GOLD 12H CHART ROUTE MAP ANALYSIS FOR THE WEEK12H GOLD Chart: Updated Analysis and Strategic Outlook (10the Feb 2024)

Hello Traders,

Here’s the latest 12H GOLD chart update, featuring a detailed review of recent movements and actionable insights for the upcoming market sessions. Our diligent tracking since October 2023 has consistently delivered 100% target accuracy, as evidenced by the marked Golden Circle areas on the charts. Let’s dive into the highlights and what lies ahead.

Previous Chart Review

* Entry Level 2814: ✅ DONE

* TP1 2858: ✅ DONE

* The price broke above the resistance level 2858 and reached a new ATH at 2886 last week.

* EMA5 held above 2858, which fueled the strong bullish push during Friday’s NFP release.

What’s Next for GOLD? Bullish or Bearish?

The price is currently consolidating around 2858, with EMA5 playing a crucial role in determining the next trajectory.

Resistance Levels: 2903, 2948, 2993

Support Levels (Activated GOLDTURN Levels):

2813 (Critical Weighted Level)

2770 (Critical Weighted Level)

2710 (Critical Weighted Level)

2664 (Major Support Level)

2599 (Lower Major Demand Zone and Retracement Range)

EMA5 Behavior (Red Line):

* Currently sitting below TP1 (2858) but indicating sustained bullish momentum.

* EMA5’s crossing and locking above or below key levels will signal the next move:

Bullish Scenarios:

Scenario 1: If EMA5 crosses and locks above TP1 (2858), expect a bullish rally toward 2903.

Scenario 2: If EMA5 crosses and locks above TP2 (2903), the next target is 2948.

Scenario 3: A further cross and lock above 2948 could drive the price to 2993.

Bearish Scenarios:

If EMA5 fails to sustain above TP1 (2858) and resistance levels hold, expect a pullback toward support zones:

Scenario 1: A cross and lock below Entry (2813) could lead to a decline toward 2770.

Scenario 2: A further drop below 2770 may target 2710 as the next support level.

Scenario 3: Continued bearish momentum could push the price toward 2664 and, ultimately, 2599 (Retracement Range).

Short-Term Strategy:

Anticipate possible reversals at weighted GOLDTURN levels 2813 and 2770.

Leverage 1H and 4H timeframes to capture pullbacks around these levels.

Target 30–40 pips per trade, focusing on shorter positions for effective risk management.

GOLDTURN levels provide reliable bounce opportunities, allowing you to buy at dip levels.

Long-Term Outlook:

Maintain a bullish bias while using pullbacks as buying opportunities.

Buying near key support levels ensures better entry points and mitigates risks, avoiding the pitfalls of chasing tops.

Final Thoughts:

Trade with precision, discipline, and confidence. Our accurate, multi-timeframe analysis equips you to navigate the market effectively. Stay updated with daily insights to remain ahead of market trends.

We appreciate your support! Don’t forget to like, comment, and share this post to help others benefit.

Best regards,

📉💰 The Quantum Trading Mastery Team

Goldminers

Gold (XAU/USD) Technical Analysis – Bearish Rejection Expected fThis chart represents an analysis of Gold (XAU/USD) on a 30-minute timeframe. Below is a breakdown of the key elements:

Key Observations:

Downtrend Formation

The price is trading within a downward channel, marked by two descending trendlines.

The overall trend appears bearish, indicating potential further declines.

Supply Zone (Resistance) Around $3,025 - $3,030

The price is approaching this key resistance area.

If the price fails to break above, it could lead to a rejection and continuation of the downtrend.

Demand Zone (Support) Around $3,000 - $3,006

This is the target area where buyers may step in to support the price.

A downward move towards this zone is anticipated.

Projected Price Movement

The blue arrows suggest a bearish scenario.

A rejection from the supply zone is expected to push the price downward.

The final target is the demand zone near $3,000.

Conclusion:

Bearish Bias: The price is currently in a downtrend, with the expectation of a rejection from resistance and a move toward the lower support zone.

