Goldsetup

"Gold Just Respected The OB Like a Pro! 1:7 RR Setup LIVE!"📈 GOLD (XAUUSD) – 1H SMC Setup | April 30, 2025

This is a textbook Smart Money bullish entry — we’ve got the clean sequence of Order Block ➝ CHoCH ➝ Mitigation ➝ Pump.

🔍 Structure Analysis:

After a strong selloff, price created a valid Bullish Order Block around 3,253 – 3,285 (highlighted in purple).

Price swept previous lows (liquidity grab) before returning to mitigate the OB.

The Change of Character (CHoCH) marked the shift from bearish to bullish intent.

Price wicked into the OB zone → buyers stepped in → sniper entry executed ✅

🎯 Trade Setup:

Entry: 3,285

SL: 3,253 (below OB wick)

TP1: 3,310

TP2: 3,345

TP3: 3,370+ (Potential Imbalance Fill)

RR: ~ 1:7 (massive!)

🧠 Why This Works (SMC Logic):

Liquidity sweep before entry = market manipulation phase

OB = institutional footprint

CHoCH confirms momentum flip

Entry right at mitigation level = minimized drawdown, max RR

📌 Execution Notes:

Patience was key: entry triggered only after full mitigation of OB

No candle close below OB = confidence to hold

Now in expansion phase → trailing stop for runners 🏃♂️

💡 Pro Tip:

Price doesn’t reverse randomly. It reacts to zones where Smart Money operates — just like this OB. Learn the game, don’t chase the candles.

🔥 Final Thought:

This is the kind of setup you print out and pin on your trading desk.

Risk was tight. Reward? HUGE. This is why we follow structure, not emotions.

🗣️ Drop a 🔥 if you caught this Gold move!

💾 Save this post for your SMC playbook.

📤 Share it with your trading squad — don’t gatekeep winning setups.

Gold Technical Update (4H Time Frame) / Gold BullishAs we mentioned last week, gold was consolidating on the 4H time frame. After the breakout, all our projected targets were successfully achieved as of yesterday.

Currently, gold is forming a bullish flag pattern on the 4H chart — a continuation pattern that often signals the potential for further upside.

If gold sustains above the 3275–3280 zone, we may see renewed bullish momentum with the following potential targets:

Target 1: 3300

Target 2: 3340

Target 3: 3360

Target 4: 3400

⚠️ This is a technical analysis-based outlook. Traders are advised to manage their positions with proper risk-reward strategies and stay updated with market developments.

Gold Potential Bullish Breakout (Potential HH formation)With with continued global tariff panic between USA and China, Gold price still seems to exhibit signs of overall Bullish momentum as the price action may form a prominent Higher High on the shorter timeframes with multiple confluences through key Fibonacci and Support levels which presents us with a potential long opportunity.

Trade Plan:

Entry : 3363

Stop Loss : 3278

TP 0.9 - 1 : 3439.5 - 3448

Gold Sell and Buy Trading PlanH4 - We had a strong bullish move with the price creating a series of higher highs, higher lows structure

This strong bullish move ended with a bearish Divergence

While measuring this strong bullish move using the Fibonacci retracement tool we have two key support zones that has formed (marked in green)

So based on this I expect short term bearish moves now towards the Fibonacci support zones and then continuation higher.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD (XAU/USD) at ATH – Two Key Scenarios to WatchGold has reached ATH, and we're currently testing a critical resistance zone. Look at my previous published post, perfectly played out and we're just getting started.

📈 Scenario 1: If the 1H candle body breaks above resistance with a confirmed close, we’re likely to see a push toward the $3,300 level before a potential pullback toward $3100

📉 Scenario 2: If we fail to break resistance, a pullback toward the $3,100 zone is expected before a bounce back to $3,350.

Wait for a retest confirmation on the 1H candle body closure before taking any position.

Updates will be published!

