Plug Power (PLUG): Recovery Play or Terminal Decline?Plug Power Inc. (PLUG) , a company focused on green hydrogen and fuel cell technologies, stands as one of the most emblematic examples of a boom and bust cycle in the speculative clean energy sector.

It reached an all-time high of USD 75.49 in January 2021 , driven by market enthusiasm over the energy transition. However, since then, the stock has collapsed by more than 99% , hitting a low of USD 0.69 on May 16, 2025 . It currently trades below USD 2, reflecting a massive loss in market capitalization and deep investor distrust.

🧮 Fundamental Analysis

1. Business Model

Plug Power develops integrated systems for the generation, storage, and distribution of green hydrogen, mainly targeting logistics, mobility, and high-energy industrial sectors.

2. Financial Issues

Persistent losses: the company has been unprofitable for years. In 2024, it posted a net loss of over USD 700 million.

High operating costs and poor efficiency in hydrogen project execution.

Accounting concerns: the SEC flagged accounting issues in 2021 and 2022, further damaging institutional confidence.

3. Capital Dilution

Plug has repeatedly financed its operations through equity offerings, significantly diluting shareholders. Recent rounds were issued at very low prices, worsening the drop in share value.

4. Cash Position

As of June 2025, the company requires new capital to continue operations, facing the risk of issuing more shares or convertible debt under unfavorable terms.

⚠️ Key Risks

Delisting risk if the stock doesn’t remain above USD 1.00 in the short term.

Bankruptcy risk (Chapter 11) if no strategic financing or partnerships are secured.

The green hydrogen sector is still not cost-competitive without subsidies, and competition is fierce (Air Liquide, Linde, Bloom Energy, etc.).

✅ Opportunities

Potential to secure strategic alliances with utilities, automakers, or industrial partners.

Ongoing green subsidies from the U.S. and EU may offer short-term support.

Much of the negative outlook seems already priced in: current market cap is around USD 1.8 billion, with physical assets and contracts still in place.

📉 Technical Analysis

From its all-time low of USD 0.69, PLUG staged a strong rebound, gaining +294% to reach USD 2.03 on July 21, 2025 . It now trades in a consolidation zone between the 23.6% (USD 1.71) and 38.2% (USD 1.52) Fibonacci retracements , which may act as short-term technical support.

This is a high-risk, high-volatility stock , capable of generating outsized returns — or total losses. Strict risk management is essential.

Repeated Rejections at the 200-EMA

The 200-day exponential moving average (EMA 200) has acted as a dynamic resistance throughout PLUG’s multi-year downtrend. Over the past three years, the stock has attempted to break above it on at least three occasions — in 2022, 2023, and 2025 — but failed each time.

The most recent attempt, in July 2025, ended with a reversal after reaching USD 2.10, which also coincides with the 23.6% Fibonacci retracement from the all-time high. Unless the stock breaks above the 200-EMA with strong volume and an ascending price structure, the bearish trend remains intact.

🧠 Speculative Position

We are currently positioned with a bullish options strategy targeting a speculative upside:

📈 Buy CALL USD 2.00 (exp. January 16, 2026)

🛡️ Sell CALL USD 5.00 (same expiration)

→ This forms a Bull Call Spread, limiting downside risk while maintaining a favorable risk/reward ratio.

🧾 Conclusion

Plug Power is no longer a fundamentally sound investment , but rather a high-risk speculative play , comparable to a synthetic long-term call option . If the company survives, restructures its balance sheet, and secures strategic partners, the upside could be substantial — but the risk of total capital loss remains very real .

🧭 Suitable only for experienced traders with speculative capital and disciplined technical execution.