Confirmation Needed: Watch for price action signals, such as rejection wicks or bearish candlesticks, to confirm the downward move

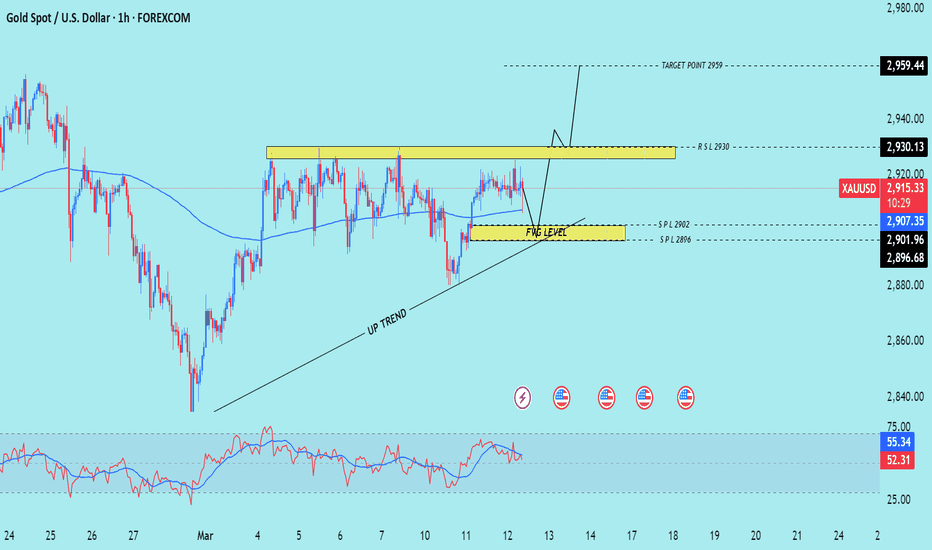

GOLD TRADING PONT UPDATE >READ THE CHAPTIANBuddy'S dear friend 👋.

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders Gold 1H time. Look 👀 first take FVG level that take entry buying said target point 2959 New ATH wait for FVG level good luck 🤞

Key Resistance level 2930 + 2959

Key Support level 2909 - 2902 - 2896

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

XAU/USD "The Gold vs U.S Dollar" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold vs U.S Dollar" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 2960.00

Sell Entry below 2925.00

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

-Thief SL placed at 2920.00 for Bullish Trade

-Thief SL placed at 2955.00 for Bearish Trade

Using the 30min period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 3030.00 (or) Escape Before the Target

-Bearish Robbers TP 2880.00 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

XAU/USD "The Gold vs U.S Dollar" Metal market is currently experiencing a Neutral trend (there is a higher chance for Bullishness)., driven by several key factors.

⭐Fundamental Analysis

The current price of XAU/USD is 2940.00, indicating a strong bullish trend. The gold market is driven by various fundamental factors, including:

Inflation concerns: Rising inflation expectations and a potential decline in the US dollar may boost gold prices.

Interest rate policies: The US Federal Reserve's interest rate decisions may impact gold prices.

Global economic uncertainty: Ongoing trade tensions, Brexit uncertainty, and geopolitical risks may drive safe-haven demand for gold.

⭐Macro Economics

The global economic outlook is uncertain, with:

Recession concerns: Weak economic data and trade tensions have raised concerns about a potential global recession.

Central bank rate hikes: The US Federal Reserve and other central banks may continue to raise interest rates, impacting currency markets.

Inflation expectations: Rising inflation expectations may boost gold prices.

⭐COT Data

Commercial Traders: Net short 143,000 contracts (a decrease of 11,000 contracts from the previous week)

Non-Commercial Traders: Net long 104,000 contracts (an increase of 8,000 contracts from the previous week)

Non-Reportable Positions: Net long 39,000 contracts (an increase of 3,000 contracts from the previous week)

Open Interest: 544,000 contracts (a decrease of 10,000 contracts from the previous week)

⭐Market Sentimental Analysis

Market sentiment for XAU/USD is:

Bullish: 62% of investors expect gold prices to rise, driven by inflation concerns and global economic uncertainty.

Bearish: 21% of investors expect gold prices to fall, driven by potential US dollar strength and interest rate hikes.

Neutral: 17% of investors remain neutral, awaiting further market developments.

⭐Intermarket Analysis

The XAU/USD pair is highly correlated with:

USD Index: A weaker US dollar may boost gold prices.

10-Year Treasury Yield: Lower yields may increase demand for gold.

S&P 500: A decline in the S&P 500 may drive safe-haven demand for gold.

