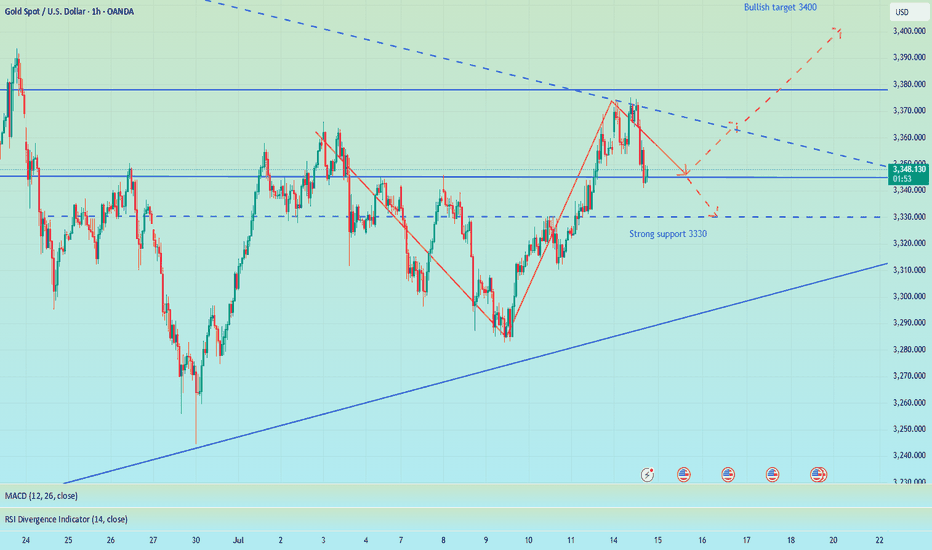

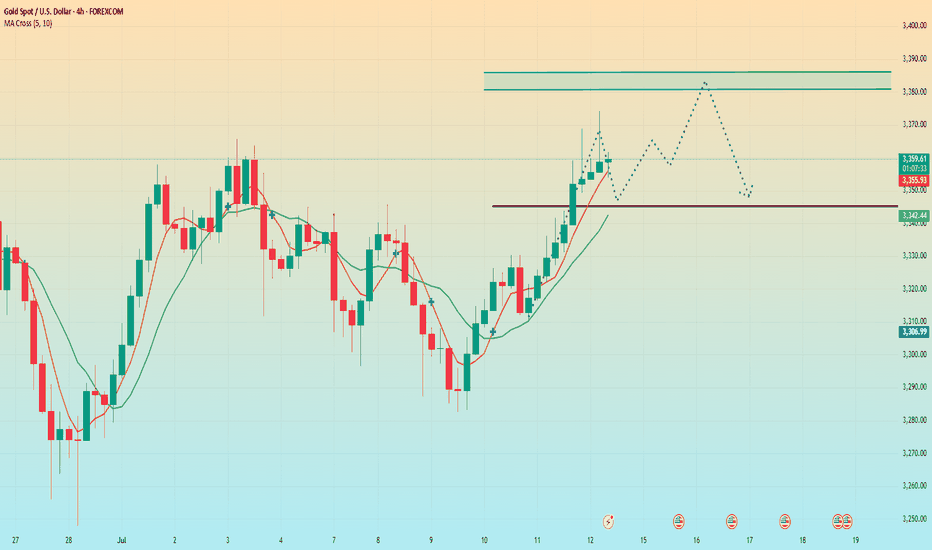

Converging triangle, may rise again in the short termUnder the influence of recent tariffs and the Federal Reserve's interest rate cuts, the main trend of the gold market remains bullish, but from the weekly and monthly level analysis, there is a high probability that it will pull back again after this round of highs and maintain a large range of fluctuations at a high level. Technical analysis shows that gold currently does not have the conditions for a unilateral surge at the daily level. Although the key level of 3345 has been broken, the continuity of the market is extremely poor, and volatility is still the main theme. At present, the trend of gold has formed a converging triangle pattern, and it may rise again in the short term. However, we need to be vigilant that the weekly line may form a high-rise and fall pattern, and the price of gold may fall back to 3300! Therefore, in today's late trading, you can consider retreating to the 3335-3330 area to go long

OANDA:XAUUSD

Goldprice

Gold Aiming Higher: Bullish Momentum Toward Key S&D ZoneHello guys!

The main bullish trend remains intact on Gold. After forming a solid base near the QML level, price has been respecting the ascending channel structure and is now pushing toward the upper boundary of that channel.

The current price action shows strength and momentum, and with the recent breakout above the midline of the channel, it signals that buyers are likely to push price toward the next key area of interest.

