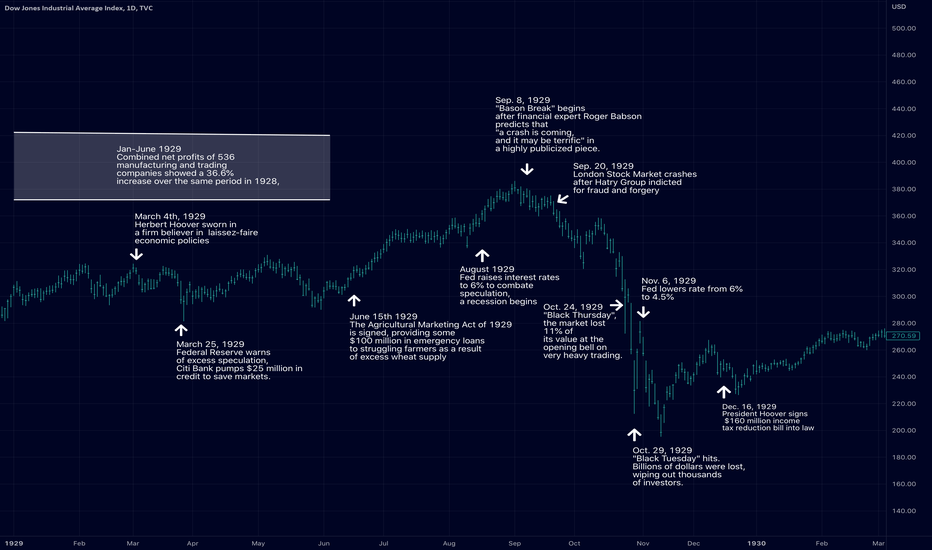

Great Depression 2.0 Starting in 2030?Looking at the Dow Jones, we can see clear cycles forming on this index. I believe we could see one more major run on the Dow between now and 2030, followed by a repeat of the Great Depression. I could easily be wrong, but the charts suggest this is a very real possibility.

So, between now and our potential top in 2030, we have an opportunity to make a significant amount of money in markets like crypto.

As always, stay profitable.

– Dalin Anderson

Great

The 4th TURNING and Davos' GREAT RESETThe 4th Turning is a sociological study of the last 600 years of Wester culture. In it, the authors conclude that society goes through 4 stages culminating in the 4th Turning, a time of chaos and upheaval that ends with the establishment of

a "new order". We are in that period now, and the excessive debt, inflation and political tensions around the world indicate that there is a monumental change coming. Perhaps Davos' GREAT RESET as annunciated by Klaus Schwab, Perhaps something worse. Only time will tell.

💡Don't miss the great Sell opportunity in GBPUSDWe are in a downward channel that we have now reached the top of the channel and we expect more decline. It seems that this decline will continue until 1.35$, and if there are signs of buying in this area, we can think of a good purchase. I will definitely update the analysis by then. I will be happy for you to support me with your likes and comments.

XAUUSD SELL let's gooooooo super hyped for this week prayed before hitting the charts currently listening to clb just vibing but here is what we have on GOLD over here...

• so a downward trendline has been formed on my DAILY and WEEKLY with two touches

• so now market is approaching the trendline so i'll be looking to go SHORT

• once market reaches the trendline i'll be looking for price to respect it by closing below the trendline on the H4 and D1 but then i'll enter based off my H1 where i'll be looking for a bearish confirmation candlestick

• SL will be put just about that resistance level and TP1 will be by the opposing upward trendline

GREAT SUCCESS!!

GBP/CAD Fibonacci Span Tool - Speculation The first three are set to the best of my knowledge of how you use the tool. The last one is speculative because the high in the market is only assumed at this point, in my analysis. It appears the previous lower ranging area broke to the upside. If there is only one previous example & it eventually broke to the north, the probability in the current consolidation is that it will do the same.

EOS CRYPTO BUMP AND RUN PATTERN TO $26!!! +330% OPPORTUNITY!!!EOS Coin's 2hour chart has just shown a Bullish Bump and Run Reversal. EOS has broken above a significant resistance and has recently shown it is a new support in the Throwback To Trendline Phase. With that resistance being flipped, this may indicate that the next technical resistance is to be around 14.91! 14.86 is EOS Coin's yearly high, and with a break of this yearly high, EOS can push 26.01 per coin which is about a +72% increase, and 330% from current areas. OPPORTUNITY IS EVIDENT IN THE PRESENT, BUT IF ONE DOES NOT INCLUDE HIMSELF, HE MAY NEVER SEE! TRUST YOURSELF and HAPPY ROARING 20's! BITFINEX:EOSUSD

IMPORTANT NEWS: Reef Chain Testnet Launching on 31st MarchSAVE THE DATE.

"We're launching the Reef Chain Testnet on 31st March & we're proud to serve as the Gateway to DeFi.

This development marks a major milestone for $REEF and brings us a step closer to our main goal of making DeFi easy."

- REEF Finance, march 23 of 2021

More info at: twitter.com

Reporting of the Reporting? (Jan 1st 2021)Not a metric one would hope keeps exploding upwards, but it will be interesting to see what the USA COVID-19 death reporting looks like over the next year now that 2020 is over with. Hopefully by summer we see these numbers flatten again, but I expect a new surge around August/September 2021 along with the changing of the seasons and weather. These conclusions should be pretty obvious to most.

Expected 2021 EOY USA Cases: 650,000 - 786,000 Deaths

Thanks for tuning in :) Disclaimer, anyone in the trade needs to do their own due diligence and decide what is right for YOU. My charts can be wrong at any time and it's very important that you have your own strategies and plans in place. I run this channel for my own educational purposes of learning to trade, and I will never be 100% right, so please do not let me confirm any bias for you! (Dangerous to do so, stay safe and remember the basics & rules of risk assessment.) Expect the unexpected and happy trading!

Bitcoin versus the Great ResetSo it became obvious that Bitcoin was initially created by the intelligence community to make the population consent to a 'world currency'.

From A to Z, this currency has been manipulated. Most of it is owned by a couple of addresses.

Central banks have shown their interest for crypto since 2017 (that's initially why I got into crypto btw).

They are about to introduce their own stablecoins:

www.ecb.europa.eu

Following this old prediction, and based on the known date of the great reset (spring 2021) :

Here is my analysis.

The US debt is increasing at an unsustainable rate. In the US money is given directly to the population, so they can buy cryptos to try to become rich.

So the collapse of the US dollar is soon. We have had negative interest rates for quite some times. The lockdowns make the implosion inevitable on the short term.

Political instability in the US might lead to a split of the country, destroying its currency. All of these factors point to a collapse of currencies globally for spring 2021 (according to many 'leaks').

We know that stablecoins from countries like China or the EU, will be distributed to the population via a UBI system.

This will start as soon as the collapse happen, to 'feed' the population. Stock markets are correlated to Bitcoin, when they go down bitcoin goes down. Obviously they will go down in spring and so will bitcoin. They can easily bring the value of BTC to zero since they own most of it. People will flock into stablecoins, which at this point will be the offical stablecoins from china, the EU, and maybe the US. But I wouldn't be surprised if only the EU and China get a stablecoin: The states that compose the USA could join the EU (a failed brexit will make the UK rejoin). In an alternative scenario, like in the book 1984, the UK will create a bloc with the remains of the USA, and get its stablecoin.

There is no way that Bitcoin can survive the great reset, it was expandable and created by the elites to make people consent to digital supranational stablecoins. They control it.

Therefore I am expecting the peak of BTC to happen rather soon, before or shortly after spring. I believe it will not go down before the stablecoins are introduced, because the idea is to make people adopt these stablecoins as a safe haven to a falling bitcoin. So if there is a delay in the technical implementation of their coins, I believe BTC will not go down, and this could lead us to 2022, because normally BTC follows a 4 year cycle, so this would have been the default scenario, if we didn't know the date of spring 2021. On a side note the digital euro is officially not supposed to be introduced before mid 2021, so maybe end of 2022 is more accurate.

This means that you should go long BTC until the supranational stablecoins are introduced, then short it. We will experience months of bull market. I believe that they will have to moderate the bull market, to make it last until their coins come into play.

Pound ($GBPUSD) 🔔 | What Wikipedia Cant Tell You About GBP🛑 The pound is showing weakness as it seems to move in lockstep with the broader markets today. Further, economic data is set to come on Friday which should show a contraction in the UK economy due to the lockdowns.

While short term trends are bearish and the COVID fears are ramped up, there is still a case for the bulls due to the overall bullish trend... if the Pound can hold here. Let's take a look at some levels for the bears and bulls.

Support.

The current S1 bullish orderblock cluster is pretty much already lost, but it is none-the-less our primary support (it can still act as support if the bulls rally quickly).

Meanwhile, the S2 bullish orderblock is bound to see a reaction in the likely event that the bulls can't hold the current range S1.

If we do get a reaction at S2 it is possible we will try to retest the current range. This move could have enough momentum to bring back the bull trend, however, we more so would expect a move like that to lead to further correction eventually finding support at the S3 S/R flip and orderblock cluster.

Resistance.

In the unlikely case the bulls can take control back from the bears here, the first point of potential resistance is the R1 bearish S/R flip.

While R1 is notable, a turnaround by the bulls at this point will likely lead to a sustained move higher with the R2 S/R flip acting as resistance before the previous highs at the R3 bearish S/R flip and bearish orderblock are tested.

Summary.

The bears seem to have a pretty clear path to victory here with a wave of COVID and other assorted fears gripping the markets after an extended and bullish run. The Pound seems to be caught up in the whirlwind of chaos sweeping the markets, and this has us favoring the bearish outlook.

The bulls will have to step in quickly to change our minds, although there is still clearly a path forward for them.

Resources: www.dailyfx.com

Hit that 👍 button to show support for the content and help us grow 🐣