⭐News and Events

Upcoming events that may impact the XAU/USD pair include:

US Federal Reserve Interest Rate Decision: March 15, 2025

US GDP Growth Rate: March 25, 2025

US Inflation Rate: March 29, 2025

⭐Seasonality

Gold prices tend to be:

Stronger during the winter months: Due to increased demand for jewelry and coins.

Weaker during the summer months: Due to decreased demand for jewelry and coins.

⭐Positioning Analysis

Traders are advised to:

Consider long-term investments: As gold prices are expected to rise due to inflation concerns and global economic uncertainty.

Monitor market volatility: As interest rate hikes and US dollar strength may impact gold prices.

Diversify portfolios: By investing in other assets, such as currencies, stocks, or bonds.

⭐Next Trend Move

The XAU/USD pair may experience a:

Bullish move: Driven by inflation concerns and the US Federal Reserve's potential interest rate hikes.

Bearish move: If the US dollar strengthens or global economic uncertainty increases.

⭐Overall Summary Outlook

The XAU/USD pair is expected to experience volatility due to:

Global economic uncertainty: Ongoing trade tensions, Brexit uncertainty, and geopolitical risks.

Inflation concerns: Rising inflation expectations and a potential decline in the US dollar.

Central bank rate hikes: The US Federal Reserve and other central banks may continue to raise interest rates.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

GOLD(UPDATE)Hello friends

Considering that we are at a price ceiling and the power of buyers has decreased and we are witnessing the formation of lower ceilings, we can enter a sell transaction if the resistance level is not broken, of course with capital and risk management.

This analysis is reviewed only from a technical perspective.

*Trade safely with us*

GOLD TRADING POINT UPDATE > READ THE CHAPTIANBuddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders Gold 3 time frame 🖼️ looking FVG rejected point below 👇 2929+ 29209. Technical patterns). Weekly basis setup. )

Key Resistance level 2929 + 2957

Key Support level 2891 - 2848

2832

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

GOLD TRADING POINT UPDATE >READ THE CHPATIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders list time post signals Hit sucksfully My target point ) Now Gold making choch FVG level) FVG level 2897 + 2906 down 👇 👎 trend 📉 point below 👇 ⬇️ target point 2868- 2859 first. Hit sucksfully FVG level that take entry ☺️ 🥂 good luck 🤞

Key Resistance level 2897 + 2906

Key Support level 2868- 2859

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

General Market Ramblings - $BTCUSD, $TSLA, $GDX, $DAL, $BBEUHi, all. Wanted to get something published for the first time in awhile. Unfortunately my mom passed away recently and that has been something I have been going through. It is therapeutic to record something and get it out to you all. I am approaching feature film length on this one, so kudos if you make it through the whole video.

I just wanted to discuss some general market thoughts here - especially as we are now in an interesting time. I hope you do find some value here! Believe me, this really is just scratching the surface of my market thoughts and the different stocks that I have thoughts on. But again, really just wanted to get something out to you guys. Even if you tune in for a minute or two, thanks for watching! It means a lot. Feel free to provide feedback as well of course.

As always, a lot of my thoughts are based on the "Time @ Mode" method that we discuss in the Key Hidden Levels TradingView chat.

Also, as always, these are strictly my thoughts and opinions. I am not a professional and I encourage you to do your own research before making investment/trading decisions. These opinions are not financial advice.

Assets in this video: COINBASE:BTCUSD , COMEX:GC1! , NASDAQ:TSLA , AMEX:GDX , CBOE:BBEU , NYSE:DAL , maybe others I forgot about.

3.7 Gold wedge wide consolidation, waiting for non-agricultural 2928 is the defensive point, short near 2923, if weak, it is 19-20 here, once the four-hour below the medium-term moving average, it is dispensable for the evening data, basically it is a rebound short, pay attention to the three points below 95-84-65. Personally, I expect that today will be a Black Friday.

Trading is for profitable trading, not for gambling or trading, so traders must understand what operations to take at what stage the price is! Traders are not always long or short, and traders always change with market changes! Traders must have their own defense system to control risks!

Gold must be watched tonight.Everyone, open your eyes. From the current technical trend, this wave of rise has been under continuous pressure near 2920. The short-term upward momentum is insufficient. The short-term high-level oscillation of 2915-2920 is maintained.

