Accumulate for Long TermNestle is trading at a little discount as compared to it's historic valuation for last 6-7 years. This is a growing stock, so it will be good to buy some shares now. Some details of it's strategies and products portfolio below - Happy Trading :)

Over the past six to seven years, Nestlé India has demonstrated consistent revenue growth, driven by a combination of strategic initiatives and a strong product portfolio. Key factors contributing to this sustained growth include:

1. Innovation and Product Diversification: Nestlé India has prioritized innovation, launching over 140 new products in the past eight years. These introductions span various categories, including science-led nutrition solutions, millet-based products, and plant-based protein options, catering to diverse consumer needs.

BUSINESS-STANDARD.COM

2. Strengthening Core Brands: The company has focused on reinforcing its flagship brands:

Maggi: Achieved the status of the largest market globally for Maggi, driven by balanced product mix, pricing strategies, and volume growth.

THE HINDU BUSINESS LINE

KitKat: India became the second-largest market for KitKat worldwide, reflecting robust performance in the confectionery segment.

THE HINDU BUSINESS LINE

Nescafé: The beverage segment, particularly Nescafé, has seen significant growth, introducing coffee to over 30 million households in the last seven years.

THE HINDU BUSINESS LINE

3. Expansion into New Categories: Nestlé India is exploring opportunities in emerging sectors such as healthy aging products, plant-based nutrition, healthy snacking, and toddler nutrition. These initiatives aim to tap into evolving consumer preferences and health-conscious trends.

CFO.ECONOMICTIMES.INDIATIMES.COM

4. Focus on Premiumization: The company is enhancing its premium product offerings, including the introduction of Nespresso and health science products. This strategic move aims to have premium products contribute to 20% of sales in the long term, up from the current 12-13%.

GOODRETURNS.IN

5. Strategic Partnerships: A notable collaboration with Dr. Reddy's Laboratories to form a joint venture in the nutraceuticals space underscores Nestlé India's commitment to expanding its health science portfolio and leveraging synergies for growth.

THE HINDU BUSINESS LINE

Collectively, these strategies have enabled Nestlé India to maintain a consistent upward trajectory in revenue, effectively adapting to market dynamics and consumer demands.

Growth

Long for Long Term - Discount price in terms of Revenue/shareAs seen in the Revenue Grid indicator, stock is currently trading at 2 to 2.5 times it's Revenue per share, which is a very low valuation historically. It crossed below this valuation, only at covid pandemic crash. Given the consistent Revenue increase, this is a fair value to buy for a long term view.

Don't Confuse "DYOR" with Confirmation Bias in Crypto TradingIn the crypto space, influencers and self-proclaimed crypto gurus constantly tell you to " do your own research " (DYOR) while presenting coins that will supposedly do 100x or become the "next big thing." They always add, " this is not financial advice ," but few actually explain how to do proper research.

On top of that, most influencers copy each other, get paid by projects to promote them, and—whether they admit it or not—often contribute to confirmation bias.

What is confirmation bias? It’s the psychological tendency to look for information that confirms what we already believe while ignoring evidence that contradicts it.

For example, if you want to believe a certain altcoin will 100x, you’ll naturally look for articles, tweets, and videos that say exactly that—while ignoring red flags.

How do you distinguish real research from confirmation bias?

This article will help you:

• Understand confirmation bias and how it affects your investments

• Learn how to conduct proper, unbiased research

• Discover the best tools and sources for real analysis

________________________________________

What Is Confirmation Bias & How Does It Sabotage Your Investments?

Confirmation bias is the tendency to seek, interpret, and remember information that confirms what we already believe—while ignoring evidence to the contrary.

In crypto, this leads to:

✔️ Only looking for opinions that confirm a coin is "going to the moon"

✔️ Avoiding critical discussions about the project’s weaknesses

✔️ Believing "everyone" is bullish because you're only consuming pro-coin content

The result?

