Mastering bullish candlestick patterns - How to use it!In this guide, we will explore some of the most important bullish candlestick patterns used in technical analysis. These patterns are essential tools for traders and investors who want to better understand market sentiment and identify potential reversal points where prices may start moving upward.

What will be explained:

- What are bullish candlestick patterns?

- What is the hammer?

- What is the inverted hammer?

- What is the dragonfly doji?

- What is the bullish engulfing?

- What is the morning star?

- What is the three white soldiers?

- How to use bullish candlestick patterns in trading?

What are bullish candlestick patterns?

Bullish candlestick patterns are specific formations on a candlestick chart that signal a potential reversal from a downtrend to an uptrend. These patterns are used by traders and investors to identify moments when the market sentiment may be shifting from bearish to bullish. Recognizing these patterns can help traders time their entries and make more informed decisions based on price action and market psychology. While no single pattern guarantees success, they can provide valuable clues when combined with other forms of analysis such as support and resistance, trendlines, and volume.

What is the Hammer?

The Hammer is a single-candle bullish reversal pattern that typically appears at the bottom of a downtrend. It has a small real body located at the upper end of the trading range, with a long lower shadow and little to no upper shadow. The long lower wick indicates that sellers drove the price lower during the session, but buyers stepped in strongly and pushed the price back up near the opening level by the close. This shift in momentum suggests that the downtrend could be coming to an end, and a bullish move might follow.

What is the Inverted Hammer?

The Inverted Hammer is another single-candle bullish pattern that also appears after a downtrend. It has a small body near the lower end of the candle, a long upper shadow, and little to no lower shadow. This pattern shows that buyers attempted to push the price higher, but sellers managed to bring it back down before the close. Despite the failure to hold higher levels, the buying pressure indicates a possible reversal in momentum. Traders usually look for confirmation in the next candle, such as a strong bullish candle, before acting on the signal.

What is the Dragonfly Doji?

The Dragonfly Doji is a special type of candlestick that often indicates a potential bullish reversal when it appears at the bottom of a downtrend. It forms when the open, high, and close prices are all roughly the same, and there is a long lower shadow. This pattern shows that sellers dominated early in the session, pushing prices significantly lower, but buyers regained control and drove the price back up by the end of the session. The strong recovery within a single period suggests that the selling pressure may be exhausted and a bullish reversal could be imminent.

What is the Bullish Engulfing?

The Bullish Engulfing pattern consists of two candles and is a strong indication of a reversal. The first candle is bearish, and the second is a larger bullish candle that completely engulfs the body of the first one. This pattern appears after a downtrend and reflects a shift in control from sellers to buyers. The bullish candle’s large body shows strong buying interest that overpowers the previous session’s selling. A Bullish Engulfing pattern is even more significant if it occurs near a key support level, and it often signals the beginning of a potential upward move.

What is the Morning Star?

The Morning Star is a three-candle bullish reversal pattern that occurs after a downtrend. The first candle is a long bearish one, followed by a small-bodied candle (which can be bullish, bearish, or a doji), indicating indecision in the market. The third candle is a strong bullish candle that closes well into the body of the first candle. This formation shows a transition from selling pressure to buying interest. The Morning Star is a reliable signal of a shift in momentum, especially when confirmed by high volume or a breakout from a resistance level.

What is the Three White Soldiers?

The Three White Soldiers pattern is a powerful bullish reversal signal made up of three consecutive long-bodied bullish candles. Each candle opens within the previous candle’s real body and closes near or at its high, showing consistent buying pressure. This pattern often appears after a prolonged downtrend or a period of consolidation and reflects strong and sustained buying interest. The Three White Soldiers suggest that buyers are firmly in control, and the market may continue moving upward in the near term.

How to use bullish candlestick patterns in trading?

To effectively use bullish candlestick patterns in trading, it’s important not to rely on them in isolation. While these patterns can signal potential reversals, they work best when combined with other technical tools such as support and resistance levels, moving averages, trendlines, and volume analysis. Traders should also wait for confirmation after the pattern forms, such as a strong follow-through candle or a break above a resistance level, before entering a trade. Risk management is crucial—always use stop-loss orders to protect against false signals, and consider the broader market trend to increase the probability of success. By integrating candlestick analysis into a comprehensive trading strategy, traders can improve their timing and increase their chances of making profitable decisions.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