The target is clearly defined: the supply zone around 3409–3423, which has previously acted as a major resistance area.

Core idea:

Main trend: Bullish

Structure: Ascending channel

Support confirmed: QML zone bounce

Current behavior: Price moving along the top of the channel

Target: 3409–3423 supply zone

Gold/XAUUSD Analysis Breaks Bullish Channel – Targeting 3400+🟨 Market Context:

Gold (XAU/USD) has recently completed a significant technical move that signals the potential start of a strong bullish continuation phase. After a period of consolidation inside a descending channel, price has broken above key resistance levels and is showing firm buyer strength across the board.

🔍 Technical Structure Breakdown:

🔹 Descending Channel (Consolidation Phase)

For several sessions, gold was confined within a well-defined descending channel, which typically indicates a temporary correction in a broader bullish trend. This phase served as a liquidity-building zone where smart money accumulated long positions.

🔹 Breakout & Retest Confirmation

The breakout above the upper boundary of the channel was clean and impulsive, confirming bullish intent. This breakout aligned perfectly with a previous demand zone (now retested as support), adding strong confluence.

Key Breakout Zone: $3,330–$3,340

Retest Action: Price pulled back to test the breakout zone, respected it, and printed a bullish reversal.

This behavior confirms the “breakout–retest–continuation” pattern—highly reliable in trending markets.

🔹 SR Interchange – Key Pivot Zone

The level around $3,340 served a dual role:

Previously acted as resistance within the channel.

Now acting as support post-breakout (SR flip).

This interchange area is significant because it reinforces the idea that bulls are now defending this level aggressively.

🔹 Bullish Pattern Confirmation

A bullish price pattern has formed exactly at the SR zone and near the trendline. This double confluence (pattern + level) provides high-probability trade setups and confirms the entry point for buyers.

🔹 Ascending Trendline Support

An emerging bullish trendline is now guiding the move upward, confirming that the market has shifted its short-term trend. Every bounce on this trendline reinforces bullish structure and validates higher-low formations.

🎯 Price Targets & Expectations:

✅ Previous Target Zone:

Around $3,375, already tapped and respected.

This shows that gold is following technical targets with precision.

🎯 Next Bullish Target:

$3,400 – $3,410 zone stands as the next supply region.

This area is a major psychological resistance and aligns with historical reaction points.

🧠 Trading Insight & Strategy:

With current price action and momentum, buying dips remains the optimal approach, provided the price stays above the SR Interchange zone.

🔽 Entry Zone: $3,345 – $3,350

📈 Targets:

TP1: $3,375 (partial exit)

TP2: $3,400–$3,410 (final target)

❌ Invalidation Zone (Stop Loss): Below $3,330

Breaking below this would invalidate the breakout structure and possibly signal a false breakout.

📌 Summary:

✅ Clear breakout from descending channel

✅ Retest of previous demand and SR flip zone

✅ Bullish pattern confirmed on key support

✅ Ascending trendline intact

🎯 Next logical move: $3,400+

The gold market is giving strong bullish cues, and this setup could be a textbook example of “buy the breakout, ride the trend.”

Stay sharp, trade smart, and keep your risk in check. 👑

XAU/USD(20250715) Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

3353.05

Support and resistance levels:

3386.70

3374.12

3365.96

3340.13

3331.97

3319.40

Trading strategy:

If it breaks through 3353.05, consider buying in, the first target price is 3365.96

If it breaks through 3340.13, consider selling in, the first target price is 3331.97

Today's summary and tomorrow's market forecast📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

Bros, I had some things to deal with just now so I went out for a while. Now I come back to share my ideas. When the market is blindly chasing longs, I chose to give a bearish trading opportunity. I know that after I proposed the idea of shorting to test the support level of 3340-3330 below, many people were skeptical and even looked at it with a sarcastic attitude. After all, most people in the market are long. But facts and results have proved that only by following the trend can there be better room for operation. When doing transactions, you must first have a clear goal. Those who follow the crowd will often only blame their mistakes on others or luck.

Regarding the arrangements for future trading, first of all, 3375-3385 above is still an important short-term resistance. If today's closing is above 3360, then 3375 will most likely be tested again during the Asia-Europe trading session. Once it goes up again, it is very likely to break through the resistance area of 3375-3385. Before the US data, the price may stay at 3390 or 3400. On the contrary, if today's closing is below 3360, then the price still has room for adjustment. In this way, 3340 will not be the low point of this week. The bearish volatility in the Asian and European sessions will also test the strong support of 3330-3320.

