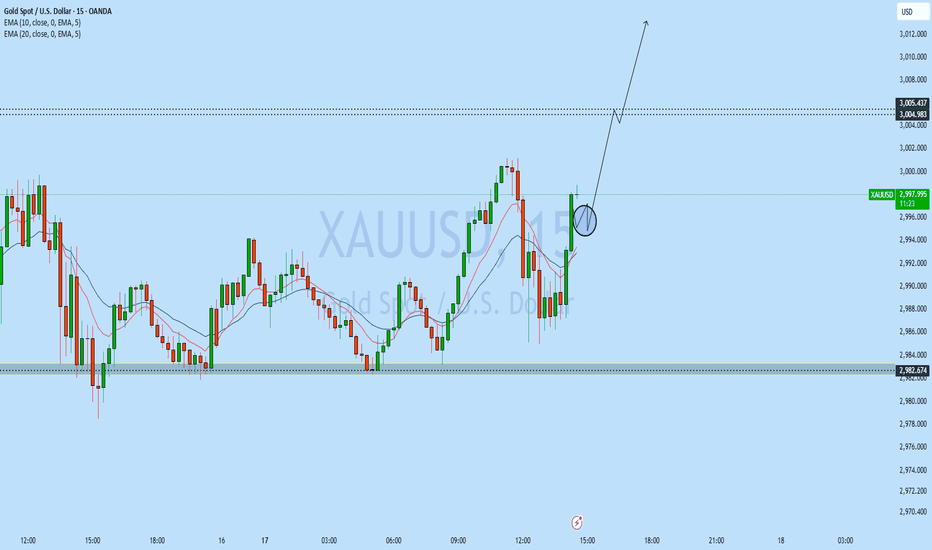

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3032 and a gap below at 3015. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3032

EMA5 CROSS AND LOCK ABOVE 3032 WILL OPEN THE FOLLOWING BULLISH TARGET

3050

EMA5 CROSS AND LOCK ABOVE 3050 WILL OPEN THE FOLLOWING BULLISH TARGET

3065

EMA5 CROSS AND LOCK ABOVE 3065 WILL OPEN THE FOLLOWING BULLISH TARGET

3080

EMA5 CROSS AND LOCK ABOVE 3080 WILL OPEN THE FOLLOWING BULLISH TARGET

3097

BEARISH TARGETS

3015

EMA5 CROSS AND LOCK BELOW 3015 WILL OPEN THE FOLLOWING BEARISH TARGET

2999

EMA5 CROSS AND LOCK BELOW 2999 WILL OPEN THE FOLLOWING BEARISH TARGET

2978

EMA5 CROSS AND LOCK BELOW 2978 WILL OPEN THE SWING RANGE

SWING RANGE

2950 - 2927

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Goldtrading

GOLD 4H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3045 and a gap below at 3018. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

3045

EMA5 CROSS AND LOCK ABOVE 3045 WILL OPEN THE FOLLOWING BULLISH TARGET

3067

EMA5 CROSS AND LOCK ABOVE 3067 WILL OPEN THE FOLLOWING BULLISH TARGET

3089

EMA5 CROSS AND LOCK ABOVE 3089 WILL OPEN THE FOLLOWING BULLISH TARGET

3114

BEARISH TARGETS

3018

EMA5 CROSS AND LOCK BELOW 3018 WILL OPEN THE FOLLOWING BEARISH TARGET

2985

EMA5 CROSS AND LOCK BELOW 2985 WILL OPEN THE SWING RANGE

SWING RANGE

2947 - 2918

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

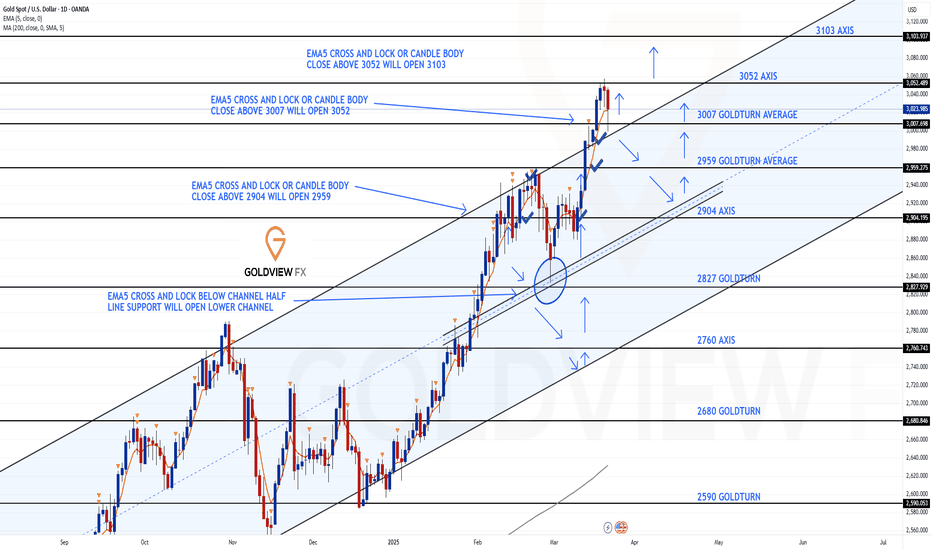

GOLD DAILY CHART MID/LONG TERM UPDATEHey Everyone,

This is an update on our daily chart idea that we are now tracking for a while now. If you have only started following us, please read the updates below at the bottom from previous weeks to see how effectively we have been tracking this.

Last week we completed target to the channel top and stated that if we see ema5 lock outside the channel then we will look for support outside the channel on the channel top for a continuation.

- This played out perfectly with ema5 cross outside of the channel top and then the channel top provided support for a continuation. We are now seeing no candle body close or ema5 lock above 3052 confirming the rejection and expect to see play between 3007 and 3052 to break and confirm our next range.

This is the beauty of our Goldturn channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

We will use our smaller timeframe analysis on the 1H and 4H chart to buy dips from the weighted Goldturns for 30 to 40 pips clean. Ranging markets are perfectly suited for this type of trading, instead of trying to hold longer positions and getting chopped up in the swings up and down in the range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up using our smaller timeframe ideas.

Our long term bias is Bullish and therefore we look forward to drops from rejections, which allows us to continue to use our smaller timeframes to buy dips using our levels and setups.

Buying dips allows us to safely manage any swings rather then chasing the bull from the top.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

LAST WEEK UPDATE

The half line of our unique channel gave the perfect bounce into the next axis target at 2904, inline with our plans to buy dips just like we stated. We now have a body close once again with ema5 cross and lock above 2904 leaving the range above open. We will continue to look for support at the ascending half-line of the channel, as we climb into the range.

PREVIOUS WEEKS UPDATE

After completing our Bullish targets we stated that the channel top will act as resistance confirmed with ema5 rejection. A break of the channel top with ema5 would confirm a continuation and failure would confirm rejection. This allowed us to identify true breakouts against fake outs.

We also stated that we need to keep in mind the channel half line below to establish floor to provide support for the range, should we continue to track further up. A break below the half line will open the lower part of the channel to establish floor on the channel bottom. The safest way to track this movement is by buying dips.

- Once again this played out perfectly as we got the rejection on the channel top followed with the channel half line test, which gave the perfect bounce like we stated. We will now either look for a continuation from this bounce or a cross and lock below the half line for a break into the lower channel floor.

GOLD WEEKLY CHART MID/LONG TERM ROUTE MAPHey Everyone,

After tracking and completing our last weekly chart successfully we have now updated a new weekly chart idea to track our long term range and targets.

We are currently seeing a candle break above the channel half-line and will need ema5 to co=follow to confirm the break out for a continuation above.

However, we have a detachment to ema5 lagging also potentially due for a correction. The play range on the weekly chart is 2943 below and 3094 above. We will look for ema5 lock or body close above or below to confirm the next mid to long term range.

This is the beauty of our channels, which we draw in our unique way, using averages rather than price. This enables us to identify fake-outs and breakouts clearly, as minimal noise in the way our channels are drawn.

Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

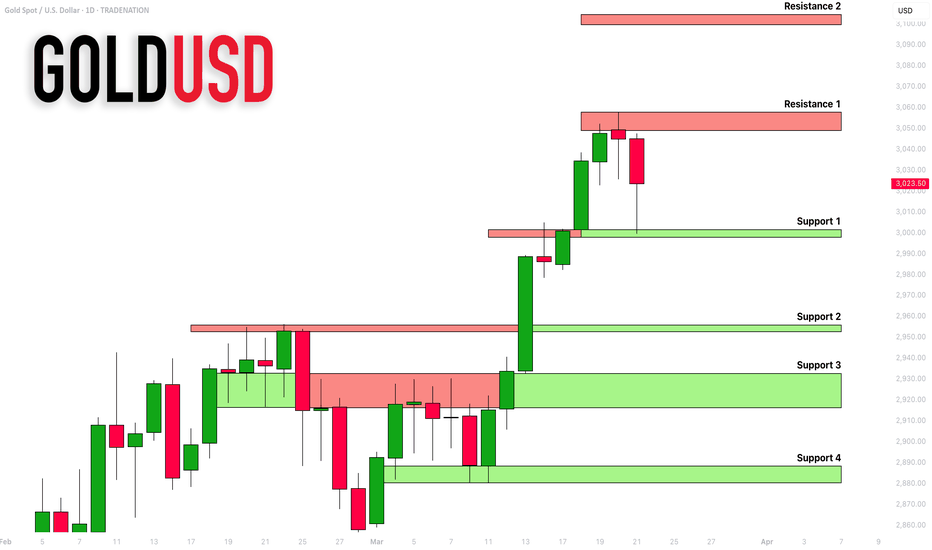

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest support & resistance analysis

for Gold for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD ROUTE MAP UPDATEHey Everyone,

Great finish to the week with our chart ideas playing out, as analysed.

We completed our Bullish targets 2993, 3011, 3029 and 3049 all with cross and lock confirmations to give us plenty of time to get in for the action. No further lock above 3049 confirmed the rejection into the lower Goldlturns, which all gave the 30 to 40 pip bounces inline with our plans to buy dips, just like we always state.

BULLISH TARGET

2993 - DONE

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011 - DONE

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3029 - DONE

EMA5 CROSS AND LOCK ABOVE 3029 WILL OPEN THE FOLLOWING BULLISH TARGET

3049 - DONE

We will now come back Sunday with our updated Multi time-frame analysis, Gold route map and trading plans for the week ahead and also a new Daily chart long term chart idea, now that this one is complete.

Have a smashing weekend!! And once again, thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

2 more reasons to buy gold? Israel is sending a delegation to Washington for strategic talks on Iran, while Trump has reportedly given Tehran a two-month deadline for a nuclear deal—so far, Iran isn’t engaging.

So, the question is: Are we headed towards military conflict or a significant wave of sanctions?

Meanwhile, protests erupted after Erdoğan’s main rival was arrested, triggering a sharp selloff in Turkish markets. The lira hit record lows, forcing the central bank to intervene with nearly $10 billion in currency sales.

Turkey’s inflation remains elevated at 39%, with interest rates at 42.5%. Continued lira weakness could push inflation higher, forcing further rate hikes and adding to the country’s economic instability.

GOLD ROUTE MAP UPDATEHey Everyone,

Another Piptastic day on the charts with our analysis playing out perfectly.

After completing all our Bullish targets yesterday we confirmed the gap to 3049 remained open after cross and lock above 3029.

- This was hit perfectly today completing this target. No further cross and lock above 3049 confirmed the rejection into the lower Goldturn for the bounce just like we said!!

We will now see price play between both these Goldturns until we see a cross and lock on either level to confirm the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2993 - DONE

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011 - DONE

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3029 - DONE

EMA5 CROSS AND LOCK ABOVE 3029 WILL OPEN THE FOLLOWING BULLISH TARGET

3049 - DONE

EMA5 CROSS AND LOCK ABOVE 3049 WILL OPEN THE FOLLOWING BULLISH TARGET

3068

BEARISH TARGETS

2968

EMA5 CROSS AND LOCK BELOW 2968 WILL OPEN THE FOLLOWING BEARISH TARGET

2942

EMA5 CROSS AND LOCK BELOW 2942 WILL OPEN THE FOLLOWING BEARISH TARGET

2922

EMA5 CROSS AND LOCK BELOW 2922 WILL OPEN THE SWING RANGE

SWING RANGE

2906 - 2886

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold/EUR (XAU/EUR) – Bearish Reversal Zone IdentifiedThis Gold to Euro (XAU/EUR) 4-hour chart shows a breakout from a descending channel, followed by a strong bullish rally. The price has now reached a key resistance zone, where sellers might step in to push prices lower.

Key Observations:

Downtrend Channel Breakout: The price was previously moving in a downward sloping channel but has now broken out, signaling bullish momentum.

Resistance Zone: The price is currently testing a significant resistance level, indicated by the marked "Sell" area.

Potential Reversal: If selling pressure increases at this resistance, we could see a price decline toward the identified target support zones.

Key Support Levels:

First Target Zone: Around 2,750 EUR

Second Target Zone: Near 2,675 EUR

Trading Plan:

Sell Setup: Look for bearish confirmation (such as rejection wicks or a lower high formation) before entering a short position.

Stop Loss: Above the resistance zone to avoid false breakouts.

Take Profit: Based on the highlighted support areas.

If bulls continue pushing beyond resistance, it could invalidate the sell setup, leading to further upside movement. Traders should monitor price action closely for confirmation.

MarketBreakdown | GOLD, GBPUSD, DOLLAR INDEX, EURAUD

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #GOLD XAUUSD 1H time frame 🥇

Earlier on Sunday, I shared a completed head & shoulders pattern on Gold.

Its neckline was respected and the price bounced from that, setting a new historic high.

That same neckline is now a perfect base for a new head & shoulders pattern.

The plan remains the same, if the price violates and closes below that

a correctional movement will be expected.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

GBPUSD looks weak and shows a clear signs of a strong overbought state.

We see a breakout attempt of a rising parallel channel at the moment.

Daily candle close below that will trigger a correctional movement with a high probability.

3️⃣ DOLLAR INDEX #DXY daily time frame 💵

Dollar Index shows clear strength after 2 recent US fundamental releases.

The last obstacle for the bulls is the underlined blue resistance,

its breakout and a daily candle close above will trigger more growth.

4️⃣ #EURAUD daily time frame 🇪🇺🇦🇺

It feels like the pair is returning to a global bullish trend.

The price has recently retraced and perfectly respected the underlined support.

With a high probability, we will see a test of a current high soon.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAUUSD: Topped. Correction to 2,815 imminent.Gold is overbought on its 1D technical outlook (RSI = 72.881, MACD = 47.430, ADX = 30.048) and is headed for the top (HH) of the 3 month Channel Up. The 1D RSI is on the very same LH formation as the top of the previous Channel Up on October 30th 2024. That resulted to a 1D MA100 pullback on the 0.5 Fibonacci retracement level. Consequently, we turn bearish here, aiming for the 0.5 Fib (TP = 2,815).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GOLD ROUTE MAP UPDATEHey Everyone,

Once again our chart levels are being respected and playing out, as analysed in true level to level fashion.

After completing all our Bullish targets 2993, 3011 and 3029, all confirmed with cross and lock, we then confirmed a lock above 3029 opening 3049 yesterday. We got the nice move up but just short of the full gap, which then followed with a rejection into the lower Goldturn for the bounce, giving us plenty of opportunities to milk the bounces just like we stated.

We still have the gap remaining open and we are seeing price play between two weighted levels. We will now look for either level to be tested and broken with cross and lock to confirm the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2993 - DONE

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011 - DONE

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3029 - DONE

EMA5 CROSS AND LOCK ABOVE 3029 WILL OPEN THE FOLLOWING BULLISH TARGET

3049

EMA5 CROSS AND LOCK ABOVE 3049 WILL OPEN THE FOLLOWING BULLISH TARGET

3068

BEARISH TARGETS

2968

EMA5 CROSS AND LOCK BELOW 2968 WILL OPEN THE FOLLOWING BEARISH TARGET

2942

EMA5 CROSS AND LOCK BELOW 2942 WILL OPEN THE FOLLOWING BEARISH TARGET

2922

EMA5 CROSS AND LOCK BELOW 2922 WILL OPEN THE SWING RANGE

SWING RANGE

2906 - 2886

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold Price Surpasses $3,000 for the First Time in HistoryGold Price Surpasses $3,000 per Ounce for the First Time in History

Just five days ago, we noted that gold was approaching the $3,000 level and suggested that a breakout could occur this month.

Yesterday, as shown on the XAU/USD chart, the spot price of gold rose above the psychological $3,000 mark for the first time ever. The new all-time high now stands at around $3,045.

Why Is Gold Rising?

Bullish sentiment is being driven by traders positioning themselves ahead of a key event—the Federal Reserve’s interest rate decision, set to be announced today. According to ForexFactory, analysts expect rates to remain unchanged at 4.5%, but surprises cannot be ruled out.

Additionally, gold is becoming more attractive as a safe-haven asset. As reported by Reuters:

→ Tensions in the Middle East are escalating—Israel warns of further casualties, as airstrikes in Gaza have already resulted in over 400 deaths.

→ Gold is gaining amid uncertainty over US tariffs.

Technical Analysis of XAU/USD Chart

In the short term, gold’s price action has formed movements that outline an ascending channel (marked in blue), with key developments including:

→ A breakout (as shown by the arrow) above not only the psychological $3,000 level but also the upper boundary of the channel.

→ A prior consolidation zone formed between $3,000 and $2,980.

It seems the bulls were looking for confirmation and confidence before attempting to break through resistance. The fact that they succeeded suggests this resistance zone may now act as support, making a retest of $3,000 possible.

However, the future direction of gold prices will largely depend on the news backdrop. Brace for volatility—the Fed's interest rate decision will be released today at 21:00 GMT+3, followed by a press conference by Chair Jerome Powell at 21:30 GMT+3.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Best GOLD XAUUSD Consolidation Trading Strategy Explained

In article , you will learn how to identify and trade consolidation on Gold easily.

I will share with you my consolidation trading strategy and a lot of useful XAUUSD trading tips.

1. How to Identify Consolidation

In order to trade consolidation, you should learn to recognize that.

The best and reliable way to spot consolidation is to analyse a price action.

Consolidation is the state of the market when it STOPS updating higher highs & higher lows in a bullish trend OR lower lows & lower highs in a bearish trend.

In other words, it is the situation when the market IS NOT trending.

Most of the time, during such a period, the price forms a horizontal channel.

Above is a perfect example of a consolidation on Gold chart on a daily.

We see a horizontal parallel channel with multiple equal or almost equal highs and lows inside.

For a correct trading of a consolidation, you should correctly underline its boundaries.

Following the chart above, the upper boundary - the resistance, is based on the highest high and the highest candle close.

The lowest candle close and the lowest low compose the lower boundary - the support.

2. What Consolidation Means

Spotting the consolidating market, it is important to understand its meaning and the processes that happen inside.

Consolidation signifies that the market found a fair value.

Growth and bullish impulses occur because of the excess of demand on the market, while bearish moves happen because of the excess of supply.

When supply and demand find a balance, sideways movements start .

Look at the price movements on Gold above.

First, the market was rising because of a strong buying pressure.

Finally, the excess of buying interest was curbed by the sellers.

The market started to trade with a sideways range and found the equilibrium

At some moment, demand started to exceed the supply again and the consolidation was violated . The price updated the high and continued growth.

Usually, the violation of the consolidation happens because of some fundamental event that makes the market participants reassess the value of the asset.

At the same time, the institutional traders, the smart money accumulate their trading positions within the consolidation ranges. As the accumulation completes, they push the prices higher/lower, violating the consolidation.

3. How to Trade Consolidation

Once you identified a consolidation on Gold, there are 2 strategies to trade it.

The resistance of the consolidation provides a perfect zone to sell the market from. You simply put your stop loss above the resistance and your take profit should be the upper boundary of the support.

That is the example of a long trade from support of the consolidation on Gold.

The support of the sideways movement will be a safe zone to buy Gold from. Stop loss will lie below the support zone, take profit will be the lower boundary of the resistance.

AS the price reached a take profit level and tested a resistance, that is a short trade from that.

You can follow such a strategy till the price violates the consolidation and establishes a trend.

The market may stay a very extended period of time in sideways, providing a lot of profitable trading opportunities.

What I like about Gold consolidation trading is that the strategy is very straightforward and completely appropriate for beginners.

It works on any time frame and can be used for intraday, swing trading and scalping

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Why gold may—or may not—reach $3,060 next Gold is now up 15.57% in 2025 after gaining 27.2% in 2024.

If the current momentum continues, traders may target the upper parallel trendline near $3,060 and rising.

Safe-haven demand is a key driver of this rally, but what could disrupt it?

For one, U.S. President Donald Trump and Russian President Vladimir Putin spoke for 90 minutes today, agreeing on steps toward a peace deal in Ukraine, including a pause on attacks on energy infrastructure. However, Putin declined to accept a broader 30-day ceasefire proposed by U.S. and Ukrainian officials.

GOLD ROUTE MAP UPDATEHey Everyone,

Another great day on the charts once again with our analysis playing out to perfection!!

After completing our 2993 Bullish target yesterday, we stated that we now have a ema5 lock above 2993 opening 3011. This target was hit today just like we said, followed with a further cross and lock above 3011 opening 3029, which was also hit today completing this range.

We now have a lock above 3029 opening 3049. We now need to keep in mind we have had no corrections from the last two days momentum. Failure to lock above the next level will follow with a rejection to find support at the lower Goldturns for bounce and then further cross and locks will confirm the next range for us.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2993 - DONE

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011 - DONE

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3029 - DONE

EMA5 CROSS AND LOCK ABOVE 3029 WILL OPEN THE FOLLOWING BULLISH TARGET

3049

EMA5 CROSS AND LOCK ABOVE 3049 WILL OPEN THE FOLLOWING BULLISH TARGET

3068

BEARISH TARGETS

2968

EMA5 CROSS AND LOCK BELOW 2968 WILL OPEN THE FOLLOWING BEARISH TARGET

2942

EMA5 CROSS AND LOCK BELOW 2942 WILL OPEN THE FOLLOWING BEARISH TARGET

2922

EMA5 CROSS AND LOCK BELOW 2922 WILL OPEN THE SWING RANGE

SWING RANGE

2906 - 2886

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD ROUTE MAP UPDATEHey Everyone,

Great start top the week with our chart idea already kicked off with our first Bullish target hit at 2993. We are now seeing a lock above 2993 opening 3011. Failure to lock above will follow with a rejection to find support at the lower Goldturns for bounce and then further cross and locks will confirm the next range for us.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2993 - DONE

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3039

EMA5 CROSS AND LOCK ABOVE 3039 WILL OPEN THE FOLLOWING BULLISH TARGET

3049

EMA5 CROSS AND LOCK ABOVE 3049 WILL OPEN THE FOLLOWING BULLISH TARGET

3068

BEARISH TARGETS

2968

EMA5 CROSS AND LOCK BELOW 2968 WILL OPEN THE FOLLOWING BEARISH TARGET

2942

EMA5 CROSS AND LOCK BELOW 2942 WILL OPEN THE FOLLOWING BEARISH TARGET

2922

EMA5 CROSS AND LOCK BELOW 2922 WILL OPEN THE SWING RANGE

SWING RANGE

2906 - 2886

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

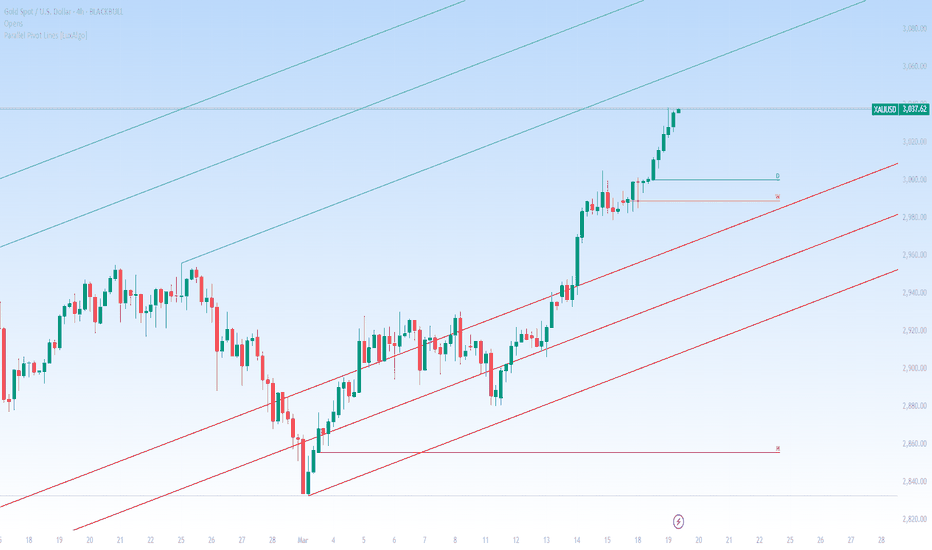

breakdown of the setup! Read CaptionThis is a 4-hour chart of Gold (XAU/USD) showing a bullish channel with price currently trading near its upper boundary. Here’s a breakdown of the setup:

Market Structure:

Trend: Gold is in a strong uptrend, moving within a well-defined ascending channel.

Current Price: Around $2,998, with a recent high of $3,000.55.

Key Target: A potential bullish breakout targeting $3,020+.

Support Zones: Highlighted between $2,930 - $2,860 as possible retracement levels.

Potential Scenarios:

Bullish Continuation: If price holds above the midline of the channel, a push toward $3,020 - $3,050 could be expected.

Pullback & Retest: A minor correction toward $2,970 - $2,960 before resuming its uptrend.

Deeper Retracement: A stronger pullback could lead to a test of $2,930 or even $2,860, aligning with the lower trendline.

Trading Plan:

Buy on dips if price retests lower support zones within the channel.

Breakout trade above $3,020 could indicate further upside potential.

Risk management: Watch for bearish rejection candles near resistance.

This setup favors bullish continuation, but a short-term pullback is possible before the next leg up. 📈🔥

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 2993 and a gap below at 2968. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 30 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

BULLISH TARGET

2993

EMA5 CROSS AND LOCK ABOVE 2993 WILL OPEN THE FOLLOWING BULLISH TARGET

3011

EMA5 CROSS AND LOCK ABOVE 3011 WILL OPEN THE FOLLOWING BULLISH TARGET

3039

EMA5 CROSS AND LOCK ABOVE 3039 WILL OPEN THE FOLLOWING BULLISH TARGET

3049

EMA5 CROSS AND LOCK ABOVE 3049 WILL OPEN THE FOLLOWING BULLISH TARGET

3068

BEARISH TARGETS

2968

EMA5 CROSS AND LOCK BELOW 2968 WILL OPEN THE FOLLOWING BEARISH TARGET

2942

EMA5 CROSS AND LOCK BELOW 2942 WILL OPEN THE FOLLOWING BEARISH TARGET

2922

EMA5 CROSS AND LOCK BELOW 2922 WILL OPEN THE SWING RANGE

SWING RANGE

2906 - 2886

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX