Harmonic Patterns

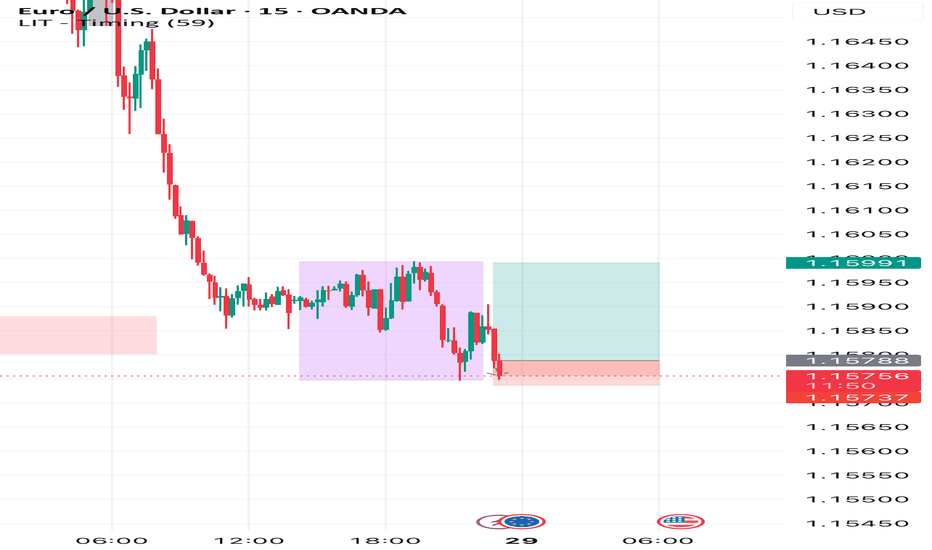

EURUSD may fall, but it's all about the FOMC DecisionEURUSD may fall, but it's all about the FOMC Decision

During the first 2 weeks of July, EURUSD fell from 1.18000 to 1.1550 and then the price rose again due to renewed tariffs.

Trump's comments regarding Powell and tariffs, according to which the EU and the US may reach an agreement soon, renewed the strength of EURUSD.

However, this time it is more related to the FOMC. If the FED cuts rates, EURUSD can drop further. When they didn't cut rates, the USD was weak or didn't move at all.

Let's see.

If Powell makes any surprises this time, EURUSD could fall, as shown in the chart, from 1.1800 to 1.1550, which is almost 250 pips lower.

Key support zones: 1.1660 and 1.1580

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

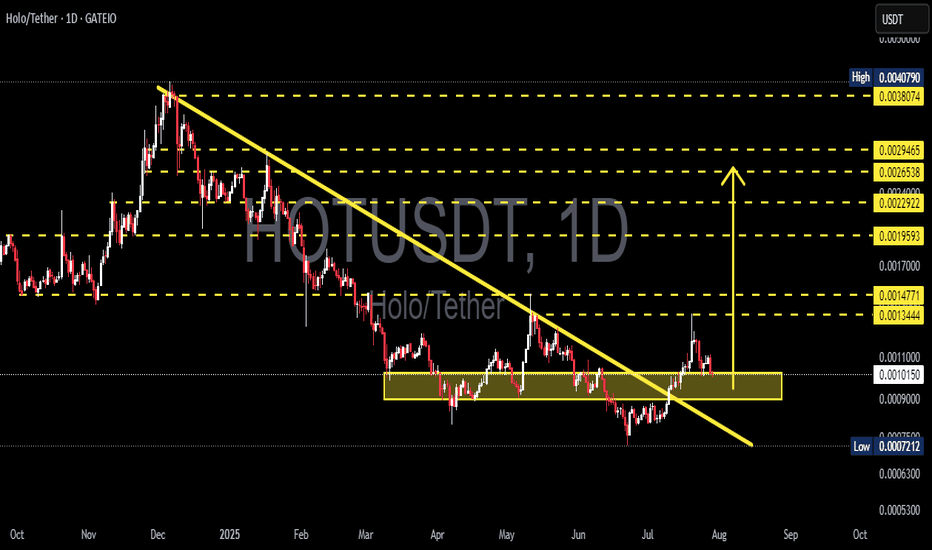

HOT/USDT Breakout Confirmation or Bull Trap? Critical Retest!🧠 In-Depth Technical Breakdown (Daily Timeframe):

HOT/USDT (Holo vs Tether) is currently at a crucial inflection point, following a confirmed breakout from a long-standing downtrend. The price is now retesting a major demand zone, and how it reacts here will determine its next big move.

Let’s dive deeper into the technical structure, chart patterns, and the possible bullish and bearish scenarios:

---

🔻 1. Trend Structure & Major Breakout

Since peaking in late December 2024, HOT/USDT was trapped in a descending trendline (yellow diagonal line).

In mid-July 2025, price successfully broke above this downtrend, signaling a potential trend reversal.

This breakout suggests a shift in market sentiment from bearish to neutral-to-bullish.

---

🟨 2. Retesting the Key Demand Zone (Support Flip)

Price is currently testing a critical demand/support zone between 0.00090 – 0.00110 USDT (highlighted in the yellow box).

