Greenenergy

REGI Neutral Possible Entry at 73.40$REGI has had a fantastic run since August of last year, running up almost 400%. REGI however has broken the 50 day SMA line which leads me to see it having more downside in the short term, going down to my price target of 73.40$. From there, REGI has the possibility of either breaking trend and continue down towards the low 50s where there is a lot of support for it or it can continue to maintain its trend and rise up to 120$. I see there to be many bullish catalysts for the stock including a Biden presidency, rising energy prices, and being undervalued compared to other companies in its industry. There are bearish warning signs which must be taken into consideration, a volatile stock/bond market, and REGI breaking the 20 day and 50 day SMA line. This is not financial advice, I am not advocating the buying or selling of REGI stock.

BUS.V -- Consolidating before another leg upBUS.V had a major news release today about the US expansion that went unnoticed by the market (so far). The company is working towards NASDAQ uplisting and steadily expanding/adding new contracts. Another important factor is that it meets the "Buy American" policy criteria. It should do very well in the US, especially when uplisting is completed.

---

Grande West Enters into Strategic U.S. Distribution Partnership with ABC Companies

VANCOUVER, BC / ACCESSWIRE / February 22, 2021 / Grande West Transportation Group Inc. (TSXV:BUS)(OTCQX:BUSXF)(FRA:6LG) ("Grande West" or the "Company"), a leading supplier of electric, CNG, gas and clean diesel buses, today announced that it has entered into a strategic U.S. distribution agreement with ABC Companies ("ABC"), a leading provider of motorcoach and transit equipment in North America.

The ABC distributorship supports Grande West's focus on U.S. expansion as it begins marketing the fully Buy America compliant Vicinity™ heavy duty mid-size bus, the Vicinity Lightning™ EV and Vicinity™ LT light duty models to new and existing customers.

Under the new agreement, ABC Companies, a leading provider of motorcoach, transit and specialty passenger transport equipment in the USA and Canada, will distribute the manufacturer's Vicinity™ heavy-duty vehicles throughout the Western United States from Texas to California. The Vicinity line fills in key transit and private shuttle markets within the ABC portfolio of new vehicles for these locations, enhancing the offering to current customers while expanding to other sectors.

"As we continue to expand the ABC product portfolio, our main goal is to provide more choice and price points for operators," said Roman Cornell, President ABC Companies. "Our customers' needs drive our strategic priorities and after an extensive search, we found the Grande West Vicinity product line achieved best in class results across a number of the Federal Transit Authorities Altoona testing procedures. Our distribution agreement with Grande West enables ABC to offer its proven track record of customer sales, service and support with a proven, high-quality Buy America compliant product line, inclusive of their innovative new battery-electric vehicles.

"The Grande West Vicinity lineup offers added flexibility and choice to our transit customer base who already utilize ABC's parts and maintenance services, providing a great fit for our large base of operators. With decades of experience in sales, technical, repair and maintenance support, ABC is committed to supporting heavy duty mid-size market users who can leverage the expertise of a proven market leader like Grande West," concluded Cornell.

"We are proud to announce our distribution partnership with ABC, representing an excellent addition to our reach in the United States, particularly as we begin to market our Buy America compliant Vicinity™ buses to new and existing customers," added William Trainer, President and Chief Executive Officer of Grande West. "In particular, ABC's well-established reputation for EV sales in the California market will prove invaluable as we bring our new Vicinity Lightning™ EV bus to market. We look forward to working closely with Roman and the ABC team going forward."

Up from here? $REGIRegi looks ready for another move up if we can close green today.

Pattern of pennants forming.

I think we will see 120 soon.

Update from a previous chart a few weeks back.

HCMC a lot of hype - how do we play this move - deep analysisSo we are looking at HCMC on a 1H chart - a short time frame because we must see all the clues in the chart so a short time frame is in order.

A couple of lines on the catalyst news just to make sure you are up to date:

The company deals with health products mostly organic foods and has several vape shops in the USA.

