Lyft, Inc. Riding High on Subscription & Urban Mobility Growth Company Snapshot:

Lyft NASDAQ:LYFT is gaining ground with a subscription-led strategy, tech-driven cost efficiency, and a rebound in urban ride demand.

Key Catalysts:

Lyft Pink Momentum & High-Margin Revenue 🎯

The subscription model is paying off—Lyft Pink adoption is rising, improving rider retention and average revenue per user (ARPU), which boosts predictable, high-margin income.

Rebound in Active Riders 🚦

Active riders surged to 23.5M, marking the fastest growth in over two years—a sign of urban mobility normalization and broader consumer engagement.

Enterprise Partnerships & Diversified Income 🤝

New deals with Fortune 500 companies provide recurring revenue streams, diversify exposure, and expand Lyft’s footprint in corporate mobility.

Efficiency Gains & Margin Expansion 💡

Gross margin expanded 300+ bps YoY due to tech upgrades in dispatch and routing, cutting costs and lifting profitability.

Investment Outlook:

Bullish Entry Zone: Above $13.50–$14.00

Upside Target: $19.00–$20.00, fueled by rider growth, subscription traction, and operational leverage.

📊 Lyft is shifting gears from recovery to growth, with improving fundamentals and a clear path to profitability.

#Lyft #LYFT #MobilityStocks #RideSharing #SubscriptionModel #UrbanRecovery #TechEfficiency #GrowthStock #ARPU #TransportationInnovation

Growthstock

Alibaba | BABA | Long at $108.84Like Amazon, I suspect AI and robotics will enhance Alibaba's NYSE:BABA e-commerce, logistics, and cloud computing operations. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NYSE:BABA has a current P/E of 14.2x and a forward P/E of 2x, which indicates strong earnings growth ahead. The company is very healthy, with a debt-to-equity of 0.2x, Altmans Z Score of 3.3, and a Quick Ratio of 1.5. If this were a US stock, investors would have piled in long ago at the current price.

From a technical analysis perspective, the historical simple moving average (SMA) band has started to reverse trend (now upward), indicating a high potential for continued (overall) price movement up. It is possible, however, that the price may reenter the SMA band in the near-term - the $80s aren't out of the question - as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NYSE:BABA is in a personal buy zone at $108.84 (with known risk of drop to the $80s in the near-term).

Targets into 2028:

$125.00 (+14.8%)

$160.00 (+47.0%)

OSCR (Long) - Impressive growth, with low but improving marginsMy last healthcare idea, which is also my most recent, has gone spectacularly wrong after the stock fell precipitously on news which I was not able to source despite my extensive efforts. So, what else to do then than to jump on another attractive healthcare idea - NYSE:OSCR

Fundamentals

The underlying growth of NYSE:OSCR can only be described as impressive, with the firm growing by more than 40% every quarter (y-o-y) ever since it has gone public back in 2021 (despite already reaching over 10b in annual sales) - I left the numbers in the chart for a reference

The reason why its valuation is so low (0.4 P/S) compared to its peers is mainly the razor-thin margins , with EBITDA margins hovering only around 2% - but this is coming from a negative territory and most importantly, continues improving.

The firm just reported another stellar earnings and from the public discourse, its insurance solutions seem to steaming through the market and gaining market share

The main risk, which is pretty significant if realized, is political, and tied to the ACA subsidies - for a great article you can read about it here

However, for someone who plans to hold for the next 3-6 months (like myself), this shouldn't be an issue

Technicals

As mentioned, the firm recently released stellar earnings which propelled the price >20% higher. After a little consolidation, the price seems to have held its ground and is now poised to go higher

The stock price also broke out from a base as depicted on the chart, though I have to admit, it does not have the degree of accumulation I would prefer but the overall setup still looks very attractive

Momentum indicators like Stochastic and MACD are all entering positive territory, meaning we are likely only entering the upside potential

Trade

I entered the trade right after the breakout as I had been eyeing the stock for some time. The next few days confirmed the breakout and the stock is now seemingly heading higher, providing another good entry point

The low of where the stock price now consolidated also represents a great stop loss point (marked by the red line on the graph)

No price targets as I am just looking to watch how the price action evolves over next weeks, but breaking the previous local high would be a good point for potentially adding

Follow me for more analysis & Feel free to ask any questions you have, I am happy to help

If you like my content, Please leave a like, comment or a donation , it motivates me to keep producing ideas, thank you :)

AppLovin Corporation (APP) – Rewiring Ad Tech with AI at ScaleCompany Snapshot:

AppLovin NASDAQ:APP is shedding its legacy gaming identity and emerging as a pure-play AI advertising infrastructure leader. Post its $900M gaming unit divestiture, the company is laser-focused on AXON 2.0, its next-gen AI ad engine, positioning APP as one of the most transformative players in the digital ad ecosystem.

🚀 Key Growth Drivers:

🧠 AXON 2.0 – AI-Powered Programmatic Ad Platform

Delivers real-time ad bidding with predictive optimization

Retail and eCommerce verticals seeing rapid adoption

Scalable infrastructure = operating leverage + high margin tailwinds

🛠️ Self-Serve & GenAI Expansion

Self-serve ad tools on the roadmap = democratizing access for SMBs

Generative AI ad creatives enable fast, customized campaigns at scale

Broadens TAM beyond top-tier advertisers to long-tail marketers

💰 High-Margin, Asset-Light Model

Post-divestiture, APP’s margins are structurally higher

Lean, software-first model with strong unit economics and cash generation

Flexibility for buybacks, R&D, or strategic M&A

📊 Market Positioning & Flywheel

Network effects: More advertisers = better data = smarter bidding

Competes with The Trade Desk, Google DV360, and Meta in ad optimization

First-mover advantage in mobile AI bidding infrastructure

📈 Financial & Strategic Highlights:

Q/Q margin expansion amid rising advertiser retention

Structural cost improvements post-gaming spinout

Potential for SEED_TVCODER77_ETHBTCDATA:2B + in annualized EBITDA as AI scaling accelerates

🧭 Investment Outlook:

✅ Bullish Above: $255.00–$260.00

🚀 Upside Target: $520.00–$525.00

🎯 Thesis: AppLovin is evolving into the NVIDIA of mobile ad tech—using proprietary AI infrastructure to reshape programmatic advertising. With high-margin growth, expanding use cases, and a clear product vision, APP is a top-tier AI advertising compounder.

#AppLovin #APP #AdTech #AXON #AIAdvertising #Programmatic #DigitalMarketing #GrowthStock

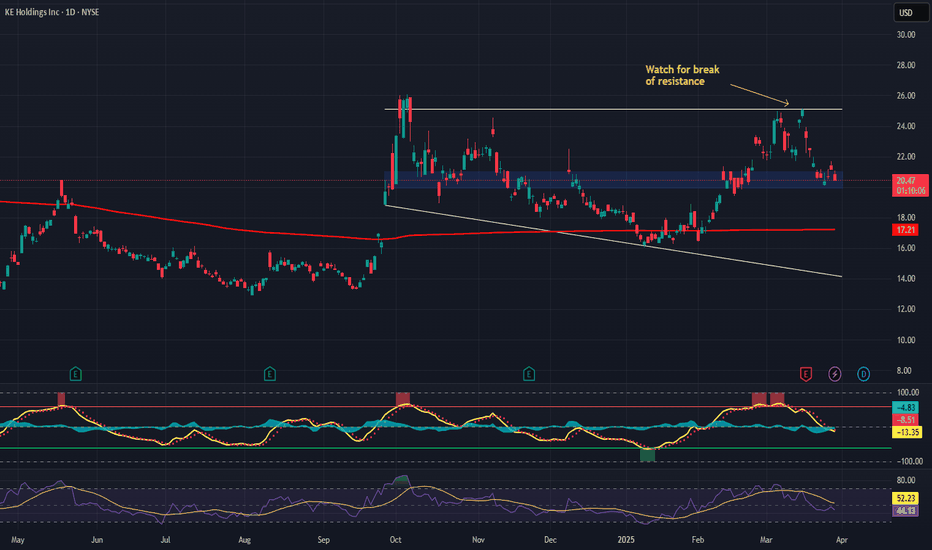

KE Holdings (BEKE) – Transforming China’s Real Estate MarketCompany Overview:

KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power).

Key Catalysts:

Strong Financial & Earnings Growth 💰

Analysts project 20.9% annual earnings growth and 26.7% EPS increase.

Reinforces BEKE’s leading position in China’s real estate sector.

Expanding Services & Market Reach 🌍

Acquisition of Shengdu Home Decoration (2022) strengthens BEKE’s homeownership services.

Broadens revenue streams beyond real estate transactions.

Strategic Backing & Partnerships 🤝

Tencent’s support enhances financial stability & collaboration opportunities.

Investment Outlook:

Bullish Case: We remain bullish on BEKE above $20.00-$21.00, supported by rising profitability & business expansion.

Upside Potential: Our price target is $36.00-$37.00, driven by earnings growth, platform expansion, and strategic alliances.

🔥 BEKE – Shaping the Future of Homeownership in China. #BEKE #RealEstateTech #GrowthStock

$CRWD: Crowdstrike – Cybersecurity Titan or Overvalued Hype?(1/9)

Good afternoon, investors! ☀️ NASDAQ:CRWD : Crowdstrike – Cybersecurity Titan or Overvalued Hype?

With NASDAQ:CRWD at $322, is this cyber guardian still leading the pack or is it time to cash in? Let's dive into the digital trenches! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 322 as of Mar 11, 2025 💰

• Recent Moves: Down from $360+ post-Q4, per X posts 📏

• Sector Trend: Cybersecurity demand remains robust, per market insights 🌟

It’s a steady ride with potential for growth! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: ~$75B (based on 232.5M shares) 🏆

• Operations: Leader in endpoint security and threat intelligence ⏰

• Trend: Expanding into AI-driven security solutions, per recent developments 🎯

Firm, standing tall in the cyber battlefield! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Win: Q1 FY25 beat estimates, guidance raised, per X posts 🔄

• Cyber Boom: Threats fuel demand, per Mar 6 chatter 🌍

• Market Reaction: Stock jumped, then dipped, per X sentiment 📋

Battling, with innovation driving the narrative! 💡

(5/9) – RISKS IN FOCUS ⚡

• Competition: Intense from Palo Alto Networks, Zscaler, etc. 🔍

• Valuation: High P/E ratio may concern some investors 📉

• Regulatory Shifts: Potential new laws impacting data privacy ❄️

Navigating challenges in a dynamic landscape! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in endpoint security 🥇

