Gold Price Drops on Tariff Selloff

Gold, long considered a safe-haven asset during times of economic uncertainty, experienced a sharp reversal of fortune this Friday, tumbling as much as 2.4% and extending losses from the previous session. This significant decline came as a surprise to many who had witnessed the precious metal steadily climb to record highs in recent weeks, fueled by persistent inflation concerns, geopolitical instability, and expectations of easing monetary policy. However, the resurgence of tariff anxieties has triggered a broad selloff across various asset classes, including gold, as investors recalibrate their risk exposure in the face of heightened economic uncertainty.1

The catalyst for this sudden shift in market sentiment has been the renewed threat of escalating trade tensions.2 While the specifics of the "tariff shock" are crucial in understanding the market reaction, the general principle is that the imposition or threat of tariffs can disrupt global supply chains, increase costs for businesses and consumers, and ultimately dampen economic growth.3 This increased uncertainty and the potential for negative economic consequences have prompted investors to reassess their portfolios and, in many cases, reduce their exposure to assets perceived as riskier or less liquid, even those traditionally considered safe havens.4

Gold's traditional role as a safe haven stems from its historical use as a store of value, its limited supply, and its lack of correlation with traditional financial assets during periods of stress.5 In times of economic turmoil, investors often flock to gold as a hedge against inflation, currency devaluation, and market volatility.6 This flight to safety typically drives up the price of bullion.7

However, the current market reaction suggests a more nuanced dynamic at play. The tariff shock appears to have triggered a broader reassessment of risk, leading to a selloff that encompasses not only equities and other riskier assets but also traditional safe havens like gold. Several factors could be contributing to this phenomenon.

Firstly, the prospect of tariffs can lead to concerns about slower global growth.8 If economic activity contracts, it could reduce overall demand, potentially impacting even safe-haven assets like gold, particularly if investors anticipate lower inflation in the long run. While gold is often seen as an inflation hedge, a significant deflationary shock could negatively affect its price.

Secondly, the imposition of tariffs can create uncertainty about future economic policies and international relations.9 This uncertainty can lead to increased volatility across all asset classes, prompting investors to reduce overall exposure and move towards cash or other highly liquid assets. In such scenarios, even assets perceived as safe havens might be sold off as part of a broader de-risking strategy.

Thirdly, the recent run-up in gold prices to record highs might have made it a target for profit-taking. After a significant rally, any negative news or shift in market sentiment can trigger a wave of selling as investors look to lock in gains. The tariff shock could have provided the catalyst for such profit-taking, exacerbating the downward pressure on gold prices.

Furthermore, the interconnectedness of global financial markets means that negative sentiment in one area can quickly spread to others.10 The fear of a trade war can impact equity markets, leading to margin calls or a general desire to reduce risk across portfolios, which could include selling gold holdings.

The extent of the gold selloff – a 2.4% drop in a single day is significant for a traditionally stable asset – underscores the severity of the market's reaction to the tariff news. This move also highlights the fact that even safe-haven assets are not immune to broad market dislocations and shifts in investor sentiment.

Looking ahead, the trajectory of gold prices will likely depend heavily on how the tariff situation unfolds and its actual impact on the global economy. If the tariff threats escalate into a full-blown trade war with significant negative consequences for growth and corporate earnings, we could see further volatility across all asset classes. In such a scenario, the initial reaction might be continued selling pressure on gold as investors prioritize liquidity and de-risking.

However, if the economic fallout from tariffs becomes more apparent and concerns about stagflation (slow growth with high inflation) resurface, gold's traditional safe-haven appeal could reassert itself. In a stagflationary environment, gold could once again become an attractive asset as a hedge against both economic stagnation and the erosion of purchasing power.

Moreover, any signs of easing monetary policy by central banks in response to slowing economic growth could also provide support for gold prices. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold and can also be inflationary in the long run.

In conclusion, the recent tumble in gold prices following the tariff shock demonstrates that even traditional safe-haven assets are susceptible to broad market selloffs triggered by significant economic uncertainties. The initial reaction appears to be driven by a general de-risking across asset classes and potential profit-taking after gold's recent record highs. However, the future performance of gold will depend on the evolving economic landscape, the actual impact of tariffs, and the response of monetary policy. While the immediate reaction has been negative, gold's role as a potential hedge against economic turmoil and inflation could see it regain its footing if the negative consequences of the tariff shock become more pronounced. Investors should closely monitor developments in trade policies and their broader economic implications to gauge the future direction of gold prices. The current volatility serves as a reminder that even in the realm of safe havens, market dynamics can shift rapidly and unexpectedly.

Goldpreis

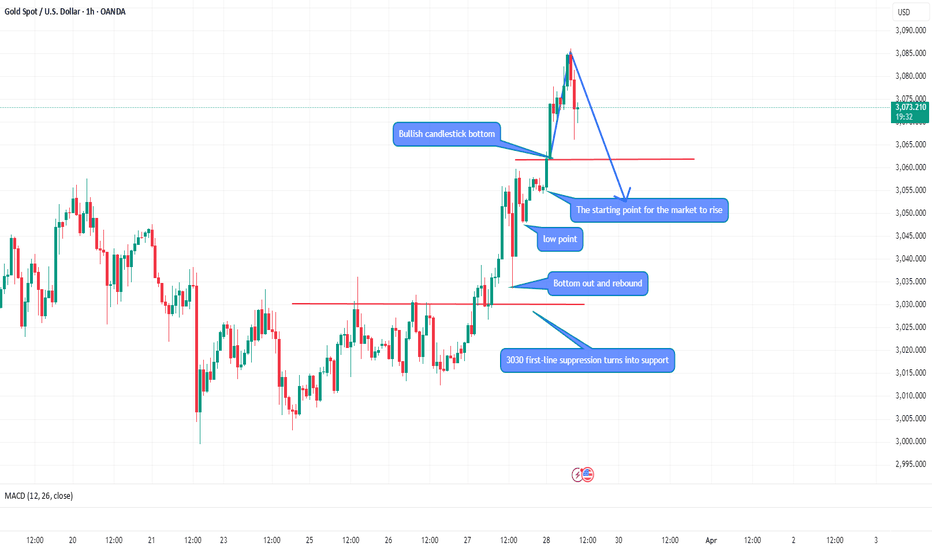

Gold market analysis, gold operation strategy and trend analysisGold early layout plan: intraday top and bottom capture is perfect! The strategy layout is truly presented, the strategy prompts shorting at 3135, accurately cashing in the high point, and falling sharply to 3070! Continue to arrange 3072 long positions to smoothly stop profit and exit at 3086.

Gold fell by 110 yesterday and rebounded by 80. Today it fell by 30 and rebounded by 50. The volatility is too big. However, the risk comes first. Strictly set a stop loss. Loss of $5-$20 makes no difference. It is not a big loss. Secondly, grasp the key points. Pay attention to a few points of non-agricultural data and cooperate with the five-minute entry on the right side. As for long and short, it is really not very important. What is important is the key position and starting point. After multiple cycles of quantification, pay attention to a few important points at night. After the operation is in place, enter the market with the resonance of one minute and five minutes. The loss is 5-6 points, and the target is 15-20 points.

Operation strategy 1: It is recommended to buy at 3018-3025, and the loss is 3005, and the target is 3035-3045

4.4 Gold is low and long, wait for non-agricultureYesterday, the gold market opened at 3134.1 in the morning. The market first fell back to 3122.6 and then rose strongly. After breaking the previous high, it reached a high of 2167.9. After that, the market began to fall under the cooperation of fundamentals and technical profit-taking. The intraday low was 3053.6. After that, the market rose strongly and reached 3135.8 before consolidating. The daily line finally closed at 3114.1. The daily line closed in a spindle shape with a very long lower shadow. After this shape ended, after the break of 2940 and 2958, the long positions were reduced, and the stop loss was followed up at 3050. If it falls back to 3082 first today, the long stop loss is 3075. The target is 3115 and 3132. If it breaks, the target is 3140 and 3150.

Structural analysis and operation suggestions after gold washAnalysis of gold market trend: Gold fluctuated quite a lot yesterday. It rose at the opening yesterday, rising to nearly 60 US dollars, and then fell back after being blocked at the 3167 line. However, it fell below 3100, and the lowest to the top and bottom conversion was around 3054, a drop of nearly 114 US dollars. Beyond expectations, it pulled back to 80 US dollars, and the daily line finally closed with a cross Yin line. The rapid roller coaster is too scary. The market volatility is too large, so you can only watch more and do less. If you encounter non-agricultural data, according to yesterday's trend, the market may not be so big today. After all, it has already ended yesterday. When the price fell sharply, and then there was a sharp rebound to stand firm at 3100, the market of gold yesterday was thrilling, a super roller coaster, and the difficulty of gold operation has increased a lot. However, this kind of market is rare after all. After the ups and downs of gold, it will return to normal. Although today's non-agricultural data, I personally tend to fluctuate in a large range. It is estimated that it will not break yesterday's high point or yesterday's low point. If combined with silver, gold is still oscillating and bearish. At present, it should peak in the short term, and it will choose a direction after a correction.

Gold technical analysis: Therefore, gold is not as strong as before, so it is possible for gold to rise or fall in this state. Pay attention to the previous high of 3150 on the upside, and pay attention to the gains and losses of 3055 on the downside. The 4-hour cycle has cleverly entered the oscillation range. Although the market has gone out of the big drop space, the 4-hour cycle Bollinger has not opened, and the moving average system has not diverged. The effective range for the time being is within 3085/3135. Therefore, if there is no large fluctuation on Friday, you can refer to the range of the 4-hour cycle to do high-altitude and low-multiple transactions. The 1-hour moving average of gold still shows signs of turning downward, but the rise of gold in the US market has not allowed the 1-hour moving average of gold to enter the dead cross pattern, but the gold bulls are not very strong. Of course, there is also the impact of non-agricultural data. It is expected that after the big rise and fall on Thursday, the impact of Friday's data will not be great. Before the release of non-agricultural data, we should operate in the range of 3120-3066. On the whole, the short-term operation strategy of gold today is to short on rebound and long on pullback. The short-term focus on the upper side is 3120-3125 resistance, and the short-term focus on the lower side is 3054-3066 support. Friends must keep up with the rhythm. We must control the position and stop loss, set stop loss strictly, and do not resist single operation. The specific points are mainly based on real-time intraday. Welcome to experience, exchange real-time market conditions, and follow real-time orders.

Gold operation strategy: Short order strategy: Strategy 1: Short gold rebound near 3120-3125, stop loss 6 points, target near 3100-3085, break to see 3065 line;

Long order strategy: Strategy 2: Long gold pullback near 3070-3065, stop loss 6 points, target near 3100-3090, break to see 3110 line;

Gold (XAU/USD) Technical Analysis: SMC Trading point update

This chart is a technical analysis of Gold (XAU/USD) on a 4-hour timeframe. Here’s a breakdown

1. Ascending Channel:

The price is moving within an upward channel, showing a bullish trend.

Higher highs and higher lows confirm the uptrend.

2. Support and Resistance Zones:

Yellow Boxes: Key support zones where price previously consolidated before moving higher.