At present, the trend of gold today is slightly weak, and it has not continued the bottoming out and rebounding the day before yesterday. Because the current position is close to the previous high point, and the current risk aversion sentiment has eased slightly, the impact of breaking the previous high again is not strong, so we can see that gold has been oscillating around the 2914-2917 range, and most of the time there is not much breakout trend!

Operation plan, today, focus on whether it will break through 2920 again. If the US market still cannot break through 2920, you can directly short gold. If it breaks through 2920 again, it is not recommended to chase high. The strong pressure area above is concentrated in the 2925-2930 area, and the possibility of a sharp rise in the short term is not great. The support area below is concentrated in the 2895-2885 area. If it falls below the support point of around 2860 again tonight, you can directly chase higher.

Gold futures intraday trading bibleAt present, from the technical trend, this wave of rise has been under pressure near 2910, and the short-term rise is insufficient. The short-term fluctuates at a high level. Although it broke a new high yesterday, the strength was obviously insufficient. It fell again after being under pressure near 2930. It is not recommended to continue chasing highs in the short term. According to the current trend, it is likely to fluctuate around a high range. Even if it does not break through, it will only be a correction in the short term, and the possibility of a sharp drop is not great. The gold price will continue to fluctuate in a high range, and the medium-term trend is still bullish.

XAUUSD: 6/3 Today's Market Analysis and StrategyGold technical analysis

Daily chart resistance 2957, support below 2892

Four-hour chart resistance 2930, support below 2887

One-hour chart resistance 2930, support below 2912

Gold news analysis: As the US tariffs on many countries continue to take effect, and more tariff plans for Europe and other countries are about to be implemented, gold's position as a safe-haven asset remains solid. Earlier this week, US President Trump imposed a 25% tariff on Canada and Mexico. However, to the surprise of the market, US Commerce Secretary Howard Lutnick hinted that some tariff relief may be provided to the two US neighbors. According to Bloomberg, Lutnick said in an interview with Fox Business Channel that there may be a way to reduce some tariffs. This news may put some pressure on the upward trend of gold prices in the short term. As tensions in the physical market ease, the extreme dislocation of gold prices is fading, indicating that the craze for shipping gold to the United States may have peaked. This change in supply and demand dynamics may also have an impact on the recent trend of gold prices. US Treasury yields have rebounded slightly, although there is still a long way to recover. The change of yield rate usually shows an opposite relationship with the gold price, which is also one of the factors that the market pays attention to.

Gold operation suggestion: Yesterday, gold experienced a wide range of long and short fluctuations in the volatile trading. The price rebounded slightly in the Asian and European sessions. The European session was suppressed below 2922 and fell back and fell. The US session accelerated downward and broke through the 2900 integer mark to reach 2894 and stabilized and began to rebound. Finally, it broke through the 2929 mark and began to fall and consolidate. The overall gold price formed a wide range of long and short fluctuations around the 2894-2929 mark.

From the current trend analysis, today's lower support continues to focus on the one-hour level 2912 first-line support and the daily level support 2892. The upper pressure focuses on the vicinity of 2930. Continue to rely on this range to participate in high selling and low buying during the day, and wait patiently for key points to enter the market.

Buy: 2892near. SL:2887 (can be entered repeatedly)

Buy: 2900near. SL:2895 (can be entered repeatedly)

Buy:2912near. SL:2908

Sell:2930near. SL:2935

Go long on gold 05-10, and continue to go long in the short termRecently, the market is also fermenting around the new US tariff policy and the US-Ukraine mineral agreement, which has triggered the Russian-Ukrainian war. Things that should have been clear have not been implemented, which has led to increased uncertainty. In addition, the Federal Reserve also plans to accelerate the pace of interest rate cuts due to the increased risk of economic downturn, so the current market trend is also very repeated. In terms of operation, it is still a repeated shock pattern before the non-agricultural data. From the trend point of view. Comparing long and short positions, long positions are still slightly stronger. At present, the gold price fluctuates in a narrow range around 2900. There is no major news to boost or suppress the gold price in the short term. Therefore, after consuming a certain amount of short-selling power, the bulls will regain control of the situation, and there will be very good trading opportunities for long gold. Now we are long gold around 2905-2910. The target is 2918-2928 area, wish us good luck! Brothers, have you followed me to go long on gold?

Want to expand profits but not expand profits, unclear about the direction, and don’t know how to analyze the market. If you are like this. Then you can try to change your trading style with a fast trading strategy. If you are interested, you can join my bottom article.