This area served as a major consolidation base in the past and is now being tested as support after the breakout.

A successful retest will validate the breakout and could spark a continuation to the upside.

---

📐 3. Chart Pattern: Falling Wedge Breakout

Price action clearly formed a Falling Wedge pattern, typically a bullish reversal setup.

The breakout from the wedge confirms bullish momentum and the potential start of a new trend.

---

🔮 4. Price Scenarios Moving Forward

✅ Bullish Scenario:

If the price holds above the 0.00090–0.00100 zone:

1. Potential upside targets:

TP1: 0.00134 (minor resistance)

TP2: 0.00147 (key structural level)

TP3: 0.00159 (breakout continuation zone)

TP4: 0.00229 – 0.00246 (historical range highs)

TP5: 0.00380 – 0.00407 (major highs from previous cycle)

2. This structure could mark the beginning of a higher low + higher high uptrend, if confirmed.

❌ Bearish Scenario:

If the price breaks below 0.00090 with strong volume:

1. Likely a return to previous support at:

0.00072 USDT (historical low and major support level).

2. This would invalidate the breakout and possibly confirm a bull trap, resuming the downtrend.

---

🧩 Other Key Technical Notes (Not Shown in Chart but Useful):

Volume: Look for high volume on the breakout and retest to confirm validity.

RSI/Divergence: Check for hidden or bullish divergence on the last swing low.

EMA 50/200: If price crosses or holds above these EMAs, it adds further confirmation of trend reversal.

---

📊 Summary & Trading Strategy:

HOT/USDT is in a critical phase of retesting a major breakout, offering traders a great opportunity to either buy the dip or wait for confirmation.

Suggested Strategy:

Conservative Entry: Wait for a bullish candle close above 0.00100 with strong rejection from the support zone.

Aggressive Entry: Buy near 0.00090–0.00100 with a tight stop loss below 0.00087.

Use resistance levels for scaling out profits or setting targets.

#HOTUSDT #HoloToken #AltcoinAnalysis #CryptoBreakout #TechnicalAnalysis #ChartPattern #BullishReversal #FallingWedge #SupportZone #CryptoTA

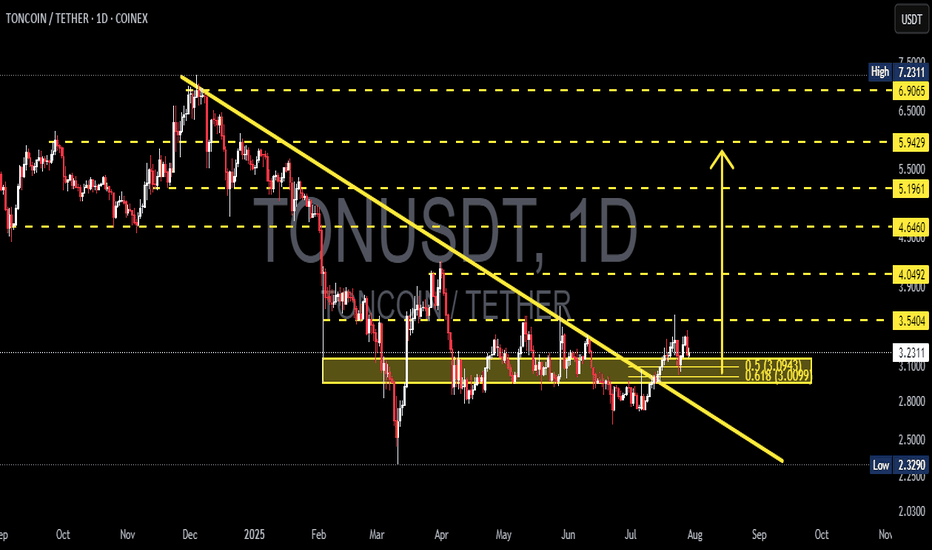

TONUSDT Breaks Out of Bearish Grip! Is a Bullish Rally?🔎 1. Key Pattern: Descending Trendline Breakout + Reaccumulation Zone

After months of downward pressure, TONUSDT has successfully broken above a dominant descending trendline that has been acting as resistance since December 2024.

✅ This breakout occurred with a strong bullish candle and aligns perfectly with a significant historical resistance zone (around $3.00–$3.12).

📌 The area also overlaps with the Fibonacci retracement levels (0.5–0.618) — a zone where trend reversals often occur.

This indicates that the move isn't just noise — it might be the start of a mid-term bullish trend.

---

🧱 2. Consolidation Box = Reaccumulation Zone

TONUSDT spent nearly 4 months ranging sideways between $2.80 and $3.20, forming a clear reaccumulation range.

🔁 This kind of price action often precedes a strong breakout, as smart money accumulates before the next leg up.

🟨 This box now acts as a critical demand/support zone for any potential pullbacks.

---

📏 3. Key Levels to Watch (Support & Resistance)

✅ Bullish Targets (Resistance Levels):

🔹 $3.5404 → Immediate resistance

🔹 $4.0492 → Major resistance to break

🔹 $4.6460

🔹 $5.1961

🔹 $5.9429

🔹 $6.9065

🔹 Local High: $7.2311

🔻 Support Levels:

🔸 $3.1248 – $3.0099 → Key Fibonacci support (0.5–0.618)

🔸 $2.8000 → Bottom of reaccumulation range

🔸 $2.3290 → Major support (also the cycle low)

---

📈 Bullish Scenario (Primary Bias)

If price holds above the key zone at $3.00–$3.12, we could see:

A move towards $3.54 USDT

Breakout above $3.54 opens the door to $4.05 → $4.64 → $5.19 and beyond

A clear structure of higher highs and higher lows confirms trend reversal

Momentum remains strong as long as price respects the breakout zone.

---

📉 Bearish Scenario (Alternative Case to Watch)

If price fails to hold above $3.00 and breaks back below $2.80:

This would suggest a false breakout

Momentum may shift bearish again

Price could revisit the $2.32 support, negating the bullish setup

A return to sideways or even downtrend structure is possible

---

🧩 Strategic Conclusion

TONUSDT has broken out of a key descending trendline and reclaimed a strong structural zone, indicating early signs of a bullish cycle.

📊 Key Levels to Monitor Closely:

Support (validation zone): $3.00–$3.12

Immediate resistance: $3.54

Mid-term targets: $4.05 → $5.19 and higher

> As long as TON stays above the golden zone (Fibonacci 0.5–0.618), bulls have the upper hand.

---

📘 Pro Tips for Traders:

Watch for volume confirmation during retests

Be patient for pullback entries or breakout confirmations

Manage risk — don’t FOMO blindly

#TONUSDT #TONCOIN #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #CryptoTrading #TON #Reaccumulation #BreakoutSetup #FibonacciSupport #BullishReversal #TONBullish

NEIROUSDT: Critical Support Zone – Rebound or Breakdown Ahead?🔍 Price Structure & Pattern Formation

On the daily chart, NEIROUSDT is currently testing a major demand zone (highlighted in yellow) between 0.0004337 – 0.0003500 USDT. This area previously acted as a strong accumulation zone back in May and is now being retested as key support.

Price has entered a consolidation range after a short-term rally from April to May 2025.

Strong Support: 0.0004337 – 0.0003500

Nearest Resistance Levels: 0.0005109, 0.0006198

---

📈 Bullish Scenario

If the price holds above the demand zone and forms a valid bullish reversal pattern (e.g., bullish engulfing, pin bar), then a bullish move could follow.

Upside Targets (Resistance Levels):

1. 0.0005109

2. 0.0006198

3. 0.0009048

4. 0.0017091 (extended target)

5. 0.0020403

6. 0.0027043 (mid/long-term target)

Bullish Confirmation:

Daily close above 0.0006198

Increasing volume on bounce

Bullish candlestick formation in demand zone

---

📉 Bearish Scenario

If the price breaks below 0.0004337 and closes the day under it, it would indicate further downside potential.

Downside Targets (Support Levels):

1. 0.0003500 (bottom of demand zone)

2. 0.0002700

3. 0.0001600

4. 0.0001390 (previous major low)

Bearish Confirmation:

Strong daily close below 0.0004337

Retest of the zone fails as resistance

Bearish volume spikes

---

📐 Price Patterns

Potential Double Bottom: A bounce from this zone may form a double bottom pattern, with the neckline near 0.0006198.

Sideways Range / Accumulation: Price action since June indicates potential accumulation if the support holds.

---

🔑 Conclusion

NEIROUSDT is at a critical juncture — waiting for confirmation whether it will bounce from this strong demand zone or break down to continue the bearish trend. Key resistance and support levels are well-defined, providing clear strategies for breakout or rebound traders.

---

📌 Trading Suggestions

Aggressive Longs: Look for bullish signals inside the demand zone (0.00043 – 0.00035)

Conservative Longs: Wait for a breakout above 0.0006198 for trend reversal confirmation

Shorts: Enter if there's a confirmed breakdown below 0.0004337

#NEIROUSDT #CryptoAnalysis #TradingView #AltcoinWatch #SupportResistance #TechnicalAnalysis #BullishSetup #BearishScenario #CryptoTA #ChartUpdate #PriceAction

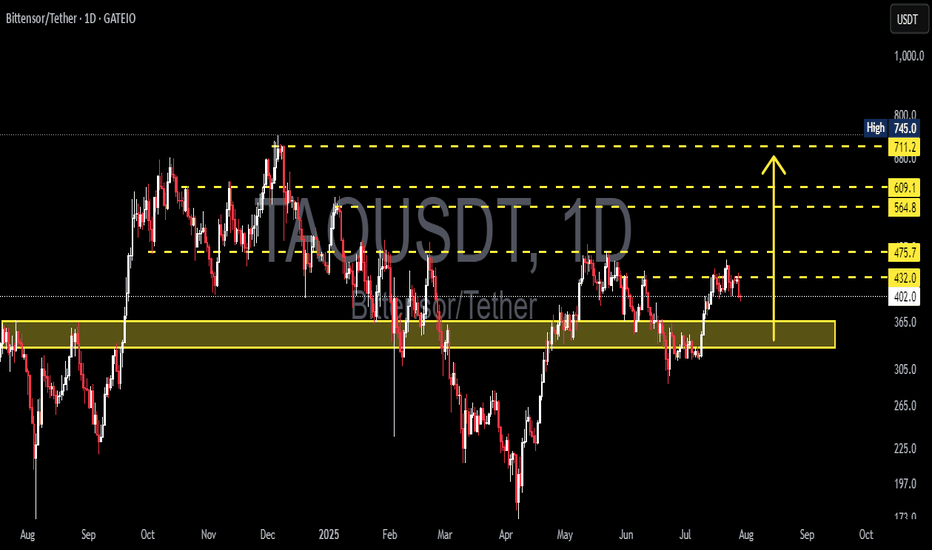

TAO/USDT: Price Likely to Retest Key Support Block 330–365 USDT?🟨 Key Zone: Yellow Support Block (330 – 365 USDT)

This zone has served as a major demand area since May 2025, acting as the base for the recent bullish move toward 475 USDT.

It represents a strong accumulation zone, where significant buying interest previously stepped in.

Given the current rejection from the 475 resistance, price is likely to revisit this block to test buyer interest and liquidity.

---

📉 Bearish Scenario: Breakdown Risk

After failing to break above 475.7 USDT, price shows signs of a short-term correction.

If bearish momentum continues:

🔽 A retest of the yellow support zone (330–365 USDT) is highly probable.

If this zone fails to hold:

📉 Next downside targets:

305 USDT – previous local low

265 USDT – next major demand level

A breakdown of the yellow block would invalidate the current bullish structure and open a new bearish leg.

---

📈 Bullish Scenario: Successful Retest and Bounce

If the price retests the yellow zone and forms a strong bullish reaction:

Confirmation signals:

Bullish reversal candles (hammer, bullish engulfing, etc.)

Increasing volume near the support zone

A successful retest could lead to:

✅ Continuation of the bullish trend

✅ Higher-low structure remains intact

Upside targets:

432 USDT – minor resistance

475.7 USDT – strong resistance zone

564.8, 609.1, and up to 711–745 USDT – extended targets

---

📌 Key Technical Levels:

Level Significance

330–365 USDT 🔲 Yellow Support Block / Demand Zone

432 USDT Minor Resistance / Previous Breakout

475.7 USDT Major Resistance (Recent Rejection)

564.8 USDT Mid-Term Resistance

609.1 USDT Next Key Resistance

711–745 USDT Long-Term Target / Supply Zone

305 USDT Support if Breakdown Happens

265 USDT Next Demand Zone Below

---

📊 Structure & Market Behavior:

No clear classic pattern (e.g., H&S or double bottom), but:

Current price is moving within a range-bound structure

Holding the 330–365 block would form a new higher low, strengthening the bullish outlook

Market is watching how price responds on retest of the yellow support

---

🧠 Notes for Traders:

Watch for volume and candle structure as price enters the 330–365 zone

This zone is a classic re-entry / reload area for institutional buyers

Conservative entry: Wait for bullish confirmation candle above 365

Aggressive entry: Ladder buys inside 330–365 with stop loss below 330

---

🏁 Conclusion:

TAO/USDT is undergoing a healthy pullback after rejection at 475.7 USDT. A retest of the yellow support zone (330–365 USDT) is highly likely. This area is crucial for the next move — either a bullish continuation with a strong bounce or a bearish breakdown signaling trend reversal.

#TAOUSDT #TAO #CryptoAnalysis #RetestSupport #DemandZone #BullishScenario #BearishScenario #AltcoinWatch #TechnicalAnalysis #PriceAction #TradingView #SupportAndResistance #GateIO #ReentryZone

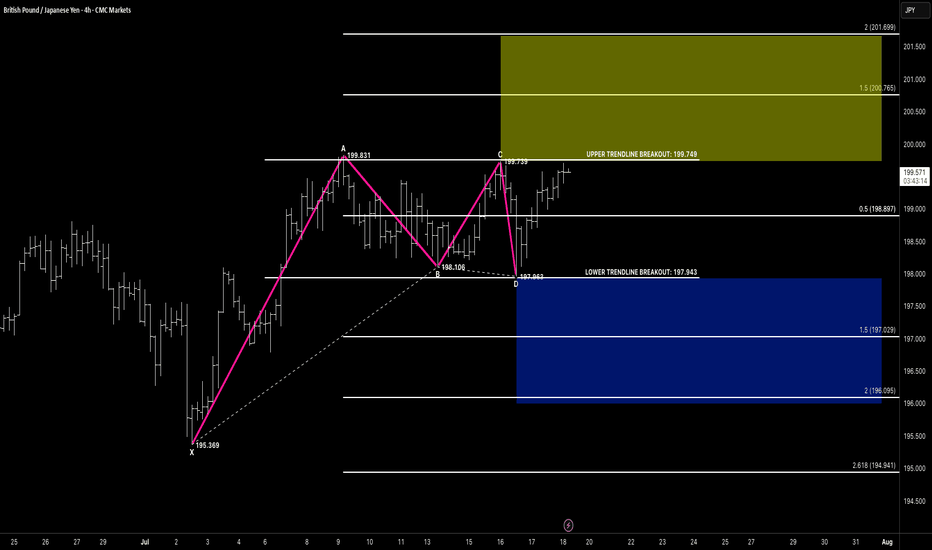

RECTANGLE CHANNELHello awesome traders! 👋

Hope you’ve managed to grab some solid pips from the markets this week. As we head into the weekend, I’m wrapping things up by dropping a few clean chart setups for you to review and reflect on.

Enjoy the weekend, recharge well — and I’ll see you sharp and ready next week for more structure-led opportunities.

📌 Pattern Breakdown

We’ve been tracking a developing rectangle channel between 197.94 (support) and 199.74 (resistance):

🔹 Price formed a clear 4-leg compression

🔹 CD leg bounced off lower support near 197.96

🔹 We’re now approaching the upper edge of the channel at 199.74

🔹 Compression structure suggests breakout potential is building

🚨 Breakout Setup in Focus

🔸 A breakout above 199.75 opens the door toward:

✅ Target 1 Zone:

• 1.5 extension = 200.76

✅ Target 2 Zone:

• 2.0 extension = 201.69

📌 Flip-side: A failed breakout and close back below 197.94 would shift structure toward:

🔻 Bearish Breakdown Targets:

• 1.5 = 197.02

• 2.0 = 196.09

• 2.618 = 194.94

We stay flexible — trade the breakout, not the anticipation.

🧠 Key Concepts in Play

✅ Rectangle consolidation

✅ Breakout-ready structure

✅ Defined upper/lower breakout levels

✅ Volume and reaction at edges = trigger

🗝 Final Thoughts

GBPJPY is boxed in tight — but momentum is clearly leaning bullish.

If we get that clean break above 199.75 with confirmation (volume, close, continuation), the 200.76+ range is firmly in sight. No breakout? No problem — structure has a plan either way.

“Boxes don’t trap the market — they build the tension. Breakouts reward the patient.”

ONDOUSDT at a Critical Fibonacci Zone! Will Move Toward $2+?ONDOUSDT is currently trading at a critical technical zone — the Fibonacci Retracement Golden Pocket (0.5–0.618) — following a significant upward rally. Historically, this zone often acts as a high-probability reversal area, or at the very least, a zone for major consolidation before the next big move.

---

🧠 Market Structure & Price Action

After reaching a local high near $1.17, price retraced and is now approaching the key support zone between $0.9435 (Fib 0.5) and $0.8951 (Fib 0.618).

This zone also coincides with a previous strong resistance, which could now act as new support (role reversal).

Current price action shows selling pressure, but there is no confirmed breakdown from the Golden Pocket yet.

---

🧩 Pattern Recognition & Key Levels

Potential Reversal Pattern: Look for a bullish falling wedge or descending channel on lower timeframes as a signal for reversal.

Demand Zone (Yellow Box): The zone between $0.8951–$0.9435 is reinforced by horizontal price structure support.

Layered Resistance Levels:

$1.1768 → Recent swing high

$1.3170 → Mid-range resistance

$1.5973 → Psychological and retracement target

$2.0412 → Range top / full recovery zone

Minor Support: If the Golden Pocket fails, potential downside targets include $0.70 and the major low at $0.5806.

---

📈 Bullish Scenario

✅ Strong bounce from the Golden Pocket

✅ Bullish candlestick confirmation (e.g., bullish engulfing or pin bar)

✅ Rising volume showing buyer presence

✅ Break above $1.1768 would signal continuation toward:

🎯 Target 1: $1.3170

🎯 Target 2: $1.5973

🎯 Target 3: $2.0412 (full structural recovery)

---

📉 Bearish Scenario

❌ If price breaks below $0.8951 with a strong bearish candle and high volume:

The structure shifts bearish, increasing risk of a drop to $0.70 – $0.62

Worst-case scenario: retest of $0.5806, the major bottom

Bullish structure invalidated upon confirmed breakdown

---

🎯 Strategy & Takeaway

ONDOUSDT is currently in a "make or break" zone. The Golden Pocket between $0.895–$0.943 could either:

Act as a springboard for the next bullish leg,

Or fail, triggering a deeper correction.

Traders should wait for confirmation via:

Candlestick patterns

Volume breakout/inflow

Break above or below the key structure

This area offers a high-reward, controlled-risk setup for swing traders, with invalidation just below the Golden Pocket.

---

📌 Summary of Key Levels

Level Description

$0.9435 Fibonacci 0.5 (support)

$0.8951 Fibonacci 0.618 (Golden Pocket)

$1.1768 Minor resistance

$1.3170 Mid-level resistance

$1.5973 Bullish target

$2.0412 Major resistance / recovery top

$0.5806 Extreme support (macro low)

#ONDOUSDT #CryptoTechnicalAnalysis #GoldenPocket #FibonacciLevels #CryptoTrading #SupportResistance #BullishSetup #BearishScenario #SwingTrade #AltcoinAnalysis

Ethereum at a Critical Crossroad: Will $4,000 Finally Break ?Ethereum is once again approaching the psychologically significant $4,000 resistance level, a high-timeframe barrier that has rejected price on multiple occasions. As the second-largest cryptocurrency by market cap pushes higher, traders are closely watching for signs of a breakout—or another range-bound rejection.

Ethereum has entered a decisive phase, with price action now testing the upper boundary of a long-standing trading range. After multiple failed attempts to breach the $4,000 mark, ETH is consolidating just below this level, creating an environment filled with both opportunity and risk. Whether Ethereum can break through or gets rejected again will shape its mid- to long-term outlook.

Key Technical Points:

- Major Resistance at $4,000: A psychologically important level and long-time price cap on high timeframes

- Defined Trading Range: ETH has remained range-bound between $1,300 and $4,000 for an extended period

- Critical Candle Closes Needed: Breakout requires strong daily or weekly closes above $4,000 to confirm

Ethereum’s price is hovering just under the $4,000 resistance zone, which has acted as a ceiling for price action since early 2022. From a high time frame perspective, ETH has been range-bound, trading between $1,300 as the range low and $4,000 as the range high. Each visit to this upper boundary has led to a rejection and a subsequent rotation back toward mid-range or lower levels.

Now, with momentum building and bullish sentiment returning across the crypto market, Ethereum finds itself at another pivotal moment. The key technical requirement for a confirmed breakout will be a decisive daily or weekly close above the $4,000 level. Without this confirmation, any temporary push above the resistance could result in a fakeout and trap late long entries.

Volume behavior around this zone remains mixed. While there is some bullish buildup in recent sessions, there has not yet been a significant influx in volume to confirm conviction from buyers. This aligns with the historical pattern of Ethereum trading at resistance before eventually pulling back, suggesting caution is still warranted.

However, should ETH close decisively above $4,000 and turn this level into support, it would mark the first major break of this range since its inception. This would likely trigger a wave of bullish momentum, possibly sending Ethereum to new yearly highs, with $4,500–$5,000 being the next logical resistance zones based on historical price pivots and Fibonacci extensions.

What to Expect in the Coming Price Action

Ethereum’s price action is currently neutral-bullish but hinges entirely on its interaction with the $4,000 resistance. A confirmed breakout could usher in a powerful rally toward new highs, while another rejection would likely continue the long-standing range between $1,300 and $4,000. Until a decisive move occurs, traders should remain cautious and reactive rather than overly anticipatory.

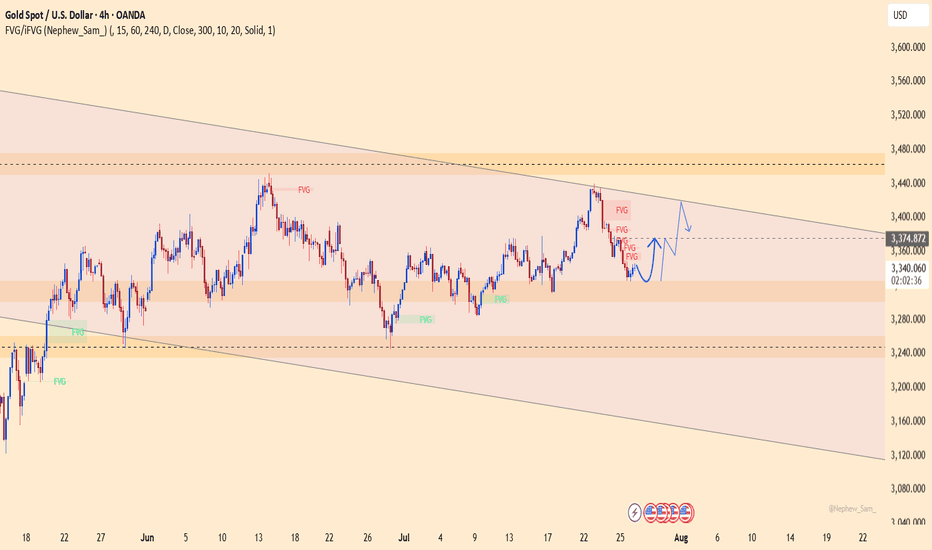

Gold: This Week's Analysis & StrategyThis week, the fluctuations have clearly moderated📉. Focus on a strategy of buying at lows and selling at highs as much as possible📈. Currently, the resistance around 3350 is prominent🚧, and 3300 acts as support below🛡️. If the decline continues, it may reach around 3285👇

We successfully took short positions last week 📉, and this week I recommend going long at lower levels 📈. Over the long term, gold remains in a bull market 🐂, but it will not repeat the frenzy seen in April; instead, it will maintain a steady upward pace ⬆️.

Market expectations for Fed rate cuts have been volatile so far this year 📊. At the start of the year, as Trump-related developments unfolded, market optimism faded 😐. Meanwhile, the de-dollarization trend fueled growing expectations of Fed rate cuts 💹. By early April, Trump’s reciprocal tariff measures—far more aggressive than expected—roiled global financial markets 🌍, triggering a surge in concerns about a U.S. recession ⚠️. Markets thus anticipated that the Fed would cut rates quickly to shore up the economy, with expectations for rate cuts within the year once exceeding 100 basis points 📉. However, shortly after, Trump announced a 90-day extension of the reciprocal tariffs, easing market pessimism 😌 and driving a strong rebound in U.S. stocks 📈. At this point, markets began worrying that his tariff policies could spark an inflation rebound 🔥, leading to a steady decline in rate cut expectations—currently, expectations for rate cuts this year have dropped to fewer than two 🔄.

Risk Warning ⚠️

Event Sensitivity: Outcomes of China-U.S. trade talks 🤝, the Fed’s statements , and nonfarm payroll data 📊 may trigger one-sided volatility. Positions should be adjusted promptly to avoid risks 🛡️

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3300 -3310

🚀 TP 3320 - 3330 - 3340

🚀 Sell@ 3350 -3340

🚀 TP 3330 - 3320 - 3310

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

Gold repeatedly tested lows. Will it break through?On Monday, the Asian market opened low and rose in the early trading. In the European trading, it rose to around 3345. The European trading was under pressure and fluctuated. The US trading began to accelerate its decline, and the lowest point reached around 3302. Then it continued to fluctuate in the range of 3300-3320.

On July 27, the United States and the European Union reached a framework trade agreement; the agreement reduced market concerns about the global economic recession, promoted the attractiveness of risky assets, and boosted the stock market and the US dollar. Although Trump has repeatedly pressured for a substantial interest rate cut, the market has strong expectations for a September interest rate cut. The current expectation of maintaining a stable interest rate dominates the market, coupled with the strength of the US dollar, which puts gold prices under downward pressure in the short term.

Gold opened low in the early trading on Monday and then rebounded to recover the losses, but then fell below the low again, and the daily line closed in the negative, and now it has formed a four-day negative decline. MA5 and 10-day moving averages form a dead cross, and there is a downward turn.

The focus on the upper side is around Monday's high of 3345, which is also near the current position of MA5, 20, and 30-day moving averages. Below this position, gold is weak; if it breaks upward, it is necessary to prevent the possibility of a rebound correction.

The lower support first focuses on the 3300 integer mark; secondly, focus on the area around 3285-3275.

Operation strategy:

Short near 3340, stop loss 3350, profit range 3320-3300;

Long near 3300, stop loss 3290, profit range 3320-3340.

Before the release of US data on Tuesday, you can maintain this operation strategy; after the data is released, adjust the strategy based on the impact of the data.

ETHUSD : Playing with the DThe good thing about a harmonic pattern is that it significantly lowers your risk. It forces you to be patient and wait.

It can be applied to all, whether FX, stocks, crypto, etc.

Why does it work better compared to others? The answer is simple - PRICE ONLY MOVES UP AND DOWN, PRICE DOES NOT MOVE SIDEWAYS.

One crucial thing we can see from the above is that the D < B. Which means if we are patient enough and wait for the appropriate time to SELL, the probability is very good to make money.

Good luck.

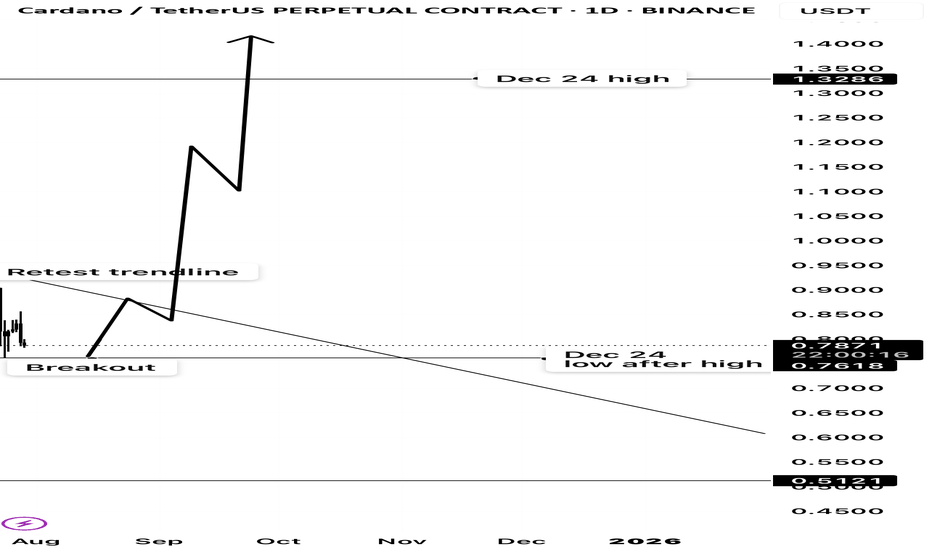

Cardano potential multi month breakout ?From december’s high cardano has been in a downtrend since.

The first low it made after the top from december had been a massive resistance.

It has risen from its 2025 lows and broke that resistance from all the way of december and retested its downtrend.

My take is, once it breaks that trendline it will go higher than the top of dec 2024.

XAUUSD – Technical rebound, but downside risks remainOn the H4 chart, gold is bouncing slightly from the 3,323 support zone after a sharp drop. However, price remains within a large descending channel and is approaching a dense cluster of bearish FVGs around 3,360–3,374.

News context:

– US GDP and ADP data beat expectations, boosting the USD and adding pressure on gold.

– JOLTS dipped but remains above 7 million → limited support for gold.

– Thailand–Cambodia conflict provides only short-term impact.

Strategy: Favor SELL if price retests 3,360–3,374 and gets rejected. Downside targets: 3,323 or lower.

Main trend remains bearish, unless gold breaks above the descending channel.