• You make emotional investments instead of rational ones

• You expose yourself to unnecessary risk

• You develop unrealistic expectations and are more vulnerable to FOMO

________________________________________

How to Conduct Proper Research & Avoid Confirmation Bias

1. Verify the Team & Project Fundamentals

A solid crypto project must have a transparent, experienced team. Check:

• Who are the founders and developers? Are they reputable or anonymous?

• Do they have experience? Have they worked on successful projects before?

• Is the code open-source? If not, why?

• Is there a strong whitepaper? It should clearly explain the problem, the solution, and the technology behind it.

Useful tools:

🔹 GitHub – Check development activity

🔹 LinkedIn – Verify the team's background

🔹 CoinMarketCap / CoinGecko – Check market data and tokenomics

2. Analyze Tokenomics & Economic Model

A project can have great technology but fail due to bad tokenomics.

Key questions to ask:

• What’s the maximum supply? A very high supply can limit price growth.

• How are the tokens distributed? If the team and early investors hold most of the supply, there’s a risk of dumping.

• Are there mechanisms like staking or token burning? These can impact long-term sustainability.

Useful tools:

🔹 Token Unlocks – See when tokens will be released into circulation

🔹 Messari – Get detailed tokenomics reports

3. Evaluate the Community Without Being Misled

A large, active community can be a good sign, but beware of:

• Real engagement vs. bots. A high follower count doesn’t always mean real support.

• How does the team respond to tough questions? Avoid projects where criticism is silenced.

• Excessive hype? If all discussions are about "Lambo soon" and "to the moon," be cautious.

Where to check?

🔹 Twitter (X) – Follow discussions about the project

🔹 Reddit – Read community opinions

🔹 – See how the team handles criticism

4. Verify Partnerships & Investors

Many projects exaggerate or fake their partnerships.

• Is it listed on major exchanges? Binance, Coinbase, and Kraken are more selective.

• Are the investors well-known VCs? Funds like A16z, Sequoia, Pantera Capital don’t invest in just anything.

• Do the supposed partners confirm the collaboration? Check their official sites or announcements.

Where to verify?

🔹 Crunchbase – Check a project's investors

🔹 Medium – Many projects announce partnerships here

5. Watch the Team's Actions, Not Just Their Words

• Have they delivered on promises? Compare the roadmap to actual progress.

• What updates have they released? A strong project should have continuous development.

• Are they selling their own tokens? If the team is dumping their coins, it’s a bad sign.

Useful tools:

🔹 Etherscan / BscScan – Track team transactions

🔹 DefiLlama – Check total value locked (TVL) in DeFi projects

________________________________________

Final Thoughts: DYOR Correctly, Not Emotionally

To make smart investments in crypto, you must conduct objective research—not just look for confirmation of what you already believe.

✅ Analyze the team, tokenomics, and partnerships.

✅ Be skeptical of hype and verify all claims.

✅ Use on-chain data, not just opinions.

✅ Don’t let FOMO or emotions drive your decisions.

By following these steps, you’ll be ahead of most retail investors who let emotions—not facts—guide their trades.

How do you do your own research in crypto? Let me know in the comments!

Learn To Invest: Global Liquidity Index & BitcoinGlobal Liquidity Index & BitCoin:

🚀 Positive Vibes for Your Financial Journey! 🚀

BITSTAMP:BTCUSD

Look at this chart! It's the Global Liquidity Index , a measure of how much extra money is flowing through the world's financial systems.

Why is this important? Because when this index is high, it often means good things for investments like #Bitcoin! 📈

Think of it like this: when there's more money flowing, people are often more willing to take risks and invest in things like Bitcoin.

See those "BullRun" boxes? That means things are looking bright! It's showing that money is flowing, and that's often a good sign for potential Bitcoin growth. 🌟

Even if you're not a pro, it's easy to see the good news here. Understanding these trends can help you make smarter decisions.

