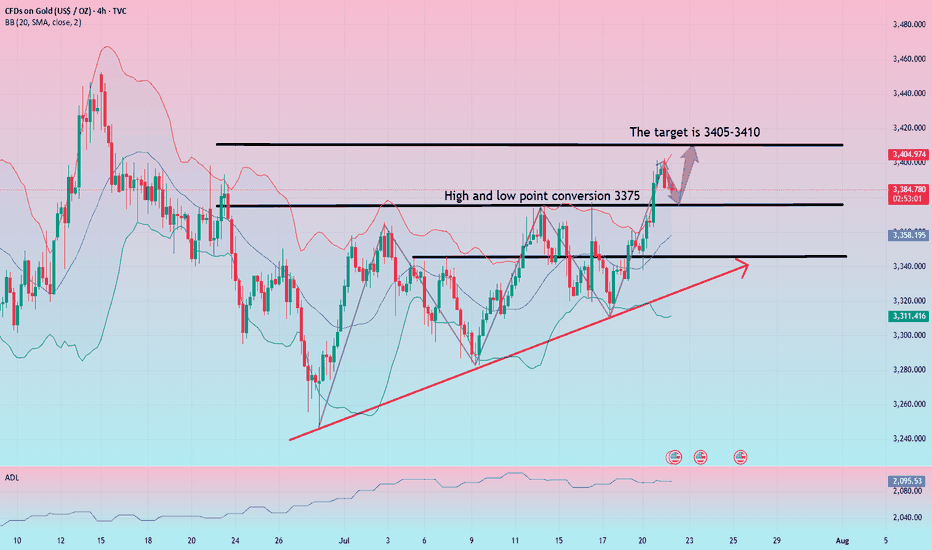

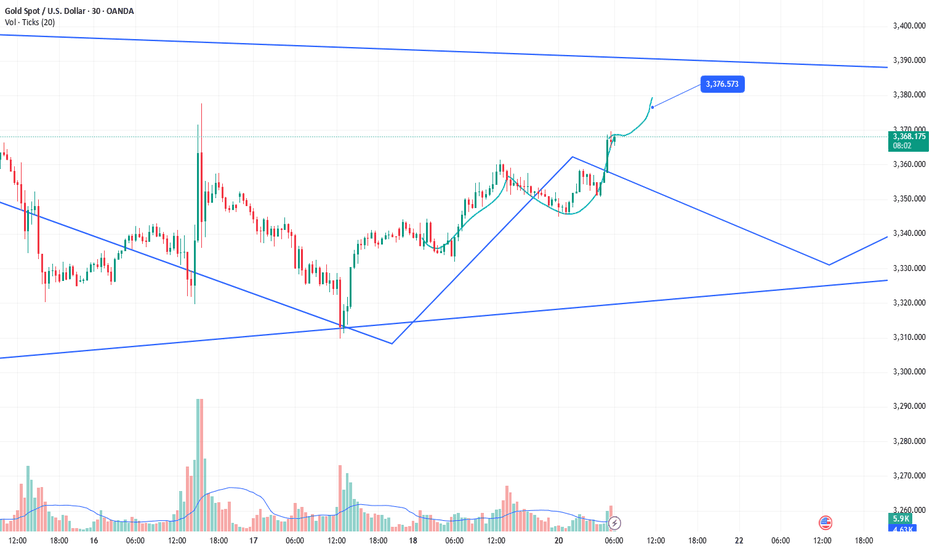

Can gold continue to fall slowly sideways? Focus on the 3375 wat

On Tuesday, spot gold fell back mildly after yesterday's surge. The current gold price is around $3,384/ounce. Spot gold prices surged more than 1% on Monday and hit a five-week high. The main reason was that the US dollar and US bond yields plummeted, and investors were uneasy about the approaching deadline for tariff negotiations on August 1. The market is facing various uncertainties, which does provide support for gold.

Views on today's gold trend!

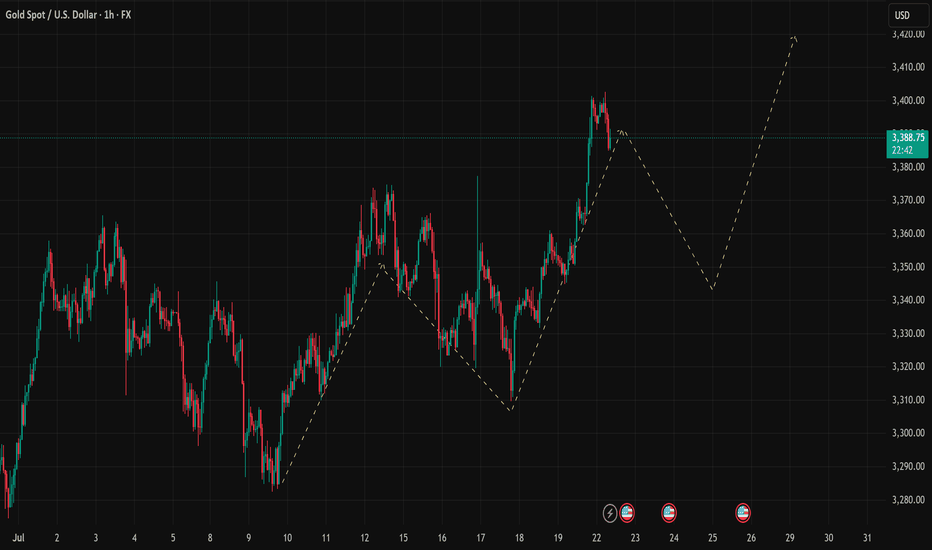

After more than a month of volatile trends, gold once again broke through the integer mark of 3,400 on the first trading day of this week. Under the current bullish sentiment of creating a new high, the previous short-term downward trend ended. From the daily chart, gold is still in an upward trend in the long term. The previous market rebounded effectively after touching the downward trend line, and the rebound force was considerable. With the restart of the bullish force, the main idea can carry the trend and buy on dips.

From the 4-hour chart, the continuous rise of gold and the turning of the moving average have made the market bulls more aggressive, which means that the previous short-term downward trend has ended. At present, a new trend is opening up in the 4-hour chart. The rise of gold has also established an upward trend line. You can consider buying on dips against the 3375 watershed.

Gold: Buy near 3375, defend 65, and target 3405-3410!

