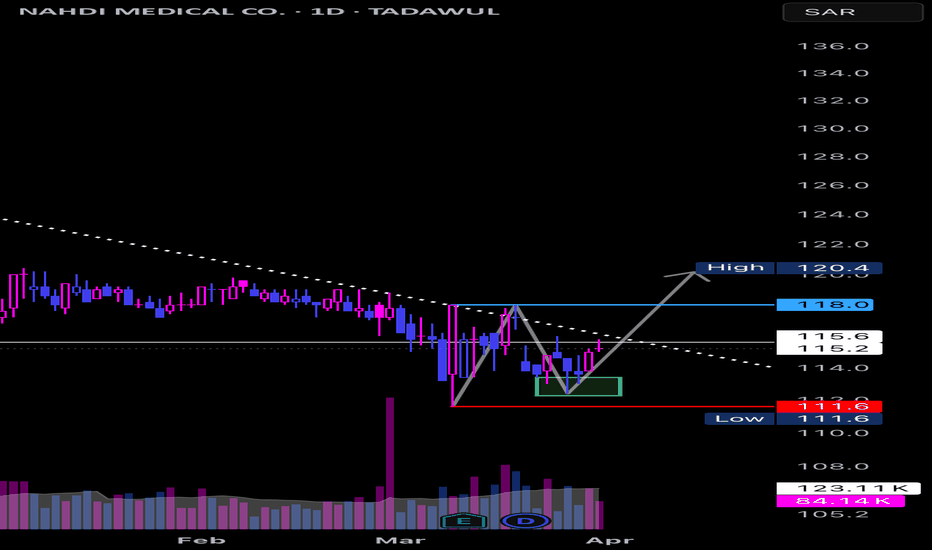

Nahdi Medical Co. (4164) - False Breakdown & Trendline Breakout?🚨 Nahdi Medical Co. (4164) recently experienced a false breakdown below 115.6, but has since recovered above it. With the stock now testing a downward trendline, crossing this line could signal the start of a new upward move. 📈

💡 Key Points:

• Current Price: 115.2

• False Breakdown at: 115.6

• Key Resistance at: 118

• Support/Stop Loss: 111.6

• Target: Potential upward swing after breaking 118

📊 Technical Analysis: The false breakdown below 115.6 followed by a recovery signals a potential bullish reversal. If the stock breaks the downward trendline and crosses above 118, it will confirm a new upward swing.

📈 Trade Strategy: The price range between 111.6 and 118 is an ideal buying zone. A breakout above the downward trendline and 118 will confirm the start of a new upward wave. Enter with a stop loss at 111.6, and if 118 is breached, expect the rally to continue.

What are your thoughts on Nahdi Medical Co.’s price action? If you think I missed something or see a different pattern, feel free to share!🔥

Growing

Are Health Savings Accounts Worth Your Time? Absolutely.When you're well, sometimes it is difficult to imagine things suddenly taking a turn for the worse. 1.5 years ago, I was as healthy as could be. I thought medical problems were for other people, my checkups always came up roses.

Then I fell ill with an autoimmune neurologic condition, likely autoimmune encephalitis, and I wish I had opened a Health Saving's Account (HSA) the day I turned 18. Funny how life teaches you those lessons.

So what is an HSA?

An HSA is an investment account whose contributions are tax-deductible and withdrawals are tax-free if used for medical expenses. This type of account is only available for those with high-deductible plans health plans. The IRS defines a high deductible health plan as: any plan with a deductible of at least $1,400 for an individual or $2,800 for a family. Literally ripped that last sentence straight out of google. Sue me. If you're uninsured, you're out of luck.

So for those who have high-deductible health plans, it's a way to not only save for sudden health catastrophes, but also to grow your wealth. With Fidelity, there is no limit to what asset class you can partake in. Other HSA's may have limitations, acting more like savings accounts.

When you make a contribution, that money is tax-deductible (so you're investing with "pre-tax dollars"), and will never, ever be taxed if used to pay for a medical expense. But what if your investments have gone down and you have to sell to pay for medical bills? Hint: don't. You can reimburse your own medical bills with NO time limit. That means you could pay $1,000 for surgery using a cash-back credit card (or whatever payment method), wait until your money grows in your HSA, then reimburse yourself tax-free in 30 years. That is, if you kept the receipt ;)

By budgeting, like using YNAB, it's easy to keep track of medical expenses and reimburse yourself tax-free when it makes the most sense. Or, if you prefer, you can invest in more conservative instruments. Like CD's, which are paying as high as 4.7%. Or you can treat it like an actual savings account and enjoy Fidelity's 2.21% APY on uninvested cash.

So for those keeping score:

-Contributions are tax deductible

-Medical expenses are tax-free when you liquidate your investment(s) to cover them, which you can do retroactively with no time limit

-Growth and trading within the account is tax-free (unless you live in CALIFORNIA or NEW JERSEY. Don't ask me, but you will be taxed on trading like you would an individual brokerage account)

-You can withdraw your funds like you would an individual brokerage account at 65 (that is, you'll be taxed but not penalized)

There are pretty hefty penalties for non-medical withdrawals before you're 65: up to a 20% penalty and ordinary income tax on capital gains. Not pretty, so don't put money into an HSA that you'll need for other things.

In addition, there are yearly limits to how much can contribute. For 2023, it's $3,850 for an individual plan, $7,750 for family plans. You can alternatively roll funds over from an IRA into an HSA (but not the other way around).

I opened one today with Fidelity and will max it out every year. I use YNAB to budget, so I can keep track of my health expenses for 2023 easy peasy. It's always best to plan for the worst.

Thanks for reading, and best of health to you.

InTheMoney

BNB short-term GrowHi friends.

Despite a bad news for inflation and us CPI comes 9.1

but we can see a short term grow in market i think.

in that case yesterday Binance burns about 450 milion $ worth of BNB.

and we are in a good support level.

in weekly timeframe we have 2 Resistance ahead:

one at 250$

and one at 315$.

if we surpass first level , we reach second simply.

315$ is also the median of Danchian channel.

hope you like my analisys.

please share me your opinion in comment.

i will be happy.

thank you all for reading my idea.

Helium reaches $1.2 billionWhat do you get when you cross blockchain, cryptocurrency, and a team of highly skilled developers? In Helium’s case, you get a $1.2 billion valuation.

Founded in 2013 by co-founders including Shawn Fanning of Napster fame, Helium began as an Internet of Things company with the aim of connecting low-powered devices without WiFi or Bluetooth.

The company successfully leveraged the growing popularity of Internet of Things devices to offer products and services of growing complexity. One of Helium’s earliest innovations was a smart sensor for refrigerators, but the company has grown in ambition since then.

Using blockchain technology, Helium launched a product called Hotspot in 2019.

Coinciding with its $15 million funding round, the launch of Hotspot was a significant moment for Helium, which still had aspirations of connecting millions of low-powered devices.

AUD CAD TECHWell, Its little bit scary position for the reason we are in a downtrend in this pair but

The trend has a very strong chance for a crossover this downtrend level or line and starts growing and test more high

As we see here This Growing Channel is very powerful and it is the main reason Why I think the price will test or check this price level there where is Take Profit Line.

Have any questions? Ideas? tell me about it! thank you

DFS Almost A BuyGrowing Bearish Divergence

MACD about to meet

Healthy RSI

This is a good stock to watch!

Supplementing Your Portfolio with NAIINAII is a sports nutrition and supplement company flushed with cash, no debt, and increased operating income over the last three years. Check out my latest analysis of the comp here: rockvuecapital.wordpress.com

The short of it: The market seems to be mis-pricing the tremendous margin and operating efficiency that NAII has compared to its peers. With higher margins, lower operating costs, and an peer leading ROA and ROE, I think the market is overemphasizing the recent downtrend in the company's earnings.

I entered at 11.35 with a stop loss at 10.00 in the paper account, risking 46bps of capital. I might add to this position if price advances in my favor.

Please be critical in your analysis, help me find my blind spots.

Always trying to improve,

Brandon

$AVOP rev generating news & hard dip this week spur interestAV1 Group garners LED contracts and is preparing for Cannabis growing LED light systems. From the recent PR: "Apollo, who will manufacture the lighting product for the Company, has also granted the Company an exclusive license to market Apollo's line of products for Oregon, Washington, California, Nevada and Mexico; all prime cannabis growth territories.

The new LED system addresses and solves a key problem common to all 'horticulture' growers, the timing from vegetative to bloom. The system enables this process to proceed as quickly as possible and increases cost-effectiveness of the growth cycle."

finance.yahoo.com

I like the consolidation at these levels after reaching almost $0.30 recently.

Possible Growing Trend in AMZN within 16-02Analyzing the situation,

I noticed that today AMZN has confirmed the breaking point of the last month's trendline.

I have reason to believe that within the next 4 days we will see a little decrease but it will be a sort of stabilization and then it will start growing establishing a new trend.

I have reason to believe that it will reach a +8,59% point in 19 days after the 28th of January.

I don't exclude an intense volatility but I think it could be a great opportunity for whom has a great margin.