Let's all aim for growth and success! 💪

Long SBIN - Trading exactly at Rev/share = 1.As per the Revenue Grid indicator, SBI is trading exactly at it's Revenue per share value. That means current price of 1 share is same as that of the revenue it is generating per share. Historically it has traded around this valuation. But given the steady growth of SBI over the years, This is a good price to buy for long term. Happy Trading :)

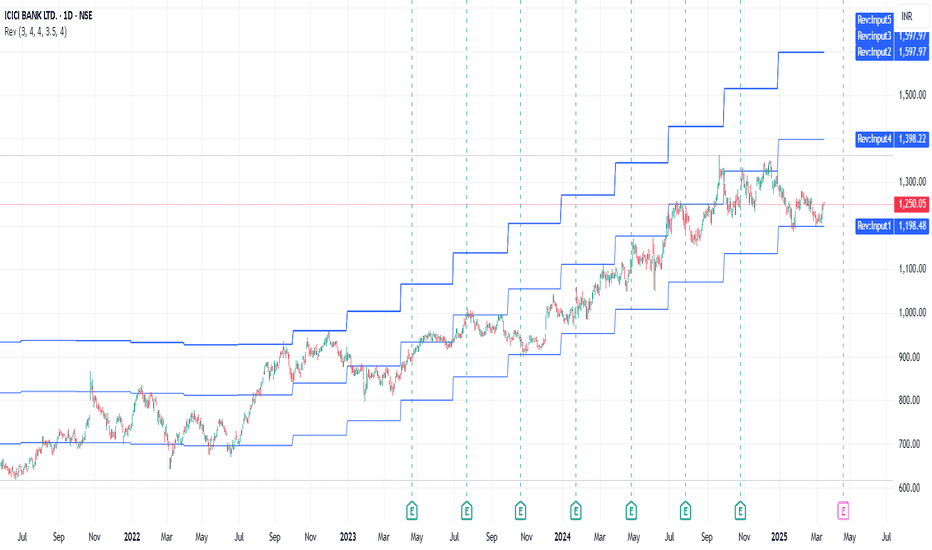

Long ICICI BankSince August 2021, ICICI Bank stock has been trading nicely between Revenue/share multiple of 3, 3.5 and 4. That means it is trading at 3 to 3.5 times it's revenue per share. It is clearly visible using Revenue Grid Indicator applied on daily chart. As per that, this is a good time to buy for a long term view. We can wait for 21 Apr 2025 for it's next earnings results also :) Happy Trading :)

The Hershey Company (NYSE:HSY) - Undervalued nowThe Hershey Company is an American multinational confectionery company, founded by Milton S. Hershey in 1894. The company initially focused on caramel and chocolate, eventually expanding into a wide range of confectionery products.

The company’s headquarters are located in Hershey, Pennsylvania, which is also home to Hersheypark and Hershey’s Chocolate World. ,

Business Model, Products, and Services

The Hershey Company is a leading confectionery manufacturer and marketer. Their core business revolves around producing and selling chocolate, sweets, mints, and other snacks.

Their key product lines include Hershey’s chocolate bars, Reese’s peanut butter cups, Kit Kat, Jolly Rancher, and Ice Breakers.

The company’s business model is centered on brand recognition, product quality, and extensive distribution networks.

Durable Competitive Advantage

Hershey possesses a strong durable competitive advantage primarily due to its iconic brand portfolio. Brands like Hershey’s and Reese’s have decades of consumer loyalty and strong brand recognition.

This aligns with the “unique product” business model, as these brands hold a distinctive place in the confectionery market.

Economic Moat

Hershey’s “economic moat” is built upon its powerful brand identity. The company’s brands have a long-standing history and strong emotional connection with consumers, creating a barrier to entry for competitors. Their distribution network also provides an economic moat.

Industry Outlook, Challenges, and Competitors

The confectionery industry is generally stable, but it faces challenges related to changing consumer preferences (e.g., healthier snacks), rising ingredient costs, and intense competition.

The company’s key competitors include Mondelez International (MDLZ), Kraft Heinz (KHC), Kellogg (K), and Campbell Soup Company (CPB). Additionally, increased competition from smaller, more innovative brands is also contributing to Hershey’s market share decline.

Health trends are a large challenge, sweet snacks have been under pressure as more consumers become aware of their calorie and sugar intake.

