Goldtrading

GS raises gold target to $4,000, UBS to $3,500 Goldman Sachs and UBS have issued another round of bullish forecasts for gold, citing ongoing market uncertainty (i.e., tariffs).

Goldman analysts now expect gold to reach $3,700 per ounce by the end of 2025, with a potential rise to $4,000 by mid-2026. UBS holds a slightly more conservative view, projecting $3,500 by December 2025.

Technically, gold has pulled back from new all-time highs seen during the Asian session but potentially remains in a strong uptrend. With prices trading well above both the 50-day EMA and 200-day EMA, shallow retracements may find support, especially as tariff-related risks persist for at least the next 90 days.

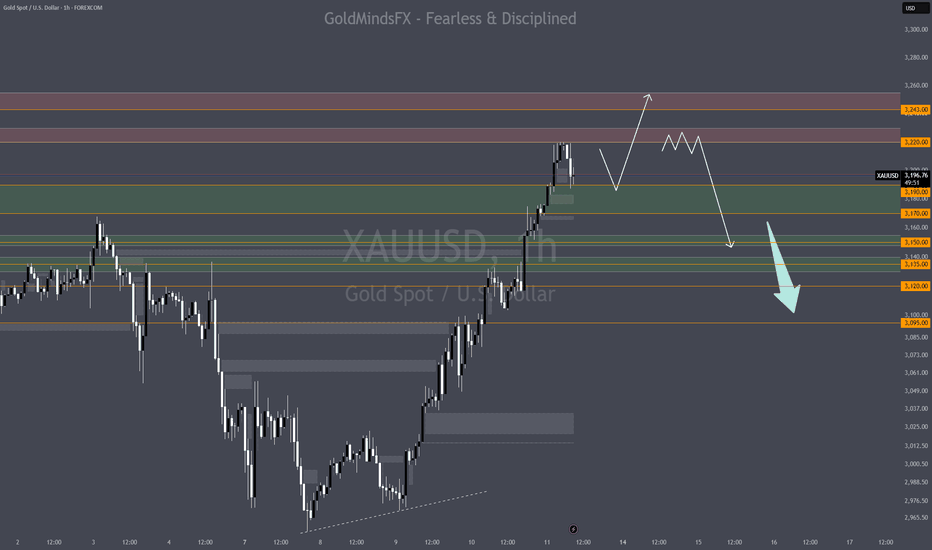

Gold Market Outlook: Potential Pullback in Play Following Early Early this morning, the gold market opened with a downside gap, potentially signaling the beginning of a corrective phase. With no high-impact economic events on the calendar today, price action may remain sideways or retrace toward the previous session’s low. On the 1-hour timeframe, bearish divergence has already been identified, supporting the case for a short-term pullback.

A similar consolidation phase occurred after the bullish momentum seen from March 11 to March 20. If no unexpected developments influence the market, comparable price behavior could emerge. Overall, conditions suggest a classic breakout–pullback–continuation scenario, which is consistent with typical movements following strong directional trends. A key resistance zone near the 3280 level is currently being observed as a potential target area

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3261 and a gap below at 3230. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3261

EMA5 CROSS AND LOCK ABOVE 3261 WILL OPEN THE FOLLOWING BULLISH TARGET

3292

EMA5 CROSS AND LOCK ABOVE 3292 WILL OPEN THE FOLLOWING BULLISH TARGET

3324

EMA5 CROSS AND LOCK ABOVE 3324 WILL OPEN THE FOLLOWING BULLISH TARGET

3352

BEARISH TARGETS

3230

EMA5 CROSS AND LOCK BELOW 3230 WILL OPEN THE FOLLOWING BEARISH TARGET

3201

EMA5 CROSS AND LOCK BELOW 3021 WILL OPEN THE RETRACEMENT RANGE

3179

3167

EMA5 CROSS AND LOCK BELOW 3167 WILL OPEN THE SWING RNGE

3120

3094

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SECONDARY SWING RANGE

SECONDARY SWING RANGE

3069 - 3038

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3045 and 3078 due to ema5 lagging behind and a gap below at 3016. We will need to see ema5 cross and lock on either weighted level to determine the next range. We have a bigger range in play then usual.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3241

EMA5 CROSS AND LOCK ABOVE 3270 WILL OPEN THE FOLLOWING BULLISH TARGET

3298

EMA5 CROSS AND LOCK ABOVE 3298 WILL OPEN THE FOLLOWING BULLISH TARGET

3329

BEARISH TARGETS

3205

EMA5 CROSS AND LOCK BELOW 3205 WILL OPEN THE FOLLOWING BEARISH TARGET

3178

EMA5 CROSS AND LOCK BELOW 3178 WILL OPEN THE FOLLOWING BEARISH TARGET

3137

EMA5 CROSS AND LOCK BELOW 3137 WILL OPEN THE FOLLOWING BEARISH TARGET

3108

EMA5 CROSS AND LOCK BELOW 3108 WILL OPEN THE SWING RANGE

SWING RANGE

3077 - 3046

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

After completing this chart idea last week, we stated that we wanted to continue to share an update on this, as its still playing out by falling back into the range.

