Gold rebound is powerless and waiting for catalyst! European sup

In the Asian session on Wednesday, spot gold suddenly fell rapidly in the short term, falling to the lowest level of 3284. At present, gold is firmly bearish in the near term, and the price of gold may fall to $3247/ounce. The Federal Open Market Committee (FOMC) is scheduled to release the minutes of the June monetary policy meeting on Wednesday. This document may reiterate what speculative interest already knows, that is, Fed officials are satisfied with their recent wait-and-see stance.

The Federal Open Market Committee (FOMC) will release the minutes of the June monetary policy meeting. The minutes of the Fed's June 17-18 meeting to be released will send a more dovish signal than expected, and the "wait-and-see period" for rate cuts may end in late summer.

Views on today's gold trend!

Looking back at the market, it fell first and then rose on Monday, and then retreated directly on Tuesday. The market turned so sharply, and after gold broke below 3300 again yesterday, the market tended to be weak. At present, the upward trend of gold is still in effect, but buyers seem to be losing momentum. It is worth noting that the relative strength index (RSI) triggered a "sell signal" as the index fell below 50, indicating that sellers outnumbered buyers.

From the perspective of price action, gold prices need to fall below the June 30 low of $3,246/oz to pave the way for further declines. From the 4-hour trend chart and the daily trend, the key node of opening pressure is around 3,321. This position is the low point of yesterday's sideways trading, and it is also the key suppression level of the trend line and the moving average. If you want to weaken again today, this position cannot stand firm, and the support below will first look at the double support of 3,376 and 3,247!

Gold: Short near 3,321, defend 3,331, and target 3,296-3,285! Enter long orders if it falls back to around 3,276 without breaking, defend 70, and target 3,310! If it continues to break, wait for the 3,347 first-line support to take more!

Goldsell

Gold’s Trap Above QML: Bearish Play UnfoldingHello Guys!

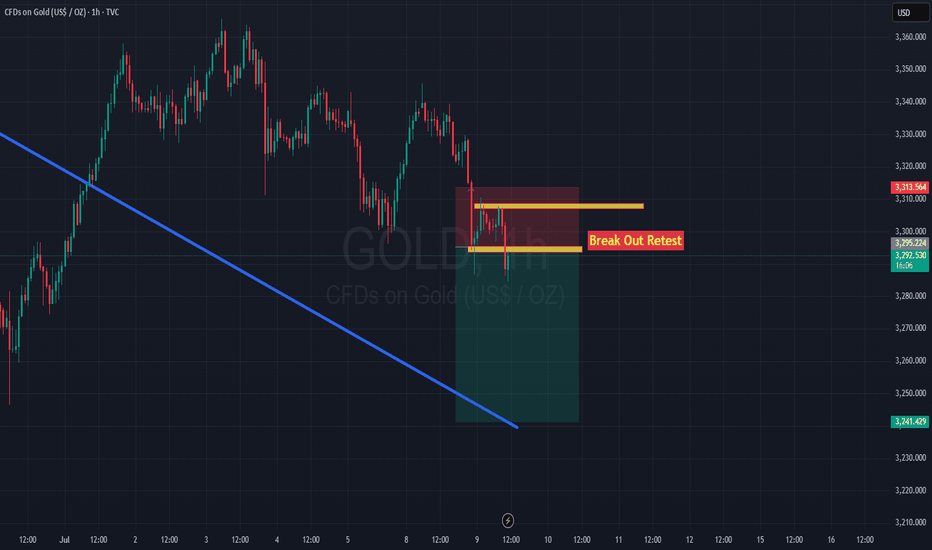

Gold appears to be forming a textbook Quasimodo reversal setup after printing a lower high into a key supply zone. Price aggressively tapped into the QML area (around 3,350–3,360), where sellers previously stepped in, and we’re now seeing signs of rejection.

The engulf zone marked earlier confirms bearish intent. It broke structure and flipped momentum. Price is currently retesting below that engulf level, likely as a last attempt to grab liquidity before heading down.

The projected move suggests a drop toward the next significant demand zone around 3,295–3,285, where the price previously found a strong bullish reaction.

Bias: Bearish below QML

Target: 3,295 zone

Invalidation: Above 3,368 (high of supply zone)

Gold (XAU/USD): Playbook in ActionHello guys!

We’ve seen a textbook QML (Quasimodo Level) setup play out beautifully on gold. Price pushed into a key supply zone and formed a QML structure, followed by a clean engulfing of the previous demand. confirming smart money involvement. As expected, the target of that QML has now been hit, tapping into the major demand zone below.

