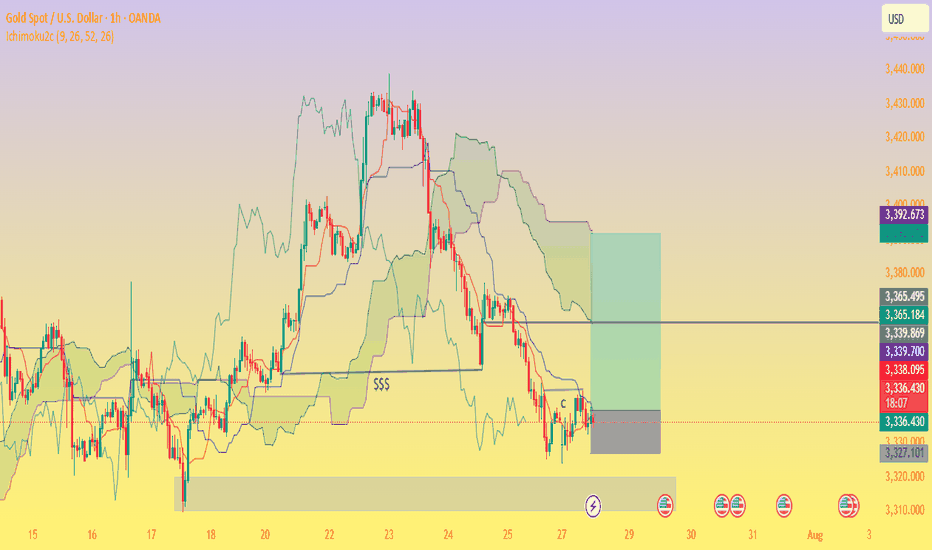

XAU/USD 1H – Range Consolidation Below Ichimoku Cloud. Chart Review & Technical Insight

1. Ichimoku Cloud & Overall Structure

Price is below the Ichimoku Cloud, with the cloud ahead sloping downward—indicative of bearish short‑term momentum and resistance overhead as long as the cloud holds above price.

The Kijun-sen (blue) line is above the Tenkan-sen (red), reinforcing the bearish bias on this timeframe.

2. Price Action & Key Zones

A support zone around 3,327–3,330 USD/oz is visible, underpinned by multiple rejection taps and price consolidation (“$$$” zone). A clean break below could open the path toward the 3,320’s or lower imbalance region.

On the upside, resistance lies near 3,339–3,340, backed by the cloud’s lower boundary and the Kijun-sen level.

The highlighted green rectangle appears to signal a potential bullish breakout target zone toward 3,365–3,392, contingent on recovery above the cloud.

3. Momentum & Trade Considerations

Momentum is weak, with price moving sideways inside a low‑volatility rectangle on diminishing volume and few directional impulses.

Possible ABC corrective structure is forming as marked, suggesting price may oscillate sideways or continue correcting within established bounds.

A bullish scenario would require clearing the Ichimoku Cloud and resistance at 3,340–3,360 USD.

Conversely, a bearish breakdown below ~3,327 could confirm continuation deeper into the 3,320s or toward the next significant demand zone near 3,300 USD.

.

✅ Summary

Bias: Slightly bearish to neutral until price can clear the Ichimoku Cloud.

Key Levels to Watch:

Support: 3,327–3,330 (immediate), then 3,320–3,300.

Resistance: 3,339–3,365, cloud top near 3,365, further target zone 3,392.

Scenarios:

Bullish breakout: Close above cloud → potential rally toward 3,365–3,392.

Bearish breakdown: Close below 3,327 → deeper correction toward 3,320 and lower imbalance areas.

