Is the gold price range about to break out?Market news: On Thursday (March 27), the United States dropped a "tariff nuclear bomb" and announced a high tariff of 25% on imported cars. This radical policy, which will take effect on April 3, marks a comprehensive escalation of its trade war strategy. The auto industry warned that this move would trigger a chain reaction of soaring prices and stagnant production. Global stock markets plummeted in response, and the S&P 500 index fell 1.1% in a single day, setting the worst monthly performance in nearly a year. Gold prices fluctuated in a narrow range on Wednesday. Although the dollar index rose to a nearly three-week high, putting pressure on gold prices, concerns about the Trump administration's new tariffs continued to provide safe-haven support for gold prices. In the early Asian session on Thursday (March 27), spot gold fluctuated in a narrow range and is currently trading around $3,020/ounce. Investors need to pay attention to further market interpretations and changes in risk aversion sentiment. Market participants are now looking forward to the US personal consumption expenditure data to be released on Friday, which may provide more information on the path of US interest rate cuts. The final value of the fourth quarter GDP of the United States and the change in the number of initial jobless claims in the United States will be released on this trading day, and investors need to pay attention to them.

Technical Review:

For yesterday, overall, the long and short positions of gold were deeply trapped in the 3032-3012 range of oscillations and saws, and the high and low points fluctuated in a range of 20 points. For this situation, it is actually a small calm compared to the previous period. However, for this kind of fluctuation, it is not easy to clearly control the long and short positions. After all, it is too affected by the market, and the randomness of the rise and fall is also subject to multiple changes!

If it is to rise, once gold encounters resistance, the strength of the collapse is still quite obvious. If it is to fall, it has been hit by a pull-up and empty. To be honest, even if you squat at high and low points, it is difficult to control. After all, the actual situation is like this. The market is also brewing some big moves. Today, GDP is coming, and you still need to guard against the reverse outbreak of long and short positions.

Today's analysis:

Gold has slightly risen and fallen during the day, and the overall trend remains in a volatile trend. Gold is currently maintaining a narrow range of fluctuations on the daily trend, but the short-term moving average has gradually diverged downward, and there are signs of weakening in the short term on the daily line. The 4-hour level trend is temporarily maintained in a volatile state, and the price is temporarily compressed between 3010-3030!

The short-term moving average continues to maintain a state close to adhesion and flattening, and tends to continue to maintain a volatile trend in the short term. It is necessary to pay attention to the continued downward trend after a small break in the 4-hour level trend. In the small-level cycle trend, after touching the previous support band, there are signs of stabilization. Pay attention to the short-term adjustment.

From the overall situation, gold is definitely in the bull market stage. At present, there is strong buying defense at the 3000 mark, and the "W" double bottom Zou shape has appeared below. If it successfully breaks through the 3035 watershed, it is expected to test the pressure near 3045 and the historical high of 3057. Now the low point of the callback begins to move up slowly, showing a small upward trend. Pay attention to the breakout market. The daily cycle hovers around the angle of the short-term moving average. There is a choice of direction at any time. Follow after the breakout!

Operation ideas:

Buy short-term gold at 3010-3013, stop loss at 3002, target at 3035-3045;

Sell short-term gold at 3038-3040, stop loss at 3049, target at 3000-3010;

Key points:

First support level: 3016, second support level: 3008, third support level: 2993

First resistance level: 3030, second resistance level: 3038, third resistance level: 3046

Goldsell

Gold-----Buy near 3014, target 3026-3060Gold market analysis:

Recently, gold buying and selling has begun to play a game, with continuous cross stars on the daily line. Yesterday, we estimated that gold would fluctuate and repair in the first half of the week, and start to exert its strength in the second half of the week. During the fluctuation, we also grasped the rhythm of the fluctuation and intercepted the operation of buying and selling. Today's idea is to see whether it breaks through. Before it breaks, it is treated as a fluctuation. Note that the big trend is still buying. The possibility of pulling up after the fluctuation is greater, so we must be careful to sell and be beaten in the next two trading days. Gold stands firmly above 3000 with multiple fundamental supports, plus the continuous positive lines of the weekly line and the support of the big cycle. In the long-term trend, it is basically difficult for gold to change the long-term buying trend without breaking 2982.

Gold in the Asian session has begun to rise again. If it breaks 3033, it will not open up new room for growth. Pay attention to the fluctuation range of the Asian session, which is 3033-3010. Look for opportunities in this range during the day. In addition, if it breaks 3033, consider buying opportunities when it falls back. Chase one-way and wait for fluctuations.

Support is 3010 and 3000, pressure is 3033-3035, and the strength and weakness dividing line of the market is 3020.

Operation suggestion:

Gold-----Buy near 3014, target 3026-3060

How to break the position of gold as it narrows in shock?Technical analysis of gold: Gold has slightly risen and fallen during the day, and the overall trend remains in a volatile trend. Gold is currently maintaining a narrow range of fluctuations on the daily trend, but the short-term moving average has gradually diverged downward, and there are signs of weakening in the short term on the daily line. The 4-hour level trend is temporarily maintained in a volatile state, and the price is temporarily compressed between 3010-3030. The short-term moving average continues to maintain a state close to adhesion and flattening, tending to maintain a volatile trend in the short term. It is necessary to pay attention to the continued downward trend after a small break in the 4-hour level trend. In the small-level cycle trend, after touching the previous support band, there are signs of stabilization again. Pay attention to the short-term adjustment.

From the overall situation, gold is definitely in the bull market stage. At present, there is strong buying defense at the 3000 mark, and the "W" double bottom Zou shape has appeared below. If it successfully breaks through the 3035 watershed, it is expected to test the pressure near 3045 and the historical high of 3057. Now the low point of the callback begins to move up slowly, showing a small upward trend. First, we will overestimate and undervalue in the 3030-3010 range. We can see that the current gold trend is also narrowing. There is no problem with short-term shock operations, but pay attention to the breakout after continuous shocks. The daily cycle hovers around the angle of the short-term moving average. There is a choice of direction at any time. Follow the breakout. Overall, today's short-term operation strategy for gold is mainly long on callbacks, and short on rebounds. The short-term focus on the upper resistance of 3030-3036, and the short-term focus on the lower support of 3010-3012. Friends must keep up with the rhythm. Gold operation strategy reference: short gold rebounds near 3030-3034, with a target of 3020-3015, and long gold callbacks near 3010-3014, with a target of 3020-3025.

If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

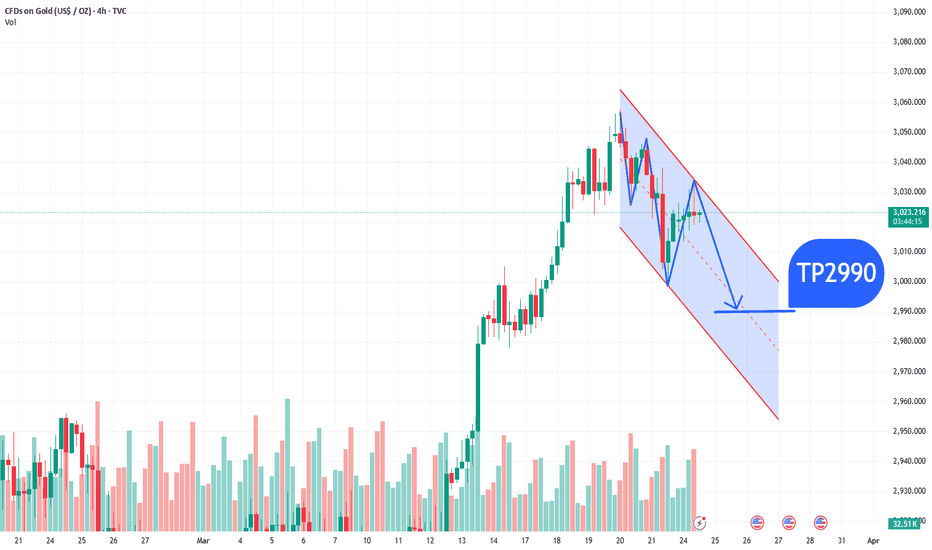

Short Position Targeting Below $3,000🔍 Market Analysis After Durable Goods Orders Release

The latest Durable Goods Orders (MoM) for February 2025 were released today, showing a surprising 0.9% increase, while economists had expected a 1.0% decline. However, core capital goods orders fell by 0.3%, indicating weaker business investment.

These mixed figures create uncertainty in the markets. The strong durable goods orders support the U.S. dollar, while the drop in business investment may signal economic concerns. In the short term, the expectation that the Federal Reserve (Fed) will not rush to cut interest rates could put pressure on gold prices.

📉 Trading Idea: Short Gold from $3,025 to Below $3,000

Entry: $3,025 (already opened)

Gold is currently trading around $3,025, showing signs of weakness near resistance levels.

Why This Short Trade Makes Sense:

1️⃣ U.S. Economic Data Supports the Dollar

The unexpected rise in durable goods orders suggests economic resilience.

A stronger U.S. dollar typically weighs on gold prices.

2️⃣ Lower Expectations for Fed Rate Cuts

These data points may reduce expectations for imminent Fed rate cuts.

Higher rates increase the opportunity cost of holding gold, which is bearish for gold.

3️⃣ Technical Resistance & Downward Momentum

Gold has struggled to break above $3,025 - $3,035 multiple times.

If this level holds, we could see a drop below $3,000 soon.

📊 Price Targets & Stop-Loss

🎯 First Target: $3,000 (psychological support level)

🎯 Second Target: $2,985 - $2,975 (next key technical support zone)

📌 Risk-Reward Ratio (RRR):

Entry: $3,025

Target: at least $3,000

RRR = 1.66 : 1 – a solid setup for a short-term trade.

🧐 Potential Risks to the Trade

⚠ If the U.S. Dollar Weakens:

If markets interpret weak core capital goods orders as a sign of economic slowdown, the Fed might shift to a more dovish stance, weakening the dollar and boosting gold.

⚠ If Geopolitical Tensions Increase:

Rising geopolitical risks (e.g., China, Middle East) could drive safe-haven demand for gold, pushing prices higher.

📌 Conclusion: Bearish Setup for Gold

Today’s Durable Goods Orders release supports a stronger U.S. dollar, while gold is struggling to break resistance at $3,025 - $3,035. As long as this zone holds, the probability of a correction below $3,000 remains high.

🟢 Plan:

Short at $3,025 is active.

Target: Below $3,000.

Gold remains volatile – keep an eye on the U.S. dollar, Fed policy, and market sentiment for further confirmation! 🔥🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Gold has been in a good range recently, which is perfect!Congratulations to everyone for realizing the range idea again。It should be noted here that since the bulls rose strongly in the early stage, the market turned to bearish, or the rhythm of bullish adjustment will not be so fast. Therefore, yesterday's daily line turned positive, not the return of bulls, but a correction in the process of decline. On the one hand, the adjustment of bulls is not enough, and the indicators show that there is still further exploration. On the other hand, although the current shock has rebounded, the strength is not strong and the continuity is poor. It is a shock upward trend and may fall at any time. Be cautious when looking at bullish. Only by matching the market and the time point can you get the correct direction. Trading focuses on ideas and planning, and doing yourself well is more important than anything else.If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

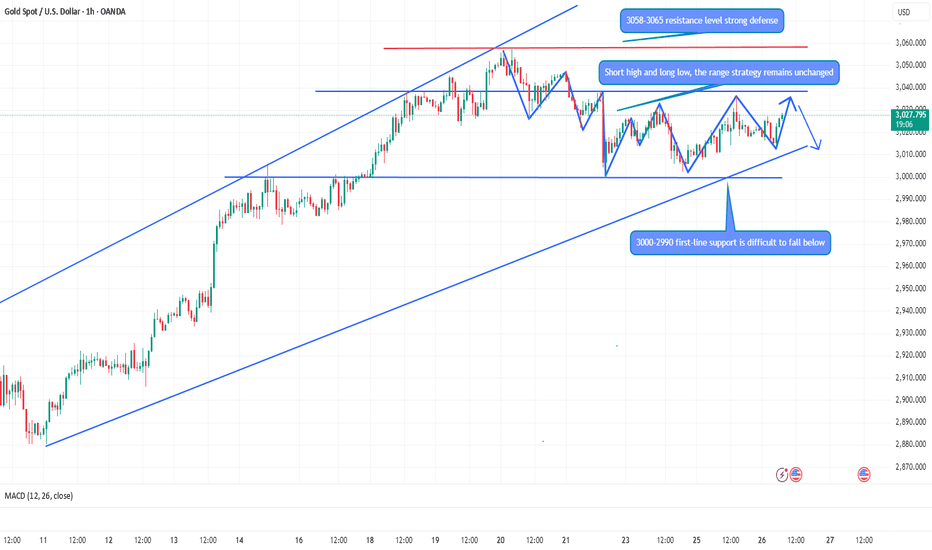

Gold hourly line pattern chart;