We also stated that whenever we see a breakout outside of our unique Goldturn channels; I always state that, when price does a correction, we look for support outside of the channel top.

- This played out perfectly, and although we saw price break back into the channel, you can see ema5 failed to break into the channel and created a Goldturn just above the channel top, highlighted by the circle, confirming the rejection and bounce into the bullish targets completing the levels above.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn. This enabled us to identify the fakeout into the channel using ema5 and gave the confirmation for the bounce.

This chart idea is now complete!. We will now update a new daily mid/long term chart idea next week.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest structure analysis

and important support & resistance levels/zone on Gold for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD 4H CHART ROUTE MAP UPDATEHey Everyone,

After completing our 1h Chart route map, please see update on our 4h chart idea, also completed perfectly!

We started the week with the drop into the weighted retracement level. No ema5 lock below confirmed the rejection, inline with our plans to buy dips and then we saw price climb up nicely clearing all our bullish targets.

BULLISH TARGET

3045 - DONE

3078 - DONE

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3109 - DONE

EMA5 CROSS AND LOCK ABOVE 3109 WILL OPEN THE FOLLOWING BULLISH TARGET

3137 DONE

EMA5 CROSS AND LOCK ABOVE 3137 WILL OPEN THE FOLLOWING BULLISH TARGET

3170 DONE

BEARISH TARGETS

3016 - DONE

EMA5 CROSS AND LOCK BELOW 3016 WILL OPEN THE FOLLOWING BEARISH TARGET

2987 - DONE

We will now come back Sunday with our updated Multi time-frame analysis, Gold route map and trading plans for the week ahead.

Have a smashing weekend!! And once again, thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

GOLD (XAUUSD): The Next Important Resistance Levels

Gold updated the All-Time High yesterday and trades

in the no-man's land again.

Here are the next potentially significant resistances

based on psychological levels.

Resistance 1: 3247 - 3252 area

Resistance 2: 3397 - 3302 area

Important historic supports:

Support 1: 3128 - 3167 area

Support 2: 2953 - 2982 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold Ideas April 11th - Brand new ATH 3220 & PPI✨ MARKET CONTEXT:

Gold is currently testing the 3220 supply ceiling after a massive bullish leg. Liquidity has been swept above March highs, and PA is now in a highly reactive zone. If price rejects here, we look for imbalances to be mitigated below before continuation.

🙌Wait for clear PA confirmation on all entries (5-15m structure shift, engulfing candles, liquidity grabs).

If PPI news hits hard, we might see manipulation — trade after the first 15–30 min.

Don’t overtrade. Let the levels come to you.

Goldie loves the drama. You love the sniper entries. 💅🏽🎯

🎯 Key Reversal Zones for Friday (Potential Pullback if News Hits or Profit Taking Begins):

1. 3190–3195: Minor mitigation zone for continuation longs.

2. 3183–3189: Ideal for sniper entries on a juicy dip.

3. 3170–3175: Key mid-structure retest + liquidity zone.

4. 3148–3155: Full pullback area if market turns bearish post-news.

Keep these levels on your radar, especially if Friday gets volatile. Don’t chase the hype—let price come to you.

🧵 Key Imbalance Refill Zones:

- 3195–3203: First scalp area, high confluence.

- 3178–3184: Strong impulse base.

- 3162–3169: Ideal sniper entry with bullish PA.

- 3148–3154: Big daddy support (but news sensitive!).

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

📣 If this strategy sparked clarity, hit that like button and follow our community for more in-depth ideas. 💛

GOLD ROUTE MAP UPDATEHey Everyone,

Another awesome day on the markets with our Bullish targets getting smashed.

After completing all targets upto 3078 yesterday, we continued to get candle body close breakouts above 3078 opening 3094 and above 3094 opening 3119 and then ema5 lock above 3119 confirmed 3148 for the perfect finish to this chart idea.