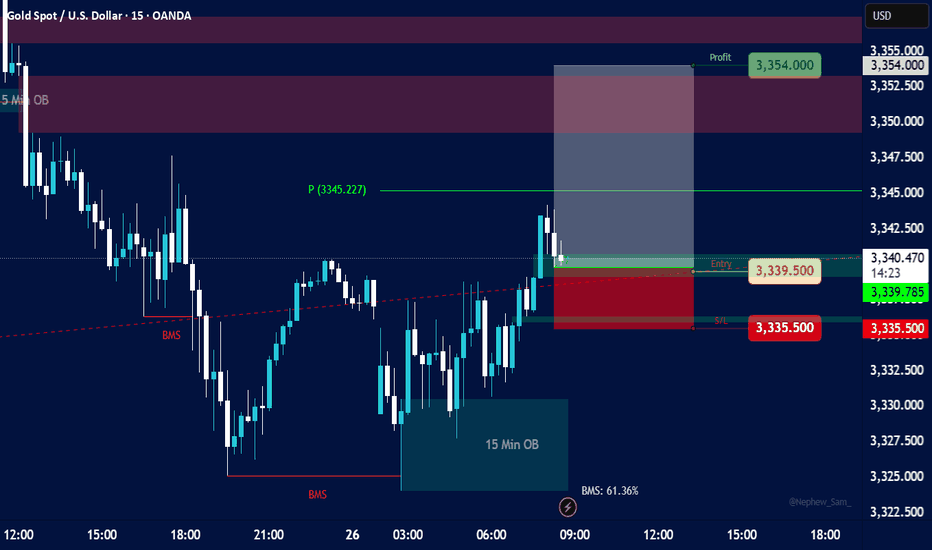

15-minute timeframe for XAU/USDKey Elements and Observations:

Price Action:

The price initially shows a downtrend, breaking below a previous low, indicated by "BMS" (likely "Break in Market Structure" or "Break of Market Structure").

Following the break, the price consolidates and then shows a strong upward movement, breaking above a resistance level, again marked by "BMS." This suggests a potential shift in momentum from bearish to bullish.

Order Blocks (OB):

5 Min OB (Blue Box, Top Left): There's a "5 Min OB" marked at a higher price level earlier in the chart. This represents a bearish order block, where significant selling pressure was previously observed.

15 Min OB (Teal Box, Bottom Right): A "15 Min OB" is identified at a lower price level (around 3326.00 - 3330.00). This is likely a bullish order block, indicating an area where institutions or large players placed buy orders, leading to a bounce in price.

Break in Market Structure (BMS):

Two "BMS" labels are visible:

The first BMS (red dashed line below 3330.00) indicates a break of a support level during the downtrend.

The second BMS (red dashed line above 3330.00) indicates a break of a resistance level during the subsequent uptrend, confirming a potential shift in market bias to bullish.

Entry, Stop Loss, and Take Profit (Trade Setup):

Entry (Green Line): The suggested entry point for a long (buy) position is at approximately 3339.50. This entry aligns with a retest of a previous resistance level that has now turned into support, or potentially the lower boundary of a small bullish order block or fair value gap.

Stop Loss (Red Line/Red Box): The stop loss is set at 3335.50. This is placed below a recent low or significant support level, specifically within a red-shaded area that likely represents a "Supply/Demand" zone or an area where the trade would be invalidated.

Take Profit (Green Line/Green Box): The take profit target is 3354.00, resulting in a "Profit" of 3354.00. This target is placed at a significant resistance level or an area where price might reverse. The white shaded box above the entry, extending to the take profit, highlights the potential profit zone.

Risk-Reward Ratio: While not explicitly calculated, the visual representation suggests a favorable risk-reward, with the potential profit (green box) appearing larger than the potential loss (red box).

Pivot Point (P):

A "P (3345.227)" is marked on the chart, likely indicating a pivot point, which can act as a dynamic support or resistance level. The current price is trading above this pivot point, further supporting a bullish bias.

"BMS: 61.36%" (Bottom Right):

This percentage likely refers to a "Break in Market Structure" metric or a specific trading indicator that quantifies the strength or probability of the market structure shift. 61.36% suggests a reasonably strong confirmation.

Implied Trading Strategy:

The chart depicts a bullish reversal strategy, likely based on "Smart Money Concepts" or "ICT" (Inner Circle Trader) principles. The strategy involves:

Identifying a shift in market structure: Price breaking highs after breaking lows, signaling a change from bearish to bullish.

Utilizing Order Blocks: Using the 15 Min OB as a foundational support level and potentially looking for entry confirmations around it.

Waiting for a Retest/Pullback: The entry around 3339.50 suggests waiting for a pullback after the initial bullish impulse. This could be a retest of a broken resistance level, a fair value gap (FVG), or a small bullish order block within the larger 15 Min OB.

Placing Stop Loss Strategically: Below a significant low or invalidation point.

Targeting Previous Highs/Resistance: Setting the take profit at a logical resistance level where previous selling pressure was observed.