Hammer

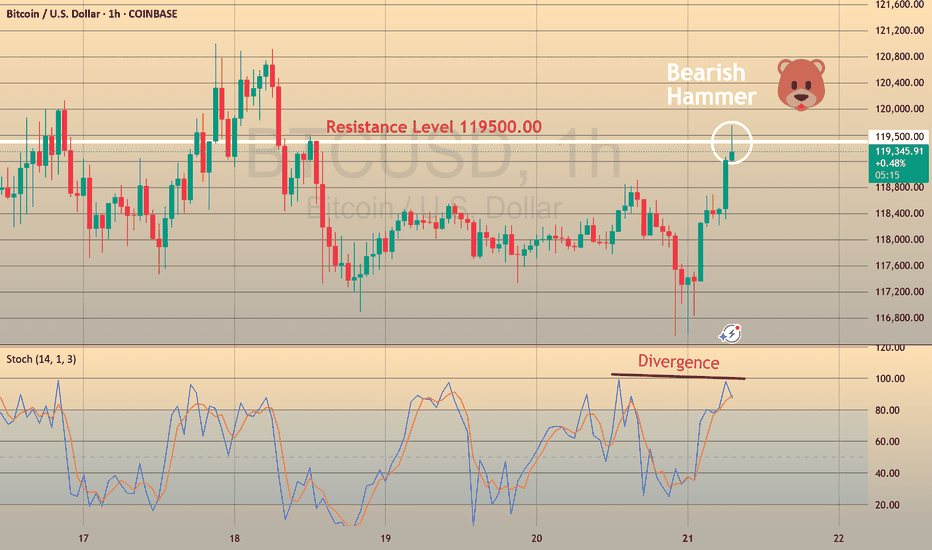

BTCUSD - BEARISH DIVERGENCE DETECTEDCAPITALCOM:BTCUSD

BTCUSD has been in a bullish trend over the past few hours and is now approaching the resistance at 119,500.00.

On the hourly chart, a bearish hammer has formed alongside a stochastic divergence, signaling potential downside.

⚡ This signal is reinforced by a strong resistance level above, adding weight to a possible pullback scenario.

📉 If BTCUSD rebounds from this level, consider Sell setups with take profit at the nearest support.

📈 If it breaks out, look for Buy opportunities on confirmation.

⚡ We use Stoch (14) to spot potential reversals when it exits overbought or oversold zones — helping you catch clear, confident entries.

What Is the Hanging Man Candlestick Pattern: Meaning & Trading?What Is the Hanging Man Candlestick Pattern, and How Can You Trade It?

In the world of technical analysis, candlestick patterns play a vital role in helping traders decipher market trends and potential reversals. Among the many setups, the hanging man holds particular significance. This distinctive formation captures traders' attention as it often serves as a warning sign of a possible trend reversal. This article will go through the technical analysis of the hanging man formation and explain how traders can trade with it.

What Is a Hanging Man Pattern?

The hanging man candlestick pattern is characterised by a small body near the top of the candlestick, a long lower shadow, and little to no upper shadow. It resembles a figure hanging from its head, hence the name "Hanging Man."

Psychology Behind the Hanging Man

The psychology behind the hanging man candlestick pattern reflects a shift in market sentiment. After a sustained uptrend, the appearance of this pattern indicates that buyers are losing momentum. The long lower shadow shows that sellers were able to push prices down significantly during the trading session. Although buyers managed to drive prices back up, the close near the open price suggests weakening bullish sentiment. This pattern signals that selling pressure is increasing, potentially leading to a bearish reversal as confidence among buyers diminishes.

The hanging man is a versatile formation that can be applied across a wide range of financial instruments, including stocks, cryptocurrencies*, ETFs, indices, and forex, on different timeframes.

Identifying a Hanging Man Candlestick on Trading Charts

To spot a hanging man pattern in stocks and other financial instruments, you may follow these key steps:

Look for an existing uptrend: Start by identifying a prevailing upward price movement on the chart.

Locate a candlestick with specific characteristics: Search for a candlestick with a small body near the top, a long lower shadow, and little to no upper shadow. This formation resembles a figure hanging from its head. The colour of the candle doesn’t matter, but if it’s bearish, the signal is stronger.

Consider supporting indicators: Utilise other technical indicators or oscillators to further validate the potential reversal. These can include trendlines, moving averages, or momentum indicators that align with the bearish interpretation.

Note that there is no such thing as an inverted hanging man candlestick or a bullish hanging man candlestick pattern.

Trading the Hanging Man Pattern

Those trading the hanging man reversal pattern need to apply a systematic approach in order to increase the likelihood of successful trades. Here are a few steps traders usually follow to trade this pattern:

- Identification: Identify the setup by using the steps mentioned above.

- Look for confirmation signals: The setup alone is not sufficient for making trading decisions. Seek additional confirmation through subsequent candlestick patterns or technical indicators. This can include bearish candlestick patterns (e.g. bearish engulfing or shooting star), a breach of support levels, or the convergence of other indicators signalling a potential reversal.

- Define your entry point: An entry point can be either when the next candlestick confirms the bearish sentiment or when the price breaches a significant support level.

- Consider risk management: Assess the risk-reward ratio of the trade and ensure it aligns with your risk tolerance. For efficient risk management, you may adjust your position size accordingly. Risk management tools like position sizing, setting stop-loss orders, and diversification may help protect your capital. You may set a stop-loss order above the hanging man pattern to limit potential losses if the trade goes against you.

- Identify profit targets: The candlestick itself doesn't provide specific targets. Traders can identify profit targets by looking at previous support levels, Fibonacci retracement levels, or other technical analysis tools like moving averages or pivot points.

- Monitor the trade: Keep a close eye on your position as it progresses. Pay attention to any changes in market conditions or additional signals that may invalidate the trade.

- Learn from outcomes: Regardless of the outcome of the trade, analyse it afterwards to identify areas for improvement. Assess whether the setup provided accurate signals and identify any factors that may have affected its success. This analysis will help refine your trading strategy over time.

