GRAB 1W: Two Years of Silence — One Loud BreakoutGRAB 1W: When stocks go quiet for two years just to slap bears across both cheeks

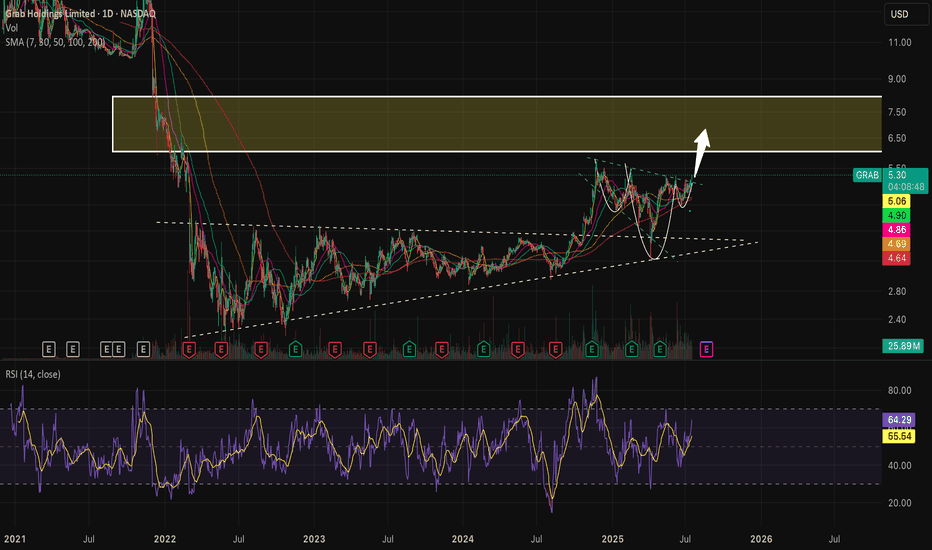

The weekly chart of GRAB shows a textbook long-term accumulation. After spending nearly two years in a range between $2.88 and $4.64, the price is finally compressing into a symmetrical triangle. We’ve already seen a breakout of the descending trendline, a bullish retest, and the golden cross between MA50 and MA200. Volume is rising, and the visible profile shows clear demand with little resistance overhead.

The $4.31–$4.64 zone is key. Holding this level opens the path to $5.73 (1.0 Fibo), $6.51 (1.272), and $7.50 (1.618). The structure is clean, momentum is building, and this accumulation doesn’t smell like retail — it smells institutional.

Fundamentally, GRAB is a leading Southeast Asian tech platform combining ride-hailing, delivery, fintech, and financial services. Yes, it’s still unprofitable (–$485M net loss in 2024), but revenue is growing fast, recently crossing $2.3B. Adjusted EBITDA has been improving steadily, and the company holds $5.5B in cash equivalents with minimal debt — giving it excellent liquidity and expansion flexibility.

Valued at ~$18B, GRAB operates in the world’s fastest-growing digital market, with increasing institutional exposure from players like SoftBank and BlackRock. The 2-year base hints at smart money preparing for the next big move.

Tactical plan:

— Entry: by market

— Targets: $5.73 → $6.51 → $7.50

— Stop: below $4.00 or trendline

If a stock sleeps for 2 years and forms a golden cross — it’s not snoring, it’s preparing for liftoff. The only thing left? Don’t blink when it moves.

Grab

$GRAB ready for the launch to $6-8 range- NASDAQ:GRAB market leader in south east asia with diversified business in a growing economy has massive TAM and strong tailwinds i.e economy of scale.

- it provides you to diversify your portfolio with emerging markets.

- NASDAQ:GRAB was consolidating and now is ready for the impulsive move to its new range of $6-8 where it might consolidate further to challenge the all time highs.

GRAB — Breakout Confirmation and Strong Upside PotentialGrab Holdings (GRAB) is currently forming a promising technical setup supported by a breakout from long-term consolidation. After printing a strong low and breaking out of a multi-year range, the price action confirms a bullish reversal with clear structure.

Technical Analysis

– Trendline breakout and bullish market structure shift

– Price is consolidating above the breakout level, forming a continuation zone

– Valid entries: market execution above $4.50 or limit orders near $4.00 support

– First profit target: $6.60 (around 40% growth)

– Second target: $10.15 (over 100% from entry)

The setup suggests increasing bullish momentum. A clean consolidation above previous resistance strengthens the case for a breakout continuation toward $6.60 and potentially $10.15.

Fundamental Backdrop

Grab is a Southeast Asian tech leader operating across ride-hailing, food delivery, and digital payments. The company continues to reduce losses, improve margins, and expand its fintech arm. With rising digital adoption in the region and a shift toward profitability, GRAB is gaining investor attention. Its most recent earnings report showed improving revenue trends and narrowing net losses — a strong signal of long-term sustainability.

Conclusion

Grab Holdings presents a well-aligned opportunity from both a technical and fundamental perspective. With a clear structure, breakout confirmation, and fundamental turnaround, this setup fits both swing and midterm investment strategies. Risk management is still key — stops should be placed below consolidation lows or key structure levels.

If buyers were to GRAB shares now volume will be the key.Overall uptrend starting from Sept 2024 still intact multiple attempts above 5$ to no avail next is a retest and its looking ripe for a next leg up extension into a higher price range.

Needs more buying volume.. if this doesn't change then price will stay within this range

which its been trapped in this zone since Nov 2024.

Grab Holdings (GRAB) – Turnaround Phase BeginsGrab appears to be entering a clear turnaround phase based on its latest financials. Revenue continues to grow, and more importantly, the company has achieved positive EBITDA and Free Cash Flow (FCF) for the first time in 2024.

Key Highlights

Revenue growth: $675M (2021) → $2.8B (2024 TTM), 4x increase

EBITDA turns positive: from -$1.5B to +$93M

Operating Cash Flow (OCF) turns positive: +$852M

Free Cash Flow (FCF) positive: +$739M

Net debt significantly reduced: $2.18B → $364M

Cash position strong: $2.96B in cash & equivalents

Risks & Watch Points

Net income remains negative: -$105M

Equity is decreasing, potentially limiting future investment flexibility

Highly sensitive to macro risks (pandemic, recession)

Fintech division (GXS Bank) growth may bring credit risk

Grab is expected to begin realizing its profit-generating potential starting this year

The recent weekly candle tested the previous structure and could serve as a key reference point for trading.

Premarket Analysis: GRAB - Grab Holdings LimitedGrab Holdings just rebounded strongly off this $4.05 Support Level that was established back in Oct. 2025 while also releasing news of Grab partnering with Tech Firms to assess ithe mpact of autonomous vehicles in South Asia. With this trade, we will be looking for a $4.50 retest and bounce back to $4.80.

Entering around $4.10-$4.12, anything below that and above $4.05 would provide a potential 15-20% Swing Trade, placing a stop loss at $3.88 to secure our 3:1 Risk Reward Ratio.

$GRAB yourself some GAINS!NASDAQ:GRAB yourself some GAINS!

The longer the base, the higher the space!

Lots of retail and super investors buying this name.

A train that goes in motion stays in motion...

- Wr% is in motion to the Green Support Beam.

Typically, this name would probably pull back with the direction of the Wr%, BUT... this stock is getting hyped up by a lot of super investors and retail investors right now. I think this week we will see a large move upward as HYPE creates FOMO which takes the stock HIGHER!

Staying patient here...

Not financial advice

$GRAB - One of the best DCA opportunity! PT : $7-10- NASDAQ:GRAB is no brainer buy sub $5 and ride it till $7-10

- It's like NYSE:UBER of south east asia.

- If you believe that in upcoming years, income per capita in south east asia will grow then you are investing in the right company!

- This stock provide me diversification outside of US and allows me to capture the network effect of growing economy be it via inflation or actual income per capita.

- NASDAQ:GRAB is blue chip stock for south east asians. Their fund managers, public will likely add it in their retirement savings account.

- Passive inflows alone will lift the market cap of the company.

- NASDAQ:GRAB will be double digits. It's just matter of when!

- This NASDAQ:GRAB isn't a trade for me but an investment. I don't care if it crashes by 30-50% or go up by 30-50% in next 1-2 years.

- I'm looking at a multibagger investment and aim for at least 4-5x from current level.

Ryde's Zero-Commission Model: A Disruptive Shift!!The e-hailing industry thrives on competition, but few have innovated as boldly as Ryde.

Traditionally, e-hailing platforms operate by charging drivers a commission fee on each trip, often ranging from 10% to 25%.

While this provides platforms with a steady revenue stream, it has long been criticised for cutting into drivers’ take-home pay. Ryde’s new model of zero-commission charged on drivers eliminates this commission structure entirely, ensuring they retain the full fare for every ride.

To make this approach viable, Ryde has introduced a nominal platform fee for riders, charging S$0.55 for trips costing S$18 or less, and S$0.76 for rides above S$18. For non-cash payments, a small transaction fee of 1.9% plus S$0.24 is applied. This transparent pricing strategy balances affordability for riders and operational sustainability for the platform.

By adopting this model, Ryde directly addresses a key pain point in the e-hailing industry: the financial strain faced by drivers. Empowering drivers to earn more from their rides not only increases their financial stability but also fosters greater loyalty to the platform. This innovative approach positions Ryde as a driver-friendly alternative, distinguishing it from competitors that rely heavily on commissions to generate revenue.

For riders, the benefits are equally significant. Ryde’s pricing remains competitive despite the introduction of platform fees. Transparency in fare calculations builds trust among passengers, ensuring they know exactly what they are paying for. In an industry where fare structures are often complex and opaque, this clarity enhances the user experience and strengthens Ryde’s reputation as a reliable and ethical service provider.

Now is the time to watch Ryde closely. Its innovative business model has already begun to draw attention, and the potential for growth is significant. The zero-commission structure is likely to increase driver participation, enabling Ryde to expand its services and reach. Furthermore, its ethical and transparent approach builds trust among both drivers and riders, laying a strong foundation for continued success.

Ryde’s decision to embrace innovation and fairness demonstrates its adaptability in a rapidly evolving industry. This willingness to challenge the status quo makes it more than just another e-hailing platform. Ryde represents a shift towards a more equitable future in ride-hailing, one where drivers, riders, and the platform itself can thrive together. In an era where consumers and stakeholders value ethical practices, Ryde is not just a company to watch—it’s a company worth supporting.

Selling Pressure is Over: Ryde Group Ltd. (NYSE: RYDE)Our analysis indicates that the recent selling pressure on Ryde Group Ltd. (NYSE: RYDE) appears to have stabilised. This could signal a potential trend reversal, as evidenced by a flattening Relative Strength Index (RSI), suggesting diminished bearish momentum. Additionally, the Moving Average Convergence Divergence (MACD) is approaching a potential golden cross, further supporting the likelihood of a bullish shift.

If RYDE’s share price holds steady within the $0.600 - $0.620 range, we anticipate a possible rebound towards the resistance levels at $0.650 - $0.700. A successful breach of these levels could close the gap from previous price movements, marking a significant step in the stock’s recovery trajectory.

GRAB stock is close to reaching profitability, might go on sale Future price of GRAB in 5 years could be $11-$22 if earnings keep rising. If we go into recession, the multiple on GRAB stock could fall since its trading 5x sales and near 40x cashflow. Risky stocks often fall to 2-3x sales or near 20x casfhflow, even if they have good growth prospects.

Keep in mind that there is hot geo political tension that could create risk or headlines that create better pricing opportunities.

Note, Grab is still not profitable for this year, and analysts are looking for next year in 2025 for profitability. The business is still not proven, so only small positions would make sense until the we see real earnings and a proven business. There are many more opportunities right now given the recent sell of in stocks.

GRAB - Penny Stock Volatility Based LONG GRAB is a multi-dimensional fintech company serving SouthEast Asia. It does there what DASH

UBER and PYPL do in the US. Like many other or even most penny stocks it has volatility

which is the foundation for swing trading it for good profits. On the 60 minute chart are

the horizontal supply and demand zones as well as dynamic areas of high volume and volatility

as anchored VWAP bands and lines used for analysis that GRAB is now in the area of the

first lower band line and is predicted by the Luxalgo regression forecast to fall into the

demand zone confuent with the second lower band line. For forecast for after a predicted

bounce, GRAB will move higher toward the supply zone on the chart. Accordingly,

I will watch GRAB to fall into the demand zone where it will pick up long buyers such as

myself. I sell set a stop loss at 2.90 and two targets, the first being the mean VWAP level

of 3.2 for a close of 1/3rd of the position and then 3.4 ( first upper VWAP) for a close

of another 1/3rd of the position and finally a target of 3.55 just under the demand zone.

The trade is for a trade of about 15% gain over 1-2 weeks which needs little attention when

alert/ notification price levels are set. This allows for stress free trading without much

effort or screen time.

Liquidity Pools EURUSDHi,

I can see at least two Liquidity Pools on Medium/Higher Time Frame for EURUSD,

and price is likely to seek these. The question is if it will go first below or first up. Instinctively, I usually want to trade upwards or the reversal, but since price short term is already downwards, and thus closer to the lower Liquidity Pool, then perhaps that is the wiser choice, to do a small short if anything.

But there are liquidity pools to the upside, which can give a great reward if it reaches there, and you have traded near these lows.

Have a great day in Jesus' name!

-ThomChris

$UBER - Rising Trend Channel [MID-TERM]🔹Rectangle formation produced a POSITIVE signal at the break through resistance at 29.76.

🔹The target price of 38.72 has been achieved, but the formation continues to indicate a consistent direction.

🔹In case of a NEGATIVE reaction, support at approximately 43.50.

🔹Technically POSITIVE for the medium long term.

Chart Pattern:

◦ DT: Double Top | BEARISH | 🔴

◦ DB: Double Bottom | BULLISH | 🟢

◦ HNS: Head & Shoulder | BEARISH | 🔴

◦ REC: Rectangle | 🔵

◦ iHNS: inverse head & Shoulder | BULLISH | 🟢

Verify it first and believe later.

WavePoint ❤️

GRAB Holdings Options Ahead of EarningsIf you haven`t bought GRAB ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of GRAB Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price in the money calls with

an expiration date of 2023-10-20,

for a premium of approximately $0.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Grab Holdings is your chance for a 10xGrab is the leading superapp in Southeast Asia , providing everyday services such as mobility, deliveries and digital financial services to millions of Southeast Asians. After a long-lasting Downtrend, Grab found a Bottom and formed a Continuation Pattern . If this Pattern breaks to the Upside, mixed with good Fundamentals, the stock could go back in a Range between 10-15 Dollars . On August 23th Grab is publishing their Quarter Results . The Revenue of Grab grew over 100% last Quarter and the loss improved by nearly 80% . This Quarter the could go Breakeven , which could lead to a positive buying Signal for Grab. I will Update you if we got an Outbreak!

Have a nice Day!

GRAB Holdings Options Ahead Of EarningsAnalyzing the options chain of GRAB Holdings prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $0.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

GRAB Holdings Options Ahead Of EarningsLooking at the GRAB Holdings options chain ahead of earnings , I would buy the $3.50 strike price Calls with

2023-3-17 expiration date for about

$0.32 premium.

If the options turn out to be profitable Before the earnings release, I would sell at least 50%.

Looking forward to read your opinion about it.

Grab stock future value in 2031 using crayons and binocularsStocks are businesses. most of them anyways. some are expensive hobbies until the money runs out.

Its a good exercise to value opportunities as you see them. useful to weigh it and make notes in your files.

Maybe not now, but later, your pitch with be thrown, and you might be ready to swing at it.