Red Arrows: Marking resistance zones where the price faced rejection.

Green Arrows: Indicating support levels where the price bounced.

3. Current Price Action:

Price recently dropped to a key support zone (around $3,050).

A bullish reaction is expected from this level.

If support holds, the price may continue the uptrend toward the target of $3,186.

4. Projected Move:

The black zigzag line suggests a potential bounce from support.

If the support level holds, price could move back up within the channel.

Mr SMC Trading point

Conclusion:

If price respects the support zone, there could be a good buying opportunity.

A break below the support zone would signal potential bearish movement.

Monitoring price action around the yellow zone is crucial for confirming direction.

Pales support boost 🚀 analysis follow )

Is the golden large-scale "roller coaster" near miss?Gold took a large "V"-shaped reversal pattern on Thursday, with the highest hitting 3167 in the Asian session, and continued to fluctuate and fall in the European session. It successfully fell to the lowest 3054 before the US session and then rebounded. As of now, gold has deeply bottomed out and rebounded to 3135. It has now started the oscillation mode. Gold continues to fluctuate in the range of 3100-3135, waiting for the release of the initial jobless claims data in the US session. The data is bearish, and the shorts broke through the 3080 line. After all, the technical adjustment is almost done, and everyone can find opportunities to go long. Later, gold hit the 3054 line and rebounded quickly, and the long orders also recovered the losses. This process is full of thrills and excitement. After all, such a large bottoming rebound is relatively rare. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with us!

From the 4-hour analysis, pay attention to the short-term suppression of 3130-35 on the upper side, and pay attention to the short-term support around 3100-3106 on the lower side. Pay attention to the support of 3083-3087. After stabilizing above this position, continue to follow the low-long rhythm, and stick to the idea of going long after stepping back. I will remind you of the specific operation strategy during the trading session, so pay attention to it in time.

Gold operation strategy: Go long at 3105-3095

The battle for the 3200 mark is imminentThe United States has officially launched a tax increase policy on major global trading partners. The wide range of goods involved and the high tax increase are rare in history. The essence of the tax increase is to require countries to have the same tax rate on US goods as the US export tax rate to them. For example, if Indian motorcycles face a 2.4% tax in the United States, and American motorcycles are taxed 100% in India, the United States will reversely tax Indian motorcycles at 100%. This "tit-for-tat" mechanism directly leads to a surge in the price of imported goods, and companies are forced to restructure their supply chains. Next, once the Federal Reserve starts to cut interest rates, gold is bound to reach a new level. Cutting interest rates is the general trend. When the economy is down, only by cutting interest rates can economic development be stimulated, and raising interest rates will only push the economy to the brink of collapse. The US economy is already in collapse, not on the edge!

After the tariff news, gold quickly retreated to 3105 and then soared, reaching a high of 3168. Gold, hold the position of 3100 US dollars, which is the key to determine the long and short positions. The rising market is not about staring at the high point speculation, but the gains and losses of the key support area. As long as the key support is not broken, the rising trend will not see the top.

Gold operation suggestion: long around 3120-3110

The tariff hammer helps bulls rise stronglyTechnical analysis of gold: Affected by fundamentals, gold rose sharply again. The daily line finally closed in the positive zone and maintained a strong high at the opening. Pay attention to the upper and lower support of 3148 during the day. If it holds, it will have the momentum to continue to rise. The 4H cycle will strongly break through the upper Bollinger Band. , moving higher around the moving average support, there is no doubt that it is strongly bullish. At the same time, the middle rail has recovered, and the middle rail is still a key watershed. The lower support is around 3148 and 3138. We will go long according to the strength of the decline during the day, and then gradually look at 3170 and 3200!

Operation suggestion: Gold is long near 3138-40, stop loss at 3130, and look at 3150 and 3170!

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Operate according to your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. The market is changing rapidly. There is no general who always wins in this market. Therefore, it is important for us to make corresponding adjustments according to market changes. We must do a good job of protection. There will always be some ups and downs in the market, but there will be a rainbow after the rain. We must not forget our original intention and forge ahead.

The long-short sweep may still explodeThe tariffs were also successfully implemented. In response, the market bulls and bears also responded strongly. After all, the 3105-3142 area rose and fell in seconds, which was a terrifying market. Of course, to be honest, this wave of turbulence was mostly caused by institutions. After all, the market smashing was also extremely strong. However, I don’t agree with the impact of the tariffs implemented last night. First of all, looking back at the market situation, Trump said that tariffs would be imposed on many countries, which actually meant a 20% retaliatory tariff on the European Union. As for some other countries, only a 10% general levy was implemented, which relatively resulted in an unequal tariff situation. Of course, Trump also reiterated that Canada and Mexico still have tariff exemptions in a limited range of goods. So what impact will this situation have on the bulls and bears of gold? To be honest, personally, I have undoubtedly overestimated the announcement of this tariff. In other words, the implementation of this tariff is a bit insufficient in my eyes. After all, I expected that Trump would make major changes in his previous speech. As a result, it is a significant reduction compared to his previous years in office. This has also limited the outbreak of risk aversion. Of course, trade risks definitely exist, but through the matter of adding Mexico, this is completely negotiable. For this tariff event, I don’t think there is a big risk stimulus. Of course, the key is to see whether the market buys it. If the market thinks it will stimulate long-term risk aversion, then it will inevitably be pushed up by buying. However, the intensity of yesterday’s tariffs was not strong in my opinion. This may also limit the outbreak of longs to a certain extent. After all, the market’s expectations for it were too strong in the early stage, which also led to the early rise of longs, which also included the digestion of news. For this, you still need to be cautious.