Goldprice

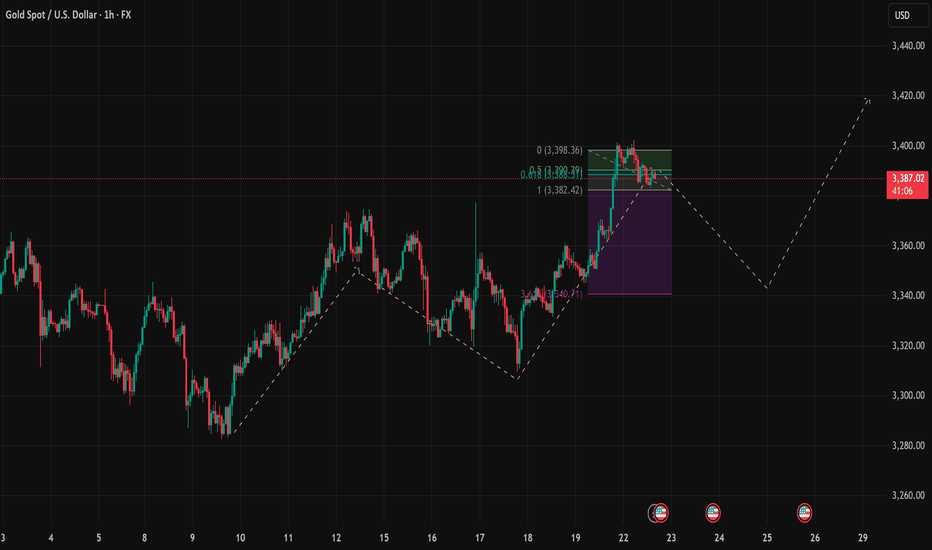

Gold Consolidates Before Breakout – A Prime Buy-the-Dip Gold Consolidates Before Breakout – A Prime Buy-the-Dip Opportunity

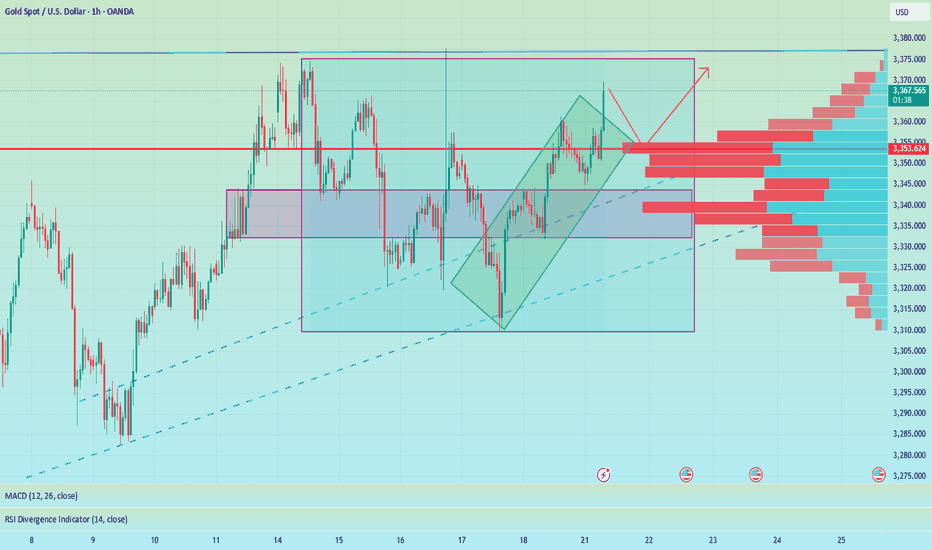

On the 1H chart, XAUUSD continues to display a bullish market structure with a series of higher highs and higher lows. After a strong rally from the 3.618 Fibonacci extension zone at 3,340.71, price reached a local high at 3,398.36 and is now undergoing a sideways consolidation just below resistance.

Technical Breakdown:

Price Structure: Gold remains within a bullish trend. The current pullback appears healthy and corrective, forming a potential launchpad for the next leg higher.

Fibonacci Retracement: Price is hovering around the 0.618 (3,388.39) and 0.786 (3,390.49) retracement zones of the previous bullish leg. This area acts as a strong short-term support zone – if held, it may trigger a continuation move.

Key Support Levels:

Short-term: 3,382.42 (Fibonacci 1.0)

Medium-term: 3,340.71 (Fibonacci extension 3.618)

Long-term: 3,321.58 (major swing low)

Key Resistance Levels:

Immediate: 3,398.36 (recent local top)

If broken, potential targets lie around 3,420–3,430 based on projected trendline extensions.

EMA & RSI: Although not displayed here, price action suggests that gold is trading above both the EMA20 and EMA50 – a bullish sign. If RSI forms a mild bearish divergence in the overbought zone, a short-term dip to test Fibonacci support is likely before continuation.

Trading Strategy:

Scenario 1 – Buy the Dip (Primary Setup):

Wait for price to pull back toward 3,382 – 3,385 (Fibonacci 1.0).

Set buy limit entries, SL below 3,375, TP1 at 3,398, TP2 at 3,420.

Scenario 2 – Breakout Trade:

If price breaks and closes above 3,398 with strong volume, consider a breakout buy.

SL below 3,385, target 3,420–3,430.

Scenario 3 – Bearish Reversal (Low Probability):

If price decisively breaks below 3,380, gold may retest the 3,340–3,350 support zone.

Only consider short positions with confirmation from volume or reversal patterns.

Conclusion: The trend remains bullish. The current pullback offers a favorable opportunity to rejoin the uptrend. Watch the 3,382–3,385 area closely as it may serve as the next springboard higher.

If you found this strategy useful, be sure to follow for more trade setups and save this post for your watchlist.

What are your thoughts on today’s gold setup? Let’s discuss in the comments below.