After the deep sweep and reaction from demand, price retraced upward into a potential lower high area. Based on structure and liquidity dynamics, two potential scenarios are in play:

We’re executing a two-step plan here:

Step 1: Short position from the QML + supply area, aiming for the next blue demand zone. Liquidity has been taken above the high, confirming the setup.

If we get a clean reaction near the blue area, that’s our signal to flip long. We expect a pullback toward $3310 area.

XAUUSD Loses Short-Term Support – Deeper Decline May FollowGold (XAUUSD) is showing clear signs of short-term weakness after losing a key support zone around 3,287 USD – which previously aligned with the rising trendline and the 61.8% Fibonacci retracement level (3,295.20 USD) of the prior downward move.

1. Price Structure and Current Pattern:

Price has formed a descending triangle and just broke below its lower boundary with strong bearish candles.

Consecutive bearish candles with short lower wicks indicate strong selling pressure with little buying interest.

After being rejected at 3,304.25 USD – the most recent swing high – price has dropped toward the 0.0% Fibonacci level at 3,280.57 USD.

2. Fibonacci and Key Price Zones:

The 3,295.20 area (Fibo 0.618) has now become a strong resistance after a failed recovery attempt.

The 3,280 – 3,275 zone is the next target for bears if no strong reversal appears in upcoming sessions.

A break below 3,275.73 may open the path for further downside toward 3,268 – 3,260.

3. Trendlines and Candle Behavior:

The short-term rising trendline (in red) has been broken alongside increasing sell volume.

The upper descending trendline (in light blue) remains intact, confirming that the overall structure is still bearish.

Suggested Trading Strategy:

Sell on rallies: Prefer short entries around 3,290 – 3,293, with a stop loss above 3,296.

Short-term target: Look for potential take-profit zones at 3,275 – 3,268.

Avoid bottom fishing unless there’s a strong bullish reversal signal such as an engulfing or hammer candle backed by volume.

Conclusion:

Gold is under visible downside pressure below key technical resistance. If the price fails to hold above 3,280, the downtrend could extend further. Traders should remain cautious of weak pullbacks and look to enter in line with the dominant bearish trend.

Gold fell under pressure, and the watershed is 3321.

⭐️Gold Information:

During the Asian session on Wednesday, gold prices (XAU/USD) continued to be under pressure, falling below the $3,300 mark, hitting the lowest point in more than a week. The decline in gold prices comes as the market generally believes that the Federal Reserve (Fed) will maintain high interest rates for a longer period of time, especially as the market expects that tough U.S. tariffs may exacerbate inflation in the coming months.

Such expectations have pushed up U.S. Treasury yields and stabilized the U.S. dollar (USD) near a two-week high hit on Tuesday - a key resistance for the non-yielding precious metal, which continues to face downward pressure.

⭐️Personal comments:

Gold price fell below support, Dow Jones H1 pattern, gold price fell below 3300

⭐️Set gold price:

🔥Sell gold area: 3344-3446 SL 3351

TP1: $3335

TP2: $3320

TP3: $3302

🔥Buy gold area: $3256-$3254 SL $3249

TP1: $3268

TP2: $3280

TP3: $3298

⭐️Technical analysis:

Set reasonable sell orders based on technical indicators EMA 34, EMA89 and support and resistance areas.

XAU/USD) bearish Trand analysis Read The captionSMC trading point update

Technical analysis of (XAU/USD) on the 3-hour timeframe, projecting further downside after rejection from a resistance zone aligned with a descending trendline.

---

Analysis Summary

Trend Bias: Bearish

Current Price: ~$3,301.96

Structure: Price is respecting a descending channel, with multiple rejections from the upper boundary and key resistance zone.

---

Key Technical Insights

1. Resistance Zone & Downtrend Line:

Price was rejected from a resistance block near the EMA 200 (~$3,331) and descending trendline.

This level has repeatedly triggered strong downside moves (highlighted with red arrows).

2. EMA 200 Reaction:

The EMA 200 at $3,331.10 is acting as dynamic resistance.

Each time price reaches or crosses above this line, selling pressure increases.

3. Bearish Price Projection:

After recent rejection, the chart anticipates a pullback to the support zone between $3,248.26 and $3,245.71.

A deeper drop toward $3,159.13 is projected as a next major target, consistent with previous price moves.

4. RSI Indicator:

RSI at 40.24 suggests bearish momentum is still in play but not yet oversold—indicating room for more downside.

