NASDAQ100 continue its strength due to the strong earning seasonFundamental:

USTEC (NASDAQ100) continues its strength, propelled by robust Alphabet (GOOG) earnings that buoyed technology companies. Cloud services recorded the largest growth at 32% YoY, primarily driven by AI. Concurrently, the company plans to allocate $85 bln to capital expenditure in 2025 for AI, an increase from $75 bln, signaling continued surging demand for AI infrastructure.

In addition, recent US economic data indicated strong consumption and optimism, with the July Services PMI expanding to 55.2 from 52.9 in the previous month. Initial Jobless Claims also fell to 217k, the lowest in 14 weeks, reinforcing optimism regarding the labor market, alongside stronger-than-expected Nonfarm Payrolls from early July.

Inflation data showed a minor impact from tariffs, and tariff negotiations have progressed favorably. Trade deals have been secured with Vietnam, Indonesia, Japan, and the Philippines, and potential trade agreements with the Eurozone and India are anticipated before the deadline.

Major earnings releases are slated for next week, including MSFT, META, and QCOM on July 30. AMZN and APPL's results the following day could provide a clearer picture of USTEC's overall earnings.

Meanwhile, USTEC's forward P/E currently stands at 27x, aligning with its 5-year average despite reaching a new record high, suggesting further upside potential.

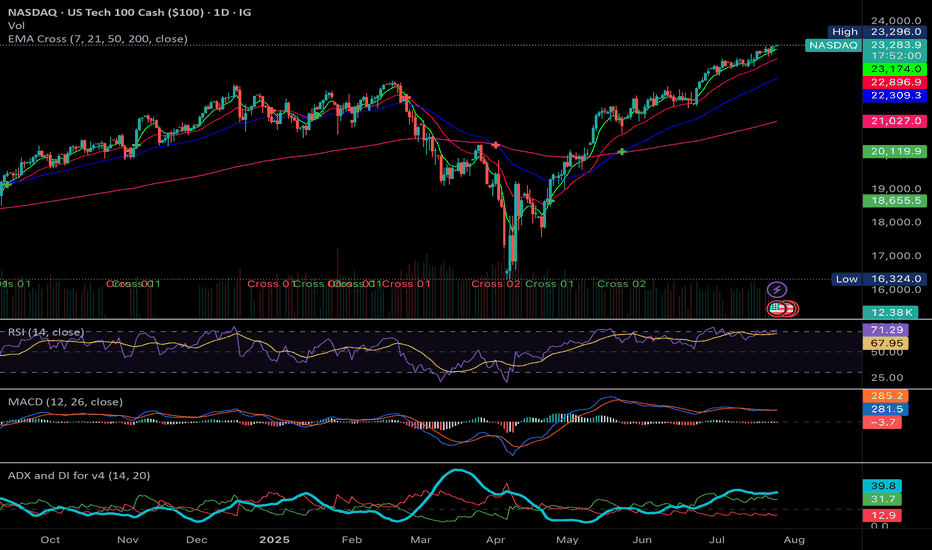

Technical:

The index is trading above its EMAs, which are extending, signaling a continuation of the rally.

If USTEC sustains its momentum, the index may reach 24000 upon breaking above the potential resistance at 23400.

Conversely, a pullback near the swing high may suggest a retest of the support at 23000.

Google (Alphabet)

GOOGL Alphabet Options Ahead of EarningsIf you haven`t bought GOOGL before the rally:

Now analyzing the options chain and the chart patterns of GOOGL Alphabet prior to the earnings report this week,

I would consider purchasing the 215usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $8.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Alphabet (GOOGL) Stock Approaches $200 Ahead of Earnings ReleaseAlphabet (GOOGL) Stock Approaches $200 Ahead of Earnings Release

According to the Alphabet (GOOGL) stock chart, the share price rose by more than 2.5% yesterday. Notably:

→ the price reached its highest level since early February 2025;

→ the stock ranked among the top 10 performers in the S&P 500 by the end of the day.

The positive sentiment is driven by expectations surrounding the upcoming quarterly earnings report, scheduled for release tomorrow, 23 July.

What to Know Ahead of Alphabet’s (GOOGL) Earnings Release

According to media reports, Wall Street analysts forecast Alphabet’s Q2 revenue to grow by approximately 11% year-on-year, with expected earnings per share (EPS) of around $2.17 — up from $1.89 a year earlier. Notably, the company has consistently outperformed estimates for nine consecutive quarters, setting a positive tone ahead of the announcement.

Despite the optimism, investors are closely monitoring two key areas:

→ Cloud computing competition , where Google Cloud contends with Microsoft Azure and Amazon AWS;

→ Growing competition in the search sector , linked to the rise of AI-based platforms such as ChatGPT.

In response, Alphabet is significantly increasing its capital expenditure on AI infrastructure, planning to spend around $75 billion in 2025. These investments are aimed at both defending its core search business and advancing the Gemini AI model, while also strengthening Google Cloud’s market position.

Technical Analysis of Alphabet (GOOGL) Stock

Since April, GOOGL price fluctuations have formed an ascending channel (marked in blue).

From a bullish perspective:

→ the June resistance level at $180 has been breached and may soon act as support;

→ previous bearish reversals (marked with red arrows) failed to gain momentum, suggesting sustained demand is pushing the price higher.

From a bearish standpoint, the price is approaching:

→ the psychological level of $200, which has acted as a major resistance since late 2024;

→ this barrier may be reinforced by a bearish gap formed in early February.

Strong results from the previous quarter, combined with optimistic forward guidance from Alphabet’s management, could provide bulls with the confidence needed to challenge the $200 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, there is a chance that we will see new all time highs soon.