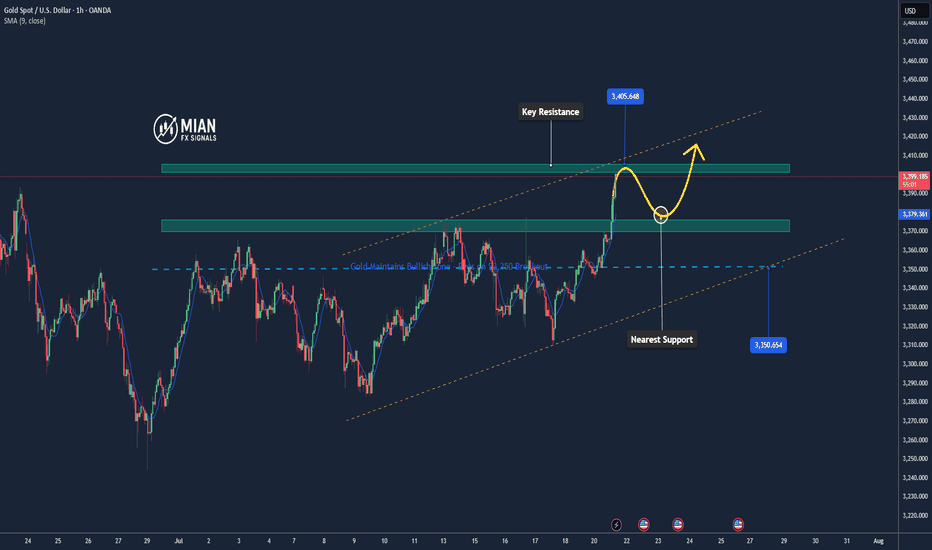

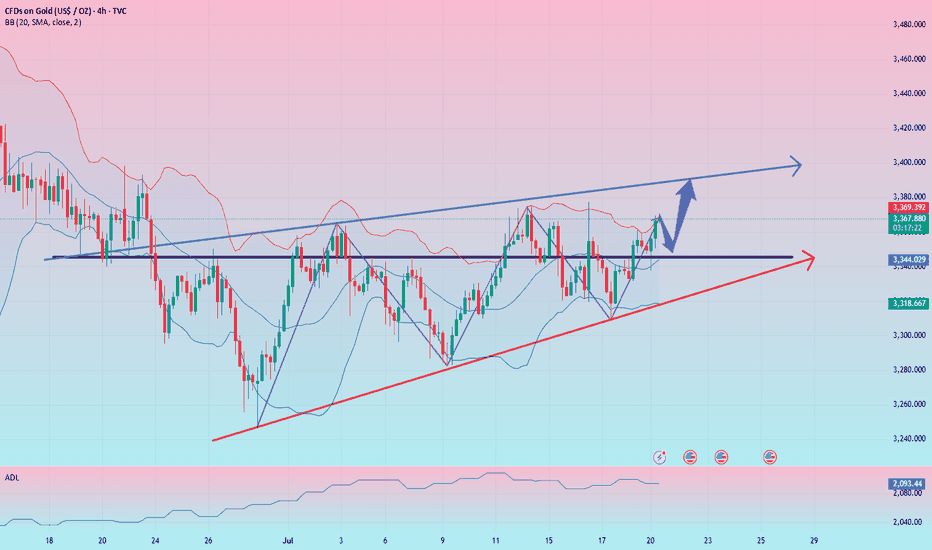

Gold Could Extend Rally if Breaks 3,400📊 Market Overview

Gold is currently trading around 3,400 USD/oz, up approximately +1.41% over the past 24 hours.

The upward momentum is supported by a weakening US Dollar following dovish-leaning remarks from the Fed, along with growing demand for safe-haven assets amid trade uncertainties.

📉 Technical Analysis

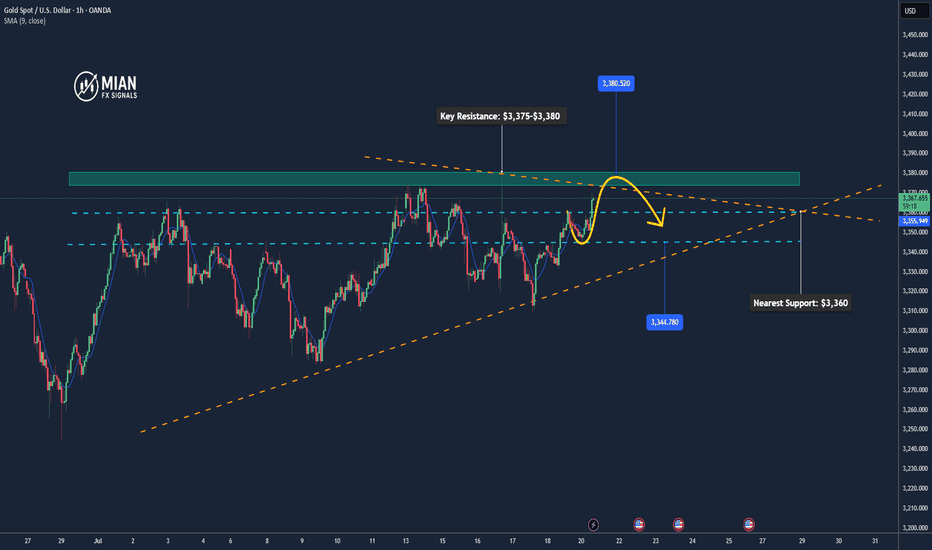

• Key Resistance: ~3,400–3,405 USD (psychological zone; a break above could open the path for further gains).

• Nearest Support: ~3,370–3,375 USD, followed by 3,345–3,350 USD, which marks today’s low.

• EMA 09/20: Price is currently trading above both EMA 9 and EMA 20, confirming a short-term uptrend.

• Momentum / Oscillators: RSI is in the overbought zone; MACD and ADX still show a “buy” signal → bullish trend continues, but watch for possible technical pullbacks.

📌 Opinion

The price may continue to rise if it breaks above the 3,400 USD/oz level, especially if the USD remains weak and safe-haven flows continue to support gold. However, if there’s short-term selling pressure or a USD rebound, gold may pull back toward the 3,370–3,375 USD support zone.

💡 Trade Setup

SELL XAU/USD at: 3,400–3,405 USD

🎯 TP: 3,380 USD

❌ SL: 3,410 USD

BUY XAU/USD at: 3,370–3,375 USD

🎯 TP: 3,390–3,395 USD

❌ SL: 3,360 USD

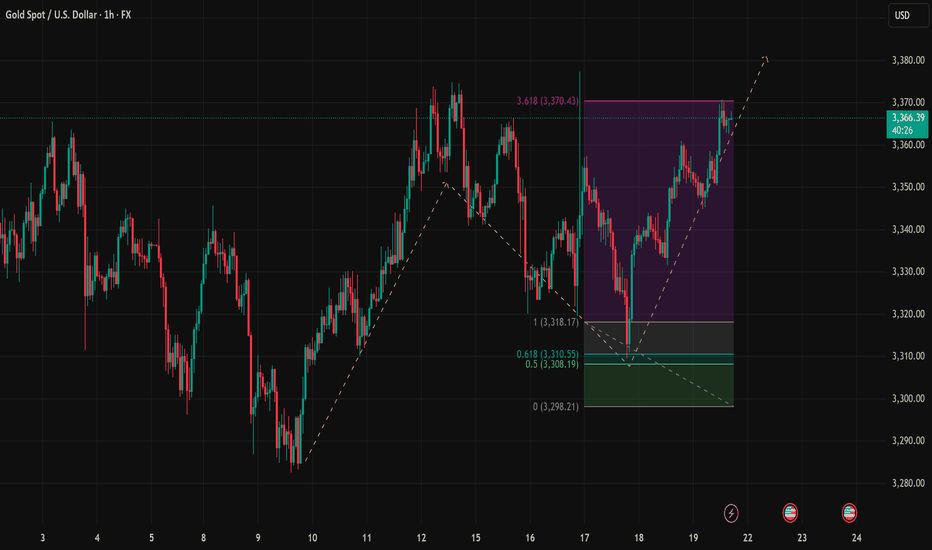

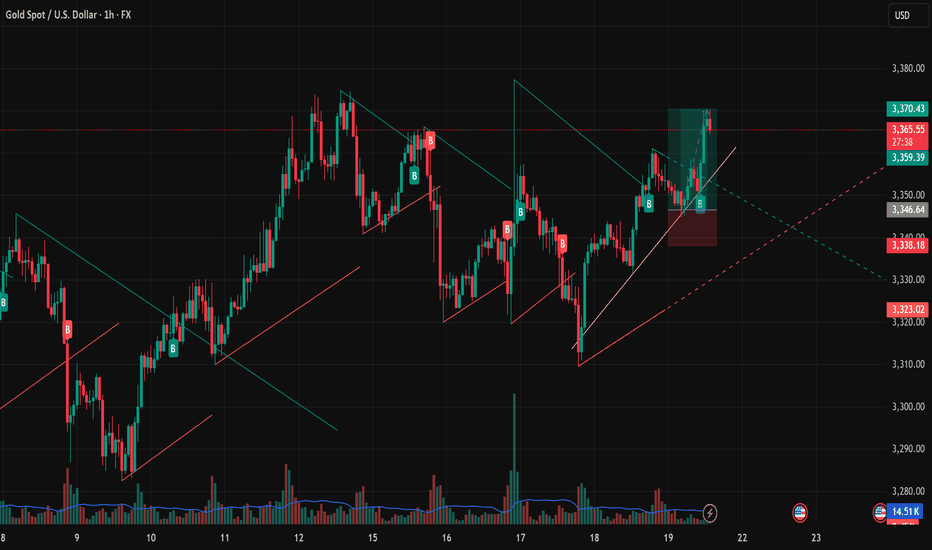

Gold Approaches 3,370 Resistance – Watch for Short-Term PullbackIn the July 21st trading session, gold (XAUUSD) on the H1 timeframe continues to push higher and is now testing a key resistance zone around 3,370 USD, which aligns with the 3.618 Fibonacci extension level. This zone is considered a high-probability area for profit-taking after a strong rally from the 3,308–3,310 USD support zone (aligned with the 0.5 and 0.618 Fibonacci retracement levels). The short-term bullish structure remains intact as long as price stays above the rising trendline from July 18th, with dynamic support currently sitting near 3,350 USD.