We can now move over to our 4H chart idea and our remaining multi timeframe route maps to continue to track the movement for the rest of the week.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3055 - DONE

EMA5 CROSS AND LOCK ABOVE 3055 WILL OPEN THE FOLLOWING BULLISH TARGET

3078 - DONE

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3094 - DONE

EMA5 CROSS AND LOCK ABOVE 3094 WILL OPEN THE FOLLOWING BULLISH TARGET

3119 - DONE

EMA5 CROSS AND LOCK ABOVE 3119 WILL OPEN THE FOLLOWING BULLISH TARGET

3148 - DONE

BEARISH TARGETS

3034 - DONE

EMA5 CROSS AND LOCK BELOW 3034 WILL OPEN THE FOLLOWING BEARISH TARGET

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999 - DONE

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2975 - DONE

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2922

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold Ideas ahead of CPI on April 10thCurrently, Gold is at 3082, with a mix of uncertainty ahead of tomorrow's CPI release. The market is in a wait-and-see mode as traders position ahead of the data, which could drive volatility. With the macro context in mind, we’ll be focusing on key support and resistance levels, aiming to capture price action based on SMC &more.

🔻 Sell Zone #1 – Intraday Fade

📍 Sell (confirmation only): 3,095 – 3,108

📉 SL: 3,110

🎯 TP1: 3,080

🎯 TP2: 3,060

🎯 TP3: 3,040

⚠️ Tip: Move SL to breakeven when TP1 hits fast

🔺 Sell Zone #2 – Double Tap and Dump

📍 Entry: 3,125 – 3,139 (Ideal: 3,135 – 3,139)

📉 SL: 3,145

🎯 TP1: 3,105

🎯 TP2: 3,080

🎯 TP3: 3,055

⚠️ Tip: Use only with clear rejection (M5/M15 M-pattern or bearish engulfing)

🟢 Buy Scenario 1 – “Reclaim Retest”

📍 Entry: 3,066 – 3,068.50

📉 SL: 3,062

🎯 TP1: 3,089

🎯 TP2: 3,113

🎯 TP3: 3,127

🧠 Trigger: M1/M5 CHoCH or Bullish Engulfing

📌 Confluence: M5 Order Block + Fair Value Gap (Discount Zone)

🟩 Buy Zone – Deep Value Pullback (Fresh Setup)

📍 Entry: 3,035 – 3,040

📉 SL: 3,025

🎯 TP1: 3,080

🎯 TP2: 3,095

🎯 TP3: 3,110

⚠️ Tip: Wait for strong bullish reaction (M5/M15)

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

📣 If this strategy sparked clarity, hit that like button and follow. 💛

My trade for GOLD (XAUUSD) todayHere's my trade for GOLD today. From daily tf where my bias is bullish targeting the PDH and structure tf which is 1H then entry tf which is 5m. Now for my idea, i am expecting for price to go towards the PDH and that's where i got my bias. For my structure clearly we can see that the recent 1H candle respected the recent bullish FVG so now i can see that the bias is aligned with my structure tf. Once i saw that my entry tf is also aligned with my structure tf, i decided to enter with a target of 1:3R

GOLD ROUTE MAP UPDATEHey Everyone,

Piptastic day on the markets today with our chart idea playing out, as analysed.

After failing to open the swing range yesterday, we stated that the retracement range will continue to provide support back into the Bullish Goldturn targets. The retracement range gave the bounce into 3015, 3034, 3055 just like we said.

The momentum was too strong to get the ema5 lock above 3055 to confirm 3078. However, the candle body close above 3055 gave the confirmation for the 3078 target, which was also hit completing this range

We will now look for a break above 3078 for a continuation above or a rejection here will see the lower Goldturns tested again for the bounces. The market is moving in bigger ranges so candle body close can also give earlier confirmations for the next Goldturn without ema5 lock.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3055 - DONE

EMA5 CROSS AND LOCK ABOVE 3055 WILL OPEN THE FOLLOWING BULLISH TARGET

3078 - DONE

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3094

EMA5 CROSS AND LOCK ABOVE 3094 WILL OPEN THE FOLLOWING BULLISH TARGET

3119

EMA5 CROSS AND LOCK ABOVE 3119 WILL OPEN THE FOLLOWING BULLISH TARGET

3148

BEARISH TARGETS

3034 - DONE

EMA5 CROSS AND LOCK BELOW 3034 WILL OPEN THE FOLLOWING BEARISH TARGET

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999 - DONE

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2975 - DONE

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2922

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Learn 3 Best Time Frames for Day Trading Forex & Gold

If you want to day trade Forex & Gold, but you don't know what time frames you should use for chart analysis and trade execution, don't worry.

In this article, I prepared for you the list of best time frames for intraday trading and proven combinations for multiple time frame analysis.

For day trading forex with multiple time frame analysis, I recommend using these 3 time frames: daily, 1 hour, 30 minutes.

Daily Time Frame Analysis

The main time frame for day trading Forex is the daily.

It will be applied for the identification of significant support and resistance levels and the market trend.