Supply chain risks are also a consistent threat for The Hershey Company, as disruptions in the procurement of key raw materials like cocoa, sugar, and dairy could impact production costs and margins. Additionally, geopolitical instability, trade restrictions, and transportation bottlenecks may further challenge the company’s ability to maintain steady inventory levels and meet consumer demand.

Comparative Analysis

The following is a comparative analysis of the company’s financial position and performance. The analysis evaluates eight key financial ratios to determine whether the company possesses a durable competitive advantage. The company’s financial ratios are compared with the median ratios of its main competitors.

Gross Margin %

Hershey maintains a consistent gross profit margin of 42%, which is significantly higher than the competitor average of 33.62%.

A high gross profit margin stems from the company’s durable competitive advantage, allowing it to price its products significantly higher than its competitors while maintaining strong profitability.

R&D to Revenue Ratio %

Hershey’s R&D expenditure is relatively low at 0.5% compared to its competitors’ 0.9%. This suggests that its competitive advantage relies more on brand strength and distribution than on product innovation.

Depreciation to Gross Profit Ratio %

Hershey’s depreciation-to-gross-profit ratio is a reasonable 9.48%, slightly lower than its competitors’ 9.65%, suggesting efficient asset utilization.

Interest Expense to Operating Income Ratio %

Hershey’s Interest Expense to Operating Income Ratio is 7.4%, significantly lower than its competitors’ 16.3%, indicating a strong financial position.

Operating Margin %

Hershey’s operating margin is strong, consistently above 20%. This suggests efficient operations and pricing power.

Free Cash Flow Margin %

Hershey’s free cash flow margin fluctuates, but it consistently remains higher than that of its competitors. This is a strong indicator that Hershey has a durable competitive advantage.

Basic Earnings Per Share (EPS)

Hershey’s EPS shows a generally upward trend, indicating consistent profitability.

Return on Equity (ROE)

Hershey’s ROE is strong and significantly higher than that of its competitors, indicating efficient utilization of shareholder equity.

Based on the analysis of key financial ratios, we have determined the following: The Hershey Company’s financial condition is stronger than that of its competitors. We believe the company holds a competitive advantage within its industry.

Intrinsic Value Valuation

Intrinsic Value: $236.80

Current Price: $171.16

Margin of Safety: 27.72%

Based on the provided data, Hershey’s stock appears to be undervalued, with a significant margin of safety.

The company’s strong brand portfolio, consistent profitability, and efficient operations are positive indicators.

The 27.72% margin of safety provides a good buffer against potential market fluctuations or valuation errors.

Recommendation: Given the current undervaluation and the company’s strong fundamentals, a “buy” recommendation is warranted. However, investors should carefully monitor industry trends, competitive pressures, and potential risks related to changing consumer preferences and ingredient costs.

XAUUSD BUYS PLAYING OUT PERFECTLY Hey guys if you got in for the Gold buys that I posted when I executed I bet you’re in deep profit now, we up 1:1 so put trade at breakeven and hold to Tp I’m targeting $3000 tho I don’t know if price will get there so take your profits when you feel like is enough for you…let’s see how it ends…

NVDA Breakdown: Is a Trend Reversal Unfolding?NVDA is showing signs of weakness, with an A-B-C correction potentially unfolding, hinting at a trend reversal. The near-term peak in AI compute demand, proven by DeepSeek , and NVDA’s reliance on Taiwan-based TSMC amid geopolitical risks add fundamental pressure. Broader market sentiment hasn’t turned fully bearish yet either, with CPCE unchanged for March — suggesting market participants haven't fully priced in further downside.

$NYSE:VRT (Vertiv Holdings, LLC) Bullish Outlook NYSE:VRT

Company Overview:

Cooling for Data Centers. One of the very few.

Vertiv Holdings Co. engages in the design, manufacture, and service of critical digital infrastructure technology that powers, cools, deploys, secures and maintains electronics that process, store and transmit data. It also offers power management products, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure.

