DPRO falling wedge breakoutDPRO has broken out of a falling wedge on the weekly. Ticker will respond well to Trump's "Big Beautiful Bill" which includes over $30 billion for defense/military spending. The drone company is already making progress with US military projects and is setting up for a strong rally.

Growthstocks

TOM LEE leading the charge in this new BULL MarketThank you for providing excellent analysis,

being on the right side of the trade

and helping retail with your public speaking on your own channel, podcasts, and of course CNBC.

I wish you continued success in you Granny shots ETF which is already over $1.5 Billion in AUM!

ABCL — Bullish Breakout with Upside PotentialAbCellera Biologics Inc. (ABCL) has recently confirmed a breakout above a long-term descending trendline, followed by a successful retest of both the trendline and previous local highs. This technical development increases the probability of a sustained upward move.

The first target stands around $5.70, with a potential medium-term extension toward $13.20, offering attractive risk-to-reward parameters.

The company operates in the biotechnology and healthcare innovation sector — one of the most promising and rapidly advancing industries. While such stocks often face increased volatility due to news-driven events, the potential for high returns makes them compelling for both swing traders and long-term investors.

Lemonade, Inc. (LMND) – AI-Driven Disruption in InsuranceCompany Snapshot:

Lemonade NYSE:LMND is a tech-forward insurer reinventing traditional insurance through AI, data science, and a mobile-first experience across renters, homeowners, auto, pet, and life products.

Key Catalysts:

AI + OpenAI Integration 🚀

Collaborations with OpenAI are powering Lemonade’s RealTime API and AI voice agents, improving claims automation and customer support.

Enhances scalability and reduces overhead, key to long-term margin expansion.

Operational Resilience 🔥

Despite a $22M wildfire loss in California, Lemonade met Q1 guidance—thanks to robust reinsurance and effective risk management, underscoring operational maturity.

Auto Insurance Momentum 🚗

Car insurance was the top growth driver in Q1 2025, tapping into a multi-billion-dollar market where Lemonade still holds early-stage penetration.

AI-powered underwriting gives it an edge over legacy incumbents.

Investment Outlook:

Bullish Entry Zone: Above $38.00–$39.00

Upside Target: $65.00–$70.00, supported by AI innovation, product diversification, and scalable infrastructure.

🧠 Lemonade is not just selling insurance—it’s rewriting the rulebook on how it’s delivered, priced, and experienced.

#Lemonade #LMND #Insurtech #AIInsurance #OpenAI #DigitalTransformation #AutoInsurance #TechStocks #GrowthStocks #ClaimsAutomation #Reinsurance #Fintech #CustomerExperience

GRAB — Breakout Confirmation and Strong Upside PotentialGrab Holdings (GRAB) is currently forming a promising technical setup supported by a breakout from long-term consolidation. After printing a strong low and breaking out of a multi-year range, the price action confirms a bullish reversal with clear structure.

Technical Analysis

– Trendline breakout and bullish market structure shift

– Price is consolidating above the breakout level, forming a continuation zone

– Valid entries: market execution above $4.50 or limit orders near $4.00 support

– First profit target: $6.60 (around 40% growth)

– Second target: $10.15 (over 100% from entry)

The setup suggests increasing bullish momentum. A clean consolidation above previous resistance strengthens the case for a breakout continuation toward $6.60 and potentially $10.15.

Fundamental Backdrop

Grab is a Southeast Asian tech leader operating across ride-hailing, food delivery, and digital payments. The company continues to reduce losses, improve margins, and expand its fintech arm. With rising digital adoption in the region and a shift toward profitability, GRAB is gaining investor attention. Its most recent earnings report showed improving revenue trends and narrowing net losses — a strong signal of long-term sustainability.

Conclusion

Grab Holdings presents a well-aligned opportunity from both a technical and fundamental perspective. With a clear structure, breakout confirmation, and fundamental turnaround, this setup fits both swing and midterm investment strategies. Risk management is still key — stops should be placed below consolidation lows or key structure levels.

GH (Guardant Health) — Breakout Setup with Strong Upside PotentiGuardant Health (GH) is showing signs of completing a long-term accumulation phase and transitioning into a bullish trend. After breaking out of a major descending trendline and holding above key resistance at $38.30, the stock entered a tight consolidation range — a classic base formation before a potential breakout.

Technical Highlights:

– Confirmed trendline breakout

– Price is consolidating above previous highs

– Entry zone around $50–$51

– First target: $70 (+40%)

– Second target: $103 (+100% from current levels)

Fundamental Support:

Guardant Health is a leading precision oncology company specializing in liquid biopsy technologies for cancer screening and monitoring. The company continues to expand its product offerings, especially in early cancer detection — a market with huge long-term growth potential. Recent news includes positive developments in clinical trials and expanded partnerships, which could significantly boost revenue.

Institutional interest in GH has also been rising, with increased buying activity visible in the most recent 13F filings. The overall market sentiment toward biotech stocks with strong data pipelines is improving, which further supports the bullish outlook.

Conclusion:

GH is a strong candidate for medium- to long-term growth. The technical setup aligns with a fundamental narrative of innovation and market expansion. Partial profit-taking could be considered at $70 and $103. Due to the volatility of biotech stocks, proper risk management and position sizing are essential.

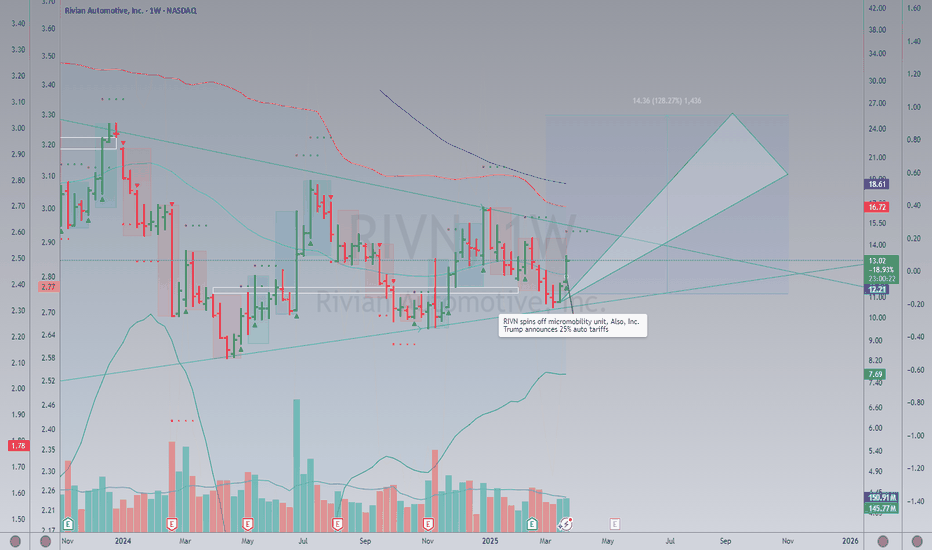

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back higher here over time. In the signal system I have been taught via the T@M strategy, Rivian is putting in a range expansion to the upside on the weekly time frame. If you take the range of the past monthly consolidation period, attach it to the "mode" (or central zone of the consolidation range), it gives you a target of $25 over the next few months. Now, whether this is another fake out just to reverse on us... again... remains to be seen of course. It is early in the idea. But potentially offers a decent risk/reward position here.

I just do not see Rivian really going away at all and, if they can keep refining their business, they could see some success going forward. Anyway, hope you enjoy this idea! As always, position carefully as the market is risky business.

Including the Daily Chart below for your reference as well.

Uptrend Stock / Swing and Run Trend / SE (NYSE)Uptrend Stock / Swing and Run Trend

SE (NYSE)

Fundamental

Sea Limited operates in three highly attractive business segments:

Sea Money – The company’s digital financial services arm offers consumer and SME lending, mobile wallets, and payment processing services.

Shopee – The largest e-commerce platform in Southeast Asia and Taiwan, with strong market presence and growth.

Garena – The company’s digital entertainment division, providing access to popular mobile and PC games. It also promotes eSports. Garena has developed its own successful game titles such as Free Fire, a globally popular battle royale game.

Sea Limited's key strength lies in its integrated platform that combines e-commerce, digital finance, and digital entertainment under one umbrella. This synergy allows the company to cross-leverage its customer base—for example, using Shopee users to promote Sea Money's financial services.

Technical

The price has been forming accumulation patterns at the bottom and gradually rallying upwards.

It’s showing a sideways-up structure, where the price bases sideways and then continues to rally upward in steps.

This setup allows for buy-the-dip opportunities using an indicator called Regression Trend to identify the trading channel.

For swing trading, one could buy on dips near the lower support band and sell at resistance on the upper band.

As shown in the chart (with circles marked), I’ve been buying on dips along the way.

In the most recent phase, you can consider buying around $139. If the price breaks out, the next support levels to watch would be around $143 and $147.

Target prices:

First target: $150

Next targets: $160 and $170

Stop Loss:

If the price drops below $120 and breaks the price structure, that would be the stop level.

As the quarterly earnings announcement approaches, the price is rallying in anticipation, and it's showing strong momentum within an uptrend—very positive sign.

KRYSTAL Integrated Services LtdTechnical View: KRYSTAL is consolidating between ₹520–₹550 after a rally from March lows. A breakout above ₹560 could target ₹600+, while a dip below ₹500 may weaken momentum. RSI shows moderate bullishness.

Fundamental View: FY24 revenue grew ~44% YoY to ₹981 Cr; net profit rose ~26% to ₹48 Cr. ROE ~18%, ROCE ~20%. Recently secured a ₹349 Cr 3-year contract from Tamil Nadu Medical Services.

Action Plan:

Short-term: Buy above ₹560, target ₹600.

Long-term: Attractive valuation; accumulate on dips ₹450–₹500 zone.

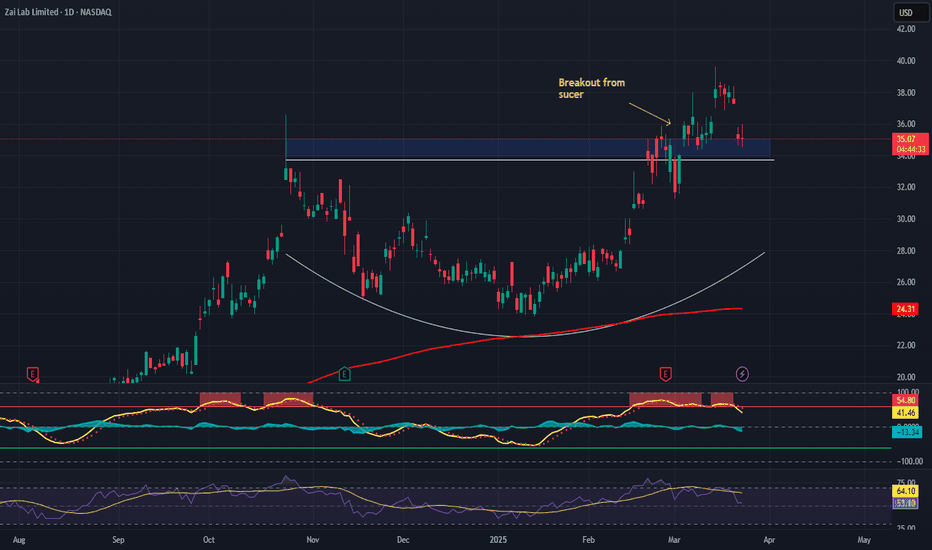

Zai Lab (ZLAB) – Biotech Growth & Profitability PathCompany Overview:

Zai Lab NASDAQ:ZLAB , a leading Chinese biotech firm, is on track for non-GAAP profitability by Q4 2025, driven by strong revenue growth & cost management.

Key Catalysts:

Financial Discipline & Expansion 💰

Operating losses fell 45% in Q4 2024, highlighting cost efficiency while scaling operations.

Analysts project $2 billion in annual revenue by 2028, reinforcing long-term value creation.

Blockbuster Drug Pipeline 💊

VYVGART generated $93.6M in its first full launch year, demonstrating strong adoption.

KarXT & bemarituzumab are key upcoming growth drivers, expanding ZLAB’s market footprint.

Investment Outlook:

Bullish Case: We are bullish on ZLAB above $34.00-$35.00, supported by financial execution & product expansion.

Upside Potential: Our price target is $54.00-$55.00, driven by strong product adoption & long-term growth trajectory.

🔥 Zai Lab – Unlocking the Future of Biotech Innovation. #ZLAB #Biotech #GrowthStocks

Defensive Sector with Growth PotentialSupporting Arguments

Current Market Uncertainty Sustains Demand for the Defensive Sector. NEE represents the defensive utility sector. Given the current political and economic uncertainty in the market, there could be an additional catalyst for the company's stock price growth.

Demand for Green Energy from the IT Sector. More than 80% of the company's portfolio consists of renewable energy sources (RES). Demand from data centers in the IT sector may allow the company to outperform competitors.

Attractive Valuation Levels and Technical Outlook

Investment Thesis

NextEra Energy (NEE) has strong long-term growth prospects due to the increasing demand for RES and the electrification of various sectors. Their integrated business model, combining the regulated utility business FPL and the competitive renewable energy business NEER, ensures both stability and growth opportunities. NEE's leadership in RES production, along with investments in battery energy storage and gas infrastructure, allows the company to benefit from the growing demand for clean energy solutions.