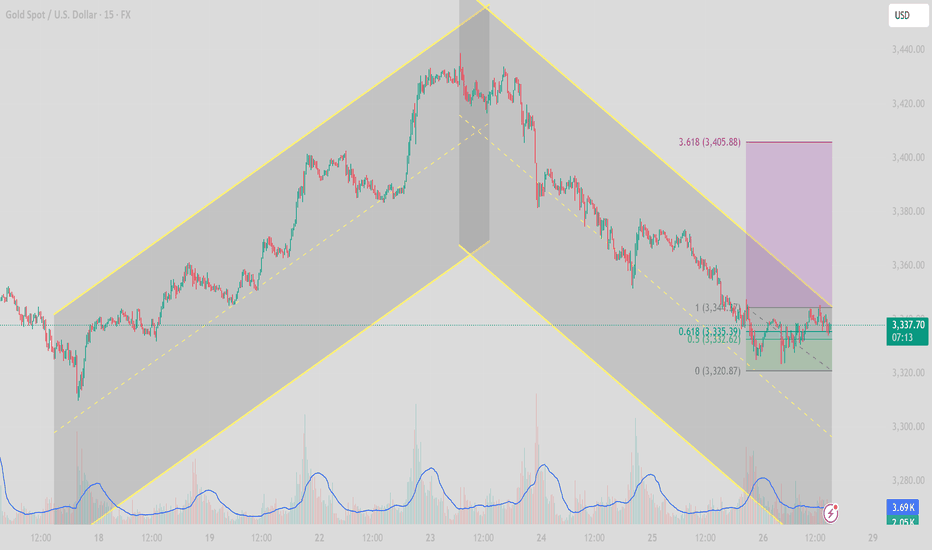

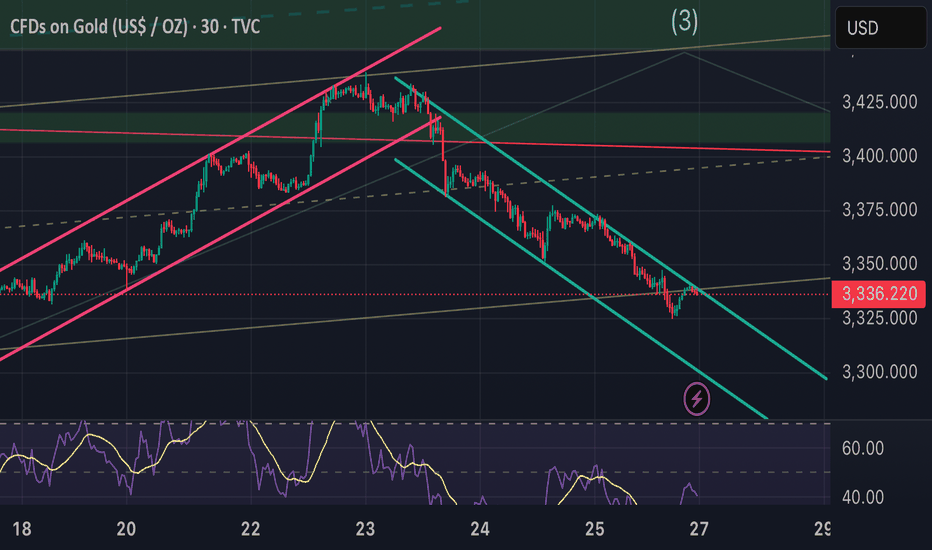

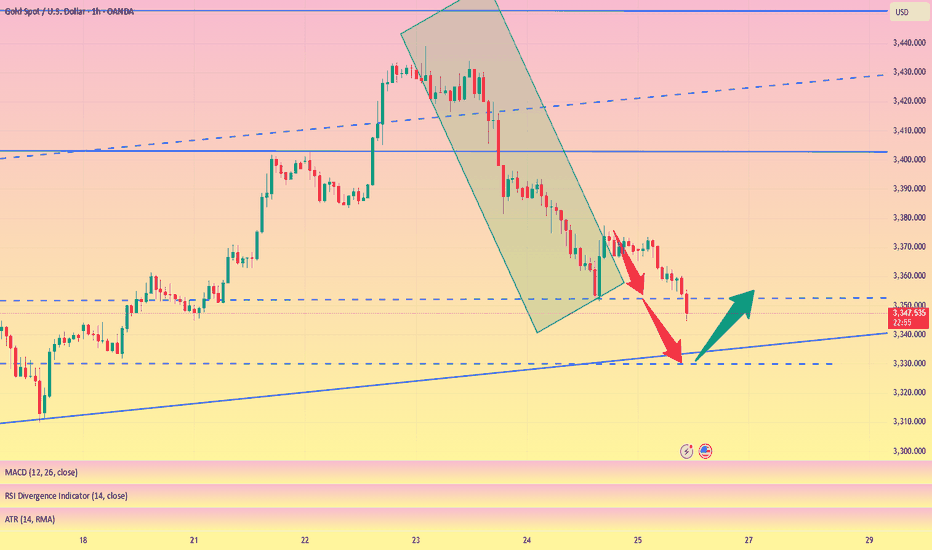

[XAUUSD] Gold Price Analysis July 28Symmetrical Channel Structure and High-Probability Trading Strategies

