Gold begins to retreat and dive!You should be careful in the next two days of this week. Based on my years of experience, the trend before and after the interest rate decision must be opposite. Before the interest rate decision, gold attacked fiercely, so after the interest rate decision, you should be careful that gold will fall back quickly. As of now, gold has retreated to around 3045, and it has retreated by about 12 US dollars from the high point. It can be seen that the current gold MA5-MA10 moving average position is around 3040. The MA20 moving average position below is here 3025-20. In other words, once gold is below 3040, you should be careful that it will further touch 3020-25. The current AM5 moving average position of the daily chart is just around 3020, which coincides with my analysis above. Once it falls below 3040, it will develop towards 3025-3020. Therefore, I suggest that you can pay attention to the 2045-50 position area for short selling.

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Goldsell

Gold: Buy near 3037, target 3045-3060Gold market analysis:

Gold is currently at a high of 3055, is 3100 still far away? Yesterday we arranged to buy at 3034, buy at 3028, and buy at 3025, all of which were profitable. The daily line closed positively and rose again in the US market, because the Fed's interest rate results were in line with expectations and supported gold. In addition, the expected two interest rate cuts also supported gold. The purchase of gold is really smooth and smooth, and the fundamentals and data all support it. It is difficult to change the trend in the short term.

Today's gold 3020 is still a strong support. Yesterday's low was 3022, which means 3022-3020 is a strong support for the day. In the Asian session, we will wait for more opportunities for it to step back. Yesterday, it rose because of the data. Let's see if it will retrace.

Support 3037, 3030, strong support 3020-3022, no pressure can be seen in the Asian session, and the watershed of strength and weakness in the market is 3037.

Fundamental analysis:

The Federal Reserve will maintain the benchmark interest rate at 4.25%-4.50%, which is in line with market expectations. The dot plot shows that it is expected to cut interest rates twice in 2025, and the Federal Reserve will begin to slow down the pace of balance sheet reduction on April 1.

Operational suggestions:

Gold----Buy near 3037, target 3045-3060

Gold analysis layoutOn March 20, the Federal Reserve kept its benchmark interest rate unchanged at 4.25%-4.50%, in line with market expectations, indicating that uncertainty in the economic outlook has increased. The dot plot shows that two rate cuts are expected in 2025, consistent with December last year. In addition, the Fed will begin to slow the pace of balance sheet reduction on April 1. Recent indicators show that economic activity continues to expand at a solid pace. In recent months, the unemployment rate has stabilized at a low level and labor market conditions remain strong. Inflation levels remain high. The committee's goal is to achieve maximum employment over the long term and maintain inflation at 2%. Uncertainty in the economic outlook has increased. Uncertainty about the economic outlook has increased.

Gold fluctuated sideways on Wednesday, running in the range of 3045-3022. We have basically grasped the intraday market profits. From the current market, it should be noted that while maintaining the bullish bullish trend, this wave of increases should be treated with caution. The possibility of a change in gold prices is expected to increase at the end of the week. From a technical point of view, the trend is definitely bullish. Under the big positive weekly line, although there is no peak for the time being,

The H4 cycle has formed an absolute divergence at a high level, and a strong squat may appear at any time. The trend support of the daily cycle has two points 3000 and 2955. It seems that the price span is relatively large, but it is easy to fall. The support point of the H4 cycle is near 3015, so the key point in the short term is 3015. Once it breaks, it will no longer be so strong, and it is likely to go directly to 3000.

Investment strategy: Gold 3045-3055 short, target 3030-3020

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Gold is in trouble, and a backhand blow turns the tideThe gold market is like sailing on a rough sea. Every market fluctuation is a severe test. This time, after we shorted gold, the market suddenly fluctuated sharply due to the news. Our account suffered a floating loss and our heart was hanging. However, professional traders will not be intimidated by short-term difficulties. We quickly analyzed the news in depth, from geopolitical dynamics to economic data interpretation, without missing any details. At the same time, combined with complex and changeable technical aspects, we accurately captured the market reversal signals and decisively seized the opportunity to switch to long positions. We not only turned losses into profits, but also reaped rich profits. In the ever-changing investment world, only calm analysis and decisive decision-making can make you the final winner.