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD

Gold----Buy near 3348, target 3369-3389Gold market analysis:

Looking back at last week's market, the market performance on Monday and Tuesday last week was quite abnormal, belonging to the rhythm of a big oscillation. The following three trading days were basically relatively normal, and the market rose all the way after the buy-in. The overall market was a bottoming-out and rebounding market. Recently, investors are very confused about whether the general trend is bullish or bearish? First of all, we need to distinguish how long the general trend cycle is? If you look at the weekly line, you can at least see a 2-4 week trend. If you want to see a trend for a month, then you have to look at the weekly K-shaped and monthly trend. I understand that the long-term trend is at least a trend of one month to half a year. With the current instability of the international situation, the trend of Russia and Ukraine, the situation in the Middle East, and Trump's global tariff war, I think the half-year trend is bullish. We are short-term traders, and basically can't see that far. Looking at the trend of one week at most is the limit. Playing with long-term trends requires a 100-point mentality, and playing with short-term trends only requires technology. The first thing every Monday is to figure out the trend of the week. Buy short-term climb at the weekly close. This week's thinking is bullish first. We estimate that there will be a decline in the second half of the week. Today's weekly line is treated as a low-price buy first, and pay attention to the retracement to the support to buy. The low point of Friday's retracement near 3348 is a new support, and it is also the starting point of the pattern support 3344. In addition, the hourly stepping point is near 3342. If it does not break 3342 today, insist on buying. If it breaks, adjust the thinking to be bearish in time. A small step on the Asian session is also an opportunity to get on the train.

Pressure 3397, support 3348, 3345, 3342, the watershed of strength and weakness in the market is 3342.

Fundamental analysis:

Last week, Trump increased tariffs on Canada and will soon increase tariffs on Brazil. There is no signal of stopping the tariff war. It is long-term bullish for gold. The situation in the Middle East has not completely stopped, and it is also a long-term suppression of the US dollar to support gold.

Operation suggestion:

Gold----Buy near 3348, target 3369-3389

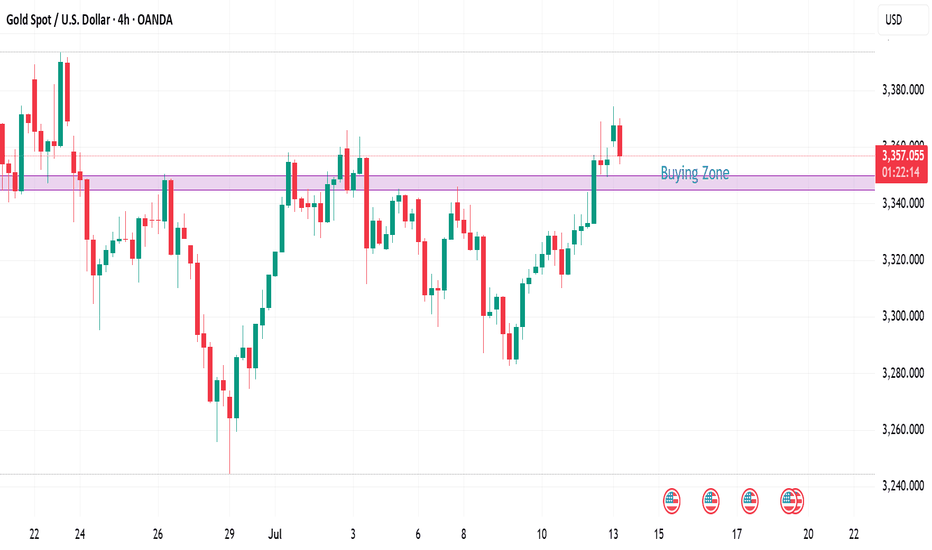

Good opportunity to wait for recovery and buy GoldOANDA:XAUUSD Confirmation of breaking Key level 3330 on Friday has formed an Uptrend in Gold. Reaction at GAP 3368 is obvious in an uptrend. Gold trend is favoring buying to 3388 and 3400 next week.

Support: 3345-3331

Resistance: 3387-3400

BUY Trigger: Retest and Reject support 3345

BUY Trigger: 3331 ( Strong support zone)

Target: 3400

SELL Trigger: rejection 3387 with bearish confirmation

Leave your comments on the idea. I am happy to read your views.

Gold fluctuates downward, go long again when it falls back

Gold is currently fluctuating downward. Although the trend is bullish, we must not rush into the market. The technical side needs to step back. We need to be cautious when going long. We need to grasp the entry position and step back to 3340-45 and then more!

From the 4-hour analysis, the short-term support below focuses on the neckline of the hourly line of last Friday, 3340-45, and the focus is on the support of 3325-30. The intraday step back continues to follow the trend and the main bullish trend remains unchanged. The short-term bullish strong dividing line focuses on the 3325 mark. The daily level stabilizes above this position and continues to follow the trend and bullish rhythm. Before falling below this position, continue to follow the trend and follow the trend. The main tone of participation. I will remind you of the specific operation strategy in the VIP group, and pay attention to it in time.

Gold operation strategy:

Gold goes long at the 3340-45 line when it steps back, and covers long positions at the 3325-30 line when it steps back, stop loss 3317, target 3365-70

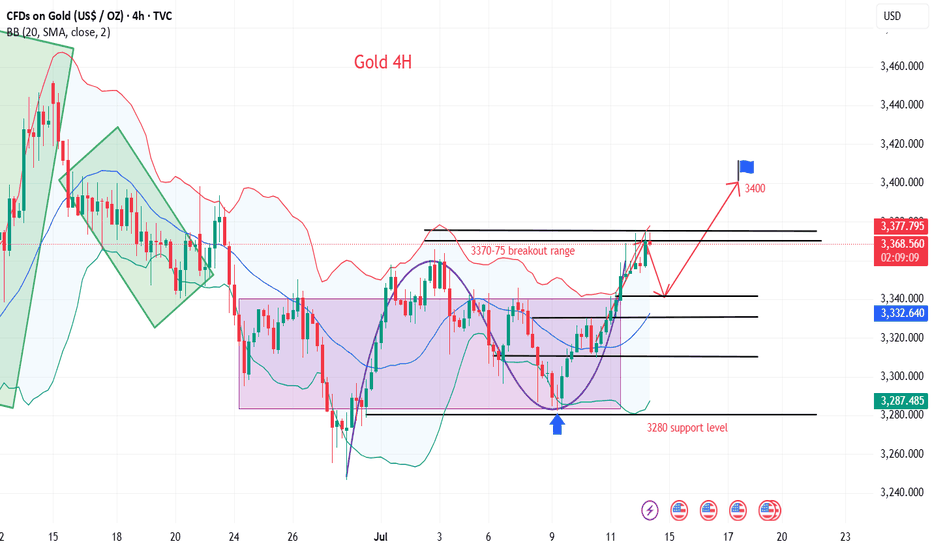

The market is bullish, but I am bearish. Don't regret it.📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

This week, the US CPI data, consumer index, tariff issues and geopolitical situation are all key points to pay attention to. In the morning, both our long and short positions had good gains, making a good start to the week. The best way is to follow the trend and grab limited profits!

In the 4H cycle, the current trend shows a Zhendan upward pattern, and bulls still occupy the dominant low position in the short term. At the daily level, three consecutive positive days at the end of last week broke through the middle track, and the high point broke through the previous high, indicating that the short-term adjustment is over, and the rise in the market to test 3400 will be a high probability event. At present, the MACD daily line is bullish, the Bollinger Bands are flat, and the gold price is above the middle track. The bulls are strong, but there is still a need for a correction. Intraday trading focuses on the strength of the European session. If the European session is strong, the US session will continue to rise, and if the European session is weak, the US session will bottom out again. In the short term, if it touches 3370-3375 again, you can consider shorting and look towards 3365-3355 SL 3380.

🎯 Trading Points:

sell 3370-3375

tp 3365-3355-3345

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD OANDA:XAUUSD

XUA/USD) Bullish Analysis Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) analysis on the 3-hour

---

Gold (XAU/USD) 3H Technical Analysis Summary

Market Structure: Bullish breakout

Price has successfully broken above both the downtrend line and the support zone (highlighted in yellow), signaling a shift in structure from bearish to bullish.

Key Support Zone:

The yellow zone (~3,335–3,355) was previously a resistance area. After the breakout, it is acting as a strong support level and has been retested.

Trendlines:

Downtrend line: Broken and retested.

Uptrend line: Guiding current price action, supporting higher lows and forming an ascending channel.

200 EMA (blue line):

Price is trading above the EMA 200 (~3,331), confirming bullish bias and providing dynamic support.

Momentum (RSI 14):

RSI is around 67.85, showing strong bullish momentum.

Nearing overbought, so a minor pullback or consolidation could occur before continuation.

Volume:

Increase in buying volume near breakout area suggests institutional interest or strong buyer conviction.

Mr SMC trading point

---

Conclusion:

Price has shifted into a bullish continuation pattern.

A successful break and retest of structure and trendlines increases the likelihood of further upside.

As long as price holds above the yellow support zone and the uptrend line, bullish momentum is favored.