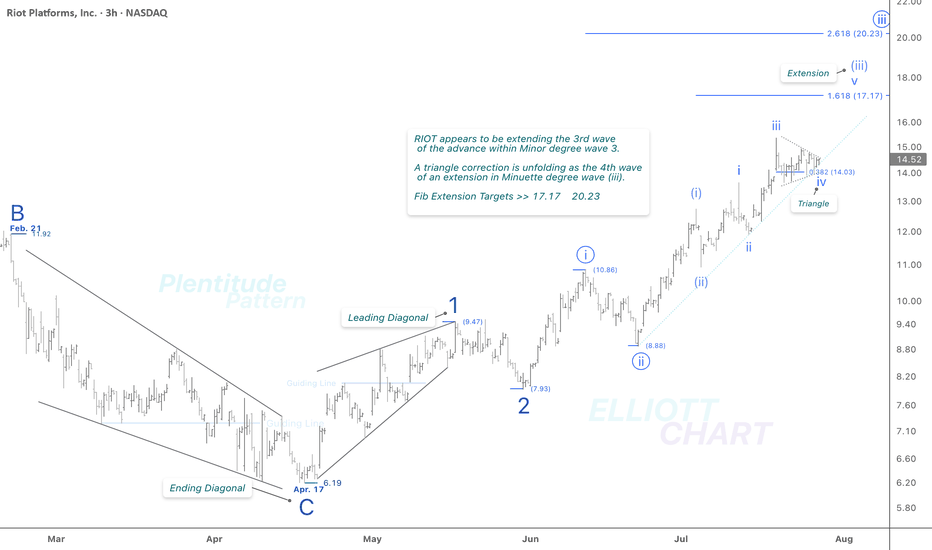

RIOT / 3hThere is no specific change in NASDAQ:RIOT 's previous analysis. As depicted on the 3h frame above, it appears to be extending the third wave of an impulsive advance within Minor degree wave 3. As anticipated, a triangle correction has emerged as the fourth wave within the ongoing extension of the Minuette wave (iii).

The Fibonacci extension levels of 17.17 and 20.23 remain valid and continue to align with the current wave structure.

>>> In this timeframe, I'm analyzing the initial rising tide within the ongoing Intermediate degree wave (1), where a nested series of waves have quite well revealed: 1, 2 → i (circled), ii (circled) → (i), (ii) → i, ii. The extreme high of this impulsive sequence lies beyond the visible range of the current chart.

NASDAQ:RIOT CRYPTOCAP:BTC BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

Bullish bounce off overlap support?Dow Jones (US30) is falling towards the pivot and could bounce to the 1st resistance which acts as a swing high resistance.

Pivot: 44,596.08

1st Support: 44,267.57

1st Resistance: 45,106.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

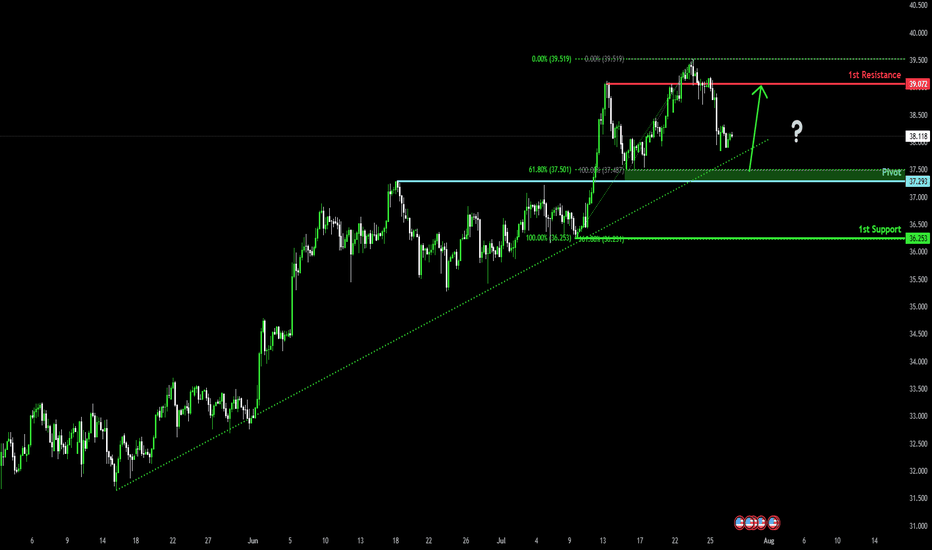

Falling towards pullback support?The Silver (XAG/USD) is falling towards the pivot, which is a pullback support and could rise to the 1st resistance.

Pivot: 37.29

1st Support: 36.25

1st Resistance: 39.07

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop for the Gold?The price is reacting off the pivot and could drop to the 1st support, which is a swing low support that aligns with the 127.2% Fibonacci extension.

Pivot: 3,319.63

1st Support: 3,271.54

1st Resistance: 3,345.37

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Heading into multi swing high resistance?The Loonie (USD/CAD) is rising towards the pivot, which has been identified as a swing high resistance and could reverse to the pullback support.

Pivot: 1.3782

1st Support: 1.3691

1st Resistance: 1.3855

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.