Then looking back at the current market, the tariffs have been implemented, and in a blink of an eye, we will also welcome the announcement of non-agricultural data. As far as the current market is concerned, the various US economic data have also improved relatively. After all, the substantial growth of ADP has undoubtedly dispelled the rumors of economic downturn. After all, the warming of the labor market undoubtedly reflects the warming of the US economy. Under the influence of tariffs, it has indeed boosted the US economy. Of course, the impact of the data is not just that. The current remarks about the slowdown in inflation are self-defeating. Due to the implementation of tariffs, inflation is likely to rise further. This directly hits the Fed's expectations of a rate cut, and the warming of the labor market has further limited the possibility of the Fed implementing a rate cut. In this regard, no matter what the final result of the market outlook is, based on the current situation, I personally think that it is really difficult for the Fed to implement a rate cut this year, which has also led to a reduction in the momentum of gold bulls. Moreover, if this situation continues, the Fed does not rule out the possibility of being forced to implement a rate hike. Although Trump is also calling on the Fed to cut interest rates, the fact is that it cannot be implemented at present, unless the US talks with other countries again during this period to discuss a reduction, as it did with Canada and Mexico. Otherwise, as time goes by, as the tariff issue intensifies, inflation will be restricted, thus affecting the implementation of the Fed's policy. At this time, you can pay more attention to the market dynamics.

So for today, although gold is currently stimulated to rise, I don't quite agree with the emergence of new highs for gold bulls. To put it bluntly, for now, even if a new high appears, gold breaks through 3160, which is more of a possibility of inducing more. I am not saying that I am blindly bearish, but you have actually seen that gold is blocked at a high level, and the momentum of falling back is also extremely strong, especially gold started three consecutive positives last Friday, and as of Tuesday this week, it stopped falling near the highest point of 3149. The bull outbreak is already facing exhaustion. Even if the bulls rise again today, where can they rise, to 3200? Then what? You should know that it is cold at the top. Unless there is absolute bullish momentum to support gold to continue to rise, there will be a peak at any time. The short space is still large, just waiting for an opportunity. In particular, the sharp increase in ADP has led to the market betting on the negative non-agricultural data. Once gold is blocked from rising, it will inevitably collapse in an instant. Especially when this kind of news stimulates gold to rise, retail investors in the market will not consider its fundamentals. They will only think that interest rate cuts are absolutely good for bulls and the implementation of tariffs is absolutely good for bulls, which will lead to buying. This is also a chance for institutions to snipe bulls. For this, for today and tomorrow, even if gold breaks a new high, you should not blindly follow the trend. Remember to guard against the possibility of a resurgence of shorts. In this regard, I personally prefer the possibility of shorts looking back at the possibility of breaking 3100 and falling to 3080-3050. You can be cautious about this.

As for today's opening, gold opened high at 3141, and encountered a flash crash at 3128 at the opening, and then rebounded to 3139 and then flash crashed to 3123. This performance can be said to be extremely strong. In this case, I certainly cannot notify the operation. After all, the fluctuation is too fast. With a quote every second, even if you give an order, you may not be able to enter the market in time. For this, you still need to wait for the market to calm down. As for today's market, the fluctuation may be relatively strong. You can wait and see and be cautious. As for the specific operation details, I will give them in real time. Remember to strictly follow my requirements to control the position and stop loss.

Gold Market and the Impact of Trump’s Tariff PolicyGold prices hit a new all-time high as investors seek safe haven assets amid growing uncertainty in the global economy. After several rounds of market turmoil, investors have recovered somewhat in Asian markets this week. In the coming week, the focus will be on the reciprocal tariff plan that Trump will announce on April 2. If Trump decides to take tough measures and implement high tariffs across the board, it may have a big impact on the market. However, if there is some relaxation of tariff policies, such as tax exemptions for specific countries, then the market may have a chance to rebound.

Trump was proud of Wall Street's record highs during his first term, but now seems to be less concerned about the stock market and more focused on the adjustment of overall economic policies. I think this may be the time to make structural changes to the US economy, although these adjustments may bring challenges in the short term, but the hope is that the economy will recover before the mid-term elections next year.

In addition, Asian stock markets have also been affected by volatility, especially the automotive industries in Japan and South Korea are under pressure. The automotive manufacturing industries in these countries face the challenge of change due to the upcoming 25% tariffs. Investors are full of doubts about Trump's tariff policy, and market sentiment is cautious, and all parties are waiting for the policy announcement on April 2.

In short, although the market has rebounded in the short term, future trends still need to focus on Trump’s tariff decisions and their potential impact on the global economy.

Regional shocks, friends holding positions should pay attention!Technical analysis of gold: Gold first rose and then fell, but the subsequent rebound was indeed quite strong, exceeding our expectations. Gold fell into a large range of fluctuations, which added a certain degree of difficulty to the operation. Although gold rebounded beyond expectations, it still did not break through today's high point, so it is still under pressure in the range of the head and shoulders top pattern. At most, it is still a shock, and there is no need to think about whether it will rise sharply.

The 1-hour moving average of gold has gradually begun to show signs of turning, and the 1-hour gold is also a head and shoulders top pattern. Even if it is pulled back and forth again, gold will continue to fluctuate in a large range. There are more data in the second half of this week, and there are also important events. So gold still needs to wait for news or data to let gold go out of a new round of direction. If gold does not break through the intraday high, we will continue to focus on high altitude. Retracement is supplemented by long positions.