In today’s trading session (July 28), the XAUUSD 15-minute chart reveals a clear symmetrical channel pattern, indicating a technical correction after a previous strong uptrend.

1. Trend Structure

Phase 1 (July 18–23): Price moved within an ascending channel, forming higher highs and higher lows — a clear bullish structure.

Phase 2 (July 23–26): After peaking, price reversed into a descending channel, establishing a bearish sequence of lower highs and lower lows.

Currently, price is consolidating near the lower boundary of the descending channel, testing short-term support.

2. Key Support and Resistance Levels

Price Level

Technical Significance 3,360 – 3,365

Key resistance zone – top of descending channel 3,345

Dynamic resistance – EMA21 on M15 3,320 – 3,315

Crucial support zone – lower boundary of channel 3,300

Psychological support & prior swing low (July 10)

3. Price Action and Indicators

Volume has gradually decreased, signaling potential weakening of selling momentum.

RSI on M15 has rebounded from the oversold zone, currently moving above 40, suggesting a short-term technical bounce.

EMA21 & EMA50 are still sloping downward, confirming short-term bearish pressure.

4. Intraday Trade Scenarios

✅ Scenario 1: Rebound Play from Channel Support

Entry: 3,320 – 3,325 (after bullish confirmation candle)

Stop Loss: Below 3,312

Take Profit: 3,345 – 3,355 (resistance zone & mid-channel)

⚠️ Scenario 2: Trend-Following Short from Resistance

Entry: 3,345 – 3,350 (if price rejects at EMA21 or channel resistance)

Stop Loss: Above 3,360

Take Profit: 3,320 – 3,310

5. Strategy Outlook

XAUUSD remains in a corrective bearish phase after a strong rally. As long as the 3,312 level holds, there’s potential for a technical rebound during the London–New York session. However, sellers remain in control unless price breaks and closes above 3,360.

Follow for more real-time gold strategies. Save this post if you found it helpful!

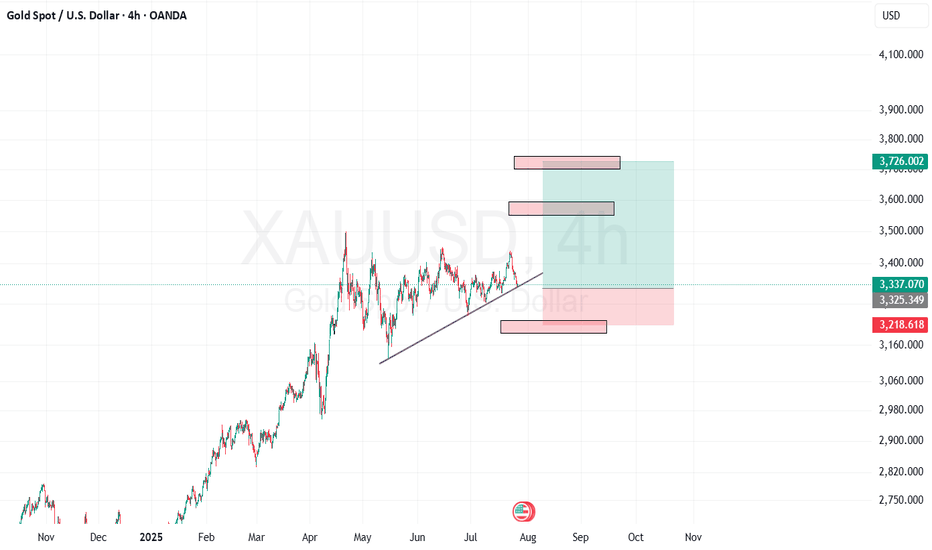

XAUUSD📈 XAUUSD (Gold) – Buy Setup | 4H Timeframe

Market Context:

After continuous selling, price is now testing a strong 4H and Daily support zone.

A clear bullish candle has formed, signaling potential reversal.

