Harmonicelliottwaves

WATCH BTC For a BreakOutPrice needs to break down from Red-Box then we can have a pullback in the smaller RedBox for a Short Position.

The Target will be around PRZ ( 24,000 ~ 22,000 $ ) which can have a Pump in Price of +30K $

Watch out for a Bearish signal!

IF it's not broken down from the Red Box it will fail the Bearish Scenario.

We will update it soon.

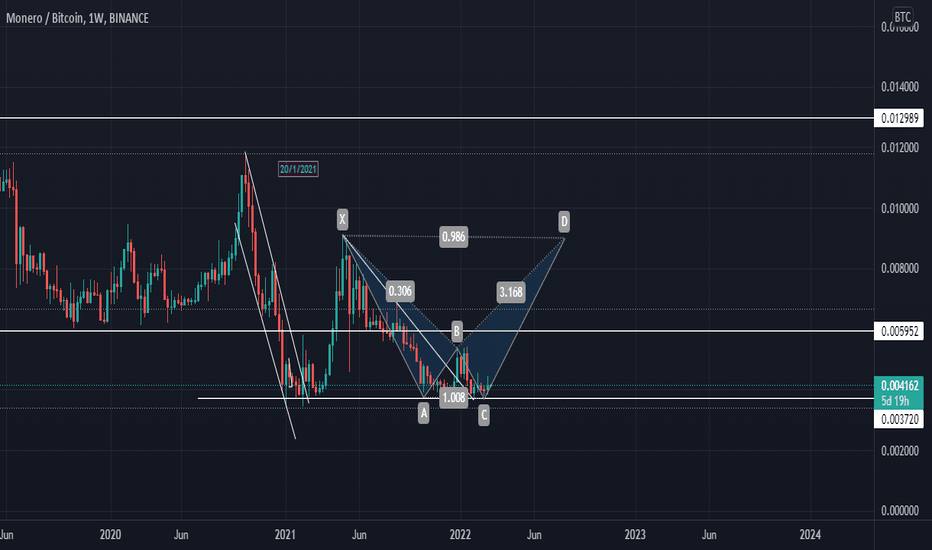

XMRBTC will formed a Harmonic PatternXMRBTC will form a Harmonic Pattern will continue price in the trend

EURUSD H4 Last Descending wave scenario Hello traders this is the last chance for a drop for EURUSD H4 and it is the wave -c- from 5 . I determined two harmonic patterns here a daily Bat and H4 Shark . This analysis is made by Harmonic elliot wave and Harmonic patterns . I expect a big up trend after this short downtrend .

GBPUSD D1 Long scenario Hello traders this is an update for GBPUSD D1 I determined a possible route for GBPUSD D1 and also I see a Crab Harmonic pattern here too that confirm this rising too . This analysis is made by Harmonic Elliot Wave principle I hope this analysis would be useful for you . see plz weekly analysis time frame

OIL_BRENT Monthly analysis and prediction with an important dateHello traders this analysis based on Harmonic Elliot waves , Financial astrology , Harmonic patterns , Ichimoku (it has been removed for better view of chart )

I think this rising up for oil will stopped soon ( as I wrote in chart in 30 March 2022 ) and also I predict a Shark Harmonic Patter and also the end of wave 5 from a (Based on Harmonic Elliot wave principle ) .I used Ichimoku for some targets and trend route so I removed it in this chart .I hope this analysis would be helpful for you . Please don't forget to like and share if it was helpful for you !

USDCAD W1 Interesting future route Hello traders this is my analysis about USDCAD W1 .This analysis made by Harmonic Elliot and Harmonic pattern

as you see after completion of wave e from 4 ( small price rising in daily time frame ) I expect a sharp down trend as wave a from 5 until determined target that it is PRZ from our assumed Gartly Harmonic pattern too ! I hope this analysis would be helpful for you

XAUUSD Monthly Interesting and important ideaHello traders this my opinion and my analysis about future of GOLD .this analysis was made by Harmonic Elliot Wave ( tried to use HER method) , Harmonic Pattern , Price action and Ichimoku (It's because our chart is crowded enough !) . I see a uptrend as wave 5 from wave c from major wave 5 . and also an expanded flat as wave a for correction ( It is maybe for a big demand for Gold and it will be as extended wave (b) in the flat ) . and also I can see a Three Drive Harmonic pattern . in a price action view we can see a rising wedge too so I see sharp drop for GOLD in future !

I know this chart is crowded and I'm sorry !

Bitcoin has produced the first micro rally and hit resistanceBitcoin has approached the target for that first a-b-c move up of the early January low.

That Red Target box is drawn at confluence of:

- two Anchored Weighted Moving Averages

- downward sloped red trend line,

- 100%, and 138.2% ext of wave -a- up.

After completion of that rally we can see another pullback in wave -ii- down to re-test the breakout resistance level 42,800 from above

ETH correction cycle / Short position opportunityThis is one Scenario based on Harmonic Elliot Wave principle .

in this Bearish scenario Wave (( C )) of higher time frame is complete and we Expect Corrective Cycle began .

First target is 3500

Second target is 2700

its even possible that correction cycle go for 2000 USDT (23.6% fibo lvl )

Good luck .

KOTAK BANK & BANK NIFTYHello

Welcome to this analysis on Bank Nifty and Kotak Bank

On the hourly chart Bank Nifty appears to be ending its 5 waves up from Aug 23rd lows (this can stretch to 38000)

Kotak Bank in daily time frame is at a Bearish Harmonic AB=CD Pattern along with 1.27x its Fibonacci extension of the IHS breakout. (this can stretch till 1925)

Both can cool off a bit from these levels - approx 38% of its recent run up could be a retracement level