Short-term pullbacks may offer new long opportunities.

---

Please support boost 🚀 this analysis)

Beware of the market's trap of luring more investors, short 3335Regarding recent trading strategies, I believe you have also seen my trading win rate. I often inform the future trend of gold several hours or even days in advance, because my many years of trading experience have made me an excellent poisonous wolf in the trading market. Now I see a lot of bullish voices in the market, but my wolf’s sense of smell has discovered danger signals. In the short term, I think that without the influence of news, the market needs to digest the overbought momentum of the bulls. From the 4H chart, the middle track of the Bollinger Band is at 3332, which is very close to the strong support of 3330 given by us during the day. Therefore, I think that at least within 4 hours, gold will fall back to test the support below 3340-3330, or even 3320. Since most people want to follow the crowd, let them go. They will only fall into the trap set by the market. Let's prove with facts whether following the wolf pack will make you hungry or well fed.

OANDA:XAUUSD

Gold May Temporarily Correct Under Resistance Pressure📊 Market Overview:

• Gold reached resistance around $3,365–$3,370/oz before showing signs of cooling due to mild profit-taking.

• Ongoing trade tensions and geopolitical risks — such as President Trump’s tariff plan — continue to support safe-haven demand, driving gold close to a three-week high.

• Strong central bank purchases reinforce the long-term bullish outlook.

📉 Technical Analysis:

• Key Resistance: $3,365–$3,370

• Nearest Support: $3,300–$3,320

• EMA 09: Price is currently below the EMA 09, suggesting a potential short-term pullback. (Price is still above the EMA50, supporting the recent uptrend.)

• Candlestick patterns / Volume / Momentum:

o RSI near 57 – neutral but slightly declining.

o MACD and ADX remain bullish, indicating underlying strength but with possible short-term consolidation ahead.

📌 Outlook:

Gold may experience a short-term pullback if it fails to break through the $3,365–$3,370 zone and geopolitical tensions ease.

However, the medium-to-long-term trend remains bullish, especially as central banks continue to accumulate gold and global risks persist.

💡 Suggested Trading Strategy:

SELL XAU/USD: $3,363–$3,366

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,369

BUY XAU/USD : $3,317–$3,320

🎯 Take Profit: 40/80/200 pips

❌ Stop Loss: $3,214

Gold bulls explode to new highs

💡Message Strategy

Gold prices hit a three-week high near $3,375 an ounce in early trading on Monday before retreating. Gold prices are under selling pressure again as buyers failed to sustain higher levels hit earlier on Monday.

Gold prices hit a three-week high in early Asian trading on Monday, supported by safe-haven demand after U.S. President Trump threatened to impose 30% tariffs on imports from the European Union and Mexico.

Gold prices encountered resistance just below the 23.6% Fibonacci retracement of April’s record rally at $3,377 an ounce in early Asian trading on Monday.

Despite the pullback, the 14-day relative strength index (RSI) continues to show additional upside as the indicator is well above its midline, currently near 54.20.

📊Technical aspects

Gold 4H chart. From the perspective of the morphological structure, gold has recently been rising in lows, and has been oscillating upward along the rising trend line, moving out of the standard rising trend wave rhythm. On Friday night, the bulls once again made a strong effort to break through the key pressure level of 3345.0, further opening up the bullish upside space, and the market outlook continues to see the bullish continuation of the market.

According to the comprehensive MACD indicator, the fast and slow lines are running above the 0 axis, indicating that the bullish power dominates the market trend. In terms of strategy, it is recommended to follow the bullish rebound wave trend to find support levels and ambush long orders.

💰Strategy Package

Long Position:3335-3340,SL:3320,Target: 3390-3400

Gold breaks trendline towards 3390, Uptrend resumes✏️ OANDA:XAUUSD The price increase will continue today and will be even stronger. After breaking the trendline, gold has strong support. SELL strategies are only considered to find short-term reaction points waiting for the next trends.

Gold has confirmed the uptrend is back, heading to 3390 today.

📉 Key Levels

Support 3330-3314

Resistance 3345-3362-3388

Sell trigger: rejection from 3345 with bearish confirmation

Sell zone: 3362–3387 (Strong resistance)

BUY trigger: 3330-3314 support with bounce confirmation

Leave your comments on the idea. I am happy to read your views.

