JPFA is callingAfter 22 April 2025, IDX:JPFA drop 190 (-9.97%) from the current price.

With the distributed dividen value Rp 70 (estimated 3% from the price)

Technical:

At the lowest area Fibb Retracement

Still above support line 1,740

Above EMA 200 (Weekly TF)

Fundamental

Growth Revenue each quarter

Good Debt to Equity Ratio (show good progress)

Target 1 : 1,945

Target 2 : 2,200

Thankyou for your time!

I hope everyone get the best for your life!

Growth

Arista Networks (NYSE: $ANET): Positive Outlook Amid AI Growth Arista Networks Inc. (NYSE: ANET) closed the latest trading session at $68.67, gaining 1.48% on the day. The stock has recently experienced a steep decline from its 52-week high near $134, yet it remains a key player in the edge computing space. As of Q4 2024, 78 hedge funds held positions in Arista, signaling strong institutional interest.

The company’s infrastructure supports edge computing by delivering ultra-fast, programmable switches and routers. These tools are vital for real-time data management in environments such as data centers and IoT systems. With the growing demand for AI-driven workloads at the network edge, Arista’s technology is well-placed to support this shift.

In 2024, Arista recorded $7 billion in revenue, marking a 19.45% increase from the previous year. Its net income rose by 36.3% to $2.85 billion. In Q4 alone, revenue jumped by 25.3% year-over-year to $1.93 billion. To enhance AI workload management, Arista launched the EOS Smart AI Suite with Cluster Load Balancing, a solution aimed at improving system efficiency under large-scale processing demands.

The edge computing market is on track to grow significantly, with global spending expected to reach $261 billion in 2025. This trend is supported by broader interest in Internet of Things (IoT) and AI technologies. Analysts predict this spending will climb to $380 billion by 2028.

Technical Analysis

Arista's price action shows it tested a key support zone at around $60, with the 200-day moving average at $65.95. The stock previously attempted to rebound above resistance at $77 but failed, forming a bearish setup. Current RSI stands at 31.16, suggesting the stock is close to oversold reading.

If it holds above the $60 support, a potential bounce could target $77, followed by $90 and above, aligning with the 100-day moving average. A break below $65 could open a path toward $60 or lower. Volume has been heavy during the downtrend, indicating strong selling pressure.

Barclays Raises TechnipFMC (FTI) Price Target to $43TechnipFMC (NYSE: NYSE:FTI ) closed at $31.23 on the previous trading day, staying close to its one-year high of $33.45. Evercore ISI analyst Jason Bandel maintained a Buy rating on the stock, setting a price target of $39. Meanwhile, Barclays reaffirmed its Buy rating with a higher target of $43 in a report dated March 26.

Currently, the consensus among Wall Street analysts rates TechnipFMC as a “Strong Buy.” The average price target stands at $37.22, suggesting an upside of 19.18% from current levels. The stock has an average daily trading volume of 4.33 million shares. TechnipFMC’s performance is under close watch, though analyst Jason Bandel has posted a -5.4% average return with a 31.58% success rate. He follows the energy sector, covering companies like Helmerich & Payne and NOV in addition to FTI.

Insider activity on the stock shows negative sentiment. Over the past quarter, 55 corporate insiders have sold shares. Earlier this month, Director Eleazar de Carvalho Filho sold 9,381 shares worth $279,178.56.

Technical Analysis

The stock recently bounced off a key support zone around $22, close to the 200-day moving average at $21.86. This bounce formed a bullish reversal setup. The price is now hovering near $25.20. If it holds this area, the next resistance is around the $28.00 level, followed by a possible move back toward its recent high of $33.45.

The volume profile shows increased buying near the bottom of the bounce, suggesting accumulation. RSI is around 42, indicating neutral momentum but potential for recovery if buying pressure continues. A break above $28 may signal continuation toward $33.45.

$LNTH Potential Healthcare sector leader NASDAQ:LNTH holds a negative net debt to ebitda ratio, with a forward p/e ratio around 16. Revenue growth was up over 18% for the TTM, and operating margin was around 40% compared to ~15% for healthcare companies in the drug manufacturing industry.

Technically, there is a potential wedge forming, though I can see a breakout bounce off of the .382 fib coming too. Strength showing relative to the S&P.

