Google (Alphabet)

$XOM hot commodity!$XOM has been one of the hot commodity for the past the few months. gas prices keeps surging up and up due to various reasons.

for now, oil started to cool down after hitting the ATH and continues trend lower below ema line for the past few days

for momentum move. although its started to pulls back, there's a possibilities that it might bounce back up due to war conflict

between the two countries Ukraine and Russia. once the war is officially started the oil might start move again due to possible high demand.

overall, the market is still very bearish and specially the tech market. please trade cautiously.

Day trade or scalp target play: 02/22/22

Buy call above 76.90 sell at 78.90

Buy puts below 76.10 sell at 75.31

Hello everyone,

welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock is going to go over the next day or week play and where I would look for trading opportunities

for day trades or scalp play.

If you have any questions or suggestions which stock I should analyze, please leave a comment below.

If you enjoyed this analysis, I would definitely appreciate it, if you smash that LIKE button and maybe consider following my channel.

Thank you for stopping by and stay tune for more.

My technical analysis is not to be regarded as investment advice. but for general informational proposes only.

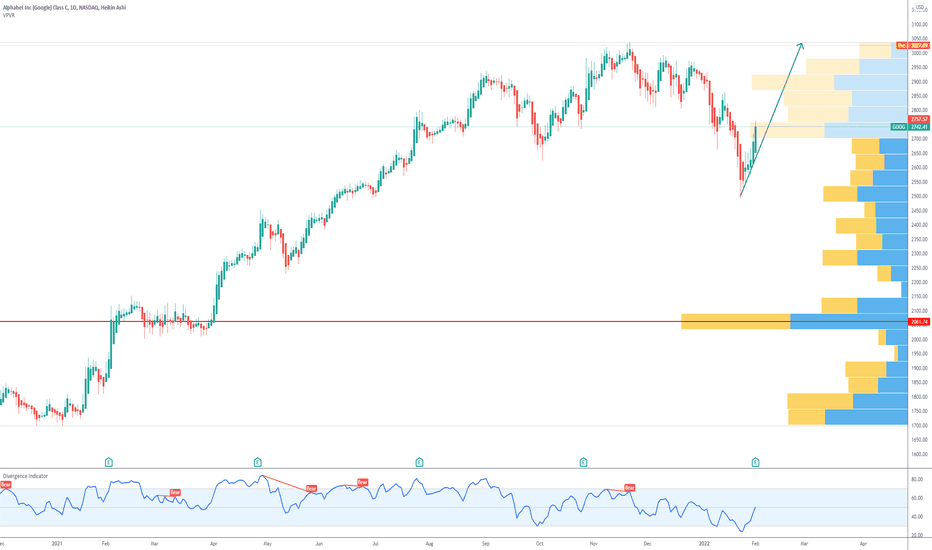

GOOG: Time to buy the DIP? Complete analysis (H,D and W charts).Hello traders and investors! Let’s see how GOOG is doing today!

First, we see a good reaction today, in the 1h chart, as the support area between the two black lines at $ 2,667 - $ 2,651 is holding the price nicely.

Right now is a good time for a bullish reaction, and GOOG could fill the last gap at $ 2,747.65. However, in order to reverse, we must see a stronger bullish structure, because the trend is still bearish. We see nothing but lower highs/lows, and the 21 ema is descending as well.

This could be a sign of exhaustion, but it is too soon to tell. Let’s look for more clue in the daily chart:

What I find curious is that GOOG is dropping with low volume. Its volume has been below the average since Feb 8, indicating that it is not dropping because of sell pressure. Instead, it just looks weak, and the price will get more and more discounted, until GOOG becomes attractive again to investors.

The weekly chart offers more ideas:

In the weekly chart, GOOG did a Bearish Engulfing last week, just under its 21 ema – not a good sign. It seems it could drop more, maybe to the previous support level at $ 2,492.84, but this is where things get dangerous.

If GOOG loses this support, it might trigger this Head & Shoulders chart pattern, and this will officially trigger a bear market on GOOG. Of course, this scenario wasn’t triggered yet, but it is important to pay attention to the signs it is giving to us right now.

I’ll keep you guys updated on this, so, remember to follow me to not miss any of my future analyses.

Alphabet | Fundamental Analysis |LONG| MUST READ !There is no denying that Alphabet has become a force to be considered with. Indeed, not many companies can boast that their branded product or service has become a verb: "google it." Beyond search, Alphabet is a leader in digital advertising, smartphone operating systems led by Android, and cloud computing with the rapidly growing Google Cloud.