Gold gaps up and open higher,beware of going long at high levelsBros, the Asian session opened higher in the morning. Currently, gold is falling back to the SMA1O moving average. We will continue to be bullish after it falls back and stabilizes. At present, it has broken through the key resistance level of 3360. The daily line has shown a strong pattern of three consecutive positives. The gold price remains in the rising channel, and the bullish trend is obvious. As the gold price moves up, the short-term moving average moves up with it. At present, 3355-3345 constitutes an important support in the short term, and 3375-3385 above constitutes a short-term resistance area. Whether it can stand firmly above 3360 this week is the key.

Severe overbought in the short term, there are trading risks for long positions at high levels. Short-term operation suggestions for the Asian and European sessions: consider shorting when it touches 3365-3375, and stop loss when it breaks 3375. The target focuses on 3355-3345, and the breakout looks at 3330-3320. On the contrary, if it stabilizes at 3355-3345, you can consider going long.

XAU/USD technical analysis setup Read The captionSMC trading point update

Technical analysis of (XAU/USD) on the 6-hour timeframe, focusing on a key resistance zone that could trigger either a bullish breakout or a bearish reversal.

---

Analysis Summary

Current Price: $3,357.95

Trend Context: Price is testing a strong resistance zone with a possible breakout or rejection in play.

---

Scenario 1 – Bullish Breakout

1. Resistance Zone: $3,357–$3,372

Multiple previous rejections.

A confirmed close above $3,372.77 signals bullish strength.

2. Upside Targets:

Target 1: $3,393.87

Target 2: $3,452.08

3. Indicators:

RSI at 63.74, approaching overbought but still with room to rally.

EMA 200 is trending upward, supporting bullish bias.

---

Scenario 2 – Bearish Rejection

1. If price fails to close above $3,372.77, a rejection from resistance is likely.

2. Downside Targets:

Reversal projected toward the key support zone at $3,246.97

EMA 200 at $3,300.97 may provide temporary support before breakdown.

---

Trade Ideas

Direction Entry Level Stop-Loss Target 1 Target 2

Bullish Close above $3,372 Below $3,346 $3,393.87 $3,452.08

Bearish Rejection from $3,357–$3,372 Above $3,380 $3,300 → $3,246.97

Mr SMC Trading point

---

Summary

This is a critical decision point for Gold. A breakout above resistance can propel price to $3,450, while rejection could drive price back to $3,246. The reaction at the current zone will dictate the next major swing.

Please support boost 🚀 this analysis)

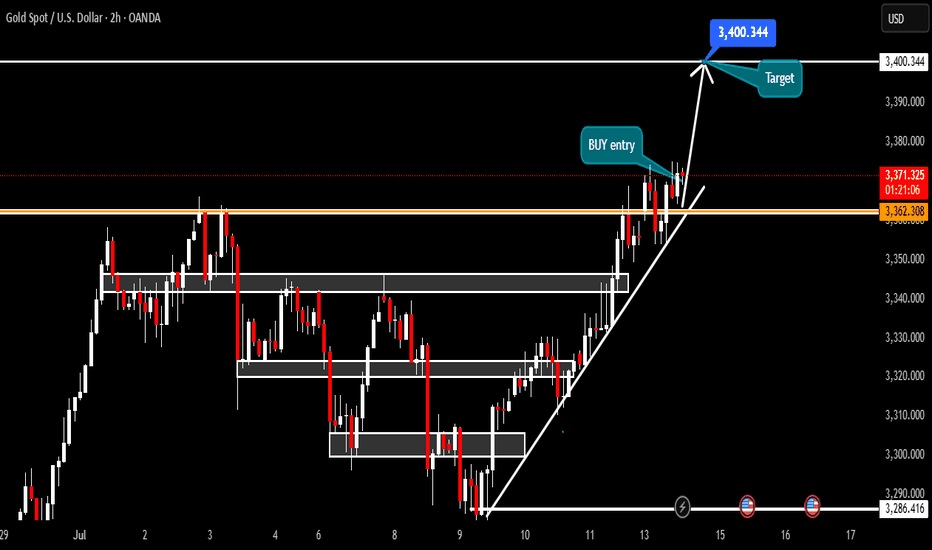

Market Analysis: Gold Climbs Higher Amid Market OptimismMarket Analysis: Gold Climbs Higher Amid Market Optimism

Gold price started a fresh increase above the $3,350 resistance level.

Important Takeaways for Gold Price Analysis Today

- The gold price started a fresh surge and traded above $3,330.

- A key bullish trend line is forming with support at $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price formed a base near the $3,280 zone. The price started a steady increase above the $3,330 and $3,350 resistance levels.

There was a decent move above the 50-hour simple moving average and $3,360. The bulls pushed the price above the $3,365 resistance zone. A high was formed near $3,373 and the price is now consolidating.