Gold operation strategy: short gold when it rebounds to 3130-3035, stop loss at 3140, target 3120-3110; long gold when it falls back to 3110-3100, target 3120-3130.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, operate according to your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform us in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

Beware of gold tariff changes! Intraday Gold Trading Buckle UpGold news: In the early Asian session on Wednesday (April 2), spot gold fluctuated in a narrow range and is currently trading around $3114.90/ounce. Gold prices rose and fell on Tuesday. Spot gold rose to around the 3150 mark earlier, setting a new record high of $3148.85/ounce, but then fell back due to profit-taking, closing at $3114.03/ounce, down about 0.3%. US President Trump plans to announce comprehensive tariffs on countries with trade imbalances with the United States on April 2, which has spawned a large number of safe-haven buying, helping gold prices to continue to rise, but near the last moment, some bulls took profits in advance. Gold has always been seen as a hedge against geopolitical and economic uncertainties. On Monday, gold closed with its strongest quarterly performance since 1986 and broke through $3,100 per ounce, becoming one of the most significant gains in the history of precious metals.

Technical analysis of gold: Gold 4-hour chart retreated to the middle track and paused for a while. Today, the battle between the high point 3148 and the 4-hour middle track will be fought. Losing the middle track will further increase the adjustment space. On the contrary, holding the middle track to recover the high point will continue the slow rise. The market outlook will continue to cooperate with the slow rise method of one step back and one turn back. That is, the repeated high-exploration and fall method. From the 1-hour chart of gold, the rising volume at the end of the wave-shaped tail is usually not sustainable, accompanied by the one-step back and one-step wash-out method. After yesterday's retreat, today's early trading rose quickly, accompanied by a big negative line in the hourly chart to retrace and correct, and stepped back to the local high of 3150. The fluctuation base is large and the adjustment space can be large or small. It is not easy to chase high at the current position. Although shorting is against the trend, the implementation of overbought tariffs on the technical level will also be realized, and the room for adjustment cannot be underestimated. We should use ultra-short-term combined with medium and long-term short-term to respond to short-term adjustments. On the whole, today's short-term operation of gold recommends shorting mainly on rebounds, supplemented by longs on callbacks. The top short-term focus is on the first-line resistance of 3138-3140, and the bottom short-term focus is on the first-line support of 3100-3083. Friends, you must keep up with the rhythm. It is necessary to control the position and stop loss, set stop loss strictly, and do not resist the order operation. The specific points are mainly based on real-time intraday trading. Welcome to experience and exchange real-time market conditions. 🌐Follow real-time orders.

Gold operation strategy reference: Short order strategy: Strategy 1: Short stop loss of 6 points near 3136-3138 when gold rebounds, target around 3115-3100, break the position and look at 3085 line;

Long order strategy: Strategy 2: Go long when gold pulls back around 3105-3095, stop loss 6 points, target around 3120-3110, and look at the 3130 line if the position is broken;

Trading discipline: 1. Don’t follow the trend blindly: Don’t be swayed by market sentiment and other people’s opinions, and operate according to your own operation plan. The market information is complicated and complex, and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, notify you in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

3100 Danger? Has a short trend emerged after gold’s sharp fall?If you persist in doing something for three days, it is just a whim! If you persist in doing it for three months, it is just a start! If you persist in doing it for 10 years, it can be considered a career! Whether in life or trading, if you want to succeed, it is like sailing against the current. If you don’t advance, you will retreat. Only by working hard, persisting, moving forward bravely, and overcoming obstacles can you reap your own "success"! A new day begins, and every step of the strategy is the beginning of a battle. Execute the operation, if you don’t move, you will be fine, but if you move, you will be thunderous! 1-5 current price transactions per day make the operation easier!

Gold technical analysis: After the gold surged, it appeared under pressure. The price reached 3149 and then retreated. The US market continued to decline after the shock. Don’t do more if it falls below 3120 in the evening, and be alert to the possibility of retreating to 3100. The short-term means that the bulls have temporarily come to an end and began to retreat and adjust the trend.

In addition to Trump’s announcement of tariffs this week, there will also be non-agricultural data, so this week is destined to be extraordinary. This is also the risk that has been repeatedly reminded. Don't be blindly overwhelmed by bulls. You need to respect the market at all times. After falling below 3120, there is room for a retracement, but whether the overall trend has turned is still uncertain. This week is very critical. There are important fundamental news. It is necessary to confirm whether it will change the fundamentals. Only when there is a change will the trend turn. Pay attention to the 3120 first-line resistance on the top of the 4-hour chart, and pay attention to the 3100 support on the bottom in the short term. It is recommended to operate in the range. Gold operation suggestion: short selling near 3115-3119, stop loss 3130, target 3105-3100

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, operate according to your own operation plan, market information is complicated, and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform you in time if there are changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

The bulls continue to reach new highsEarly layout plan for gold: As mentioned in our previous article, we decisively laid out gold short positions when entering the market at key points in the early stage, strictly implemented the fast-in-fast-out trading strategy mentioned in our article, perfectly hit the stop-profit target TP, and successfully made profits.

Gold technical analysis: Gold bulls dominate the screen, continuously breaking new historical highs. The current highest has reached 3149. The daily line has also closed positively, galloping in the market, invincible, and also let the bears flee. The current trend is basically in a regular form. The bullish trend is still strong. The early opening sprint broke through the 3130 line. We directly went long in the real market and successfully reached the target 3140-3145. Yesterday, the technical side of gold ushered in an accelerated rise in the Asian market. In the afternoon, the bulls in the European market continued to break through and stand above the 3100 integer mark to reach 3120 and continue to fluctuate strongly. Last night, the US market retreated twice to confirm that it stabilized at the 3100 mark and further continued to break through the 3127 mark and closed strongly. Our real market and the analysis of the article before the US market last night also successfully entered the long order at the 3103 line. I believe that friends who follow me can see that if your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate!