Greenenergy

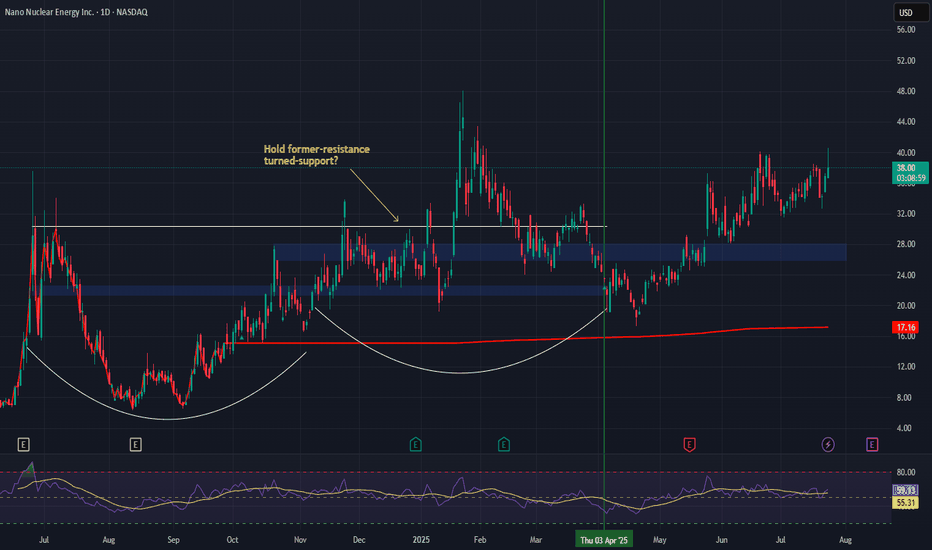

Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

Green Plains | GPRE | Long at $4.18Green Plains NASDAQ:GPRE , a company involved in the production of fuel-grade ethanol and corn oil, and grain handling/storage has seen a significant decline in stock price since 2023. Analyzing the company's historical stock performance shows it is highly cyclical and goes through "boom and bust" cycles every 4-8 years - whereby during booms the price has typically 10x'ed from the lows. History may not repeat, though.

From a pure technical analysis perspective, the company has already entered and slightly exited by "crash" simple moving average zone (green lines). While the lows may not be in yet, this zone (currently between $1.20 and $3.30) typically represents a longer-term bounce area or price consolidation.

Fundamentally, the company is currently unprofitable but expected to become profitable in 2026 and beyond. Debt-to-equity = 0.72x (low/moderate). Price-to-book = 0.31x. During the most recent earnings call, Chief Legal and Administration Officer at Green Plains noted the company’s past performance has not met expectations, but stressed “that is changing.” This includes exiting non-core operations and launching the sale of non-strategic assets in a commitment to achieve $50 million in cost reductions. The company is on track to meet that goal and has already achieved $30 million in annualized cost savings.

It's a speculative play that could go to $0. But at $4.18, NASDAQ:GPRE is in a personal buy zone based on technical analysis as well as future fundamental predictions (which could be BS...).

Targets:

$6.00

$8.00

Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by acquiring an additional 650,000 shares. This decisive investment, following an earlier purchase, clearly signals robust conviction in Plug Power's future growth trajectory, despite prior market challenges. Analysts also reflect this cautious optimism, with an average one-year price target that suggests a significant upside potential from the current valuation.

A major catalyst for the renewed interest stems from Plug Power's expanded strategic collaboration with Allied Green Ammonia (AGA). This partnership includes a new 2-gigawatt (GW) electrolyzer project in Uzbekistan, part of a substantial $5.5 billion green chemical production facility. This facility will produce sustainable aviation fuel, green urea, and green diesel, positioning Plug Power's technology as foundational to large-scale decarbonization efforts. This initiative, backed by the Government of Uzbekistan, further solidifies a broader 5 GW partnership between Plug Power and AGA across two continents, highlighting the company's capability to deliver industrial-scale green hydrogen solutions.

While these strategic wins are promising, Plug Power continues to navigate financial headwinds. The company has faced recent revenue declines and currently reports significant annual losses and cash burn. To address capital needs, it is seeking shareholder approval to issue more shares. However, the substantial, multi-gigawatt contracts secured, particularly with Allied Green, underscore a strong future revenue pipeline. These projects affirm the critical demand for Plug Power's technology and its pivotal role in the evolving green hydrogen economy, emphasizing that the successful execution of these large-scale ventures will be key to long-term financial stability and sustained growth.

First Majestic Silver Corp. (AG) – Shining Bright in 2025 Company Snapshot:

First Majestic NYSE:AG is emerging as a top-tier silver producer, with a strong focus on sustainable mining and community alignment. Operational discipline, paired with rising commodity prices and robust ESG scores, positions AG for long-term upside.