Recently, the tech giant informed about a historic 20-for-1 stock split, reducing the size of its stake for the first time in eight years. Now investors who have been considering buying the stock are encountered with a bothersome question: should they buy the stock now or wait until after the split?

It's been a long time since Alphabet held its last stock split. In fact, the last time it happened was when the company was still called Google. That was in 2014, and Google didn't change its name to Alphabet until late 2015.

What's notable about the previous stock split is that it created non-voting Class C shares of Google, while Class A shares maintained the standard one vote per share. In April 2012, a shareholder lawsuit was filed alleging that co-founders Larry Page and Sergey Brin orchestrated the stock split to maintain control of the company to the detriment of shareholders. As a result of the split, the company increased the number of shares without a commensurate increase in voting rights. The lawsuit was eventually settled, allowing the split to proceed with shareholder compensation.

In the nearly two years between the announcement and the actual stock split, Google stock was up about 74%.

Typically, a split does not change the overall economic value of the company that is doing the split. One share of Alphabet worth $2,800 is worth as much as 20 shares worth $140 (20 x $140 = $2,800). As with pizza, the number of slices does not change the overall size of the pie. Nevertheless, some argue that the underlying effect is positive for investor psychology.

That's exactly what happened when several well-known companies made headlines over the past couple of years as investors rushed to buy shares after the stock split announcement. Apple stock rose 34% in a month after announcing a 4-for-1 stock split in July 2020. Tesla followed suit less than two weeks later, announcing a 5-for-1 stock split. Between the announcement and the completion of the split, the stock jumped 81%.

A similar situation occurred in May 2021, when The Trade Desk announced a 10-for-1 stock split and Nvidia unveiled plans for a 4-for-1 stock split. The Trade Desk and Nvidia stock rose 27% and 24%, respectively, between the day of the announcement and the day the split was completed.

Aptus Capital Advisor senior analyst and portfolio manager David Wagner opined on the situation, "We all know the split doesn't boost the fundamental value of the company. ... but from what we've seen in the market with Tesla and Nvidia, people like to chase splits."

There are many reasons to think that Alphabet will continue on the same upward trajectory that led to that famous stock split.

Google's dominance in search remains unchallenged, with about 92 percent of the global search engine market. Alphabet is using this advantage to gain a leadership position in digital advertising, which accounts for about 29% of global digital ad spending. Nor should we forget Google Cloud, which has quietly risen to the top three, behind only Amazon Web Services and Microsoft Azure.

These factors drove Alphabet's strong performance. In the fourth quarter, revenues of $75.3 billion rose 32% year over year, and operating margins improved, boosting earnings per share (EPS) to $30.69, a 38% increase.

For investors who are optimistic about Alphabet, there's no reason to hesitate to buy the stock, unless, of course, your financial situation allows you to shell out almost $3,000 per share. If that's the case, and your broker doesn't offer the option to buy fractional shares, a stock split will make them much more affordable over time.

If you plan to buy Alphabet stock now, keep in mind that it may require additional record keeping. Those who are buying the stock now (at about $2,800) need to remember to adjust their records to reflect the revised cost base by dividing it by 20 to account for newly issued shares ($2,800 / 20 shares = $140). This will become important when you eventually sell your stock and settle with the tax authorities. Fortunately, brokerage firms know how to do this, so it shouldn't be too difficult.

Given Alphabet's market dominance, great execution, and continued outlook, it doesn't matter if you buy the stock now or wait until after the July 18 split-adjusted trading. What matters is that you buy them.

QQQ and techInside week, high of last week was 370.1 and low was 351.52. Previous week high was 374.36 and a low of 334.15. Looking to see what way we break this upcoming week. A lot of the big names already reported. AAPL, AMZN, and GOOG rally and help push QQQ higher while the weakness of them all FB got destroyed by their poor earnings report. Been seeing a lot of people who didn't like that AMZN beat because of RIVN IPO. The question is do we chop around this week or do we break the inside week in any direction. I am ready to play puts or calls depending on how we open up on Monday.

AAPL - Daily / Apple Joins the Death Cross Cult of FANGsApple's Impulse Weakening Impulse Structure has finally broken.

We warned of this on February 6th, the Retracement was concluding

as many of the FANGs were seeing 55/199 Crosses occurring.

2C was a weak retracement, we were looking forward to more, but

it simply was not to be.

Yields crossing 1.691 were our LIS for the cross over 2% and onto 2.06

to and through 2.082 / 2.12 / 2.189 / 2.26 / 2.28 and on to the UTL

with a potential Throw over to 2.5%.

Apple will lead 3A (a powerful move lower to new lows) as its weighting

is sizeable for NQ.

As previously indicated 141s are the Initial Price Objective for 3/5 IT.