From the 4-hour analysis, today's short-term support is around 3117-3124, with a focus on the 3100-3106 line. Intraday operations follow the retracement and continue to be long. The short-term bullish strong dividing line focuses on the 3096-3100 line. The daily level stabilizes above this position and continues to maintain a low-long rhythm. Short selling can only enter the market at key points, and enter and exit quickly, without fighting. I will remind you of the specific operation strategy during the session, so pay attention to it in time.

Gold operation strategy: 1. Gold retracement 3117-3124 line long, retracement 3100-3106 line long, stop loss 3097, target 3145-3150 line, break and continue to hold;

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, operate according to your own operation plan, market information is complicated, blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technological changes, notify you in a timely manner if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve steady asset appreciation.

Verified again, bulls continue to hit new highsGold technical analysis: Gold opened at 3130 in the morning. Yesterday, gold technically accelerated in the Asian session. The European session bulls continued to break through and stood above the 3100 integer mark to reach 3120 and continued to fluctuate strongly. The US session stepped back twice to confirm the stabilization of the 3100 mark and further continued to break through the 3127 mark and closed strongly. Friends who follow me can see that our real-time analysis and the analysis of the article before the US session also successfully entered the long order at the 3103 line. This also verifies the 3127-3130 line suppression given in my article last night. The daily K-line closed with a shock and broke through the high-middle Yang. The overall gold price ushered in the rhythm of bulls accelerating the rise after breaking through the 3050 mark. The daily level closed with a strong medium-yang for three consecutive trading days. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate!

From the 4-hour analysis, today's short-term support is around 3118-3124, with a focus on the 3100-3106 line. Intraday operations follow the retracement and continue to be long. The short-term bullish strong dividing line focuses on the 3096-3100 line. The daily level stabilizes above this position and continues to maintain a low-long rhythm. Short selling can only enter the market at key points, and enter and exit quickly, and do not fight. I will remind you of the specific operation strategy during the session, so please pay attention to it in time.

Gold operation strategy: 1. Gold retracement 3116-3124 line long, retracement 3100-3106 line continue to cover long positions, stop loss 3097, target 3145-3150 line, and continue to hold if it breaks.

Trading discipline: 1. Do not blindly follow the trend: Do not be swayed by market sentiment and other people's opinions, operate according to your own operation plan, market information is complicated, and blindly following the trend can easily fall into the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform you in a timely manner if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in volatile markets, and achieve steady asset appreciation.

Strong acceleration to the top? Gold trading analysis strategyGold early layout plan: Long and short strategies in the real market all the way to stop profit, lucrative profits, witnessed by the whole network!

News: On the fundamentals, last week's re-strengthening, in addition to the escalation of tensions in the global economy and trade, there is also support from the Middle East tensions and the optimistic impact of the Ukraine negotiations that are not as expected; and this week will usher in Trump's tariff week, and countries are currently relatively tough and oppose the unilateral imposition of tariffs by the United States. And a comprehensive response is about to be made. This will increase economic concerns and the safe-haven demand for gold. Therefore, although there are some profit-taking and resistance suppression in the gold price at present, under the mutual game of global trade tariffs and the intensification of geopolitical tensions, a temporary retracement is still creating entry opportunities for bulls, and in the short term, it is still expected to refresh the historical high to around US$3,150. In the day, we will pay attention to data such as the Chicago PMI in March and the Dallas Fed Business Activity Index in March in the United States. It is expected that the impact will be limited. According to the trend of last week, there is also momentum for strengthening again. Therefore, the day will still be bullish and rebound-oriented. This week, the focus will be on the implementation of global trade tariffs on Wednesday and the non-farm payrolls report on Friday, which may strengthen gold's safe-haven appeal. Other important data include Tuesday's ISM manufacturing PMI and JOLTS job openings, Wednesday's ADP employment, and Thursday's ISM non-manufacturing PMI and initial jobless claims.

Gold technical analysis: Gold technical analysis: Gold is really simple, you can make money with your eyes closed, and now it has reached the point where everyone can make money. On the contrary, I began to become cautious and timid. Gold jumped high in the early trading, quickly sold off and washed the market, and successfully got many people off the bus with a trick of fishing for the moon in the bottom of the sea, and then pulled up all the way, which was really strong. I emphasized before that gold would not peak if it did not soar by hundreds of dollars, and now this rhythm is getting closer and closer. Today, it rose by 50 US dollars a day. I dare to guarantee that there will be another day of 100 US dollars this week, which means that the top is just around the corner. Go long with the trend, but don't be a long-term investor. Today, we will focus on the breakout of 3127-30. If it fails to break higher, then this point may become a short-term high point. It is best to go long when it falls back to around 3100-3105. Finally, I would like to advise the majority of retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, overall, today's short-term operation strategy for gold is to go long on pullbacks and go short on rebounds. The short-term focus on the upper resistance of 3128-3130 and the short-term focus on the lower support of 3100-3097. Friends must keep up with the rhythm. Maintain the main pullback and go long. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the session, and pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate with us!

Gold operation strategy: Go long on the 3100-3105 line of gold.

Trading discipline: 1. Don’t blindly follow the trend: Don’t be swayed by market sentiment and other people’s opinions. Follow your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform us in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

Gold's Historic Ascent: Breaking the $3,100 Barrier

Gold, the timeless safe-haven asset, has surged to unprecedented heights, breaching the $3,100 per ounce mark for the first time in history. This remarkable rally, fueled by a confluence of geopolitical tensions and economic anxieties, underscores gold's enduring appeal as a hedge against uncertainty. The recent surge, surpassing the previous record set just days prior, signals a potent shift in investor sentiment, driven significantly by the United States' imposition of new levies.

