GOOGL

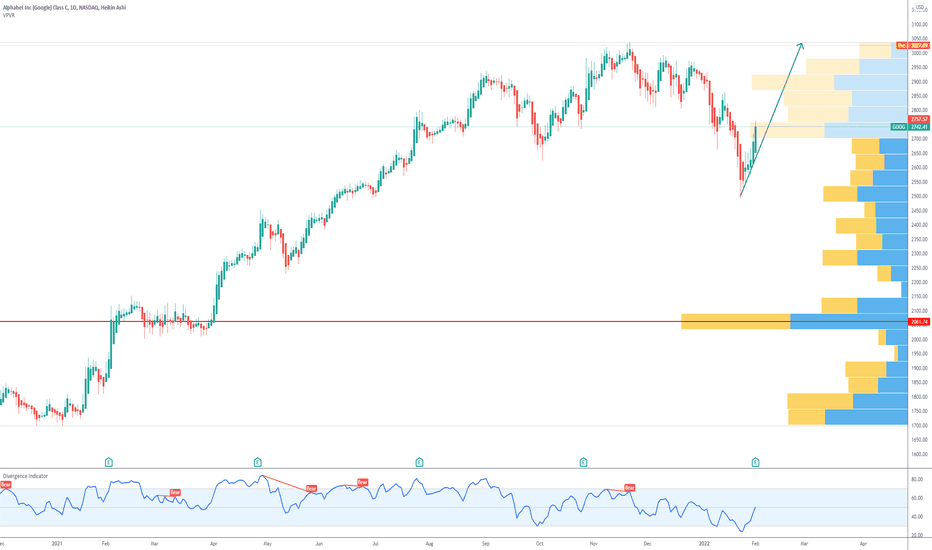

Google: Buy SupportAlphabet - Short Term - We look to Buy at 2511.77 (stop at 2443.90)

Preferred trade is to buy on dips. Previous support located at 2500.00. The medium term bias remains bullish. Although this gives the medium term bias a mild bearish edge, we expect intraday trading to continue to be mixed and volatile.

Our profit targets will be 2719.44 and 2826.06

Resistance: 2700.00 / 2850.00 / 3000.00

Support: 2500.00 / 2400.00 / 2220.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Google getting smaller. GOOGLImmediate targets 2505,2384. Invalidation 3248.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

Google (GOOGL) |The best area to climb🔥Hello traders, Google in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

The waves that we counted are the main waves 1 and 2 and the rest of the waves are related to the microwaves of the main wave 3.

From these microwaves, waves 1 and 2 are over and now we are inside wave 3.

Wave 3 itself forms wave 4 at a lower level.

This wave 4 can be counted as triangles and flats, and both patterns are probably in their last microwave.

It is expected that after one descent, correction and another descent, an upward movement corresponding to a 5 out of 3 out of 3 wave will be formed, and this movement will be confirmed after breaking the upper side of the channel.

But if this channel is broken, the counting will be fielded downwards and an upward movement will take place in another area.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

Alphabet / Google (GOOGL) - DCF Model - Intrinsic ValueThis valuation analysis is based on a base case scenario DCF model.

Google DCF Model Assumptions:

Tax Rate = 16.2%

Discount Rate = 8.4%

Perpetual Growth Rate = 2.0%

EV/EBITDA Multiple = 12.5x

Transaction Date = 05/02/2022

Fiscal Year End = 31/12/2022

Current Price = 2,865.86

Shares Outstanding = 662

Debt = 26,206

Cash = 20,945

Capex = 24,640

Base Case Scenario:

In addition to the above assumptions, the below DCF model is based on our base case scenario, which assumes a revenue growth over the next five years of 18%, 16%, 14%, 13%, 12%. These revenue growth assumptions are slightly below the analysts' forecasts at the time of analysis.

DCF (5Y) EBITDA EXIT MODEL:

Terminal Value

Final Forecast EBITDA (m) = $196,262

EV/EBITDA Multiple = 12.5x

TERMINAL VALUE (m) = $2,453,270

Intrinsic Value:

Enterprise Value (m) = $1,986,779

Plus: Cash (m) = $20,945

Less: Debt (m) = $26,206

Equity Value (m) = $1,981,518

EQUITY VALUE / SHARE = $2,992.69

DCF (5Y) GROWTH EXIT MODEL:

Terminal Value

Final Forecast FCFf (m) = $119,494

Perpetual Growth Rate = 2.0%

TERMINAL VALUE (m) = $1,902,831

Intrinsic Value

Enterprise Value (m) = $1,616,256

Plus: Cash (m) = $20,945

Less: Debt (m) = $26,206

Equity Value (m) = 1,610,995

EQUITY VALUE / SHARE = $2,433.09

DISCLAIMER:

All information and analysis are based on the author's views, opinions, and assumptions at the time of writing. Bull Headed Bear makes no guarantees of the information's reliability and accuracy. The information is to be used for entertainment and informative purposes only. Bull Headed Bear and its authors reserve the right to change their views, opinions and assumptions due to many influencing factors.

Any actions taken based on this information is strictly at your own risk. All investments carry a risk of loss, and you could lose all your money. Consider seeking professional advice from a financial advisor. Bull Headed Bear and its authors will not be liable for any losses or damages from the information here or its website.

DISCLOSURE:

I/we have open long positions in GOOGL. We do not intend on altering this position in the coming weeks.

NASDAQ:GOOGL

GOOGLE STOCK MID TERM ANALYSISGOOGLE, just like virtually every other tech stock has had an outrageous run in 2020-2021, but is showing increased signs of weakness. Trend line is broken on both the weekly and monthly time frames, and technical indicators show bearish divergences across the board. In addition, growing fears of a Russian invasion in Ukraine don't make matters any better. Going short, this is another no brainer to me.

TP 1: $2200

TP 2: $1700

GOOGL: You must watch this KEY POINT closely!Hello traders and investors! Let’s see how GOOGL is doing today!

In the 1h chart, it is a clear bear trend, as it is doing lower highs/lows. However, we have a key point to watch from here: The dashed line at $ 2,754.

This line was a previous resistance before the Monster Gap after earnings, and when GOOGL lost its strength, it worked as a support for the price. This movement follows the Principle of Polarity in Technical Analysis. Yesterday this line was our resistance again, and this is why this is the most important key point to watch.

Only by breaking this line, we would see GOOGL turning bullish again. What’s even more curious, is that when we look at the daily chart, we see two more resistances at the same price of the dashed line in the 1h chart:

Coincidence or not, the 50% retracement, and the 21 ema are both near the $ 2,754 area, making it a powerful resistance, indeed.

As long as GOOGL remains under this key point, nothing new will happen. However, if it does break it, we might see the end of this bearish sentiment on GOOGL, and possibly even a buy sign.

I’ll watch GOOGL closely from now on, and I’ll keep you guys updated on it. So, remember to follow me to not miss any of my future analyses.

Google (GOOGL) |The best area for correction♻️Hello traders, Google in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

The waves that we counted are the main waves 1 and 2 and the rest of the waves are related to the microwaves of the main wave 3.

From these microwaves, waves 1 and 2 are over and now we are inside wave 3.

Wave 3 itself forms Wave 4 at a lower level.

This wave has 4 triangular patterns, which is in its last wave, ie wave e, which has the ability to return from the same range and can even continue this downward movement up to Fibo 0.5.

To confirm further movement, it is necessary to break the current range (price 2660) downwards.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

"OK Google, what is patience?"Since the pop on earnings and the split news I have been watching for a good pullback on Google NASDAQ:GOOG . I am operating under the thesis that the pre-split price action will signal a rally as in other past tech stocks. This rally may take a while because the July 15th split date is relatively far out. For the last several days I have been waiting for the price to come to the 2775 level it must hold to remain bullish to retest and break the high.

FAANG Dead? The NEW Tech Stock Leaders!With the disasterous earnings of Netflix NASDAQ:NFLX and Facebook NASDAQ:FB this past month it may be time to call for a new acronym of the still bullish and strong Tech Stock leaders of the market: Micosoft NASDAQ:MSFT - Apple NASDAQ:AAPL - Google NASDAQ:GOOG - Amazon NASDAQ:AMZN

Google (GOOGL) | The last target to climb🔥Hello traders, Google in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

The waves that we counted are the main waves 1 and 2 and the rest of the waves are related to the microwaves of the main wave 3.

From these microwaves, waves 1 and 2 are over and now we are inside wave 3.

Wave 3 itself forms Wave 4 at a lower level.

According to its current structure, this wave 4 has formed a complex pattern, ie double zigzag, and now the ascent is related to wave 5 from wave 3 to wave 3, and if it is confirmed that it will make another ascent, otherwise it is still inside wave 4 and the structure Wave 4 is a triangular structure that requires a half of the previous wave and a maximum of up to 0.50 Fibonacci to complete the minimum drop.

❤️Please, support this idea with a like and comment!❤️

IS GOOGLE READY TO RECOVER FROM ITS CRASH ?I think that google is long for the moment, the stock could still crash again and go lower but then recover again, we can see that google is a very stable stock and his movements are perturbed by things going in the world these days

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

If you enjoyed this post and agree with me, a like and a sub would be very nice : )

If you have any other ideas or simply disagree, manifest yourself in the comments ⬇️⬇️⬇️

Stay updated for more content

Have a nice Day : ) Bye!

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

GOOGL post earnings and stock split announcementAAPL and TSLA did a stock split in 2020. So I use those to get an idea of what GOOGL can do after it's announcement. AAPL from announcement to stock split went up about 35%, and TSLA went up 80%. I don't know how much GOOGL will go up but I am going to buy bull call verticals for the next several weeks.

GOOG Alphabet Inc. 20-to-1 Stock SplitRuth Porat, Alphabet CFO: “The reason for the split is it makes our shares more accessible”

Alphabet Inc . 20-to-1 Stock Split on July 15 could lead to Alphabet’s listing on the Dow Jones Industrial Average , the indexs that holds 30 blue-chip companies.

And you all know how appealing were Apple , Tesla and Nvidia for retail investors after the stock splits!

My short term price target is the all time high, $3037.

Looking forward to read your opinion about it!

GOOGLE Stock Split - Big opportunity!Today on earnings NASDAQ:GOOG announced an upcoming 20 to 1 stock split. This is a major news event with a history we can look back on. There are three instances from the last two years (TSLA, AAPL, NVDA) where tech stocks announced splits and then proceeded to FOMO rally. Trade with proper risk controls but look for opportunity NOW in Google!

I talked about this trade last year with Nvidia when that stock did a split. It is the same trade. Check link below:

Alphabet (NASDAQ: $GOOG) Drops Stock Split + Strong Earnings!🤓Alphabet Inc. provides online advertising services in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. The company offers performance and brand advertising services. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, such as ads, Android, Chrome, hardware, Google Maps, Google Play, Search, and YouTube, as well as technical infrastructure and digital content. The Google Cloud segment offers infrastructure and data analytics platforms, collaboration tools, and other services for enterprise customers. The Other Bets segment sells internet and TV services, as well as licensing and research and development services. The company was founded in 1998 and is headquartered in Mountain View, California.