---

Bearish Trade Idea

Element Level / Description

Entry Zone Below resistance: $3,310–$3,320

Target 1 $3,248.26–$3,245.71 (support zone)

Target 2 $3,159.13 (channel base / next support)

Stop-Loss Above $3,335 (above resistance zone)

---

Risk Considerations

Fundamental catalysts: Gold is sensitive to USD strength, interest rate decisions, and macroeconomic data.

Invalidation: A strong breakout and close above the descending trendline and EMA 200 would negate the bearish outlook.

---

Summary

This analysis outlines a bearish setup for XAU/USD, supported by trendline resistance, EMA rejection, and RSI momentum. If current structure holds, a move toward the $3,245 and $3,159 levels is likely.

Please support boost 🚀 this analysis)

Gold will continue to fall today.Gold continued to fall in the US market after hitting a high on Tuesday and hit a recent low. Currently, there is a fierce competition between long and short positions. The repeated swings in the US tariff policy have caused fluctuations in risk aversion sentiment, and the probability that the Federal Reserve will maintain interest rates above 95% in July has supported the US dollar. Technically, we need to focus on the key support of 3260 and the strong resistance range of 3320 above. The hourly chart shows that the short-term moving average diverges downward, and the K-line is under pressure, showing short-term fatigue, suggesting that there is still a need for a correction today.

Thank you for your likes and support!

I will continue to share my views.

I wish you a smooth trading!

XAUUSD Short-Term Correction From the Top ZoneOn the 15-minute chart, XAUUSD showed a strong upward momentum starting below the 3,300 USD mark, reaching a peak near 3,346 USD. This rally was supported by a clear bullish structure and an ascending trendline.

However, once the price hit resistance at the top, selling pressure intensified, pushing the price into a downward correction. A clear pullback zone has formed between 3,346 USD and the support area around 3,318 USD — currently acting as a buy-side liquidity pocket.

Crucially, the price broke below the previous uptrend line and is now being capped by a descending resistance trendline, indicating a short-term bearish bias. Multiple failed attempts to break above the 3,332 – 3,335 USD area confirm that sellers still have the upper hand.

Additionally, the price action within this correction zone hints at a potential distribution pattern. Without strong buying interest to reclaim the 3,335 USD level, further downside remains possible.

Suggested Trading Strategy:

In the short term, traders may consider a “Sell on Rally” approach if price continues to fail at the 3,332 – 3,335 USD resistance zone.

Conversely, if a clear breakout occurs above the descending trendline and especially above the 3,336 – 3,338 USD area, the bullish trend may resume.

Conclusion:

XAUUSD is undergoing a technical pullback after a sharp rise. The market is currently in a tug-of-war between profit-taking pressure and recovery attempts. How price reacts at the current resistance will determine the next key move.

XAUUSD D1 – Gold Under Long-Term Bearish PressureGold is currently trading around 3,328 USD after failing to break above the descending trendline that started from the mid-June peak. On the chart, the price forms a series of lower highs and lower lows — a classic signal of a medium-term downtrend.

The descending trendline (green) acts as dynamic resistance. Each time price approaches it, strong selling pressure pushes it back down, showing sellers are in control.

In the short term, the 3,300 – 3,310 USD area serves as immediate support. If this zone is broken, price could drop further toward the major support zone around 3,260 – 3,270 USD.

Conversely, a confirmed reversal would only be valid if price breaks above the descending trendline and closes sustainably above 3,371 USD — a historically significant distribution zone.

The most recent daily candle is a small-bodied red candle with a long lower wick, indicating weak buying pressure and market indecision — typical in a consolidation phase before further downside.

Strategy Summary:

Favor short positions on pullbacks to the descending trendline.

Avoid bottom-fishing until a confirmed breakout above major resistance.

Traders should monitor the 3,300 USD zone closely in upcoming sessions.

Note: The analysis above is for informational purposes only and does not constitute investment advice. Stay tuned for further updates and adjust your trading plan accordingly.

What’s your take on the next move for gold? Share your thoughts in the comments!

Gold Continues Slight Pullback📊 Market Overview:

• Gold prices dropped ~0.7% to around $3,319/oz as optimism over the US trade negotiations and a tariff delay (from July 9 to August 1) reduced safe-haven demand.

• The US dollar strengthened slightly on upbeat economic data and expectations that the Fed will not cut interest rates in July, adding pressure on gold prices.

📉 Technical Analysis:

• Key resistance: $3,348 – $3,360 – $3,400

• Nearest support: $3,318 – $3,290

• EMA09: Gold is trading below the EMA50, indicating a short- to mid-term bearish bias.

