DXY BEARISH TREND 30-JUL 15-JUN 2025There are some major upcoming events that could significantly impact the US dollar index (DXY), including the ADP Non-Farm Employment Change and the Federal Funds Rate decision. Because of this, I expect the DXY to continue its downward movement until it reaches around 94.5. If it breaks below that level, it’s also possible that it could drop further and reach 89.00.

Currently, the DXY is expected to start its move downward from the 99.20–99.50 range, making a decline from that level quite likely

Harmonic Patterns

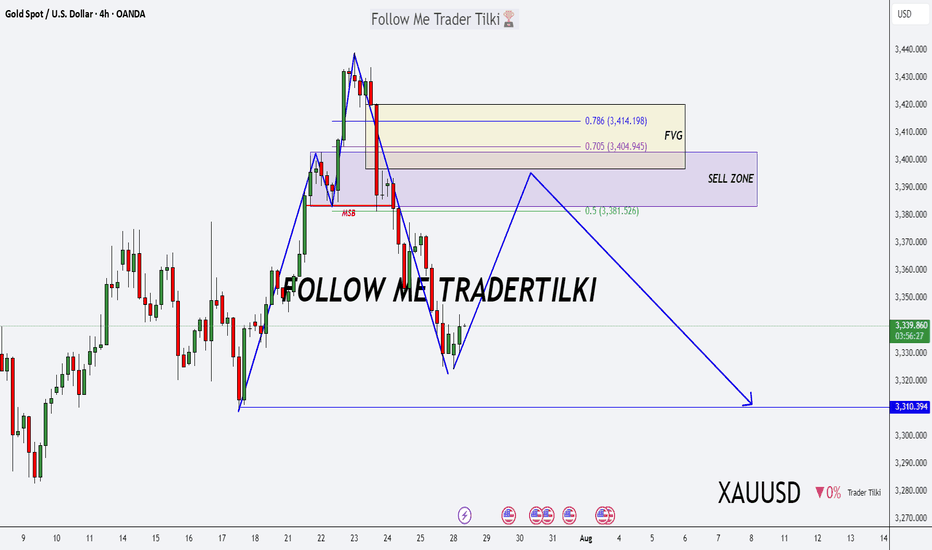

Gold next move (Read Description). Hello, Traders.

As we achieved more than 400 pips on last trade, Now I’m back with new idea for next move.

As you can see the gold is dropping since last few days.

Now the trend is bearish according Higher Time Frames and Bullish trend in Lower Time Frames, We will have to follow the Higher Time Frames to find the next move.

The market is creating the trend line buy according to H1,M30 and also respecting the trend line.

Keep in mind the trend is bearish, the gold will drop.

If the price doesn't breaks the 3347, then next move will be around 3284. If the price breaks the 3347 then gold will fly, trend will be change.

Kindly share your ideas and drop positive comments, Thanks.

btc buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Gold Alert: Key Levels for Potential Sell Setup!Good morning, my friends 🌞

Here’s today’s gold analysis. I'm expecting a decline in gold prices, specifically from the 3,383–3,420 level.

Once a correction starts around that zone, my target will be 3,310. Gold has been riding a strong uptrend, and if we reach those levels, I’ll be expecting a pullback and opening a sell position accordingly.

Please set your stop loss based on your personal margin preferences.

Your likes and support are my biggest motivation for continuing to share these analyses. Thank you to everyone showing appreciation 🙏

DOLLAR INDEX DXYThe latest U.S. economic data released on July 30, 2025 shows:

ADP Non-Farm Employment Change: Actual increase of 104,000 jobs, significantly above the forecast of 77,000. This marks a strong rebound from the previous decline of -23,000 in June and indicates solid labor market momentum, particularly in services sectors like leisure/hospitality, financial activities, and trade/transportation. However, education and health services saw job losses. Wage growth remains steady at 4.4% year-over-year for job-stayers.

Advance GDP q/q Growth: Actual growth came in at 3.0%, beating the forecast of 2.5% and improving sharply from -0.5% previously. This suggests that the economy is expanding robustly in the second quarter

Advance GDP Price Index q/q (Inflation measure): Actual was 2.0%, slightly below the forecast of 2.2%, and down from 3.8% previously, indicating easing inflation pressures .

Interpretation of this data for Federal Reserve policy:

The stronger-than-expected job growth and GDP expansion signal a resilient economy, which may reduce the immediate likelihood of Fed rate cuts, as these indicators support sustained economic momentum.

The slightly softer inflation reading on the GDP Price Index suggests inflation pressures are continuing to moderate, which could offer some flexibility to the Fed.

Overall, the Fed is likely to view this data mix as supportive of a cautious, data-dependent approach, possibly maintaining current rates in the short term without rushing to cut, but monitoring to ensure inflation stays on a downward path.

If the Fed prioritizes strong growth and a resilient labor market, rate hikes or holds are more likely than cuts. If inflation remains subdued, it could permit a gradual easing down the line but probably not immediately.

Let me know if you want a detailed outlook on market reactions to this release or the potential Fed communication following today’s data.

#GOLD

AVAX 8H – Trend-Capturing with the MACD Liquidity Tracker This AVAX 8H chart is a prime example of how the MACD Liquidity Tracker Strategy captures major trends with minimal noise. Designed for swing traders and trend followers, this system uses MACD momentum (25/60/220) and a 50-period EMA to filter entries and avoid chop.

🔍 What This Chart Shows:

A +150% long triggered in April and held cleanly through the rally

No entries during the June downtrend — thanks to bearish state filtering

A fresh +174% long in July as momentum and trend realigned

Visuals are crystal clear:

Blue candles = Bullish bias

Pink candles = Bearish bias

Arrows = Filtered entries only

MACD Histogram = Momentum strength

EMA = Trend direction

🧠 Why It Works:

Most traders struggle with second-guessing and emotional exits. This system removes the guesswork by enforcing strict momentum + trend alignment and delaying signals during unclear price action.

Ideal for crypto traders who want to follow strong trends with confidence and skip the noise in between.

ETH 4H – Trendline Test or Trap? Golden Pocket BelowEthereum’s 4H chart shows price compressing against rising trendline support after a strong impulse move in July. While bulls have defended the key reclaim zone (white box) multiple times, momentum is fading and structure is at risk.

Price is now coiling just above the diagonal trendline — a decisive bounce here could spark continuation. However, a breakdown opens the door to deeper retracements.

Key Fib retracement levels below:

0.5 at $3,032 – Initial reaction zone

0.618 (Golden Pocket) at $2,817 – High confluence support

0.786 at $2,511 – Extreme retracement target

The Stoch RSI is deeply oversold, suggesting a bounce may be near — but confirmation is needed.

📊 Things to watch:

Reaction at trendline support

Sweep of reclaim zone followed by reclaim

Golden Pocket retest with bullish divergence

If support holds, this could be a textbook higher low. If not, expect liquidity hunts toward the fib zones. Stay nimble.

Perfect candidate for a strategy backtest or reactive plan using alerts and confirmation tools.

Today's Gold Price: (3280-3290) Be Cautious About Bottom-fishingToday's Gold Price: (3280-3290) Be Cautious About Bottom-fishing

Today's gold price volatility was another lethargic day.

It oscillated back and forth between 3300 and 3330.

Like a loom, it was a lethargic experience.

In fact:

This market trend is typical of gold's volatility.

It suggests that significant news will be released today.

Buyers are reluctant to buy in large quantities.

Shorts are reluctant to sell in large quantities.

Everyone is waiting and watching.

Once news and market sentiment emerge, we will choose a new direction.

As shown on the 4-hour chart,

the area around 3330 has become a strong resistance zone.

The area around 3300 has become a temporary resistance zone.

The area around 3280 has become a strong support zone.

However, it is worth noting that when this ascending triangle descends, trading volume increases, indicating active selling.

Gold prices are rising, but trading volume is shrinking.

This clearly shows that the funds driving gold prices are not currently active enough.

This suggests that the current bullish momentum has yet to fully develop.

Bulls remain weak and wary of bears.

As a result, everyone awaits today's release of a small amount of non-farm payroll data and the Federal Reserve's interest rate decision.

I expect the Fed to adopt a more dovish stance this time, meaning that while they won't cut rates immediately, they will hint at a rate cut later this year.

Gold prices are likely to continue to fluctuate widely.

Trading Strategy:

Support: $3,280/$3,290

Resistance: $3,330/$3,300

Aggressive Strategy:

Sell Price: $3,295-$3,300

Stop Loss: $3,305

Target Price: $3,280-$3,280

Conservative Strategy:

Sell Price: $3,320-$3,330

Stop Loss: $3,335

Target Price: $3,300-$3,280

Bottom Picking Strategy: (Cautious)

Buy Price: $3,280-$3,290

Stop Loss: $3,275

Target Price: $3,330/$3,350

Review and plan for 31st July 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Bitcoin Cash (BCH): Looking For Touch To 200EMABCH looks overbought to us, and where we are now, we are looking for another touch to that 200 EMA, which would give us another good opportunity for long, so the plan is simple and that's what we are looking for.

Repeat of history, as they say!

Swallow Academy

CryptoTrade: AVAXUSD Long Trade with SL and TPCOINBASE:AVAXUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Solana (SOL): Triangle Pattern | Waiting For Bullish BreakoutSolana failed to break down from the local neckline zone (or support zone, for those who want to call it that). What we got instead is buyside dominance, where buyers took back the area and are now pushing the price back toward the upper side of that triangle pattern, so that's where our current target is sitting, as long as we break that line.

Swallow Academy

Pattern: Wedge Structure | Elliott Wave | Order Block PlayHere’s a powerful and professional description you can use when publishing this chart on TradingView:

---

🔻 Day 4 | EUR/USD Analysis 🔻

Chart Type: 3H Timeframe

---

📌 Chart Breakdown:

EUR/USD is respecting a textbook XABCD wedge pattern with clean Elliott Wave structure forming inside.

We’ve marked 5 key waves (1–5) completing within a falling wedge, aligning with a 50–60% retracement (Golden Zone) between point A and D.

🧠 Most traders miss the Golden Zone, but it’s often the clearest sign of upcoming trend continuation. Here, that continuation is bearish.

---

✅ 3H Confluence Factors:

Wedge forming within a larger downtrend

Multiple Break of Structures (BOS) confirming bearish momentum

Price targeting 1.12956 zone (mapped order block)

Elliott Wave fractals confirmed within structure

Hidden supply zone respected at Wave 4

---

📉 Expecting:

Retracement to supply → drop toward demand zone near 1.12956

---

📎 Strategy Insight:

SMC + Elliott Wave + Multi-timeframe path tool mapping gives us high confluence to expect continuation into the demand area.

💬 Comment below your views —

Do you also trade Wedges with Elliott Wave confirmation?

#EURUSD #WedgePattern #ElliottWave #SmartMoneyConcepts #OrderBlock #TechnicalAnalysis #TradingView #ForexIndia

---