We believe it can move lower to the 411 EMA @ ~ 133.4.0.

Apple has lost the Edge in innovation and is unable to complete with the

Google's innovations and breadth of Carrier Market Integration.

After months of research into Global Access - the Edge Google has over

Apple is immense. The Pixel 6 is functionally a very basic, well made

Smartphone.

Where it excels is in AI Integration and Carrier switching.

I have begun converting to Google's Hardware and Service for all lines and

services, consolidating a number of Business Lines for Global use while

traveling outside the United States.

Apple is unable to offer anything remotely competitive, their claims to

developing a true Global Phone with improved carrier switching is quite

distant at this point in time.

Margin compression, Debt, a very Real Lack of Innovation (Share Buybacks

as opposed to CapEx Investment), and Accountants gaming the Future... Unlikely

Apple will ever return to its former Halcyon days as a leading TECH Innovator.

______________________________________________________________________

Instead, APPLE will be the Anchor that drags the NQ to new Lows in 3/5 IT and

then 5/5 for the IT Correction.

5/5 will then take this Overhyped Cult to new ATHs into Q3 of 2022.

From there our price Target remains $35 into 2025.

SOLBTC in Bull Flag - upside PT of 0.023 or $1,587This translates to a PT of nearly $1,500 for 1 SOL token. You can see the flagpole extrapolation in red and then the 2nd half push PT in orange (both align very nicely which suggest we are halfway through our entire flagpole move right now with another half to go).

Last time this happened, SOL moved higher by 724% in 99 days!Just like my last major call in SOL back on August 7th, 2021, here again SOL is at a nexus point where the CC SMA 50 will turn green in the coming weeks. I'm currently projecting that this turns green by beginning of March. Once this occurs, SOL will enter a new impulsive surge higher which will likely be in conjunction with major catalysts such as scaling, mainnet release, NFTs, and DeFi drivers. Star Atlas is a AAA game that is being launched as well on Solana's ecosystem so I expect there to be renewed optimism in the coming weeks as more updates are released. Solana is without a fact the most bullish network atm due to its scaling potential that is happening in front of our eyes. Having the backing of SBF helps quite a lot as well.

See my prior major call on SOL below to see how well that played out. Accumulating here prior to the CC SMA 50 turning green would allow you to make higher returns, but of course you can wait until the signal is confirmed later this month or in early March.

SOL: D & W Hidden Bullish Divergence and Large Wedge FormationSOL is a very strong project with extremely strong fundamentals (user growth, speed, cost) versus competitors. Despite the recent wormhole hack which wasn't an issue of SOL but an issue with a bridge is making headlines, this only provides an opportunity to buy cheaper than normal imho.

SOL will no doubt fix any congestion issues it had in the past as their lead dev devoted an 8 week campaign to bolster the network and solve any issues. These are top programmers from Qualcomm and you can rest assured these sort of programmers are much better than crypto programmers. SOL allows MUCH easier to use programming languages than other rival coins such as ETH which relies solely on Solidity and feedback from top programmers is that Solidity is not easy to use at all. This impact development significantly as the legacy world still has 98% of programmers and if you want your crypto project to grow in the long-run, it's ideal to have the easier programming languages to onboard those 98% to create apps and develop for the best projects.

Lastly, SOL has an asymmetric advantage as it is backed by one of the brightest minds in the space, Sam Bankman-Fried. Sam's pro-regulator clarity stance will make SOL a crowd favorite to overcome any hurdles in the future.

My price targets for SOL are in the mid $400-$500 by mid-year. It sounds lofty but again, SOL is actually onboarding users and is increasing its re-investment into the network and into R&D. It would only infer a $130B market cap which isn't that high compared to what coins like XRP did in the last bull-run in 2017 when there were 10% of the investor pool. XRP achieved $130B market cap in 2017. SOL is about 100x more useful than XRP so as the large wedge formation suggests, SOL's terminal value is likely multi-thousand dollar range. This of course depends on how quickly SOL's programming team develops top products. With SOL Pay just launching on the market a few days ago that provides a direct conversion into USDC upon paying for goods and services, SOL could be at the beginning of yet another impulse wave higher. SOL Pay is a game changer in terms of adoption, and will only quicken major developers to come into the Solana ecosystem, as more of the legacy guys will want to join networks that are headed by legacy programmers.

Lastly, there is strong Hidden Bullish Divergence on the daily and weekly charts - this is a longer term signal that typically plays out over weeks/months.

If you own a big bag of ETH or DOT, it would be wise to diversify a bit into SOL for your long-term bags here.