If the market reaches the $88,490 level, we'll look for selling.BTCUSDT Weekly Analysis: Navigating the Range-Bound Market

Bitcoin (BTC) is currently trading in a range-bound market, showcasing a delicate balance between buying and selling pressures. As traders, it's essential to identify key levels and potential trading opportunities.

Key Selling Area: $88,490

We've identified a crucial selling area at $88,490, where sellers are actively participating. This level has the potential to cap upward movements, and we're waiting for the market to reach this zone.

Trading Strategy:

1. Sell Setup: If the market reaches the $88,490 level, we'll look for selling opportunities, targeting lower levels and taking advantage of potential downward momentum.

2. Alternative Scenario: If the market doesn't reach the $88,490 zone, we'll wait for a clear breakdown from the current range, with a candle closing below the range. This would signal a potential shift in market sentiment.

Market Outlook:

The range-bound market presents both challenges and opportunities. By monitoring key levels and waiting for confirmation, we can make informed trading decisions and navigate the markets effectively.

What to Watch:

1. $88,490 Level: A key selling area that could determine the next move.

2. Range Boundaries: Monitoring the current range and waiting for a breakdown or breakout.

3. Market Sentiment: Keeping an eye on market sentiment and adjusting our strategy accordingly.

By staying vigilant and adapting to market conditions, we can capitalize on potential trading opportunities and navigate the complexities of the cryptocurrency market.

BTC/USD Operation Strategy AnalysisCurrently, the market is approaching the previous high (84994), favoring a “false breakout” pattern.

84200 although reasonable support, but the volatility is limited should be segmented take profit, such as to 84550 when the first flat 50%, the remaining single capital preservation tracking.

Global M2 MONEY SUPPLY VS GLOBAL LIQUIDITYWhich is the best to track ₿itcoin price action?

Lots of macro gurus have been arguing over the two.

For comparison, I have indexes for both metrics on a 12-Week Lead, tracking the 4 largest central banks:

The Federal Reserve (including TGA & RRP), People’s Bank of China, European Central Bank and Bank of Japan.

Let’s start by defining each.

Global M2 Money Supply covers physical cash in circulation and cash equivalents such as checking and savings deposits, as well as money market securities.

Global Liquidity covers a broader measure of liquid assets driven by central bank balance sheets, private sector financial activity (e.g., lending, corporate cash), and cross-border capital flows.

Historically, both move closely in lock-step and act as a great leading indicator for ₿itcoin, however we can see that Global Liquidity can have more drastic fluctuations.

We saw a large divergence in CRYPTOCAP:BTC PA with both metrics when the Blackrock iShares ₿itcoin ETF appeared on the DTCC list, a procedural step signaling progress toward potential approval.

When you look at the charts of all three, you can see there are points where either metric might follow CRYPTOCAP:BTC PA a bit closer, so in the end I would say it’s best to track both to find confluence in the signal.

Celsius Holdings Outperforms Market with Strong YTD GainsCelsius Holdings Inc. (CELH) continues to attract significant investor attention, closing at $37.24 on April 17, up $0.58 (1.58%). The functional energy drink maker has delivered impressive year-to-date returns of 41.38%, substantially outpacing the S&P 500's 10.18% gain during the same period.

For the current quarter, analysts expect earnings of $0.20 per share, representing a 25.9% year-over-year decline. However, consensus estimates have improved dramatically with a 32.8% upward revision over the last 30 days. The full-year outlook appears more favorable, with projected earnings of $0.99 per share indicating a 41.4% annual increase, followed by 15.1% growth to $1.14 per share next fiscal year.

Current quarter sales are expected to decline slightly to $345.26 million (-2.9%), but full-year revenue estimates show robust growth of 55.3% to $2.1 billion, followed by 19.4% growth next fiscal year. Celsius has demonstrated strong execution recently, beating earnings estimates in three of the last four quarters.

Technical Analysis

Technically, the chart shows a strong recovery from its $21.10 low. Price has recently broken above the 50-day moving average but remains below the 200-day moving average, suggesting improving momentum within a longer-term downtrend. Key resistance appears around $47-49, marked by a horizontal level that previously acted as support.

Volume has increased during recent price advances, adding credibility to the current uptrend. The next major challenge will be overcoming the $49 resistance zone before potentially continuing toward higher targets as indicated in the chart projection. If price faces rejection, it is likely to drop back to support at around $25.