📝Levels to watch:

$200

🙏🏻#LONGTERMVISION

Philip - Swing Trader

GOOGLE Count changed, Bullish outlook.I have adjusted NASDAQ:GOOG NASDAQ:GOOGL Elliot wave count with a wave 1 completing a leading diagonal backed up by a deep wave 2 correction into High Volume Node support (HVN). We potentially have another 1-2 with fast drop and recovery to the S1 daily pivot which would make long term outlook extra bullish by extending target.

Wave 3 is underway with a target of the all time hime high HVN for wave 5. The next resistance HVN is $191.

Price above the daily pivot and is continuing upwards after testing as support.

Analysis is invalidated below $162 swing low.

Safe trading

#ALPHA /USDT breakdown alert#ALPHA

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.01111, acting as strong support from which the price can rebound.

Entry price: 0.01156.

First target: 0.01288.

Second target: 0.01400.

Third target: 0.01512.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Google MUST hold this critical level!NASDAQ:GOOG local analysis update

📈 𝙇𝙤𝙣𝙜 𝙩𝙚𝙧𝙢 Further decline below the daily 200EMA, High Volume Node (HVN) and pivot point which it closed below on Friday could see google price fall back below $140.

📉 𝙎𝙝𝙤𝙧𝙩 𝙩𝙚𝙧𝙢 the bullish run has ended with Fridays bearish engulfing, first support below the support it is currently sat at is $156.

Irans conflict has investors shaken and not willing to hold assets over the weekend on the fear of worse news. However, if the conflict is resolved investors could have a great buying opportunity.

𝙏𝙚𝙘𝙝𝙣𝙞𝙘𝙖𝙡 𝘼𝙣𝙖𝙡𝙮𝙨𝙞𝙨

Price is challenging a triple shield: major support HVN, daily pivot and the daily 200EMA. Holding this level is critical and locks in a corrective Elliot Wave pattern from the $140 level completing between the 0.5-0.618 Fib retracement.

Daily DEMA Is about to produce a death cross while RSI is neutral with plenty of room to fall.

Safe trading

GOOG | The Year of Quantum | LONGAlphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

GOOGL Swing Trade Plan – 2025-06-06📈 GOOGL Swing Trade Plan – 2025-06-06

Bias: Moderately Bullish

Timeframe: 7–10 days

Catalyst: Ongoing AI sector momentum, low VIX, strong long-term trend

Trade Type: Single-leg call option

🧠 Model Summary Table

Model Direction Strike Entry Price Targets Stop Confidence

Grok Moderately Bullish $182.50 $0.92 +50% -50% 72%

Claude Moderately Bearish $170 PUT $1.95 +50–100% -30% 75%

Llama Moderately Bullish $182.50 $0.92 +50–70% -20–30% 80%

Gemini Moderately Bullish $182.50 $0.92 $1.38 / $1.84 $0.45 75%

DeepSeek Neutral (No Trade) — — — — 60%

✅ Consensus: Moderately Bullish

⚠️ Short-Term Disagreement: Claude and DeepSeek flag short-term overbought risk

📉 Technical & Sentiment Summary

Price Action: Strong bullish trend on daily/weekly; 15-min extended

RSI: Overbought on short-term, but daily RSI has room

MACD: Mixed intraday, bullish daily

Sentiment: AI hype supportive, VIX declining

Max Pain: $165 → minor resistance bias, unlikely to dominate

✅ Final Trade Setup

Parameter Value

Instrument GOOGL

Direction CALL (LONG)

Strike $182.50

Expiry 2025-06-20

Entry Price $0.92

Profit Target $1.38 (+50%)

Stop Loss $0.64 (–30%)

Size 1 contract

Entry Timing At market open

Confidence 75%

💡 Rationale: 4 of 5 models lean bullish; solid R/R from this OTM strike with tight premium.

⚠️ Risks to Watch

15-min chart overbought RSI could cause chop early next week

MACD divergence on lower timeframes may delay breakout

Max Pain at $165 could cap upside short-term if momentum fades

Time decay intensifies midweek → stick to stop or trail profits

GOOG In Trouble!I first started warning about GOOG back on March 18, 2025

Since GOOG has formed this big bear flag outside the structure in the middle of nowhere.

This is an indication of more weakness to come!

GTF out is in order for bulls. It is better to be out of the market wishing you were in and then in the market wishing you were out!

I can only provide the setup. The rest is up to you.

Click like, follow, for more. Let's get to 5,000 followers.

GOOGLE Repeating 2024 pattern and eyes $197.00Alphabet Inc. (GOOG) has established a Channel Up pattern since the (near) 1W MA200 (orange trend-line) rebound. With the 1D MA50 (blue trend-line) now acting as a Support, this pattern resembles the Channel Up formations that emerged in 2024.

Both in terms of 1W RSI and pure price action alike, we are in a similar consolidation level as November and April 2024. Both patterns peaked after similar rallies (+40.60% and +46.23% respectively), so the minimum Target we are expecting on the medium-term is $197.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOUBLED MONEY in 3 days! $6/share win for $0.50/share stop loss!🔥 +100% in 3 days ✅ $6 to $12 Swing Pick buy on Friday before market close at $6 NASDAQ:ASST

Just 3 days later it's $12 for a mega win!

And to make that much better the risk was only $0.50 per share while going for $6/share win so 1:12 risk/reward ratio

Google to $200!NASDAQ:GOOG NASDAQ:GOOGL

We are uptrending back to ATHs on Google here after they have lagged this whole rally and are the CHEAPEST MAG 7 STOCK!

- Volume shelf launch

- Rising Wr%

- Bouncing off key S/R zone

- H5 Indicator is about to flip to green and make a bullish cross

- Volume is climbing

- Bullish engulfing candle

- Daily looks great as well

Target is $200