NZDJPY Long Entry IdeaPer myfxbook, retail is 78% short on NZDJPY, making me bullish. On the 1D, higher highs and higher lows have been made, giving me no reason to go bearish. There's also divergence between price and Cumulative Delta Volume (CDV). CDV has trended up short term, while price had trended down. Suggesting a weak sell. Price has seemed to find support right around 80.00, a nice whole number price. However, right below price is a large 4h imbalance inside of a 1D imbalance, where 50% of each imbalance lies right around 79.50, a nice half level. This area is also around the 50% retracement of the recent bull run if you apply a fib. My TP1 is the 4h imbalance that hasn't been filled, which is right around 81.5, another half level. Since this imbalance didn't break the previous short term market structure, I think price is likely to surpass this imbalance. Hence, my TP2 is targeting last month's highs at 82.5, another half level. A triple top formed right below last month's highs, providing liquidity for price to go to last month's highs, making it a likely target in my opinion.

Half

Where is BTC Going After that Surge?Hey all - That was quite a dramatic last few days, luckily we had Long positions both on our Daily Tipster and Intra-Day Scalper! Plenty of green for us with Bitcoin, Ethereum, Litecoin and ETC! (We missed DASH - but it hasn't gained as much anyway!)

So let's look at the King of Crypto, Bitcoin, where's it heading now? Carry on up to $9800, $10,400? Or back down to $8000 as if nothing has happened! Is this the start of the Bull Run we've been waiting for? Or simply reverting to mean after the big drop experienced at the start of March? The gains could also be an Organized FOMO Rally by big players, tempting smaller traders in using the Halving as a catalyst/panacea to their trading needs; only to wipe them out with a big drop due to over-extension and not enough genuine support.

Who knows? We can all speculate about where the price is heading next, we still believe we're on for $11-12,000 by the halving in early-mid May, and given what's happened in the last 48 hours - we're getting closer!

From here, we can see the price of BTC tickling $9,000 for a good few hours, maybe even a day or so. From there we'll be looking at a quick rise to $9800 - or a sharp fall to $8200. We're just not sure... what do you think?

Good Luck & Happy Trading

-theCrypster

Wartsila share are at the lowest price for several yearsWärtsilä, also spelled Wartsila and Waertsilae is a company based in Finland. The company's main business is fitting out the entire engine rooms of large ships.

Their website describes the activity as follows: Wärtsilä is a global leader in smart technologies and complete lifecycle solutions for the marine and energy markets. By emphasizing sustainable innovation, total efficiency and data analytics, Wärtsilä maximises the environmental and economic performance of the vessels and power plants of its customers. In 2018, Wärtsilä’s net sales totalled EUR 5.2 billion with approximately 19,000 employees. The company has operations in over 200 locations in more than 80 countries around the world. Wärtsilä is listed on Nasdaq Helsinki.

Today, 18/7/2019, the company announced their half year results. The results were worse than expected. Orders missed by 5% on both divisions. EBIT missed by 16%.

The outlook was far from bright. They wrote: "The demand for Wärtsilä’s services and solutions in the coming 12 months is expected to be somewhat below that of the previous 12 months (previously in-line)." Analysts are estimating about 5% worse. The shares are down around 11% this morning to EUR 11.15.

We can expect a series of analyst downgrades in the coming weeks. This means the share price could well head lower. Prior to the results the shares had already been under pressure, trending lower since March 2019. In fact the share have been a broad based down trend since September 2017, when they traded at a peak of EUR 20.25 now they are EUR 11.15. Prior to today's results the shares had been under pressure after another Finnish company (Fiskars Corporation), decided to distribute its 5% stake in Wartsila as a dividend to its investors. The share were distributed in June 2019. It seems that those investors sold the Wartsila shares, depressing the share price.

Whilst it will take quite some time for investors to change their view, and there is little prospect of a share price rise, there are some investors who think new shareholders are getting quite a bargain.

1) dividend yield 4.4%

2) P/e ratio 15X (forecast for 2018)

3) Prospects for refitting engines due to modern pollution controls.

4) The company's leading position in a cyclical market could mean a strong price recovery when the economy improves.

The company's recent dividend isn't too bad, being more than 4% of the share price. The company paid a dividend of EUR 0.48 for 2018.

Is the dividend sustainable? Wärtsilä's says its target is to pay a dividend of at least 50% of operational earnings over the cycle. In the first half of 2019 the company had earnings per share of EUR 0.22 vs EUR 0.21 in the previous year. Usually the company earns more in the second half than the first half. With an EPS estimate for the full year of EUR 0.60 to EUR 0.80, it looks like the dividend for 2019 might be under threat.

At the end of the day, it looks like the shares are going to stay in the doldrums for quite some time until there are concrete signs of recovery. Looking at the chart, I reckon the downtrend can continue for a while. I would stay away.

Bitcoin: halving is pressurizing market sellers, again

2015 : the market was too primitive at the time for the bullish prerequisites to be relevant, but let's still do it:

- Bottom of the market and coming halving in 2012 : 371 days.

- Bitcoin dropped around 90% from its cycle top, at least 1 year before the halving

- Bitcoin was above the weekly 50 Smma and used it as a support at least 6 months before the halving

2015

- Bottom of the market and coming halving in 2016 : 546 days.

- Bitcoin dropped around 85% from its cycle top, at least 1 year before the halving

- Bitcoin was above the weekly 50 Smma and used it as a support at least 6 months before the halving

2019:

- Bottom of the market and coming halving in 2020 : 525 days.

- Bitcoin dropped around 85% from its cycle top, at least 1 year before the halving

- Bitcoin is above the weekly 50 Smma and is using it as a support at least 6 months before the halving

Morals of the story :

Beeing long term bearish now (new lows, bitcoin goes to zero) is beeing counter trading the main behaviour of the Bitcoin market itself, which is very risky.

If Bitcoin settles below the weekly 50 Smma starting from now, be very fearful.

Odds to revisit the low 6k-high 5k area: low

Odds to revisit the 3k area: almost null

Take care

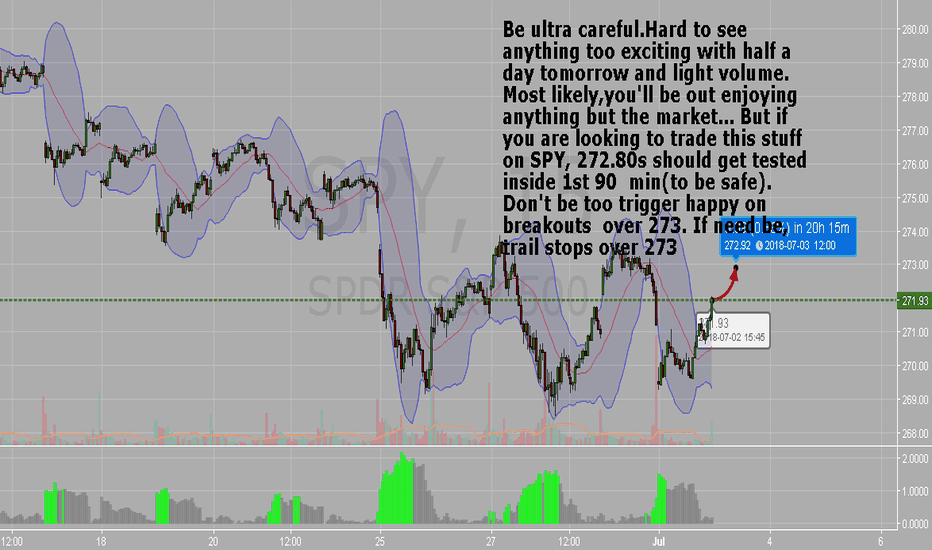

SPY half day dragEvery now and then, 'they'll pull a surprise half day rally.

It's design to complete some orderbooks when no one is looking. Not the only reason of course,but it helps when volume is low to help market makers shift the market to their benefit easier.

That said,I'm not going to be going too frenzied after the 273 attempt tomorrow,price now 271.84.

I've seen the machines go bonkers into the half day close decently.

FTSE 100: UKX Inter-Generational High: Super Cycle only half wayFTSE 100 Inter - UKX - Inter-Generational Cycle High - Half-Way House

Nine years from high to low. Nine years from low to High on

FTSE in fact the secondary or final rally high set in week of

13.03 00 as Internet generation 1 peaked with Nasdaq and

techs' peak reached that week). Low reached March 9th 2009.

The next cycle date falls between Friday 2nd March and

Friday 9th March. If the major markets break below the lows

of last week we can therefore most likely expect a low to

form at this point in time - and if they can hold up today and

rally from here the next high is likely to be struck in the 5

trading days between March 2rd '18 and March 9 '18.

Whichever way it breaks from here should be worth following

in the near term - but start to look for a significant change in

trend in either event come 2nd March through 9th.

Looking even further out in time this peak now is likely only an inter-generational cycle high, marking the half-way point in the old 18 year generation cycle. The real grand super-cycle high (high to super-high) is not reached on this chart until March 1st 2027.

Time, as always, will tell.

In the meantime, there's a nearer term FTSE strategy outlined below.