Gold once touched the 3002 line to stabilize, and the daily line level fell back three times in a row. There is still room for decline in the short term. Pay attention to the obvious support of the 3000 mark below. If it does not break, it will still be a repeated trend. On the contrary, there will be a continuous decline. In terms of operation, continue to go short on the rebound! Operation suggestion: short at 3025-3030. The target is 3016-3010. On the contrary, if it falls back to 3010-3005, go long and the target is 3020-3025.

So amazing! Accurate again, follow-up strategyToday, the first wave of gold price retreated from around 3026 to around 3013 in the Asian session. The lower support is obviously moving up gradually. Yesterday's white session also started to rise from above 2310. The two retracements before the US session only reached 3014 before rebounding quickly. At present, the focus on the upper side is the suppression of 3030-35. The hourly line of gold is now oscillating in the range box. Only after gold breaks through the box, will the gold market appear. Gold hit the 3035 line on Tuesday, but gold quickly fell back after hitting the high. We actually shorted at the 3032 line. The perfect harvest was harvested after stepping back. Gold did not break through the 3030-35 line suppression we mentioned above. If it breaks through the 3035 line and stands firm, then the bulls will rise and hit a new high. Our operation of stepping back to do more ideas remains unchanged, but we should not chase more directly, otherwise the adjustment of stepping back will be more uncomfortable. Be a steady hunter and wait quietly for the appearance of prey.

From the 4-hour trend, the upper short-term resistance focuses on 3030-35, and the lower support focuses on 3000-3005. Relying on this range, the layout of the long and short oscillation range is maintained. In the middle position, watch more and move less and chase orders cautiously, and wait patiently for key points to enter the market. I will inform you of the specific operation strategy in time. Gold operation strategy: 1. Go long when gold falls back to 3010-3000. If the subsequent market breaks through the 3035-3040 resistance line, we will adjust whether to go short based on the technical and news aspects and notify everyone in time.If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

Interval oscillation, opportunities are within your graspMy dear friends, the gold range idea has been fulfilled again. Do you still remember the batch shorting gold strategy we laid out before? Facts have proved that our vision and judgment are extremely accurate! At present, the gold price has successfully reached the target area. Congratulations to everyone for making a profit again. This wave of operations is simply beautiful. I am honored to be recognized and encouraged by everyone. We set sail on the road of trading. I will bring my trading strategy plan, and you will bring your execution discipline. I believe we will definitely have good results.

But investment is never a one-shot deal. The current profit is only a phased result. The gold market has always been turbulent, and the subsequent trend is full of uncertainty. The operation strategy plan can first refer to the unchanged range thinking method I mentioned earlier, the high-altitude and low-multiple operation strategy, and conduct in-depth technical and news analysis. Gold will temporarily maintain a volatile thinking approach. The large range focuses on 3035-3000, and is in horizontal consolidation. In the 4H cycle, the Bollinger Bands are also in a closed state, and the K-line is interlaced at the middle track. In the short-term sideways consolidation and accumulation stage, the operation relies on 3035 as the critical point of adjustment. Below this position, continue to look at the callback, recover and stabilize, and then adjust the thinking. Pay attention to the support of 3012 and 3000 below. Maintain high-altitude and low-multiple operations as a whole, and follow up after the breakthrough. The specific operation is combined with the short-term pattern. Once there is a new change, I will inform you as soon as possible. Operation suggestion: Gold is short near 3030-35, and the target is 3020 and 3015! It is long near 3010-3000. The target is 3015 and 3026!If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

Analysis of the latest gold price trends!Market news:

In the early Asian session on Wednesday (March 26), spot gold fluctuated in a narrow range and is currently trading around $3,017/ounce. London gold prices rose slightly on Tuesday, temporarily staying above the 3,000 integer mark. On the one hand, tariff concerns still provide safe-haven support, and on the other hand, the poor performance of US consumer confidence data dragged down the trend of the US dollar and US bond yields, providing support for international gold prices! There is uncertainty about Trump's tariff plan to be announced next week. Investors are worried about the world situation, especially US policies, so they buy gold investment as an alternative asset because they are worried that the US government may plunge the world into a global recession. Supported by safe-haven demand, gold prices rose. It is generally expected that Trump's tariff policy will drag down economic growth, trigger further trade tensions, and push up inflation. Currently waiting for the US personal consumption expenditures (PCE) price index to be released on Friday to look for hints about the Fed's further policy moves. In addition, investors need to pay attention to the performance of the initial monthly rate of durable goods orders in the United States in February on this trading day. Meanwhile, the United States said it had reached agreements with Ukraine and Russia to ensure safe navigation in the Black Sea and prohibit strikes on energy facilities in both countries. Investors need to pay attention to changes in risk aversion in the market.

Technical Review:

Technically, the gold daily line closed with a small positive repair yesterday, and the price closed within the range of MA10-7-day moving average. The Bollinger bands of the hourly chart and the four-hour chart were all closed, and the early price of 3020 was in the middle track of the Bollinger band adjustment! The upper track of the four-hour chart suppressed the 3038 line, the lower track supported the 3003 line, the MA10/7-day moving average was glued, and the RSI indicator was flat. It is expected that the gold price will continue to fluctuate in a wide range, and the trading idea will still be based on high-altitude swing trading, and low-multiple auxiliary short-term participation.

Today's analysis:

Gold is currently temporarily maintaining a high level of shock repair in the daily trend. In the 4-hour level trend, after continuous shocks, the technical pattern has gradually been repaired. The short-term moving average has gradually turned upward and diverged. The K line has slowly stood on the short-term moving average. In the short-term trend, it is maintained in a stronger trend. The current price is temporarily under pressure around 3035. However, the overall market is still volatile. The US market reached 3036 at the highest and fell back under pressure. This position is the 618 resistance of the decline and rebound. At the same time, it has risen three times. Note that more positions are required. Today, you can pay attention to the 3005/3008 support to buy. In the short-term, the shock market can be seen. Both buying and selling can participate. In the hourly level trend of gold, the price has fallen back after touching the previous pressure zone. In the short-term trend, the technical pattern has also begun to weaken. It tends to have a certain adjustment space in the short term, but the strength needs to be considered. At present, the bottom divergence pattern has formed on the hourly chart. At the same time, the short-term moving average has turned upward. It is expected that gold will still have a rebound demand in the short term. If the gold price stabilizes above $3,010, the short-term target will be in the $3,035-3,045 range, and further breakthroughs are expected to test the $3,050 line.

Operation ideas:

Buy short-term gold at 3005-3008, stop loss at 2996, target at 3020-3030;

Sell short-term gold at 3033-3035, stop loss at 3044, target at 3000-3010;

Key points:

First support level: 3013, second support level: 3005, third support level: 2992

First resistance level: 3032, second resistance level: 3038, third resistance level: 3046

Go long and win, then go short on the reboundToday, the layout of gold is to go long in batches near 3005-3008, and 3020 is a successful profit. Now the rebound continues to go short.

In terms of the daily line structure, yesterday's rebound of gold first touched the pressure of the 5-day line, and then the market retreated to the vicinity of the 10-day line. The overall trend is in line with expectations, fluctuating within the daily average range, and the rhythm of rising first and then falling also increases the expectation of the continuation of the short-term market adjustment. The pressure of the 10-day line can continue to be paid attention to on the upper side of gold during the day, but the 10-day line has now moved down to the vicinity of 3027, and today's market opened near the 5-day line 3012. Combined with the trend of the hourly chart, gold fell again to the vicinity of 3000 overnight, indicating that the short-term trend still follows the technical trend, but the main sentiment of the market is still controlled by the bulls. If the fundamentals unexpectedly break out with good news, the bulls' sentiment may go crazy at any time. In the day, we can pay attention to the pressure near the short-term trend line 3025 on the upper side of gold, and continue to pay attention to the competition around 3005-00 on the lower side. If 3000 is lost, we will look for a larger space to retrace. If the market has been fluctuating above 3000 today, the risk of short-term market variables will increase.

For specific operations, it is recommended to be short at 3020-3025, and look at 3015-3005.

If your current gold operation is not ideal, I hope to help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, remember to pay attention to the bottom 🌐 signal in time.

Gold - Short Term Sell Idea Update!!!Hi Traders, on March 20th I shared this idea "Gold - Expecting Retraces and Further Continuation Lower"

We expected to see retraces and further continuation lower. You can read the full post using the link above.

The bearish move delivered, as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold (XAU/USD) Bearish Setup – Potential Drop to $2,991This is a trading setup for Gold (XAU/USD) on the 30-minute timeframe, showing a potential bearish move.

Analysis:

Key Indicators:

200 EMA (blue line) at 3,019.55: Acting as a resistance level.

30 EMA (red line) at 3,017.45: Providing short-term trend guidance.

Price Action & Structure:

The price previously rejected from a resistance zone (purple area) and started forming lower highs.

Repeated bearish patterns suggest another potential drop.

The chart highlights measured moves of previous declines (-30.62, -24.75), indicating a possible repeat of the pattern.

Trade Setup:

Bearish Outlook: Price is expected to drop towards the target point at 2,991.43.

Entry: Near the break of the lower trendline in the ascending wedge.

Target: 2,991.43 (marked as "TARGET POINT").

Risk Management: Ensure proper stop-loss placement above recent highs.

Conclusion:

If price respects the pattern, a downward move is likely.

A confirmed break below support could accelerate the drop.

The opening situation is clear, practical guideGold news:

The rise of the US dollar index benefited from Trump's tariff policy. Just yesterday, Trump suddenly announced: a 25% tariff on the purchase of oil and natural gas from Venezuela, and claimed that individual tariffs would be reduced. The market's tense nerves were released, and the US dollar index rose sharply. As the end of the month approaches, the market needs to rebalance its investment portfolio, increase the allocation of US dollars to hedge against unknown risks, and push the US dollar to continue to rise. Yesterday, the market news was light. Today, the market will welcome the speech of Federal Reserve Board Governor Kugler on "Economic Outlook and Entrepreneurship". Immediately afterwards, New York Fed Williams will speak at a public event. In addition, there is the March Conference Board Consumer Confidence Index at 10 pm. The above events and data are concentrated in the evening tonight, which will have a certain impact on the market and need to be paid attention to. The price of gold has begun to retreat from its historical high, and the power of safe-haven buying has eased. This retreat momentum is expected to intensify further, especially in terms of technology.

Gold technical analysis:

Currently, the price of gold is running in a similar triangle range, and the correction cycle is prolonged. On the one hand, the bulls rebounded after the pressure, and it was difficult to return to the strong position directly; on the other hand, the retracement was supported by the key top and bottom conversion support belt of 3005-3000. This trading day focuses on the gains and losses below the low of 3000 at the end of last Friday, and the breakthrough below the 3030 pressure line above. If it fails to break through, it is likely to fluctuate around this range during the day.

Gold operation suggestions: short near the rebound of 3020-3025, long near the retracement of 3000-3005.

The two orders of gold on Monday were perfectly grasped, and now everyone has made a profit. The two orders on Monday ended perfectly. If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. The information I recently shared about the gold market has received a lot of feedback, and everyone said it was very helpful! If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, and remember to pay attention to the bottom 🌐 signal in time.

Gold (XAU/USD) Technical Analysis – Bearish Rejection Expected fThis chart represents an analysis of Gold (XAU/USD) on a 30-minute timeframe. Below is a breakdown of the key elements:

Key Observations:

Downtrend Formation

The price is trading within a downward channel, marked by two descending trendlines.

The overall trend appears bearish, indicating potential further declines.

Supply Zone (Resistance) Around $3,025 - $3,030

The price is approaching this key resistance area.

If the price fails to break above, it could lead to a rejection and continuation of the downtrend.

Demand Zone (Support) Around $3,000 - $3,006

This is the target area where buyers may step in to support the price.

A downward move towards this zone is anticipated.

Projected Price Movement

The blue arrows suggest a bearish scenario.

A rejection from the supply zone is expected to push the price downward.

The final target is the demand zone near $3,000.

Conclusion:

Bearish Bias: The price is currently in a downtrend, with the expectation of a rejection from resistance and a move toward the lower support zone.

Confirmation Needed: Watch for price action signals, such as rejection wicks or bearish candlesticks, to confirm the downward move

Price approaching OB POI with Trendline LiqPrice is currently bullish, structure turned bullish from last week's CHOCH and Mondays subsequent break of structures to make price bearish for the short=term, how short-term is price bearish for ? i have no idea but price will definitely still go for the ATH maybe inside this week or early next week which will be a new month (April).

Right now, I'm bearish still hence this setup, it's actually a decent setup though (OB+IDM to take out the trendline liq)

Disclaimer: Do your own analysis and please kindly risk what you can, apply proper risk and money management.

3000 is not broken, the rebound points to a new trendIn the current gold market, the downward trend is more obvious. However, it is noteworthy that gold has tested the key point of 3000 many times, and each time it breaks through, it is unstable. This fully shows that the defense above the 2995-2990 support area is extremely strong and difficult to be effectively broken in the short term.

Combined with the downward momentum observed in the 3000 point range, although it is in a downward trend, the possibility of a sharp decline is extremely small. Judging from the comprehensive judgment of technical analysis and market sentiment, gold will not only not continue to fall, but will most likely rebound. It is initially estimated that the rebound target will reach the area around 3015, and it is very likely to extend further to the area around 3025-3035. Let us look forward to the performance of gold together!

The content I shared recently about the gold market has received a lot of feedback, and everyone said it was very helpful!If you don’t know when to enter the market, you can follow me 🌐, I will release specific signals in real time, and remember to pay attention to the bottom 🌐 signal in time.

XAUUSD , we encounter to the trendlineHello everyone

According to the the chart and the time , if the candle stick is closing to complete the candle stick pattern and cannot go up to the trendline you can take short position, BE AWARE .

if you have any question and need help send us messages

Thank you

AA

Gold----Sell near 3025, target 3000-2982Gold has risen too much before. There have been technical adjustments in the past two days. The general trend is still bullish, but we are just a short-term trader and we need to follow it. Yesterday, we just lost 3033 in the 3025 short position we arranged. In the evening, we went short again at 3031. Judging from the current performance, the market is in line with our expectations. Today's short-term continues to fluctuate. Note that the weekly buying and selling watershed is 2982, which is also the starting point of last week. The daily line has begun to attack downward. Is it the time to sell or just adjusted to continue to rise? Pay attention to two positions in the future. One is the low point of this wave, 2998, and the other is 2982. If these two positions cannot stop the decline, we will consider the adjustment of the big short position. Today's idea is to consider the opportunity to sell on the rebound.

The K-line pattern begins to decline. Today, we will focus on the suppression of 3025 and 3018. The K-line pattern forms a triangle to be broken. If the Asian session rebounds, consider selling it first. If the Asian session breaks the position of 2998, you can continue to sell it when it rebounds. The bottom of gold fluctuations is also at this position. If it breaks, it will be around 2982.

Suppression 3025 and 3018, strong pressure 3033, the strength and weakness watershed of the market is 3018.

Operation suggestion

Gold----Sell near 3025, target 3000-2982

Descending Channel in XAU/USD (Gold)Trade Setup for Descending Channel in XAU/USD (Gold)

**📉 Bearish Trade Setup (Sell Strategy)**

Since the price is trending within a descending channel, the best trade approach is to **sell at resistance** and **target support levels**.

**📌 Entry Points:**

🔹 **Sell Entry #1:** Near the upper boundary of the descending channel (~3,020 - 3,030).

🔹 **Sell Entry #2:** If price retests and fails to break above the 21 EMA (~3,015 - 3,018).

**🎯 Target Levels (Take Profit - TP):**

✅ **TP1:** 3,000 (Psychological level and lower channel support)

✅ **TP2:** 2,980 (Next major support zone)

✅ **TP3:** 2,960 (Extended target if the trend continues)

**🔒 Stop Loss (SL):**

🚨 **SL Above 3,035-3,040:** If price breaks out above the descending channel, it invalidates the setup.

**📊 Trade Confirmation:**

✅ **EMA Rejection:** Watch for price rejecting the **21 EMA (Blue Line)** as resistance.

✅ **Volume Analysis:** Look for increased selling volume when price approaches resistance.

✅ **Bearish Candlestick Patterns:** Such as **bearish engulfing, shooting star, or evening star** near resistance.

**📈 Alternative Bullish Setup (If Trend Breaks Upward)**

If price **breaks above 3,040 with strong volume**, it could signal a trend reversal. In this case:

🔹 **Buy Entry:** After a confirmed breakout & retest above 3,040.

🎯 **Targets:** 3,060 - 3,080.

🚨 **SL:** Below 3,030.

**Conclusion:**

🔻 **Primary Strategy: Sell on Rallies within the Channel.**

🔺 **Alternative Plan: Wait for a Bullish Breakout Before Buying.**

📉 **Stay disciplined with Stop Loss & Risk Management!*

Tue 25th Mar 2025 XAU/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAU/USD Sell. Enjoy the day all. Cheers. Jim

Gold (XAU/USD) Bearish Outlook: Key Levels to WatchBuddy'S dear friend SMC Trading Signals Update 🗾 🗺️

This chart represents the price action of Gold (XAU/USD) on a 1-hour timeframe, showing potential areas of resistance, support, and liquidity zones. Here’s a breakdown of the analysis:

Analysis of the Chart:

1. Resistance Level (3,023-3,030 zone)

The price has reacted multiple times (red arrows), indicating strong selling pressure.

A fair value gap (FVG) is present, suggesting potential mitigation before further movement.

2. Current Price (3,011.76)

The price is trending downward after rejecting the resistance level.

It is approaching the diamond zone, a potential short-term support before continuation.

3. Key Support Levels:

Diamond Zone (~3,000 region)

Could cause a temporary bounce before further decline.

Order Block (~2,952-2,938 zone)

This is a strong demand zone and a potential target area for price action.

4. Target Levels:

The analyst expects a downward move toward 2,952, aligning with a liquidity grab scenario.

5. RSI Indicator:

RSI is at 44.27, suggesting bearish momentum, with the possibility of further downside.

A break below 40 RSI may confirm more selling pressure.

Mr SMC Trading point

Risk Management Considerations:

Entry: A possible short entry could be around the FVG level (~3,020-3,030) if price retraces.

Stop Loss: Above 3,035 to avoid being trapped in a fake breakout.

Take Profit: Around 2,952-2,938 as per the target point.

USD Update & Impact on Gold:

If USD strengthens, gold may drop further due to their inverse correlation.

Key upcoming economic data (interest rate decisions, inflation reports) could increase volatility.

Pales support boost 🚀 analysis follow)

Perfect hit, interval thinking remains unchangedThe idea remains unchanged according to the previous article!

In the wave of financial markets, accurate prediction is the badge of strength. Previously, we firmly arranged short selling, and it turned out that this decision was extremely correct! The trend of gold perfectly matched our expectations, falling all the way back to the area around 3010-3000.

Next, new opportunities have emerged. We will adopt the high-altitude and low-multiple operation mode within the range. At present, we have decisively gone long in the area around 3010-3000. Every ups and downs of the market are opportunities for us to make profits. Let us be full of confidence and look forward to the subsequent wonderful performance of gold together, and work together to reap more fruits of victory!

If you don’t know when to enter the market, you can follow my 🌐signal. I will release specific signals in real time. Remember to pay attention to the 🌐signal in time.

The trend of gold has been weakFrom the current market analysis, the 4-hour chart shows that the gold price is weak, while the 1-hour chart tends to fluctuate and correct. Therefore, short-term operations can rely on $3030 and $3020 to bearish gold.

Note:

1. Determine the trading cycle, set the direction in the big cycle, and enter the market in the small cycle.

2. Follow the trend: 3 waves up and down without breaking the high and low points is a shock, and 3 waves of high and low points rising or falling is a trend. Don't do shocking market, don't stop if you don't understand it, and control your hands.

3. Wait for the position, pay attention to the profit and loss ratio when entering the market. Set a stop loss.

4. Don't trade emotionally, respect market uncertainty, and accept stop loss.

5. Finally, repeat the execution unconditionally.

I wish you a smooth transaction