• Candle/volume/momentum: On the 1H and 15-min charts, the price structure shows a clear bearish expansion – trading below pivot levels with a "bearish opening" setup, suggesting strong selling momentum.

📌 Outlook:

Gold may continue to move slightly lower in the short term if positive trade headlines and USD strength persist. However, if there’s unexpected negative news—like geopolitical tensions or a Fed policy pivot—gold could quickly rebound.

💡 Suggested Trading Strategy:

SELL XAU/USD at: 3,348 – 3,350

🎯 TP: ~40/80/200 pips

❌ SL: ~3,355

BUY XAU/USD at: 3,290 – 3,295

🎯 TP: ~40/80/200 pips

❌ SL: ~3,285

Shorts trapped? No, the head and shoulders top is still downOver the weekend, I gave a trading strategy for going long at 3315-3305. Today, I updated and optimized the long order trading, maintained the high-short-low-long trading strategy, and began to rebound near the 3300 line, and successfully touched the long TP 3333. At present, I am executing short trades again according to the trading strategy and holding short orders.

Although gold has only retreated to around 3330, I am not worried about losses and failures in short trades. As I wrote in today's post, the daily K-line chart has a head and shoulders top pattern. As long as the bulls fail to recover 3360, it is still a short trend. Therefore, in the short term, I still think that the rebound is a good opportunity for us to go short.

At present, the short-term bullish momentum of gold has been consumed and the downward trend continues. Therefore, I still insist on holding short orders in the short term.

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and being strict with yourself. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD FXOPEN:XAUUSD OANDA:XAUUSD TVC:GOLD

15-minute candlestick chart for Gold Spot (XAU/USD)15-minute candlestick chart for Gold Spot (XAU/USD)

📉 **1. Trend Overview:**

* The overall direction is **bearish (downtrend)** — this is confirmed by:

* **Price below the 50 EMA** (black line)

* **Lower highs and lower lows**

* Continuous rejection from resistance

---

### 🟩 **2. Resistance Zone (\~3,312 to 3,320):**

* This is the area where price has **previously failed to break above** multiple times.

* Sellers dominate this level — price tends to drop when approaching here.

* A **bullish breakout above 3,320** may signal trend reversal.

---

### 🟥 **3. Support Zone (\~3,296 to 3,303):**

* This area has seen **strong buying** (look at the lower wicks and reversal candles).

* Price has bounced multiple times from this zone — it's acting as a **floor**.

* If price breaks **below this support**, further downside is likely.

---

### 📊 **4. Indicators:**

* **EMA 50 (black line)**: Shows the medium-term trend — it's sloping down, confirming bearish bias.

* **Shorter EMAs (red and blue)** are also above price, indicating pressure from sellers.

---

### 💡 **5. Price Action & Volume Insight:**

* A recent **rejection wick** at support suggests buyers are still active here.

* However, volume is increasing during the latest drop — **bearish momentum** is building.

* Watch how price behaves around 3,302–3,303 — consolidation here could lead to a breakout or breakdown soon.

---

### 🧠 **Trade Setups:**

#### **A. Bearish Scenario (Breakdown Trade):**

* 🔻 *Sell below 3,296 (support break)*

* 🎯 Target: 3,288 or lower

* 🛑 Stop Loss: Above 3,304

#### **B. Bullish Scenario (Bounce Trade):**

* 🔼 *Buy near 3,296–3,303 (support bounce)*

* 🎯 Target: 3,312–3,320 (resistance)

* 🛑 Stop Loss: Below 3,295

---

### ✅ **Summary:**

* Market is **bearish**, but currently **testing strong support**.

* Watch closely for a breakout below support or a pullback to resistance.

* Best strategy: **Sell the breakdown or sell the pullback to resistance.**

New tariffs are coming. How should gold respond?📰 News information:

1. 90-day tariffs are about to expire

2. New unilateral tariffs

3. Geopolitical situation

📈 Technical Analysis:

On July 4th local time, there were constant turmoil in American politics and trade. Trump declared that the US government would send letters to trading partners that day to set new unilateral tariff rates, which would most likely take effect on August 1. He also revealed that the new tariff rates could soar to 70%. At the same time, Japan-US trade negotiations encountered obstacles, India planned to impose retaliatory tariffs on the United States, and the China-EU tariff war had also begun. At present, the news seems to be more favorable to the bulls.