• Innovation: AI and ML-driven solutions keep it ahead 📊

• Financial Health: Strong cash position, no debt 🔧

Built to withstand cyber storms! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: High valuation, competitive pressures 📉

• Opportunities: Growing demand for cloud security, new market segments 📈

Can it capitalize on the digital expansion? 🤔

(8/9) –📢Crowdstrike at $322—your investment move? 🗳️

• Bullish: $400+ soon, cyber threats fuel growth 🐂

• Neutral: Holding steady, balancing risks and rewards ⚖️

• Bearish: $280 drop, overvalued in a cooling market 🐻

Cast your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Crowdstrike’s $322 stance shows resilience 📈, but cautious investors eye valuation and competition 🌿. Dips are our DCA playground 💰. Grab ‘em low, ride the wave! Gem or bust?

$CY6U: CapitaLand India Trust – Bangalore Boom or Borrowing Bust(1/9)

Good afternoon, Tradingview! ☀️ SGX:CY6U : CapitaLand India Trust – Bangalore Boom or Borrowing Bust?

At 1.02 SGD, is this Indian office play a hidden gem or a debt-laden mirage? Revenue’s up, insiders are buying—let’s unpack the curry! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: 1.02 SGD 💰

• Recent Moves: Modest gains in 2025, per trends 📏

• Sector Buzz: India’s office market heating up 🌟

It’s a slow simmer, but spice is brewing! 🔥

(3/9) – MARKET POSITION 📈

• Market Cap: Around 1.36B SGD (1,333.5M shares) 🏆

• Operations: Office projects, Bangalore expansion ⏰

• Trend: Revenue hit S$278M, up from S$234M 🎯

Rooted in India’s growth soil! 🌱

(4/9) – KEY DEVELOPMENTS 🔑

• Expansion: Bangalore office buy locked in 🔄

• Insider Buying: Confidence despite earnings dip ahead 🌏

• Sentiment: Cautious cheers, per market vibes 📋

Scaling up, but debt’s the side dish! 🍛

(5/9) – RISKS IN FOCUS ⚠️

• Earnings Drop: 39% decline forecast over 3 years 🔍

• Borrowing: Heavy reliance raises eyebrows 📉

• Global Noise: China stimulus, trade jitters ❄️

Spicy risks on the horizon! 🌩️

(6/9) – SWOT: STRENGTHS 💪

• Revenue Jump: S$278M from S$234M last year 🥇

• India Play: Bangalore’s office boom 📊

• Insider Faith: Buying signals grit 🔧

A curry with some kick! 🍲

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Debt load, earnings slide ahead 📉

• Opportunities: India’s resilience, market gaps 📈

Can it spice up profits or just heat debt? 🤔

(8/9) – 📢At 1.02 SGD, revenue up, insiders in—your vibe? 🗳️

• Bullish: 1.20 SGD soon, India shines 🐂

• Neutral: Flat, risks weigh ⚖️

• Bearish: 0.90 SGD, debt bites 🐻

Drop your take below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CapitaLand’s Bangalore bet and S$278M revenue pop tasty 📈, but debt and a 39% earnings dip loom 🌫️. Volatility’s our mate—dips are DCA spice 💰. Scoop low, rise steady! Gold or ghee?

COINBASE ($COIN) – RECORD EARNINGS, VOLATILE REACTIONCOINBASE ( NASDAQ:COIN ) – RECORD EARNINGS, VOLATILE REACTION

(1/8)

Coinbase just posted a Q4 2024 revenue of $2.27B (+138% YoY, +89% QoQ!)—crushing estimates of $1.87B. Transaction revenue soared 194% YoY to $1.6B. Ready to dive in? Let’s go! 🚀💸

(2/8) – EARNINGS BEAT

• EPS: $4.68, smashing estimates of $2.04 🤯

• Net income: up 300% YoY, fueled by trading volume +185% 📈

• Assets on platform: +46%, sign of growing trust and adoption 👥

(3/8) – STOCK REACTION?

• Surprisingly flat or slightly down post-earnings 🤔

• Market may have priced in these mega-growth numbers already

• High beta (3.61) means volatility—strap in! ⚠️

(4/8) – SECTOR SNAPSHOT

• P/E ratio ~49.5 (forward 43.76)—high, but robust growth could justify 🏦

• Analysts’ avg. price target: $274.65 vs. current price ~$300—some see overvaluation unless growth keeps surging 💹

• Faster revenue growth than many fintech peers, yet higher volatility 🌀

(5/8) – RISKS TO WATCH

• Crypto Volatility: If the market cools, trading volume slides 😰

• Regulatory Battles: SEC classification = potential compliance woes ⚖️

• Competition: Binance, Kraken, DeFi—Coinbase must keep innovating 🏁

• Economic Sensitivity: Slowdowns can reduce trading appetite 🌐

(6/8) – SWOT HIGHLIGHTS

Strengths:

• U.S. market leader, regulatory advantage 🇺🇸

• Growing subscription/services revenue (+71% YoY)

• User base & brand loyalty remain strong 🌟

Weaknesses:

• Reliance on crypto market sentiment → volatility

• Elevated valuation vs. peers, less margin for error

Opportunities:

• Expand into regions with surging crypto adoption 🌍

• Tokenization, stablecoins, new blockchain products

• Potentially friendlier crypto regs = less legal risk 👀

Threats:

• Regulatory crackdowns → higher costs, narrower product offerings

• DeFi could disrupt centralized exchanges

• Market saturation → possible price wars 💢

(7/8) –Is Coinbase overvalued at $300 despite epic growth?