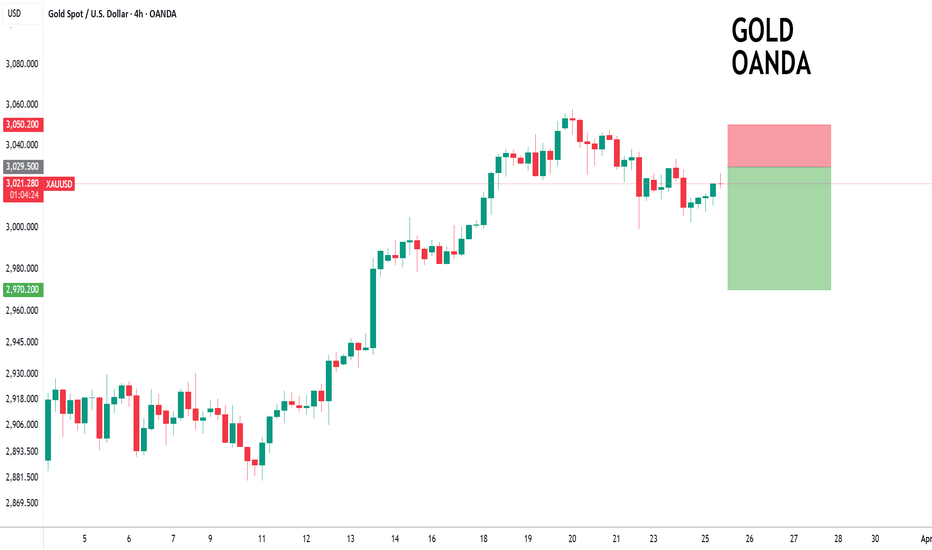

GOLD to turnaround?XAUUSD - 24h expiry

Previous support at 3030 now becomes resistance.

Although the bulls are in control, the stalling positive momentum indicates a turnaround is possible.

Posted a Bearish Inverted Hammer Bottom on the Daily chart.

A higher correction is expected.

The RSI is trending lower.

We look to Sell at 3029.5 (stop at 3050.2)

Our profit targets will be 2970.2 and 2960.2

Resistance: 3020.8 / 3033.3 / 3047.4

Support: 3014.5 / 2999.3 / 2978.4

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

XAU/USD 24 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Bias and analysis remains the same as analysis dated 23 March 2025.

Price has printed a bearish CHoCH following printing further all time highs.

Price is now trading within an established internal range. I will however continue to monitor price.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or nested Daily and H4 demand levels before targeting weak internal high priced at 3,057.590.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

As per analysis dated 19 March 2025 whereby I mentioned as an alternative scenario that internal range has significantly narrowed. All HTF's require a pullback, therefore, it would be completely viable if price printed a bearish iBOS.

This is how price printed, by printing a bearish iBOS.

Price has yet to print a bullish CHoCH to indicate bullish pullback phase initiation, however, price has traded into premium of 50% internal EQ, therefore, I am happy to confirm internal range.

Intraday Expectation:

Price has traded in to premium of 50% EQ and has mitigated M15 supply zone.

Technically, price to target weak internal low priced at 2,999.465.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

Gold - Expecting Retraces and Further Continuation LowerH1 - Bearish divergence on the moving averages of the MACD indicator.

Followed by bearish trend pattern in the form of three lower highs, lower lows structure

Strong bearish momentum

Potential drop after retraces if the strong resistance zone will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

----------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAU/USD 14 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Previous analysis was not met as price printed a bullish iBOS. Support in the rise of price is largely due to the trump trade and tariff war which is causing market jitters.

Intraday Expectation:

Price to indicate bearish pullback phase initiation by printing bearish CHoCH. Bearish CHoCH positioning is denoted with a blue dotted line.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has further printed a bullish BOS. Remainder of analysis and bias remains the same as yesterday's analysis dated 13 March 2025

Analysis and bias has not been met, largely due macroeconomic events, particularly the Trump trade tariff war, which is causing uncertainty within the markets which is supporting Gold price.

Price has printed a bullish iBOS.

Within the structure following the iBOS, price has printed a several bearish CHoCH's with very minimal pullbacks before continuing bullish.

In order not to distort internal structure range I will apply discretion and not classify bearish CHoCH without considerable pullback.

Intraday Expectation:

Await for price to print Bearish CHoCH which is supported by a pullback relative to recent price action.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

XAU/USD 06 March 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Price has printed a bullish CHoCH according to analysis and bias dated 28 February 2025.

Price is currently trading within an established internal range.

Intraday Expectation:

Price is now trading in premium of 50% internal EQ where we could see a reaction at any point. Price could also target H4 supply zone before targeting weak internal low, priced at 2,832.720

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

Price could also be driven by President Trump's policies, geopolitical moves and economic decisions which are sparking uncertainty.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

Analysis and bias remains the same as analysis dated 03 March 2023.

As mentioned in my analysis dated 28 February 2025, whereby price printed a bullish CHoCH but stated I would continue to monitor price.

On this occasion I have marked the previous bullish CHoCH in red as price did not pull back deeply enough to warrant internal structure breaks, additionally, there was minimal time spent .

Price has printed a further bullish CHoCH which is now confirmed. Price is not trading within an established internal range.

