Grubhub

Everybody GRUBs...Weekly trying to hodl the 200ema, Daily SetupGRUB

BUYZONE = 63-65 (383fib)

Cost Avg Down = 55-57 (.5fib)

1st Target = 72 (236fib)

2nd Target = 76

3rd Target = 80

HODL Target = 85+

______________________________________________________________________________________________________________________

This content is for informational, educational and entertainment purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

GRUB - GRUBHUB Technical AnalysisTechnical analysis:

Hold Before going long -wait until the end of the price setback.

Fundamental Analysis

Uber is likely to pull out of merger talks with GrubHub over antitrust concerns raised with the potential deal.

Grubhub will likely merge with a European company instead, Faber reported.

Grubhub - Fundamental AnalysisGo long - Mainly based on the below fundamental analysis

Uber (UBER), Grubhub (GRUB) – The Wall Street Journal reports the CEOs of both companies met over the weekend to continue merger discussions, as they try to work out a stock-swap deal that would combine Uber’s delivery service, Uber Eats, with Grubhub. Grubhub continues to maintain that Uber’s current offer is too low.

GrubHub ($GRUB): Uber Wants To Buy This, But Do We?✨ New charts every day ✨

Like, Comment & Follow to help the community grow 🎉🎉

---

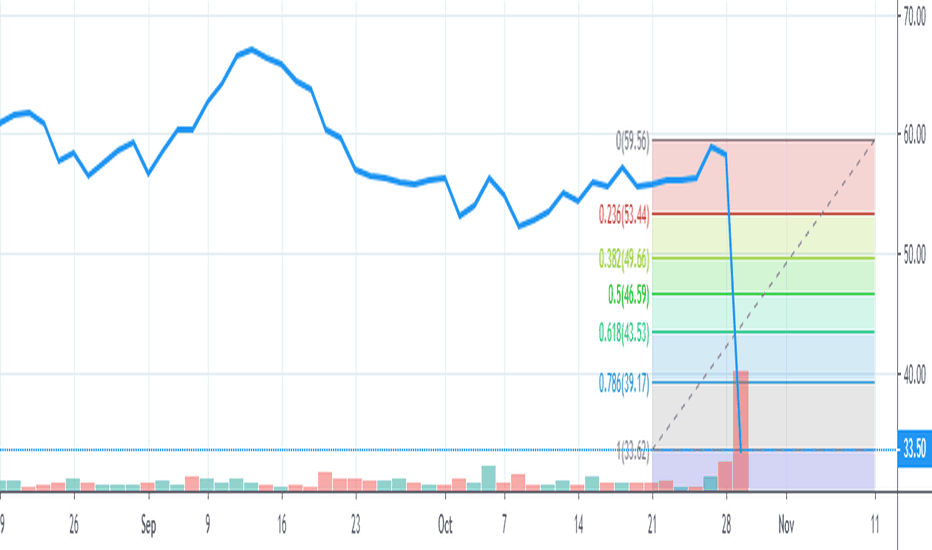

Grubhub’s stock spiked today by almost 40% due to Uber’s offer to buy Grubhub. That offer is bullish, but the reality is Uber and GrubHub haven’t agreed on a price yet. It is very likely the market won’t be deciding the price based on FOMO, and instead Uber and GrubHub will decide a price based on other metrics. Since it is doubful Uber will overpay, it is prudent to look at resistance levels assuming GrubHub beings trading again.

Resources: www.cnbc.com

---

1. Fractal Trend is showing a downtrend (Maroon bar color) on the 4 hour chart.

2. With this strategy, we we want to enter short on bearish order blocks plotted by Orderblock Mapping (Maroon) and bearish S/R levels plotted by Directional Bias (Maroon).

3. Since the overall trend is down, the play here is to see how tomorrows open is and consider a short if price is rejected at R1 intraday.

With this chart we potentially won’t have much time to make any play before Uber and GrubHub come to a deal and shares stop trading. The goal here is to get a quick short in before the deal goes through. Otherwise, the point of this chart is to just point out potential resistance and support levels if trading keeps up. Whatever you do, you don’t want to be paying more for GRUB than Uber does.

Grubhub ir breaking out $GRUB$GRUB broke the resistance for double bottom. Volume is super, RSI is the higher high.

If you find my charts useful, please just leave me a "Like"

thx

$GRUB Looks To Be Breaking Out$GRUB looks like it's ready to make a move higher. The stock is still 30% off its 52-week highs and 19.23% of the float is short, so there's plenty of short covering that can take place. There also could be some M&A happening in the food delivery space. DoorDash (DOORD), Postmates (NYSE:POST) and Uber Eats (NYSE:UBER) have been in various merger talks over the last year, sources confirm to The Wall Street Journal. Grubhub (NYSE:GRUB) wasn't mentioned in those particular discussions, but is believed to also be open to a deal of some sorts.

Grubhub Inc., together with its subsidiaries, provides an online and mobile platform for restaurant pick-up and delivery orders in the United States. The company connects approximately 105,000 local restaurants with diners with diners in various cities. It offers Grubhub, Seamless, and Eat24 mobile applications and mobile Websites; and operates Websites through grubhub.com, seamless.com, eat24.com, and menupages.com. The company also provides corporate program that offers employees with various food and ordering options, including options for individual meals, group ordering, and catering, as well as proprietary tools that consolidate various food ordering into a single online account. In addition, it offers Allmenus.com and MenuPages.com, which provide an aggregated database of approximately 440,000 menus from restaurants in 50 U.S. states; Grubhub for Restaurants, a responsive Web application that can be accessed from computers and mobile devices, as well as Grubhub-provided tablets; point of sale (POS) integration, which allows restaurants to manage Grubhub orders and update their menus directly from their existing POS system; and Website and mobile application design and hosting services for restaurants, as well as technology and fulfillment services, including order transmission and customer relationship management tools. The company was formerly known as GrubHub Seamless Inc. and changed its name to Grubhub Inc. in February 2014. Grubhub Inc. was founded in 1999 and is headquartered in Chicago, Illinois.

As always, trade with caution and use protective stops.

Good luck to all!

GRUB | ShortTo begin, I am an American albeit do not live in the USA right now; I know what Grub Hub is though. Therefore, would love to hear & listen to positive or negative comments to this position.

To begin, GRUB has an earnings submission coming very soon ; their stock has not acted positively to them since ~2018; pls take a look.

Since 31 OCT '19 ( low ), it has increased by 72% . Run the numbers but you will see this is right on 3 Standard Deviations in their short history. This move only happened once & that was in AUG '16; which can called the "GRUB Bull Mrkt" ( I just made that up ); again, take a look. During that lead up, it did "top out" & pull back a bit. I believe this time to be different as I believe we are in a "GRUB Bear Mrkt" ( 6 Mnth moving average pulls below 12 Mnth ) & will not only pull back but will break the previous low as we are in "GRUB Bear Mrkt"

Aside from Moving Averages, why a GRUB Bear Mrkt? I would advise to take a look at the news for GRUB "this month." Mgmt is making changes to many aspects of their billing; they typically don't give concessions to their revenue providers when times are good.

Low barriers of entry in this mrkt don't help & they are riddled with competition; Uber for example.

I won't go into details about Stop Losses :: enclosed one in x2+ Mnthly ATR albeit anything can happen after earning submission.

As mentioned, pls share comments!

UBER - Don't buy the dip, yet...Analyst earnings review

UBER had third-quarter earning results above the top- and bottom-line S&P Capital IQ consensus expectations.

However, we still expect losses in Uber Eats, along with more aggressive investments in ATG, to delay Uber’s first full-year adjusted EBITDA until 2022.

Analyst target: $58

Uber's IPO lock-up period over!!

Tomorrow November 6th, 2019 . Investors who got in at the IPO, can now start selling their shares.

We could see a potential drop, as it has happened with other IPO's so far.

Extremely Oversold Buy short term grubhubI dont know why sometimes markets overreact this way.

If you look at grubhub earnings , yes it was bad , but not so bad that you wipe out half its marketcap.

EPS was in line

The orders have dropped though by 15% which for me is a bad sign.

And the orders and revenues might continue to drop considering their estimate for next quarters being 315-335 million against the expectations of 388 million.

but even then I still believe the company can bounce back and this huge drop might compensate a little bit at the end.

I dont think its worth 50-60 usd though. With competition from Ubereats, doordash and postmates rising, i think grubhub right now should be around 35-40 usd

Good news though is they will add non partner restaurants in the future, and are expanding heavily in order to retain their customers. If they manage it then their valuation might rise more.

Short term trade 1 days to few weeks

Buy Grubhub - 34

Tp 1 - 36 (short term trade for a day or two )

Tp 2 -38 (this might take a while)

Autonomous Trading Decimates GrubHUB Shares Billionaire LaughsIt's hilarious! JUNK RATING = CRASH = NO RISK

Alex Vieira Bearish AI Trading Forecast Destroys GrubHub A crash forecast means CRASH anywhere in the world! It's the highest ROI since the Great Depression for savvy investors

$GRUB True Bullish Harami DailyGRUB GrubHub has just completed printing a true Bullish Harami candlestick pattern at the bottom of a downtrend. Attached link to diagram explaining the rules for the bullish harami. Large bearish candle, followed by a gap up from close bearish candle, whose body is no bigger than 25% the preceding bear candle. In addition to this pattern, the RSI has shown a breakout from its downtrend pattern and oversold conditions. This looks like a good, short term long play to me, I like the August 23rd C62.5, currently around .55 per contract. Happy hunting and GLTA!! a.c-dn.net

GRUBHUB - short term correction and a bounceGRUB NYSE:GRUB is bounced off a long term historical trendline up. As long as it is not breached, expect a bounce after a minor correction.

Good Grub!Weekly and daily bullish divergences starting to play out. Needs to close daily above 75 and then it should start really cooking (pun intended)...

Target 100 for now

Enjoy

Picking a Buy Point for Uber (UBER)The IPO for Uber (UBER) has fallen out the bed. The company priced its IPO at $45, opened at $42, and closed at $41.57. UBER’s one-day total loss in value from the IPO price was apparently the largest in history. For a moment, UBER looked like it could stabilize around its poor first day. Unfortunately, the next trading day a major market sell-off helped take UBER down another 11.0% to close at $37.00.

{Uber (UBER) is two days old and has managed to sink 17.8% from its IPO price. This 15-minute chart shows the current persistence of selling.}

I believe retail investors have typically been left out of the big IPO cash machine of 2019 (like most successful IPOs). Yet, with 207M shares put out to market (180M from the company and 27M from selling stockholders), I strongly suspect too many retail investors got caught up in the UBER slide.

First of all, valuation is a tenuous metric for UBER. TechCrunch provided great coverage of the UBER S1 filing which threw into question the $90-$100B valuation at the time, down from a peak of around $120B. UBER is now valued at a $62B market cap. Here are some choice quotes which undermined any justification for premium pricing for UBER:

“…Those figures say show Uber’s growth slowing as it scaled. Still, at Uber’s revenue scale, growing 42 percent is impressive. However, the pace of deceleration from 2017’s over 100 percent figure could provide pause to some investors looking at Uber’s results from a growth perspective. And, when examined quarterly, the company’s revenue deceleration is even starker…a closer look at those quarterly results indicates that the company is growing at a rate much slower than that yearly total.”

“The company’s operating losses decreased year over year from $4.1 billion to $3.1 billion. Improving net loss is a positive for Uber, but $3.1 billion is still a huge figure, particularly within the context of slowing growth.”

In other words, UBER is NOT the kind of stock investors should rush to grant a premium. Still, UBER is now priced at 5.5x sales, just above the 5.1x for Grub Hub (GRUB) which competes directly with Uber Eats and also strongly relies upon a flexible labor force of non-professional drivers.

{Grubhub (GRUB) is well off its all-time highs but has not (yet?) reversed the big breakout from July, 2017.}

Based on this admittedly simplistic valuation exercise, I am going to hazard a guess that buying Uber around current levels is a good long-term bet assuming it proves to be a viable business. My preferred spot to buy UBER is around 5x sales or $33-$34 to account for more of the risk in the business and the stock.

Technicals should help refine the entry point. For technicals, I lean on my framework of stepping aside while sellers are getting busy and jumping in when buyers show strong interest: “Anatomy of A Bottom: Do Not Argue With Sellers – Celebrate With Buyers.” In Uber’s case, buyers prove nothing until they are able to at least breach Monday’s gap down. In the absolute best case scenario, I would buy at $39.50 and stop out below $36. I will be much more interested in applying the technical framework if (once?) UBER breaks $36.

I will likely be slow to speculate on UBER because I got caught up using options to generate a lower entry price on Lyft (LYFT). At $48.15/share Lyft is well below the $55 strike price of the last put I sold (October expiration). Lyft is currently valued at 5.4x sales, but I used GRUB for UBER’s valuation yardstick because of its extended trading history.

{Lyft (LYFT) closed at a fresh all-time low after freshly breaking down last week.}

Options are not yet available for UBER. When they are trading, I will reach for selling puts before next picking a spot to buy shares.

Be careful out there!

Full disclosure: short LYFT puts and long calls

Chart Analysis - GurbhubPossible support level is 63.34/423.60% and expected will rebound from that.

Grubhub - Potential ShortNasty bearish engulfing on today’s daily close. Needs to slide a little lower before it’s really tempting, but if we see a significant break below support around 66 or 67, with no traps or reversals, there may be a great opportunity to short. Would reassess each day thereafter, but with a target cover near the gap fill around 52 or 53.

GRUBHUB : What would be next move? There is two or three Resistance and support which decides where it will go.

Scenario : 1

If it sustains its trend by support 1, then there is 70% chances to get resistance 1. Now the interesting thing is that if Grubhub will sustain its uptrend, then R1 will become Support for the next move.

Scenario : 2

If its fail to sustains its trend by support 1, then there is 50% chances to move down and getting Support 2. Now this level is nearest spot to get back on R1. Otherwise we have to wait long time to get high return.

We can't ignore the next earning report of Grubhub NYSE:GRUB NYSE:GRUB , and its revenue in compare to last quarter. It will most important happen to decide its next move towards down or up?

Keep it in Mind :

Support S1 : 78.45

Support S2 : 73.16

Resistance R1 : 82.71

Buy in Deep. "Redmark probability" will be convert in opportunity to buy. Don't miss the opportunity to get high returns.:)

Target :

Short Term : 10% Price $82.5

Long term : $101.00

Stop Loss : $71.00 NYSE:GRUB

GRUB - Quick dip to $68, before the jump off to $282 by NYSE:GRUB certainly headed higher, but that C wave has to complete first. my best guess is the golden pocket, the 618. But once past this pothole, ohhhhh boy the fun starts.. I got 161.8% of primary Wave 1, off the “estimated” end of Wave 2... COMING IN HOT $282, The Last Jedi Leap Call Options..

The price awakens December 2019..