— proper SL is essential.

🔔 Trade Plan: Buy Gold

Entry: Stop Loss: TP mentioned in charts

GoldXau usd daily analysis

Time frame 4 hours

Gold is moving up and down in the yellow triangle, you can see on the chart

I think Gold move up to 3450 $ and if we have no positive news, it will drop to the down side. This analysis has good benefit and Risk rewards ratio is 3

On the other hand if Gold break the 3320 $ my analysis is faild and must listen to the economic news

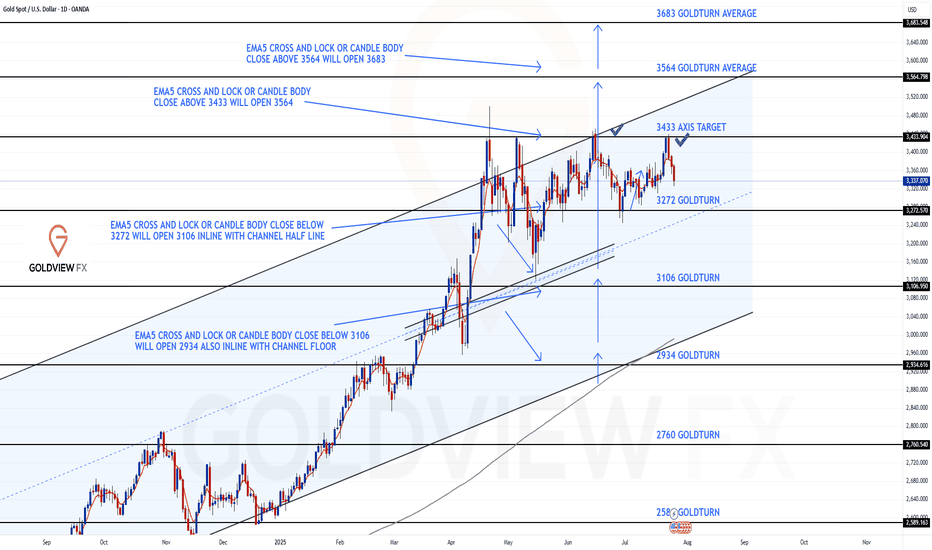

GOLD DAILY CHART ROUTE MAPHey Everyone,

Daily Chart Update – Bounce + Rejection: Structure Still Dominates

Just a quick follow up on our range structure, we got exactly what we were anticipating.

Price gave us the perfect bounce off 3272, launching into 3433 for THE test of resistance. That move delivered another clean 160+ pip rotation, once again showing how laser accurate the structure has been.

As expected, 3433 held as resistance, and the lack of a break and hold above confirms another clean rejection. The range between 3272 support and 3433 resistance remains firmly in play, and structure continues to govern price action to the pip.

Here’s where we are now:

🔹 Range Still Active

Price continues to rotate inside our 3272–3433 box. Until we see a clean break and close beyond either boundary, we’ll keep playing the range.

🔹 No Breakout = No Change

The failure to break and lock above 3433 confirms rejection. We’re still looking for EMA5 lock for potential breakout confirmation, until then, range trades rule.

🔹 Precision Holds

Both 3272 and 3433 have now been tested and held perfectly. The respect these levels continue to show reaffirms their importance in our roadmap.

Updated Key Levels

📉 Support – 3272

Continues to act as a major pivot. Valid long entries remain on dips into this zone, unless a breakdown occurs.

📈 Resistance – 3433

Now officially tested and confirmed. Watching closely for any future breakout attempts or another rotation lower.

Thanks again for all the amazing support. Sticking to the plan, trading the structure, and staying disciplined.

Mr Gold

GoldViewFX

XAU/USD Breakout Playbook – Rob the Market!🚨💰 GOLD HEIST IN MOTION! | XAU/USD Thief Trading Strategy (Breakout Edition) 🏴☠️

🧠 Strategic Mindset | Not Your Average Chart Talk

Yo Market Bandits & Pip Hunters – welcome to the underground playbook!

This isn't your grandma’s chart breakdown – it’s a Thief Trading Takedown on XAU/USD (Gold), where we’re not chasing the market… we’re outsmarting it.

THE MASTER PLAN: Enter Like a Ghost, Exit Like a King 👑

📍 ENTRY POINT – The Break-In Begins!

💥 Breakout Level: Watch for 3370.00 resistance to crack – this is our green light.