From a price action perspective, the latest candles are showing upper wicks near the 3,370 resistance, suggesting early signs of selling pressure. If combined with an overbought RSI condition (often seen in such extended moves), this increases the probability of a short-term retracement.

Key intraday levels to watch:

– Resistance: 3,370.43 (Fibonacci 3.618 extension)

– Dynamic Support: 3,350 (ascending trendline)

– Major Support: 3,310 – 3,308 (Fibonacci 0.618 – 0.5)

– Trend Reversal Level: 3,298.21 (recent swing low)

XAUUSD Trading Strategy for Today:

Primary Scenario – Short Setup near 3,370 if bearish confirmation appears:

Entry: 3,370 – 3,372

Stop Loss: 3,378

Take Profit: 3,350 → 3,330 → 3,310

Alternative Scenario – Buy the dip at trendline support if bullish price action confirms:

Entry: 3,350

Stop Loss: 3,340

Take Profit: 3,370 → 3,380+

In summary, gold is trading at a critical short-term resistance zone. A rejection from 3,370 could trigger a healthy correction toward support zones, while a clean breakout above it would signal strength and open the path toward 3,380–3,390. Traders should stay alert and wait for clear confirmation before entering positions.

Follow for daily gold strategies and save this post if you found it useful for your trading setup.

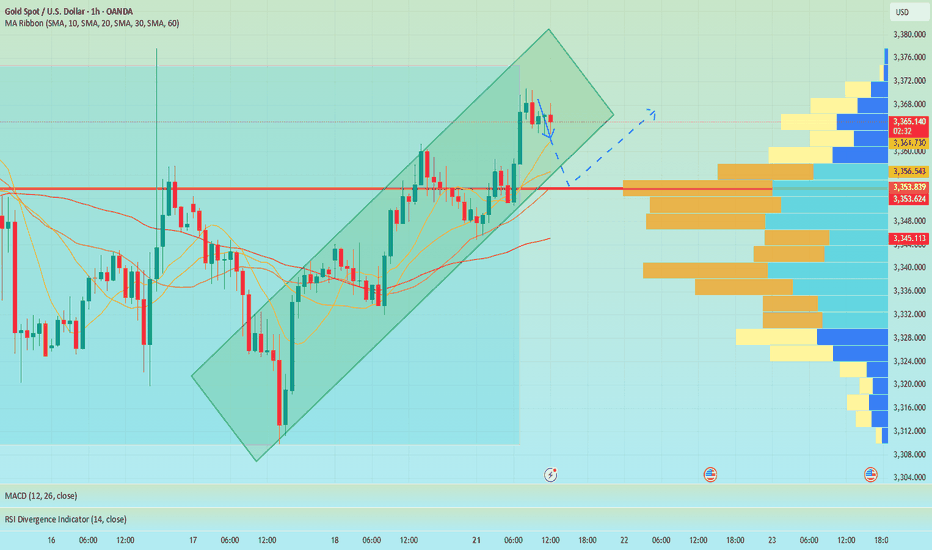

XAUUSD Continues Bullish Structure With Key Retracement OpportunTechnical Outlook – 22/07/2025

On the 1-hour chart, XAUUSD is maintaining a clear bullish market structure with a sequence of higher highs and higher lows. The projected price path drawn on the chart suggests a potential retracement before a continuation toward the 3,420 USD region. Let’s break down the key technical zones and strategies for today:

Key Levels to Watch

Immediate Resistance: 3,390 – 3,400 USD

This is the recent high. A breakout above this area could trigger momentum toward the projected 3,420 USD extension.

Support Zone: 3,345 – 3,350 USD

This zone aligns with the potential pullback as illustrated on the chart, offering a high-probability buy-the-dip opportunity. It coincides with previous structure resistance now turned support.

Trendline Support: The ascending yellow trendline has been respected multiple times and should act as dynamic support on any intraday retracements.

Indicators & Tools Used

EMA: Price is currently trading above the short-term EMA (not shown), suggesting intraday bullish bias remains intact.

RSI (Recommended Use): Look for RSI near 40–50 on the pullback for confluence at support.

Fibonacci Tool (suggested): If measuring from the swing low near 3,320 to the high of 3,390, the 0.618 Fib lies close to 3,345 – an ideal area to look for long entries.

Suggested Trading Strategies

🔹 Buy the Dip Strategy:

Wait for a corrective move into the 3,345–3,350 area. Confirm with bullish reversal candles or RSI support, then enter long targeting 3,400–3,420. Stop-loss ideally below 3,335 (structure break).

🔹 Breakout Continuation Strategy:

If price breaks cleanly above 3,390 with volume, a momentum trade toward 3,410–3,420 is viable. Use tight trailing stops to protect gains.

🔹 Avoid chasing highs – Patience at support zones or confirmation above resistance will offer better reward/risk setups.

Conclusion

Gold is respecting bullish market behavior on the 1H chart, and while a short-term correction is expected, the broader trend favors upside continuation. The 3,345–3,350 area will be critical for today's trading decisions.

Remember to follow for more updates and strategy insights. Save this post if you find it useful.

If you’d like, I can also add a version using RSI or Fib levels directly plotted. Let me know.

XAU/USD) Bullish trend analysis Read The captionSMC Trading point update

Technical analysis of XAU/USD (Gold) on the 1-hour timeframe. Here’s a breakdown

---

Technical Analysis Summary

Descending Channel Breakout

Price action previously formed a descending wedge/channel, shown by the two black trendlines.

A bullish breakout occurred above the trendline, signaling a shift in momentum from bearish to bullish.

Key Support Zone

The yellow highlighted zone (around $3,338–$3,340) is marked as the “new key support level”.

Price is expected to retest this area (confluence with 200 EMA), which aligns with standard bullish breakout behavior.

The green arrow indicates potential bounce confirmation.

Bullish Projection

After the retest, price is projected to climb steadily toward the target point at $3,394.52.

The setup anticipates around 56.27 points upside, or roughly +1.69% gain from the support zone.

---

Target

$3,394.52 – defined using the previous range breakout height and horizontal resistance.

---

Trade Idea

Entry: On bullish confirmation near $3,338 support zone.

Stop Loss: Just below the yellow zone (e.g., under $3,330).

Take Profit: Near $3,394.

