EURJPY SHORT - BEARISH BAT PATTERN - 4HR EURJPY

Looking to hit a key resistance level around 125.680

Bearish bar pattern also completes at point (D) on my chart

Trendlines created channel that could be broken out from In a bullish move before the reversal begins around point (D)

TP 1 at .381 Fib Level

TP 2 at .618 Fib Level

Once price reaches TP 1, drop stop loss into profit to protect capital from loss.

Harmoincs

Long Opportunity On USDJPYA little messy, however there are 2 harmonic patterns nearing completion. The more recent pattern will near completion for the BC extension, while the prior pattern will be completing the CD extension.

Both are in similar areas, however there are quite a few pips risked between the PRZ of each pattern.

Entries w/ SL posted for each pattern

BTC/USD Potential Bearish Cypher Pattern #Bitcoin $BTCShort at the .786 PRZ with stops above new highs. Take some profit / move stops to break even at the .382 retracement and close the remainder at .618.

I enjoyed this short video on this pattern .

Simplified image via Google search .

If you're already long, stay long otherwise consider that the 13 EMA is suppressing price at the moment so you might want to wait for a deeper retracement into that yawning chasm in the volume profile with stops below new lows.

I occasionally post unpublished ideas / charts on Twitter: @grahvity

NZDUSD Daily Outlook + TCT+ Bat PatternNZDUSD has been in a downtrend on the Daily chart for a very long time. We may be in the middle of another retracement giving us a great opportunity short into strength. This will be a Huge trade and would require a 350 Pip Stoploss. But the Reward is over 1,200 Pips. This is an excellent opportunity for a Position Trader as it will take months to play out.

I have made a "Kill Zone" using a variety of technical patterns.

1. We have a Bat Pattern completion @ .7565

2. ABCD Pattern (just barely makes into my kill zone) completion @ .7414 along with the 78.6% Fib Retrace

3. 1.618% Ext - Pulled from lows to B leg of Bat Pattern. It has a nice confluence with the Bat Pattern

This will be a HIGH CTS (Combined Technical Score) trade IF market will push back up there.

Best of Luck!

ESM6 Bullish Bats - TYPE2 Support ChallengeI am BEARISH on SPX w/ 1570 as the big WEEKLY target. These Bullish Bat patterns are great intraday long trades but the trend is down. We just hit the TYPE2 reversal of BOTH. This is the line in the sand for bulls - short AND long-term. A violation of 2030-2035 will trigger the decline. The #s to watch on the downside are 1950, then 1830 then 1570.

Rare Advanced Pattern Cluster - EUR.AUD - Cypher, Bat & GartleyOn the EUR.AUD 15 min chart we 5 potential long opportunity's at the D leg completion of Bullish Cypher, Gartley and Bat setups.

Bullish Cypher Setup ( White ) - D leg completion 1.5503

Bullish Bat Setup (Red) - D leg completion 1.5490

Bullish Gartley Setup (Yellow) - D leg completion 1.5492

Bullish Gartley Setup (Green) - D leg completion 1.5498

Bullish Gartle y Setup (Purple) - D leg completion 1.5512

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Website: www.UKForexSignals.com

Instagram: www.Instagram.com

Instagram: www.Instagram.com

Twitter: www.Twitter.com

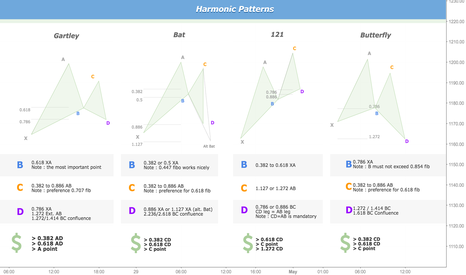

Harmonic Patterns ratio and examplesHi,

Above, some harmonic patterns that i often look for (bullish ones)

These patterns, when identified, have a good risk/reward ratio. They allow traders to enter into the market with minimal risk. Obviously, you need some other confirmations before taking the trade on the pattern completion.

If the point D occurs with some divergence on classic oscillators (RSI / Macd, Sto), on a bottom (or top, if pattern is bearish) of a trendline / channel, previous support/resistance levels, supply/demand zone...then there are good probabilities to see price react on the completion of the pattern.

There are plenty of patterns, but this selection, from my side, is a good start for those who want to learn harmonic pattern.

Below some examples that have worked nicely (this don't work each time, this would be too easy ;)