Live Market Example

Consider the example of a hanging man on the forex USDJPY pair. An entry is placed on the next bearish candlestick with a stop loss just above the hanging man. The take profit order is at the next level of support marked by the orange line.

Limitations of the Hanging Man Candlestick

The hanging man candlestick pattern, while useful, has certain limitations that traders need to consider:

- False Signals: The hanging man can produce false signals, especially in volatile markets where price movements are erratic.

- Market Context: The effectiveness of the pattern varies depending on the broader market context and prevailing trends.

- Timeframe Sensitivity: Its reliability can differ across various timeframes; what works on a daily chart may not be as effective on an intraday chart.

- Not Standalone: It should not be used in isolation but as part of a comprehensive trading strategy that includes other indicators and risk management tools.

Comparing the Hanging Man to Similar Candles

Understanding how the hanging man pattern differs from similar candlestick patterns helps in accurate technical analysis. Here's a brief comparison of the hanging man with related patterns.

What Is the Difference Between a Hanging Man and a Hammer?

Both have the same candle structure. However, the hanging man candlestick occurs in an uptrend and signals a potential bearish reversal, while the hammer occurs in a downtrend, indicating a potential bullish reversal. Interestingly, it is possible to see a hanging man candlestick in a downtrend, often as part of a bullish retracement. Both candles require confirmation from subsequent price movements. They should be analysed within the context of the overall market trend and other technical indicators.

What Is the Difference Between a Pin Bar and a Hanging Man?

A pin bar and a hanging man are both single-candlestick patterns with small bodies and long shadows, but they serve different purposes in technical analysis. The pin bar has a small body and a long tail, indicating a reversal, but it can appear in any market condition. Its long tail shows a strong rejection of a certain price level, with the body pointing in the direction of the anticipated reversal.

The hanging man, however, specifically occurs after an uptrend and signals a potential bearish reversal, characterised by a small body at the top and a long lower shadow, indicating selling pressure.

What Is the Difference Between a Shooting Star and a Hanging Man Candlestick?

The shooting star and the hanging man are both bearish reversal patterns, but they differ in their appearance and context. A shooting star occurs after an uptrend and features a small body at the bottom with a long upper shadow, indicating that the price was pushed up significantly but fell back down, showing strong selling pressure.

The hanging man also appears after an uptrend but has a small body at the top with a long lower shadow, suggesting that sellers dominated the session despite an initial push by buyers. Both require confirmation from subsequent candlesticks to validate the reversal.

Final Thoughts

While the hanging man alone is insufficient for making trading decisions, it serves as a warning signal that buyers may be losing control and that selling pressure could increase. Traders seek additional confirmation through subsequent candlestick patterns, support and resistance levels, and other technical indicators to validate the potential reversal.

By understanding the implications of the setup within the broader market context and employing proper risk management strategies, traders can enhance their decision-making process and improve their chances of identifying different trading opportunities.

FAQ

What Does the Hanging Man Pattern Indicate?

The hanging man trading pattern in technical analysis typically indicates a potential trend reversal in an uptrend. It suggests that the buyers, who have been driving the market higher, are losing control, and the selling pressure may increase.

The hanging man is represented by a small body near the top of the candlestick, a long lower shadow, and little to no upper shadow. It resembles a figure hanging by the neck. This visual representation conveys the potential bearish sentiment.

Can a Hanging Man Candle Be Bullish?

No, there is no such thing as a bullish hanging man candlestick pattern. The bearish hanging man pattern indicates a potential trend reversal from an uptrend to a downtrend.

Is the Hanging Man Pattern Reliable?

The reliability of the formation, like any candlestick pattern, can vary depending on several factors. While the setup is widely recognised and considered a potential bearish reversal signal, it should not be relied upon as the sole basis for trading decisions. It is crucial to consider other factors and confirmation signals to increase its reliability.

What Is the Confirmation Candle for the Hanging Man?

A confirmation candle for the hanging man is a bearish candlestick that follows the pattern, confirming the reversal. This can include a bearish engulfing candle or a candlestick closing well below the hanging man's body, indicating increased selling pressure.

Is the Hanging Man Pattern Bearish?

Yes, it is generally considered a bearish pattern in technical analysis. It is formed when the price’s open or close is near or at its high, there is a significant decline during the trading session, and it closes not far from the opening price. The pattern resembles a hanging man with his legs dangling.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Mastering Candlestick Patterns - How to use them in trading!Introduction

Candlesticks are one of the most popular and widely used tools in technical analysis. They offer a visual representation of price movements within a specific time period, providing valuable insights into market trends, sentiment, and potential future price movements.

Understanding candlestick patterns is crucial for traders, as these formations can indicate whether a market is bullish or bearish, and can even signal potential reversals or continuations in price. While candlesticks can be powerful on their own, trading purely based on candlestick patterns can be challenging and risky.

-----------------------------------------------------------------------------------------------

What are we going to discuss:

1. What are candlesticks?

2. What are bullish candlestick patterns?

3. What are bearish candlestick patterns?

4. How to use candlestick patterns in trading?

-----------------------------------------------------------------------------------------------

1. What are candlesticks?

A candlestick in trading is a visual representation of price movement in a specific time period on a chart. It is a fundamental element used in technical analysis to study market trends, determine price levels, and predict potential future price movements. A single candlestick consists of four main components: the open, close, high, and low prices for that time period.

Here’s how a candlestick works:

- The Body: The rectangular area between the open and close prices. If the close is higher than the open, the body is green, indicating a bullish (upward) movement. If the close is lower than the open, the body is red, signaling a bearish (downward) movement.

- The Wick (high and low of the candle): The thin lines extending above and below the body. These represent the highest and lowest prices reached during the period. The upper wick shows the highest price, while the lower wick shows the lowest price.

- The Open Price: The price at which the asset began trading in that time period (for example, the start of a day, hour, or minute depending on the chart timeframe).

- The Close Price: The price at which the asset finished trading at the end of the period.

-----------------------------------------------------------------------------------------------

2. What are bullish candlestick patterns?

What is a Hammer Candlestick Pattern?

A hammer candlestick pattern has a small body near the top of the candle and a long lower wick, typically two to three times the length of the body. There is little to no upper wick. This formation shows that during the trading session, sellers managed to push the price significantly lower, continuing the downward momentum. However, buyers eventually stepped in with strong demand and drove the price back up near the opening level by the close.

What is an Inverted Hammer?

An inverted hammer has a small body near the bottom of the candle with a long upper wick, usually at least two to three times the size of the body, and little to no lower wick. This unique shape resembles an upside-down hammer, hence the name.

What is a Dragonfly Doji?

A dragonfly doji has a unique shape where the open, close, and high prices are all at or very close to the same level, forming a flat top with a long lower wick and little to no upper wick. This gives the candle the appearance of a "T," resembling a dragonfly.

What is a Bullish Engulfing?

A bullish engulfing candlestick consists of two candles. The first candle is bearish, indicating that sellers are still in control. The second candle is a large bullish candle that completely engulfs the body of the first one, meaning it opens below the previous close and closes above the previous open. This pattern reflects a clear shift in market sentiment. During the second candle, buyers step in with significant strength, overpowering the previous selling pressure and reversing the momentum. The fact that the bullish candle completely engulfs the previous bearish candle indicates that demand has taken over, signaling a potential trend reversal.

What is a Morning Star?

The morning star consists of three candles. The first is a long bearish candle, indicating that the downtrend is in full force, with strong selling pressure. The second candle is a small-bodied candle, which can be either bullish or bearish, representing indecision or a pause in the downtrend. Often, the second candle gaps down from the first, indicating that the selling pressure is subsiding but not yet fully reversed. The third candle is a long bullish candle that closes well above the midpoint of the first candle, confirming that buyers have taken control and signaling the potential start of an uptrend.

-----------------------------------------------------------------------------------------------

3. What are bearish candlestick patterns?

What is a Shooting Star?

A shooting star has a smal body near the low of the candle and a long upper wick, usually at least twice the size of the body, with little to no lower wick. This shape shows that buyers initially pushed the price higher during the session, continuing the upward momentum. However, by the close, sellers stepped in and drove the price back down near the opening level.

What is a Hanging Man?

A hanging man has a distinct shape, with a small body positioned near the top of the candle and a long lower wick, usually at least twice the length of the body. There is little to no upper wick. The appearance of this candle suggests that although there was strong selling pressure during the session, buyers managed to bring the price back up near the opening level by the close. Despite the recovery, the long lower wick shows that sellers were able to push the price down significantly at one point. This introduces uncertainty into the uptrend and can indicate that bullish momentum is weakening.

What is a Gravestone Doji?

A gravestone doji has a distinctive shape where the open, low, and close prices are all at or near the same level, forming a flat base. The upper wick is long and stretches upward. This shape resembles a gravestone, which is where the pattern gets its name.

What is a Bearish Engulfing?

A bearish engulfing candlestick pattern is a two-candle reversal pattern that typically appears at the end of an uptrend and signals a potential shift from bullish to bearish sentiment. The first candle is a smaller bullish candle, reflecting continued upward momentum. The second candle is a larger bearish candle that completely engulfs the body of the first one, meaning it opens higher than the previous close and closes lower than the previous open. This indicates that bears have taken control, overpowering the buyers, and suggests a potential downside movement.

What is an Evening Star?

An evening star is a bearish candlestick pattern that typically signals a potential reversal at the top of an uptrend. It consists of three candles and reflects a shift in momentum from buyers to sellers. The pattern starts with a strong bullish candle, showing continued buying pressure and confidence in the upward move. This is followed by a smaller-bodied candle, which can be bullish or bearish, and represents indecision or a slowdown in the uptrend. The middle candle often gaps up from the first candle, showing that buyers are still trying to push higher, but the momentum is starting to weaken. The third candle is a strong bearish candle that closes well into the body of the first bullish candle. This candle confirms that sellers have taken control and that a trend reversal could be underway. The more this third candle erases the gains of the first, the stronger the reversal signal becomes.

-----------------------------------------------------------------------------------------------

4. How to use candlestick patterns in trading?

Candlestick patterns are most useful when they appear at key levels, such as support, resistance, or significant trendlines. For instance, if a bullish reversal pattern like a hammer or bullish engulfing forms at a support level, it may indicate that the downtrend is losing momentum, and a reversal could be coming.

Trading based on candlestick patterns alone can be risky. To improve your chances of success, always seek additional confirmation from other technical analysis tools. Here are some common ones:

- Support and Resistance Levels: Look for candlestick patterns that form near key support or resistance levels. For instance, if the price reaches a support zone and a bullish reversal candlestick pattern forms, this may suggest a potential upward reversal.

- Fibonacci Retracement: Use Fibonacci levels to identify potential reversal zones. If a candlestick pattern appears near a key Fibonacci level (such as the Golden Pocket), it adds confirmation to the idea that the price may reverse.

- Liquidity Zones: These are areas where there is a high concentration of buy or sell orders. Candlestick patterns forming in high liquidity zones can indicate a stronger potential for a reversal or continuation.

- Indicators and Oscillators: Incorporating indicators like the Relative Strength Index (RSI), Moving Averages, MACD, or Stochastic RSI can help confirm the momentum of the price. For example, if a candlestick pattern forms and the RSI shows an oversold condition (below 30), this could indicate a potential reversal to the upside.

It’s crucial to wait for confirmation before entering a trade. After a candlestick pattern forms, it’s important to wait for the next candle or price action to confirm the signal. For example, if you spot a bullish reversal candlestick like a hammer at support, wait for the next candle to close above the hammer’s high to confirm that buyers are in control and a reversal is likely.

-----------------------------------------------------------------------------------------------

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Mastering Candlestick Patterns: Visual Guide for Traders

🔵 Introduction

Candlestick charts are among the most popular tools used by traders to analyze price movements. Each candlestick represents price action over a specific time period and provides valuable insights into market sentiment. By recognizing and understanding candlestick patterns, traders can anticipate potential price reversals or continuations, improving their trading decisions. This article explains the most common candlestick patterns with visual examples and practical Pine Script code for detection.

🔵 Anatomy of a Candlestick

Before diving into patterns, it's essential to understand the components of a candlestick:

Body: The area between the open and close prices.

Upper Wick (Shadow): The line above the body showing the highest price.

Lower Wick (Shadow): The line below the body showing the lowest price.

Color: Indicates whether the price closed higher (bullish) or lower (bearish) than it opened.

An illustrative image showing the anatomy of a candlestick.

🔵 Types of Candlestick Patterns

1. Reversal Patterns

Hammer and Hanging Man: These single-candle patterns signal potential reversals. A Hammer appears at the bottom of a downtrend, while a Hanging Man appears at the top of an uptrend.

Engulfing Patterns:

- Bullish Engulfing: A small bearish candle followed by a larger bullish candle engulfing the previous one.

- Bearish Engulfing: A small bullish candle followed by a larger bearish candle engulfing it.

Morning Star and Evening Star: These are three-candle reversal patterns that signal a shift in market direction.

Morning Star: Occurs at the bottom of a downtrend, indicating a potential bullish reversal. It consists of:

- A long bearish (red) candlestick showing strong selling pressure.

- A small-bodied candlestick (bullish or bearish) indicating indecision or a pause in selling. This candle often gaps down from the previous close.

- A long bullish (green) candlestick that closes well into the body of the first candle, confirming the reversal.

Evening Star: Appears at the top of an uptrend, signaling a potential bearish reversal. It consists of:

- A long bullish (green) candlestick showing strong buying pressure.

- A small-bodied candlestick (bullish or bearish) indicating indecision, often gapping up from the previous candle.

- A long bearish (red) candlestick that closes well into the body of the first candle, confirming the reversal.

2. Continuation Patterns

Doji Patterns: Candles with very small bodies, indicating market indecision. Variations include Long-Legged Doji, Dragonfly Doji, and Gravestone Doji.

Rising and Falling Three Methods: These are five-candle continuation patterns indicating the resumption of the prevailing trend after a brief consolidation.

Rising Three Methods: Occurs during an uptrend, signaling a continuation of bullish momentum. It consists of:

- A long bullish (green) candlestick showing strong buying pressure.

- Three (or more) small-bodied bearish (red) candlesticks that stay within the range of the first bullish candle, indicating a temporary pullback without breaking the overall uptrend.

- A final long bullish (green) candlestick that closes above the high of the first candle, confirming the continuation of the uptrend.

Falling Three Methods: Appears during a downtrend, indicating a continuation of bearish momentum. It consists of:

- A long bearish (red) candlestick showing strong selling pressure.

- Three (or more) small-bodied bullish (green) candlesticks contained within the range of the first bearish candle, reflecting a weak upward retracement.

- A final long bearish (red) candlestick that closes below the low of the first candle, confirming the continuation of the downtrend.

🔵 Coding Candlestick Pattern Detection in Pine Script

Detecting patterns programmatically can improve trading strategies. Below are Pine Script examples for detecting common patterns.

Hammer Detection Code

//@version=6

indicator("Hammer Pattern Detector", overlay=true)

body = abs(close - open)

upper_wick = high - math.max(close, open)

lower_wick = math.min(close, open) - low

is_hammer = lower_wick > 2 * body and upper_wick < body

plotshape(is_hammer, title="Hammer", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

Bullish Engulfing Detection Code

//@version=6

indicator("Bullish Engulfing Detector", overlay=true)

bullish_engulfing = close < open and close > open and close > open and open < close

plotshape(bullish_engulfing, title="Bullish Engulfing", style=shape.arrowup, location=location.belowbar, color=color.blue, size=size.small)

🔵 Practical Applications

Trend Reversal Identification: Use reversal patterns to anticipate changes in market direction.

Confirmation Signals: Combine candlestick patterns with indicators like RSI or Moving Averages for stronger signals.

Risk Management: Employ patterns to set stop-loss and take-profit levels.

🔵 Conclusion

Candlestick patterns are powerful tools that provide insights into market sentiment and potential price movements. By combining visual recognition with automated detection using Pine Script, traders can enhance their decision-making process. Practice spotting these patterns in real-time charts and backtest their effectiveness to build confidence in your trading strategy.

2250: LONG AFTER HAMMER CANDLE FORMATION2250: SAUDI INDUSTRIAL INVESTMENT

has historically appreciated, on a weekly timeframe, once a hammer candle had been formed at an 'area of interest' or below it

The 'area of interest' is the price range of 18.10 - 18.30. There are 2 cases of hammer candle formation: 1) at the area of interest 2) below the area of interest. Both cases are marked in the chart.

Case 1: Hammer candle formed at area of interest

Enter a long position with TP: 25% (min) ; SL: below hammer candle's lower wick

Case 2: Hammer candle formed below area of interest

Enter a long position after taking confirmation of RSI (should be 30 or less) with TP 1: upto the area of interest ; TP 2: 70% ; SL: below hammer candle's lower wick

At the time of publishing this idea, case 2 is active and TP 1 has already been achieved. All eyes can be set on TP 2: 70%

Best of luck!!

SWING IDEA - DEEPAK NITRITE LTDDeepak Nitrite , a leading chemical company known for its diverse product portfolio, is showing a promising setup for swing trading.

Reasons are listed below :

2500 Support Zone : The price is resting on a well-tested support level around 2500, adding to the reliability of a potential bounce.

Hammer Candle on Weekly Timeframe : The appearance of a hammer candle suggests a reversal could be on the horizon as buyers regain control.

Golden Fibonacci Support : The current price aligns with a key Fibonacci retracement level, providing additional support.

50 EMA Support on Weekly Timeframe : The price holding above the 50 EMA is a sign of continued strength and underlying support.

Trend Intact with Higher Highs and Higher Lows : The consistent formation of higher highs and higher lows reinforces a bullish trend.

Target - 3000 // 3170

Stoploss - weekly close below 2440

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - JIO FINANCIAL SERVICESJio Financial Services , an emerging force in the financial sector, exhibits signs of a potential upward move, presenting a swing trading opportunity.

Reasons are listed below :

Strong Support Zone at 300 : This level has proven to be a strong support, enhancing the likelihood of a bounce.

Bullish Hammer on Weekly Timeframe : A bullish hammer candlestick pattern indicates potential reversal and buyer interest at lower levels.

0.5 Fibonacci Support : The price is aligned with the 0.5 Fibonacci retracement level, suggesting that it could act as a springboard for further upward movement.

50 EMA Support on Weekly Timeframe : Trading above the 50 EMA adds to the bullish outlook and provides an additional layer of support.

Target - 360 // 385

Stoploss - weekly close below 295

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - SHEELA FOAMSheela Foam , a key player in the Indian mattress and foam market, presents a potential swing trading setup.

Reasons are listed below :

800-850 Support Zone : This strong support level is holding, indicating possible resistance to further downside.

Bullish Hammer Candle on Weekly Timeframe : This pattern suggests a reversal of bearish momentum and renewed buying interest.

Gradual Rise in Volumes : Increasing volumes support the potential for a sustained upward move, reflecting growing investor interest.

Target - 1060 // 1290

Stoploss - weekly close below 780

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - EQUITAS SMALL FINANCE BANKEquitas Small Finance Bank , a leading small finance bank in India, is showing promising signs for a potential swing trade.

Reasons are listed below :

75 Zone as a Strong Support Zone : The 75 level has proven to be a solid support zone, providing a strong foundation for a potential upward move.

Bullish Hammer on Weekly Timeframe : The formation of a bullish hammer on the weekly chart, which also engulfed the previous week's candle, indicates strong buying pressure and a potential reversal from the support level.

0.5 Fibonacci Support : The stock is currently resting at the 0.5 Fibonacci retracement level, a key area where buyers often step in to push the price higher.

Gradual Uptick in Volumes : An increasing volume trend suggests growing investor interest, further supporting the potential for a bullish move.

Target - 95 // 105 // 115

Stoploss - weekly close below 72

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Top 3 Must-Know Candlestick Patterns for BeginnersGet your cup of coffee or tea ready we are doing a crash course on Candlesticks today

I’m walking you through three candlestick patterns every beginner trader should know—Doji, Engulfing Candles, and Hammers (including the Inverted Hammer). These patterns are super helpful when you’re trying to spot market reversals or continuations. I’ll show you how to easily recognize them and use them in your own trades. Let’s keep it simple and effective.

Key Takeaways:

Doji: Indicates indecision, potential reversals.

Engulfing Candles: Bullish or bearish reversal signals.

