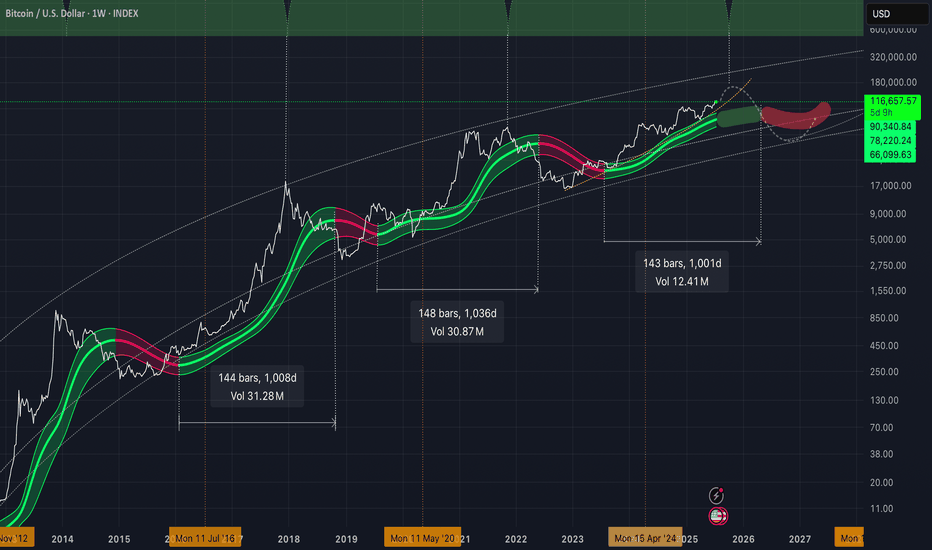

Gaussian suggesting the last leg to the upside!As we approach close to the ~1000 days of bull market conditions above the green GC. Volatility to the upside should be coming before peaking at some point probably in October. Make sure to sell some coins before we get back to the core of the Gaussian. We could be seeing the price tank from 40k-50k later next year. Cheers!

Greed

The Cycles of Cryptocurrencies: Patience is Key!Hey, let's share with beginners, ok =)?

The cryptocurrency market is widely known for its volatility, and understanding the cycles of highs and lows is essential for those looking to invest wisely. These cycles are a natural part of the financial ecosystem and often follow patterns similar to those of other speculative markets.

During moments of high prices, known as “bull runs,” enthusiasm takes over. Headlines boast astronomical gains, investors pour in en masse, and there’s a general feeling that "this time is different." Many beginners end up buying at the peak, driven by the fear of missing out (FOMO).

On the other hand, moments of low prices, or “bear markets,” bring uncertainty and pessimism. Prices plummet, and the same investors who bought during the hype start selling, often out of desperation or lack of understanding of the cycles. It's important to remember that markets have historically recovered, rewarding those who remain calm and patient.

The lesson here is clear: don’t act on impulse. Experienced investors see downturns as opportunities to buy assets at lower prices, while beginners end up selling at a loss—losses that could have been avoided with a long-term strategy.

If you're just starting in the cryptocurrency world, remember: patience is key. Avoid acting emotionally, always educate yourself about the market, and understand that opportunities aren’t lost—they simply change hands. Plan your investments, set clear goals, and above all, don’t panic.

Share! =)

Fighting Emotions: Overcoming Greed and Fear in the MarketThere are moments in life that remain etched in memory forever, dividing it into "before" and "after." For me, that pivotal moment was the fateful day I lost an enormous sum of money—enough to live comfortably for 3–5 years. This loss was not just a financial blow but a deep personal crisis, through which I found the true meaning of trading and life.

When I first embarked on the trading path, success came quickly. My initial trades were profitable, charts followed my forecasts, and my account grew at an incredible pace. Greed subtly crept into my heart, whispering, "Raise the stakes, take more risks—the world is yours." I succumbed to these temptations, ignoring risks and warnings. It felt as if this success would last forever.

But the market is a force of nature that doesn’t tolerate overconfidence. On what seemed like an ordinary day, everything changed. Unexpected news rocked the market, and my positions quickly went into the red. Panic consumed me, and instead of stopping and accepting the losses, I decided to recover them. That mistake cost me everything.

In just a few hours, I lost an amount that could have secured my life for years. I stared at the screen, unable to believe my eyes. My heart was crushed with pain and despair. In that moment, I realized that greed had brought me to the brink of ruin.

After that crash, I was left in an emotional void. Fear became my constant companion. I was afraid to open new positions, afraid even to look at the charts. Every thought about trading filled me with anxiety and regret. I began doubting myself, my abilities, and my chosen path.

But it was in that silence that I started asking myself important questions: How did I end up here? What was driving me? I realized that greed and a lack of discipline were the reasons for my downfall.

Understanding my mistakes, I decided not to give up. I knew I had to change my approach not just to trading but to life as well. I began studying risk management, trading psychology, reading books, and talking to experienced traders.

Key Lessons I Learned:

Acceptance of Responsibility : I stopped blaming the market or external circumstances and took full responsibility for my decisions.

Establishing Clear Rules : I developed a strict trading plan with clear entry and exit criteria.

Emotional Control : I began practicing meditation and relaxation techniques to manage my emotions.

Gradually, I returned to the market, but with a new mindset. Trading was no longer a gambling game for me. I learned to accept losses as part of the process, focusing on long-term stability rather than quick profits.

Risk Diversification : I spread my capital across different instruments and strategies.

Continuous Learning : I invested time in improving my skills and studying new analytical methods.

Community and Support : I found like-minded people with whom I could share experiences and get advice.

That day when I lost everything became the most valuable lesson of my life. I realized that true value lies not in the amount of money in your account but in the wisdom and experience you gain. Greed and fear will always be with us, but we can manage them if we stay mindful and disciplined.

Takeaways for Traders :

Don’t Let Greed Cloud You r Judgment: Set realistic goals and celebrate every step forward.

Fear is a Signal : Use it as an opportunity to reassess your actions and strengthen your strategy.

Risk Management is Your Best Friend : Always control risks and protect your capital.

My journey was filled with pain and suffering, but it was these hardships that made me stronger and wiser. If you are going through difficult times or standing at a crossroads, remember: every failure is an opportunity to start over, armed with experience and knowledge.

Don’t give up. Invest in yourself, learn from your mistakes, and move forward with confidence. Let your path be challenging, for it is through overcoming obstacles that we achieve true success and inner harmony.

Your success begins with you.

If you enjoyed this story, send it a rocket 🚀 and follow to help us build our trading community together.