Intraday Expectation:

Price to continue bullish, react at either premium of internal 50% EQ, or M15 supply zone before targeting weak internal low priced at 2,832.720.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

GOLD 4H ROUTE MAP TRADING PLAN / READ CAPTION CAREFULLYGOLD 4H Chart Analysis – 17th Feb 2025

Review of Previous Chart:

Entry Level: 2814

Take Profit 1: 2850.15 ✅ (Hit)

Take Profit 2: 2876.95 ✅ (Hit)

Take Profit 3: 2903.76 ✅ (Hit)

Take Profit 4: 2925.85 ✅ (Hit)

To Achive TP5, TP6, TP7 and TP8, please consider the following scenario below. Read the caption carefully.

Key Level: 2876

Resistance Level: 2900, 2925, 2942, 2952, 2984, 3017, 3052

Support Levels (Goldturn Levels) : 2876, 2852, 2828, 2803, 2776, 2747

GOLDTURN KEY LEVELS ARE ACTIVATED

EMA5 Behavior (Red Line):

Current EMA5: 2902.10

* EMA5 is fluctuating between two key weighted levels, with a gap above 2925 and below the 2900 GoldTurn level.

* A crossover of EMA5—either above or below the weighted level—will signal the next significant move for GOLD.

Bullish Targets

EMA5 cross and hold above 2900, will open the following bullish target 2925 ✅ DONE

EMA5 cross and lock Above 2925, will open the following bullish target 2952

EMA5 cross and lock Above 2952, will open the following bullish target 2984

EMA5 cross and lock Above 2984, will open the following bullish target 3017

EMA5 cross and lock Above 3017, will open the following bullish target 3052

Bearish Targets

EMA5 cross and lock Below 2900: will open the following bearish target 2876 ✅ DONE

EMA5 cross and lock Below 2876: will open the following bearish target 2852

EMA5 cross and lock Below 2852: will open the following bearish target 2828

EMA5 cross and lock Below 2828: will open the following bearish target 2803 (Retracement Range)

EMA5 cross and lock Below 2803: will open the following bearish target 2747 (Swing Range)

Trading Plan:

* Stay bullish and buy pullbacks from key levels.

* Avoid chasing tops—focus on buying dips.

* Use smaller timeframes for entries at Goldturn levels.

* Aim for 30–40 pips per trade for optimal risk management.

* Each level can yield 20–40+ pips reversals.

Short-Term Strategy:

Anticipate possible reversals at weighted GOLDTURN levels 2876, 2852 and 2828.

Leverage 1H timeframe to capture pullbacks around these levels.

Target 30–40 pips per trade, focusing on shorter positions for effective risk management.

GOLDTURN levels provide reliable bounce opportunities, allowing you to buy at dip levels.

Long-Term Outlook:

Maintain a bullish bias while using pullbacks as buying opportunities.

Buying near key support levels ensures better entry points and mitigates risks, avoiding the pitfalls of chasing tops.

Trade with confidence and discipline. Stay tuned for our daily updates! Please support us with likes, comments, and follows to keep these insights coming.

📉💰 The Quantum Trading Mastery

GOLD MONTLHY CHART LONG ROUTE MAP ANALYSISDear Traders,

Attached is the Monthly Chart Route Map for GOLD. Since October 2023, we have been consistently analyzing and trading GOLD with 100% accuracy in our targets. The Golden Circle Area marked on the chart clearly reflects our precise analysis and targets achieved.

The EMA5 has crossed the ENTRY LEVEL, leading to the successful achievement of TP1, followed by TP2. We are now anticipating TP3.

What’s Next for GOLD?

The FVG has provided strong support at 2535 level that caused the price to push upward to 2785 and also the monthly chart confirms that EMA5 has crossed and locked above TP2 (2603), signaling the next bullish target at TP3 (2920). While external market factors may slow momentum or cause temporary reversals, we are confident that TP3 will be reached in due time.

Once TP3 is hit, a significant correction to lower weighted levels is expected before the bullish trend resumes, as indicated on the chart.

Key Levels:

Support: 1969

TP1: 2286 ✅ (Achieved)

TP2: 2603 ✅ (Achieved)

TP3: 2920 ⏳ (Pending)

Short-Term Strategy:

We will utilize smaller timeframes (1H and 4H charts) to buy dips at key weighted levels, targeting clean 30-40 pips per trade. This strategy is most effective in ranging markets, avoiding extended holds that may be exposed to high volatility.

Long-Term Bias:

Our outlook remains bullish, viewing market drops as buying opportunities. We will continue to leverage predefined levels and setups for optimized entries in smaller timeframes.

🔺 THE QUANTUM TRADING MASTERY 🔺

Gold Approaching Major Resistance – Will It Drop to 2,736$?OANDA:XAUUSD is nearing the upper boundary of an ascending channel, which aligns with a major resistance zone. This area has acted in the past as a reversal point, making it a key level to watch for potential bearish movements.

If the price confirms rejection at this level, I anticipate a move downward toward the 2,736$ level, consistent with the channel’s structure and a nearby support zone. Conversely, if this resistance is breached, it could signal increased buying pressure and a continuation of the bullish trend.

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Following on from the initial KOG Report we've not done too badly managing to plot the path for the move and jump on board with it over the week. Yesterday we wanted that pullback into the 2685-90 region to continue with the bias and the bias levels which didn't hit exactly but the move continued and we've completed all of our targets for the week.

Now, again we're a bit high, so if you're looking for trades the only option is to wait for the pull back, or for those on the boxes and scalping, look for a reversal from above, if not broken, support has flipped 2710!

For us, a great week on the gold and the rest of the markets, we'll be taking it easy tomorrow.

KOG’s Bias for the week:

Bullish above 2650 with targets above 2700✅, 2706✅ and above that 2716✅

Bearish on break of 2650 with targets below 2640 and below that 2635

RED BOXES:

Break above 2690 for 2700✅, 2703✅, 2706✅, 2710✅ and 2724✅ in extension of the move

Break below 2680 for 2667, 2665, 2655 and 2640 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

XAU/USD 14 January 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bearish.

-> Internal: Bullish.

Analysis/Intraday expectation remains the same as analysis dated 16 December 2024.

Price is clearly unable to target weak internal. This is due to the fact that Daily and Weekly Timeframe remain in bearish pullback phase.

Price Action Analysis:

Technically price is to target weak internal priced at 2,721.420. Price has sweeped liquidity,

for two possible reasons.

1. To assist price to complete bearish pullback phase, react at either discount of internal 50% or H4 demand zone before targeting weak internal high.

2. To assist Daily and H4 TF's to complete bearish pullback phase with price to print a bearish iBOS and target strong internal low priced at 2,536.855.

Intraday Expectation:

Intraday expectation and alternative scenario as per points 1 and 2.

Note:

With the Federal Reserve's dovish stance and persisting geopolitical uncertainties, heightened volatility in Gold is expected to continue. Traders should proceed with caution and adjust risk management strategies in this high-volatility environment.

H4 Chart:

M15 Analysis:

-> Swing: Bearish.

-> Internal: Bearish.

Price Action Analysis:

Yesterday's Intraday expectation was not met with price failing to target weak internal high, printing a bearish iBOS. Internal structure has now aligned itself with swing structure.

This could potentially be an early indication that both Daily and H4 pullback phases are incomplete. It would also be useful to remember that Weekly TF remains in its bearish pullback phase.

Price subsequently printed a bullish CHoCH thereby confirming internal range and indication of bullish pullback phase initiation.

Intraday Expectation:

Price has yet to trade in to premium of internal 50% EQ or M15 supply zone. Expectation is for price to target weak internal low, priced at 2,656.880.

Note:

With the Federal Reserve maintaining a dovish stance and ongoing geopolitical tensions, volatility in Gold prices is expected to remain elevated. Traders should exercise caution, adjust risk management strategies, and stay prepared for potential price whipsaws in this high-volatility environment.

M15 Chart:

Gold next push to the upside or downside. 😌 Price has bn playing around last week high.

🫴🏻If price breaks the previous week high 2658.40 and a close above it, there's a higher probability 💯 that price is going to clear the liquidity above 2692.76 and get to the daily point of interest 2706.89 💫

🫴🏻If price did not breaks the previous week high with a candle closure above it. I am anticipating price to clear both this current week Monday's Low 2614.76 and previous week Monday's Low 2596.12.

🫵🏼 Watch out for this. The simple thing is to let price do what it wanted to and you trade what you see.

Please bost if you find this one insightful.

GOLD- Levels for Monday 6th- Friday 11th JanuaryHope this benefits you guys. This is not typical S&R or S&D. These levels are based on volume profile and really powerful. NOTE, don't treat these levels as buy and sell points. You will still need to have context behind your trade and use these levels as a reference point. one of the strategy I use is, volume profile along with cumulative delta and footprint. Look for shift in value, delta divergence etc. and when price reaches one of those levels, use footprint for entry. Bottom line is, you have to have context behind your trade. Without context, you are hunting in the dark. Have fun and enjoy