1️⃣ Bullish—Crypto momentum will keep fueling NASDAQ:COIN 🚀

2️⃣ Neutral—Growth is great, but so is the price 🤔

3️⃣ Bearish—Regulatory & competition threats loom large 🐻

Vote below! 🗳️👇

TSSI to $81 or higherOverview

Total Site Solutions, Inc. ( NASDAQ:TSSI ) is an information technology company that provides software and services to its clients. They are involved in the setting up, maintenance, and deployment of various technological hardwares and softwares that assist their clients in remaining competitive.

Technicals

TSSI is up by 1,257.6% since May 2024. While no substantial trading patterns may be available to assist with navigation, fibonacci retracement levels could help in finding entry and exit points.

If the share price can garner significant support between $11.55 and $12.25 then a potential bull flag may be in development.

Fundamentals

I like to do my research before investing in a company to make sure they are either profitable or have consistent revenue growth, even if the technicals look like a good opportunity at face value. I pulled annual reports as far back as 2020 in addition to reviewing all 2024 quarterly reports. Here is what I found:

Annual Revenue has consistently increased since 2021-Q4 (average annual gain of 16.72%)

Annual Gross Profit has consistently increased since 2021-Q4 (average annual gain of 19.06%)

Annual Net Income has consistently increased since 2022-Q4 (average annual gain of 147.87%)

The annual reports provoke confidence but it was the quarterly reviews that sealed the deal for me. After comparing the accumulative (Nine Months Ended) totals to the 2023 Annual Report, here is what I found:

YTD Revenue has increased by 80.37% since 2023-Q4 Annual Report

YTD Gross Profit has increased by 37.60% since 2023-Q4 Annual Report

YTD Net Income has increased by 5,390.54% since 2023-Q4 Annual Report

Price Target

There are approximately 24,587,000 outstanding shares according to the Q3-2024 quarterly report, leaving the current market cap around $307M. At a modest market cap of two billion then this would leave TSSI's share price near $81.

Now whether or not I would consider selling at this price range is completely dependent on the health of the company at that moment in time. If TSSI can continue its trajectory and growth, then this roller coaster ride could extend beyond the $81 price target.

Home Depot (HD) Analysis Company Overview:

Home Depot NYSE:HD , the largest home improvement retailer, leverages its extensive network of stores, robust e-commerce platform, and strategic acquisitions to maintain a dominant market position. The company continues to innovate and adapt to evolving consumer demands while capitalizing on macroeconomic trends.

Key Drivers of Growth:

Strategic Acquisition of SRS Distribution Inc.:

The acquisition enhances Home Depot’s market reach and diversifies its product offerings, particularly in specialty building materials.

This move is expected to drive revenue growth and profitability, strengthening its competitive position.

Projected Sales Growth:

Fiscal 2024 sales are projected to grow 3.8% year-over-year, showcasing Home Depot’s resilience and its ability to capitalize on consistent consumer demand for home improvement products.

Impact of Federal Reserve Rate Cuts:

Recent rate cuts are expected to stimulate housing activity, increasing demand for renovation and home improvement supplies, a key driver of Home Depot’s sales.

Strong Brand and Omni-Channel Presence:

Home Depot’s extensive store network and advanced e-commerce platform provide a seamless customer experience, offering resilience in both physical and digital retail markets.

The company’s reputation as a trusted supplier to both consumers and professionals enhances brand loyalty and repeat business.

Investment Outlook:

Bullish Stance: We are bullish on HD above $385.00-$390.00, supported by its strategic growth initiatives, favorable macroeconomic tailwinds, and robust operational performance.

Upside Target: Our price target is $570.00-$575.00, reflecting Home Depot’s strong growth potential and ability to navigate dynamic market conditions.

📈 Home Depot—Building the Future of Home Improvement! #HomeImprovement #GrowthStock #HD

Tesla Stock Down 30% This Year. What Happened to the EV King?The electric-car maker is in dire need of charging after losing more than $260 billion this year and turning Elon Musk into the biggest loser among the world’s wealthiest.

Table of Contents

» How It Started vs How It’s Going

» Nothing Magnificent About It

» Competition Revs Up

» Teslas Pile Up on Weak Demand

» If You’re Having a Bad Day, Read This

📍 How It Started vs How It’s Going

Tesla (ticker: TSLA ) kicked off the year as the big tech highflyer we all know. With a valuation of more than $780 billion, the electric-car maker stepped into 2024 as the world’s largest EV seller. Deliveries were standing at record highs and chief executive Elon Musk was the world’s richest person and was looking at a gargantuan $55 billion pay day.

All of that was taken away in one way or another. Chinese automaker BYD (ticker: 1211 ) dethroned the EV kingpin by selling 526,000 EVs for the fourth quarter of 2023, more than Tesla’s 484,000. Even as Tesla reclaimed the top spot in the January through March quarter, it flagged a worrying signal that its business was shrinking.