The Catalyst: US Levies and Geopolitical Turmoil

The primary catalyst for gold's dramatic ascent is the escalating geopolitical landscape, particularly the United States' implementation of new levies. These levies, often associated with trade disputes and economic protectionism, inject uncertainty into global markets. Investors, seeking to mitigate potential losses, flock to safe-haven assets like gold, driving its price upward.

Beyond the immediate impact of US levies, a broader sense of economic fragility permeates the market. Concerns about inflation, rising interest rates, and potential economic slowdowns have created a climate of apprehension. In such environments, gold's historical role as a store of value becomes increasingly attractive, bolstering its demand.

Gold's Safe-Haven Status: A Time-Tested Phenomenon

Gold's allure as a safe-haven asset is deeply rooted in its intrinsic properties and historical performance. Unlike fiat currencies, which are susceptible to inflation and government policies, gold retains its value over long periods. In times of economic and political instability, gold tends to outperform other asset classes, serving as a reliable hedge against market volatility.

This safe-haven status is further reinforced by gold's limited supply and its universal recognition as a valuable asset. The precious metal's physical nature and its role in various industries, from jewelry to electronics, contribute to its enduring demand.

The Market Reaction: A Surge in Investor Confidence

The surge in gold prices reflects a significant shift in investor confidence. As traditional investment avenues become increasingly risky, investors are turning to gold as a means of preserving capital. The influx of funds into gold-backed exchange-traded funds (ETFs) and other gold-related investments underscores this trend.

The market's reaction also highlights the interconnectedness of global economies. The US levies, while originating from a single nation, have reverberated across international markets, triggering a flight to safety. This demonstrates the profound impact of geopolitical events on investor behavior and asset prices.

Analyzing the Price Surge: Factors at Play

Several factors contribute to gold's current price surge:

• Currency Fluctuations: A weakening US dollar can make gold more attractive to investors holding other currencies.

• Inflationary Pressures: Rising inflation erodes the purchasing power of fiat currencies, increasing the appeal of gold as an inflation hedge.

• Interest Rate Policies: Lower interest rates can reduce the opportunity cost of holding gold, as it does not generate interest income.

• Geopolitical Instability: Political conflicts, trade disputes, and economic sanctions create uncertainty, driving demand for safe-haven assets.

• Central Bank Purchases: Central banks often hold gold reserves as a hedge against currency fluctuations and economic instability. Their purchasing activity can influence gold prices.

•

Looking Ahead: The Future of Gold Prices

Predicting future gold prices is inherently challenging, as they are influenced by a complex interplay of factors. However, several trends suggest that gold's upward trajectory may continue:

• Persistent Geopolitical Tensions: Ongoing political conflicts and trade disputes are likely to sustain demand for safe-haven assets.

• Economic Uncertainty: Concerns about inflation, rising interest rates, and potential economic slowdowns are expected to persist.

• Increased Investor Interest: The recent surge in gold prices has attracted significant investor attention, potentially leading to further inflows of funds.

However, potential headwinds could also impact gold prices:

• Strengthening US Dollar: A stronger US dollar could make gold less attractive to international investors.

• Rising Interest Rates: Higher interest rates could increase the opportunity cost of holding gold.

• Improved Economic Outlook: A more optimistic economic outlook could reduce demand for safe-haven assets.

The Significance of Gold's Milestone

Gold's breach of the $3,100 mark is a significant milestone, reflecting the profound impact of geopolitical tensions and economic anxieties on global markets. It underscores gold's enduring role as a safe-haven asset and its ability to preserve value in times of uncertainty.

As investors navigate the complexities of the global economy, gold is likely to remain a key component of diversified investment portfolios. Its historical performance, intrinsic properties, and universal appeal make it a compelling asset in an increasingly uncertain world.

3.31 Gold US market operation analysis suggestions!Gold intraday analysis and operation: How to judge the next step after gold breaks through 3130!

Gold's strong rise in the Asian session has brought the price of gold close to 3130 and finally stagnated at 3127. The impact of the US market has not yet appeared, but with the current trend, the volatility of gold tonight will not be too small. The overall idea is to maintain the low north. The intraday volatility range is maintained within the range of 40 points between 3090 and 3130. The current increase has exceeded market expectations. Although there is selling pressure, it is all suppressed by the bulls!

US market pressure focus: 3130-3150 above and 3110-3095 below

The above analysis is a personal analysis suggestion, I hope it can bring some gains to everyone!

We will update regularly every day and introduce to you how we manage active ideas and settings. Thank you for your likes, comments and attention, we are very grateful

Gold surges and then falls, indicating an imminent fallGold early stage layout plan: Long and short strategy all the way to stop profit in the actual market, huge profits, witnessed by the whole network!

Technical analysis of gold: At present, Trump's tariff policy will be officially announced on Wednesday. Today, Asian stock markets fell across the board in the Asian session, because Asian stock markets opened the earliest. According to historical laws, the stock market's reaction is the fastest. European stocks may also fall across the board. The short-term decline in the stock market often brings a short-term rebound in the price of gold. Focus on the trend of the US stock market. Once the US stock market falls sharply and rapidly, it is often accompanied by a rapid decline in the price of gold. In the morning, the price of gold has rebounded by more than 50 points from the low of 3076 to 3127. After rebounding by more than 50 points, we can intervene in short selling at 3120-25, and close the position when it falls back to around 3105-15. Today, the European and American sessions focus on the breakout of 3127-30. If the European session fails to break higher, then this point may become a short-term high point. It is best to take long positions when it falls back to around 3105-3100. Finally, I would like to advise all retail investors that when the market fluctuates violently, if you cannot control yourself and go with the trend, then shorting may be the best choice. It is better not to do it than to make mistakes! Watching more and doing less is also a suitable strategy. I will remind you of the specific operation strategy during the trading session, and you should pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate and exchange!