Vertiv Group Corp., established in 2016 after its acquisition by Platinum Equity, stands as a global leader in data center cooling solutions. Offering precision cooling systems and thermal management solutions since its inception, Vertiv has garnered recognition for its innovative technologies and commitment to sustainability. Recent developments, especially in energy-efficient cooling systems, underscore its dedication to meeting evolving market needs. Vertiv's focus on innovation, reliability, and customer satisfaction has solidified its position as a top choice for organizations seeking cutting-edge cooling solutions for their critical digital infrastructure.

Other companies may partake in Data Center Cooling but Vertiv (VST) specializes in it. That's the big difference. It's not a side piece of the business to make additional $. That's what makes it special. That's why I mentioned there really isn't many companies that specialize in this critical area especially with the growth of data centers.

Technicals:

Positive Divergence

RSI at 36 and as of now crossing RSI-Based MA

Descending Wedge (breaking out as of 3/12)

Downside: A lot of resistance to break through as in it 's under ALL Moving Average's.

Overall NYSE:VRT continues to to increase every single quarter and is in a very strong market of data centers as these will continue to increase and need cooling. Institutions own 83.77%

VRT Snapshot

VRT Growth

INTC | If Keeps This up it will get Past it's Technical IssuesINTC makes CNBC news as top mover today 3-12-25, it needs the attention, why... if Intel keeps this up it will get past it's technical issues which I think it will; buyout rumors are very real and possible and it's getting the attention it DOES deserve, I think it surprises the market with moves higher. Apple or Samsung could use all the patents and history on this mega-company, at this price I feel it's a steal absolutely. Someone must be eying taking it out outright IMO.

Strong technicals are forming right here and now.

CHINA FIN MARKETS | Investing in China & AIChina's market resurgence might pose some great opportunities for investors, especially after a long bearish cycle for the global Chinese financial markets.

February 2025 saw a significant shake-up in global markets, with China emerging as a key player driving investor sentiment. The MSCI China Index surged by 11.2% for the month, vastly outperforming the MSCI US Index:

One of the biggest catalysts behind China’s recent rally has been its advancements in Artificial Intelligence (DeepSeekAI being one of the key drivers).

By operating at a fraction of the cost of their US counterparts, such as OpenAI and Meta, DeepSeek's competitive advantage has given China an edge in the AI space, which can be seen in the market confidence.

XIAOMI has been one of the top gainers, largely as they are expanding their market penetration:

Chinese markets in February saw a boost when President Xi Jinping was warmly received by tech industry leaders. A handshake between Xi and Alibaba’s Jack Ma who previously stepped back from the public eye following regulatory crackdowns, was seen as a major gesture of reconciliation between the government and the private sector. This renewed support for private enterprises.

China’s long-term strategy has been paying dividends in high-tech industries. China has increased its global market share in nearly all industries and is outperforming competitors in cost-efficiency, particularly in sectors like copper smelting.

Despite recent gains, China’s stock market has yet to fully recover from its underperformance over the past decade. While the MSCI China Index has risen 34.6% over the past year, long-term returns still lag behind global markets. A US$100 investment in an MSCI World Index tracker in 2010 would have grown to US$480 by early 2024, whereas the same amount invested in an MSCI China Index fund would have only reached US$175.

China’s resurgence has brought a renewed sense of optimism, but investors remain cautious. While AI advancements and low cost of labor have positioned China as a competitive force, historical challenges like regulatory intervention, tariffs and economic instability still loom.

_________________________

Rate gain: Techno funda pick RateGain Travel Technologies Ltd is the leading distribution technology company globally and the largest Software as a Service (SaaS) provider in the travel and hospitality industry in India. The firm offers travel and hospitality services across different verticals like hotels, airlines, online travel agents, meta-search companies, package providers, car rentals, cruises, and ferries.

technically trading at prior support areas !

TSLA’s Failed Breakout: Reversal or Deeper Drop Ahead?Tesla (TSLA) Market Outlook & Long-Term Investment Report

Tesla (TSLA) has positioned itself as more than just an electric vehicle (EV) manufacturer. With its advancements in robotics, artificial intelligence (AI), autonomous driving, and energy solutions, Tesla is becoming a major player in multiple high-growth industries. While recent price action has shown volatility, long-term investors see buying opportunities at key support levels.