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Gold surged higher and fell again, signaling an imminent declineAt present, there is a suppression signal below 3045, but it may take some time to consolidate. It fell back under pressure on Wednesday morning, and stabilized and rose briefly to 3045 after touching the middle track. Then there was a small dive to 3022 in the European session and then rose again. This is obviously a high-level sweep, and the market has begun to fight fiercely for longs and shorts; it may go back and forth in the high range of 3020-3045, and finally wait for the announcement of the interest rate decision to stimulate and guide. If the news of the interest rate cut is implemented, it is still predicted that there will be a wave of "selling facts" decline, and then stabilize and bottom out and rise to counterattack. Then the next operation suggestion is to try to correct the decline at a high level, and continue to go up along the trend after touching 3015 or 3000 or 2980. The decline correction and squat adjustment are all preparations for further historical highs in the future.

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Gold (XAU/USD) on a 4-hour timeframe, showing a potential short Chart Analysis:

Current Price: $3,039.93

Resistance Level: $3,055.47 (marked as a key level where a sell opportunity is identified).

Target Level: $3,000.73 (suggested as the take-profit area).

Support Zone: Highlighted around $2,900.

Trading Idea:

The price is in an uptrend, but a potential reversal is expected at the $3,055.47 resistance level.

If the price fails to break above this resistance, a short position could be considered.

Entry Strategy: Sell near $3,055.47 upon confirmation of rejection.

Target: A drop towards $3,000.73.

Stop Loss: Above the resistance zone to manage risk.

Conclusion:

This is a counter-trend short setup, aiming for a pullback within the broader bullish trend. Traders should monitor price action near resistance before entering a trade.

Gold shows signs of waterfall-like plungeStimulated by the news, gold has risen rapidly to around 3045. Obviously, gold has seen a very obvious forced rise. After the rapid rise of gold, there must be a technical demand for a fall. I expect 3045-3055 to be the high point of gold in the day, so when you all want to chase the rise of gold, I have already started to short gold!

So in terms of trading, the relatively safe way is to short gold at a high level. In short-term trading, we can boldly short gold with the 3030-3040 area as the main force. I believe there will be a good profit!

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Has gold peaked? Long or short?Gold 1-hour chart has fallen from a high level, so it is difficult for gold to rise directly without news support in the short term. You can continue to short gold after it rebounds. If the Fed's interest rate decision does not rise sharply, then the idea of shorting gold at a high level will continue. Gold rebounds to observe 3045 pressure level

make a prompt decision! short high positionAnd from the chart, although gold has risen strongly, it still faces resistance in the 3039-3045 area in the short term. This is the last line of defense in the bear market, so it is not easy for gold to continue to break through. If gold fails to successfully cross this resistance area, then after consuming the bullish momentum to a certain extent, gold may retreat again and retest the 3015-3005 area.

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Gold sounds the horn of the counterattackThe gold bulls are too crazy and there is no chance of falling back. So when the market is too hot, you have to be careful, gold may stage the final madness.

Gold begins to rise and fall rapidly in the first hour, then gold begins to have short-term resistance, and the first-line resistance near 3040-3050 becomes effective, gold will usher in a reversal, and gold rises and falls and begins to adjust significantly to the 3015-3005 area, or even lower. The bullish trend of gold has been very strong in the early stage. However, when the market is too hot, it is also the time to be cautious and short under high pressure.

You can read bottom signals, interpret daily market trends, share real-time strategies, and stop blindly following the trend.

Gold 2873 to 3037!Your Trust in Our Recommendations DeliversDear Followers,

Our recommendations aren’t just predictions—they’re tangible results we achieve together through your trust and our meticulous market analysis! 📊

✅ On February 4th, we advised buying Gold at 2873, confidently stating that the 3037 target was within reach!

✅ Today, Gold has successfully hit the target, proving once again the precision of our analysis and the power of our strategies! 🏅

📢 To followers who acted on our recommendation:

Congratulations! 🎉 You exemplify smart investing by trusting data-driven insights.

⚠️ For those who missed the opportunity:

Regret over missed gains hurts more than taking calculated risks! 💔

Don’t repeat this mistake—follow us now to catch the next golden signals before they surge!

🛎 Hit "Follow" and turn on notifications (🔔) to receive our updates instantly.

✍️ Questions? Drop them in the comments—our team is here to guide you to your next profit.

Seize the golden opportunity at high altitudeDuring the price fluctuations, after two obvious market declines, the market bulls once showed a relatively strong upward trend, which made some investors confused about the market trend. However, after a comprehensive analysis of multi-dimensional factors in the market, including in-depth analysis of global economic data, geopolitical situation evolution and market capital flows, it is believed that the current high-altitude strategy in the gold market still has significant advantages.

From the perspective of technical analysis, gold prices are facing great pressure near key resistance levels, and the market short-selling momentum has not yet been fully released.

From a fundamental perspective, although the regional situation has caused short-term risk aversion fluctuations, the long-term economic trend still suppresses gold prices. Based on the above analysis, we firmly maintain the original strategy, and the 3025-3035 range is still an ideal position for short selling. Investors can decisively establish short positions in this range, set reasonable stop loss and take profit targets, and achieve steady returns with the help of market fluctuations. In the gold market full of variables, only by strictly adhering to the strategy can we ride the wind and waves and seize wealth opportunities.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

Gold bulls are going crazy, need to be careful at this time

Gold bulls are too crazy and there is no chance of a pullback. So when the market is too hot, you have to be careful. You need to be cautious when doing long positions at high levels, and beware of gold falling back after a surge and starting to make a sharp adjustment.So at this position I think shorting would be better

Gold 25-35 is directly short3025-3035 is directly short

Gold continues to fall back. The current technical indicators of the K-line are all bullish, but the market may not necessarily rise. The K-line has been soaring all the way, and it must take a break and adjust. Correction is inevitable, and adjustment is also inevitable. Two horizontal and one vertical is the way to go

Gold is bullish across the network. This is an event that is prone to black swans. The hourly line also shows a bearish engulfing pattern, and the closing price of the big negative line entity is lower than the opening price of the positive line. Falling back is also inevitable. It must fall back to the position of the moving average. This is an inevitable thing. Go short at 3025-3035. The target area is 3010-3000.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

The secret behind gold's crazy riseGold surged as soon as it was stimulated by the news, but it is expected that this momentum will not last long. Instead, it is a good opportunity to short at high levels. From a macroeconomic perspective, the current global inflation expectations and monetary policy trends have a profound impact on gold demand. In terms of technical indicators, MACD shows that although bullish energy is being released, KDJ has entered the overbought area. It is expected that after gold hits the resistance range of 3025-3035 in the short term, continue to increase short positions and increase the number of transactions, with the target of 3010-3000, accurately grasp the band opportunities, and use the possible correction market to achieve profit goals.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

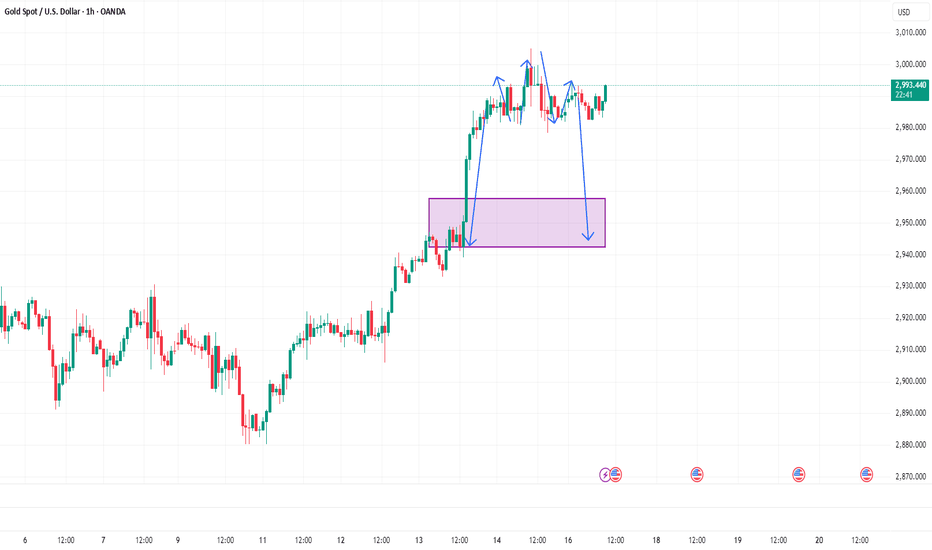

Gold Price Analysis: Supply Zone Rejection & Potential Drop to ESupply Zone Resistance (~3,004.973): Price is currently testing this resistance area, which could lead to a potential rejection.

FVG (Fair Value Gap) Support Level (~2,949.378 - 2,945.323): This area is marked as a potential support zone where price might find buying interest.

EMA 200 Support (2,945.323): A critical dynamic support level that aligns with the FVG zone.

Indicators:

EMA 30 (Red Line - 2,990.457): Short-term trend indicator.

EMA 200 (Blue Line - 2,945.323): Long-term trend indicator.

Price Action & Prediction:

The price is in the supply zone resistance and could potentially reject downwards.

The blue projected path suggests a pullback to the FVG support zone before a possible rebound.

If price breaks below this support, further downside could be expected.

Potential Trade Idea:

Short Setup: If rejection occurs at resistance, a short trade targeting the FVG/EMA 200 support could be considered.

Long Setup: If price reaches the FVG zone and finds support, a long position targeting previous highs could be a strategy.

Excellent window for gold-------News---

The U.S. inflation data for February was released, and the data showed that the U.S. inflation in February fell across the board, exceeding expectations. The decline in inflation also gave the Federal Reserve more room and possibility for interest rate cuts, and also slightly reduced the concerns originally caused by tariffs. However, with the full implementation of tariffs on Europe, retaliation from Europe also followed, and concerns about the global economic downturn also intensified. The U.S. dollar index rebounded slightly and then fell again.

Gold hourly line pattern chart;

Spot gold; Previously, the gold market continued its strong upward trend, and the bulls performed extremely well. On Wednesday, gold successfully broke through the key resistance level of 2930, breaking the previous confinement and opening the upward channel. On Thursday, the rally not only continued, but also entered a large-volume stage, directly breaking through the previous high of 2956, and without any stop, the highest impact reached 2990. The daily line closed with a long positive line, showing a strong pattern of three consecutive positive attacks. On Friday night, it even reached above 3000. You can short sell near 3000 above, and continue to hold the short positions at the previously arranged points. Reduce positions at the target area of 2970, and exit all positions when it reaches 2950.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

Gold is testing the barrier again! About to plungeGold hit a new record high again on Friday, reaching 3005 at one point, and also perfectly reaching 3000 points. Obviously, the bulls' goal has been basically achieved. The current K-line must fall back. Moreover, Trump imposed sanctions on the Middle East at the weekend, but the gold price did not rise. Obviously, the bulls are also weak.

From the perspective of gold trend, the situation between Russia and Ukraine has become confusing again under the background of the originally expected clear situation, so the risk aversion sentiment has heated up again. In addition, the global trade concerns caused by Trump's tariff policy have led to the intensification of the risk of global economic recession. The uncertainty of the market has also increased again. At this time, gold has become the most sought-after product in the market. From a technical point of view, gold has repeatedly rushed to the 3000 mark last week. On Friday, it pulled out a Yin cross star at a historical high. There is a need for adjustment in the short term. Don't watch it blindly for the time being.

There is an obvious bearish engulfing at the top of the gold four-hour line, that is, the big Yin line entity directly covers the Yang line entity, forming a top signal. At the same time, the K-line is also seriously deviated from the moving average. It is an abnormal trend again. The decline is inevitable, and returning to the moving average is also a certain short selling.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

The 3000 mark falls back, continue short-term operationsAfter gold tested the 3000 mark again, it fell back and is currently hovering around 2990. It failed to test 3000 again in the short term. This position is obviously suppressed in the short term. The second upward test quickly fell back. The gold price may fall further. The idea is to follow the trend and short-sell. Pay attention to the short position near 2990, and the target area is 2980-2970. If it falls below 2980, you can directly look at the position of 2955-2940.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

The gold high top signal appears, deep correction!It can be found that 3004 is just the top position of the 4-hour chart. After failing to break through the range last Friday, a retracement signal has also appeared. The current lower range support of the 4-hour chart is 2955-50. And 2955-50 happens to be the previous high point. Therefore, this position may be the dividing point between long and short positions of gold this week.

Secondly, from the hourly chart:

It can be seen that the current hourly chart of gold shows signs of a head and shoulders top. Once gold falls below 2980 today, it is very likely to develop towards the lower 2955-2940. 2955-50 happens to be the 618 position of this trend. The lower 50% is around 2940, which may also be the extreme retracement position of gold. Therefore, I do not recommend that you continue to chase more, but consider entering the market to short near 2990. If it falls below 2980, you can directly look at the position of 2955-2940.

You can read bottom signals, interpret daily market trends, share real-time strategies, and no longer blindly follow the trend.

GOLD TRADE IDEA : SELL | SHORT (17/03)Gold is at a crossroads. After continuously breaking ATH records it is now looking tired. It has given me signs of a potential reversal. A break to the downside would confirm that. I have reason to believe that it’ll begin dumping the second smaller opens. Even then a break downwards would help us make a decision.

N.B.: This is not financial advice. Trade safely and with caution.

Gold (XAU/USD) 30-Minute Analysis – Bearish Breakdown Towards $2Gold (XAU/USD) 30-Minute Analysis – Bearish Setup 📉

Key Observations:

Rising Wedge Breakdown:

The price has been moving within an ascending channel (EA TRADE LINE).

A potential breakdown is forming as the price approaches resistance.

EMA Levels:

30 EMA (Red, 2,986.22): The price is hovering near this level, showing potential weakness.

200 EMA (Blue, 2,950.00): This is the first major support level in case of a decline.

Bearish Projection:

A break below current levels could trigger a sharp drop.

The target zone is around 2,902.73 – 2,902.41, aligning with prior support.

Risk Management:

Stop-loss (Red Zone): Placed above 2,990.86 to protect against invalidation.

Take-Profit (Green Zone): Set near 2,902, offering a strong risk-to-reward ratio.

Conclusion:

Bearish Bias: A drop seems likely if the price fails to reclaim higher levels.

Confirmation Needed: A clean break of 2,980 could accelerate the move.

Risk Factor: If price reclaims 2,990+, the bearish setup might be invalid.

Would you like a refined entry strategy or more confirmation signals?

GOLD TRADING POINT UPDATE >READ THE CHPTAIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 list week profitable profomans reached target point 2961 ) New technical analysis setup for Gold 🪙 a short trend 📉 analysis setup. Guys 🤝 Gold 🪙 1 Time Frame 🪟 patterns chart 📉. Looking for selling zone ☺️ 🤝 FVG level 3006$ 2996$ rejected point below 👇 ⬇️ target point 2832 - 2818. ) again back 🔙 that entry buying said. Update you next analysis Guys 🤝 now follow it' good luck 💯

Key Resistance level 2996+ 3006

Key Support level 2832 - 2818

Mr SMC Trading point

Pales Support boost 🚀 analysis follow)