Guess?, Inc. Reports Fiscal Year 2025 Fourth Quarter ResultsGuess?, Inc. (NYSE: NYSE:GES ) a company that designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children- operating through five segments: Americas Retail, Americas Wholesale, Europe, Asia, and Licensing, reports fiscal year 2025 fourth quarter results.

Reports Highlights

Fourth Quarter Fiscal 2025 Results:

Revenues Increased to $932 Million, Up 5% in U.S. Dollars and 9% in Constant Currency

Delivered Operating Margin of 11.1%; Adjusted Operating Margin of 11.4%

GAAP EPS of $1.16 and Adjusted EPS of $1.48.

Full Fiscal Year 2025 Results:

Revenues Increased to $3.0 Billion, Up 8% in U.S. Dollars and 10% in Constant Currency

Delivered Operating Margin of 5.8%; Adjusted Operating Margin of 6.0%

GAAP EPS of $0.77 and Adjusted EPS of $1.96

Full Fiscal Year 2026 Outlook:

Expects Revenue Increase between 3.9% and 6.2% in U.S. Dollars

Expects GAAP and Adjusted Operating Margins between 4.3% and 5.2% and 4.5% and 5.4%, Respectively

Expects GAAP EPS between $1.03 and $1.37 and Adjusted EPS between $1.32 and $1.76

Plans to Execute Business and Portfolio Optimization Expected to Unlock Approximately $30 Million in Operating Profit in Fiscal Year 2027

Financial Performance

In 2024, Guess?'s revenue was $3.00 billion, an increase of 7.88% compared to the previous year's $2.78 billion. Earnings were $60.42 million, a decrease of -69.15%.

Analyst Forecast

According to 5 analysts, the average rating for GES stock is "Strong Buy." The 12-month stock price forecast is $21.6, which is an increase of 115.14% from the latest price.

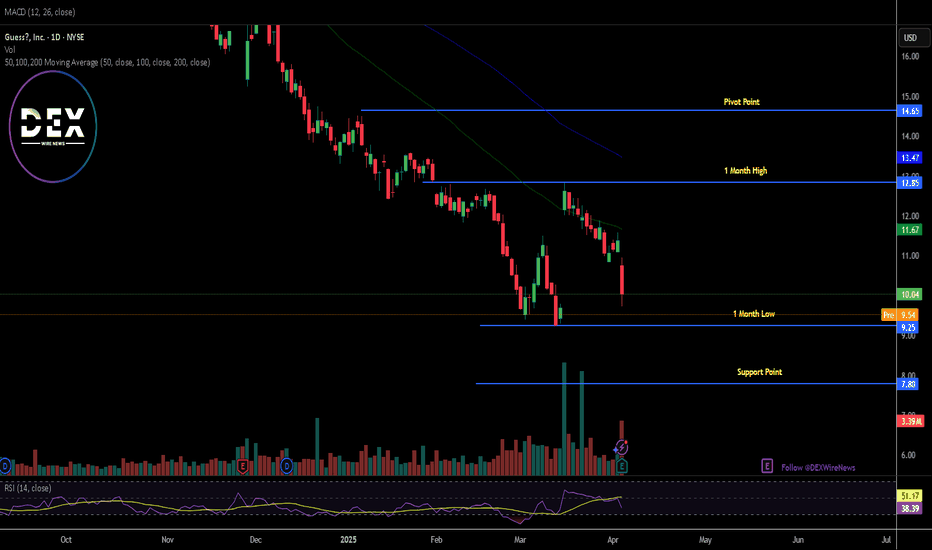

As of the time of writing, NYSE:GES shares closed Thursday's session down 11.78% extending the loss to Friday's premarket trading down by 2.38%. With a weaker RSI of 38, should trades open, NYSE:GES shares might break the 1-month low pivot and dip to the $7 support point. About $2.85 trillion was wiped out from the US stock market yesterday.

Guess

2025 S&P500 Forecast Guess by Tim WestI included 2024's guess that I posted here in January last year which turned out to be quite accurate in terms of "action" and "direction". The volatility the market saw with wild swings back and forth was outlined on here as we reached the clusters of guesses from Wall Street estimates.

This is an old technique that I learned from Ken Fisher of Fisher Investments and from Forbes Magazine. His wise and witty insights were the foundation of my investment strategy when I started investing in the mid 1980's.

Basically, when you see what the "market expectations" are for a market like the FOREXCOM:SPX500 or S&P500 Index, you can then figure out what needs to happen to get the market to their estimates and realize the market will go to somewhere else other than their guesses.

With 2024 showing a majority of "less than historical average" forecasts and more downside forecasts, it was quite clear that the market could easily outpace or outperform those forecasts.

Now that 2025 shows that analysts are looking for an average year or more, I think it is safe to say that we won't get an average year.

We now have a rising US dollar, which hurts overseas earnings. We also have higher energy prices which also hurts earnings. And yet we have plenty of cash on the sidelines as everyone who missed the rally is hoping to buy on a decline and others are just happy to earn 5% on their cash balances thanks to an ultra-tight Fed (compared to the last 20 years).

So, I expect more of the same that we have seen in January and I also expect sharp declines if we get any moves above the highs and up towards 6500 on the SPX.

GES Guess? Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GES Guess? prior to the earnings report this week,

I would consider purchasing the 23usd strike price at the money Puts with

an expiration date of 2023-12-15,

for a premium of approximately $1.82.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

GES Guess? Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GES Guess? prior to the earnings report this week,

I would consider purchasing the 19usd strike price Puts with

an expiration date of 2023-10-20,

for a premium of approximately $1.07.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

GES- BULLISH SCENARIOGuess? Inc., ticker symbol GES, released its first-quarter fiscal 2024 results, surpassing market estimates for both revenue and earnings. However, compared to the previous year, both metrics experienced a decline.

The company's international business exhibited strength during the quarter. This, coupled with solid product margins and effective cost-control measures, helped mitigate the challenges faced by the Americas Retail business due to reduced customer footfall in stores. Guess? has been successful in enhancing its brand image and maintaining a strong global distribution network, benefiting from its diversified business model.

Looking ahead, management remains positive about fiscal 2024, anticipating low single-digit growth in revenue. Additionally, they expect strong profitability and robust cash flow generation. Following the earnings announcement, Guess? shares saw a 1.3% increase during the after-market trading session on May 24.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

ATOM price perdiction P2As we saw, A lot of people are looking at ATOM. ATOM was one of the biggest gainers on 3 Dec 2021 but came back fast. With Atom pumping it got some media attention but not too much. Once the altcoin season in December goes parabolic ATOM will go to around 50$ at the end of 2021. ATOM has a lot of support at 25$ and massive resistance at 33$. I think some 2x/3x in a month are possible. Target around 45 - 60.

YETI - impulse waveOutcome Predictions

- (pink) price continues with uptrend until after earnings report. stock hits price high for wave again before correction and EMA folding over before 5th wave

- (blue) EMAs fold over now with larger drop to $62

- (purp) correction already over

Patterns

- two nearly identical bull runs

- may have already seen same $12.50 drop twice

- third stair would create 5 wave uptrend

- steady and significant earnings growth for last 3 years

Other Factors

- extremely strong brand

- dominance in general market sustained by dominance in specific markets (eg. fishing), unlike competitors (hydro flask)

- upcoming earnings report

Doubts

- the patterns I mentioned are kinda silly

- no major signals, these are pretty much wild guesses

*** WARNING ***

I am very new to this, don't trust me!

btc equilibriumIt didn't drop and so it hit an equilibrium of zzzzz

I just felt like making this to look at later and see if it really is this boring now, weeks before holidays will either prove or return volatility

banks pls stop

btw: think i seriously lost like every single trade today time for a break, owie

Just a guess, not an analysis.So, a good guess is as good as a formal job.

Here I guess that the indecision here is due to a price rising too fast.

As TFUEL's price is sitting up there about 60% from the lowest price seen here,

the buyers will only proceed to jump in at a possible lower level. Just a guess.

______________________________________________________________________

Please, don't take my writings as Financial Advice. They are made for Educational purposes only.

It is strongly recommended for every individual to double check everything before making any serious investment in any endeavour.

Camarilla pivots Wild guess for coming PASo this is not financial advice. I come to this guess because we have a tiny channel on the daily levels just under the pivot point. If we break the pivot I think the daily could swing high and take us up to low 10kish. that is where both the weekly and monthly top range level is (10.2-10.4) for max resistance. And since it is early In the week I think perhaps we will correct it from there. seems like a fitting hunt and false break out on low time frame traders shifting into a suitable early weekly and monthly Range downside play for proper correction. From there we maybe could see if it holds up... IF it happens.

A Scribble of GERIt looks to me like this will need a revisit in November. But from the looks of it, a correction takes this to $20+ by November, then it becomes tempting to sell. Or keep it for the Divs it pays. Either way, Come November, I will decide one way or the other.

GUESS Key Level Broken| Bearish Retest| Volume Climax Evening Traders,

Today’s technical analysis will be on GUESS, breaking major structural support and confirming a bearish retest,

Points to consider,

- Bear Trend (consecutive lower highs)

- Structural support breached

- Confirmed S/R Flip

- RSI oversold

- Stochastics in lower regions

- Volume climax evident

GUESS has been in an established bear trend with consecutive lower highs, a new local low has been confirmed with its recent wick down.

Weekly structural support has been breached; this is a high timeframe support, broken with convincing volume with a confirmed bearish retest. Bulls were not able to break above the now resistance – confirming the S/R flip.

RSI is currently oversold; a reversion back to neutral territory is highly probable. The stochastics on the other hand is in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the

upside.

Volume climax is evident, signalling a temporary bottom is in; however this is likely to change due to the confirmed S/R flip.

Overall, in my opinion, Guess is likely to test lower lows upon breaking key structural support. This is also combined with the greater economic situation; the retail sector is largely hit.

What are your thoughts?

Please leave a like and comment,

And remember,

“Don't blindly follow someone, follow market and try to hear what it is telling you.” ― Jaymin Shah

BTC Flippening: Roadmap for 8K, 12K, and beyond.This sort of sums up all the targets being called out from on high, but in a way that combines fractal flipping, chart patterns, and waves. We were all expecting something big on September 11, but nothing happened. Or maybe BTC flipped again. The flip traces sort of a mirror image of previous prices.

Looking at a chart patterns site, it was intuitive to visualize how well the broadening bottom pattern would fit the BTC flip hypothesis. It would form a symmetrical fractal ending on December 24, repainting previous big moves in crypto. The points are not random. They fall on the Friday of each week. Why Friday? Because that's payday, when the weekend starts. Friday is the day stock options expire worthless for 90% of retail traders. It's a day when institutions have taken that money and moved markets many times before.

It seemed necessary to predict prices going low enough to take out stops, and then bouncing up for a bull trap before committing to larger down moves. Expect the unexpected in the short term. And then zoom out to see how it all fits.

Institutions and CFDs seem to enjoy painting obvious daily patterns like these on charts for their trading educators to stand on. They entice undisciplined speculators to open margin accounts for 100x wreckage on small moves. The tops and bottoms coincide with support and resistance levels extrapolated from previous price action and are not set in stone. But it would be interesting to see how many are hit.

And there is still plenty of room for doombear barts in the holiday aftermath with their jaunty 1-2K predictions.