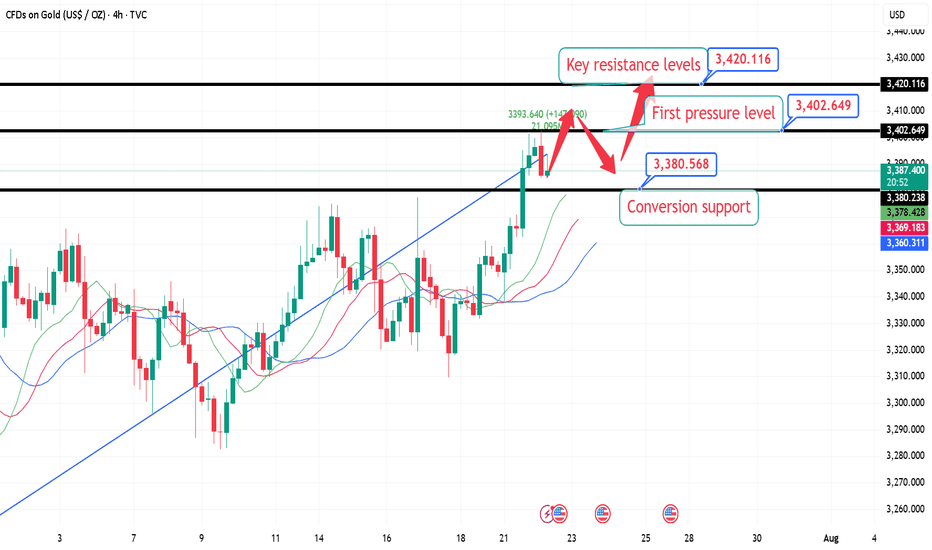

7.22 London Gold Market Analysis and Operation SuggestionsFrom the market perspective, the trend suppression line from the historical high of 3500 to the secondary high of 3452 has moved over time and is now around 3420, which can be used as an important resistance level reference for this week; the previous resistance level of 3376 can be converted into support after breaking through. For intraday short-term operations, focus on this range of callbacks and go long, wait for the key resistance level to be touched before going short, or see if there is an opportunity to arrange a mid-term short order based on the real-time trend.

Specific intraday operation ideas:

①. When the gold price falls back to around 3380, participate in long orders and call, protect the position of 3374, and first look at the position of 3402, the high point on Monday;

②. After yesterday's high point breaks, wait for a correction to around 3395 to continue to participate in long orders and call, protect the position of 3388, and look at the key suppression level of 3420;

③. (Aggressive orders, for those who are afraid of missing out) If you are short or have enough positions, you can first participate in long orders with a light position at the current price of 3388, and wait for 3380 to increase your position, and the target is the same as above.

Goldtoday

7.22 Gold falls back and continues to be bullish, 3400 is not thFrom the 4-hour analysis, the short-term support below is 3370, the important support is 3350-55, and the upper resistance is 3400-05. The overall support during the day is to maintain the main tone of high-altitude and low-multiple cycles in this range. For the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market.

Analysis of short-term operations of gold on July 21Daily Analysis:

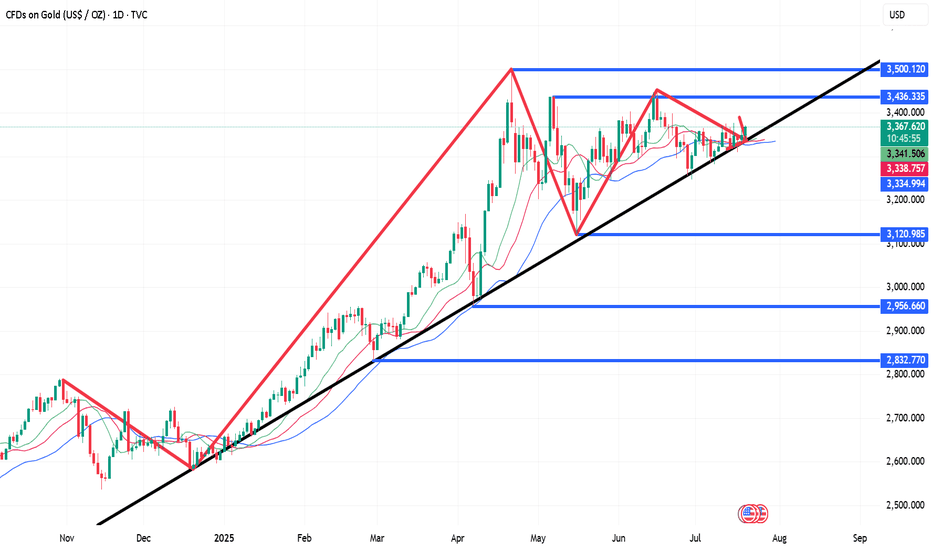

On the daily chart, it can be seen that gold has rebounded from the main rising trendline again, and bargain hunters have set clear risks below the trendline, betting on a price rebound to the 3438 resistance level. Bears need the price to break below the trendline to open up space for a deeper correction, with the next target looking at the 3120 level.

4-hour analysis

On the 4-hour chart, it can be seen that there is a secondary resistance area near 3377. If the price rebounds to this level, it is expected that bears will intervene here and set risks above the resistance, with the goal of pushing the price below the main trendline. Bulls will look for the price to break through this resistance to increase their bullish bets on the 3438 level.

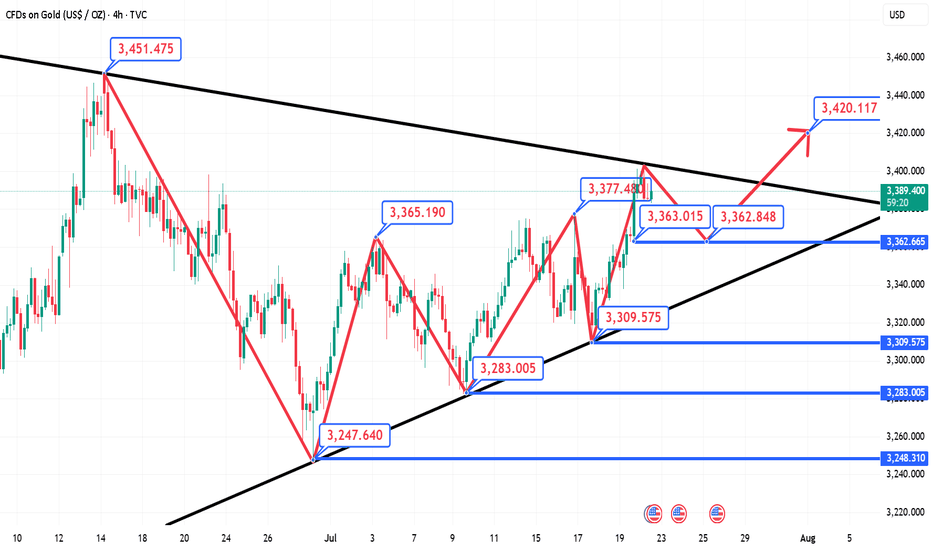

Buy first when gold falls back, and pay attention to the strengtGold went on a roller coaster ride last week. It rose to around 3377 at the beginning of the week and then fell back under pressure. After stabilizing near 3309 on Thursday, it strengthened again on Friday and came under pressure near 3361. It fell back slightly to around 3344 at the opening in the morning and is currently rising again. In the morning, pay attention to the opportunity to buy first after the pullback, pay attention to the strength of the European session, and pay attention to the pressure near 3378/80 on the upside.

7.18 Gold intraday operation strategy, short-term short first stFrom the 4-hour analysis, the short-term support below continues to focus on around 3316-25, the short-term suppression above focuses on the 3340-45 line, and the key pressure above focuses on the 3380 line. The overall support of 3316-3345 range still maintains the main tone of high-altitude and low-multiple cycles. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market.