As for Elon Musk, he lost a court battle over his lofty $55 billion pay package when a judge called it “an unfathomable sum.” Shortly before that, he handed the World’s Richest title to Amazon founder Jeff Bezos .

📍 Nothing Magnificent About It

Chugging through first-quarter twists and turns, Tesla drifted away from the highly exclusive club called the “Magnificent Seven.” The group of companies with a snappy nickname is made up of Microsoft (ticker: MSFT ), Nvidia (ticker: NVDA ), Facebook parent Meta (ticker: META ), Google parent Alphabet (ticker: GOOGL ), Amazon (ticker: AMZN ), Apple (ticker: AAPL ), and outsider-in-the-making Tesla (ticker: TSLA ).

How did that happen and why is Tesla at risk of falling out of the Magnificent Seven? Tesla’s valuation — which is notoriously volatile and hard to pinpoint — saw a massive 30% drop over the first three months of 2024, turning the stock into the worst performer in the S&P 500. More than $260 billion has been washed out since early January, giving the EV maker a price tag of around $520 billion today. Zoom further out, and you see Tesla peaked during the Reddit stocks meme-trading era of 2021 when shares hit an all-time high of $417. Back then, Tesla became the first car manufacturer to break into the $1 trillion club.

Tesla stock has lost about a third of its valuation this year. Source: TradingView

The drastic fall spotlights a stark difference between Tesla and the rest of the Magnificent Seven big shots. The other tech giants are at the top of well-developed yet competitive industries. Take for example Microsoft — the software mainstay has created for itself a competitive moat in the enterprise and retail software business.

Tesla, on the other hand, is the trailblazer for the EV revolution but charged up rivals are shifting gears, threatening to soak up market share fast.

📍 Competition Revs Up

Chinese smartphone maker Xiaomi (ticker: 1810 ) last week unveiled a slick-looking, tech-rich electric ride. The model is called SU7 and it clocked up 10,000 reservations in the first 4 minutes after launch. Then it got to 89,000 in 24 hours. The successful launch bumped Xiaomi’s market cap by $4 billion to around $50 billion, or 10 times less than Tesla. The SU7, however, is priced lower than a high-end Model 3.

Tesla has more rivals to outsell, among them BYD (ticker: 1211 ) and the more-niche player Rivian (ticker: RIVN ). Rivian is an EV startup that marked a 70% increase in sales for the first quarter. The number, however, is a tiny 13,980 units delivered.

📍 Teslas Pile Up on Weak Demand

Tesla’s year went from bad to worse this week when it announced it had delivered 386,810 EVs in the first quarter. The number was about 20,000 below the most bearish forecast on Wall Street. It was also 9% lower than last year’s first quarter, indicating that the company’s business is shrinking.

More importantly, Tesla produced 433,371 units, leaving about 46,000 waiting to be purchased by customers. The difference between production and deliveries meant that unsold models are piling up. A demand issue maybe?

📍 If You’re Having a Bad Day, Read This

In all that chaos, Elon Musk emerged as the world’s worst moneymaker, taking a huge blow to his net worth so far this year. According to the Bloomberg Billionaires Index , the eccentric engineer is down $45 billion to roughly $180 billion, taking the number one spot on the loser board.

Elon Musk owns a 20.5% stake in Tesla worth about $120 billion, according to a December 31 filing . The stake consists of 411 million shares of common stock and 303 million stock options with a strike price of $26 a pop.

The majority of Musk’s wealth is concentrated in his EV company, but he also owns private social media platform X, former Twitter, and space exploration company SpaceX, among other businesses.

📍 What’s Your Take?

Are you buying the dip in Tesla stock? Or are you waiting for a deeper drop before scooping up some shares for yourself? Let us know your thoughts on Tesla’s future in the comments below!

🚀if you liked this article, give us a follow to make sure you don't miss any.

💖 TradingView Team

If Seize the Day was a Company: Nvidia’s Formidable RiseUnhinged demand for Nvidia’s AI chips bumped the company’s valuation to $2 trillion, adding half of that in less than four months. Read how it happened.

Table of Contents

Genesis

Compiling

Speedrun

Benchmark

Spillover

Overclock Much?

Rage Quit

More Players Exit

Wild Rivals Appeared!

Runtime

Genesis

It’s a crisp, sunny morning in 1993. You’re at your local diner in Silicon Valley, casually sipping your coffee and waiting for your meal. At the table next to you, three engineers are cranking on caffeine and dreaming up a gig that would end up changing not only their lives, but also usher in a new era of computing. It’s the three founders of a company called Nvidia (ticker: NVDA ).

A business-savvy 30-year-old Oregon graduate Jensen Huang, hardware savant Chris Malachowsky and software geek Curtis Priem spun up the business more than 30 years ago. Together, they set up their venture in a bid to bring 3D graphics to the gaming space.

Compiling

Today, the thriving company is doing much more than that. Nvidia, which traces its humble origins back to a Denny’s diner, is now the backbone of the artificial intelligence revolution.

Nvidia was for a long time shoved into the deeper corners of the gaming space and was barely known to the public. For most of its existence, it’s been making graphics cards, which are used by gamers, crypto miners, plain PC users and professionals from various industries.