On the downside, immediate support is near the $3,350 level and the 23.6% Fib retracement level of the upward move from the $3,282 swing low to the $3,373 high.

Besides, there is a key bullish trend line forming with support at $3,350. The next major support sits at $3,330 and the 50% Fib retracement level.

A downside break below the $3,330 support might send the price toward $3,300. Any more losses might send the price toward the $3,280 support zone.

Immediate resistance is near the $3,370 level. The next major resistance is near $3,380. An upside break above $3,380 could send Gold price toward $3,400. Any more gains may perhaps set the pace for an increase toward the $3,420 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAU/USD 14 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

XAUUSD Analysis – July 14, 2025: Gold Tests Critical Resistance Gold (XAUUSD) is currently trading around $3,373, rebounding strongly from the recent low at $3,294. Price is now testing the key resistance zone at $3,372–3,375, which aligns with the 0.0 Fibonacci retracement of the previous downtrend and a significant supply zone on the H4 timeframe.

1. Technical Analysis (H4 Chart):

🔹 Fibonacci & Price Action:

The price found strong support at $3,294, where previous demand and Fibonacci levels converge.

A sharp bullish move has pushed price above the 0.5 (at $3,316) and 0.618 (at $3,322) Fibonacci levels – signaling strong buyer interest.

The $3,372 zone is now acting as short-term resistance, matching the previous swing high.

🔹 EMA & RSI:

EMAs are trending upward, confirming short-term bullish momentum.

RSI is approaching overbought territory, suggesting a potential pullback in the short term.

🔹 Trendline & Structure:

Price remains above the rising trendline, indicating sustained bullish momentum.

The nearest support zone is now at $3,322 – $3,333, which overlaps with key Fibonacci and previous structure levels.

2. Key Price Levels:

Price Zone

Significance:3,372 – 3,375

Short-term resistance – Fibo 0.0:3,345 – 3,333

First support – pullback zone:3,322 – 3,316

Strong support – EMA + Fibo 0.5:3,294 – 3,287

Major support – recent swing low

3. Suggested Trading Strategies:

Strategy 1 – Take Profit for Existing Longs:

If you entered long positions near $3,295–$3,300, consider taking partial profits at the current resistance zone ($3,372–$3,375).

Strategy 2 – Short-Term Sell Opportunity:

Consider a short entry near $3,372–$3,375, with a stop-loss above $3,383.

Target profit: $3,333 – $3,322

Strategy 3 – Buy on Dip (Trend Continuation):

If price pulls back to the $3,333 – $3,322 support and holds, this is a good zone to enter long.

Stop-loss below $3,316, with potential target back to $3,385 – $3,400 if a breakout occurs.

Gold is showing a solid recovery after a sharp decline, but it is now testing a key resistance zone around $3,373. Caution is advised in the short term, as a pullback may occur. Priority should be given to "Buy on Dip" strategies if support zones hold.

Gold Weekly Analysis | Will $3,360 Break or Hold? [July 14–18]In this video, I break down the recent gold price action and what to expect in the coming week. We’ll review how gold responded to last week’s FOMC minutes, why $3,360 remains a key decision zone, and what upcoming U.S. economic data (CPI, PPI, Retail Sales) could mean for price movement.

👉 If you find this content valuable, don’t forget to Vote, Comment, and Subscribe for weekly market breakdowns.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#GoldAnalysis, #XAUUSD, #ForexTrading, #GoldForecast, #MarketOutlook, #TechnicalAnalysis, #FundamentalAnalysis, #GoldPrice, #FOMC, #CPIData, #PPIdata, #DollarIndex, #TradingStrategy, #WeeklyOutlook, #GoldTechnicalAnalysis, #TradeSmart, #Darcsherry

Affected by tariffs, gold rose again.On Saturday, Trump announced that he would impose a 30% tariff on goods imported from the European Union and Mexico from August 1. This news triggered a rise in risk aversion in the market. As a traditional safe-haven asset, gold was once again sought after. The price continued the rise on Friday and continued to open high in the early Asian session. As of now, the highest price reached around 3373.

From the current market point of view, after breaking through the triangle pattern last Friday, there was a sharp rise. The price successfully stood on the short-term moving average, showing an overall bullish trend. However, it should be noted that the short-term moving average has not yet formed an upward cross, which means that there is a high possibility of a confirmation process in the future. Looking back at the trend in the past two months, gold rarely opens high and then continues to rise. Most of them open high and go low. Therefore, under the current situation, although it is bullish overall, it is not advisable to blindly chase more. It is more suitable to wait for a decline before arranging more orders. The key lies in grasping the decline position.