First go long gold, then go short goldThe current international gold price shows a typical head and shoulders bottom reversal pattern, with 2900-2905 below being the key support area for gold. From a technical perspective, it shows that gold has accumulated reversal momentum at the bottom after falling, and the release of ADP employment data may promote the accelerated rise of gold prices. Then the resistance above gold will first focus on the suppression of the 2930 line. If gold breaks through 2930, then we can test the key resistance area of 2945-2955, the historical high.

Therefore, in short-term trading, I advocate going long gold. When gold falls back to around the 2910-2900 area, we can go long gold.

In fact, as long as you grasp the rhythm, it is easy to profit from gold trading. If you don't know the accurate trading rhythm, you can follow my trading ideas. I post my trading ideas every day and I also post free trading signals on a regular basis. Many friends have given feedback that it is very helpful. If you want to learn market trading logic, or you want clear trading signals and make more profits, I can satisfy you. Follow the bottom of the article to enter for details!

3.4 Short-term technical analysis of goldLatest technical analysis of gold

Despite the rebound in gold prices in the Asian session on Monday, the technical side of gold prices deserves caution before making new bullish bets.

From a technical perspective, gold prices fell below the 23.6% Fibonacci retracement level of the rebound from December to February last year last week, which is seen as a key trigger by sellers. In addition, oscillators on the daily chart have just begun to gain negative traction and support the prospect of gold prices continuing the corrective pullback from the historical peak.

Therefore, any subsequent gains may still be seen as selling opportunities and are limited near $2,885/oz. The $2,900/oz mark is closely followed, and if it is broken, gold prices may climb to $2,934/oz before moving towards the record high near $2,956/oz.

On the other hand, Friday's swing low (around the $2,833-2,832/oz area) now seems to protect the recent downside. If it falls below the above area, gold prices may fall to the 38.2% Fibonacci level (around $2,815-2,810/oz). If gold encounters some follow-up selling and falls below the $2,800/oz mark, it may indicate that gold prices have peaked and may pave the way for further declines.

3.3 Gold is under high pressure, beware of a pullbackThe gold four-hour line is also suppressed by the moving average, and the rebound is short-lived, and it is directly pressed on the floor. At the same time, the upper resistance of 2880 and 2890 is an obvious resistance. The K line is just a rebound and is definitely not a reversal. It is obviously still empty below the two resistances, and the K line is suppressed directly to the point of being unable to breathe, and is pressed on the floor. The K line goes down from 2955 to 2830. This big short is obviously still strong.

Short-term suggestion 2880 SELL

3.3 Short-term technical analysis of goldThe gold market completed its February structure last week. Looking back at the market in February, the market fell back after opening at 2880.9 at the beginning of the month. The monthly line reached a low of 2770.47 and then the market fluctuated and rose strongly. The monthly line reached a high of 2956.3 and then the market fell back due to profit-taking in the late trading. The monthly line finally closed at 2859 and closed in an inverted hammer pattern with an upper shadow longer than the lower shadow. After the end of this pattern, the market will have certain pressure to continue to adjust in early March. However, the large cyclical bullish pattern is complete and the trend is still bullish.

GOLD | Bearish Reversal Pattern – More Downside Ahead?### **Analysis & Description:**

This is a **1-hour chart of XAU/USD (Gold vs. U.S. Dollar)** from TradingView, highlighting a **bearish trend reversal pattern**. The price action forms a series of **lower highs and lower lows**, indicating a clear **downtrend formation**.

#### **Key Observations:**

1. **Lower Highs & Lower Lows:**

- The chart outlines a classic **bearish market structure** with multiple rejection points.

- Each bullish rally is met with strong selling pressure, leading to a downward continuation.

2. **Momentum Weakness (MACD Indicator):**

- The MACD at the bottom indicates **bearish momentum**, with both the MACD line and Signal line in negative territory.

- This suggests that selling pressure dominates and further downside movement is likely.

3. **Price Projection:**

- The final arrow suggests **further downside movement**, possibly breaking below key support zones.

- If price breaks below the **$2,807 support**, it could accelerate selling toward **$2,780 – $2,750 zones**.

4. **Possible Trading Strategy:**

- **Bearish Confirmation:** Traders should watch for a breakdown below **$2,807** for a short-selling opportunity.