They filled a lawsuit against the giant Philip Morris for patent infringement (‘the 170 patent’) on what they refer to as ‘Electronic Pipe’ this is taken from the SEC report (file number 001-36469) :

“An electronic pipe, comprising:

a battery, an electronic module, a combustible material reservoir, and a heating element fixed in the combustible material reservoir.

combustible material loaded into the combustible material reservoir.

wherein the pipe is structured to transmit an electric current from the battery to the heating element, the heating element initiating a combustion reaction in the combustible material reservoir.”

Ok Let’s try to break it down:

1. - First thing we saw is a healthy trending asset. From 0.000096 till 0.001475- moving in a correction motive pattern which is what we want to see on a stock.

-RSI not overbought and except for rare peaks overall looks good.

- Notice ADX is NOT trending in that part and that means gradual moves up.

- Notice the massive wick on catalyst news that gave us a clear signal that the hype is coming (red square – red star – super important to spot these clues in the chart early!)

2. - Then it exploded upwards – this is HYPE and a lot of it – stock because ‘meme’ trading and was trending on social media and every kid with a TikTok and a trading account started talking about it like we discovered Microsoft in the 90’s – which is obviously not the case . The stock took off from 0.0016 to 0.0064 in 3 trading days – but what goes up must come down.

- RSI peaking to overbought and pullback is in order soon

- ADX losing trending momentum and crossing down from the 60 level of ADX – pullback coming-

3. - Smart money started exiting and left a lot of new retail traders holding the bag. If you ask me we had a lot of money pulling out from the 8th of Feb and started dollar cost averaging out of the trade gradually.

- Notice we have 2 Fib retracements on the chart :

- One from the beginning of trend (26 of Jan)

- Ne from the beginning of impulse move (8 of Feb)

- If we look at the 50 levels of both we will see most pullbacks was already done – but I emphasize the word – MOST – because I think we can get in at a cheaper price on the stock around 0.0032 – that doesn’t mean the pullback will go directly to that level but as we always remind our union traders – patience is in order! so we can see accumulation with a bit of a rise but buying power is getting weaker and who knows if we are also seeing inside buys -which can be reasonable.

4. So what’s next? FDGT will wait on a pullback and for the hype to slightly calm down because we are looking at a lot of new traders in the stock at the moment – which means they can be easily shaken off by drops of price – we will wait to see if we can get the asset on the lows of 0.0032.

5. Given the catalyst of the trial I would suggest easing into the trade with small orders and buying dips till we see the interest peaking again to the higher levels and to start dumping out shares above the 0.007 price. that doesn’t mean our price target is 0.007 but our first stop on taking profits and we need to monitor volumes to see if the hype is getting bigger or smaller to know when is our next stage.

If you want me to cover the next stage just comment here and we will follow up if there is demand.

Let's just quickly cover volumes – so we understand what to look for as a comparison in the upcoming moves :

Avg volume 3 months: 6B

Last month volume : 13.5B (average)

Last week: 20B ( mostly sell volume)

Target volume for future moves: above 10B but must be a buying volume! currently not the case.

3 things worth noting here as the pessimistic view :

1. PM has probably the best lawyers in the world!

2. this trial can go on for years if PM will not offer a settlement!

3. the cost of running a trial for so long will cost Healthier Choices (HCMC) a LOT of money in a court battle!

just keep those points in mind.

Trade safe and be safe – the traders union is here for you!