Technical Analysis & Key Levels

1. High-Timeframe Context (HTF)

- HTF Resistance: $415.71 – Tesla attempted to break above this level but faced rejection, leading to a sharp pullback.

- Major Support & Resistance Zone – A critical level where Tesla has previously consolidated and reacted strongly.

- Liquidity Zones (LQZs):

- Daily LQZ (~$238.18) – A key demand area where buyers could step in.

- Weekly LQZ (~$182.44 - $108.01) – A deeper liquidity zone, potentially offering even better long-term buying opportunities if the downtrend continues.

2. Market Structure & Trend Analysis

- **Failed Breakout:** Price action showed a breakout above resistance, but the failure to hold led to a sharp reversal, indicating a potential liquidity grab.

- **Retest of Support:** The price is currently testing a significant support level, which will determine the next move.

- **Momentum Shift:** The aggressive rejection at HTF resistance suggests sellers are in control in the short term, but this creates long-term entry opportunities.

Long-Term Investment Thesis

Tesla's expansion into AI, robotics, and autonomous technology presents significant long-term growth potential beyond its traditional automotive business. Here are the key areas driving Tesla's future:

1. Robotics & Artificial Intelligence

- **Tesla Optimus Robot:** Tesla’s humanoid robot project is expected to revolutionize industrial automation. It could become a major revenue source as industries move toward AI-driven labor solutions.

- **Neural Networks & AI Advancements:** Tesla’s AI systems, used for Full Self-Driving (FSD), are also being adapted for robotics, increasing its competitive edge.

2. Energy & Infrastructure Expansion

- **Solar & Energy Storage:** Tesla’s **Megapack** and **Powerwall** businesses are growing as renewable energy adoption accelerates.

- **Grid-Scale Energy Solutions:** Tesla’s energy division could play a crucial role in stabilizing power grids worldwide, providing another strong revenue stream.

3. Autonomous Vehicles & FSD

- Tesla’s **Full Self-Driving (FSD)** software could create a high-margin subscription-based revenue model.

- The potential for a **Tesla Robotaxi network** could disrupt the ride-sharing industry and unlock new business models.

4. Synergies with SpaceX & AI Computing

- Tesla benefits indirectly from advancements in **SpaceX** technologies, such as materials science and AI computing.

- The **Dojo supercomputer** is being developed to enhance AI training, which could accelerate Tesla’s robotics and self-driving ambitions.

Investment Strategy & Accumulation Plan

For long-term investors, Tesla's volatility provides attractive buying opportunities. A strategic approach would involve:

1. Key Accumulation Levels

- **Daily LQZ (~$238)** – A strong support zone where Tesla could see renewed buying interest.

- **Weekly LQZ (~$182-$108)** – A deeper level that may offer excellent long-term value if the price declines further.

2. Dollar-Cost Averaging (DCA) Strategy

- Instead of trying to time the absolute bottom, investors can **ladder buy-ins** at different liquidity zones to optimize their cost basis.

- This reduces risk and takes advantage of market dips without excessive exposure.

3. Risk Management & Long-Term Horizon

- Tesla is known for its volatility; maintaining **a long-term vision (5+ years)** is crucial for maximizing gains.

- Investors should be prepared for short-term fluctuations while focusing on Tesla’s multi-industry expansion.

Conclusion

Tesla’s failed breakout and recent pullback present a strategic buying opportunity for long-term investors. With its advancements in robotics, AI, energy, and autonomous technology, Tesla is well-positioned to be a key player in multiple trillion-dollar industries over the next decade. The current price action suggests that accumulation at liquidity zones could provide strong long-term returns.

As the robotics industry grows, Tesla’s potential as a leading producer for industrial automation is increasingly clear. Investors with a bullish long-term outlook may find current and upcoming dips as prime entry points.

Final Thought

**Is Tesla’s current dip a gift for long-term believers?** With its expanding technological footprint, this may be an opportunity to accumulate before the next major growth cycle. 🚀

ADA | UPDATE | Heading for BIG THINGS ??Lace Light Wallet has announced the release of Daedalus 7.1.0 for Cardano, which introduces various security improvements and bug fixes.

This might be particularly important , considering the recent hack on ByBit where billions of dollars worth of ETH was allegedly stolen by the Lazarus group. (More on that, here:)

The price reacted positively briefly to the news, until whales took the opportunity to "sell the news", as we are currently seeing a correction in both the daily and the weekly timeframe:

Ada is likely on par for a further correction, should the current support level not hold. The next zone would be retesting the wick:

It's possible that with these continued improvements, Cardano could be a sleeping giant, waiting for it's moment to shine - in which case, given the functionality is there, the price could easily double from the previous ATH.

_________________ BINANCE:ADAUSDT

NVDA Stock: Under $120 pressured? $111 Break Signals $100 RiskIs NVIDIA (NVDA) stock in trouble? As long as NVDA stays under the 120 area, it’s under serious pressure, and the red flag is a drop below 111, opening the door to a fall to the 100 area. In this video, we dive into the latest NVDA stock analysis, breaking down how U.S. export controls have slashed sales to China—now just 15% of total revenue—spooking investors. Could this be the catalyst for a bigger crash? We explore technical levels (120, 111, 100), the impact of CEO Jensen Huang’s sales warning, and what it means for NVDA stock price in near term. Don’t miss this critical update— Drop your thoughts in the comments: Is NVDA a buy or a sell at these levels?

Incoming BNB chain forks with 0,75s block time!BNB chain upcoming forks significantly reducing block times, increase TPS and decrease fees!

The Pascal hard fork in March 2025 is a big milestone in BNB Chain’s evolution setting the stage for the two upcoming BNB Chain forks:

1. Lorentz (April 2025): Reduces block intervals to 1.5 seconds

2. Maxwell (June 2025): Further reduces block intervals to 0.75 seconds

Very bullish for all BNB chain projects and it´s main token BNB and defi platforms like CAKE. Finally Ethereum compatible chain's direct hit to Solana's heart and it's performance. The Maxwell fork in June will be game changer for crypto industry.

Almost instant defi experience with decreasing Ethereum activity might lead to 2025 be a BNB chain season.

Incoming BNB chain forks with 0,75s block time!BNB chain upcoming forks significantly reducing block times, increase TPS and decrease fees!

The Pascal hard fork in March 2025 is a big milestone in BNB Chain’s evolution setting the stage for the two upcoming BNB Chain forks:

1. Lorentz (April 2025): Reduces block intervals to 1.5 seconds

2. Maxwell (June 2025): Further reduces block intervals to 0.75 seconds

Very bullish for all BNB chain projects and it´s main token BNB. Finally Ethereum compatible chain's direct hit to Solana's heart and it's performance. The Maxwell fork in June will be game changer for crypto industry.

My short-term prediction once Pascal fork is implemented to main net in the middle of March 2025.

DELL: Expecting Strong Forecasts for 2025Key arguments supporting the idea

Attractive Multiples and Technical Outlook

Growth Across All Business Segments

Dell Rapidly Expanding Market Share in AI Server Segment

Dell Technologies develops, manufactures, and sells a wide range of integrated solutions, products, and services. The company operates through two segments: Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG). The ISG segment provides solutions for customers’ digital transformation, including artificial intelligence (AI), machine learning, data analytics, as well as modern and traditional data storage. The CSG segment offers branded personal computers, including laptops, desktops, workstations, and peripherals such as monitors, keyboards, and webcams.

Investment Thesis

Positive Technical Outlook and Low Multiples. After releasing financial results for Q3 FY2025, Dell’s stock entered a correction phase, reaching three-month lows. However, the stock subsequently resumed an upward trajectory. Currently, the RSI technical indicator remains below the overbought zone, signaling further upside potential. Dell’s market multiples appear highly attractive. The forward P/E ratio of 14 is slightly above the company’s historical levels but remains significantly lower than the sector average (24) and the S&P 500 index (23). The forward P/S ratio of 0.8 is considerably below the sector average (3.28), reinforcing the view that Dell is currently undervalued.