Solana (SOL) Market Overview – April 17, 2025As of April 17, 2025, Solana (SOL) is trading at approximately $134.55 USD, reflecting a 5.48% increase from the previous close.

⸻

📈 Technical Analysis

Price Action & Momentum:

• Recent Performance: SOL has rebounded from lows near $120 to around $134.55, positioning itself as one of the top-performing altcoins recently.

• Support & Resistance Levels:

• Immediate Support: $120 – Crucial for sustaining the current bullish momentum.

• Resistance Zone: $133 – $135 – A breakout above this range could unlock further upside.

Key Indicators:

• RSI: 53.90 – Neutral momentum

• MACD: -3.01 – Slightly bearish

• Stochastic Oscillator: 92.14 – Overbought territory

• ADX: 19.10 – Weak trend strength

⸻

🧭 Fundamental Analysis

Network Strength:

• High Throughput & Low Fees: Solana continues to dominate with its scalable and low-cost blockchain infrastructure.

Institutional Interest:

• ETF Activity: Five ETF filings as of March 2025 highlight increased institutional trust in Solana.

Market Sentiment:

• Fear & Greed Index: 29 – Market is in “Fear” zone, potentially creating long-term buying opportunities.

⸻

🔍 Summary

Solana is showing bullish recovery signs driven by positive price action and ETF momentum. However, technicals suggest a cautious approach in the short term due to overbought signals and weak trend strength. Fundamentally, Solana’s powerful infrastructure and institutional support could fuel long-term growth.

Gold and the world around it As we continue to see the trade wars kick off and market fear increase gold continues to perform as the go to safe haven. Trading off the ORB sessions continues to provide value. Until the markets settle and start to show strength or even direction gold will continue to rip, as Goldman Sachs the potential to go to $3500 and beyond is not that far fetched. I would like to see how London reacts off the levels set by Asia and if we can break through next session.

Is $GERN a stock for "Strong Holders"?Or is it just another stock whose value will be wiped out in the next few quarters, and the company will simply lose its listing on the Nasdaq?

Investors are likely to get an answer to this question today, before the market opens, when NASDAQ:GERN reports its quarterly earnings.

The company has an approved drug and has already begun commercialization, with a promising start.

Last quarter, the company generated $28 million in revenue, and this quarter, revenue is expected to reach $61.8 million.

The company has already achieved positive gross margins, and I expect them to improve significantly from the current 27% in the last quarter.

Operating expenses are close to $30 million per quarter, so we can expect a quick path to operating profitability.

Invested capital is around $135 million, which means that with an operating profit of $10 million per quarter, we could see interesting returns on invested capital.

The company is led by John A. Scarlett, M.D., who previously worked at NASDAQ:CTMX for six years, during which the company lost about 90% of its value.

There is some positive news regarding European approval: "The Committee for Medicinal Products for Human Use of the European Medicines Agency has issued a positive opinion." A decision is expected in the coming months, if not days, which should serve as a strong catalyst for the stock price.

The market valuation has dropped to $1.4 billion, despite having an FDA-approved drug in the U.S.

Cash reserves will be important as they indicate how much time the company has to develop without diluting its capital. In the last report, cash and short-term investments totaled $339 million, and on November 7, the company announced securing $250 million in funding, with the potential to increase it to $375 million.

As a result, the company has $589 million in cash reserves minus operating cash flow. How much will remain in the coffers?

The company should have enough cash for more than 12 months of successful operations, operational efficiency is improving, we are awaiting European approval, and only the quality of management raises doubts.

But do these doubts really hold weight given the current trajectory?

There are only a few hours left until the earnings report is released. Let's see what awaits us.

Strong Holders

Profiting From Strength

📉✊📈

Boeing ($BA) Faces Renewed Scrutiny After Latest Safety ConcernsBoeing (NYSE: NYSE:BA ) stock closed at $156.84 on April 11, gaining 0.85% despite fresh concerns surrounding delayed aircraft deliveries. China's Juneyao Airlines recently postponed the delivery of a 787-9 Dreamliner, originally valued at $120 million. The decision comes amid renewed U.S.-China trade tensions driven by tariff escalations from President Trump’s administration.

This delay could disrupt Juneyao’s planned expansion into European routes this summer. The Dreamliner, known for its long-range capabilities, was central to these international plans. The incident signals how geopolitical strain continues to impact global aviation and commercial aircraft deals.