🕵️♂️ Entry Style:

• Buy Stop above MA resistance zone (fast & clean)

• OR Buy Limit near swing low zones after confirmation pullback (sniper entry)

🧠 Thief Tip: Wait for the breakout to happen. No orders, no SL before it. Patience is profit.

🔄 Layer the Entry:

• Deploy DCA (Dollar Cost Averaging) or scaling entries with precision

• Build positions like stacking cash bags — smart, silent, and calculated

🛡️ PROTECT THE LOOT – Stop Loss Logic 💣

📍 SL Guide: 3310.00 (4H swing low – update as price structure evolves)

🔥 SL ONLY comes after breakout. Set it too early? That’s how you get caught.

⛔ No pre-breakout orders. No early SL. Stay invisible till it's go time.

🎯 THE ESCAPE – Profit Like a Phantom 🚀

💸 Take Profit: 3450.00

📉 Scalpers: Trail SL as price pushes – never give back stolen pips

🌀 Swing Traders: Monitor resistance layers – don’t let the bulls turn on you

🧭 CONTEXT – Why This Setup?

🔍 Macro Snapshot:

• Trend: Neutral/Bullish Lean

• Influencers: COT reports, geopolitical tension, dollar flows

• Sentiment Shifting – watch the herd, but don’t run with it

🗞️ News Risk: Don’t get wrecked by events! Avoid entries during high-impact news.

🚨 Trailing SL is your best weapon during volatility.

⚡ POWER UP THE CREW – Support the Movement

💬 Drop a comment, hit the 🔥 like button, and share with your trading gang

More Thief Trading blueprints coming soon – bigger breakouts, cleaner setups

⚠️ STAY SHARP, THIEVES!

This ain't financial advice – it’s an outlaw’s edge on the market.

Trade smart. Risk well. Protect the bag.

🏴☠️ XAU/USD GOLD HEIST IN PROGRESS... Join the Movement. Let’s Rob the Market.

GOLD (XAU/USD) SHORT TRADE PLAN

July 25, 2025

Trade Overview (My setup)

- Direction: Short (SELL)

- Entry Price: $3,330

- Take-Profit: $3,270

- Stop-Loss: $3,370

- Lot Size: 0.18 lots (18 oz)

- Risk: $720

- Reward: $1,080

- Risk/Reward Ratio: 1.5 : 1

Technical Analysis Supporting the Bearish Bias

1. Price Structure & Trend

- Descending channel observed on the 4H chart - strong short-term bearish signal.

- Series of lower highs and lower lows confirms bearish trend.

- Price is testing $3,325-$3,300 support - breakdown opens downside to $3,270-$3,250.

2. Key Support/Resistance Zones

- Key support: $3,300 being tested.

- Resistance: $3,360-$3,370 zone - logical stop-loss location.

3. Indicator Confirmations

RSI (4H): ~35-40, bearish territory, no bullish divergence.

Moving Averages: Price below 50 EMA and 200 EMA - bearish crossover.

MACD: Bearish crossover, histogram confirms selling momentum.

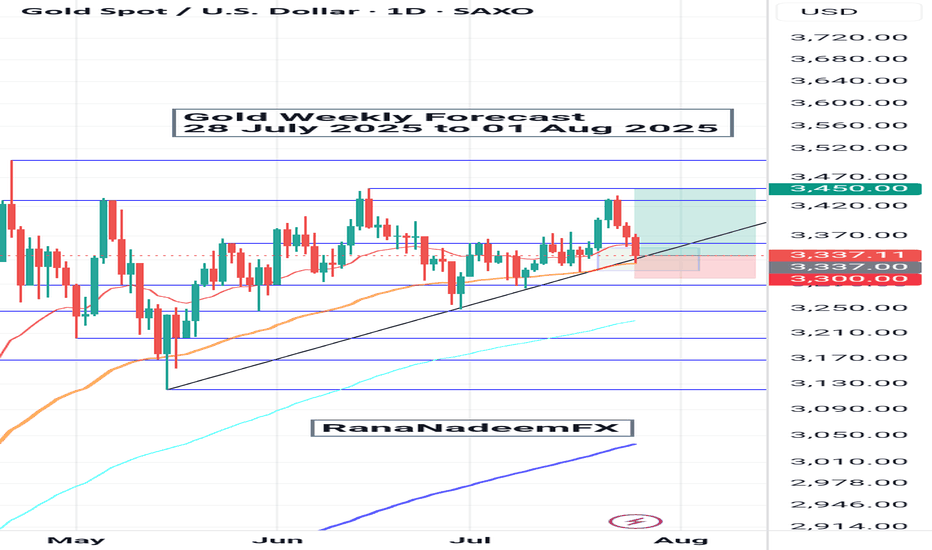

Gold Weekly Forecast (28 July – 01 Aug 2025)📈 Gold Weekly Forecast (28 July – 01 Aug 2025)