Key Catalysts:

Record Silver Output 📈

Q1 2025: 3.7M ounces of silver, up 88% YoY

Operational turnaround across four Mexican mines driving momentum

Efficiency gains enhance margins as silver prices rally

Silver Market Tailwinds ⚡

Rising demand for silver in green energy, EVs, and inflation hedging

AG is well-leveraged to price appreciation with a pure-play silver exposure

ESG Excellence 🌍

Ranked in top 20% of global miners by ISS

Strong ratings from S&P, Sustainalytics, and LSEG

$1.2M in community investments = 89% drop in local complaints—a key to operational stability

Strategic Appeal to ESG Investors 📊

Increasing alignment with institutional mandates for sustainable resource extraction

Low controversy score enhances potential for index inclusion and fund flows

Investment Outlook:

✅ Bullish Above: $5.75–$6.00

🚀 Target Range: $9.50–$10.00

🔑 Growth Drivers: Operational scale-up, ESG leadership, and tailwinds from rising silver demand

📢 AG: Where high-grade output meets high-impact sustainability.

#SilverStocks #ESGMining #AG #Commodities #PreciousMetals #GreenEnergy

Institutional Rotation & Setup for Potential Re-Rating in 2025 I have outlined some areas of interest in the chart and some possible ways to reach 2.50 area. Below my personal thoughts behind this.

Institutional Activity & Accumulation

• Mirabella Financial Services LLP holds 10.48% (77.6M shares); estimated VWAP entry: ~1.4217 NOK.

• Alden AS holds 32M shares (4.3%) and remains a large holder after trimming slightly.

• Previous active players in 2024 (Skøien AS, Tigerstaden AS, Dukat AS) have exited, marking a rotation.

• Institutional base is solidifying — setting the stage for potential re-rating in 2025.

Technical Structure

• Institutional accumulation range: 1.10 – 1.30 NOK.

• Strong historical bid defense around 1.150 – 1.160 NOK.

• Previous resistance: 1.40 – 1.45 NOK. Break above this level could trigger expansion leg.

• Volume patterns align with accumulation and shakeout phases.

Trade Strategy

• Add Zone: 1.15 – 1.18 NOK (on strength or dip support hold).

• Watch Zone: 1.22 – 1.26 NOK (for volume and continuation breakout).

• Profit Trim Zone: 1.55 – 1.65 NOK (historical upper range boundary).

• Stop Loss Consideration: Below 1.13 NOK (only if broken on volume).

Risk Management

• Watch for loss of support with accelerating volume.

• Avoid adding on breakdowns below 1.13 NOK.

Upcoming Catalysts

• Commercialization of solid-state batteries (volume shipments, integration deals).

• Revenue reports showing real customer traction.

• New strategic partnerships or OEM announcements.

• Market sentiment shift on green battery tech / reshoring themes.

Smart Money Summary

• Entry confirmation from Mirabella (~1.42 NOK), Alden (~mid-1.30s).

• 1.15 – 1.20 NOK has been a recurring buy zone across many sessions.

• Institutional rotation shows early traders out, long-term capital in.

Risks

• Early product and production phase.

• Funding might be needed in Q2 - 2025.

• General market sentiment due to high volatility at the moment.

Disclaimer: This post is for informational and educational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. The content reflects personal analysis and opinion based on publicly available data. Please conduct your own due diligence or consult a licensed financial advisor before making any investment decisions. I hold a personal position as disclosed and may update or change it at any time without notice.

Energy Web - This cycles Energy sector playIm going to be breaking-down what I feel are the best long-term holds in each sector/category of crypto. Starting with the energy sector. I will tell you the pros and cons of each project.

Energy Web

EWT can beak out of this 4 year long downward trend/channel. There is a ton of upside potential. EWT has many strategic partnertships and completely flown under the radar. Once long term disgruntled holders are out. This project could definitely fly. Especially once the energy narrative begins to pick up. I took a postion around $1.32. I think that this project definitely has $20+ potential. One of the major downsides to the project is that the CEO has esentially been missing in action for a while with no explanantion. Even without the CEO is appears the team has been consistently builing.

The price action of this token has been pretty stagnant but that can all change in a blink of an eye. In my opinion this project has bottomed out and offers much more reward than risk at this level.

None of this is financial advice. This is just all my opinion.

Thanks for viewing my post! Best of luck to all traders!!!

Potential Correction Ahead for Waaree Energies Ltd After Strong Analysis:

1.Price Surge and Overextension: Waaree Energies Ltd has witnessed a sharp upward move, pushing prices significantly higher in a short period. This steep ascent could indicate an overextension, making the stock vulnerable to a pullback or consolidation phase.

