OTE: Stock Breathes Again After Romania Exit OTE: Stock Breathes Again After Romania Exit – Strong Support from AXIA – Bullish Rebound from Key Support Zone (TECHNICAL ANALYSIS)

KONSTANTINOS GKOUGKAKIS – July 30, 2025, 07:31

Romania is over, shareholder returns are next. OTE’s strategic exit from the loss-making Romanian mobile market (Telekom Romania Mobile) gives the Group renewed momentum. AXIA Ventures sees clear positive impact on liquidity and OTE’s investment profile.

A Move the Market Was Waiting For

The green light from Romanian authorities for the sale of Telekom Romania Mobile (TKRM) didn’t come as a surprise—but the market reaction revealed how eagerly it was anticipated. For years, OTE was trapped in a challenging investment in Romania. Now, the Group breathes easier, freeing itself from a burden that dragged down cash flows, operations, and stock dynamics.

What AXIA Says – Capital Relief, Liquidity and Shareholder Rewards

AXIA Ventures is clear and direct: the deal will have a positive effect on free cash flow and capital returns to shareholders. AXIA estimates an immediate cash flow benefit of €10 million for 2025, with €20–30 million annually thereafter. At the same time, they foresee a €40–50 million increase in shareholder capital returns, translating to at least a 10% boost in total yield to shareholders for 2025.

Cash Flows Without TKRM – OTE Gets Breathing Room

TKRM was expected to have a negative €70 million cash flow impact in 2025—a figure already baked into OTE’s guidance of €460 million free cash flow, of which €451 million (or 98%) is planned for distribution:

€298 million in dividends

€153 million in share buybacks

With the Romania exit, OTE gains a fresh window for special capital returns beyond what’s already planned. Management has confirmed that any additional net cash benefit from the transaction will be returned to shareholders, reinforcing market confidence.

A Costly Chapter Closes – The Numbers Speak

TKRM came at a high price. In 2024 alone, the subsidiary posted €143 million in losses, adding to a decade-long total exceeding €440 million. Equity was wiped out, and the operation was sustained only by Group funding. While the sale doesn’t command a high price tag, it helps avoid hundreds of millions in future losses and unlocks a tax credit of over €100 million, according to AXIA.

The total estimated benefit stands at €560 million—or €1.39 per share.

Stability and Strategic Clarity

OTE stock needed a catalyst like this. Despite solid fundamentals and international momentum, the uncertainty around TKRM was a drag. Now, the picture is clear:

Strategic cleanup is complete

Focus shifts fully to profitability and Greece

The investment story becomes positive, predictable, and scalable

No surprise that AXIA maintains a “buy” rating with a €19.5 price target. Similarly, NBG Securities sees a 29% upside (targeting €19.8), calling OTE an “ideal pick for defensive portfolios.”

A Two-Step Deal – Vodafone and Digi Split the Assets

The Romanian deal involves two separate transactions:

Digi Communications will acquire TKRM’s prepaid mobile customers, spectrum licenses, and part of the base station infrastructure.

Vodafone Romania will acquire the rest of TKRM’s equity, excluding 7 shares owned by Radiocomunicații.

Final closing is pending approval from ANCOM (Romanian telecom regulator) and is expected within Q3 2025.

The Bigger Picture: OTE on a New Trajectory

The Romania exit is part of a wider strategic transformation. OTE is betting on technological leadership, leveraging the global Telekom brand, and targeted capital returns.

COSMOTE leads with 70% 5G SA coverage and 99% total population reach.

Investments in FTTH, FWA, AI-RAN, and MagentaONE build an integrated digital services ecosystem.

Srini Gopalan’s “un-carrier mindset” strategy signals OTE is no longer playing defense—it's attacking with tech and international scale.

Why Now? Why This Way?

Simple answer: it had to happen. The Romanian mobile venture had failed. Exiting now—while tough at first—paves the way for better capital allocation, higher returns, and strategic clarity.

The market got the message. AXIA confirmed it. And the stock finally took the breather it needed to restart its climb.

OTE Technical Analysis – July 30, 2025

Short-Term Picture: Bullish Reaction from Strong Support Zone

OTE stock shows clear signs of recovery after a period of pressure. Accumulation around €15.00–15.20 created a solid support base, confirmed by Buy signals and strong green volume spikes.

The current price sits at €15.83, posting a +0.44% daily gain, and approaches the critical 0.5 Fibonacci retracement level at €16.12—a key intermediate resistance between the low of €15.02 and the high of €17.89.

Fibonacci Retracement Levels

0.382 at €15.79: already breached (bullish sign)

0.5 at €16.12: immediate resistance

0.618 at €16.45: strong resistance level; a break here could lead to retesting €17.00–17.80

A clean breakout above €16.12 would be a bullish confirmation, targeting €16.80–17.20.

MACD – Momentum Strengthening

The MACD is turning bullish:

MACD Line: -0.0188, rising toward

Signal Line: -0.0884

Histogram: +0.0696, indicating momentum buildup

A bullish crossover is expected soon, reinforcing the positive bias.

RSI – No Overbought Signals, Room to Rise

The RSI is at 59.91, not yet in overbought territory, suggesting room for further gains before any pullback. The RSI-based moving average sits at 45.53, confirming upward momentum.

Exponential Moving Averages (EMA)

EMA 20: €15.50

EMA 50: €15.72

EMA 100: €15.97

EMA 200: €15.93

Price is currently above all major EMAs, reinforcing the bullish scenario. A possible Golden Cross could materialize on the 4-hour chart. Staying above EMA 100 (€15.97) will be key.

Volume – Breakout Confirmed by Strong Demand

Volume surged significantly during the breakout above €15.60, validating buyer interest. Green bars dominate the latest sessions, showing a shift in sentiment and confirming demand.

Momentum with Structure, But Watch Key Zones

OTE’s stock has entered a positive momentum phase, with several technical indicators (MACD, RSI, Fibonacci) pointing to potential continuation. Recent news about the TKRM sale adds fuel.

Still, the €16.12–16.45 zone is critical. A clean breakout on strong volume could lead to a full recovery of June’s losses and pave the way for new 2025 highs.

Greece

Motor Oil Q3 - 9M Performance ReviewMotor Oil has reported its financial results for the first nine months of 2024, revealing a significant drop in net profitability. The company faced pressures due to global energy instability, geopolitical tensions, and a catastrophic fire at its refinery in Kalamaki, Corinth.

Significant Profit Decline

Motor Oil’s financial data showed a 68.9% reduction in net profits, amounting to €224.05 million, down from €717.25 million in the same period of 2023. The third quarter was particularly unfavorable, recording net losses of €137.9 million, offsetting positive performances in the earlier part of the year.

This decline in profitability was attributed to:

Reduced refining margins

Increased operating costs due to the refinery fire

Geopolitical tensions in Eastern Europe and the Middle East, which heightened energy market volatility and disrupted operations

Stable Revenues but Lower EBITDA

Revenue for the nine months reached €9.368 billion, a marginal decline of 6% compared to €9.968 billion in the same period in 2023. However, EBITDA dropped by 34% to €768 million, reflecting lower efficiency in refinery operations and reduced product margins.

Notable changes in product margins:

Jet Fuel margins decreased from $31.6/bbl in Q3 2023 to $15.7/bbl in Q3 2024.

Increased Investments and Negative Cash Flow

Despite challenges, Motor Oil maintained its investment strategy:

Capital expenditures (Capex) rose to €298 million in 2024, compared to €246 million in 2023, underscoring its commitment to clean energy and sustainable development.

However, free cash flows turned negative at -€129 million, a stark contrast to the positive €746 million in 2023. Net debt also increased to €1.836 billion from €1.518 billion at the end of 2023, due to higher investments and liquidity pressures.

Extraordinary Refinery Taxation

The company’s tax obligations have been affected by new policies:

In July 2024, Law 5122/2024 introduced a temporary solidarity contribution of 33% on taxable profits exceeding 20% of the average taxable profits for the 2018-2021 period, as defined by EU Regulation 1854/2022.

The Pillar II Global Tax initiative mandates a 15% minimum tax rate for multinational enterprises with annual revenues above €750 million, effective from January 2024. While this affects Motor Oil’s activities in the UAE, Croatia, and Cyprus, the impact is expected to be minimal.

Dividend Distributions

Motor Oil continues its tradition of rewarding shareholders:

For 2023, a total gross dividend of €199.41 million (€1.80 per share) was approved and distributed in two phases.

An interim dividend of €0.30 per share was declared for 2024, payable on January 3, 2025.

Risk Management and Corporate Governance

Amid geopolitical tensions and economic instability, Motor Oil has strengthened its risk management framework:

Three Lines of Defense Model:

Operational units assess and manage risks.

Risk Management and Compliance Units provide oversight and guidance.

The Internal Audit Unit independently evaluates the system’s effectiveness.

Financial risks, including commodity price, currency exchange, and interest rate fluctuations, are managed using financial derivatives.

Additionally, the company remains committed to transitioning to clean energy and sustainable practices, integrating Environmental, Social, and Governance (ESG) criteria into decision-making processes.

Challenges and Resilience

Motor Oil has faced significant challenges in 2024, including:

Geopolitical tensions in Eastern Europe and the Middle East.

Fluctuations in energy prices and exchange rates.

The decline in Brent crude prices from $87/bbl in Q3 2023 to $80/bbl in Q3 2024.

Recent developments include:

Competition Fine: A €9.2 million fine from the Hellenic Competition Commission, contested by the company.

Fire Incident: A fire on September 17, 2024, reduced refinery capacity to 65-80%. Repairs are underway, with full capacity expected by Q3 2025.

Leadership Changes: Following the passing of Chairman Vardis I. Vardinogiannis, the Board appointed Ioannis V. Vardinogiannis as Chairman and Georgios Prousanidis as Vice Chairman.

Outlook

Motor Oil remains focused on adapting to evolving market conditions, maintaining its resilience and commitment to long-term sustainability and growth. While 2024 has been marked by challenges, the company’s strategic direction and robust risk management frameworks position it for recovery and continued success.

The Risky Strategy of Vassilakis: Aegean’s Profit Decline The Bold but Risky Strategy of Vassilakis: Aegean’s Profit Decline and the Volotea Acquisition

Aegean's nine-month financial results for 2024 confirmed a worrisome trend that had begun to surface on the stock market, revealing a significant deterioration in the company's financials. The 3% drop in revenue and a 23% decline in post-tax profits compared to the same period last year underscore the financial pressure facing the company.

This downward trend is also reflected in Aegean’s stock, which has plummeted by 26.22% over the past six months, showing losses of 13.14% since the start of the year. These developments intensify investor pessimism, with the stock nearing its 52-week low.

Despite these challenges, Aegean made a bold yet potentially risky move by acquiring a 13% stake in Volotea, one of Europe’s top low-cost carriers. This €100 million investment could be seen as Aegean’s attempt to strengthen its position in the European market and increase its international presence. However, given the current negative financial state, the investment appears risky, particularly considering the challenges the company is already facing.

Mr. Vassilakis, Aegean's chairman, continues to pursue investments despite the company’s financial difficulties, a strategy that could lead to further risks. Aegean is facing a decline in efficiency and a serious drop in key financial metrics. Especially concerning is the EBITDA, which dropped by 10%, indicating reduced operational profitability and raising doubts about the long-term viability of this strategy.

The decision to allocate such a large capital amount for an acquisition amid falling profits leaves room for questioning the appropriateness of this move in the current economic climate.

Looking ahead to the year’s end, prospects appear bleak, as the company’s financial trajectory suggests potentially greater losses. The negative growth rate in critical indicators suggests that challenges will persist, casting doubt on the profitability of the Volotea acquisition at this stage.

This acquisition could only be successful if Aegean manages to reverse its negative course and capitalize on its investment in Volotea, but current signs leave little room for optimism. The combination of financial challenges and high acquisition costs may confront Aegean's management with tough decisions.

Key financial results for Aegean for Q3 and the nine months of 2024:

Third Quarter 2024 compared to 2023:

Revenue: €630.8 million (down 3% from €653.6 million in 2023)

EBITDA: €182.3 million (down 20% from €227.9 million in 2023)

Earnings before interest and taxes: €136.1 million (down 27% from €186.2 million in 2023)

Earnings before taxes: €138.8 million (down 18% from €168.8 million in 2023)

Net profit after taxes: €108.3 million (down 19% from €133.6 million in 2023)

Nine Months 2024 compared to 2023:

Revenue: €1,379.9 million (up 4% from €1,331.7 million in 2023)

EBITDA: €329.9 million (down 10% from €367.4 million in 2023)

Earnings before interest and taxes: €199.5 million (down 21% from €253.7 million in 2023)

Earnings before taxes: €170.4 million (down 22% from €217.5 million in 2023)

Net profit after taxes: €132.0 million (down 23% from €170.7 million in 2023)

National Bank of Greece (NBG) - Comprehensive Analysis

In one week from today, the annual general meeting of the shareholders of the National Bank of Greece (NBG) will convene, where, among other matters, they will decide on the distribution of a dividend for the first time in nearly 15 years, amounting to €0.37 (€0.36 net).

NBG is currently attracting investment interest for two main reasons:

Dividend Distribution: Investors are buying the stock to ensure they receive the dividend.

Upcoming Privatization: The privatization is scheduled for the fall.

There is a belief that the stock will recover from the dividend cut-off, as the placement for the remaining 18.39% held by the Hellenic Financial Stability Fund (HFSF) will not take place below €8.

This is considered a safe bet, especially as recent analyses predict the stock price could rise even above €10.

Axia: Raises the target price for the stock to €10.50 from €8.80 previously.

UBS: Boosts the target price to €11.

The analysis of technical indicators and financial data of the National Bank of Greece presents a positive outlook for the current and future trajectory of the stock.

Technical Analysis

Price:

The current price is €8.186. The price has broken above the Fibonacci 0.618 level at €8.124, indicating upward momentum.

Moving Averages (EMA):

EMA 20: €7.967

EMA 50: €7.962

EMA 100: €7.912

EMA 200: €7.653

EMA 20 (€7.968): The price is above the 20-day EMA, indicating short-term upward momentum.

EMA 50 (€7.962): The price is above the 50-day EMA, indicating medium-term upward momentum.

EMA 100 (€7.912): The price is above the 100-day EMA, indicating long-term upward momentum.

EMA 200 (€7.653): The price is above the 200-day EMA, indicating strong overall upward momentum.

Relative Strength Index (RSI):

RSI (14): 64.14, indicating that the stock is in the bullish zone but not yet overbought.

MACD:

Histogram: 0.0244 (positive, indicating upward momentum)

MACD: 0.0325 (MACD line is above the signal line, indicating an upward trend)

Signal: 0.0080

Pivot Points

Support Levels:

S1: €7.778

S2: €7.610

S3: €7.464

Resistance Levels:

R1: €8.128

R2: €8.270

R3: €8.418

Central Pivot Point:

P: €7.940

The price is above the central pivot point (P: €7.940), indicating an upward trend. The price is approaching the first resistance level (R1: €8.128) and has the potential to test higher resistance levels (R2: €8.270 and R3: €8.418).

Conclusion Pivot Points:

Upward Trend: The current price is above the central pivot point, indicating an upward trend in the market.

Support and Resistance Levels:

Immediate support at €7.778 (S1), with further support at €7.610 (S2) and €7.464 (S3) if the price falls.

Immediate resistance at €8.128 (R1), with further resistance at €8.270 (R2) and €8.418 (R3) if the price continues to rise.

Performance Metrics:

1 week: +3.65%

1 month: +4.31%

3 months: +16.47%

6 months: +18.12%

Year to date: +30.17%

1 year: +32.06%

Positive returns for all periods (1 week, 1 month, 3 months, 6 months, year to date, and 1 year) indicate a continuous and steady upward trajectory of the stock. The significant return over the past year (+32.06%) strengthens confidence in its bullish outlook.

Overall Assessment:

Based on the updated technical indicators, the stock of the National Bank of Greece continues to exhibit strong upward momentum.

Specifically:

The stock prices are above all significant moving averages (EMA 20, 50, 100, and 200), indicating a stable upward trend in the short-term, medium-term, and long-term horizons.

The RSI is in a healthy bullish zone (63.90), suggesting that the stock is not overbought and has room for further growth.

The positive MACD histogram and the fact that the MACD line is above the signal line reinforce the stock's bullish outlook.

Conclusion:

The National Bank of Greece appears to be in a solid upward trend based on both technical indicators and financial results. Investors may consider that the stock still has room for growth; however, they should closely monitor technical indicators and financial results to adjust their investment strategies accordingly.

Do it like GreeceStudy the greek economy & politics from the period 1990-2012 and you might find a lot of similarities with that is currently happening in the US. Greece experienced a credit boom from 1990-2008, people however were living above their means. We faced the biggest bubble in Greece's economic history during the 1999 when everybody was playing the stock market! and i mean everybody! i remember my father telling me that the biggest sign he saw that the bubble was about to pop was when his mother in law (late 99) came and told him that she wanted to play the stock market as well! When he asked her why she replied: because the other granny across the street is making money... That was the sing! who the hell was left to buy????

Then the bubble popped together with the .com bubble but people were not selling in the contrary in 2003 they start borrowing and selling their houses,farms whatever they had and played all in! because in their mind and in the media that was the bottom! The ultimate buy the dip!!!then we had the golden age of modern Greece! Various outstanding sports events wins! like the Euro 2004, beating the US Basketball Team, and the cherry on top hosting the Olympic Games of 2004, oh boy euphoria was back in the game and this time for good! We were borrowing more and more money to live a life we could not support! our debt got bigger and bigger but when the 08 housing market popped it was time for us to pay our debts!

You know what happened next! check the graph here (www.capital.gr) but only till 2012 because then we had to recapitalize our banks 4 times so the graph is not representative of the whole market. From a political perspective the 2 biggest political parties left and right had to form a government together in order go through this tough period. Our debt was restructured and taxation went sky high! especially for the middle class who paid the majority of the bill!

How are things now? well we sold almost all our assets to foreign investors/countries for peanuts! we got used after 10 years to a -50% income and prices are something like 100%-200% higher than 2000...

@ECB - We need help! #GR10Y #Greece #ECBDear Mrs Lagarde,

please assign an employee and buy all bonds from Greece.

The divergence must be addressed immediately before the end of the month.

Please also get the state security to find out who is selling their bonds here.

So it does not go on, that here insiders simply sell off before the outstanding bonds are converted into 100 year permanent bonds.

Something like in April 20 must not happened again.

With kind regards

Your personal supervisor

Stefan Bode

Greece 10-year bond nearing ALL-TIME lowsReally, really remarkable to see this.

Remember the Greek/eurozone debt crisis? That's what the big spike is. Now, here we are. Greek bonds are nearing their lowest levels ever.

The only explanation is that people are seeking the safest form of assets in government bonds and Central Banks are becoming more helpful managing debt and supporting their countries.

I share this as an observation that is shaping the world and the economy picture. It also is potentially showing the strength of the Eurozone and the way the countries are coming together. Pay attention to the EURUSD or European assets in these countries. If they are indeed balancing their budget, have their fiscal house in order, and the central banks are willing to support them, Europe could be ready for some more strength.

#GR10Y - #ECB is BANKRUPT Part 1 #Greece #EURUSD @lagarde @ecbIn the short term, the ECB is still holding out against the capital flight from Greek government bonds, but it is powerless against the capital flight out of the euro.

The ECB's new bazooka won't help, Mrs Lagarde.

As you can see in the chart, the candy has been sucked and the trader world can see that too.

Best regards from Hannover (Lower Saxony)

Stefan Bode

#GR10Y - #ECB is BANKRUPT Part 1 #Greece #EURUSD @lagarde @ecb

Gain on GREK's uptrendSince the last few months, powered by the new elected government in Greece, GREK has been recovering. This recovery has to do with greater expectations investors have from the new government. GREK shows a clearly established upternd. A reasonable strategy would be to wait until the current swing is over, reaching the support and then to follow the uptrend.

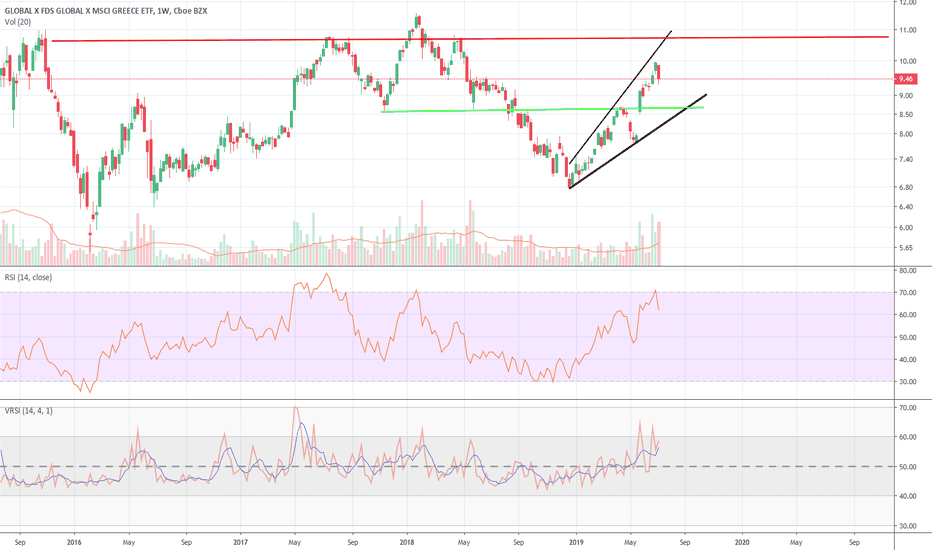

GREK: Greece ETF, potential for +20% profit.GREK has broken upwards in late May following a Golden Cross formation in late April. The last 3 times a Golden Cross took place the ETF rose (on the cross date) by +8.40% once and roughly over +30% twice. Currently it is already up by +8.40% from the Golden Cross occurrence so if it starts breaking higher, we have a confirmation for an additional +20% rise, which puts the upside target at 11.45.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

GrreceCan be described as a bag full of shit, but has been steadily advancing the past months, with elections coming soon...

one of the most bombed out market it as spent 30 months building a long bottom between 0.550-1.074

If the new democracy is elected and say the right words investment could return driving the market higher.

On the other hand this is greece so not expecting much a pull back to support to 90 with a nice cup handle would ideal to jump in with a small position probably sell some at 1,076 which would be a double top.. but if it breaks through to the other side.. them me and Jim Morrisson will be happy-

Long for a 10% gain possibly

Long NBGIFStory : National Bank of Greece announced a Q2 net loss a couple of days ago which sunk it's share price to an almost all time low - with not much downside left (technically), continued reduction of the bad loans in it's books and a perceived improvement in alignment of Greek policies to the EU expectations a bullish case is not hard to build. Furthermore, technicals confirm a good entry level for this trade.

Entry Price : USD 2.15

Stop Loss : USD 1.49 (-31%)

Take Profit : USD 3.5 (+0.62%)

Expected Duration : 1-3 months

GREK LONG ON THIS BAD BOYGet ready ladies and gentlemen, this bad boy is almost at its support, get in set a stop loss just beneath its support line and, it should bounce off. The open interest for jan 20s on this b*tch also looks hella dope. Lets make some f*ucking money :) (can you swear on this site? I dont really want to censor myself) anyways have a great day fellow traders!

Are Brexit fears oversold?Obviously, being smart, sane, savvy and logical traders, we all recognise that there is a monstrous Godzilla formation looming over cable right now. I don't mean some obscure Japanese candlestick formation, but the actual Godzilla, poised to run rampant and squash the UK into smithereens if it votes leave in June.

I would contend that the opposite may be the case.

When the ever entertaining Boris Johnson came out as pro Brexit, there was a mini tumble in cable. Journalists perhaps not that au fait with markets warned that our friend Godzilla was stretching and limbering up for action. Really, it wasn't such a big deal.

The fact is that Boris was expected by many to support the Government line. His declaration was seen by many as a politically motivated direct challenge to Cameron, and call to arms in the race to replace him.

New Labour were able to rule untroubled by the Tories for so long due to the Tories poisonous split over Europe. Over time, Cameron has managed to unite the party, but as the vote runs nearer, its becoming more apparent that the party could get torn apart once again. Boris' decision was the equivalent of setting fire to a bridge, and undermining the Prime Minister very publicly.

As seen with Blair and Brown, handovers can be troublesome affairs and breed instability and uncertainty over policy which genuinely unsettle markets.

The fact that we all need to remember is that markets price information in. People will be watching polls, betting markets, political declarations, corporate decision making and the like for inklings into how the vote will go. Investors and traders will respond to this data long in advance and prepare themselves accordingly.

There will not be a situation where a vote is made and then at 4am when the results are announced, the world jumps up and sells cable.

There may be a short term dip lower, but I suspect that this is an opportunity to get long.

Chart wise, as you can see here from the weekly GBP/USD chart, there is a multi year down trend which at present is running in tandem with the 50W SMA lower. RSE looks uninspiring and set to drift along in the lower half of the range. Slow stochastics have shown an interesting bit of widening which are worth watching. It could be an indication of a push higher if continued, but equally a further cross is an indication of continuation.

The obvious thought is that there is tough resistance ahead and all the fundamental focus is on downside risks. However, as mentioned in my other post, Grexit is a very real possibility this summer , and the issue could overshadow the entire Brexit scenario.

Throughout the ever lasting eurozone debt crisis, the UK and sterling has offered investors a bit of safe haven effect. Should the UK look likely vote to leave we could see a dip to lows around 1.38 (approx), the long term low where I can imagine a boat load of orders sit, before investors pile in on the bid as the Greek situation causes systemic financial instability.... again.

Fakey Breaky...what?The Euro is back under major resistance...was this a fake break out? We are watching closely and looking for opportunities to the short side. if the bulls rally and take out the most recent highs then the squeeze will be on and Euro bears will be jumping off the ship. We want to see a test of the major resistance and sellers to step in. NO TRIGGER, NO TRADE!

Is about to test 1.1 from below - Resistance aheadTowards tomorrow's Greek vote, $EURUSD is about to test 1.1 which is now resistance.

The bearish scenario here is that $EURUSD will be blocked by 1.1 and the fast daily SMA line and continue lower to complete the bullish Gartley.

The bullish move, in case of a breakout, is limited with the 50 SMA line and the downtrend line not to far above the resistance.

EUR/USDBEARS!!! let the siege begin, 1.10429 has been broken and re-tested for a real move down south.Visually you can see my targets, those are logical points in market where the market has been before: individuals and institutions will be looking to push the market to those level before anything else. As you know humans are repetitive that's why the market usually repeats its self over and over again.

$EURUSD - Forget the short term. #Greece WHO?? Long term view!Fundamental have not changed long term.

Don't forget a little thing called QE. Sept 2016!

We started off last month with weak US data but we are slowing see an uptick as predicted.

Personal spending will start rebounding in the next few months which will put the pressure to raise rates.

Job creation should also see an uptick which will lend to September rate hikes.

The human physiological of the market will start pricing in hikes no matter what. As FED is very mums to the when it will actually happen.

Currently the Fed is priced in too Dovish.

Watch for clues in the data and HOLD on for the ride and forget the short term noise!