"OK Google, what is patience?"Since the pop on earnings and the split news I have been watching for a good pullback on Google NASDAQ:GOOG . I am operating under the thesis that the pre-split price action will signal a rally as in other past tech stocks. This rally may take a while because the July 15th split date is relatively far out. For the last several days I have been waiting for the price to come to the 2775 level it must hold to remain bullish to retest and break the high.

FAANG Dead? The NEW Tech Stock Leaders!With the disasterous earnings of Netflix NASDAQ:NFLX and Facebook NASDAQ:FB this past month it may be time to call for a new acronym of the still bullish and strong Tech Stock leaders of the market: Micosoft NASDAQ:MSFT - Apple NASDAQ:AAPL - Google NASDAQ:GOOG - Amazon NASDAQ:AMZN

GOOG - Daily Impulse Failure AheadAlphabet stock @ $3,000 provides entry after the 20:1 Spilt @ $150 - Round Numbers

appear to be favored.

The Daily Impulse will fail, although to can move higher this week, the Gaps will be filled.

If we were to own a FANG it would be GOOG and GOOG Only.

_______________________________________________________________________________

Now is not that entry.

GOOG Alphabet Inc. 20-to-1 Stock SplitRuth Porat, Alphabet CFO: “The reason for the split is it makes our shares more accessible”

Alphabet Inc . 20-to-1 Stock Split on July 15 could lead to Alphabet’s listing on the Dow Jones Industrial Average , the indexs that holds 30 blue-chip companies.

And you all know how appealing were Apple , Tesla and Nvidia for retail investors after the stock splits!

My short term price target is the all time high, $3037.

Looking forward to read your opinion about it!

GOOGLE Stock Split - Big opportunity!Today on earnings NASDAQ:GOOG announced an upcoming 20 to 1 stock split. This is a major news event with a history we can look back on. There are three instances from the last two years (TSLA, AAPL, NVDA) where tech stocks announced splits and then proceeded to FOMO rally. Trade with proper risk controls but look for opportunity NOW in Google!

I talked about this trade last year with Nvidia when that stock did a split. It is the same trade. Check link below:

Alphabet (NASDAQ: $GOOG) Drops Stock Split + Strong Earnings!🤓Alphabet Inc. provides online advertising services in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. The company offers performance and brand advertising services. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube, as well as technical infrastructure and digital content. The Google Cloud segment offers infrastructure and data analytics platforms, collaboration tools, and other services for enterprise customers. The Other Bets segment sells internet and TV services, as well as licensing and research and development services. The company was founded in 1998 and is headquartered in Mountain View, California.

Google forecast for this week!Another 5% decline is highly likely for this week!

Best,

Moshkelgosha

DISCLAIMER

I’m not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA , an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this site are for informational purposes only and do not constitute financial, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using this site, you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this site.

Can the Market Rally without Apple?

In doing my homework - I've trying to determine whether this market can rally in the weeks ahead?

With a 3 Trillion dollar market cap you need $APPL - As matter of fact if you watch Apple trade you can see the S&P 500 move almost exactly the same. Which never ends well on long enough timeline.

I reduced the number of indicators to keep the chart clean. They all say the exact thing - on daily AAPL is a sell. Five shown. Notice the indecision in the green candles - the regime change is underway.

I'm a fan of market and volume profile but sometimes you need a different eye. APPL can retest the highs even reach an All Time High once more - before pulling the rug.

The trendline right beneath price has been tested 3 times. Line drawn by algo BTW. It will break and most likely return to the trendline before this breakout in October 2021.

This takes AAPL to the mid- $140's - not the end of the world, but a huge impact on US equites.

The indicator on the bottom show there is no strength, moreover not shown its also divergent - but it can stay way for a while on a daily chart.

Draw this trendline on your own charts and keep an eye on it. That said a well placed news bomb will most likely make quick work of this trapping longs. Think Evergrande Sept 2021.

Which is funny - that's in the lows 4300's - and where this market will likely return. Ok 4260 - but I'm not argue about days range.

So we'll if they gamma squeeze this AAPL one more time. One way or another Frazier is going down.

Facebook and Google, Netflix all look weak too and look similar on this chart setup. The only one that breaking up is Tesla (shaking head). However TSLA is a casino ticket not the market.

Google: Lower Prices Incoming? Alphabet - Short Term - We look to Sell at 2807.00 (stop at 2861.00)

We look to sell rallies. Previous support level of 2800.00 broken. Trading volume is increasing. The bias is still for lower levels and we look for any gains to be limited. Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 2800.00, resulting in improved risk/reward.

Our profit targets will be 2630.00 and 2460.00

Resistance: 2800.00 / 2900.00 / 3000.00

Support: 2700.00 / 2600.00 / 2500.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.