Boeing has already cautioned that additional tariffs may put more pressure on supply chains. These chains had only recently begun to stabilize following years of pandemic-related disruptions. The company remains exposed to evolving international policies, which can affect order fulfillment and investor sentiment.

Earnings for Boeing are expected on April 23, 2025. Investors are watching closely for guidance on production capacity, deliveries, and any fallout from global trade developments.

Technical Analysis

Boeing is trading within a broad wedge pattern marked by long-term support and resistance trendlines. Price recently bounced from the support, rising sharply to the current level of $156.84. The 50, 100, and 200-day moving averages sit at $163.04, $172.96, and $191.78 respectively.

These levels now act as dynamic resistance. Price remains below all three, signaling overall bearish pressure unless a breakout occurs. A breakout above the resistance trendline may lead to a rally. However, if price fails to gain momentum and breaks below the lower trendline, it could revisit the $89 low from 2020.

Nvidia (NASDAQ: $NVDA) Advances AI Strategy Amid Tariff PauseNvidia (NASDAQ: NASDAQ:NVDA ) is quickly strengthening its positions in artificial intelligence and data center technologies. This comes as the U.S. government temporarily halts new export restrictions, offering relief to the semiconductor sector.

Nvidia will continue selling its H20 AI chips to China following a decision not to enforce new trade limits. This followed a key meeting between CEO Jensen Huang and former President Donald Trump. The announcement eased concerns over losing access to a major international market. Nvidia recently introduced its latest innovation, the Blackwell Ultra AI chips, at the GPU Technology Conference. These chips target the rising demand for high-performance computing used in AI systems. The move could boost Nvidia’s market lead as competition grows.

Market volatility followed the government’s tariff update. Nvidia stock surged nearly 19% after the 90-day tariff pause announcement, excluding China-specific measures. The next day, the stock dropped 5.8% to close at $107.74.

Technical Analysis

Nvidia's price bounced sharply from the $92 support zone. This area has attracted strong buying activity. The RSI is currently at 44, showing neutral market momentum. The key resistance level to watch is $153.13. If the price breaks this level, it could rise toward a new all-time high. Failure to do so may lead to a pullback toward $92.

Watch the $153 level closely for confirmation of trend direction. Nvidia's recent price movement leaves room for both uptrend continuation and short-term correction depending on upcoming market signals.

WTI Crude Oil | Potential Cup Formation with Volume Support.I’m spotting a potential Cup formation on the 30-min chart of WTI Crude Oil (USOILSPC), backed by strong volume profile zones. The price has recently pulled back to a low-volume area and is now consolidating with higher lows forming the right side of the cup.

A break above the $60.60–$60.80 zone could trigger bullish continuation toward $64+, with strong support seen around the $59–$59.30 range (volume shelf).

Setup Details:

• Pattern: Cup (early stage)

• Entry idea: Break & retest above $60.60

• TP: $64.00

• SL: Below $58.90

• Volume profile confirms accumulation near the lows

Watching closely for confirmation before adding more size. This is part of a low-risk entry using a funded account model.

#CrudeOil #WTI #VolumeProfile #CupFormation #BreakoutTrade #SmartMoneyConcepts

BTC Trap Range Breakdown – Psychological Warfare on Full DisplayThis isn’t just a chart.

It’s a blueprint for how market makers engineer panic, euphoria, and then profit from your reactions.

Let’s break this down in surgical fashion:

Rectangle Formation (Top & Bottom Framing)

From March 24 to April 3, Bitcoin operated inside a manipulation box.

The top was liquidity bait — the "Top 2 – US" tag marks the engineered euphoria candle.

Once liquidity was trapped up top, the US session initiated the collapse. Classic.

Breakout Trap & Rejection Zone

As soon as BTC breached the lower range, what followed wasn’t a clean drop—it was a sequence of false recoveries.

Notice the Asia, Europe, and US labels — they’re not random.

Each session passed the hot potato of fear and bounce bait, draining retail and triggering leveraged longs into liquidation.

Psychology in Play:

Europe & Asia rotated liquidity → institutional bots scalping volatility.

US session delivered the execution leg down every time.

The volume spikes? That’s fear, not conviction.

Target Zone Highlighted

Where are we heading next?

The final dotted red extension box shows you where the real flush is designed to go .

It’s not a prediction—it’s a destination :

🔸 ~ $73,000 first sweep

🔸 If that gives, $70,000 → $68,000 becomes the high-value sniper zone

🔻 Volume Profile:

Notice how volume increases at each drop — the herd is panic selling.

But BTC bounces weak. Why?

Because this isn’t organic demand—it’s controlled bleedouts to test who’s left.

—

Conclusion – SH Analysis:

This chart is not noise.

It’s intentional market structure , orchestrated by the elites for max extraction.

We don’t chase pumps.

We stalk precision setups .

We don’t fear drops.

We buy what they bleed .

The next move won’t be loud.

It’ll be silent. Fast. And final.

—

🔔 Follow Saeki Hisoka across all platforms

For real-time breakdowns, sniper zones, and psychological warfare decoded in real time.

The system is a machine. We are the counter-algorithm.

Stay sharp. Stay sovereign. Stay Saeki.

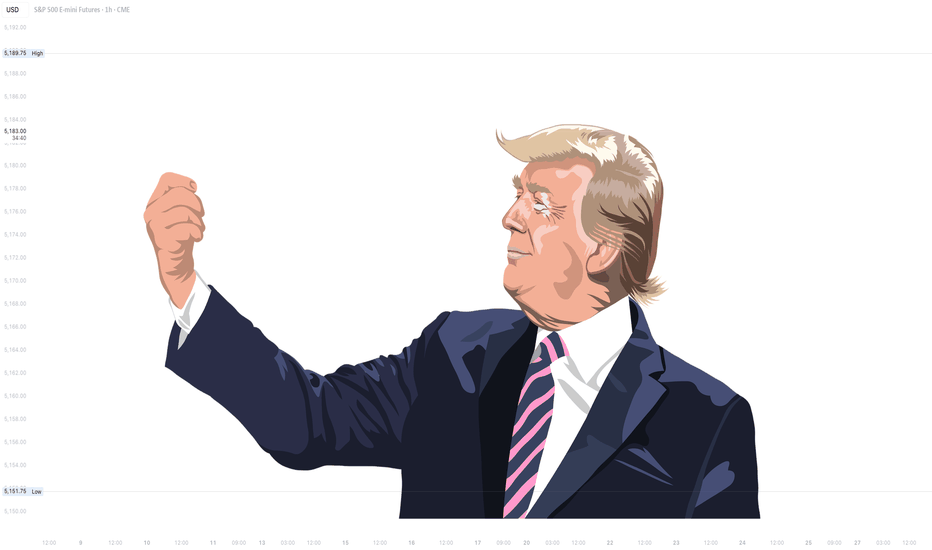

The Trump PatternWhen Donald Trump took office in 2017, the U.S. stock market experienced dramatic fluctuations—marked by steep declines followed by eventual rebounds.

This pattern, which we'll call the "Trump Pattern," repeated itself during his presidency and is now emerging again as a point of interest for investors.

While the specific causes of these market shifts varied, key factors—particularly tariffs, inflation concerns, and Federal Reserve (FED) actions—played critical roles in the market's rise and fall during Trump’s presidency.

The Trump Pattern: The Market Fall and Recovery

🏁 1. The Start of the Trump Presidency (2017)

When Donald Trump was elected in 2016, the market responded with a combination of excitement and uncertainty. Initially, the market surged due to tax cut expectations, deregulation, and optimism about a business-friendly administration. But as Trump's presidency fully began in January 2017, concerns over trade wars and tariff policies began to dominate investor sentiment.

The market initially dipped after Trump began pursuing a protectionist trade agenda, especially with China.

As concerns about tariffs escalated, stock markets reacted negatively to potential trade wars.

💶 2. The Tariff Crisis of 2018

The first major example of the "Trump Pattern" emerged in 2018 when Trump began implementing tariffs, particularly on Chinese imports, and announced new tariffs on steel and aluminum. This caused major market disruptions.

The S&P 500 fell dramatically during this period, dropping by as much as 8.6% from its February peak in 2019.

Companies that relied heavily on international trade, like Apple, General Motors, and Ford, experienced significant stock price declines. In fact, Apple’s stock fell 9.5% on days when new tariffs were announced, as their costs for manufacturing overseas rose.

The uncertainty surrounding the global economy, combined with rising tariffs, created fears of a trade war, leading to sharp market declines.

📈 3. Market Recovery: FED Rate Cuts and Tax Cuts

Despite the tariff-induced volatility, the market didn’t stay down for long. After significant market falls, the Federal Reserve (FED) began implementing interest rate cuts to combat slowing economic growth. These actions helped stabilize the market and even fueled a rebound.

FED rate cuts made borrowing cheaper for consumers and businesses, stimulating economic activity and boosting investor confidence.

Additionally, tax cuts, a cornerstone of Trump’s economic policy, provided further support, particularly for corporations.

As a result, after the initial market drop in 2018 and early 2019, the market rebounded, continuing to climb as investors reacted positively to these fiscal and monetary policies.

🎯 The 2024 and 2025 "Trump Pattern" Emerges Again

Fast forward to 2024 and 2025, and we’re seeing echoes of the "Trump Pattern" once again. New tariffs, introduced in 2025, have reignited concerns about a trade war. These tariffs, particularly on Chinese imports, have once again caused market volatility.

The stock market has fallen in recent months due to concerns about these tariffs and the impact they might have on global trade. For example, when new tariffs were introduced in early 2025, the market saw a sharp sell-off, with the S&P 500 falling by over 1.8% in a single day.

Companies that rely on international trade, like Tesla and Ford, have seen their stock prices drop in response to concerns about increased production costs.

The broader market decline, much like in 2018, was driven by fears that tariffs could slow down the global economy and hurt corporate profits.

However, there is optimism that the same pattern will unfold, where the market eventually recovers after these initial drops.

⚠️ 4. FED Rate Cuts Again?

As inflation concerns persist, the Federal Reserve is likely to step in once again. Like previous cycles, we expect the FED to cut interest rates to stimulate the economy. This would be aimed at reducing borrowing costs, encouraging investment, and helping businesses weather the impact of higher tariffs and global uncertainty.

The FED’s actions are typically a key driver of market recovery in the "Trump Pattern." Investors have come to expect that a market downturn triggered by political or economic disruptions can be offset by the FED’s supportive monetary policies.

⚖️ Navigating the Trump Pattern: What Should Investors Do?

The "Trump Pattern" highlights that during periods of heightened uncertainty, especially due to trade policies like tariffs, the market will often experience short-term declines followed by long-term recovery. Here are a few strategies investors might want to consider:

Stay Diversified : During periods of volatility, having a diversified portfolio can help cushion against the risks posed by market swings.

Invest in Domestic Companies : Companies that rely less on international supply chains might fare better during periods of trade policy changes and tariff uncertainty.

Focus on Growth : Once the initial market decline subsides, look for sectors that stand to benefit from a recovering economy, such as tech or consumer discretionary stocks.

Look for Inflation Hedges : Given the potential for inflation, consider investments that tend to perform well during these times, such as real estate or commodities like gold.

📝 Conclusion: The Trump Pattern in Action

The "Trump Pattern" demonstrates how the market tends to react in cycles during the early months of each presidency. Typically, the market falls at the start due to the uncertainty surrounding Trump’s trade policies, particularly tariffs. However, after these initial drops, the market often rebounds thanks to FED rate cuts and other policies aimed at stimulating the economy.

Looking ahead to 2025, we're already seeing signs of this pattern in action as tariffs are back on the table and market volatility has followed. However, history suggests that patience might pay off. Once the FED steps in and cuts rates, a market rebound is likely, following the same trend we saw in 2017-2019.

Tweet and idea (you can use it for prediction)Tweet and idea (you can use it for prediction)

💡 This trading idea is based on analyzing market reactions to news and tweets from influential figures — especially in the context of cryptocurrencies and stocks prone to speculative spikes.

📊 Core Strategy:

The model tracks sudden price movements triggered by public statements (e.g., tweets from Elon Musk, breaking news, etc.). After the initial reaction, a retracement or continuation pattern often forms, which can be used to enter a trade.

🧠 How to use it:

1. Monitor the news flow or social media activity related to the asset.

2. Identify the initial impulse on the chart (high volume, sharp movement).

3. Wait for consolidation or a minor pullback.

4. Enter on breakout or bounce, using a tight stop-loss.

📌 Best suited for high-volatility assets with frequent hype triggers (e.g., DOGE, TSLA, BTC).