Mr SMC Trading point

---

Conclusion

This is a classic breakout-retest-play, supported by trendline structure, a key horizontal support zone, and RSI strength. As long as price respects the highlighted support, the bullish outlook remains valid.

Please support boost 🚀 this analysis)

Gold rises continuously and then moves unilaterally? 3375 is the

At the beginning of this week, international gold prices rose, benefiting from the weaker dollar, while investors paid attention to news on trade progress before the US tariff deadline on August 1. As US inflation data was lower than expected and the market may have some defensive bets against tariffs, gold finally rebounded from the main upward trend line again. The lower-than-expected US inflation data did not trigger the market to re-price more hawkish rate hike expectations.

From a larger perspective, as the Fed's easing policy progresses, real yields may continue to fall, and gold should maintain an upward trend.

Views on today's trend!

Today, gold is rising slowly, and basically there is no chance of a correction, so it also led to our opening directly chasing a wave of gains, and the market has actually had some risks after the rebound to above 3370. After all, the 3373-75 line was a dense pressure area before.

From the current hourly chart, gold has been moving along the upper track of the moving average and has accelerated since breaking through the 3375 line. It is possible that it will test the 3410 line today. After all, it is already at the 3395 line, and today's strength and weakness watershed has actually shifted from 3340 to 3375. After all, the top and bottom conversions are raised synchronously!

Gold: Long around 3375, defend 3365, and target 3395-3405!

Accurate prediction, continue to buy after retracement to 3353📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

Gold is currently rising rapidly, reaching a high near 3368, and the overall bullish trend has not changed yet. It is not recommended to continue chasing the highs at present. Those who are long at 3345 can consider exiting the market with profits. The technical indicators are close to the overbought area and there is a certain risk of a correction. Be patient and wait for the pullback to provide an opportunity. At the same time, 3353 has become the position with relatively large trading volume at present, and the top and bottom conversion in the short term provides certain support for gold longs. If it retreats to 3355-3345, you can consider going long again, with the target at 3375-3385. If it falls below 3345, look to 3333, a second trading opportunity within the day. If it falls below again, it means that the market has changed, and you can no longer easily chase long positions.

🎯 Trading Points:

BUY 3355-3345

TP 3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

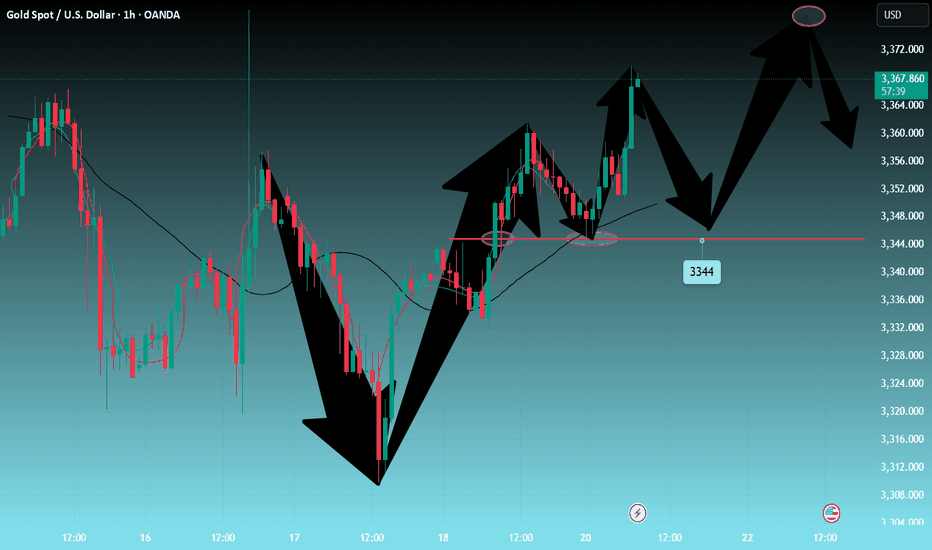

Gold----Buy near 3344, target 3360-3377Gold market analysis:

Recently, the daily gold line has been switching back and forth. If you look at the daily line from around June 25 to around July 21, it is a large range of fluctuations, and there is no big change in structure. The weekly line has not run too far in the past three weeks, and it is also a small range of fluctuations. We need to adjust our thinking in time in operation. For example, the market from Thursday to Friday last week was a market with rapid conversion of buying and selling. We adjusted our thinking in time on Friday to make a profit from the bullish 3337 layout. Moreover, our analysis chart also clearly shows that gold has fallen back at 3357, and gold began to fall back at 3361. Today, we must buy at a low price to be bullish. 3377 is a hurdle on the daily line, and it is also a barrier that is difficult to cross for buying. If the highest position can be reached this week, it can be confirmed that it is a real buy. Otherwise, it is a daily line structure of fluctuations. The support of the weekly line this week is around 3308 and 3000. Only when this position is broken on the weekly line can the weekly selling position be confirmed. Otherwise, it depends on the daily line structural fluctuations of 3300-3377.

In the Asian session, we will first arrange long orders at the small support of 3344. The larger support is the 1-hour pattern support near 3331. In the Asian session, we must first look for opportunities to buy at low prices. If 3331 is broken directly, we have to think whether it is a volatile market again. The volatile market is repeated. Don't get on the bus in the middle position. We should grasp the rhythm more, so that we can get both buying and selling profits.

Support 3344 and 3331, pressure 3361 and 3377, the watershed of strength and weakness in the market is 3344.

Fundamental analysis:

Today is a holiday in Tokyo, Japan. In addition, there is no major data this week. We focus on the fundamentals. Trump's tariffs are still a focus.

Operation suggestions:

Gold----Buy near 3344, target 3360-3377

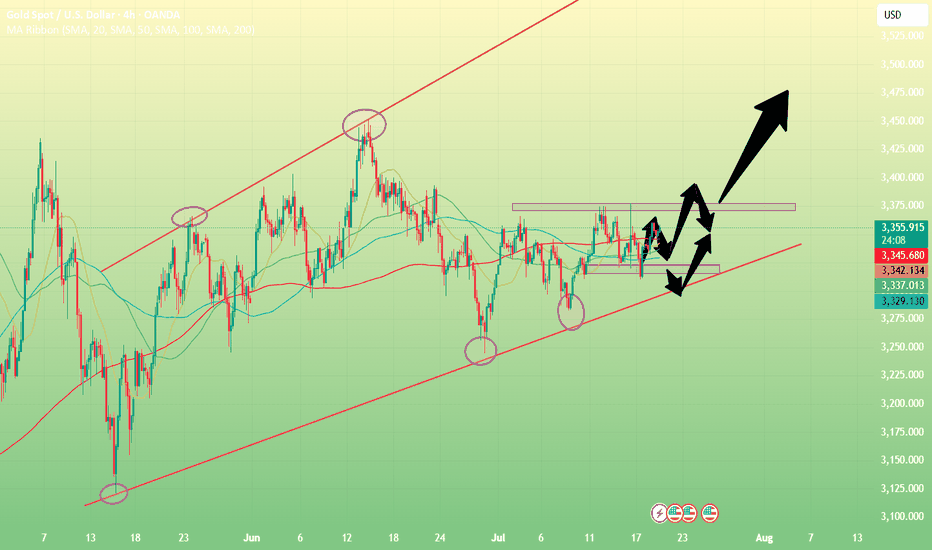

In-depth analysis of gold price trends this week!Market news:

During the Asian morning session on Monday (July 21), the London gold price rose slightly to above $3,350 and is currently trading around $3,356/ounce. The weakening dollar and continued geopolitical and economic uncertainties have boosted demand for safe-haven spot gold, supporting international gold prices, but the rebound in the University of Michigan survey index may limit gold's gains.Although gold prices may face correction pressure in the short term, international gold has limited room to fall. Factors such as economic slowdown, lower interest rates and rising inflation will attract more buyers to enter the market. The continued purchases by central banks over the past two and a half years have also provided solid support for gold prices. The tension between Trump and Powell is the main reason why gold prices remain high.Looking ahead, the market focus will shift to this week's ECB monetary policy meeting. Economists generally expect the ECB to keep interest rates unchanged, and preliminary manufacturing data released this week may also trigger some market fluctuations. This week's economic data and Fed dynamics will be key variables in the trend of gold prices. No matter how the market fluctuates, the long-term value of gold cannot be ignored, and investors need to pay close attention to macroeconomic changes and political events.

Technical Review:

Technically, the daily chart of gold still maintains the adjustment of the middle track of the Bollinger Band, forming a yin-yang alternating shock consolidation. However, on Friday, the gold price closed with a small positive K, and the price MA10/7-day moving average closed above 33/42. From the indicator point of view, the MACD indicator momentum column shortened, and the RSI indicator ran around 50, indicating that the market buying and selling forces were balanced.The 4-hour chart shows that the gold price fluctuated and tended to buy and consolidate at 3330-3360. At present, the moving average system opened upward. As long as gold does not lose 3320, it is expected to continue to sprint upward to 3375/3400. On the contrary, if it loses the support of 3320/10 again, it is regarded as a short-term weak shock downward. On the whole, the current trend of gold is oscillating and tending to buy and consolidate. Today's trading idea is mainly to buy at a low price and sell at a high price.

Today's analysis:

Since there is no major economic data this week, in the absence of geopolitical risks and emergencies, it is expected that gold will still see a small range of shocks and consolidation this week, and the range can be focused on 3400-3300. The daily Bollinger Bands continue to close, with the upper track at 3375 and the lower track at 3288. The short-term moving averages are intertwined near the middle track, suggesting that gold will still be dominated by fluctuations in the short term. In terms of operation, keep the idea of selling at high prices and buying at low prices. Do not chase the rise and sell at the fall. Wait for the breakthrough signal to be confirmed before following the trend. Today’s support is at 3340. You can use this as a key point to arrange buy orders during the day. The key point above is 3361, which is the high point of last Friday. 3361 is a short-term pressure point. If there is no correction today and it directly breaks 3361, we can follow the trend directly. If there is a correction, pay attention to the bottom structure above 3340 and buy at the bottom!

Operation ideas:

Buy short-term gold at 3340-3343, stop loss at 3332, target at 3370-3390;

Sell short-term gold at 3377-3380, stop loss at 3388, target at 3340-3320;

Key points:

First support level: 3340, second support level: 3332, third support level: 3320

First resistance level: 3375, second resistance level: 3388, third resistance level: 3410

Barrick Gold Corp (B) – Riding the Gold SupercycleCompany Snapshot:

Barrick $B is a global gold and copper mining powerhouse, poised to thrive amid soaring gold prices and escalating macroeconomic uncertainty.

Key Catalysts:

Gold Bull Run Tailwind 📊

Spot gold is surging, with projections aiming for $2,700/oz. As a low-cost, large-scale producer, Barrick stands to gain significantly from margin expansion and free cash flow acceleration.

Global Diversification 🌍

Operations across North America, Africa, and Asia offer geographic balance—mitigating regional risk while ensuring strong production continuity.

Insider Confidence + Lean Costs 🔒

CEO Mark Bristow and other execs are actively buying shares, signaling deep conviction.

With industry-low all-in sustaining costs (AISC), Barrick boasts high operational leverage to gold’s upside, especially in an inflationary environment.

Investment Outlook:

Bullish Entry Zone: Above $18.00–$19.00

Upside Target: $28.00–$29.00, fueled by macro gold strength, disciplined execution, and insider alignment.

⛏️ Barrick is a prime gold cycle play, combining operational excellence with strategic global scale.

#BarrickGold #GoldStocks #GoldPrice #Commodities #InflationHedge #MiningStocks #InsiderBuying #AISC #PreciousMetals #MacroTailwinds #B

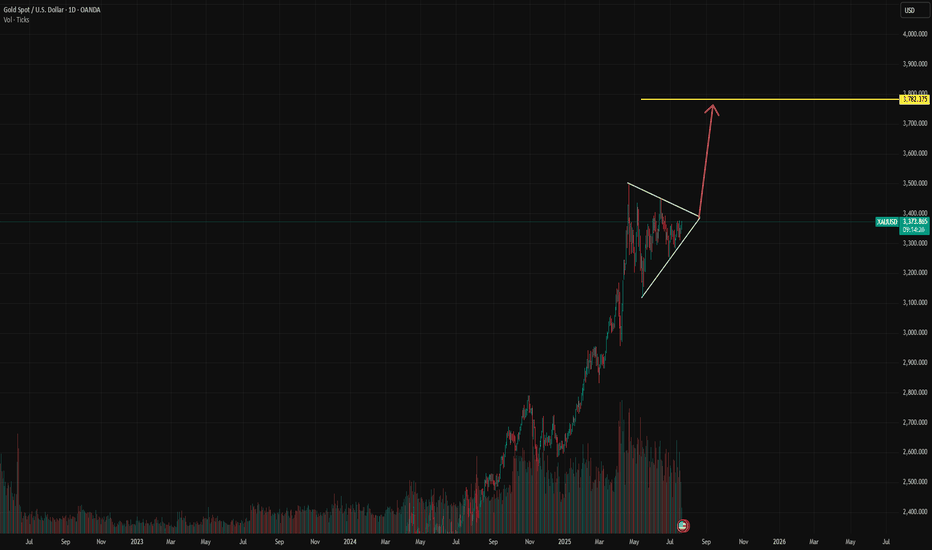

GOLD - Lovers Elliott wave - looking strong Short/Medium termGOLD-----Daily counts indicate Excellent bullish wave structure.

Both appear to be optimistic and this stock invalidation number (S L) wave 2 low

target short / long term are already shared as per charts

correction wave leg seems completed (C)

Investing in declines is a smart move for short/ long-term players.

Buy in DIPS recommended

Long-term investors prepare for strong returns over the next two to five years.

one of best counter

Every graphic used to comprehend & LEARN & understand the theory of Elliot waves, Harmonic waves, Gann Theory, and Time theory

Every chart is for educational purposes.

We have no accountability for your profit or loss.

Gold is about to approach the top suppression position, so be ca

Today, Monday, gold continued its upward trend from last Friday, and the highest so far is around 3370.

Last Thursday, it once reached a low of 3309, and then rebounded sharply, entering the upper suppression area again.