By: RanaNadeemFX

🔍 Technical Overview:

Gold (XAUUSD) is currently trading around $3,337, showing rejection near the previous resistance zone of $3,430–$3,450. The market has recently pulled back after testing this resistance and is now approaching a confluence support area formed by:

Dynamic trendline support (ascending black line)

Horizontal support zone around $3,300–$3,320

50-day EMA providing additional support

This zone is critical and likely to act as a bullish demand area, provided no major fundamental risk-off event occurs.

📌 Key Levels to Watch:

Support Zones: $3,300 / $3,270

Resistance Zones: $3,430 / $3,450

📊 Trade Setup Highlighted on Chart:

A buy opportunity is marked from current price levels with a potential bounce back towards $3,430–$3,450.

Entry Zone: Around $3,330 to 37

Target: $3,450

Stop Loss: Below $3,300

This setup offers a favorable risk-reward ratio, assuming price respects the support and resumes the upward trend.

🧠 Bias: Bullish (as long as price stays above $3,300 support zone)

⚠️ Note: Keep an eye on upcoming US economic data releases and geopolitical developments which could add volatility to gold prices.

📌 Follow for more: @RanaNadeemFX

#GoldAnalysis #XAUUSD #WeeklyForecast #TechnicalAnalysis #TradingView #ForexTrader #PriceAction #GoldOutlook #SmartMoneyConcepts

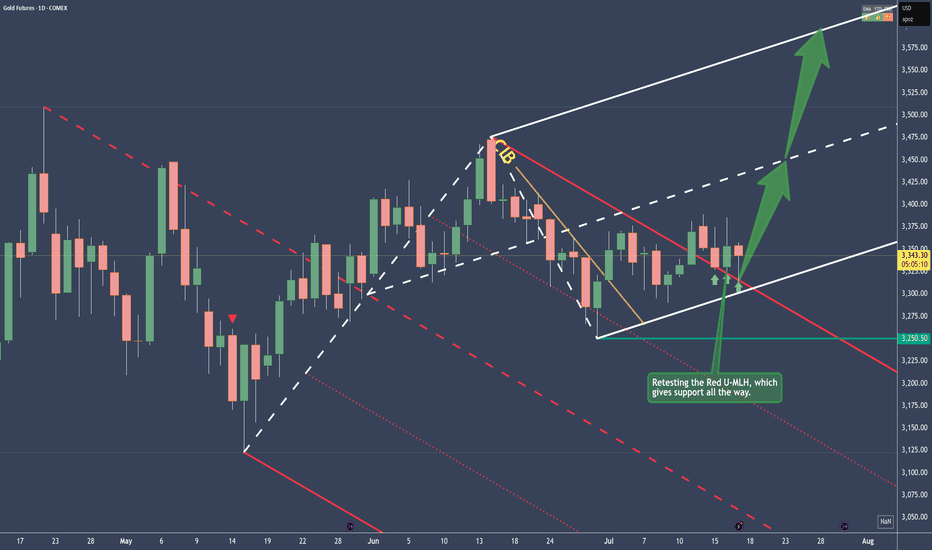

Gold - Bullish and here's whyPrice traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior.

From there on, sideways action, until the break of the Red U-MLH happened.

After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long Down-Wick. That's indicates good strenght.

To me this looks like a good long trade, but as everytime, play it save and don't let greed eat your brain ;-)

XAUUSD Analysis : Reversal Zone & Trendline Break Setup 🧠 Market Breakdown (Based on MMC Concepts)

Gold (XAU/USD) recently touched an All-Time High, followed by a sharp correction respecting a clean descending trendline — confirming strong selling pressure in the short term.

After price completed a Channel Supply zone (highlighted), it dropped significantly and created a 2x Supply Structure along with a QFL (Quasimodo Failure Level) — a strong indication of liquidity engineering by smart money.

Now, price has entered the Major Reversal Zone, which aligns with a key minor structural demand level. The reaction here becomes highly important, as it could mark the beginning of a new bullish leg.

📌 Technical Conditions

Trendline (Condition 1): Still active; breakout confirmation required for bullish entry.