2.Resistance Levels:

Immediate resistance is observed around the 3,600 level, with another support/resistance flip level near 3,300. Price nearing these levels might trigger profit-taking or selling pressure from short-term traders.

3.Overbought RSI Indicator: The RSI is currently in overbought territory, signaling an overvalued condition. Historically, an RSI above 70 often suggests a cooling-off period might be near, as buying momentum may slow down.

4.Volume Insights: The recent price rally has been accompanied by high volume, which validates the strength of the trend. However, any decrease in volume while the price stays elevated could indicate waning buying interest, strengthening the case for a correction.

Conclusion: Given the steep rise, overbought RSI, and proximity to resistance, caution is advised. A healthy correction could provide better entry opportunities. Monitor for potential reversal signals and volume changes to gauge the sustainability of this trend.

Trade Idea: Consider waiting for confirmation of a pullback or consolidation before entering new positions. Key support areas for potential retracement include 3,300, 2,625, and 2,280.

75: Identifying Support around €13.36 Amidst Selling PressureCurrently, we are witnessing selling pressure on the Fastned stock without significant buying interest. However, by examining historical data, we can identify a point of interest around the €13.36 level. This area has previously acted as a support zone, making it a potential accumulation point.

Recent developments support this analysis. Fastned recently raised €32.9 million through the issuance of new bonds, with €12.3 million coming from existing investors extending their bond maturities. This successful fundraising indicates a growing interest and confidence from private investors in Fastned’s long-term potential.

Given this backdrop, we anticipate that the €13.36 level could attract accumulation as investors recognize the company's ongoing investments in the fast-charging infrastructure for electric vehicles. As more motorists transition to electric vehicles, the demand for Fastned's services is expected to increase, potentially driving the stock's recovery.

Monitor the €13.36 level closely for signs of accumulation and potential buying opportunities, considering the growing interest and financial backing Fastned is receiving.

OKLO a pre revenue green energy startup LONGOKLA represents a high risk high reward play on green energy. It is a pre-revenue nuclear

power generation plant in Idaho destined to sell electricity to the grid as well as nearby

government customers including a miliary base. As such the risk is inherent but so is the

potential upside. This is a long trade buying at the bottom and looking for 50% upside or more.

On the 120 minute chart price is ascending through EMA lines in the past couple of days.

Price is rising as compared with anchored VWAP lines and the RSI indicator confirms bullish

momentum. I will take a long trade here especially as making a trade supporting green energy

helps in a socially responsible way the energy trend in sustainability.

SUZLONG DAILY TIME FRAMEThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

We do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Keep it simple, keep it Unique.

Please keep your comments useful & respectful.

Thanks for your support.....

Tradelikemee Academy

Sanjay K G

PLUG set up on support for Long EntryPLUG is on a 60 minute chart ascending in a relatively parallel channel and oscillating within

it. Price has cycled into the lower thick green support trendline. A falling wedge pattern is seen

It is now on its second touch of the support. PLUG has gained 75% in three weeks. As a green

energy small cap, it is sharing an uptrend with FCEL, QS and others.

I find PLUG properly situated to add to my position taking a trade of more shares long. I call it

buying a fall into support and buying a falling wedge set up for a breakout ( again).

Yesterday a successful put option scalp provided profit to redeploy here. I will roll over

options expiring February 16th into March 16th. The monthly call contracts have the narrower

spreads and better liquidity from volume.

UEC an uranium miner rerverses and warms up LONGUEC in the past several days has put in a double and bottom appears to be gaining bullish

momentum based on the trend angle from today. The volatility indicator triggered buying

price pressure five days ago as shown on the indicator and encirled. the volatility of yesterday

and today may be shorts covering to close synergized with new buyers. The uranium sector

is heating up at this time. Many of the stocks in this sector are over the counter. The ETFs

are URA and URNM. I will add to my long position in UEC now.

Equinor (EQNR) | Technically a Great Opporunity!Hi,

Long story short, technically the price of EQNR has started to approach an interesting price level. A lot of criteria are matching and from my point of view, those who have waiting for an opportunity to jump in then you can slowly start building your position. Obviously, after you have done your homework about fundamentals - this, what I share here, is basically pure technical. If you find something interesting from fundamentals as well then you have two green lights from both analyses and you are ready to go!

Criteria inside the marked box, starting from the highest

1. Equal waves from the top

2. Previous yearly highs starting to act as support levels (highs from 2006, 2008, 2014, 2019)

3. Fibo golden ratio 62%

4. 50% drop from the all-time high.