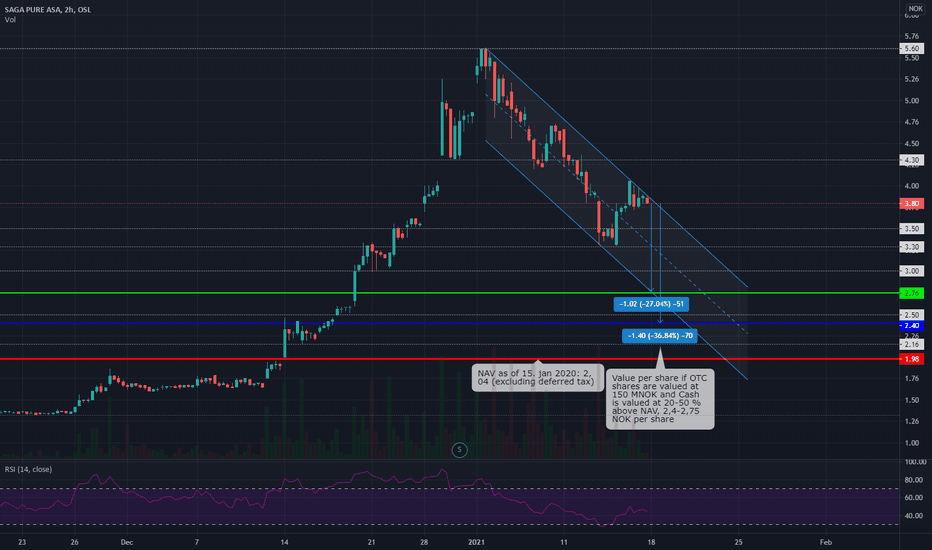

Saga Pure trading at 175-194 % of NAV (price target 2.2-2.9 NOK)Saga Pure ( OSL:SAGA ) is an investment company focusing on renewable and clean energy. Their investments are in both publicly traded companies and in private companies. The largest shareholder is Øystein Stray Spetalen.

The company was previously named Saga Tankers and owned stocks in S.D. Standard Drilling, an indoor sport arena and other smaller investments. Prior becoming an investment company the company owned various tanker vessels that was sold in 2011 and 2012. The company launched a new strategy in the fall of 2020 where investments would focus on renewable and clean energy. With a new strategy they divested what they considered outside the Company's main investment focus (except Vistin Pharma and Element), hired a new CEO (Bjørn Simonsen) and have issued shares a number of times to fund future investments.

According to my calculations, Saga Pure is currently trading at 175-194 % of net asset value. My price target is 2.2-2.9 NOK per share.

The company published a prospectus 11th of January 2021 as they are doing three subsequent offerings after the a number of private placements. According to my understanding of the prospectus:

Net asset value as of 15th of January 2021 before execution of subsequent offerings:

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Net cash-liabilities: 517.1 MNOK

Cash received from partial divestment of Everfuel ASA: 13.3-101.5 MNOK

NAV: 921.34-1,009.54 MNOK

In addition to the assets listed above they have an nine-month option for a 30 MNOK investment in Bergen Carbon Solutions.

NAV per share:

Post private placements (469,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options (484,149,831 shares), NAV 1,96-2,15 per share

Post private placements + CEO options + Subsequent offering I (488,149,831 shares), NAV 1,97-2,15 per share

Post private placements + CEO options + Subsequent offering II (493,049,831 shares), NAV 1,98-2,15 per share

Post private placements + CEO options + Subsequent offering III (497,849,831 shares), NAV 2.00-2.17 per share

If we assign the cash holdings with a value 20-50% above NAV the price target for Saga Pure is 2.2-2.8 NOK per share. If we value investment in private companies (executed in 11th and 28th of december 2020) at double the investment price target is 2.3-2.9 per share.

Investments:

Everfuel ( OSL:EFUEL ), 1.8 million shares, listed on Euronext Growth, market price as of 15th of January 2021 153 NOK, fair value 275.4 MNOK

Vistin Pharma ( OSL:VISTN ), 2,284,280 shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 20 NOK, fair value 45.69 MNOK

Element ( OSL:ELE ), 970 thousand shares, listed on Oslo Stock Exchange, market price as of 15th of January 2021 5 NOK, fair value 4.85 MNOK

Horisont Energi ASA, 35 MNOK, not listed, fair value at investment date 35 MNOK

Bergen Carbon Solutions AS, 30 MNOK (+option agreement with the right to invest additional 30 MNOK in a nine-month period), not listed, fair value at investment date 35 MNOK

Sum listed investments (fair value, market price): 325.94 MNOK

Sum investment in private companies (investment value): 65 MNOK

Capitalization and indebtedness adjusted for post-balance sheet events, private placements and investments:

Cash: +537.2 MNOK (including private placements, excluding potential proceeds from subsequent offerings)

Trading securities: +18.1 MNOK

Long term debt: -0 NOK

Other current financial debt: -38.2 MNOK (including 35 MNOK investment in Horisont Energy)

Net cash-liabilities: 517.1 MNOK

Other noteworthy changes in balance sheet:

Saga Pure has divested 700,000 shares in Everfuel between 29th of October 2020 and 6th of January 2021. Bringing their investment from 2.5 million shares to 1.8 million shares. The price for the 700,000 shares sold is unknown. The market price per share has a low of 19 NOK and a high of 145 NOK in the same period. This will have a positive effect on their cash holding by 13.3 - 101.5 MNOK.

Private placements since 20th of October 2020:

Number of shares prior 20th of October 2020: 286,149,831

54,000,000 (2020-10-20), gross proceeds 70.2 MNOK, cost 1.5 MNOK, net proceeds 68.7 MNOK

34,000,000 (2020-11-30), gross proceeds 54.4 MNOK, cost 1.2 MNOK, net proceeds 53.2 MNOK

35,000,000 (2020-12-14), gross proceeds 73.5 MNOK, cost 1.3 MNOK, net proceeds 72.2 MNOK

30,000,000 (2020-12-21), gross proceeds 87 MNOK, cost 2.0 MNOK, net proceeds 85 MNOK

30,000,000 (2020-12-29), gross proceeds 123 MNOK, cost 2.0 MNOK, net proceeds 121 MNOK

Number of shares post private placements: 469,149,831

Number of shares available in subsequent offerings:

4,000,000, price 2.1 NOK per share, potential gross proceeds 8,4 MNOK (bringing the total number of shares to 473,149,831)

4,900,000, price 2.9 NOK per share, potential gross proceeds 14,21 MNOK (bringing the total number of shares to 478,049,831)

4,800,000, price 4.1 NOK per share, , potential gross proceeds 19,68 MNOK (bringing the total number of shares to 482,849,831)

Subscription period ends on 27th of January for all three subsequent offerings.

Number of shares the board has allocated to share options (25 million shares authorized to allocate for options for employees and key persons):

5,000,000, strike 1.5 NOK

5,000,000, strike 2.0 NOK

5,000,000, strike 2.5 NOK

10,000,000, authorized but not allocated

Other information from the prospectus:

Saga pays a fee on a total of NOK 200,000 ex. VAT each month to Ferncliff Holding AS for consultancy services carried out by Martin Nes and Øystein Stray Spetalen. Ferncliff Holding AS is a company owned and controlled by director and main shareholder in Saga, Øystein Stray Spetalen.

The Company pays on a hourly basis for back-office services such as accounting, and a monthly fee for rent of office premises and common costs.

Will these Green Energy Stocks Gained 400%-1300% in 2021?With the prospects of the green infrastructure plan by Joe Biden, green energy sector has seen a resume of interest from the investors and traders. Five green energy stocks with strong momentum have been selected from from the AMEX:PBW ETF (Invesco ETF Wilderhill Clean Energy), which are potentially near the buy point based on the technical analysis with price action trading and volume spread with Wyckoff analysis.

Check out the trading plan of each stock with entry point and stop loss based on either breakout trading or simple pullback trading strategy for these stocks - PBW, NASDAQ:FUV , NYSE:NIO , NASDAQ:TSLA , NASDAQ:ENPH , NASDAQ:IEA .

Possible Trend Continuation via Symmetrical TriangleSunrun is currently nearing the end of a symmetrical triangle formation, recently making its 3rd higher low and 3rd lower high in the previous trading sessions. A break of the top trendline would be a continuation of the uptrend into new highs. Bullish bias as TAN and other solar names have been getting lots of attention through Biden getting elected, and the proposed Green New Deal + re entry of the Paris Climate accord. Plan accordingly as the days lead up to break out of the triangle range.

The Green decade has begun [ETF trades setup ICLN/SPY]A detailed analysis on the subject of the expected green revolution in this decade.

I won't dwell into the chart technicals' instead I will focus my attention on the fundamentals, in three key bullet points:

A) Firstly, I chose ICLN since it's by far the largest by volume and assets, green ETF. Interestingly it has had quite an abysmal performance relative to SPY for the past decade, as well as an appallingly negative Sharpe.

Since 2018, it's performance has picked up and relatively stabilized wrt the SPX. Despite of the negative dividend yield carry of about -1%, ICLN (0.62%) vs SPY(1.59%), it's negligible compared to the price appreciation component of these ETFs.

Moreover, it seems that the pandemic has been a positive catalyst overall, since it increased the odds of Biden winning the U.S. elections, and we all know the Democrats stance on environmental policy as compared to Trumps non-existent one. The Biden-Harris odds realized last week, which was followed by a bull-run. Considering the current pace of the momentum channel, ICLN is undoubtedly in a parabolic formation.

B) Another indication, is the price appreciation of precious metals used in production of sustainable energy products, such as lithium, palladium, nickel to name a few. Relative to gold, these metals generally have a positive market beta since their demand is largely influenced by economic growth, especially from some of the developing countries in the past decade(India, Indonesia, China etc).

Palladium:

Lithium ETF :

Nickel:

Essentially, the price appreciation of these metals certainly is an indication of the growing demand, and therein the growth potential of the whole renewables sector, also an indication of the ecologically friendly premium corporates and governments are willing to pay. Naturally, if the cost of inputs becomes too high, implying a demand gap, but also lack of supply as it becomes more difficult to extract these metals, which in fact might produce more pollutants than the gain from utilizing these metals in developing sustainable products. However, it seems that this discussion so far is not in the news headlines, so therefore the current trend isn't threatened for now.

C) It is important to distinguish between the types of market participants wrt to their portfolio preferences, biases and why they are willing to pay for an ecological and/or CSR premiums. The general consensus is that CSR investments lately have outperformed sin stocks on a relative basis. One of the explanation is CSR branding, and the idea that consumers will pay a premium to be associated with such a brand, therefore the stocks that score highly on the ESG scale, are simply better investments despite their high multiples.

ESG/SPY:

I think in general, it boils down to three types of market participants in ESG assets:

1. Investors that genuinely care for the environment, and are extremely elastic in terms of the ESG premiums they pay.

2. Investors that are seeking "warm glow", i.e own these assets for the sake of feeling better about their choices. In this group I'd add investors that hold these assets for their reputational benefits.

3. Traders looking to profit off the current momentum channel, without any views on the environmental issues that we're facing.

In summary, it's clear that the sector principally benefits from governmental subsidies/investments, which is perhaps the only way to deal with this issue. With the Biden/Harris catalyst, as well as increase awareness of the emerging economics, specifically the example of the Chinese governments' willingness to transition their infrastructure investments more and more into renewables, the renewables sector is expected to boom for at least the entire decade. One could say that we're looking at the start of the next bubble- "The Green Bubble". Parallels can be drawn to the Japanese bubble of the early 90's, and the tech bubble of the 2000's. However, since this is governmentally induced sector growth, it is also a permanent price shock that will be sustained by governments green infrastructure investments.

This is it for the upcoming green revolution.

-Step_ahead_ofthemarket

________________________________________________________________________________________

>>I do not share my ideas for the likes or the views. This channel is only dedicated to well-informed research and other noteworthy and interesting market stories.>>

However, if you'd like to support me and get informed in the greatest of details , every thumbs up and follow is greatly appreciated!

Disclosure : This is just an opinion, you decide what to do with your own money. For any further references or use of my content- contact me through any of my social media channels.

Multi-year bear market end or not?? Prologue:

This pair has been in a multi-year bear market and all that could change soon.

This year alone, the price hit a multi-year low of 0.80189. The price has recovered to a year high of 0.90110. However, since July, the price slid into a zone between support and resistance that have kept the price ranging for the past few months. It's important to note that the pair aggressively rejected the March support at the 0.382 fibonacci retracement level of the previous multi-year bull run from January 2009. This support zone has held the price above the 0.382 Zone for the past 5 years as the pair corrects.

The price can continue lower to test this zone again. However, I'm not motivated by a further downside as I will explain in this idea.

Price Action this year.

Price gained 12.37% from the March 16th Low till July. Currently, the price is still ranging and has already rejected the 0.382 fibonacci retracement level twice. The pair has formed a higher low whenever the price tested the level pushing the pair into a pennant pattern against multi-year trendline. It's still possible for the price to reject the major trend line and create another swing downward.

In the past few weeks, price has broken above a strong resistance which it's currently testing. I expect a bullish push in the medium term but the pennant holds it against a long term bullish impulse.

The Oil Demand Wild Card

So, why I'm I bullish on the long term? Simple, heading to 2050, many countries around the world will have achieved their net-zero emissions target. This time it's different as countries in the G20 are pushing for a green energy development as a strategy to stimulate the countries after the 2020 recessions. In addition to this, the corporate world is also looking to reduce emissions from supply chains. Support from many people around the world will push the demand for oil down.

The OPEC Wildcard

With falling oil demand, the OPEC members will certainly manipulate supply of the blackgold in order to stabilise prices as their economies are still highly dependent on oil. This is the only thing that might stop the CAD from weakness.

My Sentiment

Personally, I feel that the oil demand narrative will take hold and that the pair may exit the multi-year bear market as the CAD has a high correlation to oil prices. However the OPEC manipulation of oil supply might keep the price stabilised. Peak oil is coming sooner and green energy will be cheaper than the fossil fuel in supply chains.

In the meantime, I expect price to keep ranging as demand of oil will be low with new lockdowns in Europe.

VESTAS to benefit from Biden's victoryBloomberg:

Biden has outlined plans to spend $2 trillion on clean energy as part of his economic recovery plan.

Europe has a global advantage in so-called green tech and the region’s solar and wind energy leaders would get a major boost from a “blue wave” of Democratic victories.

Technically:

Measured Move Up and the target as mentioned.

UUUU Can Benefit Long Term LongThere are several stocks that are worth considering in this bottoming of the Uranium cycle. Some have better looking charts than others, and some have held up better than others. Yet, I've decided to go with $UUUU, even though it has not held up best thus far.

Technically, we may have just seen a capitulation-esque move, setting up the last best chance to get in. I was able to average in on January 31 for $1.41... (bringing my average entry to $1.71) but am posting this now at $1.68.

There is bullish divergence set up on this weekly chart with MACD and RSI printing a higher low, coinciding with the most recent low in price.

Also, see the yellow line for average volume, which has clearly ticked up since 2017 levels and the notable spike since June 2018.

This all looks very bullish to me long term.

I don't have a target in mind yet, but buying and holding unless and until there is a monthly close below $1.20.

Fundamentally, Energy Fuels (UUUU) not only can benefit from the long term resurgence of Uranium, but also is positioned to benefit from its Vanadium.

These prospects are increased all the more by the global push for the 'green' economy... regardless of the actual merits behind such push.

A recent short video from Francis Hunt is titled " Oil is Dying ".

Why fight the big money?

May this post be of use to you.

In God's Will

UIOGD - JMJ

NEL Hydrogen stock drops but fundamentals remain strongIn January, NEL Hydrogen finished a very successful large private offering at NOK 5.45 ( nelhydrogen.com ) , but both the technical uptrend and fundamentals remain solid, with the company set to invest the proceeds from the placement in rapidly scaling up production facilities.

Company twitter feed for news: twitter.com

[Cryptosfeels] Pssst! WPR/BTC Kucoin winningchickendinner and ..Well guys, look www.kucoin.com

We have some electrifying quarters and medium projection.

wepower.network

coinmarketcap.com

I think it's a good time to buy, the dice are laid...

AVL Elliot WaveAVL has had a really nice run up in price finishing off last year on a high.

Buy range around the 50% fib level point "c" after the Weekly RSI cools off. MACD is the most diverged its been in a long time and the BULL volume is Decreasing setting up for a pull back to give us a better entry price for Long positions. Interesting area to watch is the middle uptrend line where we may see a bounce before seeing further upward movement. If we break look for a long entry in the .036-.032 range.

The fundamental's of this company look solid with the Vanadium Re-flow battery market getting a lot of attention lately. With some recent positive news we may just see a bounce off the middle trend line and some more continuation.

news:

smallcaps.com.au

Lets see :)