Reversal Zone (Demand Area): Price currently reacting; signs of rejection forming.

Smart Money Behavior: Liquidity sweep + QFL zone = potential institutional accumulation.

Momentum Watch: Look for bullish engulfing or strong pin bar as confirmation.

🎯 Price Levels to Watch

Upside Targets:

🔹 TP1: 3,360 – 3,380

🔹 TP2: 3,420 – 3,440

Invalidation Zone:

🔻 Break and close below 3,300 = bearish continuation likely.

💡 Conclusion

Gold is approaching a decision point. If this reversal zone holds and we break the trendline, we could see a strong rally back toward previous supply zones. However, failure to hold could bring price lower for further liquidity grabs.

Stay patient. Let price confirm.

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 ConfluenceGold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence

Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive.

Price is now approaching a key confluence zone at $3,336 , where:

The 0.618 fib retracement from the recent swing low to high aligns perfectly,

The ascending trendline support (respected multiple times since May) intersects, and

The oint of Control (POC) from the visible volume profile shows dominant volume transacted.

This area represents a high-probability support level where bulls may attempt to defend again. We’re monitoring for reaction and potential entry signals around this level. A break below would invalidate the rising wedge structure and shift bias toward lower fib extensions.

Wait for 3330 to buy the bottom and reduce unnecessary operation#XAUUSD

We have made good profits from short selling yesterday. Currently, gold has fallen to 3350📎. The 4HMACD death cross has increased in volume and is expected to continue to decline. Consider going long near 3330📈. I don’t think it is prudent to bottom out at 3340. Move forward steadily on Friday and reduce unnecessary operations⚖️.

🚀 BUY 3335-3330

🚀 TP 3345-3362

Be alert to new lows, pay attention to 3350 and go long at 3330📰 News information:

1. Tariff issues

2. Next week's NFP data

📈 Technical Analysis:

Last night, gold rebounded to only around 3377 before starting to fall back. Our judgment that the current rebound is weak is completely correct. 3350 is the support point of the bottoming out and rebounding to nearly $20 last night. Whether the European session can go down to 3350 will determine the trend of gold.

From the daily chart, the daily line has fallen for two consecutive days, suggesting that the price may continue to fall today. At present, we need to pay attention to this week's starting point of 3344-3345, and then the 3330 line below. The extreme decline is 3320-3310. At the same time, the narrowing of the daily Bollinger Bands is also paving the way for next week's NFP data.

From the 4H chart, the current MACD indicator crosses and increases in volume, and the middle track of the Bollinger Bands and SMA30 basically overlap near 3388. As for the hourly chart, the upper pressure is mainly concentrated near 3375-3377, which is also the high point of the rebound last night. If gold rebounds directly upward and encounters pressure and resistance at 3375-3385 for the first time, you can consider shorting and strictly implement stop loss.

Overall, if the current market falls to 3350-3345 for the first time and gets effective support, you can consider going long with a light position, defend 3340, and look to 3356-3362; if the decline is strong and continues to fall below 3350, the best stable long point for the day is 3330-3320, defend 3310, and earn $10-20 to leave the market.

🎯 Trading Points:

BUY 3350-3345

TP 3356-3362

BUY 3330-3320

TP 3345-3360

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

From Breakdown to Breakout? Gold Eyes Support Based Reversal!Gold is approaching a critical support area.

Previously, the price was holding above a key support level, but that zone has now been breached and is likely to act as resistance going forward. However, just beneath the current price, there's a well-established support level still intact—reinforced further by the presence of a bullish Fair Value Gap (FVG).

This setup hints at a possible reversal or a short-term surge from this zone. If market conditions align, gold may stage a pump from here. Keep this level on your radar—it could turn into a decisive point for price direction.

🛡 Always conduct your own analysis before taking any trades. DYOR.

XAUUSDHello Traders! 👋

What are your thoughts on GOLD?

Gold entered a corrective phase after reaching the top of its ascending channel. Price is now approaching the channel bottom, which coincides with a key support zone.

As long as the channel support holds, we expect a bullish reaction from this area, potentially driving price back toward the next target level.

The uptrend remains valid as long as price does not break and close below the lower boundary of the channel.

A rebound from channel support may signal the start of the next upward leg.

Invalidation occurs only if price breaks and holds below the channel.

💡 Will gold bounce from channel support and resume its rally? Share your view in the comments! 🤔👇

Don’t forget to like and share your thoughts in the comments! ❤️