First of all, from the current perspective of the US dollar:

The US dollar is currently in a retracement, and the rise of gold is understandable.

The US dollar has not yet stepped back to the right level, at least it has to step back to around 98.0.

And it has to stabilize at the support near 98.0, so the US dollar may stretch again in the future.

Once it stretches from 98.0 again, the highest can reach above 99.0.

If the US dollar can stabilize above 98.0, then gold should also reach its peak by then.

To be honest, gold is still a little short of the mark at the moment.

3370 is not the top position. It would be best if it could reach a new high, break through around 3380, and then come down again, then the top can be determined.

From the current 4-hour gold chart, we can also see that the top suppression position has not been touched.

Therefore, we still cannot act rashly and cannot chase too much.

It is best to wait for the US market to reach around 3380 to form a top structure.

Combined with the situation of the US dollar, short gold, if gold falls again, at least go back to test 3330-40.

If the US dollar is stronger and can stand above 99.0, it is also possible for gold to directly fall below the 4-hour chart trend line support.

Ultra-short-term trading. Profit of $10/ounceThe order to buy XAUUSD successfully made a profit. The current gold price is 3367. Stimulated by the weekend news, the expected trend was achieved smoothly, and the short-term bulls were strong. Buying can continue to be the main focus. Relying on the half-hour and one-hour trends, trading can be carried out in the London market for the purpose of buying and profit. The increase is about $10/ounce.

Gold 1H - Retest of channel & support zone at 3340After breaking out of the falling channel, gold is currently retesting its upper boundary — now acting as support. The 3340 zone is particularly important as it aligns with the 0.618 Fibonacci level and high volume node on the visible range volume profile. The price action suggests a potential bullish rejection from this area. With both the 50 and 200 EMA below price on the 1H, the short-term trend remains bullish. The 4H trendline further supports this setup. RSI is cooling off near the neutral zone, leaving room for another leg higher toward the 3377 resistance zone. If 3340 fails, 3324 (0.786 Fibo) becomes the next line of defense. Until then, the structure remains bullish following the successful breakout and retest of the channel.

Gold momentum is about to explode, is 3400 still far away?

💡Message Strategy

Gold prices rose as expected on Friday as a weaker dollar and continued geopolitical and economic uncertainty boosted demand for safe-haven gold. Spot gold rose 0.4% to $3,353.25 an ounce, down 1.1% in the previous session. U.S. gold futures also rose 0.4% to $3,359.70. Gold prices remained largely stable around $3,350 an ounce this week.

The trend of gold prices is currently mainly affected by the following three factors:

1. US economic data supports the US dollar

The latest US real estate data is generally positive, and building permits and new housing starts data are both above expectations. The recovery of the real estate market has reduced market concerns about economic recession, which has provided some support to the US dollar, thereby constituting a certain suppression on gold.

2. Fed policy differences trigger market games

Fed officials have obvious differences in their statements on monetary policy. Christopher Waller, a Fed governor, prefers to directly cut interest rates by 25 basis points in July, worried about economic slowdown and weak job market. San Francisco Fed President Daly believes that two interest rate cuts in 2025 are "reasonable", but is wary of the impact of excessive tightening policies on the job market.

On the contrary, Fed Governor Kugler is more hawkish, believing that recent tariffs have been transmitted to consumer prices, and high interest rates should continue to be maintained, and it is not appropriate to cut interest rates for the time being. The existence of differences has caused market expectations to waver, and gold has fallen into consolidation.

3. Inflation expectations determine the medium-term direction of gold prices

The June CPI data from the United States showed signs of rising inflation, which may cause the Federal Reserve to postpone the pace of interest rate cuts.

📊Technical aspects

From the 4H chart, gold is currently oscillating in an obvious symmetrical triangle, forming a consolidation pattern in the short term.

Bollinger Band indicator: The middle track of the Bollinger Band is at $3345, the upper track is at $3405, and the lower track is at $3280. The current price is running near the middle track, indicating that volatility is converging and there is an expectation that a direction will be chosen soon.

Support and resistance: The current key support level is $3,280; short-term support is 3,300, and the upper resistance is $3,380. After breaking through, it is expected to test the previous highs of $3,451 and $3,499.

MACD indicator: The MACD histogram is gradually converging, and the DIFF line (3.19) and the DEA line (1.91) are in a sticky state, indicating that the momentum is exhausted and the probability of short-term shocks is high, but once the volume breaks through, the trend may form quickly.

RSI indicator: The RSI indicator is currently at 53.64, which is in the neutral area and has not entered the overbought or oversold area, indicating that the market is still waiting for new direction signals.

Overall, the analysis believes that gold is at the end of a symmetrical triangle, and the technical side shows that it is about to face a breakthrough. The direction choice may appear tonight or early next week, and the idea is still mainly low-level bulls.

💰Strategy Package

Long Position:3320-3330,SL:3300,Target: 3370-80,3400

Gold is rising steadily, finding the right buying point is the k

There are no eternal friends, only eternal interests. Value exchange is the "code" of interpersonal relationships. From the president to individuals, the game of interests is everywhere.

Half a year ago, Musk strongly supported Trump to take office. The two joined forces to win the swing states. One gained power and the other gained fame. After Musk became the head of the efficiency department, he made drastic reforms and fought corruption from the outside to the inside.

Now, the two have parted ways. According to US media reports on July 20, Trump began to review the order contract between Musk's Space X and the federal government. In just 6 months, the two went from close friends to opponents. The "big and beautiful" bill was also strongly resisted by Musk.

If the big guys are like this, let alone ordinary people, their butts determine their heads, sitting in different positions to think about different interests, emotions and friendship are just outer garments, Musk spent $270 million and got fame, and Trump also got the power he pursued, there is no right or wrong.

This struggle is far from over. It is estimated that the game will continue during Trump's four years in office. Musk stands on the high-dimensional pursuit of interests for the exploration of human progress, while Trump's slogan is to make America great again. The two people have taken different routes.

What we care about is not the right and wrong of the two, but whether this right and wrong will bring turmoil to the financial market. Will Tesla be the "prince in distress"? Is there a possibility of bargain hunting after the stock price plummets in the short term? Will the gold market trigger risk aversion because of Trump's unpredictable approach? This is what we need to ponder and study.

Okay, let's talk about the gold market today:

During this period, the volatility of the gold market has become smaller and smaller, and the range of fluctuations has also been compressed. The sentiment of investors in the market is relatively low. When the fluctuations just started in April, some people who were trapped were concerned about when to get out of the trap every day. After 3 months, everyone is tired, and the fight between bulls and bears has cooled down.

However, as the shock is coming to an end, the gold price may explode into a new round of unilateral market at any time due to fundamentals, especially on August 1, Trump will implement equal tariffs on global trading partners. This king bomb has been delayed. Once it starts to land, it will inevitably cause turmoil in the financial market.

Since last week, affected by Trump's threat to fire Fed Chairman Powell, the gold price quickly hit the high of $3,370 and then fell back to $3,310. After that, the price lows continued to rise and rebounded. The top and bottom conversion of $3,345 in the morning and the support of the low point in the early morning of last Friday were the starting points for the rise. Today, the focus is on the long-short dividing point of $3,345, that is, the price is temporarily not empty above $3,345. Today is not a sharp rise at the opening. The prerequisite for a sharp rise must be that $3,345 breaks.

