HK33 to find buyers at curren support?HS50 - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

A move through 23600 will confirm the bullish momentum.

Risk/Reward would be poor to call a buy from current levels.

The measured move target is 24250.

We look to Buy at 23200 (stop at 22700)

Our profit targets will be 24200 and 24250

Resistance: 23600 / 24000 / 24250

Support: 23200 / 23000 / 22750

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Hangseng

Hang Seng Index Plunges by Around 13%Hang Seng Index Plunges by Around 13%

Hong Kong’s Hang Seng Index (Hong Kong 50 on FXOpen) tumbled by over 13% as trading resumed after the weekend with a sharp bearish gap.

According to media reports, this marked the biggest single-day drop since the 1997 Asian financial crisis.

Hang Seng Index Chart

In our analysis of the upward trend on the Hang Seng (Hong Kong 50 on FXOpen) chart a month ago, we noted that:

→ investor enthusiasm around artificial intelligence was still fuelling the rally;

→ however, the price appeared vulnerable to a correction.

We also highlighted that the outlook would largely depend on the fundamental backdrop, particularly the tariff standoff between China and the United States.

Since then, the Hang Seng Index (Hong Kong 50 on FXOpen) has fallen by around 17%, following the announcement of harsher-than-expected tariffs by President Trump, with China responding in kind.

Despite the drop, Hang Seng is outperforming peers

Despite Monday’s dramatic decline, the Hang Seng is still outperforming several other markets. As shown in the chart above, it remains in positive territory for 2025, unlike:

→ the ASX 200 (Australia 200 on FXOpen);

→ the S&P 500 (US SPX 500 mini on FXOpen);

→ and other global indices, including those in Europe and Japan.

What lies ahead?

Market sentiment remains highly sensitive to tariff-related news. For instance, Bloomberg reported that a post on social media platform X claimed President Trump was considering a 90-day pause on tariffs (excluding China), sparking hopes of a rebound.

Should Trump choose to soften the recently announced tariffs, this could act as a catalyst for a strong recovery across global equity markets.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

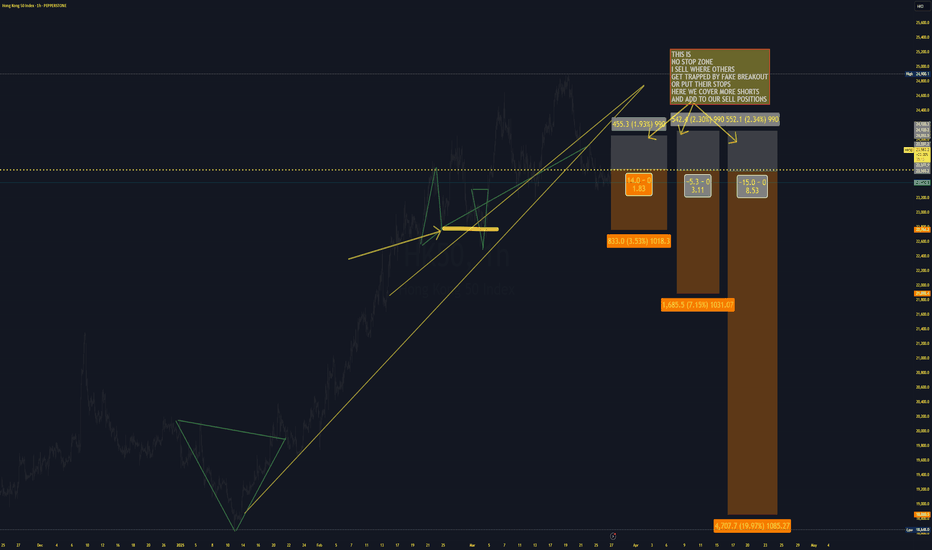

HK50 HongKong Index ShortMore pro-active policies in China

More tariffs on Copper

This will put the asian indices more under pressure

3 apporaoches

and 3 different targets

My entries are aggressive and conservative

Where others use the stop zone,there I aggressively buy/sell into my targeted potential direction(cover more shorts in this case)

More details: Please take a look at the chart above

Beginning of the Uptrend for Stock #01Beginning of the Uptrend for Stock #01: 9988 (BABA)

The price has broken out of a consolidation range that lasted approximately two years, supported by a normal volume distribution.

The stock has risen to meet the Fibonacci Extension resistance level of 161.8 at a price of 144 HKD. Currently, it is forming a sideways consolidation pattern on the smaller timeframe, establishing a base structure viewed as re-accumulation.

The 6-month target is set at the Fibonacci Extension level of 261.8, which corresponds to a price of 189 HKD. This target aligns with a price cluster based on the valuation from sensitivity analysis, using the forward EPS estimates for 2025-2026 as a key variable for calculations, along with the standard deviation of the price-to-earnings ratio.

Wait for the Right Moment to Accumulate Shares within the Consolidation Range

Purchase near the support level of the range when the price pulls back. Look for a candlestick reversal pattern as a signal to add to your position.

However, should the price break down to the lower consolidation range, the stock would lose its upward momentum, potentially leading to a prolonged period of consolidation or a deeper pullback to around 90 HKD.

Always have a plan and prioritize risk management.

Hang Seng Index Reaches Three-Year HighHang Seng Index Reaches Three-Year High

A month ago, while analysing the uptrend in the Hang Seng index (Hong Kong 50 on FXOpen), we noted that:

→ Positive sentiment was driven by the success of the DeepSeek startup, boosting Chinese tech stocks and mobile operators.

→ Price movements formed a bullish structure based on Fibonacci proportions.

→ Analysts predicted the uptrend could persist until the second half of March.

Today, the Hang Seng index (Hong Kong 50 on FXOpen) surged above the 24,500 level for the first time since February 2022. According to Reuters, investor enthusiasm for artificial intelligence continues to fuel the rally.

Technical Analysis of the Hang Seng Chart

New price data support the construction of a large-scale upward channel (marked in blue).

From a bullish perspective:

→ The median line of the blue channel has shifted from resistance to support (as indicated by arrows).

→ The price remains within the intermediate purple ascending channel.

From a bearish perspective:

→ The last two candlesticks show long upper wicks—an indication that sellers are active, possibly locking in profits.

→ The RSI indicator is forming a bearish divergence.

Given these factors, the price appears vulnerable to a pullback. However, the future trajectory will largely depend on fundamental factors, particularly the ongoing tariff tensions between China and the United States.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

HANG SENG This rally isn't over yet.Hang Seng (HSI1!) has been trading within a Bullish Megaphone for the past 13 months and since the 1D MA200 (orange trend-line) rebound on January 13 2025, it is unfolding the new Bullish Leg.

The previous two both went on to price a Higher High on the 3.0 Fibonacci extension. If this holds on this sequence too, then we are looking for a 27,500 Target price as the new top of the Bullish Megaphone.

Notice also how a 1W Bullish Cross always comes to confirm the new Bullish Leg shortly after the bottom is priced.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$NIO Price will see a rally to $30 during the coming China rallyNYSE:NIO is an EV maker in China, that moves close to AMEX:KWEB and other ETFs.

We didn't see the stock price move like during this TVC:HSI or NYSE:BABA rally, where the large Chinese equities were bid up this week. Instead, NIO has stayed flat.

Looking at the historic structure, and NIO's pattern today, I compare them and form a conclusion that this marks the beginning of the rally.

I think that the bottom is in, and that this 'triple dives' pattern represents a large reversal pattern, dating back 1 year. Just come back to this chart 12 months from now, and tell me what you think.

Update:

Look at the tilt of the support lines and compare them to each other.

Chinese Stocks Decline Amid Tariff ThreatsChinese Stocks Decline Amid Tariff Threats

According to Bloomberg, President Donald Trump raised the possibility of imposing tariffs on China during his second day in office.

“We’re considering a 10% tariff on China,” Trump announced during a White House event on Tuesday, indicating February 1 as a potential start date.

During his election campaign, Trump had mentioned tariffs as high as 60%, and the prospect of transitioning from campaign rhetoric to real action is driving bearish sentiment.

According to the technical analysis of the Hang Seng Index (Hong Kong 50 on FXOpen), price fluctuations have been forming a downward trend since October. The formation of the 2025 peak (indicated with an arrow) signals bearish tendencies, as the price failed to hold above:

→ The previous high from December, near 20,210, indicating a false breakout.

→ The psychological level of 20,000.

If Trump follows through on his promises, it is reasonable to anticipate that bears may take control of lower levels in the coming sessions.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Hang Seng H4 | Potential bearish breakoutHang Seng (HKG33) is falling towards a potential breakout level and could fall lower from here.

Sell entry is at 19,923.62 which is a potential breakout level.

Stop loss is at 20,420.00 which is a level that sits above a swing-high resistance.

Take profit is at 19,304.87 which is an overlap support that aligns with the 61.8% Fibonacci retracement level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Hang Seng Index at 0.618 Fib: Bullish SetupThe Hang Seng Index has demonstrated strong bullish momentum, adhering closely to its trendline throughout its rally. Following this upward trajectory, the price has undergone a significant retracement, finding support near the critical 0.618 Fibonacci level—a key zone for potential reversals in technical analysis. This pullback has established a higher low at 19,332, indicating sustained bullish pressure and reinforcing the current uptrend. This confluence of the Fibonacci level, trendline support, and higher-low formation presents a compelling buying opportunity, with the potential for continued upside as the bullish structure remains intact.

Hang Seng Index H1 | Falling to overlap supportThe Hang Seng Index (HKG33) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 19,905.23 which is an overlap support that aligns with the 50.0% Fibonacci retracement.

Stop loss is at 19,540.00 which is a level that sits under a multi-swing-low support.

Take profit is at 20,522.59 which is a multi-swing-high resistance that aligns close to the 50.0% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

HANG SENG Patience until December for a long term buy.Hang Seng (HSI1!) made a massive bullish break-out in September as it broke above the February 2021 Lower Highs trend-line, effectively ending its Bear Cycle. This month (October) saw it getting rejected not just on the 1M MA200 (orange trend-line) but also on its 0.618 Fibonacci retracement level.

This is a key rejection as in almost 30 years, every time the price got rejected on the 0.618 Fib, it recovered on the 3rd (1M) candle after. As a result, December will give a buy signal based on this historic price action, so have patience and take a multi-month buy then.

In most of those cases, the index rebounded to the previous High, so our Target will be 30975. Notice also that the 1M MACD is rising off a Bullish Cross. When formed below the 0.0 mark, this has also been a massive buy signal.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is a Hang Seng Revival on the Horizon?The Hong Kong Index has faced challenging years since reaching its all-time high in 2018.

The downtrend accelerated in 2021, bringing the index to a low of around 15,000.

The subsequent reversal aligned neatly with horizontal resistance and the 50% Fibonacci retracement level, indicating that the bears were not finished yet.

Indeed, 2023 also saw a continued downtrend.

However, and this is crucial, the index did not make a new low. Instead, the decline halted at the strong 15,000 support level.

In early 2024, a significant break above the falling trend line was observed at the end of April. The correction that followed confirmed the broken trend line, suggesting that this breakout is genuine and indicates a long-term shift in trend.

September began with a higher low, followed by a powerful surge above the 20,000 level for the first time in over a year.

This sequence of events suggests the potential beginning of a long-term bull trend, with the possibility of the index reclaiming the 23,000 level by 2025.

For those looking to initiate a long-term buy position, there are two key levels to watch: 19,500, the former resistance level, and 18,500, which now serves as strong support.

Why would it hold? BAIDU Big LevelChina stocks have been beaten up in recent years as the US equities leave them in their wake.

From hearing NVDA is larger than the entire china equity market, to China will always be in a bear market…are we finally into enough of support to see a material rally?

BIDU is hitting a monthly support . This also happens as the US markets could be running into a distribution phase.

Will the US Dollar staying below $102 help this emerging market company?

HANG SENG Strong sell opportunity on recurring fractal.Hang Seng (HSI1!) closed below the 1D MA200 (orange trend-line) yesterday for the first time in a month and confirmed the rejection of August 30. That was a Lower High within the established Channel Down pattern that started on the May 20 High.

This Channel Down is so far following a similar structure with the one that covered the entirety of 2023. The August 30 rejection was in fact also done on the 0.5 Fibonacci retracement level after a -17.30% decline.

If this sequence of events continue to follow the April 17 2023 rejection, we should be expecting the new Lower Low to be formed on the -0.236 Fibonacci extension. Our Target is exactly on that level at 15700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

HANG SENG Sell Signal on the 1D MA200.Hang Seng (HSI1!) has been trading within a Channel Down pattern and since the start of this week, it's sideways around the 1D MA200 (orange trend-line). As long as the 1D MA50 (blue trend-line) remains intact, we continue to be bearish within this pattern, targeting 16000 next (Support 1), expecting this to be the start of the new Bearish Leg.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Hang Seng bulls eye retest of 18kWe'll admit that the Hang Seng does not have the most bullish of structures among APAC indices, but it continues to defy bears with a break of key support. And if sentiment for global indices picks up as we suspect, it could pave the way for another cheeky long for Hang Seng bulls.

The index has seen three failed attempts to break beneath 17500 since late June. Sure, we saw one daily close below it, but the move was mostly reversed on Monday. A bullish divergence is also forming on the daily RSI (2), hence the bias for another crack at 18k minimum - a break above which brings the June and July highs around 18,400 into focus.

Yet as the 4-hour chart shows prices paused at the weekly pivot point with RSI (2) overbought, we'd prefer to wait to see if prices retrace within Monday's range before seeking longs. This could help improve the reward to risk ratio for bulls whilst prices hold above last week's low, with 18,000 and 18,400 in focus for upside targets.

TRIP.com / Beginning of Up Trend Stock Beginning of the trend Stock, breaking the Wyckoff accumulation Phase

and has Volume Profile Normal Distribution Support

The volume from Accumulation Phase has not yet been sold out. It can continue with accumulated volume with first target at 261.8 Fibonacci Retracement and cluster with 161.8 of Fibonacci Extension.

Strategy Buy on dip at 368 - 390 for buy set 1 and if the price drops to 368, there is still buy set 2 at prices 330-355 by waiting for Reversal Pattern.

Trading in your plan with your faith,

C.Goii Super Trader

HANG SENG Strong buy opportunity on the 1D MA50.Hang Seng (HSI1!) has been consolidating on the 1D MA50 (blue trend-line) for 4 straight days. Technically it is an attempt to form a bottom, which includes also the 0.5 Fibonacci retracement level, measured from the April 19 Higher Low.

The last time a trend both the 1D MA50 and 0.5 Fib was on December 28 2023 and 2 days later. As you can see that was a downtrend of 2 phases and after the 0.5 Fib/ 1D MA50 test, the price got rejected, starting the 2nd phase that extended up until the 1.5 Fibonacci extension, where the market bottomed.

As a result, it is highly likely to see a symmetrical mirror pattern. This time the 1.5 Fib ext is at 21600 and that is our medium-term Target.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

HANG SENG This pull-back is the final buy opportunity.Hang Seng (HSI1!) has started a technical pull-back after getting rejected at the top (Higher Highs trend-line) of the Bullish Megaphone. The minimum correction within this 4-month pattern has been -5.29%, so we are looking to buy after such a dip, potential 1D MA50 (blue trend-line) test and target the 2.0 Fibonacci extension (19700). This is the standard target on Inverse Head and Shoulders patterns.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Hang Seng: Is a Turnaround Coming?The Hang Seng Index, with everything measured in Hong Kong Dollars rather than US Dollars, offers a distinct perspective within our analysis portfolio, focusing on the Hang Seng Index Futures contract. Starting with a weekly chart overview, we've identified that the initial cycle likely concluded in 2008, followed by a flat correction. Notably, the correction for Wave B exceeded 100%, suggesting that the drop towards Wave (A) level, or slightly lower, is plausible.

However, there's an alternative perspective that at Wave (A) already concluded Wave II, although the rapid temporal progression for such a wave suggests this is less likely. We anticipate further declines, yet it's critical to acknowledge a potential Wave (1) and Wave (2) formation at the 78.6% level. A drop below this point should lead us towards the HK$10,500 mark, aligning with our initial entry point around HK$11,300. Despite this, it's premature to issue a limit order given the ample time to observe developments.

Daily chart observations further indicate an expectation of a 5-wave structure from (B) to (C), which has been forming quite elegantly despite Wave ((iv)) intruding into Wave ((i)) territory. This necessitates our acceptance of the current count unless we opt for an interpretation that sees a completed Wave (2) at the point marked as Wave ((iii)).

Delving into the 4-hour details reveals a persistent downtrend from the onset of what's identified as Wave ((iv)). To reverse this trend, surpassing the invalidation zone would be crucial, suggesting a reconsideration for long positions. Until such a shift occurs, the bear flag's presence likely continues to restrain any significant upward movements in the market.