The company’s booming business line right now is AI chips—hardware pieces essential for training large language models, the type that underpins systems like OpenAI’s ChatGPT.

AI chips have also underpinned another side of Nvidia—they’ve touched off a monster rally in its share price. Enough to catapult its valuation to the Top 3 of America’s biggest companies , right after iPhone maker Apple and software heavyweight Microsoft.

Speedrun

It took just about 24 years for Nvidia to step into the exclusive $1 trillion club, having started trading as a public company in 1999 at a $625 million valuation. Then in the span of just four months—November 2023 through February 2024—Nvidia added its second trillion, largely thanks to its timely expansion from its flagship products to the powerful AI chips.

Now, Nvidia is comfortably sitting in the Top 5 of the world’s largest companies .

“A whole new industry is being formed, and that’s driving our growth,” chief executive Jensen Huang told shareholders right after the company published jaw-dropping 265% revenue growth for the final quarter of 2023. The chip darling picked up $22.1 billion in sales, up from $6.05 billion a year ago. Profits swell to more than $12 billion.

Source: Stock Analysis

Benchmark

The earnings release fueled a never-before-seen $277-billion boost to the chip maker's valuation. It was the biggest one-day gain in history of the stock market, surpassing Meta’s recent $204.5 billion pump .

On the second day after the December-quarter financials were published, Nvidia went on to soar above $2 trillion in value with shares changing hands at more than $800 a pop.

Not only that, but the AI trailblazer’s report jolted markets so much it set off a buying spree on a global scale.

Spillover

In the US, the broad-based S&P 500 index notched an all-time high, joined in record territory by the Dow Jones Industrial Average. In Japan, the diverse Nikkei index broke out to a fresh record after 34 years of languishing performance.

Nvidia’s magnificent rise has propelled Huang’s personal fortune to roughly $70 billion, a reflection of his 86.6 million shares, or 3.6% of the company. Is it time for an attire upgrade away from the black leather jacket?

Shares of the company more than tripled in 2023 and pumped over 60% for the first two months of 2024.

Jensen Huang wearing his signature leather jacket—an outfit picked by his wife and daughter. Source: nvidianews.nvidia.com

Overclock Much?

The fundamentals behind the company’s breakneck growth are undoubtedly real. Demand for Nvidia’s most advanced GPUs, called H100s, is so big the chips are being delivered in armored trucks. Each one of them weighs about 290 lbs (130 kg) and will set you back about $30,000 if you’re lucky to get one.

With that said, supply isn’t too loose with Nvidia holding about 80% of that market. What’s more, a new, more powerful H200 chip will be hitting the market in the second quarter of this year.

So what does this mean for the unstoppable rally? Analysts are quick to say that as long as Nvidia maintains its tight grip over supply, outweighing demand should continue to drive the up-only narrative.

Presently, Nvidia has the capacity to develop about 1.2 million AI-focused chips a year, far insufficient to meet the insatiable demand. To illustrate, Meta chief executive Mark Zuckerberg popped on Instagram to brag about his plans of securing 350,000 units of that good H100 stuff by the end of 2024.

Besides the Facebook parent, Nvidia’s biggest customers are Microsoft, Google and ChatGPT owner OpenAI.

Rage Quit

The stampede by investors rushing to buy up stock wouldn’t be complete if it weren’t for the naysayers and doom-and-gloom forecasters. You’d be surprised to see who is on that list of permabears, slamming the chip maker and getting their short positions ready to fire. Or already fired.

Following Nvidia’s post-earnings explosion, short sellers were left nursing paper losses in excess of $3 billion. Staring at giant drawdowns might sting just as badly as missing out the ride.

Disruptive-tech investor Cathie Wood, CEO of investment firm ARK, said in 2023 that Nvidia was “ priced ahead of the curve .” By the end of the year, Wood had offloaded a stake worth more than $100 million. Estimations point that this early leave may be equal to more than $500 million in missed-out profits.

There are other notable names in the investment space who got rid of—or heavily trimmed—their Nvidia shares by the end of last year. (Hedge funds and other investment managers who oversee at least $100 million are required to disclose their holdings in public companies each quarter through a form called 13F.)

More Players Exit

In its 13F filing with the Securities and Exchange Commission, George Soros’s family office Soros Capital had completely exited Nvidia in the third quarter, selling shares worth $4.9 million.

Billionaire Stanley Druckenmiller’s family office held 875,000 shares of Nvidia going into 2023’s third quarter. By the end of the fourth quarter, that hefty stash had been reduced by roughly 40%. Druckenmiller still owns some $300 million in Nvidia shares and even scooped up call options with a notional value of $242 million.

The sellers’ argument wraps around the heavily cyclical nature of chip demand. While in good times there’s euphoria and chip companies triumph, they could also be prone to setbacks once the tide turns.

A fresh example from Nvidia’s recent performance is the 60% drop in its share price in the time span April through September 2022.

Nvidia's share price endured a 60% drop between April and September 2022.

Wild Rivals Appeared!

Competitors from the hardware corner of the economy don’t sit idle while Nvidia goes on an all-out expansion mission. Advanced Micro Devices (ticker: AMD ) is already selling chips similar to the H100s and projects revenue to land at $3.5 billion in 2024. If that number is met, or even doubles, it still will be a blip compared with Nvidia’s $100 billion full-year revenue Wall Street expects.

SoftBank-backed Arm Holdings (ticker: ARM ), whose stock is just as volatile , is in the AI race too. So is Intel (ticker: INTC ) — the US tech mainstay makes and sells chips that power generative AI software.

Nvidia, meanwhile, is busy taking steps to try and cement its dominance in the AI space. It’s already in talks with big tech giants such as Microsoft, Amazon and Google over developing custom chips. Meanwhile, all three are manufacturing their own chips.

Runtime

The big question lingering on everyone’s mind is when will that dizzying AI boom come to a halt or at least pause for breath? Nvidia’s formidable rally, fueled by the rush for graphics processors, is the very definition of what seizing the day means. What’s a reason that may extend this run?

One reason is that the company keeps adding blockbuster earnings quarter in and quarter out.

A second one—Nvidia will need to find a way to work together with tech giants seeking to cut into the AI business. And thirdly, all that effort should eventually pay off by laying out the infrastructure that will foster the much-anticipated AI-driven productivity gain.

RPAY Double digit growthRPAY managed to grow card payment volume by 25% in 2022 and aims for a modest growth in 2023. The company provided a better than estimated EPS and Revenue Growth.

Adjusted EBITDA rose by 34% and increase dits Gross Profit Margin from 76.8% to 78.8%

Consumer payments consist of 80% of total CPV, both Business and Consumer grew by 25%.

RPAY stock could be a very good bullish play with around 40% TP and 17% SL

#notfinancialadvise #adjustyoursposition

Does WING's Earnings Bounce Have Legs?WING has been an interesting story in the restaurant sector over the past 7 years. Wingstop has experienced above-average growth in both top and bottom line figures over this timeframe. Let us explore why this is the case and where the stock may go from here...

Fundamentals: WING's fundamentals are nightmarish. Incredibly high levels of debt (likely why WING has been able to expand so quickly), negative stockholders equity, 17% of shares float are short, a forward P/E of 70, yoy revenue beginning to stall with current year-end revenue expectations up only 2-3% from 2021 year-end. WING's total liabilities make up more than double its total assets. The company is grossly overvalued, Wingstop's intrinsic value is roughly 35-45 dollars a share. This bounce off of earnings is unsustainable, to say the least. The company did not even post a beat, and its shares surge 20%... this move simply does not make sense.

Technicals: Long-term uptrend still intact. This will change if a move below the A trend line occurs. Currently, WING is struggling to break above the short-term bearish trend line labeled as B . A touch at 128.43 resistance and a quick retreat back to trend line B leads me to believe this is a temporary bull run in what is a longer-term downtrend for WING.

Global macro conditions: Tightening of financial conditions, supply chain woes, war, sanctions, Supply crunches in energy commodities, climate crises, hot inflation, political unrest, and sovereign default concerns intensifying -along with other factors- all play a role in a rapidly worsening macroeconomic narrative. These factors are often talked about by economists but I fear they are overlooked in cases such as these when the market rewards a weak growth stock such as WING with a massive bounce in price off of an average earnings report, all during an unprecedentedly difficult global economy.

Targets: Unclear as to when WING will significantly fall in price. I think the deterioration of financial markets over the next few years will be serious- things will get worse and stay worse for longer than expected- and companies with trash fundamentals like WING will be the first to suffer. Needless to say, I would be short WING if given an option. I see a fall to 113.92 as a short-term lock. Longer term I expect a choppy downward trade from lower support levels to lower support levels eventually forming fresh lows at the 49.89 support level. Seems like a bit of a wild prediction I'm sure, but this is what I see.

As always this is not trading advice, good luck!

$VSBGF VSBLTY Groupe UpdateBroader markets are pulling back and $VSBGF has found it's footing. There's been recent communication from the CEO regarding partnerships and what's shaping up to be potential of an acquisition (rumor).

VSBLTY continues to land deals and the recent fundraising wasn't received well in the markets during a down cycle... but peeling back the layers, it's evident this isn't a dilution so much as giving runway for takeoff.

The market downturn has impacted the price, but it's not throwing money away imo... I am continuing to DCA into a company with a significant value add to to retail and security.

Strong Buy from my perspective.

TWLO/USD Daily TA Neutral BullishTWLO/USD Daily neutral with a bullish bias. *Twilio has fallen 81% from its ATH ($457.65) and is approaching the end of a massive Falling Wedge from March 2021.* Recommended ratio: 55% TWILIO, 45% cash. Price is currently testing the lower trendline of the Falling Wedge from March 2021 at $100.65 support. Volume has been shrinking since early May as Price trades within the second largest supply/demand zone on the chart; this is mildly bullish as it is indicative of an incoming breakout (due to it being a Falling Wedge the bias is to the upside). Parabolic SAR flips bullish at $105, this is mildly bullish. RSI is currently trending down slightly at 40 as it continues testing 37.47 support for the sixth consecutive session. Stochastic remains bullish and is currently trending up at 85; the next resistance is at max top. MACD remains bullish and is currently trending up slightly at -10; the next likely target is a test of the descending trendline from May 2020 at -4.57 resistance. ADX is currently trending sideways at 33 as Price is attempting to establish support at $100, this is neutral at the moment. If Price is able to defend $100.65 support then the next likely target is a test of the upper trendline of the Falling Wedge at $120-$125 (this is also the largest supply/demand zone on the chart) before potentially breaking out of the formation to the upside. However, if Price breaks down below the lower trendline of the Falling Wedge at $92.60, the next likely target is a test of $70 support. Mental Stop Loss: (two consecutive closes below) $95.50.

$SE #SEALIMITED Stuck Between Two AVWAPs$SE is being supported by COVID-19 lows AVWAP (Aug 17, 2020) and rejected by ATH AVWAP (Oct 19, 2021). Until we break either AVWAP, I will be neutral and wait for some movement. I do like the stock long term in my Roth IRA, so I will be slowly adding shares if it goes near or retests the support AVWAP. As mentioned in my $BTC chart, I do believe that the bottom is in for growth stocks and the R/R is appropriate for going long.

AMAT go ZOOOOOMAMAT is bound for a strong impulsive move

✅ Phase 1: a harsh pullback

✅ Phase 2: a period of consolidation

✅ Phase 3 : an impulsive move to the 0.61 line of the pullback move

❌ Phase 4: another consolidation perdiod: Skipped

✅ Phase 5: a drop to the 0.38 line of the fib retracement

🤩 Phase 6: Back to the top we go

DoorDash: The Stock that Hedge Funds LoveIn this post, I'll be taking a fundamental and technical approach to DoorDash ($DASH), an American delivery & takeout platform.

For more information on the company since its IPO, make sure to check out the post I uploaded in Dec. 2020 by clicking the chart below.

Disclaimer: This is not investment advice. This is for educational and entertainment purposes only. I am not responsible for the profits or loss generated from your investments. Trade and invest at your own risk.

Fundamentals

- DoorDash has shown tremendous growth compared to its counterparts like GrubHub and UberEats, during the Covid pandemic.

- In terms of meal delivery shares, DoorDash currently covers 57%.

- Dashers - the deliverymen on DoorDash - are gig workers, but the Biden administration has signaled that they should be classified as employees

- This would induce additional costs, and with DoorDash still not being a profitable company yet, this could negatively impact the stock's price.

- While this company is still not profitable, their Q2 financials demonstrate great growth trajectory

- Their increase in revenue isn't amazing, but the absolute value is quite high.

- Their Gross Order Value (GOV) has been growing for 5 consecutive quarters.

Technical Analysis

- The chart demonstrates that the stock is very volatile.

- But ever since we tested the IPO price support in May, we have been in an uptrend, forming higher lows and higher highs.

- The price is trading above the Exponential Moving Average (EMA) Ribbon

- A break and close above $214 could lead this stock to retest its all time highs at $256

Institutional Investors

- SoftBank holds the most stocks, owning 12.89% of the company (43.5m shares)

- The runner up on the list is Sequoia Capital, with 11.66%

- Tiger Global Management holds 3.23%, and Morgan Stanley Investment Management holds 3.13%

- Among known hedge fund managers as well, the top holders on the list (by order) are:

- Chase Coleman (Tiger Global Management)

- Jim Simons (Renaissance Technologies)

- Ray Dalio (Bridgewater Associates)

- Ken Griffin (Citadel)

Conclusion

DoorDash is a very interesting company with a business model proven successful by other companies overseas. It would be important to see the continuation in growth momentum and the company turning profitable in the next few years. Especially with a lot of institutional interest, this stock could definitely be added to your watchlist.

If you like this analysis, please make sure to like the post, and follow for more quality content!

I would also appreciate it if you could leave a comment below with some original insight :)

First global 5g/4g global satellite network and Lassonde curve.First ever global 4g/5g cellular phone network beeing built by $ASTS seems to follow similar market mechanisms and psychologies as that of junior mining operations: The Lassonde curve, with it’s two waves of share price increase.

Only competitor so far (possible duopoly) is Lockheed Martin and Omnispace cooperstion.

Technology is proven with Bluewalker 1 satellite. Huge TAM, small market cap. Founder shares in lockup for 12 months.

There was an manipulation down starting April 6, which is in steep reversal presenting an excellent entry opportunity. Well timed public offering in first wave means first phase fully financed.

Institutional ownership increasing signals exit of orphan period, entering development phase of Lassonde curve. Optimal entry.

Waiting for $CELH to skyrocketI like the way $CELH is looking right now!!

After dipping on earnings report, where expectation were too high, the company is bouncing back.

IMO the selloff was due to a few factors coming together:

- Broader market selle off and repositioning,

- increase in 10 years treasury yield,

- inflation pressure

From a stock prospective, $CELH had some issue with inventory management, in the sense that they could not bring enough products on shelves or stores. This was due, not for a problem with distribution, but the way that the company sells to stores. Because they do not keep inventories, after the demand surged, there were no product available..

On the plus side, I believe that if the company can fix this temporary problem, is well position for the future. I like $CELH especially because is a mix of growth and re-opening stock.

From the technical side, MACD just turned positive and RSI is trading in the mid range. I will be waiting for volume to kick in before adding in a meaningful way.

However, for transparency, today I entered a small position of 1000 shares and look to increase in the weeks ahead on any pullback or on any positive news.

As usual, do your own DD

Happy hunting!