Current Market Uncertainty Could Drive Stock Price Growth. Tariffs imposed by the administration on imports and their potential impact on the U.S. economy remain in investors' focus. The market has responded to high uncertainty with a significant correction in overheated sectors, and pressure may persist for some time. As a representative of the utility sector, NEE benefits from uncertainty and may continue its growth.

Demand for Green Energy from the IT Sector. The largest public companies continue to increase capital expenditures on AI infrastructure to stay competitive. A key component of such infrastructure is data centers, which consume large amounts of energy and contribute to increased environmental pollution. As a result, data center owners create strong demand for companies that provide access to RES. More than 80% of the company’s portfolio consists of renewable energy sources. Already, the company’s annual profit growth rate is twice as high as that of its competitors.

Attractive Valuation Levels and Technical Outlook. The company's stock is trading at the 200-day moving average and recently rebounded from the resistance line at the 50-day moving average, which could serve as a strong catalyst for movement toward the previous peak of $84.8. Based on the forward PEG ratio, the company is trading at about the same level as companies engaged in traditional energy sources for household supply, while maintaining profitability 5-15% higher than competitors. Based on the forward P/E ratio, the company appears cheaper than its closest direct competitors (18x vs. 20.5x).

Our target price is $82, with a "Buy" recommendation. We recommend setting a stop-loss at $64

TG Therapeutics (TGTX) – Biotech Innovation & Global ExpansionCompany Overview:

TG Therapeutics NASDAQ:TGTX is a biotech leader focused on novel cancer and autoimmune treatments, gaining momentum as an IBD Leaderboard and IBD 50 Top 10 Growth Stock.

Key Catalysts:

Regulatory Approvals & Expansion 🌍

BRIUMVI secured approvals in Europe & the UK, unlocking new revenue streams in key markets.

Strong Profitability & Growth 💰

88.3% gross margin ensures sustainable reinvestment into R&D and future pipeline advancements.

High-Growth Stock Recognition 📊

Technical strength is validated by its inclusion in top-performing stock lists, signaling strong investor confidence.

Investment Outlook:

Bullish Case: We are bullish on TGTX above $34.00-$35.00, driven by global expansion, financial strength, and biotech leadership.

Upside Potential: Our price target is $55.00-$56.00, supported by continued innovation and market penetration.

🔥 TG Therapeutics – Pioneering the Future of Cancer Treatment. #TGTX #Biotech #GrowthStocks

$CDRE: Cadre Holdings – Riding the Safety Wave?(1/9)

Good afternoon, everyone! 😊

NYSE:CDRE : Cadre Holdings – Riding the Safety Wave?

With CDRE at $30.20, is this stock a safe bet or a risky ride? Let's dive into the world of safety gear and see if Cadre's holdings hold up! 😎

(2/9) – PRICE PERFORMANCE

• Current Price: $30.20 as of March 12, 2025 😏

• Recent Moves: Down 11% from $34.02 a week ago 😬

• Sector Vibe: Safety equipment sector is growing, driven by stricter regulations and demand for safer workplaces. 📈

Short commentary: The stock's taken a hit, but the sector's looking good. Maybe it's just a temporary dip? 🤔

(3/9) – MARKET POSITION

• Market Cap: Approximately $1.23 billion 💰

• Operations: Manufacturing and distributing safety and survivability products for law enforcement, first responders, military, and now, the nuclear market. 🛡️

• Trend: Expanding into new markets with the acquisition of nuclear safety brands. 🚀

Short commentary: They're diversifying, which is usually a good sign. More markets mean more opportunities. 😉

(4/9) – KEY DEVELOPMENTS

• Acquisition of Carr's Engineering Limited's Engineering Division for nuclear safety solutions, announced on January 16, 2025. 📈

• Expected to close in the first half of 2025. ⌛

• Market Reaction: The stock has seen a recent dip, possibly reflecting integration concerns or broader market volatility. 😐

Short commentary: This should bring in new revenue streams and expand their international presence. Let's see how it plays out. 🌍

(5/9) – RISKS IN FOCUS

• Integration risks from the acquisition. ⚙️

• Supply chain disruptions. 🚚

• Regulatory changes in the nuclear sector. 📜

Short commentary: These are all things to keep an eye on, but every company has some risks. Stay vigilant! 🕵️

(6/9) – SWOT: STRENGTHS

• Strong reputation in safety equipment. 🏆

• Diverse product portfolio. 🌈

• Recent acquisition expanding into the nuclear market. 🌟

Short commentary: They're well-known and have a broad range of products, which is great. Keep up the good work! 👍

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Potential over-reliance on government contracts, integration challenges. ⚠️

• Opportunities: Growth in nuclear safety market, increasing global demand for safety products. 🌐

Short commentary: They need to manage their dependencies and make sure the acquisition goes smoothly, but there's a lot of potential for growth. Let's hope they nail it! 📈

(8/9) – CDRE at $30.20 – what's your call? 🗳️

• Bullish: Price could rise to $35+ soon, due to successful acquisition and sector growth. 🚀

• Neutral: Price remains steady, as the market digests the acquisition news. 😐

• Bearish: Price could drop to $25, due to integration risks and market volatility. 📉

Drop your pick below! 💬

(9/9) – FINAL TAKEAWAY

Cadre Holdings' $30.20 stance shows a robust portfolio and strategic expansion, but recent price dips and integration risks are concerns. Volatility’s our ally—dips are DCA treasure. Snag low, soar high!

$NIFTY: Nifty 50 – India’s Market Meltdown or Hidden Gem?(1/9)

Good Morning, folks! ☀️ NSE:NIFTY : Nifty 50 – India’s Market Meltdown or Hidden Gem?

Gift Nifty’s at 22,555, down 65 points, and the index is off 13% since October 2024! Is this a crash landing or a golden ticket in disguise? Let’s unpack the chaos! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Gift Nifty: 22,555, down 65 points (Mar 6, 2025) 💰

• Recent Trend: 13% drop from Oct 2024 highs 📏

• Sector Mood: Autos, real estate dragging, per web reports 🌩️

It’s a bumpy ride, but bargains might be brewing! 🔧

(3/9) – MARKET POSITION 📈

• Index Weight: 50 top Indian firms, 65% of NSE market cap 🏅

• Scope: Spans 13 sectors, from banks to tech ⏳

• Trend: Bearish streak persists, down 13% since Oct 🎯

Still a heavyweight, but feeling the squeeze! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Slowdown: Growth at 5%, down from 20%+ 🔄

• Macro Woes: U.S. tariffs, trade tensions spook investors 🌍

• Market Vibe: Gift Nifty signals a sour start 📋

Tough times, but sectors might shine through! 💡

(5/9) – RISKS IN FOCUS ⚡

• Geopolitics: U.S. tariff threats hit exports 🔍

• Sector Slump: Autos, real estate under pressure 📉

• Volatility: Bearish trend grips tight 🌪️

Rough waters ahead, but storms pass! 🛡️

(6/9) – SWOT: STRENGTHS 💪

• Diversity: 13 sectors, broad economic play 🏆

• Scale: Tracks India’s biggest players 📈

• Value: Potentially undervalued, per web buzz 🔩

A battered champ with fight left! 💼

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: 5% earnings growth, macro drag 📉

• Opportunities: Sector plays in banks, tech shine 📈

Can it dodge the punches and rally? 🤔

(8/9) – 📢Nifty at 22,555 (Gift), down 13%—your call? 🗳️

• Bullish: $24K soon, undervalued steal 🦬

• Neutral: Flatline, risks offset ⚖️

• Bearish: $20K next, bears rule 🐻

Vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Nifty’s 13% slide and $116 Gift price signal trouble 📉, but undervalued sectors tease upside 🌱. Volatility’s our mate—dips are DCA fuel 🔥. Buy low, aim high! Hit or miss?

BYD - What next post-earnings and the BoC's stimulus?HKEX:1211 has had a strong year in growth prospects, reporting solid earnings growth thanks to its robust EV sales and expanding footprint in international markets. The recent earnings beat highlighted an impressive increase in revenue, driven by the demand for both their electric and hybrid vehicles. But what we can notice is that the stock has only reflected this as a c.16% rise in price YTD. However, the question now is: where does BYD go from here?

- More recently, the BoC's latest stimulus measures, including rate cuts and support for the real estate sector, could indirectly benefit BYD. With increased liquidity and consumer confidence, domestic demand for EV's could rise, especially if coupled with additional green energy incentives.

- As for the earnings release, the markets reacted well, and with this new-found optimism in the markets, with both the SEE Composite Index SSE:000001 and the Hang Seng Index TVC:HSI up 5.78% and 9.28% in the past 5 days, is this the turn-around for China as a whole?

$COFORGE: Coforge Ltd. – AI Travel Tech Titan or Overhyped?(1/9)

Good afternoon, everyone! 🌞 NSE:COFORGE : Coforge Ltd. – AI Travel Tech Titan or Overhyped Split?

Coforge snags a $1.56B Sabre deal and a 1:5 stock split—shares spike 10%! Is this IT gem ready to soar or just riding AI hype? Let’s unpack the buzz! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Recent Surge: Shares up 10% post-Sabre deal news 💰

• Stock Split: 1:5 split announced, boosting accessibility 📏

• Sector Trend: IT outsourcing on fire, per X posts 🌟

It’s a hot streak, fueled by big moves! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: Not specified, but shares soaring 🏆

• Operations: Global IT player, travel tech focus ⏰

• Trend: $1.56B deal lifts travel sector outlook 🎯

Firm, staking its claim in AI-driven IT! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Sabre Deal: $1.56B, 13-year AI partnership 🔄

• Revenue Boost: Travel sector growth projected, per analysts 🌍

• Market Reaction: 10% jump, analyst upgrades flying 📋

Scaling up, with AI as the jet fuel! 💡

(5/9) – RISKS IN FOCUS ⚡

• Execution Risk: Big deal, big delivery pressure 🔍

• Hype Factor: AI buzz could overinflate expectations 📉

• Competition: IT giants crowding the space ❄️

High stakes, but risks are real! ⚠️

(6/9) – SWOT: STRENGTHS 💪

• Mega Deal: $1.56B Sabre contract, 13 years locked 🥇

• Travel Tech: Niche expertise shining 📊

• Split Appeal: 1:5 makes it investor-friendly 🔧

Loaded with ammo for growth! 💼

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Execution hiccups could trip it up 📉

• Opportunities: AI adoption, travel sector boom 📈

Can it deliver or just dazzle? 🤔

(8/9) – 📢Coforge shares up 10%, $1.56B deal in pocket—your take? 🗳️

• Bullish: Skyrocketing on AI wings 🐂

• Neutral: Solid, but watch execution ⚖️

• Bearish: Hype outpaces reality 🐻

Drop your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Coforge’s $1.56B Sabre deal sparks a 10% surge 📈, with a 1:5 split sweetening the pot 🌱. Volatility’s our playground—dips are DCA gems 💰. Snag ‘em cheap, ride the wave! Goldmine or glitter?

Celsius Stock is a fast grower at a good priceCELH is a high growth stock that has finally found a fair price.

It has a popular brand and is now available everywhere, including costco.

Pepsi is partnering with them.

Now that its down 75%, it on my radar as a fairly price high growth stock.

so what, what can I expect.

What Im hoping when I get a grower, is 20-40% per year.

I covered Palantir when it was under 10, and now its over 100 only 2 years later, a 10x.

Could that happen here, I have no idea.

All we can do is look for good value and reduce our risk by finding quality.

Cheers.

UPSTART ($UPST): AI-DRIVEN LENDING ON THE RISEUPSTART ( NASDAQ:UPST ): AI-DRIVEN LENDING ON THE RISE

1/8 – REVENUE & EARNINGS BLAST

• Q4 2024 revenue: $219M (+56% YoY) 🔥

• Powered by a 68% jump in loan originations 💸

• EPS: $0.26, beating estimates by $0.30 (analysts expected -$0.04) 🚀

• Positive Adj. EBITDA—Upstart’s inching closer to sustained profitability 🏆

2/8 – BIG FINANCIAL EVENTS

• Strong focus on AI model innovation + expanding funding supply 🤖

• Management bullish on earnings call—AI improvements = growth catalyst 🚀

• Renowned for bridging lenders & borrowers via advanced, automated credit assessments 🌐

3/8 – SECTOR COMPARISON

• Some valuation measures say overvalued (e.g., GF Value ~$28 vs. market ~$65) 🧐

• Outpacing fintech peers like SoFi, PayPal, Ally in revenue growth 📈

• Profitability & multiples (P/E, P/S) lag behind due to recent net losses 😬

• Unique AI-lending angle may justify a premium—if it pays off 💡

4/8 – RISK ASSESSMENT

• Partner Dependence: A few big lenders = high exposure ⚠️

• Economic Sensitivity: Loan defaults rise if consumer conditions worsen 🌪️

• Regulatory Hurdles: Shifting financial rules could dent operations 🏛️

• Credit Risk: Holding loans on the balance sheet—watch out in downturns 💥

5/8 – SWOT HIGHLIGHTS

Strengths:

• Advanced AI for credit analysis 🤖

• High automation in approvals ⚡️

• Scalable via partner expansions 🌍

Weaknesses:

• Limited operating history ⏳

• Recent financial losses 📉

• Reliance on key partners 🤝

Opportunities:

• New loan products (auto, HELOC, etc.) 🚗🏠

• Expanding digital lending market 🌐

• Gaining market share as AI evolves 🔬

Threats:

• Fierce fintech competition 🏁

• Possible regulatory changes ⚖️

• Macro headwinds affecting credit demand 🌩️

6/8 – UN/UNDERVALUATION DEBATE

• Some see big future potential → undervalued by growth prospects 💹

• Others worry about multiples & an over-reliance on economic upswings 😬

• Recovery depends on broader economic rebound & strong risk management 🏦

7/8 Is Upstart a gem or a risk?

1️⃣ Bullish—AI lending will transform fintech 🏅

2️⃣ Cautiously Optimistic—Need more stability 🤔

3️⃣ Bearish—Valuation & macro risks are too high 🚫

Vote below! 🗳️👇

8/8 – STRATEGY WATCH

• Keep tabs on new loan products & partnerships 🛠️

• Monitor economic indicators (defaults, credit demand) impacting revenue 💼

• Regulatory shifts can either boost or bury AI-lending advantage ⚠️

$SMCI (SUPER MICRO COMPUTER): AI-DRIVEN GROWTH AMID GOVERNANCESMCI (SUPER MICRO COMPUTER): AI-DRIVEN GROWTH AMID GOVERNANCE WOES

1/8

Super Micro Computer ( NASDAQ:SMCI ) just revealed prelim Q2 FY2025 sales of $5.6–5.7B (+54% YoY), riding AI’s wave. But delayed filings & margin pressure spark caution. Let’s dig in! 💻⚡️

2/8 – REVENUE & EARNINGS SNAPSHOT

• Q2 sales: $5.7B (vs. $5.9B est.), EPS: ~$0.59 (est. $0.64)

• Full-year outlook trimmed to $23.5–25B (was $26–30B)

• Non-GAAP gross margin: ~11.9%; operating margin: ~7.9%—still under pressure 🏭

3/8 – KEY FINANCIAL EVENTS

• $700M in 2.25% convertible senior notes → fueling AI server growth

• Filing delays (10-K, 10-Qs) → must meet Feb 25, 2025 to avoid Nasdaq delisting

• New auditor BDO checks the books—no fraud found, but concerns linger about governance 🧐

4/8 – GOVERNANCE & INVESTIGATIONS

• Ongoing SEC & DOJ probes after Hindenburg’s short-seller report

• CEO says they’ll meet filing deadline, but trust is still shaky

• Market watchers: “No fraud found” is good, but the uncertainty stings 🤔

5/8 – SECTOR CONTEXT

• Competes with Dell ( NYSE:DELL ), HPE ( NYSE:HPE )—both see AI demand, but SMCI more focused

• SMCI trades at ~11x 2025 earnings (vs. Dell at 15x, HPE at 12x)

• Could be undervalued—but only if governance issues don’t overshadow the AI growth story 🚀

6/8 – RISKS

• Margin Pressure: R&D + product mix + potential GPU shipment delays (Nvidia Blackwell)

• Debt Load: Total debt now ~$1.9B, plus $700M in convertible notes

• Regulatory Overhang: Missing that Feb 25 deadline = serious delisting risk ⚠️

7/8 Is SMCI worth the gamble?

1️⃣ Bullish—AI potential outweighs the risks

2️⃣ Neutral—Need clarity on filings & margins

3️⃣ Bearish—Governance red flags trump growth

Vote below! 🗳️👇

8/8 – STRATEGIC OUTLOOK

• 70%+ revenue from AI platforms → big edge if servers remain hot

• Partnerships w/ Nvidia & push into liquid-cooled data centers

• Delaying or messing up compliance could sabotage all that potential 🌐

TESLA: Falling wedge recovery TESLA has not participated in any buying in the larger market. But it's fallen consistently. I see a channel forming from the range in 2024. Also a falling wedge pattern developing on the 1HR. This is falling towards a semi weak support zone with a 15 min reverse H&S. Although it's below the 0.5 fib level, my view is that downside is limited and can react at this level.

Trading MRI comprehensive trade analysis for BNZIBanzai International, Inc. ( NASDAQ:BNZI ) is a marketing technology company that provides essential marketing and sales solutions for businesses of all sizes. Recent acquisitions, financial restructuring, and a reverse stock split signal strategic shifts aimed at enhancing the company’s market position. However, its financial metrics reflect significant challenges, including negative operating, profit, and gross margins.

Recent Stock Performance

Closing Price (Dec 20, 2024): $1.71 (+5.56% from previous close of $1.62).

Daily Trading Range: $1.63–$1.85.

Volume: 4.07 million shares (below the 4.23 million average).

Volatility:

5-day fluctuation: 16.33%.

30-day fluctuation: 11.04%.

Moving Averages:

+11.89% above 20-day SMA.

-19.48% below 50-day SMA.

-82.60% below 200-day SMA.

52-Week Range:

-99.23% from 52-week high.

+32.05% above 52-week low.

Recent Company Developments

Acquisitions:

Vidello: Adds 6.5M in revenue and 2.3M in EBITDA (announced Dec 20, 2024).

OpenReel: Enhances AI-powered marketing with enterprise video solutions (completed Dec 19, 2024).

Debt Restructuring (Sept 2024): 5.6M liabilities written off; 19.2M restructured.

Reverse Stock Split (Sept 19, 2024): 1-for-50 split to meet Nasdaq listing requirements.

These developments indicate strategic efforts to stabilize operations and capture growth in the video marketing sector.

Analysis Overview

Daily Timeframe:

Setup: Green Setup 3 progressing toward Green Setup 4.

Trend: Bullish short-term, supported by price action above the 20-day SMA.

Key Levels:

Resistance at $1.85.

Support at $1.60.

Weekly Timeframe:

Setup: Transition from Red Setup 8 to Green Setup 1.

Trend: Strong reversal potential.

Key Levels:

Resistance at $1.80–$1.95.

Support at $1.35.

Monthly Timeframe:

Setup: Red Setup progression from 2 to 4.

Trend: Bearish continuation.

Key Levels:

Breakdown below $1.45 signals bearish dominance.

Support at $1.30 and $1.20.

snapshot

Risk Assessment

1. Probabilities:

Daily (Bullish): ~50.7% success rate.

Weekly (Bullish Reversal): ~90% success rate.

Monthly (Bearish Continuation): ~55.6% success rate.

2. Risk-Reward Ratios:

Daily: 1:1.5 (moderate).

Weekly: 1:2 (favorable).

Monthly: 1:1.5 (moderate).

3. Trade Risks:

Financial instability and operational losses may limit upside potential.

Reverse stock split suggests efforts to manage compliance rather than growth.

Trade Recommendations

Daily Chart:

Action: Long on confirmation of Green Setup 4.

Entry: Above $1.75.

Stop-Loss: Below $1.60.

Targets: $1.85, $1.90.

Weekly Chart:

Action: Long on confirmation of Green Setup 2.

Entry: Above $1.80.

Stop-Loss: Below $1.35.

Targets: $1.95, $2.00.

Bold Prediction for Q1 2025 NASDAQ:BNZI

Optimistic Scenario:

If bullish reversals on daily and weekly charts are confirmed, supported by revenue growth from recent acquisitions:

Target Price: $2.10–$2.20.

Drivers: Growth in video marketing demand and operational cost savings from debt restructuring.

Target Price: $2.10–$2.50 by Q2 2025.

Pessimistic Scenario:

If bearish continuation dominates, compounded by financial challenges:

Target Price: $1.15–$1.25.

Conclusion and Bold Prediction

BNZI's stock performance in 2025 will hinge on the successful execution of its strategic initiatives and the market reception of its enhanced video marketing solutions.

Optimistic Scenario: Integration of Vidello and OpenReel drives growth and operational efficiencies, potentially lifting the stock to $2.50 by mid-2025.

Pessimistic Scenario: Continued financial losses and market volatility may push the stock to a low of $1.10 by mid-2025.

Investors should monitor quarterly updates on revenue growth, profitability improvements, and operational synergies from recent acquisitions. This will provide crucial insights into the company's trajectory in 2025.

Celsius ($CELH) is FINALLY BOTTOMING. NOW IS THE TIME TO BUY! NASDAQ:CELH is FINALLY BOTTOMING?! NOW IS THE TIME TO BUY!

5 REASONS WHY:

1⃣ We have DIVERGENCE on the Weekly Chart

2⃣ It's a "High Five Setup"

3⃣ It's a BUY according to my Valuation Metric Tool (4/6 score)

4⃣ Growth Beast! Beaten down over 40% this year

5⃣ Find out by watching. 👇

Video analysis 5/5. Stay tuned for more!🔔

Like ❤️ Follow 🤳 Share 🔂

Will Celsius finally get back on track with their growth or be defeated by the Goliath Monster?!

Sorry for the pauses in the middle of the video; my dog came in and was about to start howling 🐶🤣

Not financial advice.

#NFLX Targets for the Meltup in equitiesI have called a couple real big pattern moves on #Netflix

so on todays mega rally

I take a quick look at the potential price projections that may or may not end up occurring

I am not a guru or price forcaster

i just draw lines on charts like always

Your Risk

Your Reward

But i am someone who does highlight Risk i.e. downward prices when I feel/see that might be a possibility

Yes I know

this game is not easy.