From a technical point of view, gold closed higher last week, showing that there is still upward momentum this week. In the short term, we need to pay attention to the pressure in the 3365 and 3375 - 3380 areas, and the 3400 mark is a key position where bulls and bears are fighting fiercely. Before breaking through this position, we must be alert to the risk of falling back after a high rise. Pay attention to the support of 3310-3305 and 3295-3285 below. If effective support is obtained, we can consider going long. If it breaks, it may go to 3270-3260. Gold jumped to 3342 at the opening of the Asian session and then fell back. 3345 is the key in the short term. The news may affect its subsequent trend. In the short term, pay attention to the suppression of 3345 on the upper side, and further to the strong resistance area of 3365-3380. If there is resistance and pressure, you can short at a high level. The impact of recent news is erratic, so enter the market with caution and be sure to set TP and SL strictly.

🎯 Trading Points:

SELL 3330-3345

TP 3320-3310-3295

BUY 3310-3305

TP 3320-3330-3345

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD

NFP continues to ferment, short-term trend dominated by bears📰 News information:

1. 90-day tariffs are about to expire

2. New unilateral tariffs

3. Geopolitical situation

📈 Technical Analysis:

Good morning, bros. From a technical point of view, the overall trend of the daily line is a head and shoulders top. If the bulls do not recover 3360, the bears will still be the medium-term trend. The 4H MACD indicator is dead cross running. The best position for the day to deploy the short position again is 3330-3335, and the 1H chart keeps testing the 3305 first-line support, which may be broken in the short term. At present, 3295-3285 below is a relatively important short-term support. Once it falls below, it is expected to reach 3250, which is also the point I repeatedly emphasized in the morning. The intraday operation suggestion is to rebound shorting as the main, and to go long at lows as the auxiliary. Pay attention to the 3325-3335 support area on the upper side and the 3295-3285 support on the lower side.

🎯 Trading Points:

SELL 3325-3335

TP 3315-3305-3295

BUY 3295-3285

TP 3305-3315-3325

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD TVC:GOLD

On Swing Traders’ Radar: Gold Pattern Alert on the Daily Chart!Dear Traders,

In my daily gold analysis, I’m observing a Head and Shoulders pattern nearing completion. The neckline is currently positioned around the 3,247.00 level.

If this neckline breaks to the downside, gold could potentially drop toward the 3,150.00 area.

Since this is a one-day analysis—aligned with a swing trading style—it may take some time for the setup to fully play out.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

XAU/USD possible shorts from 3,350 towards 3,290 longsThis week, my focus is on a potential sell setup that could form within the 4-hour supply zone, which is currently near price. I’ll be patiently watching for signs of Wyckoff distribution within this point of interest (POI), which could confirm a short opportunity.

Given that price action has been bearish, this would be a pro-trend setup, especially with the visible liquidity resting below that we can look to target. Additionally, there is an 8-hour demand zone further below, which may provide a potential long opportunity once price reaches that level.

Confluences for GOLD Sells:

- Bearish market structure: Gold has been trending downward and has recently left behind a clean, unmitigated 4-hour supply zone, which could prompt a bearish reaction.

- Liquidity targets below: There's significant liquidity under recent lows, including Asia session lows and the 8-hour demand zone, which can be targeted.

- DXY correlation: The dollar has reacted strongly from a notable demand zone, suggesting potential upside for DXY, which may add bearish pressure on gold.

- Higher timeframe Wyckoff: A Wyckoff distribution pattern has also formed on the higher timeframe, which may indicate temporary bearish order flow.

P.S. If price disrespects the current 4-hour supply zone, I will shift focus to an extreme 3-hour supply zone above. Until price reaches that level, I may look for short-term buy setups to trade the move up.

Wishing everyone a great and profitable trading week! Stay disciplined and manage risk accordingly.

Gold Pulls Back After Strong US NFP Data📊 Market Overview:

U.S. June Non-Farm Payrolls came in at 147,000 vs. 110,000 expected, strengthening the dollar and reducing expectations for a July Fed rate cut. As a result, gold dropped nearly 1%, trading in the $3,328–3,332 zone

📉 Technical Analysis:

• Key Resistance: $3,350 – $3,360

• Immediate Support: $3,322 – $3,328

• EMA: Price has fallen below the 09 EMA, indicating a bearish short-term trend.

• Candle/Volume/Momentum: A strong bearish candle with increased volume shows significant selling pressure post-NFP

📌 Outlook:

Gold may continue its downtrend in the short term if the dollar remains strong and no fresh bullish triggers emerge. A drop toward $3,322–$3,328 is possible.

💡 Trade Ideas:

🔻 SELL XAU/USD at: $3,342 – $3,345

🎯 TP: $3,322

❌ SL: $3,348

🔺 BUY XAU/USD at: $3,322 – $3,325

🎯 TP: $3,345

❌ SL: $3,316