GOLD/SIlver Ratio Signals Risk On Gold/Silver ratio represents the appetite for risk

Stronger gold means risk off and vice versa

In spring, the ratio had hit the target for leg 2 (blue) within

large consolidation that took over 4 years to emerge

It travelled the equal distance of leg 1 (blue) and then reversed.

The next step might be the continuation to the downside for the ratio.

The minimum target is to hit the bottom of red leg 1 at 63.

The next target is located at the distance of the red leg 1 subtracted from the peak of blue leg 2. It was set at 43.

Both downside targets are within historical range.

Gold/Copper ratio shows same dynamics of "Risk-On" attitude on the market.

GOLDSILVER

Gold Spot (XAU/USD) $3400 Incoming again??Gold Spot (XAU/USD) – 1H Chart:

Chart Overview:

Overall Market Context:

Gold is currently retracing after a strong downtrend from a swing high near the supply zone. Price is reacting near a key bullish trend line and a local swing low.

Key Technical Elements:

OBV (On-Balance Volume):

The OBV has broken out of its downtrend resistance, suggesting a potential reversal in volume flow.

This shift implies bullish momentum could be building.

Trendline & Structure:

Price is respecting a bullish trend line, which has acted as dynamic support across multiple touches.

The current swing low sits right on this trend line, suggesting a possible bounce scenario.

Fair Value Gaps (FVGs) – 4H:

Two FVGs are located above current price around the 0.28–0.5 Fibonacci zone, indicating a likely magnet area if price starts to retrace upward.

These FVGs may act as short-term targets or resistance zones.

Fibonacci Retracement:

Price is currently near the 0.618–0.65 retracement zone, a classic golden pocket reversal area.

If price holds this level, a bounce toward the FVGs and supply zone is likely.

Supply Zone:

The major resistance sits above at the supply zone formed around the previous swing highs.

A rejection here could signal a return to range or continuation lower if not broken.

Demand Zone :

Below current price, a strong demand zone is marked, which historically triggered a large upward move.

If price fails to hold the trendline/swing low, this would be the next key support area to watch.

Scenarios:

🔼 Bullish Case:

OBV breakout holds and price bounces from the trendline/swing low.

Price moves up into the FVG zones and attempts to reclaim the previous swing high.

If it breaks above the supply zone, the next logical targets would be the psychological levels (e.g., $3,400+).

🔽 Bearish Case:

Failure to hold the current trendline and swing low.

Break below could lead to a move toward the demand zone, possibly sweeping lows and filling deeper FVGs.

If volume remains weak on bounce attempts, continuation of the downtrend is likely.

Summary:

Gold is at a critical inflection point. The bullish trendline and swing low offer a potential reversal area, supported by a breakout in OBV. A recovery into the FVGs above looks likely if price can maintain this level. However, failure here would lead to a drop toward the demand zone. Traders should monitor volume, OBV continuation, and price action near FVGs for confirmation.

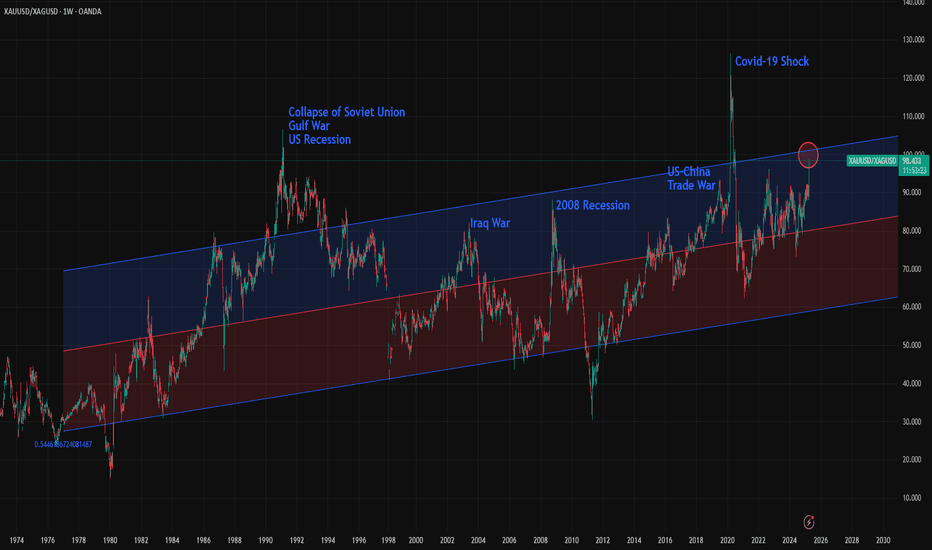

Gold/Silver Ratio Nears 100: What Does It Mean Historically?The Gold/Silver ratio is on the verge of reaching 100, an extremely rare level seen only at key historical turning points. The chart includes a 2,500-week linear regression channel, which shows that over the very long term, the ratio has been steadily rising, though at a slow pace. Occasionally, the ratio touches the 1.5 standard deviation line, and in rare, game-changing events, and sometimes it even breaks beyond that level.

Here are some of the key historical turning points marked by major spikes in the Gold/Silver ratio:

1- Early 1990s: The collapse of the Soviet Union, the Gulf War, and a U.S. recession pushed the ratio to 106. It remained above 1.5 standard deviations for more than two years.

2- 2002: Following the dot-com bubble burst, the 9/11 attacks, and the Iraq War, the ratio climbed to 82.6, nearing the 1.5 deviation line.

3- 2008 Recession: The global financial crisis triggered by the collapse of Lehman Brothers sent the ratio to 88.50. This spike sparked a major rally in both gold and silver, lasting until 2011 when the ratio reached one of its deepest bottoms.

4- 2019: The U.S.–China trade war under Trump’s first term pushed the ratio to 93, again nearing the 1.5 deviation threshold.

5- 2020 (COVID-19 Shock): The pandemic caused one of the biggest disruptions in modern economic history. Although relatively short-lived, its impacts were severe. The Gold/Silver ratio surged to 126 , marking the highest level in modern records, possibly the highest in all of history.

6- 2024–2025 (Global Trade War?): With the U.S. imposing major tariffs on key global trading partners, this could be another historic inflection point. The full impact is still unfolding, but risks of a serious global slowdown, or even a deep recession are rising. A full-scale trade war remains a real possibility.

Now, the Gold/Silver ratio is approaching 100 and nearing the 1.5 standard deviation line. It remains unclear whether this represents a powerful pair trade opportunity—"sell gold, buy silver"—or a structural breakout where the ratio stays elevated for an extended period. In either case market is showing that this is one of the rare turning point of global economy.

Important breakdown in the Gold & Silver ratio !!!This is a heads up that concerns the PM sector as well as all other assets.

An important breakdown just happened in the Gold & Silver ratio. This means precious metals bull resumes and SILVER will now overperform gold !! We are now in back test mode !

For the other asset classses this is good news also, because this breakdown in the ratio signifies the return of (asset) inflation. So this is good for stocks and crypto also.

It remains to be seen whether PM's will outperform stocks. My guess is YES.

XAUUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

$40 Silver in Sight? BofA Says Yes The Gold-Silver Ratio (XAU/XAG) measures how many ounces of silver are needed to purchase one ounce of gold, providing a clear example of the relative performance of each metal.

Bank of America (BofA) has argued there could be an opportunity to short gold against silver at its current ratio of 83.50, targeting a move down to 78.50 or 75.00, with an upside stop at 87.50.

A decline in the ratio can occur either if silver rises faster than gold or if gold falls more sharply than silver.

BofA’s 2024 gold price targets of $2,368, $2,538, and $2,643 have already been hit, with the next target set around $2,733. However, the bank advises caution on gold, instead hinting traders could focus on silver, which is nearing eleven-year highs. According to the bank, the ratio recently formed a double top, signaling a bullish outlook for silver. Silver’s potential upside targets range between $36.02 and $40.

GOLD is going to start getting much cheaper in SILVER terms.Gold has been on an absolute tear lately as the de facto U.S. corporate government has been printing and spending FRNs (Federal Reserve Notes) into oblivion. As a result, real money is gaining value against the Federal Reserve's monopoly money. Naturally, those who saw the money devaluation coming have been buying gold to preserve their purchasing power, but silver has been lagging behind, even though it has also been appreciating. Although the price of precious metals is, and will continue to be, on the rise, the price of gold is about to get much cheaper in terms of silver. Instead of buying gold, I believe the best move right now is to buy silver, hold it, and once the exchange rate drops to the 35/45 to 1 area, then exchange your silver for gold.

I believe that in the next year to a year and a half, we will see the price of gold cut in half in silver terms, which means it will take half the silver to buy the same amount of gold, effectively doubling the purchasing power of silver versus gold.

Good luck!

GOLDSILVER RATIO, Moving In Downtrend-Channel, More To Come! Hello, Traders Investors And Community, welcome to this analysis about the gold-silver ratio, its current price-action, and what we can expect the next time. In my observation, I found some significantly sings in the chart which will affect the ratio fundamentally farther the next days and weeks. The goldsilver ratio is an important ratio to track the number of silver ounces compared to one ounce gold, therefore, it is providing important information about the value between silver and gold. I made already the analysis of gold and silver, if you didn't saw these already I recommend to you that you go to my account and have looked to have a full-depth-overview of the analysis in the gold-silver ratio and its interrelation to gold and silver.

When looking at my chart you can see that the ratio is trading in a huge and fundamental downtrend-channel which you see marked in blue. We already touched the channel lower and upper boundary several times to form the overall downtrend-related channel. At the moment the ratio fell down from an important support-point at the 109 level, you can see this big red candle to the downside with high volatility it is suggesting that the ratio is turning to the downside here and that we will continue in the downtrend-channel until important support has reached.

The next time we can expect a bounce back to the 109 support/resistance level where the likelihood increases that the downtrend continues when the huge heavy bearish-confluence-cluster zone you can see in my chart is confirmed. We have several resistances there which building the logical resistance-level, first it is the 50-EMA which you see marked in blue, second, it is the 109 support/resistance level and third, it is the upper boundary of the falling downtrend-channel, therefore, I don't expect a breakout of the channel here so far and the rise to the downside will continue.

In this situation it has to keep in mind that the worth fullness of silver compared to gold rises, this is insightful because at the moment we see more volatility to the upside and sharp rises in silver than in gold, it also means that the value of silver can increase higher and gold gets cheaper compared to silver which is an indication for the bullishness I mentioned already in the silver-analysis. Investors and traders can take advantage of it when the ratio drops more to buy silver instead of gold or to exchange the gold for silver for a later exchange back when the ratio increases again. This should be a good opportunity to make a profit out of the situation with gold and silver.

Alright, this should give you a good overview, thanks to everybody for watching, support for more market insight, and all the best!

The ambition to transform opportunity into gold remains the most significant tool for a trader.

In this manner: FAREWELL

Information provided is only educational and should not be used to take action in the markets.

XAUUSD Top-down analysis Hello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

SILVERGenerally, gold and silver goes in tandem. Hence, gold is expected to go up so same may be correct for Silver. But here problem is that it has not yet broken the consolidation zone so there are chances of testing lower side of the line. As gold seems bullish what we can do here is that long can be taken with SL of recent low of the week i.e. around 61000. If that is broken no long trade should be kept.

Silver Boom - $GOLD & $SILVERI'm long term bullish on both gold and silver. With rates rising in the short term, ehh idk, but that's not the purpose of this post and real interest rates are still largely negative.

Disregarding the spike in the gold/silver ratio in 2020, the gold to silver ratio is at all time highs. Silver has proven in the past to be a potentially better hedge against inflation over gold, although both are good. Silver has legitimiate real world applications as well.

Considering the state of the world and US conditions, I love gold and silver in the medium and long term as a way to hedge against major instability.

Good luck people, protect yourself with some real money in Gold/Silver at least some....

- C

Gold Diamant Symmetric triangle 4HGOLD on the weekly chart..

A mega cup that originated from 2012 where when the rim of the cup was made the course had broken out immediately. This movement ensured that a high maar-shaped pennant formation was arranged and can / may be seen as the handle of the cup. The return after the breakout is an ideal 1/3, measured from the bottom of the cup to the highest point. The pennant breakout happened recently and gave the opportunity to take long positions or to increase the position. However, there may still be a good entry point if the pennant's resistance line is going to be tested again.

On the day and 4 hour chart, therefore, a Fibonacci retracement has been drawn in the latest uptrend and the comeback falls towards the golden pocket zone as on the support previous resistance line of the pennant.

Other agreements/formations in the pennant.

I notice that in the formation there is still a nice W pattern in development, the left one has a V formation (Adam) and the designed one is a bit rounder (Eve) and shows a 3 double bullish bottom on the day (why a triple bottom and not a head and shoulder pattern, for me it lies in the fact that the right shoulder is larger).

All of this coincides with the fact that when placed the fibonacci retracement returns to the well-known gold pocket fib. 0618 ~ 0.65 is also the neckline of the W pattern. So in order to continue Bullish, it is in my view that this red line will become and preferably also be tested in order to continue. I expect some resistance there too.

If we look at the price target ... both the cup n handle and the pennant with pole are about in the same line of expectation. Another fun fact is that recently November 17th there was a golden cross on the day* chart i.e. the 50 day (exp) moving average* crosses the 200 day (exp) moving average* this more or less indicates that the long-term trend is upward.

on the day

on the 4 hours zoomed in on last month

as described above it would be nice to do another re-test on the pennant support-formerly resistance line. I am not yet a star in the Diamond patterns (trend reversal pattern) but I think this could be/become one. hence also the symmetrical triangle drawn in on the wicks. I'm curious how the price will develop.

don't expect such a price increase in the short term.. if I take a "rough" look, a cup has also formed from '97 to '03 and the price target has taken 3 years. once again, it was roughly looked.

Keep calm, trade safe and manage your risk.

(Disclaimer: this is not a financial advice

Gold PENNANT GOLD on the weekly chart..

A mega cup that originated from 2012 where when the rim of the cup was made the course had broken out immediately. This movement ensured that a high maar-shaped pennant formation was arranged and can / may be seen as the handle of the cup. The return after the breakout is an ideal 1/3, measured from the bottom of the cup to the highest point. The pennant breakout happened recently and gave the opportunity to take long positions or to increase the position. However, there may still be a good entry point if the pennant's resistance line is going to be tested again.

On the day and 4 hour chart, therefore, a Fibonacci retracement has been drawn in the latest uptrend and the comeback falls towards the golden pocket zone as on the support previous resistance line of the pennant.

Other agreements/formations in the pennant.

I notice that in the formation there is still a nice W pattern in development, the left one has a V formation (Adam) and the designed one is a bit rounder (Eve) and shows a 3 double bullish bottom on the day (why a triple bottom and not a head and shoulder pattern, for me it lies in the fact that the right shoulder is larger).

All of this coincides with the fact that when placed the fibonacci retracement returns to the well-known gold pocket fib. 0618 ~ 0.65 is also the neckline of the W pattern. So in order to continue Bullish, it is in my view that this red line will become and preferably also be tested in order to continue. I expect some resistance there too.

If we look at the price target ... both the cup n handle and the pennant with pole are about in the same line of expectation. Another fun fact is that recently November 17th there was a golden cross on the day* chart i.e. the 50 day (exp) moving average* crosses the 200 day (exp) moving average* this more or less indicates that the long-term trend is upward.

on the day

on the 4 hours zoomed in on last month

as described above it would be nice to do another re-test on the pennant support-formerly resistance line. I am not yet a star in the Diamond patterns (trend reversal pattern) but I think this could be/become one. hence also the symmetrical triangle drawn in on the wicks. I'm curious how the price will develop.

don't expect such a price increase in the short term.. if I take a "rough" look, a cup has also formed from '97 to '03 and the price target has taken 3 years. once again, it was roughly looked.

Keep calm, trade safe and manage your risk.

(Disclaimer: this is not a financial advice

$gold - $silver ratio BT waistline of yuge megaphone, down!Huge make a phone there with gold silver ratio currently back testing it’s waist line which is also the waistline of a channel that is evident on the six monthly candles

If you go to my Twitter then you can see the zoom in the spot where it shows a wedge at that area last in the last several months that is likely to be a very bearish continuation

Dxy Is added as a factor to adjust for currency fluctuationsWe typically cleans up the signal on relevant assets

Technical analysis update: XAUUSD (9th September 2021)In recent days XAUUSD dropped below 1800 USD towards it short term support around 1785 USD. Since then it rebounded little bit and it currently trades around 1795 USD. In the big picture we are still very bullish on gold. Especially in medium-term and long-term. Although, XAUUSD failed to break above its short-term resistance and travel through its confirmation area we detailed in our previous thoughts. We are closely watching upper bound of the downward moving channel. We think this upper bound currently acts as strong support and if it is broken then more selling pressure is likely to occur. However, gold seems as its trend is further weakening and becoming neutral. We are getting strong notion that gold will remain stuck trading between 1750 USD and 1840 USD for indefinite amount of time. Despite that we remain bullish and exepct eventual breakout to the upside from this area. Because of that our short term price target remains 1850 USD while our medium term price target remains 1875 USD.

Technical analysis

Stochastic is bearish. MACD is in the bullish territory. However, it stages reversal and needs to be closely observed over the next few days. Crossover by MACD below 0 points would be bearish for gold in the short term. RSI is flattening, however, its short term structure remains bullish. ADX is very low suggesting neutral trend and sideways moving price action. Closest supports sit around 1785 USD and 1750 USD respectively. Major support sits at 1677.686 USD. Strong resistance appears around 1835 USD while another important resistance sits around 1916 USD. Overall technicals are mixed. As we mentioned previously we are getting strong notion that gold will trade sideways for while before finally new trend commences.

Our previous thought from 3rd September 2021:

Disclaimer: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not serve as basis for taking any trade action by individual investor. Your own due dilligence is highly advised before entering trade.

Silver - SHORT; SELL it here!!All the PMs but especially Silver is a Major SHORT here, with a Low-risk Entry!

A Bullish G/S and a likely USD reversal here - even if potentially limited in scope - should underpin a substantial decline in all the metals, from these levels.

Charts like this are no help, either! (Stock market forced liquidations have a tendency to spare nothing and no one, not even the PMs - at least initially.)