2025 Expected to Mark the Start of a New PC Upgrade Cycle. Following the COVID-19-driven surge in PC sales, many of these devices are reaching the end of their typical 3-4 year lifecycle. Despite initial analyst expectations for significant market growth, real growth in 2024 was just 1% YoY. According to updated IDC forecasts, 2025 is expected to be the year of PC market recovery. Key growth drivers include: massive device aging from previous years’ purchases, end of support for Windows 10 in October 2025 and increased demand for AI-integrated computers IDC projects 4.3% PC market growth in 2025, which should positively impact Dell’s largest segment – CSG.

AI Infrastructure to be the Strongest Growth Driver for ISG. Dell maintains a leading position in data center supply, alongside HP and SMCI, making it a key player in AI training infrastructure. For the first nine months of FY2025, Dell’s revenue from servers and networking equipment (part of ISG) grew 60% YoY. According to Bloomberg’s consensus, ISG revenue is expected to grow by 30% YoY in FY2025 and by another 15% in FY2026. This growth is driven by rising demand for AI servers, fueled by NVIDIA GB200 chip shipments and U.S. government AI support programs. An additional growth factor could be the shift of market share from SMCI to Dell due to suspicions of SMCI violating U.S. sanctions, which erodes customer trust and encourages migration to a more stable partner.

We maintain a Buy rating on DELL stock with a price target of $135. A stop-loss order is recommended at $90.

BYD - What next post-earnings and the BoC's stimulus?HKEX:1211 has had a strong year in growth prospects, reporting solid earnings growth thanks to its robust EV sales and expanding footprint in international markets. The recent earnings beat highlighted an impressive increase in revenue, driven by the demand for both their electric and hybrid vehicles. But what we can notice is that the stock has only reflected this as a c.16% rise in price YTD. However, the question now is: where does BYD go from here?

- More recently, the BoC's latest stimulus measures, including rate cuts and support for the real estate sector, could indirectly benefit BYD. With increased liquidity and consumer confidence, domestic demand for EV's could rise, especially if coupled with additional green energy incentives.

- As for the earnings release, the markets reacted well, and with this new-found optimism in the markets, with both the SEE Composite Index SSE:000001 and the Hang Seng Index TVC:HSI up 5.78% and 9.28% in the past 5 days, is this the turn-around for China as a whole?

ATAT: Breakout and RetestAbout Atour

Atour operates an asset-light, franchise-oriented hotel business model, primarily using a "manachised" approach where franchisees handle capital expenditures while Atour provides management, branding, and technology, supplemented by retail integration within hotel spaces.

What I like

- I remain very bullish over China stocks, as you can tell from my stock picks recently. There is a change in technical chart (HSI above weekly 200sma) and Xi government has increasingly showed interests in reviving China economy, be it more spending or talking to its leaders like Jack Ma. I think this bull run will last, and I will keep building up my positions in Chinese stocks

- Atour being IPO stock has crazy growth rates. 40% YoY over most metrics. And what's crazy is that Atour is asset light! It doesn't build hotels! They just provide management, and integrate retail within the hotel spaces. Super scalable.

- Cup and handle breakout and now retesting.

Trade plan

- Entered a small size. Intend to keep building on it as it acts right.

- Holding period can be months

American Airlines | AAL | Long at $13.34As the Great American Wealth Transfer happens, people are using that money to travel more (after all, few can afford to transfer that wealth into real estate). Airline data show passenger counts are increasing rapidly and with airfares expected to rise, this sector is likely to go through a long-awaited boom cycle.

Those following me know I am heavily long in airlines, cruise lines, and travel companies. With today's dip, and the long-term historical moving average starting to show upward momentum, American Airlines NASDAQ:AAL is in a personal buy zone at $13.34. A further dip to $11.00 to close the daily price gaps is also where I will be adding more.

Targets:

$15.00

$18.00