- **Bullish Reversal?:** If price forms a strong support at **$2,807**, we may see a bounce before further downside.

### **Conclusion:**

Gold is currently in a **short-term downtrend**, and traders should be cautious of potential bearish continuation. However, **fundamental news events** could also impact price action, so it's essential to monitor economic data and market sentiment.

#### **Key Levels to Watch:**

- **Support:** $2,807 – $2,780

- **Resistance:** $2,846 – $2,880

📉 **What do you think? Will gold continue to drop, or will we see a reversal soon? Drop your thoughts below!** 🚀

I have been emphasizing that gold is in a bearish trend recentlyI have been emphasizing that gold is in a bearish trend recently. Gold tested the support of 2830 as expected, and I made a lot of profit in all short trades. However, after gold touches 2930, you cannot directly chase short gold. According to the structure of gold, there is a certain degree of technical support near 2830, so gold may rebound to 2850 again after touching this level; and once gold fails to break through the 2850-2860 area as expected during the rebound, gold will fall again.

Then gold will easily pierce the 2830 mark during the second decline, and once gold effectively falls below 2830, gold will continue to fall and test the 2820-2810 area, and may even go lower to the area near 2800.

At present, shorting gold near 2850 has made a lot of profits. I wonder if you have followed the trading signals of shorting gold? Then the short-term will still focus on the resistance area of 2850-2860 above, and the break of 2830 below.

XAUUSD: 25/2 Today's Market Analysis and StrategyGold technical analysis

Daily chart resistance 3000, support below 2892.

Four-hour chart resistance 3000, support below 2921.

Gold operation suggestions: Gold fell first and then rose yesterday, ushering in a strong bull bottoming out and breaking through the high. The US market accelerated to break through the 2956 mark and was suppressed and fell back. It quickly fell and once broke through the 2940 mark to reach around 2930, stabilized and rebounded, and finally returned to 2950 and closed.

From the current 4-hour analysis, the support below continues to focus on the vicinity of 2921, and the short-term pressure above focuses on the 2950-55 line. Continue to sell high and buy low in this range, and wait patiently for key points to enter the market.

Buy: 2930near. SL: 2925

Buy: 2921near. SL: 2915

Buy: 2892near. SL: 2888

Use small size, control risk

GDX - Gold Miners ETF: Inverse Head & shouldersGold prices have surged to unprecedented levels in light of recent trade policy changes. The announcement by US President Donald Trump regarding a new 25% tariff on essential imports such as cars, semiconductors, and pharmaceuticals has created a wave of uncertainty among investors. This risk-off sentiment has driven many to seek refuge in safe-haven assets like gold.

Nevertheless, this upward momentum may encounter challenges if a trade agreement with China comes to fruition. A successful deal could alleviate global trade tensions, leading to a decrease in gold demand and possibly resulting in selling pressure.

However sustained high bullion prices could prove to be a significant advantage for gold miners. The GDX ETF is showing a persistent inverse head and shoulders pattern, indicating potential for further gains.

XAUUSD: 19/2Gold technical analysis

Daily resistance 2950-3000, support below 2852

Four-hour resistance 2950, support below 2896

Gold operation suggestions: Gold stabilized at 2890 yesterday and ushered in a strong unilateral rise. The Asian and European sessions slightly retreated and stabilized at 2892 and quickly bottomed out and rebounded. The European session continued to break through the 2907 mark and continued to be strong. The US bulls further raised their heads and stood on the 2920 mark and accelerated to break through 2936 and closed strongly at almost the highest point of the day.

From the current 4-hour trend, the support below is around 2869, and the short-term pressure above is around 2950. Overall, rely on this range to keep selling high and buying low. Patiently wait for key points to enter the market

BUY:2930near SL:2925

BUY:2920near SL:2915

90% of traders struggle in the GOLD market, are you the same?From the current 4-hour trend, the support point below is 2905-2908. The short-term pressure level above is around 2940-2943, and the overall support is in this range. The rhythm of high-altitude low-multiple cycles is maintained, but David believes that GOLD will break through the short-term pressure level. In the middle position, keep more watching and less action, and be cautious in chasing orders, and wait patiently for key points to enter the market.

BUY:2927

TP:2940-2950

SL:2894 OANDA:XAUUSD TFEX:GO1!