Goldsell

Analysis of gold market price structure and trends.Layout ideas。On Thursday, the US dollar index broke down sharply, successfully stimulating the market's risk-averse funds to return to the gold market again, and the gold price rose again. Let's briefly sort it out!

First: The tariff issue of the trade war caused the global market to plummet, and gold fell accordingly. The main reason was that it was necessary to sell gold, recover funds, and fill the capital margin in the stock market, foreign exchange market, and bond market; therefore, gold also plummeted downward in the past few days;

Second: The U.S. dollar index plummeted and broke through, driving market funds back into the gold market, and the gold price hit a record high again;

In yesterday's analysis of spot, you can look back at yesterday's analysis of the daily K indicator. There are two situations, restart Golden cross means breaking the top and reaching a new high. You can look back at yesterday's analysis. This is also a common indicator trend.

Spot gold opened yesterday from 3081 and quickly fell to 3071 before rebounding to around 3100. After that, the price fell back to 3078-80 and rose to around 3132. The price fell back to 3103 from around 3132 and then rebounded to around 3136 and bottomed out around 3113-16 and rose to 3175. The price fell from 3175 to around 3152-54 and then rose again to around 3176 and closed. The opening price fluctuated and rose above 3200. From yesterday's trend: 3180 and 3100 are the bottom supports, but the area around 3100 has fallen back and repaired yesterday, so 3132-36 and 3116 are the current support points. Yesterday, it also directly rose and broke through 3134-36 and then rose without stepping back. At the same time, the price rose to 3174-76 and then retreated to 3152-54, so the current support point is around 3176. The opening price directly rose from this position. Currently, 3190 is the nearest support. Comprehensive important support: ①3176 ②3134 ?③3100 ? The small support distribution in the middle is 3190-3167-3154-3115

Spot gold market analysis:

Ⅰ: Spot gold daily MACD golden cross is initially established, and the dynamic indicator STO quickly repairs upward, which represents the bullish trend of prices. At present, there is no resistance point to judge because it is a historical high, so we can only try it based on small cycle indicators. The current support point of the daily line is located near the MA5 and MA10 moving averages, 3096-3088, and it is not necessary to consider it far away from the candlestick chart.

Ⅱ: Spot gold 4-hour current MACD high golden cross oscillates with large volume, and the dynamic indicator STO is overbought, which represents high-level price fluctuations. Because the indicators are at relatively high levels, they may face short-term peak signals at any time. Currently, we focus on the support line of 3176 near the MA5 moving average.

Ⅲ: Spot gold hourly MACD golden cross is currently oscillating with large volume, and the dynamic indicator STO is running overbought, which means that the hourly line is still oscillating and strong. The current focus is on the 3245 line. If it breaks through 3245 this hour, it will continue to look for highs. Otherwise, a small cycle peaking signal will be formed at this position. The current support below the hourly line is located at the MA5 and MA10 moving averages, and the focus is on the MA10 support 3185 line. Comprehensive thinking: The current price is oscillating at a high level, and the short-term focus is on the 3245 line. If it breaks through, the price will continue to move upward. The current focus below is the support near 3190. If it falls below, the price may move to around 3150-3135.

Strategy: Currently, the 3440-50 area is temporarily set to see pressure adjustment

Go long if the key support is stabilized below, and pay attention to 3187-3170 -3153-you can go long

Gold may face sharp fluctuations,The risk of downside increases!Technical analysis: Gold daily line rose by more than $100 on Thursday, creating a rare single-day increase in more than ten years. The cumulative increase in three days exceeded $200, and the technical indicators were overbought. The current gold price is in the stage of accelerating to the top. In the short term, pay attention to the resistance of the 3245-3250 area, and be alert to the risk of falling back after a high. Although the trend is still strong, the effectiveness of technical analysis is weakened under the guidance of news. It is recommended to focus on high altitude. This week is the fifth week of rising, and the probability of a change on Friday increases.

Ⅰ: The daily indicator macd golden cross is initially established, and the smart indicator sto quickly repairs upward, representing the bullish trend of the price. At present, because it is a historical high, there is no resistance point to judge, so we can only try it based on the small cycle indicators. The current support point of the daily line is located near the moving average MA5 and MA10, 3096-3088, and it is not considered to be far away from the candlestick chart.

Ⅱ: The current macd high golden cross in 4 hours is oscillating with large volume, and the smart indicator sto is overbought, which means that the price is oscillating at a high level. Because the indicators are at a relatively high level, they may face short-term peak signals at any time. Currently, we are focusing on the support line of 3176 near the MA5 moving average.