From the perspective of pressure level, 3380-3385 is the first pressure level, and the second pressure level is 3395-3400. The support level below is around 3345, which is also the pressure level that has been emphasized in the early stage, and the top and bottom conversion position. For today's operation, Quaid recommends low-to-long.

Operation strategy:

Short near 3380, stop loss 3390, profit range 3360-3345

Long near 3345, stop loss 3335, profit range 3360-3380

Market Structure & Technical Context 14 July 20241. Price Action & Market Structure

Gold has broken recent swing highs above ~$3,360, marking a bullish Break of Structure (BOS) and signaling upward momentum continuity

Recent pullback zones around $3,350–$3,340 formed a clear Higher Low (Change of Character) — textbook price action confirmation.

2. Fibonacci Retracement / Extension

Measuring from the last swing low near ~$3,326 to swing high ~3,374:

38.2% retracement at ~$3,352 coincides with the current bounce zone.

50% retracement at ~$3,350 aligns with key structure support.

Upside extension targets: 1.272 at ~$3,396, 1.618 at ~$3,425 — overlapping major resistance zones

3. ICT & Smart Money Concepts (SMC)

Order Blocks (OBs) identified near $3,340–$3,342 (prior resistance turned support) — ideal demand zone.

A recent Buy-side liquidity grab eclipsed above $3,360, sweeping stops and gathering liquidity before the breakout — classic ICT setup .

A Fair Value Gap (imbalance) lies around $3,345–$3,350 — zone to expect value-driven retracement.

Higher timeframe has clear SMC alignment: BOS above 3,360 with CHoCH already formed.

4. Major Supply / Demand & Support / Resistance Zones

Demand: $3,340–$3,352 (OB + Fib + BOS confluence).

Supply: $3,380–$3,385 (intraday swing high resistance), followed by zone at $3,396–$3,400.

Key resistance at $3,360–$3,362 — confirmed supply pocket that needs to be reclaimed

5. Moving Average Confirmation

The 4‑hour SMA/EMA 100–200 band is sloping up just below current price (~$3,340–$3,350), reinforcing the bullish context .

1‑Hour Intraday Setups (Aligned with HTF Bullish Bias)

Setup A: Pullback into 4‑Hour OB / Fair Value Gap

Entry: Limit buy at $3,345–$3,350.

Stop: Below $3,335 (below imbalance & BOS).

TP1: $3,362 (former resistance).

TP2: $3,380 (next supply block).

Setup B: Breakout Retest of 3,360

Entry: Buy on retest of broken resistance at $3,360.

Stop: Below $3,356.

TP1: $3,380.

TP2: $3,396 (Fib extension confluence).

Setup C: Momentum Continuation Fresh Breakout

Entry: Market buy on clear H1 BOS above $3,365.

Stop: Below breakout candle low (~$3,360).

TP: $3,396 (1.272 Fib) – extend to $3,425 if momentum strong.

The Golden Setup:

Setup A—buy from $3,345–$3,350—has strong confluences:

4‑hour demand OB + fair value gap,

38.2–50% Fib retracement,

SMC BOS/imbalance alignment,

ICT-style order block zone.

This offers high edge with confluence clusters.

✔ Summary Report: Direction & Key Zones

Directional Bias:

Medium-term (4H): Bullish, confirmed by BOS above 3,360, higher lows, OB and Fibonacci alignment.

🔹 Primary Buy Zones:

$3,345–$3,350 — 4H OB + fair value gap + Fib.

$3,360 on retention — breakout retest zone.

Momentum entry >$3,365.

🔹 Key Target Zones:

First resistance: $3,360–$3,362.

Next supply: $3,380–$3,385.

Extension target: $3,396 (1.272 Fib), then $3,425 (1.618 Fib).

🔻 Watchdownside Risk:

Daily invalidation if drop below $3,335 (4H OB break).

Next support at $3,326–$3,330.

📋 Consolidated Table: Setups at a Glance

Setup Entry Zone Stop Targets

Golden $3,345–$3,350 $3,335 TP1: $3,362 / TP2: $3,380

Breakout Pullback $3,360 retest $3,356 $3,380 → $3,396

Momentum BOS >$3,365 (H1 BOS) < $3,360 $3,396 → $3,425

Final Thoughts

On the 4‑hour chart, price is firmly in a bullish regime, supported by price structure, SMC, ICT concepts, and Fibonacci confluence. The $3,345–$3,350 zone is the highest‑probability entry for buyers, offering excellent risk/reward. The Golden Setup targets ~$3,380 and beyond, combining structure, gap fill, and liquidity strategy.