GRPN

WWRGo ahead and add this to your watch list. Under 4$ is a nice risk reward as far as I’m concerned. Started a long position today sub 4, however, I’m on the fence right now. The fact that 3.90 seemed to hold up potentially boded well. Monday will be telling from a technical stand point. My advice. Don’t buy yet, but you should have this on your radar, along with GRPN

$GRPN Conveniently Moves Up into the Firing LineGRPN is a great example of a company with literally no viable path forward still somehow getting attention from retail traders.

The gap higher on awful -- but beat-the-number -- EPS provides another solid short entry as it spirals toward eventual oblivion.

GRPN - Not My Fav Stock 2 Trade But...GRPN

ENTRY = 20 - 21.50

1st Target = 25

2nd Target = 30

HODL Target = 36

This content is for informational and educational purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

____________________________________________

This content is for informational and educational purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

GRPN look for short The daily and one and four hour chart looks nice for a long but groupon had negative earnings and changing leadership also the weekly chart is deal breaker of going long, we have a one year trend line currently about $.20 away so i m looking to short GRPN near trend line i will not chase either long or short

Groupon Technical Analysis - BULLISH Here are my current thoughts on GRPN:

1) We have completed our first wave structure up and we are currently in a correction pattern before continuing to the upside. Right now it appears to be playing out as an "ABCDE" symmetrical triangle / regular flat pattern.

- If this is invalidated, I have included the possibility for if this becomes a 3-3-5 expanded / running flat (which I don't think is the case, but - you want to be ready for everything!)

2) Upon breaking out of the triangle, my 1st idea would be to play the breakout targeting a 1:1 extension of the height of the triangle, first targeting 50%, then 100% (labeled in photo).

3) Since symmetrical triangles are continuation patterns, I would then look to target a 1:1 extension of the entire wave up - targeting the $4 area.

Earnings are today so this should get interesting!

If you like my content and would like to see more, please drop a like and/or comment! Let me know if you agree, disagree, would like further explanation, or just want to talk about it.

Thank you.

GRPN target $2.96 for a 2.71% bumpIf GroupOn can break through the opening bull pin from Oct 16 of $2.91, then looking at a 2.71% bump to $2.96. The MA trend looks like it could be a risk for a cross over, but the closing 30m green candle engulfed the previous red spinning top , so expecting upward movement.

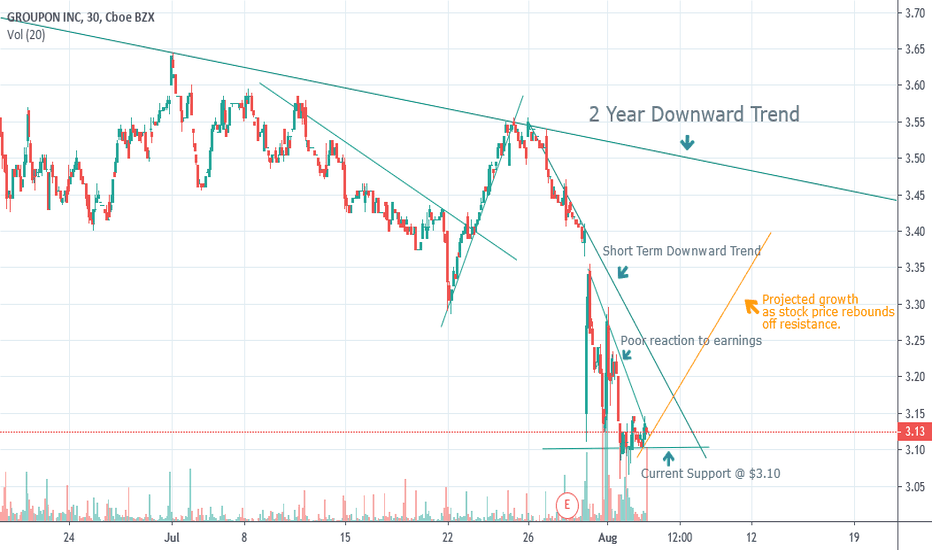

GRPN Rebound off current resistance There is a lot going on here visually but if you can see past it I believe there is a nice rebound coming for GRPN as it comes off a week of aggressive consolidation. Currently the stock price is well below 2 year downward trend and has faced steep losses since the earnings report that came out last week. I project that long term the price will continue to fall but in the short term it should bounce up to around $3.30-$3.40 before it meets resistance.

I will be buying a Call Option with a Strike Price of $3.00; expiry date of 08/23/19.

EARNINGS: JNPR, GRPN, AND TWTR (DIRECTIONAL PLAYS)A couple of other ideas for next week surrounding earnings ... . I like to have a lot of these ideas in the hopper so that I can price setups during regular market hours; some of these aren't as "sexy"/liquid during NY as they appear in off hours.

JNPR Dec 2nd 21 short puts; .45 cr at the mid (strike around long-term support). Earnings (10/25). I generally do these earnings plays with a short strangle or iron condor, but just can't get squat out of one of these strats in JNPR, so might as go directional.

TWTR Dec 16th 15 short puts; .60 at the mid (I'm more fixated on the 14 strike, since it's around long-term support). If I get a dip post earnings (10/27) that "juices up" the 14, I'll pull the trigger on that. Roll, roll, roll until a buyout rumor or until a buyout actually occurs. If it pops higher, I shrug my shoulders and say, "You doofus. You waited too long." TWTR has good metrics for my standard short strangle or iron condor, but I'm fixated on going directional here with the repetitively resurfacing buy out rumors which may, at some point in time, result in an actual buy out ... .

GRPN: Dec 16th 4.5 short puts: .31 at the mid. Earnings 10/26. That shortie is quite close into current price in the scheme of things, so this one would be a crap shoot. Either it takes off to the upside or look forward to getting put the stock at 4.5 (minus the credit you received on the front end). The good thing is that background IV is always fairly high, which would help with selling calls against.

DSKX Major Acquisition(NASDAQ: DSKX) – Research Report

Company Name: DS Healthcare Group Inc.

Stock Symbol: DSKX Company Website: www.dslaboratories.com

Trading at $1.53 Per Share (02/16/2016)

Currently DSKX has a very attractive valuation with high analyst ratings, hedge fund interest, strengthened management team and major upcoming catalyst. DSKX is trading at a 33M market cap while they are expected to close on a major acquisition which is expected to increase the company’s annual revenues to approximately $65 million and $10 million in EBITDA with the combined businesses from over 20 countries, 900 unique and diversified products, and a broad range of personal care categories. This acquisition fiercely scales up and expands DS Healthcare’s business operations, product portfolio and distribution network in one deal. With the deal in place, DSKX is trading well below 1x expected annual sales while in the recent years many of its competitors in the industry sold at approximately 5x sales. Nioxin, Chattem, Simple Health & Beauty just to name a few.

Several weeks ago, Frigate Ventures LP filed a SC 13G. In the filing, it appears Frigate Ventures LP owns 1,500,000 shares of DSKX. This shows Frigate Ventures Lp’s confidence and optimism in the future of the company and as a institutional investor with an excellent track record, its safe to assume they do their homework before buying a 7.1% stake in a company.

Read the full research report using this link www.stockpicksnyc.com