Goldusdlong

ANALYSIS ON XAUUSD (goldusd)ANALYSIS ON XAUUSD (goldusd)

Welcome to my analysis

-

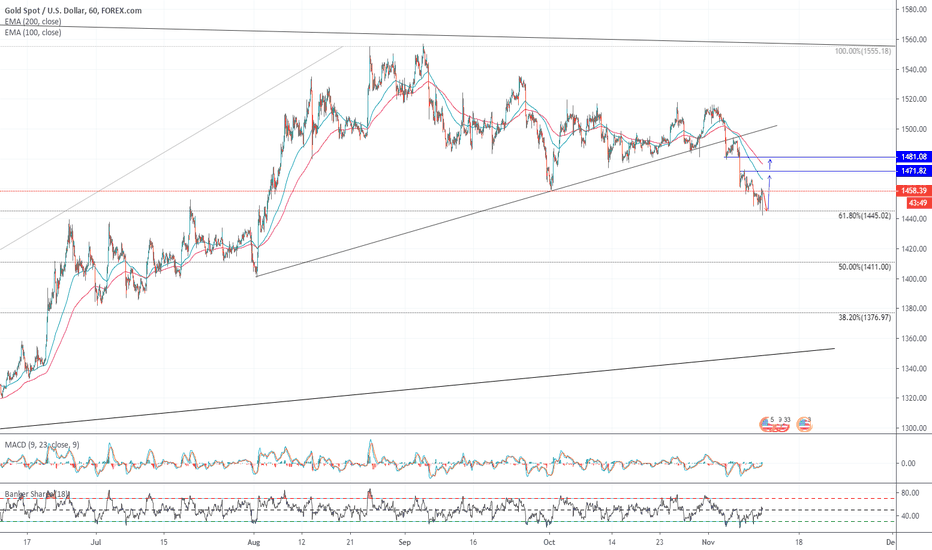

30Min CHart

-

Interesting Point of interest In the XAUUSD pair.

- Price below 100/200 day EMA.

- Buy reversal.

- Expecting more Upward momentum.

- Watch 1471.82-1481.00 for take profit.

- MACD showing bullish divergence

Stay Tuned

Gold monthly updateMonthly supply zone held very well and now consolidating just below it.

Closing the month below $1520 would send us back towards $1380-1420.

Buy anywhere between @ $1380-1420 with take profit @ $1622.

Patience is needed trading higher time frames. I make these charts for multi-month swing traders & investing purposes.

This is not a financial advise.

Gold Looks Bullish on H4Structure Change of Trend

Tendency Upward

Plan Buy

Entry Target at 1489

Entry Target will change if open bearish to 1479.80

Second Ladder Entry 1474.80

Stop Loss at 1471

Profit Target 1499

If Profit Target 1 achieved please move your stop loss to Profit Target 1 and use trailing stop thereafter.

XAUUSD trendline, 80% long if the trend did not bend.XAUUSD was been in a roller coaster ride last 2 days ago. After it goes down by 200 pips, it bounces back last night. As we can see here that the New York Initial Balance did not do well and the confirmed London Initial Balance makes the Gold soar again, we are still in a bullish scenario and sooner or later after the printing of Initial Balance in London Session we will have an idea which it might go for the day.

GOLD Important Major Trend Line (Weekly)Hi Buddies

As you can see in the chart all historical major trend lines were shown. Price just has two choices and it's going to select the following direction. if it crosses the red line successfully it will break out the head & shoulders neckline and go to the 1470-1500$ price area. the next target for this situation is the 1600-1650$ price area as the head & shoulders target. on the other hand, if it breaks the blue historical major trend line it will reach 1050$ but personally, I think the first choice is more plausible.

Good Luck...

GOLD (XAUUSD) DROPPING - CATCH THE DROP GUYSSo happy new year people, hope you all had a peaceful and happy xmas and new year.

so Gold (xauusd) has hit some resistance now, th price being rejected. i am expecting furtherdrop, that will brek the trend line.

i am gunning for TP1, if it break that then TP2.

happy trading

See previous analysis

SUPPORT THE MOVEMENT WITH YOUR LIKES, COMMENTS AND FOLLOW FOR MORE

Update on Gold - XAUUSD i am expecting a move higher on XAUUSD (gold)

this should test previous high once this small correction

is completed. we have had an impulse - reaction, then

another impulse reaction. now i am expecting another one

SUPPORT THE MOVEMENT WITH YOUR LIKES,

COMMENTS AND FOLLOW FOR MORE

XAUUSD, GOLD Opportunity!GOLD has been on a rise lately however I don't expect this to be a big bullish run for GOLD, in other words I don't think this run will take us to a peak higher than the peak we have made (1350+ area) this year. Now is a good time to buy as we have risen and retraced already so the next wave up can be anytime soon. I expect this wave to take us to 1250-1260 USD area. Where I see a retrace coming after which we should be looking to go up again. So I think this GOLD bull cycle can go and test 1300 area but don't see it passing 1320 USD barrier.

Good Luck, Traders! #moon #mooncommunity #turtlestyletrading ;)

Be a turtle my friend © Farhad Jafarov

GOLD BULLS ARE ONOn 4 Hour chart Gold has started to go up , on the 15 minute chart it has yet to complete last two sub waves of the triangle of the combination correction. The support lies at 1187 , the potential target is 1255. The structure expected ahead is a zigzag. This is an amazing trade with about 1:5 loss to profit ratio. Hope this helps you.Thanks

Gold USD - Conjunction of fundamental ind. showing LONG SIGNAL Same strategy as the related ideas below.

Currently reading a long signal.

Strategy

Refer to BTCUSD and TRONUSDT related ideas below for detail into strategy, which works well with only high volume/volatile coins.

Summary: All indicators must cross to give a strong buy/sell signal

i.e. fibonacci lines, bollinger bands , macd , rsi must be crossed simultaneously.

PNL = +4.71%

Max Drawdown = 0.55% !!!

2 closed trades in total spanning ~2.5 months (over 1.88% profit a month)

p.S. its a shame the graph above doesn't allow you to scroll back to view the whole range of time :(, but you can still view all the trades below

GOLD LONG SIGNAL w/ Spectro™ MThis is a signal using Spectro™ M

The blue background means a reversal zone.

So after this long downtrend and since we are close to a strong support around 1220, those are two good sings for a long.

We just had the buy alert, so we can expect bullish movement.

Liked it? Give it a shot at, it's really affordable - you wouldn't believe if I told you: hypester.org

GOLD: Atm at a long buy-in with an incredible Risk-Reward ratio!Hate being repetitive, this is just a midnight, somewhat of a short update.

Getting directly to the point:

a) GOLD , fell out of an upward wedge and was falling down for the major part of today(stopped around the psychological support of 1240*whole number), until it reached the 1.62 ret support of the falling wedge. Short term prospects from this wedge would be the top of the larger(grey market) falling wedge @1247-1248 with a good probability of breaking out of the wedge and targeting the medium-term marked target.

b) Now, that everyone knows that gold is at a good buy point, technically the bottom is @ around 1236.37, however I do see a large benefit with potentially entering the market at the current level, and perhaps buying some more if it actually goes all the way down to 1236.37.

c)Both the DXY index and most of the stock indexes took a hit today amidst the discouraging economic news from Asia & Mexico and the threats of a potential trade war(even though I rarely factor in such "news" from Asia in the charts, potential trade war just cannot be disregarded in any case). These news however should pertain to the rise in GOLD , silver and other assets that posses mostly a fundamental value. A weak dollar(from DXY) is the elephant in the room that can take GOLD to new heights, although I don't think that the dollar is about to go down anytime soon. This is due the fact that in order for any potential drawbacks from a trade war, to be noticed/recorded we must wait until the following quarter(Q3), until then, traders gonna speculate as much as they can. As a rule of thumb, when a potential crash happens or such news have a very bad effect on the stock market, most of the investors run directly to the safe heaven of Gold&Silver... always!

To sum it up, the current risk-reward ratio is just too good to be avoided, not mentioning the all the oversold indicators.

-For a more long term analysis, click on the posts down bellow-

.

.

.

-Happy trading folks-

Disclaimer:

//This is not a buy/sell sign, you decide what to do with your own money!//

If you liked my take on GOLD, comment your thoughts, agree or follow for more interesting TA's, it's all very well appreciated, cheers.

Buy opportunity for GoldYep, that has been an abrupt fall out of the triangle - instead of a breakout to the top!

Nevertheless - the price isn´t far away from the next supportline - the lower limit of the ascending triangle. And this should be a very strong support! Even if Gold would break the line the next support is following shortly behind: a swing trend line at 1.215$.

Watching the history of the past months this had been a level where Gold turned up.

So I expect Gold to turn within the yellow circle. And then heading to fib retracement 0.50 at 1.298$. Whe Gold wil haven broken this resistance the next aim could be 1.340$ - the upper limit of the triangle.

Meanwhile we´re approaching the peak of the triangle!

RSI and MACD are clearly in negative water. In december 2016 this had been the level where Gold turned (RSI).

Good time to accumulate some ounces.

For info:

the sell-out was partly caused by the short sellers at comex (COT-report)