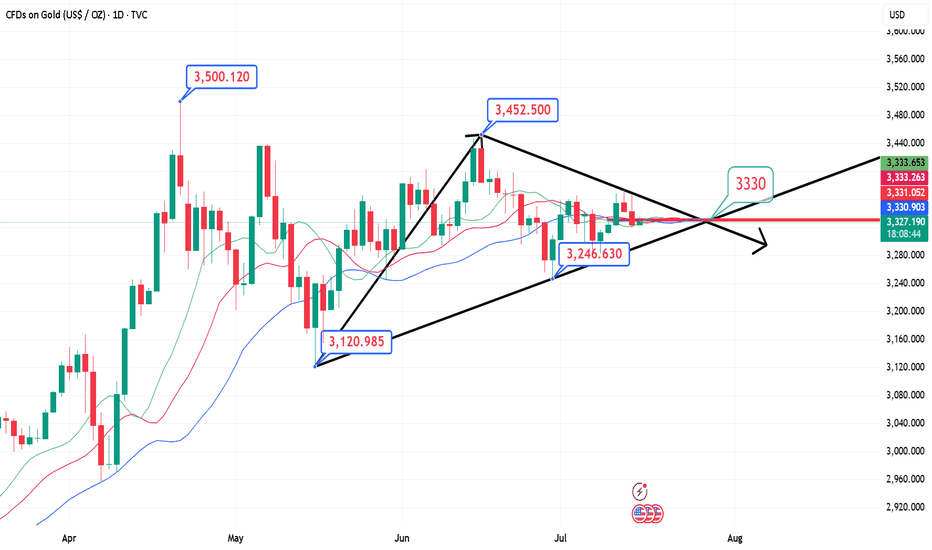

Gold is accelerating downward, pay attention to important supporThe U.S. inflation data for June was released overnight. The actual data showed that U.S. inflation rebounded slightly in June, but it did not exceed expectations. After the data was released, Trump made a speech at Truth A post on Social said that given the low consumer prices, the Fed should lower interest rates. He has been calling for a rate cut for some time, so the market still has some uncertainty about the timing of the Fed's subsequent rate cuts, but the probability is in September. The probability of keeping interest rates unchanged this month is high. The US dollar index is also supported and continues to rebound. Gold fluctuated higher from around 3344 in the morning of the previous trading day. During the European session, it refreshed the intraday high and touched the 3366 line under pressure and maintained repeated narrow consolidation. After the data was released, it first rebounded quickly to the 3360 line and then quickly fell back. After two repetitions, it finally moved downward. In the evening, it fell below the intraday low and once touched around 3320 and then stabilized and rebounded. The daily line closed with a middle shadow. Technically, the continuation of the previous convergence triangle after the break is currently returning to the downward channel again.

Pay attention to the pressure of 3342/44 during the day, and pay attention to the support near 3308 below. If it falls below 3308 again, it will return to the downward channel.

7.15 Gold Market Analysis and Operation SuggestionsFrom the 4-hour analysis, the short-term support below focuses on the neckline of the hourly line of last Friday, 3340-45, and focuses on the support of 3325-30. The intraday retracement continues to follow the trend and the main bullish trend remains unchanged. The short-term bullish strong dividing line focuses on the 3325 mark. The daily level stabilizes above this position and continues to follow the trend and bullish rhythm. Before falling below this position, continue to follow the trend and follow the trend. Maintain the main tone of participation.

Gold operation strategy:

1. Go long when gold falls back to 3340-45, and add more when it falls back to 3325-30, stop loss 3317, target 3365-70, and continue to hold if it breaks;

7.11 Gold bulls rise again, beware of the black swan coming on FYesterday, Thursday, the US dollar index rose first and then fell. It once approached the 98 mark before the US market, but then gave up most of the gains.

Yesterday, spot gold fluctuated around the 3320-30 US dollar mark. After the US market, it once touched 3310, but finally rebounded to above 3320 for consolidation.

Today, Friday, gold broke through the high point of 3330 yesterday in one fell swoop in the early trading.

So this is relatively good news for bulls.

If the high point of yesterday breaks through and stabilizes, it means that the bullish upward trend may continue today.

From the current 4-hour chart:

It can be found that the current 4-hour chart of gold has stabilized in the breakthrough range.

So if gold continues to go up, simply look at the previous high point.

The two recent high points are around 3345 and 3360.

Gold's short-term decline is limited and will continue to riseWith the rise of gold in the US market yesterday, the trend line of the downward trend channel has been supported many times in the short cycle. After the rebound, we still need to pay attention to the suppression of 3328-30. This position is the suppression position of the 4-hour downward trend channel. If it breaks, the overall trend will be a rising flag, which may continue the upward trend. Of course, if it continues to not break through the suppression of 3328-30, it may fluctuate within the range. This requires further observation.

Intraday short-term suggestions: short-term long mainly, pay attention to the support of short-term long near 3307, stop loss 3297, take profit at 3328-30 suppression, break at 3348-50, pay attention to risks.

Technical analysis guide for gold in the US market!Technical aspects:

The gold daily chart shows an obvious shock consolidation structure, and is currently running between the middle and lower tracks of the Bollinger Bands, with an overall weak trend. Since hitting a high of $3499.83, the market has fallen into a sideways consolidation range, with top resistance concentrated in the $3400-3450 range and bottom support at $3250. The recent price retracement to around 3250 failed to effectively break below, forming an important support level.

The MACD indicator crossover continues, the green column is enlarged, the double lines are downward, and the momentum is weak. The RSI indicator runs around 44, and does not show oversold or rebound signals. The price is still in a weak consolidation stage. Analysts believe that if it falls below the 3250 line, it may open up further correction space, and pay attention to the 3170 area support; on the upside, if it can effectively stand above 3400, it is expected to retest the 3450 line high.

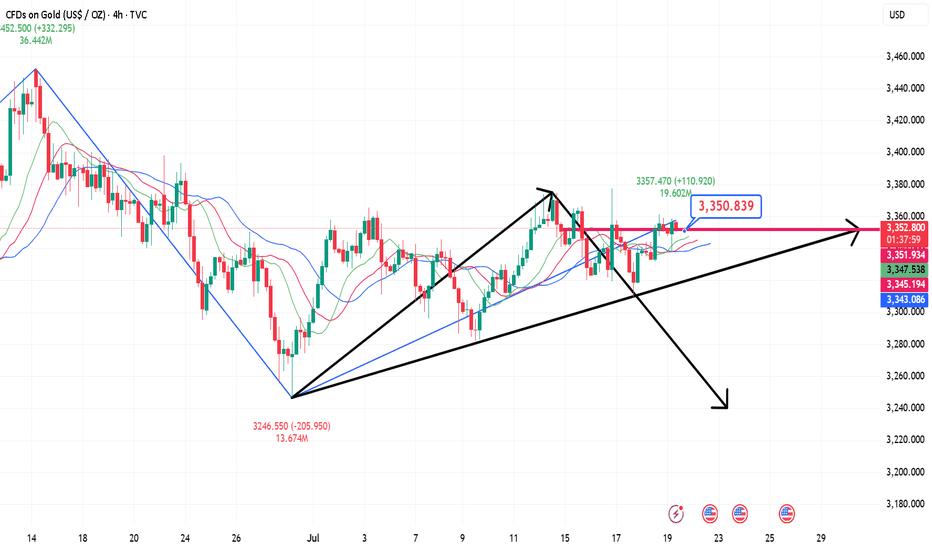

Once again, we seized a golden opportunityYesterday, gold fluctuated throughout the day and failed to break through the key range we pointed out. The current structure continues to fluctuate. During the day, we will continue to pay attention to the strong support of 3365-3360 below. This area is the key defensive position we emphasized yesterday. As long as this area is not broken, the bulls still have a chance to make a comeback. The long orders we arranged today at 3370-3375 have all been taken profit near 3387, and the short-term is perfectly realized! At present, 3400 above is the primary pressure position. We have also given a short order plan. We continue to hold it at present, and the target is to take profit when it falls back to 3380-3375.

The overall idea is to maintain the main long and auxiliary short rhythm. In terms of operation, the interval thinking is prioritized, and wait for the key points to be confirmed before taking action. If it breaks through, change the idea in time.

Operation suggestion: Gold falls back to 3375-3370 and goes long with a light position, and further falls back to 3365-3360 to cover the position. The target is 3380-3390-3400.

If you still lack direction in gold trading, you might as well try to follow my pace. The strategy is open and transparent, and the execution logic is clear and definite, which may bring new breakthroughs to your trading. The real value does not rely on verbal promises, but is verified by the market and time.

Doubletop suppressionVS multi-bottom support Entry at key pointsGold rose sharply in the U.S. market yesterday, and the daily line finally closed the Yang cross star, approaching the end of the monthly line. Recently, it has been a yin-yang cycle sweep pattern. Therefore, today we need to be careful to prevent the market from falling back and then closing in the negative range. The wide sweeping range remains at 3370-3270. If the position is broken, look at the unilateral direction. In the 4H cycle, the continuous positive pattern breaks through the mid-track, and the short-term trend is stronger. , but Bollinger has not opened his mouth, and is not optimistic about the breakthrough range. The short-term support is around 3315, which is also yesterday's low point. If it falls below, it will go to 3302. Therefore, today's operation will continue to grasp the key positions. The upper pressure will focus on 3354 and 3370, and the lower support will focus on 3315 and 3300. Go high and low in the range! Do high-altitude and low-multiple in the range!

Operation suggestion: Buy gold near 3305-3300, look at 3320 and 3345!

Gold Price Analysis. August 2024.

Today, gold is trading near the upper boundary of its ascending channel. Traditionally, this level acts as a critical resistance point, and most oscillators would suggest the market is overbought, signaling a potential selling opportunity.

However, the situation may be more complex than it appears.

Above the current price, two significant levels loom: the historical high and the psychologically important $2,500 per ounce mark. From a market behavior perspective, which often seems designed to lead retail traders astray, it would not be surprising to see a false bullish breakout above these levels. Such a move could trigger FOMO (Fear of Missing Out) buying among investors and force sellers to close their positions via stop-loss orders.

This scenario could be exacerbated by a spike in volatility, driven by geopolitical tensions or today’s critical U.S. inflation data (with further significant reports expected tomorrow).

Cycle Analysis by Fintechzoom

An overlay of active gold price cycles presents a projection line (shown in red), indicating a potential peak on Friday, followed by a downturn.

Given this outlook, it would not be surprising if we witness an attempt to breach the historical high within the next 10 days.

Gold Price Forecasts

Analysts, including those from Commerzbank, suggest that a new record high for gold is likely, as inflation data could provide additional momentum.

Strategists at JPMorgan have set a year-end target of $2,500 for gold in 2024.

XAUUSD (GOLD) I Technical and Fundamental Outlook Welcome back! Let me know your thoughts in the comments!

** XAUUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

XAUUSD:19/1 Today Analysis and StrategyGold technical chart daily pressure is 2040, with support below 2000-1966

The four-hour pressure is 2032, and the lower support is 2000-1980

One-hour pressure is 2032, support below is 2012-2000

Operational suggestions: Judging from the daily analysis, today's upper resistance continues to focus on the vicinity of 2025-2032. Counterattacks during the day rely on this position to continue to be short and then look at the downward trend. The lower target continues to focus on breaking the bottom. The short-term short-term dividing line moves down to 2032, until the daily level breaks through and reaches this position, continue to maintain the priority short selling rhythm.

SELL:near 2032

SELL:near 2000

BUY: around 2000

XAUUSD Shorts from 2050.000 down towards 1990.000This week's perspective on gold is quite interesting, considering the recent break to the downside. The current retracement, triggered by a reaction from an imbalance, has my attention focused on the 22-hour supply zone. This particular zone played a significant role in causing the downward break.

Given that price has cleared liquidity from its all-time highs, there's potential for a continued downtrend. Therefore, I'm patiently waiting for a Wyckoff distribution to unfold within the 22-hour supply zone. The goal is to capture selling opportunities, anticipating a move back down towards a robust daily demand zone where I expect a bullish reaction to occur.

Confluences for gold Sells are as follows:

- Price has recently broken structure to the downside on the higher time frame.

- ATHs of the chart got swept, enough liquidity to generate a bearish trend.

- Theres still imbalances below to fill as well as a daily demand that needs mitigating.

- Price formed a clean 22hr supply zone that has caused this BOS to happen and in the 0.78 fib range.

- Even if price wants to maintain a bullish trend it must come down to mitigate a demand.

- Sentiment analysis also suggests gold to be bearish.

P.S. While I'm currently bearish, there's a possibility that this could unfold as a temporary move toward a more favourable demand zone. This scenario might set the stage for a continuation of the bullish trend on the higher time frame. However, my immediate focus is on seeking selling opportunities to drive the price back down.

Have a great trading week ahead and let's catch some pips!

Gold Futures [GC1] - ShortGold has been trading lower consecutively for the past 3 days. We are expecting one more push to the downside during the NY session.

The trade is supported by HTF bias as bearish. Currently we have a decent retracement already above 50% since the last liquidity grab which is placing our trade in Premium range.

Entry: 2017-2022

SL: Determine once we have a valid entry trigger.

TP: Open

Goodluck!

Gold price bounces off, downside remains bets easeHere is what you need to know on Thursday, January 18:

Technical Analysis: Gold price finds a temporary support near $2,000

Gold price attempts a firm-footing near psychological support at $2,000 amid a nominal decline in the US Dollar Index. The near-term demand for the precious metal has turned bearish as it has slipped below the 50-period Exponential Moving Average (EMA), which trades around $2,017. The higher-high-higher-low formation in the Gold price is over and market participants could utilize pullbacks for building fresh shorts.

The 14-period Relative Strength Index (RSI) has dropped to near 40.00. If the RSI fails to sustain above 40.00 levels, a bearish momentum will get triggered.

•Gold price discovers bets near $2,000 but remains on backfoot amid easing Fed rate cut hopes.

•Stubborn US inflation and robust Retail Sales data favour a maintenance of hawkish interest rate stance.

•Market participants will focus on Fed Bostic’s commentary ahead.

Gold price (XAU/USD) has executed a short-term recovery move in the midst of a persistent downtrend. Gold price printed a fresh monthly low near the psychological support of $2,000 on Wednesday, then bounced.

Yet despite the rebound, the precious metal remains on the backfoot as investors continue to worry about when the Federal Reserve (Fed) will start its long awaited rate-cut cycle. The hopes of an early rate-cut decision from the Fed are easing as the last leg of inflationary pressures in the United States is turning out significantly more stubborn than previously thought, due to robust consumer spending and steady labor market conditions.

Amid an absence of front-line economic indicators, market participants are expected to shift focus towards the first monetary policy meeting of the Fed, which is scheduled for January 31. The Fed is widely anticipated to keep interest rates unchanged in the range of 5.25-5.50%. Investors will keenly focus on how the Fed proposes to make three rate cuts of 25 basis points (bps) each in 2024, as projected in the December monetary policy meeting.

Daily Digest Market Movers: Gold price finds an interim support as US Dollar corrects

•Gold price discovers an intermediate support near the psychological $2,000 level after an intense sell-off.

•The near-term demand is still downbeat as uncertainty about an interest rate cut from the Federal Reserve in March has deepened.

•Trades have pared bets supporting a rate cut in March due to resilience in the US economy.

•Bets supporting an interest rate cut of 25-basis points (bps) have increased slightly to 61% but are still below the 75% recorded last week, as per the CME Fedwatch tool.

•Market expectations for early cuts from the Fed have been pushed back as price pressures in the US economy remained stubborn and consumer spending grew strongly in December.

•Upbeat economic indicators have provided room to Fed policymakers to maintain a restrictive monetary policy stance for a longer period than that anticipated by market participants before their release.

•This week, Fed Governor Christopher Waller said the central bank should not rush taking interest rates down as more evidence is needed to ensure that price pressures are returning to 2% in a sustainable manner.

•Christopher Waller advised that the Fed should reduce interest rates “carefully and methodically”, considering resilience in the US economy.

•Meanwhile, the US Dollar Index (DXY) has rebounded after a gradual correction to near 103.20, supported by risk-off market sentiment. 10-year US Treasury yields are maintaining a firm-footing above 4%.

•Later the day, investors will focus on the weekly jobless claims for the week ending December 12 and commentary from Federal Reserve of Atlanta Bank President Raphael Bostic.

•Bostic is expected to maintain a hawkish argument considering stubbornly higher price pressures.

•On Monday, Fed’s Bostic commented that progress in inflation declining towards 2% could slow if policymakers cut interest rates soon.

XAUUSD:17/1 Today’s Market Analysis and StrategyGold technical chart daily pressure is 2040, with support below 2000

Four-hour pressure 2040, lower support 2020

One-hour pressure is 2032, support below is 2020-2000

✅Operational advice: Yesterday, gold fell all the way and continued to weaken. Today we will first break through the 2,000 integer mark, then look below the 1966 mark, and go short on rallies.

SELL:near 2030

SELL:near 2000

BUY: around 1966 (target this week)

You don’t necessarily trade according to the points I mentioned, technical analysis only provides trading direction!

Gold plunges as investors await fresh cues about Fed rate cutsGold price has been hit hard amid uncertainty over US Retail Sales and Industrial Production data.

A strong US Retail Sales data would provide more room for the Fed to maintain higher interest rates.

•Further escalation in Middle East tensions could bring some revival in the gold price.

Gold price (XAU/USD) witnesses a sell-off after failing to reclaim the weekly high above $2,060. The precious metal drops as investors reconsider the timeframe in which the Federal Reserve (Fed) may reduce interest rates. This comes after the release of the sticky Consumer Price Index (CPI) report for December, as well as hawkish comments from European Central Bank (ECB) officials recalibrating broader market expectations.

While markets continue to lean towards a rate cut decision in March, policymakers are in no hurry to endorse a dovish stance on interest rates. The consumer price inflation in the United States economy is almost double the required rate of 2%, labor demand is steady and the chances of a recession are low despite interest rates remaining in the range of 5.25-5.50%. This would allow Fed policymakers to maintain a restrictive monetary policy stance for the time being.

Going forward, monthly US Retail Sales, the Industrial Production data and the Fed's Beige Book are expected to provide fresh cues about the interest rate outlook.

Daily Digest Market Movers: Gold price falls sharply as US Dollar, yields recover

Gold price corrects to near the crucial support of $2,040 as the US Dollar Index (DXY) has recovered sharply ahead of crucial United States economic data for December.

A strong run-up in the precious metal that was propelled by firm bets in favor of early rate cuts by the Federal Reserve and deepening Middle East tensions, has stalled for now.

• As per the CME Fedwatch tool, chances in favor of an interest rate cut in March have eased nominally to 66% against 70% recorded earlier.

A gradual decline has come as investors are reconsidering strong optimism for Fed starting the rate-cut cycle from March after getting mixed cues from stubbornly higher headline consumer price inflation and softer factory gate price data.

Investors would get more cues about when the Fed could plan rate cuts after the release of the monthly US Retail Sales and Industrial Producer data, which are due to be released on Wednesday.

• Retail Sales are expected to have grown at a higher pace of 0.4% against 0.3% increase in November. Consumer spending excluding automobiles is estimated to have grown at a steady pace of 0.2%.

• The Industrial Production data is seen stagnant against 0.2% growth in November on a monthly basis.

Upbeat economic data would comfort Fed policymakers for maintaining a restrictive monetary policy stance while a soft report will firm the case of rate cuts in March.

• Before that, commentary from Fed Governor Christopher Waller will be keenly watched by market participants. Investors are eager to know how the Fed is considering the timeframe for the rate-cut cycle after the release of sticky consumer price inflation data.

• The appeal for the gold price has not been impacted on a broader basis as crises in the Middle East region have deepened after the airstrikes from the US and the United Kingdom.

Iran-backed Houthi rebels have threatened to retaliate for attacking groups in Yemen, which will keep risk sentiment on its toes.

• The US Dollar Index has broken to a new high slightly above 103.00 as investors hope that other central banks will also start reducing interest rates earlier than previously projected. Meanwhile, the 10-year US Treasury yield has rebounded swiftly above 4.0%.

Technical Analysis: Gold price corrects to near 20-day EMA

Gold price has faced a sharp sell-off after failing to recapture the weekly high of $2,062. The precious metal has dropped to near $2,040 and is expected to remain on tenterhooks before getting fresh cues about the timing of rate cuts from the Fed. The yellow metal has surrendered entire gains generated on Monday and has corrected to near the 20-day Exponential Moving Average (EMA), which trades around $2,039.

More downside could appear in the gold price if it fails to defend the January 3 low of $2,030, which will expose it towards the psychological support of $2,000.

XAUUSD:12/1 Today Analysis and StrategyGold technical chart daily pressure 2040-2053, lower support 2000

Four-hour pressure 2040, lower support 2020-2016

One-hour pressure is 2040, support below is 2031-2000

Operational suggestions: From the daily analysis, we continue to focus on the recent 2040 first-line short-term suppression at the top, and the support at 2020-2000 at the bottom. The short-cycle gold price has entered a weak and volatile consolidation trend. Before the market is stimulated by big news, continue to Keep the suppressed bearish pattern unchanged

SELL:near 2053

SELL:near 2040

BUY:near 2020

BUY:near 2000