5. The round number 200 NOK

Hopefully, it will work as good as previous Equinor ideas:

1)

2)

Good luck,

Vaido

MIC Electronics: 3 days of Lip-Lock in 10% UCMIC Electronics Limited is a global leader in the design, development & manufacturing of LED Video Displays, high-end Electronic and Telecommunication equipment. The boost in Green Energy, LED lights and Telecom has lifted the sentiments on MIC Electronics. Also, it recently started venturing into Co-Developing 42v/3A Electric Vehicle Battery Chargers for e-Bikes. All this resulting in a blasting rally in Mic Electronics

On the Technical Front:

MICEL was travelling within a Falling Parallel Channel since 2008 and finally BO of the 15 year Channel and then formed a Beautiful Cup and Handle Pattern on Monthly

After Breaking out of C&H, it has not formed a Fresh Rounding Bottom Pattern - BO also done above 50.4 (CMP 51.5)

Like the Infamous Hero Kamal-Hassan, MIC Electronics is also Lip-Locked in 10% UC for past 3 sessions :) :) :)

Targets 65, 83, 108

Disclaimer:

3+ Years Teaching Experience in Stock Market - Technical Analysis, Advanced Patterns, Emotional Management, News based Trading...

We are NOT SEBI Registered and Our focus is NOT providing Buy/Sell Recommendations/calls. Primary Objective is to provide detailed analysis of how to review a chart, explain multi-timeframe views purely for Educational Purposes.

We strongly suggest our followers to "Learn to Ride the Tide irrespective of its Side"

*** Important *** Consult your Financial Advisors before taking any positions

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

FCEL Energy Penny Stock Buy the near term Bottom LongFCEL a penny alternative energy stock is at a near-term bottom sitting at the POC line

of the volume profile and a standard deviation below the intermediate-term mean VWAP

about a month out from a good earnings beat. Given the current administrations unwavering

support for green enerby sometimes with grants subsidies and other hand- outs I see FCEL

as getting some trader attention of the good kind unlike PLUG which announced a large public

offering to dilute investors. FCEL could steal some of those investors. The supertrend indicator

is signaling a reversal at the confluence of the POC line with the VWAP band as

mentioned. My target is the mean VWAP at 1.50 for about 35% upside with a stop loss at

the recent pivot low of $1.09 making for a reward-to-risk ratio of better than 6.

I see this as a swing trade with potentially 75 days in front of it given the earning report

for 24Q1 is due a bit beyond that and best risk management would be to take a partial

and size down going into earnings.

PLUG 's momentum continuation LONGPLUG's momentum had a good move today. PLUG is moving in a descending channel. Today

other EV stocks including TSLA, LCID, NKLA, FSR had big moves. TSLA's was the smallest in

percentage but the biggest in market cap regain. PLUG is now at the 0.5 Fib

retracement level. The zero-lag MACD and dual TF RSI indicators are about to cross the zero

and 50 levels respectively. The predictive tool ( Echo by LuxAgo) predicts a move to

5.95 by mid-February. This is about 50%. With the 11% move today, PLUG could be getting

overextended but the algo does not suggest that. As with other penny stocks risks are high but

a return of 50% in three weeks would offset the risk. I will trade PLUG here using a stop-loss

of 3.55 below that black horizontal Fib level. My $3.5 options for 2/2 did 300% unrealized

today. In the next 2 days I will roll them forward into the 2/16 expiration $4.5 strikes.

Plug Power's Green Hydrogen Plant Ignites Investor OptimismThe stock of hydrogen fuel cell company Plug Power (NASDAQ: NASDAQ:PLUG ) has been on a remarkable ascent, surging over 25% in the past five trading days alone. This impressive rally is attributed to several catalysts, including today's surge of 19.3% . Amidst a challenging period marked by a "going concern" warning in its third-quarter report, Plug Power ( NASDAQ:PLUG ) seems to be staging a remarkable comeback, fueled by a significant development: the operation of its new green hydrogen plant in Georgia, now touted as the largest liquid green hydrogen facility in the U.S.

Green Hydrogen Plant: A Financial Turning Point

After weathering a storm of financial uncertainty and a plunge in its stock value, Plug Power ( NASDAQ:PLUG ) provided a business update last week that breathed new life into the company. The cornerstone of this update was the successful commencement of operations at its green hydrogen plant in Georgia. The plant not only signifies a pivotal step towards sustainability but also a potential financial turning point for the company.