This One Emotion Could Be Destroying Your Trading ProfitsIn the world of trading, emotions play a pivotal role in shaping decision-making, and one of the most powerful and potentially dangerous emotions traders face is GREED . Greed, when left unchecked, can lead to impulsive decisions, high-risk behaviors, and significant losses. On the flip side, mastering greed and learning to manage it can make you a more disciplined and successful trader. In this article, we will explore what greed in trading looks like, how it affects performance and practical strategies for managing it.

Greed in Trading?

Greed in trading is the overwhelming desire for more – more profits, more wins, more success – often without regard to risk, logic, or a well-structured plan. It can manifest in different ways, such as overtrading, chasing unrealistic returns, holding on to winning positions for too long, or abandoning a proven strategy in the hope of making quick gains.

How Greed Manifests in Trading:

📈Overtrading: A greedy trader may take on far more trades than necessary, often without proper analysis or risk management, simply to increase exposure to potential profits. Overtrading increases transaction costs, dilutes focus, and leads to emotional burnout.

🏃♂️Chasing Profits: Greed can cause traders to chase after price movements, entering trades impulsively based on fear of missing out (FOMO). This often leads to poor entry points, increased risk, and diminished returns.

⚠️Ignoring Risk Management: A greedy trader might ignore risk parameters like stop losses or over-leverage positions, believing they can maximize profits by taking on more risk. This is a dangerous path, as a single market movement in the wrong direction can wipe out large portions of capital.

⏳Failure to Exit: Holding on to winning trades for too long is another sign of greed. Instead of securing profits according to a trading plan, traders might hold positions with the hope that prices will continue to rise indefinitely, only to see their gains evaporate when the market reverses.

How Greed Affects Trading Performance

Greed can distort your decision-making process. It leads to overconfidence and clouds judgment, causing you to believe that the market will always behave in your favor. This overconfidence pushes traders to abandon their strategies or take unnecessary risks, resulting in:

Emotional Trading: The trader begins to react emotionally to every small market movement, making decisions based on feelings rather than rational analysis.

Impaired Risk Management: Greed often blinds traders to the importance of managing risk, which is the backbone of long-term trading success. A single high-risk move inspired by greed can erase months or years of gains.

Missed Opportunities: By focusing on unrealistic gains or trying to squeeze every bit of profit from a trade, a trader may miss more reliable and smaller, but consistent, opportunities.

The Psychology Behind Greed

Greed is rooted in our psychology and is amplified by the very nature of the financial markets. Trading offers the possibility of instant gains, which triggers a dopamine response in the brain, making us feel rewarded. The lure of quick profits encourages traders to take greater risks or deviate from their trading plans in pursuit of bigger wins.

However, the emotional high from successful trades is often short-lived. Traders can become addicted to this feeling, pushing them to take on more trades or stay in positions for longer than they should. Eventually, this leads to bad habits and unsustainable trading practices

How to Manage Greed in Trading

While greed is a natural human emotion, it can be controlled with the right mindset and strategies. Here are some practical ways to manage greed in trading:

1. Set Realistic Goals

The first step in managing greed is setting clear, realistic trading goals. Rather than aiming for massive, one-time profits, focus on steady, consistent returns. Define what "success" looks like for you on a daily, weekly, and monthly basis. Having measurable goals helps anchor your trading behavior and keeps you grounded.

Example: Instead of aiming for a 100% return in a short period, set a more achievable target like 5%-10% monthly. This may not sound as exciting, but it's more sustainable in the long term.

2. Stick to a Trading Plan

A well-defined trading plan is your safeguard against impulsive decisions driven by greed. Your plan should outline entry and exit points, stop-loss levels, and risk-reward ratios. By adhering strictly to your plan, you can resist the temptation to hold on to trades longer than necessary or jump into trades impulsively.

Key elements of a good trading plan include:

-Entry and exit criteria are based on analysis, not emotion

-Risk management rules (like how much to risk per trade, stop-loss settings)

-Profit-taking strategy, deciding when to lock in gains

3. Use Risk Management Techniques

Effective risk management is the antidote to greed. By setting strict risk parameters, you limit the impact of poor decisions driven by emotions. Always use stop-loss orders to protect yourself from significant losses, and never risk more than a small percentage of your trading capital on any single trade (example 1-2%).

Avoid over-leveraging, as leverage amplifies both profits and losses. While it may be tempting to use high leverage to chase bigger gains, it significantly increases the risk of catastrophic losses.

4. Take Profits Regularly

One way to counteract greed is to develop a habit of taking profits regularly. When you set profit targets ahead of time, you can ensure that you lock in gains before they evaporate. Don’t wait for an unrealistic price surge. Exit trades once your profit target is reached, or scale out by selling a portion of your position as the trade progresses.

5. Practice Emotional Awareness

Being aware of your emotional state is crucial in trading. Take the time to self-reflect and recognize when greed is influencing your decisions. Keep a trading journal to track not just your trades, but also your emotions during the process. This will help you identify patterns and emotional triggers that lead to poor decisions.

Example: After a series of winning trades, you may feel overconfident and tempted to take bigger risks. By noting this in your journal, you can remind yourself to remain disciplined and not deviate from your plan.

6. Focus on Long-Term Success

Trading is a marathon, not a sprint. Focus on the long-term process rather than short-term profits. Greed often leads traders to forget that consistent, small gains compound over time. By shifting your mindset to long-term wealth-building, you’re less likely to take excessive risks or engage in reckless behavior.

Greed is a natural emotion in trading, but it can be highly destructive if not managed properly. The key to success lies in discipline, risk management, and a well-structured trading plan that aligns with your goals. By understanding the psychological drivers of greed and taking proactive steps to control it, traders can make more rational decisions, protect their capital, and increase their chances of long-term success.

VIX to $17 Soon for another key trend line resistance test!Ensure you hedge your trades and know your maximum loss and profit, especially if you have limited funds to dollar cost average or are trading options.

For informational and educational purposes only, I prefer buying laddered call options on UVIX (1.5x), VXX (1x), and UVXY (2x) at sub-$13 levels over 2-4 weeks that align with my long "risk on" call expirations. This way, I can sell the pops and use the proceeds to add to my most committed "risk on" positions.

Good luck!

@candlestickninjatv

USDJPY return to meanAs I have said before, vying for 152+ is pure mental illness borne out of greed and brain-to-bull-market replacement.

Times of easy money off longing the dollar are over. CPI has shown this. The only things still up are fuel and rent, and arguably so.

As with anything, zoom out before you get excited and lose money. This is the only PSA I will leave here for a CONSIDERABLE time being.

BTC & ETH - Keep It Simple 📚Hello TradingView Family / Fellow Traders,

~ When in doubt, zoom out!

📰 With all the fundamental news and choppy price action, it is always a good practice to take a break, relax, and look at the big picture.

Last week, both BTC and ETH rejected the upper bound of the channel and resistance zones.

📈 For the bulls to remain in control and take over from a macro perspective in this bull run, we need a weekly candle close above 50k and 3k zones for BTC and ETH, respectively.

📉 Until then, bearish pressure may persist from a medium-term perspective and might initiate a deep correction phase, leading to the lower bound of the channels, at 35k and 2k, respectively, for BTC and ETH.

⏱ Remember:

You Are Getting Paid; To Wait!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

~Richard Nasr

Bitcoin(BTC): Markets Are Extremely Greedy!! Be Careful!!The second day of the week started with some breakouts from $45K, which has been one struggle zone for many days already. Now that we have broken that zone and resulted in another big green candle (which lately has been common), we have entered into the "Extreme Greed" situation with the marekts!

Only based on that index can we assume that we will see a drop, but this is one good additional confirmation for us that we are going to see a nice potential downfall very soon!

Greed and Fear Index: Extremely Greedy / 76

Swallow Team

Bitcoin (BTC): Another Attempt To Break $38K ZoneOn the 4-hour chart for Bitcoin, we've got an interesting setup developing. The price is teasing the upper boundary of an ascending channel, indicating a strong resistance zone around $38K. Despite recent attempts to breakout from this level, BTC is struggling to hold, signalling potential exhaustion among buyers.

With all eyes on the $38K zone, a confirmed break above could invalidate the bearish outlook, potentially triggering a short squeeze due to the recent greed in the market. However, failure to maintain above this level could see BTC slide back down within the channel and possibly test lower support levels, with significant interest around the mid-$30K range.

Swallow Team

Bitcoin(BTC) - Breaking Down From Bullish Channel (Daily Update)Trice is hovering near the 100 EMA and the lower side of the trending channel, suggesting a potential weakness. Despite a recent small bounce, the Fear & Greed Index shows a greedy market, hinting that the bullish sentiment may not hold for long. This scenario, coupled with an overbought market, raises the possibility of a short squeeze or even a continuous movement to lower zones here.

Weekly Candles are in favour for bears and same goes for daily candles, which still remain below $38K and also $40K, which both work as some sort of "physiological resistance."

Swallow Team

BTC/USDT - Markets are GREEDYWith markets being greedy and prices being overbought, we are not seeing much bullish movement here (at least not for long). We are still seeing signs of turnover; the only question is, when?

As the surge of the $40K zone is increasing and it is acting almost like a magnet, there is a chance of having a shorts squeeze near this zone, but as soon as we reach it, we are seeing a really nice drop to come after that.

Swallow Team

Lets make a BottomBounceIndicator today=Step by step annotated=

Today, I am going to try something different. Let's make a Bottom Bounce Indicator. What is a bottom bounce? Bottom Bounce is a move I saw when analyzing a massive drop. The move caught my eye and has become a staple in how I find and catch a falling Knife. I have my weaknesses and demons just like anyone else. I am severely impatient and extremely an emotional creature by nature.

**Fun Fact**

There are two (technically three if you combine them and care about people in general) but for our purposes there are two ways to make a decision in life.

Logical: Everyone has done this before:

You want to buy a new car(substitute with whatever gets the juices flowing).

You go online, you do your research and you come up with these things that are going to be absolute in your buying decision:

Year, Make , Model of vehicle you want

Color, style, package, interior

Must have features as an absolute! Like Sunroof

Dealership you will purchase from (normally closets one because people are lazy and like getting taken advantage of)

Price you will pay.(if they knew the invoice it would be that because people don't need to make profits on things that cost $20k+) “oh, you guys will make it back on someone else” (Because everyone believes they are that one person that is above everyone else and deserves things for free) I=(

Trade value you won't take a penny less for. (because for some reason everyone believes their car is in Great Condition and showcase ready)

Bank they will get their money from or Cash they have to spend(Usually if its cash it's some absurd perfect trade and absolute negative deal that makes the amount of money they have just right.) ;: )

Interest rate they will get

Amount of money they will put down

Years they will finance

**I think that covers most of it*** (boy im really going deep into this scenario….)

Here is where reality sets in…

You show up to the dealership and you tell the sales person you are just looking around. (Because you love being tortured by salesmen and you felt, “ hey I don’t get much free time let's go to the dealership and be harassed by salesman” (sounds about right) Finally, you grace the salesman with the right to show you a vehicle.

You tell them everything above about the car you want.

2024 Lexus RC350 f package White with Red interior $54,072 +++

Emotional Decision:

While on your much deserved test drive you start to take ownership of this finely crafted out of the most premium of premium hand stitched leather seats and steering wheel, wait what's that the shifter also has the same leather on it. And look at that dash it moves when I start the car! Push button Start, and the LEDS! Sunroof, Navi, Surround Sound, and OMG the seats are like Hugging me!

Who cares about Covid and being isolated from people when I can be hugged by this seat! Heated and AC, WHAT! Of course my Honda has it but not like this!

The steering wheel doesn’t even shake at like 100 mph, ok the salesman is scared….let me get a hold of myself.

Trade Details:

Trade: 2020 Honda Accord EXL Black with gray interior

55k miles regular maintenance (obvs right before the major 60k mile checkup)

tires have been changed once.

No Wrecks one owner. New was around $32-34k

4 years old 15k miles ish/yr

The decision:

Location: Local Lexus Dealership inside sitting down looking at numbers…

The mood: Serious

During the test drive you:

Fell in love hard for the vehicle

Fun fact: you can't see the outside from the inside.

Lexus doesn't make cheap interiors so it doesn't matter the color as it looks way better than the “Cord”.

While Driving you started thinking:

You know I got that bonus and haven’t touched it, I could put that down as well.

I mean I could pay another $100 a month for this.

I didn’t think I would like the Blue but I actually love it!

Black is so hot but really they are all hot! As far as interiors go.

If I could finance this through them, maybe I’ll get a rebate or something and then just refinance it with my bank so I don't have to wait and I can drive home today!

Emotional Decisions: replace all logic and throw it out the window, think of it like an extremely efficient Moving company with a crew of like 15 jacked dudes and pull up in an envoy that is reminiscent of a Military Convoy. And literally toss everything you have out the door and windows and load up, take off in less than 15 mins.

Then what happens next is they bring in the Decor team which is made up of like every reality show Fix it and ditch it Home Renovation Show put together and within the next 5 mins they fill your home full of new IDEAS! YAY!

Back at negotiations:

You stand Firm and You tell him with a serious VOICE that you will buy it for 84 months $ 690 with $5k down and that you will take $18k for your trade and not a penny less!

Finance through them for the rebate but really so you can drive home today. Interest Rate: 7.99%

All for the Vehicle you test drove:

2024 Lexus RC350 f package Blue with black interior $53,761++

After a few hours you finally walk out to see your brand New Car and get handed the 3 C’s =

See your Car

See your Keys

See you Later!

And that my friends is how emotion will destroy your logic every time!

By iCantw84it

10.30.23

In 2 days its my bday give me a Bday Gift I love Boosts! Plus they are free, if you found this somewhat entertaining, and educational pls like follow and BOOST! Thanks!

*** btw if you want to know the 3rd way just shoot me a message and a

*** btw if you want to know the 3rd way just shoot me a message and I’ll let you know.

Trading &/or GamblingThe difference between trading and gambling.

This article will shine a light on the most frequent mistakes that traders make. These mistakes blur the thin line between trading and gambling.

Many people have spoken on this topic, but we truly believe that it is still not sufficient, and traders should be better educated on how to avoid gambling behaviour and emotional outbursts. When we speak about trading versus gambling, we define gambling as the act of making irrational, emotional and quick decisions.

Most of the time, these decisions are based on greed, and sometimes fear of the trader. Let’s dive into the exact problems we have personally experienced thousands of times, and want to help others avoid.

1 ♠ Bad Money Management

This is something that everyone has heard at least once, but seems to naively ignore in the hopes that it is not that important .

It is the most important . When a trader enters trades, it is exceptionally alluring to enter with all of their money, or close to all of it. In gambling terms, that is going “All in”, or “All or nothing”.

As a rule of thumb, both traders and gamblers should only place or bet money that they can afford to lose.

Thankfully, at least in trading one can limit their loss for that specific trade, by placing a stop loss or exiting before total liquidation. In Poker, you can’t fold when you are “All in” and take a portion of your money back. However, that does not mean entering trades with full capital, even with a stop-loss, is going to give you exponential returns and feed your greed for profits.

Traders should enter positions with a small amount of their full capital, to limit the damage from losses. Yes, you also limit the possibility that you win a few trades in a row with all of your money and… There goes the greed we mentioned.

The “globally perfect” percent of equity you need to enter trades to reach that balance between being too cautious and too greedy does not exist. There are methods, like the Kelly Criterion, as described in our previous Idea (see related ideas below), that help you optimize your money management.

Always ask yourself, “How much can I afford to lose?”. Aim for a balanced approach. This way you can position yourself within the market for a long and a good time, not just for a few lucky wins. Greedy money management, or lack thereof, ends in liquidations and heartbreak.

2 ♣ The Use of Leverage

Anyone who has tried using leverage, knows how easy it is to lose your position (or full) capital in seconds. Using leverage is mainly sold to retail traders as a tool for them to loan money from the exchange or broker and bet with it. It is extremely profitable for institutions, since it multiplies the fees you pay them ten to one hundred-fold.

In our opinion, leverage isn’t something that should be entirely avoided. However, it should be limited as much as possible.

We cannot deny that using 1-5x leverage can be beneficial for people with small accounts and a thirst for growth, however as the leverage grows, the more of a gambler you become.

We often see people share profits made using 20+ times leverage. Some even use ridiculous leverages within the range of 50-125x.

If you are doing that, do you truly trust your entry so much that you believe the market won’t move 1% against your decision and liquidate you immediately?

At this point, the gambling aspect should be evident, and it goes without saying that you should not touch this “125x Golden Apple”, like Eve in the Garden of Eden. Especially when you see a snake-exchange promote it.

If you use a low amount of leverage, and grow your account to the point where you don’t need it for your personal goals in terms of monetary profit. You should consider stopping the use of it, and at least know you’ll be able to sleep at night.

3 ♥ Always Being In A Position

Always being either long or short leads to addiction and becomes gambling. While we don’t have scientific proof of that, we can give you our own experience as an example. To be a profitable trader, you do not need to always be in a position, or chase every single move on the market.

You need to develop the ability just to sit back and watch, analyse and make conscious decisions. Let the bad opportunities trick someone else, while you patiently wait for all your pre-defined conditions to give you a real signal.

When you think of trading, remember that the market has a trend the minority (around 20-30%) of the time. If you are always in a position, this means that 70-80% of the time you are hoping that something will happen in your favour. That, by definition, is gambling.

Another aspect, that we have experienced a lot, is that while you remain in a position, especially if you have used leverage, you are constantly paying your exchange fees. You can be in a short position for a week and pay daily fees which only damage your equity, and therefore margin ratio. So why not just sit back, be patient and define some concrete rules for entering and exiting?

Avoid risky situations, and let the market bring the profits whenever it decides to.

4 ♦ Chasing Huge Profits

Hold your horses, Warren Buffett. Through blood, sweat and tears, we can promise you that you cannot seriously expect to make 100% every month, no matter what magical backtesting or statistics you are calculating your future fortune on.

Moreover, you will realise that consistently making 2-5% a month is an excellent career for a trader.

Yes, the markets can be good friends for a while, you may stumble into a bull-run and start making double-digit profits from a trade from time to time. Double-digit losses will also follow if you lose your sight in a cloud of euphoria and greed.

Many times, you can follow the “profit is profit” principle, and exit at a small win if the risk of loss is increasing.

5 ♠ Being Sentimental Towards Given Assets

You may have a fondness for Bitcoin and Tesla, and we understand that because we too have our favourites. Perhaps you’re deeply attached to the vision, community and purpose of certain projects. On the flip side, there may be projects that you completely despise and hope their prices plummet to zero.

What you personally like and dislike, should not interfere with your work as a trader. Introducing such strong emotions into your trading will lead you into a loop of irrational decisions. You may find yourself asking, “Why isn’t this price going parabolic with how good the project is?”.

This sounds, from personal experience, quite similar to sitting at a Roulette table and asking: “Why does it keep landing on red when I’ve been constantly betting black? It has to change any moment now”.

First and foremost, you may be completely wrong, but most importantly – it could go parabolic, but trying to predict the exact time or expecting it to happen immediately and placing your “bet” on that is again, gambling.

Don’t get attached to projects when trading. If you are an investor who just wants to hold their shares in an awesome company, or cryptocurrency, that is perfectly fine, hold them as much as you want.

The key is to make an important distinction between trading and investing, and to base your strategy on the hand that the market provides you with.

6 ♣ Putting Your Eggs In One Basket

We all have heard of diversification, but how you approach it is crucial. A trader should always have their capital spread between at least a few assets. Furthermore, the trading strategy for each asset must be distinct, or in other words – they should not rely on the same entry and exit conditions for different assets.

The markets behave differently for each asset, and you cannot be profitable with some magical indicator or strategy with a “one-size-fits-all” style. Divide your trades into different pairs and asset classes, and study each market individually to properly diversify. Manage the equity you put into each trade carefully!

Conclusion

The takeaway we want you as a reader to have from this article is that trading without consciously controlling your emotions inevitably leads to great loss and most importantly, a lot of stress.

We hate stress. Trading and life in general is exponentially harder when you are under stress. Control your risk, sleep easy, and let the market bring you profits.

Reaching this level of Zen will not be easy, but it is inevitable. Be happy when you make a profit, no matter how small or big. A lot of small profits and proper money management complete the vision you have of a successful business. Ultimately, trading is just that – work, not gambling or a pastime activity. Treat it as work and always remember to never rely on luck.

The advice we’ve included here is written by a few experienced gamblers… Oops, I meant traders 😉.

We hope that some of the lessons we’ve had to painstakingly learn through trial and error can now be shared with those who are interested. Of course, none of this constitutes investment advice. It’s merely a friendly heads-up.

The Mind of an Ego Trader – 10 ActionsWe always hear of the two most dangerous states of trading.

Fear and greed.

But I think there is one more state, that really drives a trader to financial collapse.

EGO.

Ego is thinking you’re always right where you ignore risk and caution.

It’s the voice in your head that tells you to make risky choices because you believe you know better.

To overcome being an ego trader, we need to go inside the mind of one.

Let’s start…

Ego traders overtrade

One of the most common pitfalls of ego trading is overtrading.

This is the act of buying and selling markets way more than you should.

They believe that the more they trade, the more profits they will make.

Solution:

Adopt a well-defined trading strategy and stick to it. You need to know how and where to enter your trades with strict risk management.

Remember, quality should always be prioritized over quantity.

Ego traders like to revenge Trade

Ego traders refuse to be wrong.

They’ll take a trade in one direction, bank a loss.

And then immediately get in again, but in the opposite direction – to make up for losses.

Their goal is not to trade well but to recoup any losses ASAP.

This behaviour is often driven by the ego’s inability to accept a loss. And this will drive them crazy until they blow a big portion of their account.

Solution:

Acceptance is key.

Every trader is going to take losses.

You need to take the loss (see it as the cost of trading), and come back the next day.

Take a step back, analyse the situation objectively, and stick to your trading plan.

Ego traders ignore risk management

Egotistical traders think like this.

“I want to grow rich quickly and refuse to only bank 3% to 4% of my portfolio per trade”.

They instead risk 5%, 10% and sometimes go full port.

They have this invincibility complex, that the more money they risk the more likely they’ll build their account quickly.

But this is reckless and your portfolio won’t last long. This will often lead to disproportionate losses.

Solution:

I sound like a parrot by now.

Always adhere to your risk management rules.

Determine your risk tolerance, set risk-reward ratios for your trades, and never risk more than you’re willing to lose on a single trade. You know this!

Dismiss Market Analysis

Ego traders are emotional.

They mainly trust their feelings, their jiminy cricket voices and their instincts over solid and proven market analysis.

This will obviously lead to discretionary trading decisions, which will eventually lead them with no strategy, no discipline, no rules, and no portfolio.

Solution:

Become a trading machine.

Think like a robot and always base your decisions on thorough market analysis.

This includes both technical analysis (price trends, indicators, etc.) and fundamental analysis (economic, financial, and other qualitative and quantitative factors).

Ego traders blame everything

Ego traders often blame the market, their broker, their children, the media, or unexpected news for their losses.

You need to grow up and take on the mature approach. Every financial decision and action you make, is solely your responsibility.

Solution:

Take responsibility for your actions.

Understand that the market is unpredictable and losses are a part of trading.

Don’t trade if you’re feeling distracted,

Don’t trade if you’re feeling you’ll blame something or someone.

Learn from your mistakes and learn to humble yourself before the market does.

Ego trader are trend top and bottom pickers

These are the guys that literally try to ‘predict’ bottoms or tops.

They go against the current trend, and instead guess that the price will turn from here.

They give you every reason why the market will turn.

They know privy info that no one else does (even though all info is in the public domain).

They know strategies and indicators that make these predictions (even though all indicators are based on past data).

They see and feel out of their asses about change in trends.

And when they’re wrong (which most times they are), they find every reason, news event and indicator to guess when the market will turn.

This usually results in entering at a bad price and subsequently facing a huge loss.

Solution:

Leave the tops and bottoms.

Seriously, ignore the first 10% of the bottom. Leave 10% of the top.

Claim the 80% market move when the trend has confirmed and is showing strong momentum.

Enjoy going with the trend not against it.

Ego traders over leverage

It confounds me that traders want more leverage.

They show off about 20 times, 50 times up to 500 times.

You know what that means right?

You can lose 20, 50 or 500 times the money you put in.

Leverage is a double-edged sword.

You desire the big wins and only think of the big wins.

When then you are wrong (and you will be), you end up losing a colossal amount.

Solution:

Use leverage responsibly.

Lower the leverage, the better you can manage your risk and reward management.

Ego traders disregard stop losses

Stop losses are designed to limit a trader’s loss on a position.

However, there are two types of ego traders.

The ones that trade naked (without a stop loss) and the trade goes heavily against them where they lose their hat.

Then there are the ones that put in their stop loss. But then they move their stop loss FURTHER away where they can risk more.

Once this happens, they marry into their trade.

And they’ll keep moving the stop loss away again and again and again and then BOOK.

Gone.

Solution:

First rule – Always set a stop loss.

Second rule – NEVER move your stop loss where you can risk more.

Super important.

Ego traders dismiss discipline

They have major commitment issues.

They choose their days and times.

They trade now and then when they feel like it.

And this dismisses the discipline of taking every trade, one needs to take to build a consistent portfolio.

Solution:

See trading as a business. See trading as a job.

See your trading strategy as your boss.

Work accordingly like your life and livelihood depends on it.

Discipline is key in trading.

Maintain your discipline and eventually it’ll turn into integration.

Then you’re sorted.

Ego traders fail to adapt

The market is constantly changing.

There are always new markets.

There are always new platforms.

There are always new brokers.

There are always new innovations and features.

And yet ego traders, stay put.

You need to learn to adapt to market changes.

You need to constantly update yourself as a trader, your strategy, your watchlist and stay with the times.

With discipline, a clear plan, and a bit of humility, traders can better navigate the markets and improve their chances of success.

Let’s sum up the Mind of an Ego trader so you know how to overcome it.

Ego traders overtrade

Ego traders like to revenge Trade

Ego traders ignore risk management

Dismiss Market Analysis

Ego traders blame everything

Ego trader are trend top and bottom pickers

Ego traders over leverage

Ego traders disregard stop losses

Ego traders dismiss discipline

Ego traders fail to adapt

3 Dangerous States of a Trader“To err is human”

It comes from Alexander Pope’s poem, “An Essay on Criticism.”

This popular saying reminds us that making mistakes and feeling emotions are a common part of the human experience.

In the high-stakes arena of financial trading, most people run their trading through three main emotional states.

You might not be able to eradicate them completely but we can learn to keep them in check for superior trading performance.

Let’s go through these three powerful states.

State #1: Fear in Trading

Fear is the emotional state that:

Stops traders from actioning trades.

Letting losses run (as they refuse to take a loss)

Cutting winners too short (as they don’t want to lose their profits)

When fear dominates, traders may freeze, act too soon, act too late or not act at all.

How to Overcome Fear in Trading

A well-structured trading plan is a trader’s best defense against fear.

You need to think like the market.

You need to trade like the market.

You need to remove fear from your actions.

That’s why you need to limit your risks per trade, where the loss does not affect you emotionally.

You need to be strict with your trading plan, to avoid any discretionary and impulse trading decisions.

And it’s important to start thinking with a more mechanical and rational approach rather than fear-driven ones.

Practice mindfulness and stress management techniques can also keep your fear under control.

State #2: Greed in Trading

Greed drives traders to chase profits.

This often compels them to take on excessive risk for the chance at bigger returns.

They either increase their risk per trade, knowing that the reward will be bigger.

Or because they want more, they will hold onto positions for too long.

Having greed overtake the mind, will also result in overtrading and using up too much of their portfolios per position.

How to Keep Greed at Bay in Trading

Understand that trading is a long-term game.

Consistency with small gains will build up a portfolio.

Be content with 3% – 4% winners. Keep to this and greed will fall away and you’ll have a better chance of longevity when trading.

State #3: Ego in Trading

Ego is one state I never see anyone talk about.

All you hear is fear and greed and greed and fear.

But EGO.

Ego is probably the most stubborn enemy.

“Ego gets you inches but it doesn’t get you impact.” – Cameron Sinclair

It convinces traders that they’re right, even when the market says otherwise.

An inflated ego can lead to overconfidence, over trading, revenge trading and it can cause traders to disregard their strategy, risk and they’ll end up making irrational and dangerous trading decisions.

How to Check Ego in Trading

Even the most successful traders suffer losses.

So you need to humble yourself and adopt amore mindful approach to realistic trading.

Each small loss is a contribution and a trading cost to one step to success.

You’ll also learn more from your losses than your gains. Which will give you an opportunity to learn and improve.

So go back to your trading journal and review, monitor and analyse the true essence of what it takes to build your portfolio.

This will help keep your ego in check.

Conclusion

Fear, greed, and ego are integral parts of the human experience.

But there is NO need and use for it to succeed as a trader.

When you learn to recognise these states and, you’ll be able to manage them better.

And this will drastically improve your trading performance.

Remember, successful trading is less about conquering the market and more about mastering your emotions.

S&P 500 Head & Shoulders on the DailyThe SPY (S&P 500 Index) resembles a quite clear Head & Shoulders Pattern which is generally bearish. The daily candle chart shows a right shoulder forming with a rejection from the $445 area. With this rejection and a continuation downwards, we could see a harder fall if this aligns with the left shoulder and follows the pattern.

The other main indices also follow a similar pattern formation and could follow with a market downturn. Watching that $445 level is key to see a confirmation retest and rejection downwards. Following the lower levels, some price targets would first be the neckline as shown on the chart posted. A break below the neckline could result in a fall of the S&P 500 and if following the complete Head & Shoulders we could be seeing a realistic price target of the $410-$420 area.

Other than technicals fundamentals are definitely quite alright for the market as of now. But maybe a little too alright in my opinion. We have seen a market melt up with interest rates still sky-high resulting in more risk-ON investing rather than investing in CD's or Treasuries offering up to 5.5%.

The Greed being shown in this market is definitely visible and is something to keep note of if we break the neckline. Fear & Panic Selling could most definitely occur in this type of situation especially considering the market rally we've seen this summer.

Seasonally the fall has been quite bearish for the markets overall, and as we head into September & October we could see a similar trend to the past, but nothing is sure.

Lastly, in September / October Student Loan Repayments are resuming which could suck out millions if not billions of dollars from the United States economy as young adults chip away at debt and sacrifice spending on goods & services. This will most definitely be a crucial effect on the economy and could send markets downwards.

Keep an eye out for this pattern to play out... Definitely something to watch as we move in to Fall!

Thanks

Market Psychology and Your Trading Decisions✨ Unlocking the secrets of market psychology is vital for successful trading. Here's why:

🔹 Emotions at Play: Fear, greed, and herd mentality significantly influence your trading choices.

🔹 Rational Thinking: Being aware of market psychology helps you maintain a calm and logical approach to decision-making.

🔹 Trend Spotting: Recognizing market psychology enables you to identify potential market trends and reversals.

🔹 Tackling Biases: Self-assessment must consider three biases:

1️⃣ Confirmation Bias: Avoid favoring information that confirms pre-existing beliefs.

2️⃣ Overconfidence Bias (Dunning-Kruger Effect): Beware of overestimating your abilities as a novice trader.

3️⃣ Loss Aversion Bias: Recognize the inclination to avoid losses more than seeking gains.

🔹 Prospect Theory: Understand how prospect theory shapes decision-making, where individuals take risks to evade losses rather than pursue equivalent gains.

🔹 Stay Informed: Stay updated with market news to avoid impulsive reactions to short-term fluctuations.

🔹 Empower Your Trades: An understanding of market psychology empowers you to make informed and rational trading decisions.

✨ Harness the power of market psychology for long-term trading success! 📈💪

Unleashing the Power of Sentiment Indicators in TradingChapter 1: Introduction to Sentiment Indicators

In the world of trading and investment, understanding market sentiment is essential for making informed decisions. Market sentiment refers to the overall attitude, emotions, and opinions of market participants towards a particular financial instrument, sector, or the market as a whole. It is a key factor that influences price movements and can provide valuable insights for traders.

The role of emotions in trading is also crucial. Emotions such as fear, greed, optimism, and pessimism can significantly impact trading decisions and market behavior. Understanding and analyzing these emotions can help traders gauge market sentiment and identify potential trading opportunities.

Sentiment analysis is the approach used to measure and quantify market sentiment. It involves extracting subjective information from various sources such as social media, news articles, and options markets to determine the prevailing sentiment. The goal is to understand and interpret the collective emotions of market participants.

Sentiment indicators play a vital role in sentiment analysis. These indicators are tools and metrics that provide quantifiable measures of market sentiment. By incorporating sentiment indicators into their analysis, traders can gain a deeper understanding of market psychology and make more informed trading decisions.

In the following chapters, we will explore different types of sentiment indicators and their applications in trading. We will delve into social media sentiment analysis, news sentiment analysis, options market sentiment, and more. Through real-life case studies and examples, we will demonstrate how traders can effectively leverage sentiment indicators to enhance their trading strategies and navigate the markets with greater confidence.

So let's dive into the exciting world of sentiment indicators and discover how they can empower traders to make smarter trading decisions in various market conditions.

Chapter 2: Social Media Sentiment Analysis

Social media has become a powerful platform for expressing opinions and sharing information, making it an invaluable source for understanding market sentiment. Platforms such as Twitter, Facebook, and Reddit provide real-time insights into the thoughts and emotions of a wide range of market participants.

Traders can harness the power of social media by analyzing sentiment expressed in posts, comments, and discussions related to financial instruments or markets. This can be done through the use of sentiment analysis tools and platforms. These tools employ natural language processing and machine learning algorithms to analyze and quantify sentiment.

When analyzing social media sentiment, it is crucial to identify the influential platforms for each specific market. Different financial instruments and markets have unique social media platforms where participants share their views and opinions. For example, Twitter might be the primary platform for discussions related to cryptocurrencies, while LinkedIn could be more relevant for the stock market. By focusing on the platforms that hold more influence, traders can gain more accurate insights into market sentiment.

Real-time sentiment analysis of social media involves monitoring conversations, identifying relevant keywords, and applying sentiment analysis algorithms. This process enables traders to gauge the sentiment as positive, negative, or neutral. By tracking sentiment shifts in real-time, traders can make timely trading decisions and take advantage of emerging trends or sentiment-driven price movements.

To illustrate the effectiveness of social media sentiment analysis, let's explore some case studies. In one example, a trader monitors sentiment on Twitter for a particular cryptocurrency. By analyzing the sentiment expressed in tweets, the trader identifies a surge in positive sentiment accompanied by an increase in trading volume. This information serves as a signal to enter a long position, anticipating a price increase driven by bullish sentiment. The trader successfully profits from the sentiment-driven rally.

In another case, a trader uses sentiment analysis of social media discussions to identify a sudden increase in negative sentiment towards a stock. Recognizing this shift in sentiment, the trader decides to exit their position or tighten their stop-loss level to protect their profits, anticipating a potential price decline. This proactive risk management based on sentiment analysis helps the trader avoid potential losses.

By incorporating social media sentiment analysis into their trading strategies, traders can gain a deeper understanding of market sentiment and improve their decision-making process. However, it is important to remember that social media sentiment analysis should be used as one piece of the puzzle alongside other forms of analysis to build a comprehensive trading strategy.

Chapter 3: News Sentiment Analysis

News plays a significant role in shaping market sentiment. Positive news such as strong earnings reports, positive economic indicators, or favorable regulatory developments can create a bullish sentiment, leading to increased buying interest. Conversely, negative news such as poor economic data, geopolitical tensions, or negative corporate announcements can generate a bearish sentiment, resulting in selling pressure.

News sentiment analysis involves analyzing the sentiment expressed in news articles, press releases, and other sources of financial news. The goal is to extract the overall sentiment conveyed by the news and understand its potential impact on market sentiment and price movements.

There are various tools and techniques available for news sentiment analysis. These tools employ natural language processing and machine learning algorithms to analyze the sentiment of individual news pieces. They assign sentiment scores, such as positive, negative, or neutral, to quantify the sentiment expressed in the news.

Financial news headlines are particularly important as they often convey the key sentiment of an article. Traders can focus on analyzing sentiment in news headlines to quickly gauge the overall sentiment without delving into the complete article. This allows for efficient scanning of multiple news sources and provides traders with timely insights into market sentiment.

Incorporating news sentiment analysis into trading strategies can be done in several ways. Traders can use sentiment-triggered trade entries, where they initiate trades based on significant shifts in news sentiment. For example, a trader might enter a long position in response to overwhelmingly positive news sentiment regarding a particular stock, anticipating a price increase. Alternatively, news sentiment can serve as a confirming factor for technical analysis. If technical indicators suggest a bullish trend, positive news sentiment can provide additional confidence in the trade.

Let's examine a case study to further illustrate the application of news sentiment analysis. Suppose a trader is analyzing the sentiment surrounding a company's earnings announcement. Through news sentiment analysis, the trader identifies a strong positive sentiment across various financial news sources. This positive sentiment indicates high market expectations for the company's earnings results. Based on this analysis, the trader decides to enter a long position before the earnings release, anticipating a favorable outcome. When the company exceeds expectations and reports stellar earnings, the positive sentiment is reinforced, resulting in a significant price increase. The trader profits from the sentiment-driven rally by making a well-timed trade based on news sentiment analysis.

Chapter 4: Options Market Sentiment

Options trading provides valuable insights into market sentiment as it reflects investors' expectations and sentiment towards the underlying asset. By analyzing options market sentiment, traders can gain a deeper understanding of market sentiment and potential price movements.

One commonly used sentiment indicator in options trading is the put/call ratio. The put/call ratio compares the volume of put options, which give traders the right to sell an asset, to the volume of call options, which give traders the right to buy an asset. A high put/call ratio suggests bearish sentiment, indicating that more traders are betting on a price decline. Conversely, a low put/call ratio indicates bullish sentiment, with more traders anticipating a price increase.

Another important indicator is implied volatility. Implied volatility is derived from options prices and reflects the market's expectation of future price volatility. Higher implied volatility suggests increased market uncertainty and potentially heightened bearish sentiment, while lower implied volatility indicates lower expected volatility and potential bullish sentiment.

Traders can also analyze options-related metrics such as open interest, the skew index, and the volatility skew to gauge market sentiment. Open interest represents the total number of outstanding options contracts, providing insights into trader positioning and sentiment. The skew index measures the perceived risk of extreme price moves, while the volatility skew indicates the difference in implied volatility between options with different strike prices.

To illustrate the application of options market sentiment, let's consider a case study. Suppose a trader observes a high put/call ratio in a particular stock, indicating bearish sentiment. This signals a potential price decline. The trader combines this information with other technical indicators pointing towards a bearish trend and decides to enter a short position. As the market sentiment unfolds, the stock experiences a significant price drop, validating the initial bearish sentiment and resulting in a profitable trade for the trader.

Chapter 5: Fear and Greed Index

The Fear and Greed Index is a sentiment indicator that measures market sentiment on a scale of extreme fear to extreme greed. It combines various factors, such as stock price momentum, market volatility, junk bond demand, and safe-haven flows, to gauge overall market sentiment.

The components and calculation of the Fear and Greed Index can vary, but the index generally assigns a numerical value or category to represent the prevailing sentiment. Extreme fear levels suggest a highly pessimistic sentiment, often associated with market downturns or significant price declines. On the other hand, extreme greed levels indicate excessive optimism and potentially overbought conditions, signaling a potential market correction.

Traders can incorporate the Fear and Greed Index into their trading strategies in several ways. It can serve as a confirming factor for technical analysis, where extreme fear or greed levels align with other indicators pointing towards a potential trend reversal. Additionally, contrarian traders may use extreme sentiment levels as a signal to consider taking opposite positions, capitalizing on potential market reversals.

Let's explore a case study to demonstrate the practical application of the Fear and Greed Index. Suppose the Fear and Greed Index reaches an extreme greed level, indicating excessive optimism and potentially overbought conditions in the market. A trader who closely monitors the index recognizes this as a warning sign and starts analyzing other technical indicators. They observe overextended price levels, declining trading volume, and bearish divergence on oscillators. Taking all these factors into consideration, the trader decides to exit their long positions or initiate short positions, anticipating a potential market correction. As the market sentiment shifts from extreme greed to fear, the market experiences a significant decline, validating the trader's decision and resulting in profitable trades.

Chapter 6: Conclusion and Future Outlook

In conclusion, sentiment indicators provide valuable insights into market psychology and can significantly enhance trading decisions. By understanding market sentiment through sentiment analysis tools, traders can gain an edge in their strategies. Social media sentiment analysis allows traders to tap into the real-time opinions and emotions of market participants, while news sentiment analysis helps traders assess the impact of news events on market sentiment. Options market sentiment and sentiment indicators such as the Fear and Greed Index provide additional perspectives on investor expectations and sentiment towards the market.

As technology and data analysis techniques continue to advance, sentiment analysis is expected to evolve further. Integration of artificial intelligence and machine learning algorithms can enhance sentiment predictions and improve the accuracy of sentiment analysis tools. This will empower traders with even more robust insights into market sentiment.

To harness the power of sentiment indicators effectively, it is essential to integrate them with other forms of analysis, such as technical analysis and fundamental analysis. By combining multiple perspectives, traders can make well-informed trading decisions and increase their chances of success.

In the ever-changing landscape of financial markets, sentiment indicators will continue to play a crucial role in understanding market dynamics. By staying abreast of emerging trends and advancements in sentiment analysis, traders can adapt their strategies and stay ahead of the curve. Ultimately, by leveraging sentiment indicators, traders can enhance their trading success and capitalize on market opportunities.

FaceBook (META) - Long-Term Approach to Big Gains.Hello All,

As we can see Facebook (Meta) has sold off almost 50%. On a fear and greed chart, we would be entering the fear stage which is now presenting us with good long-term buying opportunities. In the chart we labeled three areas to start Dollar Cost Averaging back into Facebook (META). In the first area, we would allocate the smallest portion while the final area would be a larger portion.

This is for long-term holding and not trading.

The markets are extremely uncertain currently. At the end of last year, we have sent warnings to get out of the tech sector, due to high levels of greed and overextended markets propped up by money printing, new investors & news narratives. Now that these stocks are coming back to earth we are presented with new long-term opportunities over the coming months.

MILLIONARES ARE MADE IN THE BEAR MARKETS! 🐻Hello Team this is for long-term investing ONLY!

As we enter MAX PAIN ZONES that we warned of on May 21, 2021, & on our Socials make sure to keep your psychology straight.

- Remember one thing: "Millionaires are made in the bear markets." meaning this is the time to start planting seeds. -

The Lower we go the Better:

Looking at Bitcoin from a macro view of a long-term holder we have started to enter the top of the accumulation zone. Bitcoin can continue lower down towards 10-15K, along the way is a great time to start adding to your Bitcoin & Crypto positions. Bear markets tend to last a long-time with a lot of price volatility and sideways movement.

Our Strategy:

1) Have a HODL portfolio with some positions you believe in (BTC/ETH & Some main alts) that you never sell & keep on the Blockchain.

2) Swing positions that you enter during the bear markets & exit during the bull markets. These usually consist of speculative alt-coins.

3) Trading account. This is the account you use the scalp/swing trade the markets on the daily basis.

4) THE HEDGES against the markets. You know what they are :)

Remember Crypto is still highly speculative do NOT put your lifesaving in DEFI or any Crypto. Only invest what you can afford to lose... there were many lessons in this crypto cycle.

Wish you all the best! Be ready for more MAX PAIN and do not fear. Following us, you were well prepared for this outcome and played it perfectly! Have cash reserves ready and plant small seeds along the way.

Humans are not perfect- Very Basically SOPR (Spent Output Profit Ratio) measures the price bought versus price sold. ( but it's more complex than that )

- Negative SOPR typically means people are selling for a loss. ( red dotted Lines columns )

- Positive SOPR typically means people are selling for a win. ( Blue dotted Lines colums )

- So what we can notice and deduct from this graph ?

- Simply that we are not perfect.

- The Fear and The Greed.

- We scare when the price goes up too much.

- We fear when the price goes down too much.

- Most of the time we sell to early.

- Most of the time we sell when it's time to buy.

"Human being is the fact to be imperfect anyway"

Happy Tr4Ding !

Google Earnings tomorrow. Google is near resistance but could push up a bit to tage and test the breakout trendline.

The Fear and Greed index has now been trading in the fear side for 2 weeks.

Usually prolonged trading in the Fear range foreshadows a near term downward pressure. What makes this intersting is the Fear index range was just tagged on the monthly & Daily time frame.