Gold operation strategy: short gold at 3120-25, target 3105-3115, and go long at 3110-3100.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions, and operate according to your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes, inform you in time if there are any changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

Next week’s opening trend forecast and layout!Early layout plan for gold: long and short strategies in the real market, all the way to profit, rich profits, witnessed by the whole network!

Technical analysis of gold: Gold rose again at the end of Friday, and finally closed the daily line with a bald positive line. After a brief adjustment, it rose again. Then, there will be high points to see next week. Continue to maintain the main decline and long, and do not guess the top for the bullish trend. This week is also a long and short strategy to stop profit all the way, and the intraday harvest is rich! The daily support is near 3057, but the strong will not have too much retracement, otherwise it will turn into shock, and the low point of the fall is near 3073. On Monday, the strong will rely on this position to be bullish. The upper pressure is near 3087. Don’t chase more before breaking the position. Breaking the position will gradually see above 3100! Next week, we will continue to focus on retracement and long, but don’t chase more. After all, the technical side needs to step back and adjust. Stepping back and long is the way to go with the trend. Maintain the main retracement and long, and watch more and move less in the middle position. Be cautious and chase orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the trading session, please pay attention to it in time. If your current gold operation is not ideal, I hope that your investment can avoid detours. Welcome to communicate with us!

Gold operation strategy: Go long when gold falls back to 3070-60.

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Follow your own operation plan. Market information is complicated and blindly following the trend can easily lead to the dilemma of chasing ups and downs.

2. In gold trading, we will continue to pay attention to news and technical changes. Once there are changes, we will inform you in time, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

(Note: The above strategy is based on the current trend, and will be adjusted according to real-time fluctuations during trading. It is for reference only)

GOLD XAUUSD ShortI m short. Gold can go even to 3100.No matter I sell more

Wall Street goes full bull with tariffs and payrolls looming

Gold surges toward $3,100 amid unrelenting rally

Smart money knows one thing very clearly: a large part of the bad news is already baked into the prices, and there is limited room for further downside. Especially considering the parabolic moves we’ve seen

Never the less we are in overbought zone,A correction coming.That will be good chance to buy Gold again

Accurately predict the timing of short position entryAs of now, we have made profits during the trading session. But gold hit the 3048 area yesterday. What should we do if some brothers did not close the order in time? We have made corresponding adjustments according to the current market.

Gold news:

On Friday, the price of gold climbed to 3083, mainly driven by factors such as rising risk aversion, the Federal Reserve's interest rate cuts, the global central bank's gold buying boom and increased inflationary pressure. The tense situation in the Middle East, global economic uncertainty and expectations of a depreciation of the US dollar have further enhanced the attractiveness of gold. This week, gold is expected to rise for the fourth consecutive week. The US PCE (personal consumption expenditure) data to be released tonight has attracted much attention from the market because it is the core indicator of the Federal Reserve to measure inflation and may have a significant impact on market expectations and asset prices. If the PCE data triggers concerns about stagflation, it may cause US Treasury yields to rise, further boosting gold prices. If the data eases inflationary pressures, it may boost risky assets, but gold may rise simultaneously due to rising expectations of interest rate cuts. Boosted by risk aversion, gold advanced all the way yesterday afternoon, hitting a new high of 3059 during the US trading session. Today's market continued to rise at the opening, and the current highest has reached 3086. Gold bulls rose like a tiger, where is the top?

Gold technical analysis: From the wave point of view, the large level is no longer repeated. The daily line 2832 runs a standard 5-wave structure upward, wave 1 2832-2929, wave 2 2929-2880, wave 3 2880-3057, wave 4 3057-2999. Yesterday's market broke through 3057 and rose. The current market is in the 5th wave. From the wave rule, wave 1 runs 97 US dollars. If the amplitude of wave 1 and wave 5 is equal, the high point of wave 5 can be seen near 3097. Using the Fibonacci retracement extension line, pay attention to the two resistance levels of 3088-3108 above. Therefore, the short-term continues to follow the trend of low-multiple bullishness. Pay attention to whether there is a structure to go short near 3108 above. Gold is currently high, and it is bound to fall back. This crazy bull trend cannot last long. This is inevitable. The gold price is currently seriously off track, that is, it is directly off track. This is unreasonable. Return is inevitable. There must be a deep fall today. The support below is around 3050, which is also the target of the fall.

Gold operation strategy: Short gold 3075-70 to increase the number of transactions. Target 3060-3050

Trading discipline: 1. Don't blindly follow the trend: Don't be swayed by market sentiment and other people's opinions. Follow your own operation plan. Market information is complicated and blindly following the trend is easy to fall into the dilemma of chasing ups and downs.

2. The short profit area of 3060-3050 is all closed.

3. In gold trading, we will continue to pay attention to news and technical changes, inform in time if there are changes, strictly implement trading strategies and trading disciplines, move forward steadily in the volatile market, and achieve stable asset appreciation.

Summary of this weekThis week, the gold market continued its bull market, breaking through the historical high of 84 and closing. The gold price broke through the psychological barrier of 3,000. The market sentiment continued to be optimistic.

In this week's trading, we took the main approach of going long, holding long positions, buying back, and making significant profits, achieving the expected goals.

Next week, we will continue to make steady progress and formulate a more efficient profit plan.

If you also want to learn gold trading skills and profits in the market, then join my team.

Wish you all: Have a good weekend