Ⅲ: The hourly MACD is currently oscillating with large volume, and the dynamic indicator STO is overbought, which means that the hourly line is still oscillating strongly. The current focus is on the 3220 line*. If it breaks through 3220 this hour, it will continue to look for a high point. Otherwise, a small cycle peak signal will be formed at this position. The current support below the hourly line is located at the MA5 and MA10 moving averages, and the focus is on the MA10 support line of 3185. Comprehensive thinking: The current price is oscillating at a high level, and the short-term focus is on the 3220 line*. If it breaks through, the price will continue to move upward. The current focus below is the support near 3190. If it falls below, the price may move to around 3150-3135.

Strategy: Refer to 3440-45 for short selling

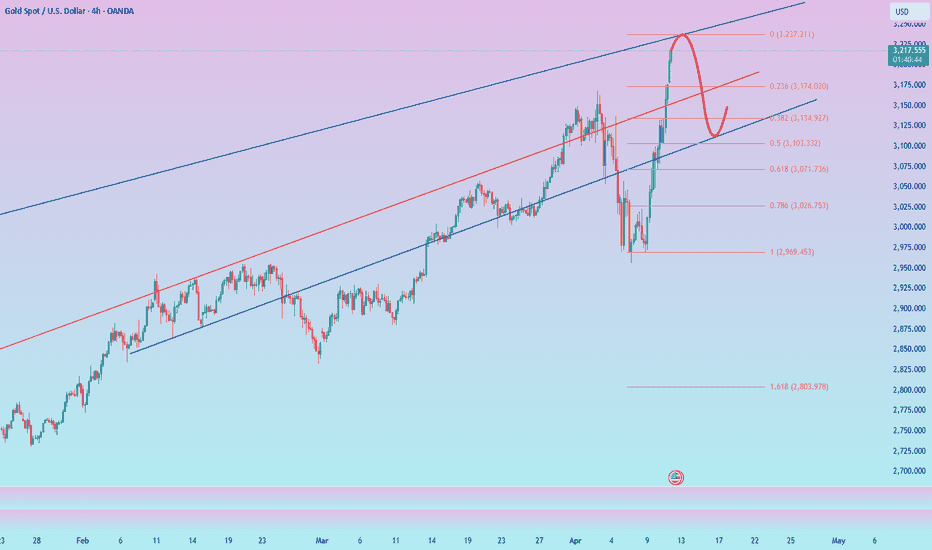

CFD Gold Chart Analysis: Wave 4 in FocusHello friends, let's analyze the Gold CFD chart from a technical perspective. As we can see, the higher degree Cycle Wave III (Red) has completed, and we're currently in Cycle degree Wave IV (Red). Within Wave IV, we expect a Primary Degree ((A)), ((B)), and ((C)) in Black. Wave ((A)) has completed, Wave ((B)) is almost complete, and Wave ((C)) is expected to follow.

Within Wave ((B)) in Black, we have Intermediate Degree Waves (A), (B), and (C) in Blue. Waves (A) and (B) are complete, and Wave (C) is nearing completion. Once Wave (C) in Blue completes, Wave ((B)) in Black will end, and Wave ((C)) in Black should begin.

According to theory, Wave ((A)) came down and then wave ((B)) retraced upwards so now Wave ((C)) should move downwards, forming a zigzag correction. The equality level is around $2858. However, we don't know if it will reach this level or extend/truncate.

The invalidation level for this view is 3169.23. If the price breaks above this level, our analysis will be invalidated.

This analysis is for educational purposes only and not trading advice. There's a risk of being completely wrong. Please consult your financial advisor before making any trades.

I am not Sebi registered analyst. My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Insight into the gold market situation and seize the opportunityHello everyone! After in-depth research and analysis of the recent market conditions, I believe that the current market has entered the stage of accelerating to the top.

From a technical point of view, such as the MACD top divergence sign, the KDJ indicator oversold, etc., all signs show that the market's upward momentum is gradually weakening, while the price is rising rapidly, which is often a typical feature of the peak stage.

The focus needs to be on the 3225-3235 area. This range has important resistance significance and has dense locked-in disks. On the other hand, through technical analysis tools such as the Fibonacci sequence, this range is also an important pressure range.

For investors with short trading rights, this is a rare opportunity to go high and short. When the price reaches the 3225-3235 area, it is a relatively ideal time to enter the short market. The one-hour moving average golden cross is formed, but after the upper rail of the Bollinger band is broken, the technical overbought risk increases, and the support near 3150 is effective. 80 points are also possible, so don't look at the current trend with a conventional perspective.

After the gold frenzy, there will soon be a sharp correctionTo be honest, I must admit that I still hold a short position. I think there should be many people holding short positions now, but they are unwilling to admit that they hold short positions because they are losing money.

I think it is not shameful to hold a short position now. Although gold has violently risen to around 3220, from the perspective of trading volume, gold is rising without volume. Without the support of trading volume, gold is destined to usher in a round of correction in the short term.

And I have reason to believe that the accelerated rise of gold is suspected of being manipulated by large institutional funds. There are two purposes. One is to accelerate the rise to attract more retail funds to flow into the market to take over; the other is to raise prices arbitrarily to make it easier to sell. So the faster gold rises, the easier it is to collapse! We first aim at the retracement target: 3150-3130 area,or even 3120.

So for short-term trading, I think we can still continue to short gold, and I am optimistic about the short position of gold! The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Accurately capture the gold pullback, shorting is the right timeDuring this period, spot gold has been like a rocket, advancing all the way and firmly in the upward channel. I have repeatedly reminded everyone before that once the US tariff stick is swung, the gold price will definitely rush up like a chicken blood. No, the facts prove that our prediction is quite reliable!

Tonight, the market ushered in another "big news" - the release of CPI data. As soon as this data came out, it directly gave the gold price a "heart shot", and the gold price was instantly pushed to around US$3160. This rise is too crazy! Interpret this data as soon as possible and pay close attention to the reaction of the gold market.

However, when the gold price rose to the previous high of US$3158-3168, it was like hitting a wall and began to "struggle". From my technical analysis point of view, there is a relatively strong resistance level in this range. It's like a person climbing a mountain, climbing to a certain height, and encountering a steep cliff. If you want to continue to go up, you have to work hard. At present, the gold price is under pressure at this position, and there are some signs of a correction. This provides us investors with a small opportunity to consider trying a short position here and earn some spread profits. I also suggest that investors can properly seize this short-term opportunity.

For example, the current gold market is like a fierce football game. The long team is strong and has been attacking all the way, and is in a dominant position. The short team can only seize the opportunity occasionally and make a quick counterattack. We investors are like coaches, and we must arrange tactics reasonably according to the situation on the field. When the long side is dominant, we can use short selling to increase our profits in a timely manner. I hope everyone can accurately grasp the market rhythm like an excellent coach.

Gold: Sell@3188-3200Gold has continued its strong rally, hitting a new all-time high, with bullish sentiment running extremely hot.

However, we must approach this rationally — every new high is usually followed by a technical pullback.

Currently, the 3200 level is a significant psychological resistance, as well as a key threshold for short-term bullish momentum.

From a technical perspective, the sharp recent rally has shown signs of momentum exhaustion, with clear overbought signals emerging.

📌 Strategy Suggestion:

Consider building short positions around the 3188–3200 zone

If 3137 is broken, further downside could extend to 3112–3090

⚠️ Risk Management Notes:

The larger the rally, the stronger the pullback potential

Avoid chasing long positions at these levels to prevent getting trapped at the top

Keep position sizes under control and set stop-losses to guard against sudden volatility

Wishing everyone smooth trades and solid profits!

GOLD MCX MINOR RESISTANCEGOLDMCX

Gold Mcx has seen huge bull run today on 10th April 2025 (Thursday), Looking at the chart it can be clearly seen yellow metal on MCX is trading in upwrad trending channel pattern and around 92400-92500 Channel Pattern Resistance can be observed. There can be some profit booking seen from current levels, One can get out of long positions and reenter long position once GoldMCX closes above 92500, till then book profits on Long positions, or sell Gold MCX with Small stoploss of 92600

Will gold fall after a strong rise Goldmarket analysis referenceAnalysis of gold market trend: Today's gold is still fluctuating greatly under the influence of tariffs. Today, we have analyzed that gold has the risk of callback, and long positions are also falling back to lows! Trend realization analysis and ideas! From the surge on Wednesday, it can be seen that the risk aversion sentiment of gold has heated up again. The current highest is 3132, which is the first target point for the rise. If it continues to rise, it can see 3150 above, so there is still a lot of room above. Everyone should pay attention to trading with the trend as much as possible. In addition, there is another uncertain factor today. The US market will release CPI data, which will also bring abnormal fluctuations in gold. Therefore, the market will also fluctuate greatly today. Everyone should pay attention to controlling risks and managing positions well.

From a technical point of view, a positive line on the daily line directly changed the extremely weak adjustment state in the previous period. Now the positive line breaks the middle track of Bollinger and pulls up the moving average. Then, gold has entered an extremely strong state of bullish trend. In this state, it will continue to rise to the previous high of 3150. Therefore, the main direction today is definitely bullish. It is normal for the small cycle to adjust under the pressure of 3100. Now the Bollinger of the 4-hour cycle has just opened, and the unilateral trend has just taken the first wave of strength. There is no problem in the next wave to rise to the high point of the daily cycle. Therefore, as long as the 4-hour cycle falls back to the support of the unilateral moving average, it is an opportunity to do more. The support below is around 3070, and the rise of the hourly cycle is around 3060. Therefore, today's gold bullishness is expected to consider 3080 or 3070. The rise in the Asian and European sessions is still at 3130. If the US session breaks through 3136, consider seeing the high point of 3150. On the whole, today's short-term operation strategy for gold is to short on rebounds and to buy on pullbacks. The upper short-term focus is on the 3136-3155 resistance line, and the lower short-term focus is on the 3080-3078 support line. Friends must keep up with the rhythm. You must control your positions and stop losses, set stop losses strictly, and do not resist single operations. The specific points are mainly based on real-time intraday trading. Welcome to experience and exchange real-time market conditions.

Gold operation strategy reference: Short order strategy: Strategy 1: Short gold rebounds near 3133-3136, with a target of 3100-3090, and a break to look at the 3080 line.

Long order strategy: Strategy 2: Go long near the 3078-3080 pullback of gold, with a target of 3105-3125, and a break to look at the 3135 line.

Gold----Buy around 3100, target 3135, 3160Gold market analysis:

The fundamentals are more inclined to buy in the past two days. The market is very crazy. When you operate, you must take a loss on each order. Don't bet on it in such a rare market in a decade, otherwise it will make you doubt your life. It is still a volatile market at the beginning of this week. We are still intercepting in the range. Yesterday, gold suddenly turned around in the morning session, and a new buying momentum began to rise. We decisively took profits from 3113 to 3130 in the Asian session. We should chase the unilateral market and wait for the volatile market. The unilateral performance of the US market from yesterday to this morning has been very obvious, and a new buying structure has started. Today, we need to follow it to buy after the retracement. There are too many days of uncertainty in the trade war, and following is the king. In addition, there are heavyweight CPI data in the evening.

Gold surged to around 3132 in the Asian session. The previous high point of the small top was around 3135. This is expected to fall back. Today's idea is to buy at a low price. Even if there is a fall in the Asian session, we will not consider selling. The small support is around 3100, and the strong support is around 3077. Consider continuing to buy in the Asian session. Above 3135 is a buying danger zone. Buying at this position must be a support position.

Support 3100 and 3077, pressure 3135, the strength and weakness watershed of the Asian session is 3100.

Fundamental analysis:

Tariffs are the biggest fundamental in the near future, and the market impact is relatively large. Today we focus on CPI data.

Operation suggestions:

Gold----Buy around 3100, target 3135, 3160

Gold Price Analysis April 10D1 candle confirms that the buyers have returned to the market with an increase of more than 100 prices. The retest points are considered buying opportunities to break ATH

3100 is a notable point for the Buy signal in this European trading session. Today's trading strategy is quite simple when a strong uptrend has just formed, we will wait for the retest points to 3100-3080-3056 for the BUY signal to break ATH. On the other hand, if gold does not test before, we can Sell Scalp around 3133 again, when it breaks, do not SELL anymore but wait for the retest of 3133 to buy up to 3162.

Have a nice day everyone

Gold (XAU/USD) 15-Min Short Setup: Bearish Reversal from ResistaEntry Point: $3,127.10

Stop Loss: $3,141.53

Target Point (Take Profit): $3,080.62

Technical Indicators:

EMA 30 (red line): $3,111.98 – showing short-term trend

EMA 200 (blue line): $3,056.92 – showing long-term trend

Setup Explanation:

This is a short/sell setup based on the following:

The price action has hit a resistance zone near $3,127 and shows signs of rejection.

The setup assumes that the price will reverse from this zone and head lower.

The Risk-to-Reward Ratio appears decent, aiming for a move of about -1.45% (-$45.34).

Current Status:

Price is currently around $3,119.69, below the entry point.

A slight bounce

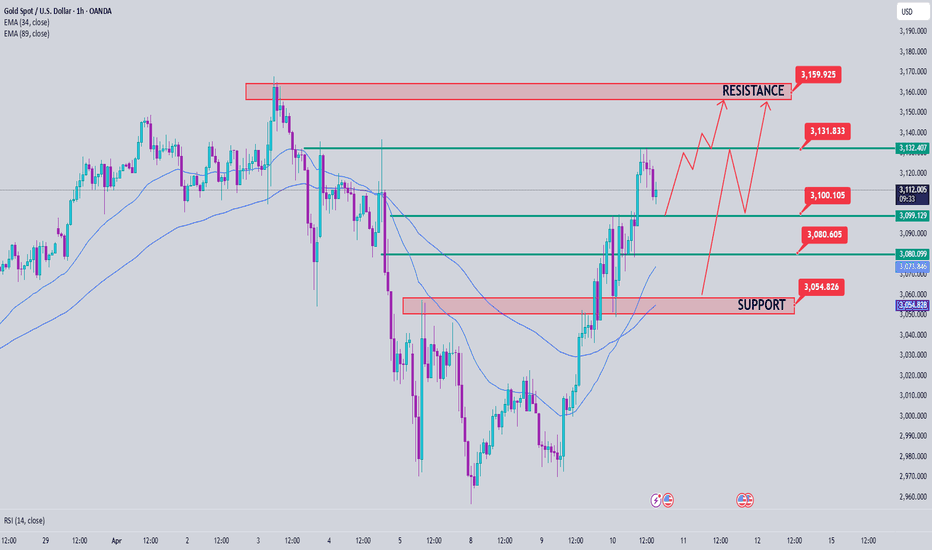

Gold price accumulates below 3038, waiting for FOMC information⭐️GOLDEN INFORMATION:

Gold prices break a three-day losing streak but remain capped below the key $3,000 level, as rising US Treasury yields dampen the appeal of the non-interest-bearing metal. Despite optimism surrounding potential trade agreements among global partners, lingering tensions in the ongoing US–China trade conflict continue to keep investors on edge. At the time of writing, XAU/USD is trading flat around $2,980 per troy ounce.

⭐️Personal comments NOVA:

Gold price moves with large amplitude, in a downward correction phase. Continues to trade below 3040 waiting for the FED's move on interest rates and agreements on tariff levels of countries around the world.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3038 - 3040 SL 3045

TP1: $3028

TP2: $3015

TP3: $3000

🔥BUY GOLD zone: $2958 - $2960 SL $2953

TP1: $2975

TP2: $2990

TP3: $3010

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold-----Sell near 3020-3060, target 3000-2969Gold market analysis:

We clearly said in our analysis yesterday that gold would rise and fall. The daily line shows that it can't go up much. We sold at 3008, 3015, 3014, and 3022 yesterday, and we made profits. Today's gold idea is to pay attention to whether it continues to swing. The daily line fell and then pulled up. The daily line hovered at the bottom. The oscillating market must find the oscillation range. Finding the rhythm is the most important thing. Yesterday, the daily line was a cross star again. Today's Asian session is expected to fluctuate. In addition, there are many fundamentals in the near future. The market has been led by the rhythm. Gold rose well before, and the sharp drop was also due to Trump's tariff policy. The global tariff war is inevitable in the future. It supports the US dollar in the long term and suppresses gold. The short-term top of the weekly line may be the long-term top.

Today's idea is to focus on the 2969-3022 range. We will look for meat in this range in the Asian session. In addition, the daily fluctuations make the indicators sluggish. If the Asian session rebounds first and approaches 3022, go short first. On the contrary, if gold breaks and stands above 3022, it will also fluctuate, but the center of gravity of the fluctuation will rise to the range of 3000-3055. The fluctuation requires patience to wait for the position, and waiting is also part of the transaction.

Support 2990, 2969, pressure 3022, the watershed of strength and weakness of the market is 3000.

Fundamental analysis:

The tariff war continues to affect the market, and the long and short positions have begun to compete. We will pay attention to CPI later.

Operational suggestions:

Gold-----Sell near 3020-3060, target 3000-2969

Is the decade-long bull run in gold prices coming to an end?Market news:

In the early Asian session on Wednesday (April 9), spot gold maintained a narrow range of fluctuations and traded around $2,983. In the previous trading day, the rebound of London gold prices was blocked, and it once surged to $3,022 during the session, but it eventually gave up its gains and fell to around $2,969 in the early trading due to the rise in U.S. Treasury yields and the decline in U.S. stocks. Although the weakening of the U.S. dollar and trade tensions provide safe-haven support for international gold, market concerns about weak demand for U.S. Treasury auctions, the outlook for the Fed's policy and increased stock market volatility still dominate short-term sentiment.The current market focus is on the evolution of the Fed's policy path and the geopolitical trade situation. Under the interweaving of long and short factors, the short-term volatility of gold has risen significantly. As tensions between historical allies over U.S. tariffs, global trade, and the wars in Ukraine and the Middle East intensify, this time it seems unlikely that the major powers will quickly unite to resolve the issues that drive investors' interest in gold as a safe-haven tool. Investors need to focus on the results of the US 10-year Treasury auction today, the minutes of the Federal Reserve's March meeting, and the quarterly earnings period opened by JPMorgan Chase and other financial reports. If the demand for US Treasury auctions is weak or the Federal Reserve releases hawkish signals, gold prices may be further under pressure; on the contrary, the worsening of the trade war situation or the continued decline of US stocks may stimulate safe-haven buying.

Technical Review:

Technical gold daily chart, four-hour chart, hourly chart maintains a volatile downward short structure. The daily chart closed with a cross star yesterday. This pattern appears in the volatile downward structure and is regarded as a relay pattern rather than a reversal signal. At present, the daily chart MA10/7-day moving average opens downward at a high dead cross of 3060, and the MA5-day moving average opens downward and moves down to 3017, and the RSI indicator runs below the central axis 50 value. The price of the short-term four-hour chart is below the MA10-day moving average, and the price remains in the middle and lower track of the Bollinger Band channel. Gold remains volatile downward, and the trading idea remains unchanged, with rebound high and low as the main support, and low and long as the auxiliary. Resistance 2996/3008 far end 3020/3036, support 2968/2956 far end 2942/2930.

Today's analysis:

The long bull market of gold started in 2015 has been going on for nearly ten years. If the gold price falls by more than 20% from the high point, it may indicate a turning point in the cycle. We need to pay attention to the signal of the Fed's policy shift and the easing of the geopolitical situation. Even if we are optimistic about the bull market in the long term, it does not mean blindly chasing highs! Gold has been crazy for 3 trading days, and it began to stabilize slowly yesterday. After falling more than 200 US dollars in the daily cycle for 3 trading days, it needs a process of shock correction. At the same time, we need to pay attention to the development of tariffs. Yesterday, I emphasized the focus on the long-short dividing point of 3030 US dollars for gold. As the key position for the top and bottom conversion, before this position is broken, continue to sell gold at a high price. Yesterday, the circle of friends in the European session also suggested selling gold in the rebound area of 3020, because the loss of 3100 US dollars in the early stage has laid the groundwork for short-term adjustments. In addition, due to the impact of trade frictions, market sentiment is overly tense, and a large amount of funds have begun to withdraw from finance, including gold, which has been sold indiscriminately. After the gold price fell below the $3,000 mark, the market selling sentiment was high, and it was believed that gold would enter a large-scale adjustment! The recent market fluctuations have been very large, which is also in line with the properties of the gold product mentioned. When all assets are sold, the currency's safe-haven properties are highlighted. The sharp drop is accompanied by a fierce rebound, and the amplitude is not small. This was the case last Thursday, Friday and today. The current market starts with a fluctuation of tens of dollars. There are opportunities but also great risks. This will be the norm if panic does not subside. What retail investors can do is to decide what they can decide and do a good job of risk control. The current market is defined as a volatile market, which is a position operation. Today, the resistance of gold focuses on selling in the pressure area of 3020-3040.

Operation ideas:

Short-term gold 2953-2956 sell, stop loss 2945, target 2990-3000;

Short-term gold 3020-3030 short, stop loss 3050, target 2980-3000;

Key points:

First support level: 2968, second support level: 2956, third support level: 2942

First resistance level: 2996, second resistance level: 3005, third resistance level: 3020

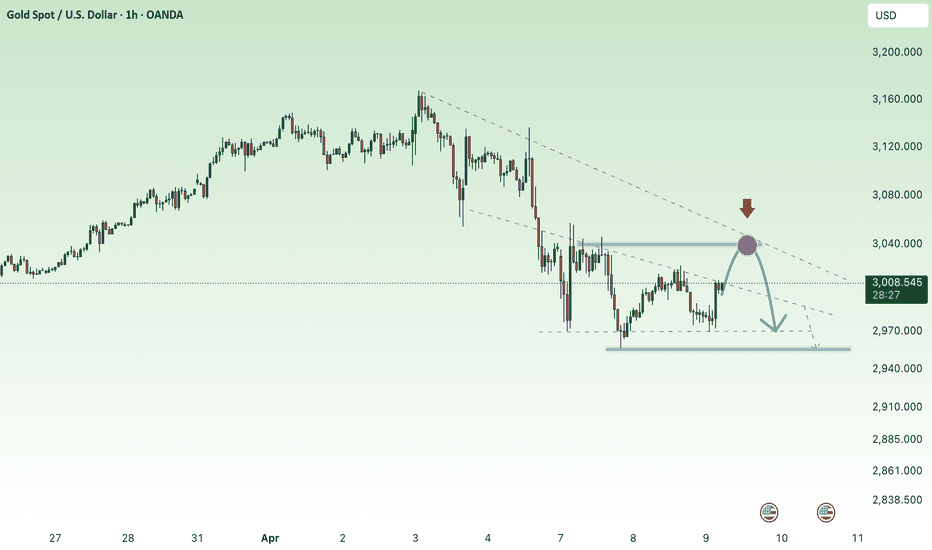

XAU/USD) Bearish trand analysis Read The ChaptianSMC Trading point update

This chart analysis is for Gold Spot (XAU/USD) on the 1-hour timeframe. Here’s a breakdown of the idea shown:

---

Key Points in the Analysis:

1. Current Price:

XAU/USD is around $2,982.92 at the time of the chart.

2. Trend:

The chart suggests a bearish outlook.

Price has been consistently rejected from the yellow supply zone (around 3,020–3,033).

EMA 200 (blue line) is above the current price, confirming downward momentum.

3. Rejection Zone:

Marked in yellow between 3,020 and 3,033. Labeled as “Reject points”.

Price failed to break above this zone multiple times.

4. Breakout Pattern:

Two descending rectangles highlight bearish continuation patterns.

A bearish flag or wedge is visible, followed by a breakout downward.

5. Target Zone:

Highlighted in yellow between 2,900 and 2,921, with target point at 2,920.615.

Price is expected to move down to this level.

6. RSI (Relative Strength Index):

RSI is declining and shows bearish divergence, supporting downside move.

Currently around 39.19, which is closer to oversold territory but still has room to drop.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Entry Area: Rejection near 3,020–3,033 zone

Target: 2,920.615 (highlighted support zone)

Stop Loss: Could be placed above 3,033 (supply zone or EMA 200)

Confluence Factors:

EMA 200 rejection

Bearish RSI divergence

Repeated supply rejection

Breakout from bear flag structures

Pales support boost 🚀 analysis follow)

Gold fell100 points for 3 consecutive days Market trend analysisStop loss is always right, even if it is wrong; holding on is always wrong, even if it is right. Stop loss is unconditional! Without trading principles and trading discipline, all technology is equal to zero!

Spot gold fell by $212 in three days, and the bears shined. A while ago, we warned of the risks, but many people scoffed at it, thinking it was alarmist and that gold would not fall. The money earned by the bull market will definitely be lost with the principal and interest under the belief of the bull market. The three-day plunge in gold is enough to make many people return to the time before opening an account in three days!

The market staged a "holiday conspiracy theory" market, because the heat has reached, and it is facing the implementation of equal tariffs. The previous surge in gold is to buy expectations and sell facts. The bullish atmosphere is unprecedentedly high, and the main force can harvest it.

How arrogant the bulls of gold were at the beginning, how embarrassed they are now; the bears are far stronger than the bulls, the bulls cut meat with a blunt knife, and the bears cut the Gordian knot with a quick knife! Gold plunged $112 from 3167 to 3055 last Thursday, $120 from 3136 to 3016 on Thursday, and $100 from 3056 to 2056 yesterday, Monday. Last year, there were five days with a plunge of nearly or more than $100, and three consecutive days recently. Because the price is high, there will be more single-day plunges of 100 or more this year.

Yesterday, all three major U.S. stock indexes stopped falling at the lifeline of bulls and ushered in an oversold rebound. The panic decline of crude oil and silver was also alleviated. Silver stopped falling at the key support of bulls at 28-28.5. It shows that risk sentiment has been alleviated to a certain extent. Market risk sentiment has been released, and gold shorts also need to rest. The main force of gold has cultivated too many bulls from January to April 2025, and cultivated the bull market thinking of retail investors. It will definitely kill the bulls with the help of this round of sharp decline, and gold can start to rise again! In the medium term, the rebound correction is for a better decline. 2956-50 will be broken, and then 2930-2880 will be broken, and the ultimate 2830 will be broken. Today is the fourth day of the decline. The decline stopped at 2956 in the early morning, which is the previous high point. At present, the first round of gold decline in the short term has been in place. Many people panicked after three days of sharp decline. Those who bought the bottom dared not buy the bottom, and those who did not short should chase the short. The main force will continue to wash the market! Today, the correction rebound is mainly seen. The upper resistance focuses on 3000, then 3030-25 and yesterday's high 3045-55 area.

The focus of the day is 2956-60, and the short-term support is 2970-75. In theory, if you want to wash the market, wash it harder. 3000 can't stop it. Pay attention to the 3020-35 range, and even rush to yesterday's high area and then fall. Gold fluctuates by more than ten or dozens of dollars in 5 minutes. The article can only give ideas and areas. More specific strategies need to be given offline in combination with real trading. Orders must be strictly carried out with losses to prevent being stuck in the wrong direction. In an emotional market, watch more and do less!

In today's market:

1: In 4 hours, the stochastic indicator temporarily forms a small golden cross, but the strength and continuity of the golden cross are not shown; MACD double lines are downward, which is a bearish signal; the indicator is not a resonant bearish signal, so the 4-hour bias is corrected; in terms of form, it breaks the bottom and sets a new low, constantly pierces, and constantly rebounds. The support near the low of 2950 is effective here, and the back and forth piercing near 2970 is of little reference significance; the second decline is around 3050 and around 3020;

2: In the daily K, the stochastic indicator continues to cross, so the main high-altitude treatment is used; MACD double lines diverge, which is a bearish signal; the daily K is a resonant bearish signal, so the main idea of shorting at highs is used; the current central axis position is around 3010;

To sum up: the intraday short-term trend is around 2950 in 4 hours, and the decline rebounds; after the correction rebound, we continue to treat it as a high-altitude; several pressure positions 3 010-3020,

The second is around 3050, followed by around 3090; on the long side, the layout is in the range of 2955-2965; the large range is positioned in the range of 3050-2950

Strategy:

Short around 3015-17, defend 3024, target 3000-2990, the operation has been made and is not considered

Long around 2995-97, defend 299 0, the target 3000-3010-3030 has been entered and is no longer considered

Intraday short around 3030-40, defense 3045, target 3000--2980-2960-2930

Intraday secondary long around 2962-64, defense 2956, target 2975-2990

After falling below 2955, it will reach 2930 and 2880.

Gold----Sell near 3013, target 2980-2960Gold market analysis:

The gold market has been fluctuating a lot in the past few days because of the tariff issue, which has led to too much uncertainty in the market. Gold closed with a large tombstone candlestick pattern on the weekly line, which means that the top has appeared. Short-term buying is not as strong as those. Yesterday, gold hit a new low again. The daily cross star has a very long upper shadow. Today, we are more inclined to sell in the face of large fluctuations. Gold may continue yesterday's fluctuations. Today, we need to focus on finding the rhythm. It swings up and down by dozens of points. Buying and selling games are used to intercept the range. 3055 is already a new large suppression position. Today, 3055 is weak below. If it breaks, we will see a new buying momentum.

In the Asian session, we focus on the small suppression in the 3013-3016 area. This position is the bottom of yesterday's small shock. In addition, the indicator suppression position is 3008-3010. The Asian session is rising strongly. The 4H is expected to close with a big positive. You can decisively sell at the suppression position. Even if it breaks, there will be a large-scale retracement. If gold stands near 3016, it may return to the oscillation range of 3016-3055.

Suppression 3013-3016, strong pressure 3045 and 3055, support 2986, 2971, 2956, the strength and weakness dividing line of the market is 3000.

Fundamental analysis:

The US tariffs on the world are still brewing, which has also led to a sharp drop in global stock markets, and the market is not optimistic about expectations. Later this week, we will focus on the heavyweight CPI data.

Operation suggestions:

Gold----Sell near 3013, target 2980-2960

Gold's slow rise approaches key resistance! Follow 3020Early layout plan for gold: On Tuesday, the public strategy suggested shorting gold at 3015, which was perfectly hit again, and successfully obtained high-altitude profits. In the real market, short orders near 3014 were also arranged, and the market closed at 3000-2998, and then 14-16 points of profit were collected!

Gold technical analysis: On Monday, gold went long and short, and then rushed up and fell back! Yesterday, it was also mentioned that it was still a high-opening strategy, and then gold rebounded and plummeted in the evening; from a technical point of view, the previous gold daily chart encountered resistance near the historical important resistance level of 3135 and then went down, pulling out a big negative line, which is a strong message for the shorts! Although the current gold price is close to the lower track of the Bollinger band below, the shorts are still very strong.

But at present, our general direction is still bearish. In addition, according to the current 4-hour chart, gold formed a double top pattern correction in the early stage. Although the short-selling force is strong at present, the long-selling force is not weak. The slow rise and pullback in the early trading has some strength. The upper resistance is still around 3020, and the key pressure is above 3035!

Gold operation strategy: short around 3015-3020, defend the key resistance of 30-35, and target 2990-80!

Investing shouldn't be so difficult. I will provide one-on-one real-time guidance and tracking services for each customer, and will also share professional opinions in time to closely grasp the market dynamics. Here, you don't need to face the complex market alone. I will help you capture opportunities accurately and keep a close eye on the market. You just need to go to work as usual and accompany your family with peace of mind. When the trading opportunity comes, I will notify you as soon as possible. You just need to do a good job of entry and exit operations and reasonable position control. Don't ignore risks due to greed or negligence to avoid major losses due to sudden changes in the market. At the same time, the market is like sailing against the current. If you don't advance, you will retreat. Investors need to continue to pay attention to market dynamics, continue to learn and improve their investment capabilities, and adjust investment strategies in time to cope with the ever-changing market. This is the relaxed state that investment should have. Only 1-5 orders a day, follow a stable strategy, and continue to reap profits. Whether it is to recover the cost or to achieve several times the growth of funds, you can do it. When the market trends come, I'll be there! Please follow and contact me in time!