Today, I think that 3345 USD should be used as the dividing point between long and short positions, that is, your stop loss should be placed below 3345, and then find a position to go long, such as within the range of 3360-55, first look at 3370-75 above, and then look at 3392-95 USD after breaking through. Some people say that they dare not do such a large stop loss? In fact, just reduce the position. The stop loss space is dynamically adjusted according to the support level. Fixed stop loss space is a false proposition.

Gold is waiting for a pullback to break through 3400In the short term, gold is stuck in a sideways trend near 3365. It is not recommended to enter this point regardless of long or short positions. It is expected that there will be certain variables in the NY period. If gold retreats and falls in the short term as we expect, it may first touch around 3361. If it falls below 3361, it is expected to touch around 3353, which is also the point I gave this morning to see support.

Judging from the market, our focus on the upper side is still the 3375-3385 resistance area. If it can be effectively broken through, it is expected to hit the 3400-3420 mark. Although the daily MACD is oscillating near the zero axis, the 4H market shows that the oscillation is strong. Our trading strategy remains unchanged in the short term. The pullback in the NY period provides an opportunity, and we can consider going long. If there is new news during the day that requires adjustment, I will notify you immediately. Bros, please be patient and wait for trading opportunities.

OANDA:XAUUSD

GBPAUD's wide trading range remains intact✏️GBPAUD is trading in a wide range. After the increase on Friday, the pair is retesting the support zone breaking past resistance. And the current reaction point also coincides with the 20 SMA. There is not much momentum for the pair to break out of the wide trading range, so buying the pair to the upper range of 2.097 is a reasonable choice at the moment.

📉 Key Levels

Support: 2.058

Resistance: 2.083-2.096

BUY Trigger: Confirmed bounce from 2.059 (EMA support)

Target 2.09600

BUY DCA Trigger: Break 2.083

Leave your comments on the idea. I am happy to read your views.

Gold Approaches New Resistance – Potential Short-Term Pullback📊 Market Update

Gold is currently trading around $3,368–$3,370/oz, up approximately 0.5% today, supported by a weaker USD and slightly declining US Treasury yields. This comes amid global trade concerns and expectations that the Fed may adjust policy in upcoming meetings.

📉 Technical Analysis

•Key Resistance: $3,375–$3,380 (pivot R2: $3,374.9, R3: $3,389.6)

•Nearest Support: $3,360 (S1: $3,335.8)

•EMA: Price is trading above the EMA9 / EMA20 / EMA50 / EMA200, confirming a strong uptrend

•Candlestick / Volume / Momentum:

o MACD & ADX still confirm strong bullish momentum

o Price consolidating in a rectangle range of $3,352–$3,366 → watch for breakout or rejection at resistance

📌 Outlook

Gold may pull back slightly if it fails to break through the $3,375–$3,380 resistance area and RSI continues hovering near overbought levels.

💡 Suggested Trade Strategy

🔻 SELL XAU/USD at: $3,375–$3,380

🎯 TP: 40/80/200 pips

❌ SL: $3,385

🔺 BUY XAU/USD at: $3,345–$3,348

🎯 TP: 40/80/200 pips

❌ SL: $3,339

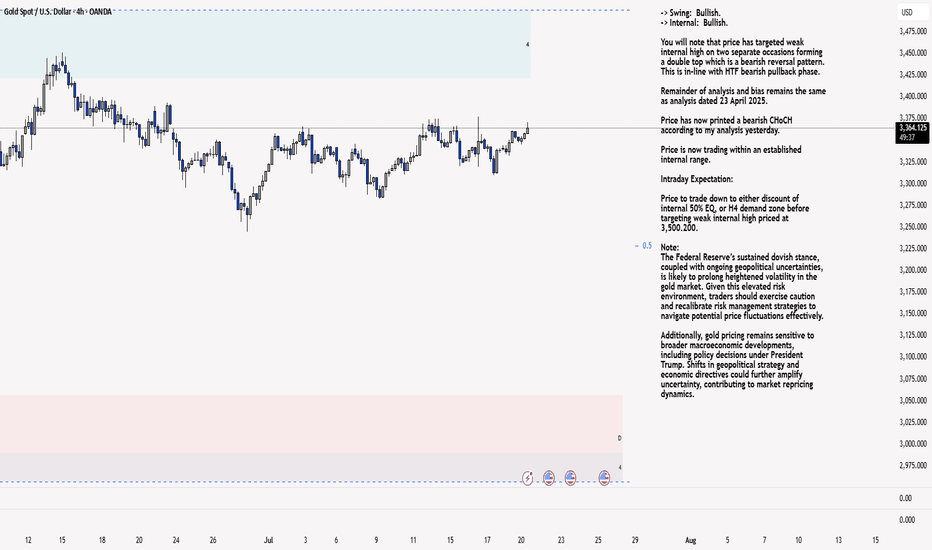

XAU/USD 21 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

XAUUSD 21/07 - Will the Bullish Momentum Continue?In today’s session (July 21), the 1H chart of XAUUSD shows a confirmed breakout above the medium-term descending trendline. The bullish momentum originated from a strong rebound at the confluence zone of support, EMA, and ascending trendline — suggesting a high-probability continuation setup for the short term.

Technical Analysis Overview:

🔹 Price Action Structure:

Price broke out of a falling wedge / descending triangle with a strong bullish Marubozu candle, confirming the breakout move.

Breakout was supported by increased volume, indicating strong institutional buying near 3,346–3,350.

🔹 Trendlines and EMA Outlook:

Price is currently holding above the ascending yellow trendline.

Short-term EMAs (e.g., EMA20/50, not shown) are likely sloping upwards and sitting below price, confirming bullish market structure.

🔹 Key Support and Resistance Levels:

Immediate Resistance: 3,370 USD – recently tested previous swing high.

Major Resistance: 3,378 – 3,385 USD – Fibonacci projection and previous supply zone.

Short-term Support: 3,359 USD – minor pullback zone and EMA alignment.

Major Support: 3,346 USD – the breakout retest zone and price structure support.

Suggested Trading Strategies:

Scenario 1: Buy the Dip

Entry: Near 3,359 – 3,346 USD (on minor retracement)

Stop Loss: Below 3,338 USD (to invalidate the breakout zone)

Target 1: 3,370 USD

Target 2: 3,378 – 3,385 USD

Scenario 2: Breakout Continuation Buy

If price breaks above 3,370 with strong candle + volume:

Entry: Around 3,372 – 3,374 USD

Stop Loss: 3,359 USD

Target: 3,385 – 3,392 USD

Additional Indicators to Watch:

RSI (not shown): If approaching 70+, watch for bearish divergence or exhaustion signals.

Volume: Sustained or increasing volume will confirm strength of the uptrend.

Conclusion:

XAUUSD is showing strong bullish technical signals after breaking the descending trendline and successfully retesting the breakout level. As long as price holds above 3,346 – 3,350, the short-term bullish structure remains intact.

- Follow for more high-quality trading strategies and daily gold analysis. Save this idea if you find it useful for your trading setup!

What’s your view on this analysis? Let’s discuss more in the comments below!