Cutting Costs and Boosting Revenue:

Plug Power ( NASDAQ:PLUG ) has faced financial challenges, including cash burn due to delays in its hydrogen production plans, leading to the purchase of hydrogen on the open market. However, the new Georgia plant is poised to be a game-changer, helping the company to cut costs and bolster revenue generation. With the plant now operational, Plug Power ( NASDAQ:PLUG ) is positioning itself to harness the growing demand for green hydrogen, driven by its applications in diverse industries.

Steel Industry Embraces Hydrogen:

The optimism surrounding Plug Power's ( NASDAQ:PLUG ) stock is further fueled by endorsements from industry players, including a notable mention from Cleveland-Cliffs, a leading U.S. steelmaker. In a recent fourth-quarter conference call, Cliffs CEO Lourenco Goncalves emphasized that "hydrogen is the real game-changing event in ironmaking and steelmaking." Goncalves's statement highlighted the transformative potential of hydrogen in these industries, positioning the United States as a frontrunner in adopting competitively priced green hydrogen for a true green industrial revolution.

The Road Ahead:

While Plug Power's ( NASDAQ:PLUG ) recent achievements have fueled optimism, it's essential for investors to remain cautious. The company is still on a journey toward realizing profits from its hydrogen production plans. As the new production facility ramps up, challenges and risks remain. Investors should carefully monitor Plug Power's ( NASDAQ:PLUG ) progress and be mindful of the evolving landscape in the hydrogen sector.

Conclusion:

Plug Power's ( NASDAQ:PLUG ) recent surge in stock value is indicative of a renewed optimism, driven by the successful launch of its green hydrogen plant in Georgia. With the potential to cut costs, boost revenue, and tap into the burgeoning demand for green hydrogen, Plug Power ( NASDAQ:PLUG ) is positioning itself at the forefront of the hydrogen revolution. As the company digs out of its financial hole, investors should tread carefully, mindful of the risks involved, even as Plug Power's ( NASDAQ:PLUG ) new production facility promises to be a catalyst for the company's future success in the evolving green energy landscape.

The Wizard with a Magic Wand !!! - Ward Wizard MobilityWardwizard Innovations & Mobility Limited is a publicly-held electric vehicle manufacturing company based in India. It is engaged in manufacturing eco-friendly electric scooters and vehicles. It operates in the electric vehicle manufacturing sector in multiple countries, including India, Uganda, and Nepal

IPO began in 2015 with the initial price around Rs. 2 - Given the focus on Electric Vehicles the price skyrocketed to over Rs. 100 / share within 7 years - literally 50x. Later it started a Flag pattern consolidation on weekly and price fell around 30-35 levels before taking a Bullish Reversal

India is leading in the Renewable Energy space and even till date the # of 2 wheelers in India is multiple times higher than 4 wheelers. EV Boost has even aggravated the Electric 2wheeler space. Though this stock does not have much history on charts - this is a Multi-bagger stock which is set to Write its own History

Technicals:

The initial call was given around 40 Levels and today it trades 82+ - a staggering 105% in a matter of 6 months.

Currently the price has completed a Rounding Bottom BO above 78 and today's 13% increase accompanied by significant volume accumulation for the past 15-20 weeks is a strong confirmation of BO.

Target: 95, 120, 140++

Disclaimer:

Stocks-n-Trends is NOT a SEBI registered company. We do not provide Buy / Sell recommendations - rather we provide detailed analysis of how to review a chart, explain multi--timeframe views purely for Educational Purposes. We strongly suggest our followers to "Learn to Ride the Tide" and consult your Financial Advisors before taking any positions.

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

The Electrified EV Chemical Industry - (1) Himadri SpecialityWith Indian Government set to replace 800K Diesel Buses to EV by 2030, there is strong Focus and Growth potential on Companies manufacturing EV Related Chemicals

Let review each EV Chemical sector companies

1) Himadri Speciality: Multi-Timeframe Analysis

Monthly: Parallel Channel - Rounding Bottom BO done and nearing Target of 350+

Daily: After Rounding Bottom BO - it is travelling inside a Smaller Parallel Channel with a Fib Retracement of 0.5

Targets - 355, 410, 500

Immediate resistance to cross - Channel BO above 315 WCB