You should find at least 2 supports that are below current prices and 2 resistances above.

In a bullish trend, supports will be applied for trend-following trading, the resistances - for trading against the trend.

That's the example of a proper daily time frame analysis on GBPCHF for day trading.

The pair is in an uptrend and 4 significant historic structures are underlined.

In a downtrend, a short from resistance will be a daytrade with the trend while a long from support will be against.

Look at GBPAUD. The market is bearish, and a structure analysis is executed.

Identified supports and resistances will provide the zones to trade from. You should let the price reach one of these areas and start analyzing lower time frames then.

Remember that counter trend trading setups always have lower accuracy and a profit potential. Your ability to properly recognize the market direction and the point that you are planning to open a position from will help you to correctly assess the winning chances and risks.

1H/30M Time Frames Analysis

These 2 time frames will be used for confirmations and entries.

What exactly should you look for?

It strictly depends on the rules of your strategy and trading style.

After a test of a resistance, one should wait for a clear sign of strength of the sellers : it can be based on technical indicators, candlestick, chart pattern, or something else.

For my day trading strategy, I prefer a price action based confirmation.

I wait for a formation of a bearish price action pattern on a resistance.

Look at GBPJPY on a daily. Being in an uptrend, the price is approaching a key resistance. From that, one can look for a day trade .

In that case, a price action signal is a double top pattern on 1H t.f and a violation of its neckline. That provides a nice confirmation to open a counter trend short trade.

Look at this retracement that followed then.

In this situation, there was no need to open 30 minutes chart because a signal was spotted on 1H.

I will show you when one should apply this t.f in another setup.

Once the price is on a key daily support, start looking for a bullish signal.

For me, it will be a bullish price action pattern.

USDCAD is in a strong bullish trend. The price tests a key support.

It can be a nice area for a day trade.

Opening an hourly chart, we can see no bullish pattern.

If so, open even lower time frame, quite often it will reveal hidden confirmations.

A bullish formation appeared on 30 minutes chart - a cup & handle.

Violation of its neckline is a strong day trading long signal.

Look how rapidly the price started to grow then.

In order to profitably day trade Forex, a single time frame analysis is not enough . Incorporation of 3 time frames: one daily and two intraday will help you to identify trading opportunities from safe places with the maximum reward potential.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD: Strong sell to the bottom of the Channel Up.Gold has turned neutral on its 1D technical outlook (RSI = 46.183, MACD = 28.120, ADX = 55.711) as it made a HH rejection at the top of its 1 year Channel Up and almost reached the 1D MA50. A bounce like November 7th 2024 is expected here and then more selling to the 1D MA100. Take that chance to short and aim for a -9% decline in total (TP = 2,900).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XAUUSD ShortWhat a Monday that was! Price broke way below 3000 and even hit 2954 level. It was a little shaky so I opt to not put in my positions, even if my predictions were correct, I chose to play safe. Today, price is still a little unstable but placing a position so to catch some pips if ever. Iv placed an SL just for Tradingview purposes, here's my position info: Open at 3014// SL 3164//TP 2964. As usual we decide as we go, but let's see how this trade rolls :)

Day 19of100

L:5

W:4

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the markets with our Goldturn levels playing out and respecting in true level to level fashion.

After completing the Bullish target from the retracement range yesterday; we stated that we were now playing in a bigger range and if 2975 fails to lock and open the swing range, the retracement range should give bounces into our Goldturns above. This played out perfectly, as 2999 and 3015 was tested from the bounce. We will now like to see ema5 lock above 3015 for a stronger confirmation for a continuation into 3034 and potentially into 3055 to test the full range again.

However, if we see the break below 2975 retracement level; it will open the swing range, which always gives us a bigger swing action then our usual weighted level bounces. This is the main difference between the weighted level bounces and our swing range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3055 - DONE

EMA5 CROSS AND LOCK ABOVE 3055 WILL OPEN THE FOLLOWING BULLISH TARGET

3078

EMA5 CROSS AND LOCK ABOVE 3078 WILL OPEN THE FOLLOWING BULLISH TARGET

3094

EMA5 CROSS AND LOCK ABOVE 3094 WILL OPEN THE FOLLOWING BULLISH TARGET

3119

EMA5 CROSS AND LOCK ABOVE 3119 WILL OPEN THE FOLLOWING BULLISH TARGET

3148

BEARISH TARGETS

3034 - DONE

EMA5 CROSS AND LOCK BELOW 3034 WILL OPEN THE FOLLOWING BEARISH TARGET

3015 - DONE

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999 - DONE

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2975 - DONE

EMA5 CROSS AND LOCK BELOW 2975 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2922

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX