THE KOG REPORT - FOMCTHE KOG REPORT – FOMC

This is our view for FOMC, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

While gold is relatively new to this range we have to entail some caution if we’re even going to consider trading this FOMC. Markets are a little fragile, we’re at ATH’s and the moves are extremely aggressive. So, we’ll highlight the red box levels and the potential move we’ll be looking for, sticking to the extreme and key levels, ignoring the intermediate levels.

Looking at the chart we have a support region below 3010-15 which if spiked into and held can push this back up this time to break above 3030 and attempt to attack that 3050 region. That in our opinion would be the first point to start looking for price to exhaust, but it will only give us the flip so longer scalps are likely to be all we’ll get.

If we break above the 3055 region we’re likely to go higher giving us a red box resistance level of 3065-75. It’s this level we would ideally like to target from a lot lower down if we can get that entry. For that reason, we have given the level below on the break of 3010 sitting around 2990-80, we’ll have to wait and see, but if we can get down there a nice swing could present itself.

RED BOX INDICATOR:

Break above 3030 for 3050, 3055, 3063 and 3070 in extension of the move

Break below 3020 for 3912, 3006, 2996 and 2990 in extension of the move

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

Goldsignals

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Major 25-year Resistance getting tested!Gold (XAUUSD) has been on a multi-decade uptrend since the 2000 bottom and shortly after the launch of its ETF. With the exception of the aggressive 2006 break-out, the majority of its price action has been inside the (blue) Channel Up but the use of the Fibonacci extension Channel allows us to catch the key levels of the post 2006 action too.

What's more important is that the market is testing the top of that (blue) Channel Up, i.e. the 1.0 Fibonacci level, for the first time since August 2020, which was a major market top and the start of a 3-year Bear Phase.

As mentioned, the only time this Resistance broke was in April 2006, when Gold truly turned parabolic. The question is, what will it be this time? A macro level bullish break-out to the Fib 1.5 extension or the more short-term dynamic of the top of the blue Channel Up and a rejection back to the long-term Support of 1M MA50 (blue trend-line)?

Tell us your thoughts in the comments section!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold is Pulling Back to Support lines & PRZ – Another Rally!?As I expected in my previous post , Gold ( OANDA:XAUUSD ) finally touched Potential Reversal Zone(PRZ) (of course with a lot of volatility).

From Elliott Wave theory , Gold appears to have completed the main wave 3 and is currently completing the main wave 4 . The main wave 4 is likely to end near the Support lines and Potential Reversal Zone(PRZ) .

I expect Gold to attack Potential Reversal Zone(PRZ) at least once more after completing the main wave 4 .

Can Gold make a new All-Time High(ATH) or Correction?

Note: There is also a possibility that the main wave 5 is a truncated wave because in PRZ we have the $3,000 round number.

Note: If Gold falls below $2,940, we can expect further declines.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

GOLD (XAUUSD): Detailed Support & Resistance Analysis

Here is my latest support and resistance analysis for Gold

ahead of the FED Interest Rate decision today.

Resistance 1: 3045 - 3050 area

Resistance 2: 3099 - 3103 area

Support 1: 2997 - 3001 area

Support 2: 2952 - 2956 area

Support 3: 2916 - 2933 area

Support 4: 2880 - 2888 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold is on Fire—But Can Bulls Hold the Line?Gold has been surging, and while I expected it to hit $3,000 this year, I definitely didn’t anticipate it happening in the first semester...

So, let’s address the big question: Can the bulls maintain this level?

Looking at the chart, since early March, TRADENATION:XAUUSD has climbed 2,000 pips (around 7%), but what stands out is that 1,500 of those pips (5%) came in just one week.

No matter how strong the bullish momentum and fundamentals are, I believe this kind of rally is unsustainable.

Technical Outlook

After pulling back from its all-time high of 2,950, gold made a false breakout, followed by an almost vertical move upward, briefly interrupted by two consolidation phases.

Fundamental Factors

The FOMC meeting is today, and while rates are expected to remain unchanged, the real market mover will be Jerome Powell’s press conference. His comments could trigger significant price action.

My Take

I expect gold to start correcting after the press conference, regardless of what Powell says. However, this is a highly risky trade, so I’ll stay on the sidelines until I see a clear reversal signal.

Final Thoughts

At the time of writing, gold is consolidating within another rectangular range, with resistance at 3,040. If we see a spike above and then a drop back to around 3,030, that would signal ( for me ) that gold has topped—at least for now. In that case, I’ll be looking to short with a target of at least 500 pips. Until then, my approach is simple: wait and see.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

SILVER (XAGUSD): Bullish Continuation Ahead

Silver formed a strong bullish pattern on a 4H.

I see a bullish flag with a candle close above its resistance line.

I think that the market is going to continue rising.

Next resistance 34.2

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

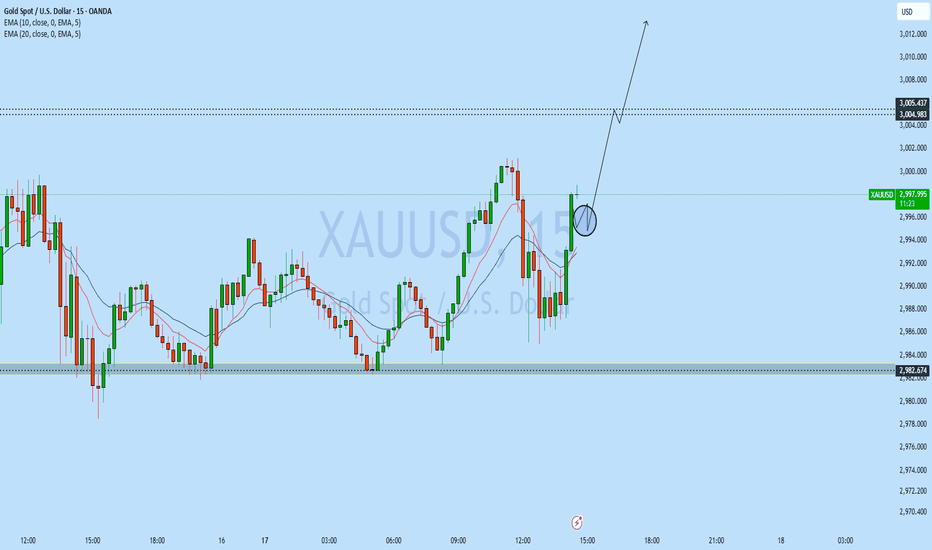

Gold Price Analysis: Supply Zone Rejection & Potential Drop to ESupply Zone Resistance (~3,004.973): Price is currently testing this resistance area, which could lead to a potential rejection.

FVG (Fair Value Gap) Support Level (~2,949.378 - 2,945.323): This area is marked as a potential support zone where price might find buying interest.

EMA 200 Support (2,945.323): A critical dynamic support level that aligns with the FVG zone.

Indicators:

EMA 30 (Red Line - 2,990.457): Short-term trend indicator.

EMA 200 (Blue Line - 2,945.323): Long-term trend indicator.

Price Action & Prediction:

The price is in the supply zone resistance and could potentially reject downwards.

The blue projected path suggests a pullback to the FVG support zone before a possible rebound.

If price breaks below this support, further downside could be expected.

Potential Trade Idea:

Short Setup: If rejection occurs at resistance, a short trade targeting the FVG/EMA 200 support could be considered.

Long Setup: If price reaches the FVG zone and finds support, a long position targeting previous highs could be a strategy.

The bear is coming soon, TP: 2965-2955Bros, bears are about to see the dawn!

Gold is fiercely fighting for control in the 2985-3000 zone. Although the winner has not been completely decided, the balance of victory is tilting towards the bears!

As gold stands above the 3000 mark, the upper space is relatively compressed, and the liquidity is getting lower and lower. Gold needs to retreat to increase liquidity! Judging from the candle chart, gold stood above 3000 twice and then quickly fell back, forming two obvious upper shadow lines, indicating that the bull market is not completely convincing, and it is very likely that a double-top structure will be technically constructed to further stimulate the decline of gold!

At present, gold has not been able to effectively fall below 2880. In addition to having a certain support structure, it is more likely to be a bull market trap! So in the next short-term trading, I do not recommend continuing to chase gold. You can use the 3005-3015 zone as resistance and boldly short gold! Then wait patiently for gold to fall back to the 2965-2955 zone.

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD is about to top. What this means for stocks?Seven months ago (August 05 2024, see chart below) we gave our long-term view on Gold (XAUUSD) based on the similarities of the current Cycle with the previous one (before the 2020 High):

The market is now approaching our 3100 Target being up +24% since then. We will not go into the similarities between those two Cycles again. The market will complete on this price a +85.42% rise from the bottom, almost reaching the 3.0 Fibonacci extension.

This cyclical pattern shows that when Gold Tops (on its 3rd 1W RSI High) and starts its 4-year Bear Cycle, the S&P500 (blue trend-line) extends its Bull Cycle up until the moment Gold tests its Bear Cycle Resistance and Double Tops, which is when the S&P500 starts its own Bear Cycle and corrects.

Before Gold tops however, the stock market does experience a volatile phase, which is exactly what SPX has been through since January. This is a great signal telling us that Gold may indeed be headed towards a Cycle Top, perhaps even as early as a month from now.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Price Analysis: Potential Head and Shoulders Breakdownhello guys.

In the 30-minute chart of Gold Spot (XAU/USD), A head-and-shoulders pattern has formed, signaling a potential bearish reversal. The price is currently consolidating near the right shoulder, and if a breakout below the neckline occurs, it could lead to a further downside.

The volume profile indicates a strong support zone around $2,962 - $2,965, which aligns with a key liquidity area. As illustrated by the red arrows, the expected price action suggests a minor pullback before continuing toward this support zone.

Traders should watch for confirmation of the breakdown before entering short positions, with a target near the highlighted demand area.