Hammer & Inverted Hammer: Bullish reversal after a downtrend.

Trade what you see and let’s get started!

Mindbloome Trader

#PENDLEUSDT #1D (Bybit) Broadening wedge breakout and retestPENDLE regained 50MA daily support then pulled back to it twice, forming a hammer.

Looks good for bullish continuation towards 200MA resistance, buckle up!

⚡️⚡️ #PENDLE/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 5.1%

Current Price:

3.5533

Entry Targets:

1) 3.2645

Take-Profit Targets:

1) 4.2309

Stop Targets:

1) 2.9419

Published By: @Zblaba

SEED_DONKEYDAN_MARKET_CAP:PENDLE BYBIT:PENDLEUSDT.P #DeFi pendle.fi

Risk/Reward= 1:3.0

Expected Profit= +118.4%

Possible Loss= -39.5%

Estimated Gaintime= 1 month

The Art of Candlestick Trading: How to Spot Market Turns EarlyBuckle up, TradingViewers! It's time to unravel the ancient secrets of candlestick patterns. Originating from an 18th-century Japanese rice trader, these patterns aren't simply red and green elements on your trading charts—they are the Rosetta Stone of market sentiment, offering insights into the highs and lows and the middle ground of buyers and sellers’ dealmaking.

If you’re ready to crack the code of the market from a technical standpoint and go inside the minds of bulls and bears, let’s light this candle!

Understanding the Basics: The Candlestick Construction

First things first, let’s get the basics hammered out. A candlestick (or Candle in your TradingView Supercharts panel) displays four key pieces of information: the open, close, high, and low prices for a particular trading period. It might be 1 minute, 4 hours, a day or a week — candlesticks are available on every time frame. Here’s the breakdown:

The Body : This is the chunky part of the candle. If the close is above the open, the body is usually colored in white or green, representing a bullish session. If the close is below the open, the color is usually black or red, indicating a bearish session.

The Wicks (or Shadows) : These are the thin lines poking out of the body, showing the high and low prices during the session. They tell tales of price extremes and rejections.

Understanding the interplay between the body and the wicks will give you insight into market dynamics. It’s like watching a mini-drama play out over the trading day.

Key Candlestick Patterns and What They Mean

Now onto the fun part — candlestick formations and patterns may help you spot market turns (or continuations) early in the cycle.

The Doji : This little guy is like the market’s way of throwing up its hands and declaring a truce between buyers and sellers. The open and close are virtually the same, painting a cross or plus sign shape. It signals indecision, which could mean a reversal or a continuation, depending on the context. See a Doji after a long uptrend? Might be time to brace for a downturn.

The Hammer and the Hanging Man : These candles have small bodies, little to no upper wick, and long lower wicks. A Hammer usually forms during a downtrend, suggesting a potential reversal to the upside. The Hanging Man, its evil twin, appears during an uptrend and warns of a potential drop.

Bullish and Bearish Engulfing: These are the bullies of candlestick patterns. A Bullish Engulfing pattern happens when a small bearish candle is followed by a large bullish candle that completely engulfs the prior candle's body — suggesting a strong turn to the bulls. Bearish Engulfing is the opposite, with a small bullish candle followed by a big bearish one, hinting that bears might be taking control of the wheel.

The Morning Star and the Evening Star : These are three-candle patterns signaling major shifts. The Morning Star — a bullish reversal pattern — consists of a bearish candle, a small-bodied middle candle, and a long bullish candle. Think the dawn of new bullish momentum. The Evening Star, the bearish counterpart, indicates the onset of bearish momentum, as if the sun is setting on bullish prices.

The Shooting Star and the Inverted Hammer : Last but not least, these candles indicate rejection of higher prices (Shooting Star) or lower prices (Inverted Hammer). Both feature small bodies, long upper wicks, and little to no lower wick. They flag price exhaustion and potential reversals.

Trading Candlestick Patterns: Tips for Profitable Entries

Context is King : Always interpret candlestick patterns within the larger market context. A Bullish Engulfing pattern at a key support level is more likely to pan out than one in no-man’s-land.

Volume Validates : A candlestick pattern with high trading volume gives a stronger signal. It’s like the market shouting, “Hey, I really mean this move!”

Confirm with Other Indicators : Don’t rely solely on candlesticks, though. Use them in conjunction with other technical tools like RSI, MACD, or moving averages to confirm signals.

Wrapping It Up

Candlestick patterns give you a sense for the market’s pulse and offer insights into its moment-to-moment sentiment — is it overreacting or staying too tight-lipped. Mastering candlesticks can elevate your trading by helping you spot trend reversals and continuations. These patterns aren’t foolproof — they are powerful tools in your trading toolkit but require additional work, knowledge and context to give them a higher probability of confirmation.

It’s time to light up those charts and let the candlesticks illuminate your trading path to some good profits!

QQQ falls back into bearish territoryQQQ past breakouts above shows it was false by selling off in a massive way with strong volume

Failed to hold above new support downward trend

Failed to hold above major horizontal support line

closed with hammer candle on high volume. This last item we dont expect to be a major turned around point back to bull. It should just be rise back up horizontal resistance before selling off again

Comparing with SPY we see that it has now for the first time broke its flat trading today and break below key support with strength. The confirmation between the indicates the bears are back in control

SWING IDEA - BIRLASOFT Birlasoft , a leading IT solutions provider, presents a swing trading opportunity based on its current technical indicators.

Reasons are listed below :

600 Zone as a Strong Support : The 600 level has been a significant support zone for Birlasoft, acting as a key level where buyers have stepped in to support the price.

Hammer Candle on Weekly Timeframe : The formation of a hammer candle on the weekly chart is a bullish reversal pattern, indicating that selling pressure has been absorbed and buyers are taking control.

0.5 Fibonacci Support : The stock is holding at the 0.5 Fibonacci retracement level, which is often a strong support level, suggesting that the stock may be poised for a rebound.

100 EMA Support on Weekly Timeframe : The 100-week exponential moving average is providing additional support, reinforcing the bullish sentiment and indicating a potential for upward movement.

Target - 680 // 733 // 845

Stoploss - weekly close below 549

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - CAPLIN POINT LABORATORIESCaplin Point Laboratories , a leading pharmaceutical company known for its focus on generic formulations with strong fundamentals, presents an attractive opportunity for swing traders and investors.

Reasons are listed below :

Support Zone at 1200-1250 : Caplin Point Laboratories has established a strong support zone in the range of 1200-1250, showcasing its resilience and attracting buying interest at these levels.

Bullish Hammer on Weekly Timeframe : A bullish hammer candlestick pattern observed on the weekly timeframe signals a potential reversal of the downtrend and indicates bullish sentiment among investors.

Bullish Engulfing on Daily Timeframe : The formation of a bullish engulfing candlestick pattern on the daily timeframe, engulfing ten previous daily candles, reinforces the bullish outlook and suggests a shift in momentum in favor of Caplin Point Laboratories.

0.5 Fibonacci Support : Finding support at the 0.5 Fibonacci level strengthens the bullish case and provides a solid foundation for potential upward movement.

Higher Highs : The stock has consistently formed higher highs, reflecting a trend of increasing bullish momentum and indicating potential for further upward movement.

Trading Above 50 and 200 EMA on Weekly Timeframe : Caplin Point Laboratories is trading above both the 50 and 200 Exponential Moving Averages (EMA) on the weekly timeframe, further confirming its bullish momentum.

Target - 1410 // 1540 // 1620

Stoploss - weekly close below 1207

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - FINOLEX CABLESA potential swing trade in Finolex cables , a prominent figure in the cable manufacturing sector.

Reasons are listed below :

The stock bounced convincingly from the strong support level of 850, indicating solid buying interest at this price point.

A hammer candlestick on the weekly timeframe signals a potential reversal, suggesting a shift from bearish sentiment to bullish momentum.

The appearance of a morning star pattern on the daily chart adds further confirmation to the bullish bias, signaling a possible trend reversal from bearish to bullish.

The stock finds support at the 0.382 Fibonacci level, reinforcing the bullish outlook. Volume Surge: Witness a notable increase in trading volumes, reflecting growing market interest and potential accumulation by investors.

FinCables has been consistently making higher highs on larger timeframes, indicating a trend of increasing bullish momentum and reinforcing the potential for upward movement.

Target - 1020 // 1150 // 1210

Stoploss - weekly close below 805

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - ANUPAM RASAYAN INDIAConsider a promising swing trade opportunity in Anupam Rasayan India , a leading specialty chemicals manufacturer.

Reasons are listed below :

Strong Support Zone at 800-850 : Anupam Rasayan India has a strong support zone established at 800-850, indicating significant buying interest and potential reversal points.

Hammer Candle on Weekly Timeframe : The presence of a hammer candlestick pattern on the weekly timeframe suggests potential bullish reversal and buying interest at lower levels.

0.618 Fibonacci Support : Finding support at the 0.618 Fibonacci level strengthens the bullish case, providing a solid foundation for potential upward movement.

Bullish Engulfing Candle on Daily Timeframe : A bullish engulfing candlestick pattern observed on the daily timeframe indicates strong buying momentum and potential upward movement.

Strong Volumes : The significant increase in trading volumes reflects growing market interest and potential accumulation by investors, adding confirmation to the bullish thesis for Anupam Rasayan India.

Target - 970 // 1080 // 1220

StopLoss - weekly close below 782

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - SYRMA SGSA potential swing trade opportunity in Syrma SGS , a notable player in the electronics manufacturing industry.

Reasons are listed below :

The stock exhibited resilience as it rebounded strongly from the 450-500 support zone, suggesting a false breakdown and indicating underlying strength.

A hammer candlestick formation on the weekly timeframe signals a potential reversal, hinting at a shift from bearish sentiment to bullish momentum.

Finding support at the 0.5 Fibonacci level further bolsters the bullish outlook, providing a solid foundation for potential upward movement.

The 50-period Exponential Moving Average (EMA) on the weekly chart acts as additional support, reinforcing the bullish bias.

Notable increase in trading volumes reflects heightened market interest and potential accumulation by investors, adding weight to the bullish case.

Syrma SGS has demonstrated a pattern of higher highs, indicating a trend of increasing bullish momentum and reinforcing the potential for upward movement.

Target - 570 // 670

Stoploss - weekly close below 448

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights