Harmonic Patterns

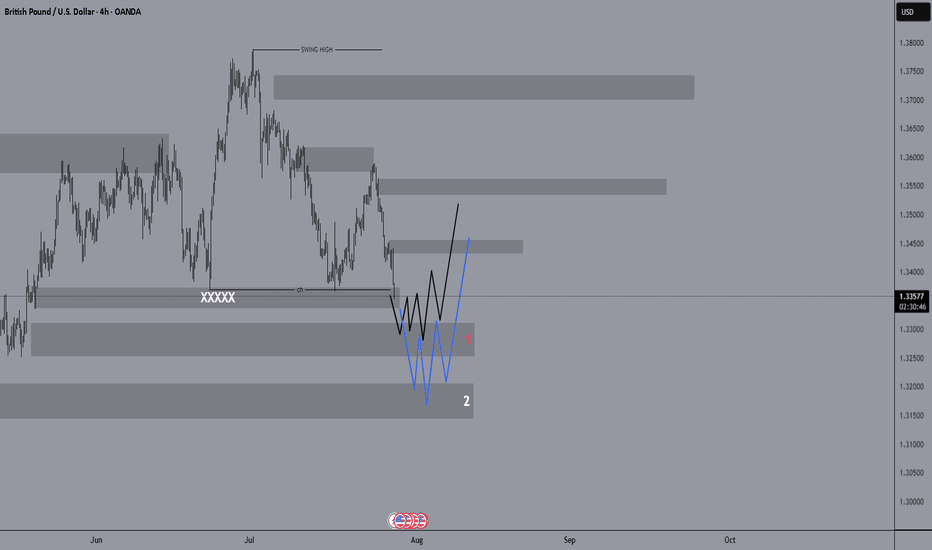

Potential bearish drop?GBP/USD has reacted off the support level which is a multi swing low support and could drop from this levle to our take profit.

Entry: 1.3387

Why we like it:

There is a multi swing low support.

Stop loss: 1.3476

Why we like it:

There is a pullback resistance.

Take profit: 1.3247

Why we like it:

There is a multi swing low support that aligns with the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

It could be a profitable deal.Hello friends, I hope you have started the week well.

I expect that after the corrections that have occurred, the price will make an upward move from areas 1 and 2, but this move is not a new ceiling because there is a possibility of a market reversal on the daily timeframe, but you should wait for the candles to close.

In the indicated areas, you can look for confirmation on lower timeframes to take a buy trade.

(You can name any currency pair you are interested in in the comments, and our team will share its opinion on that currency pair with you.)

Follow our page to see more analysis.

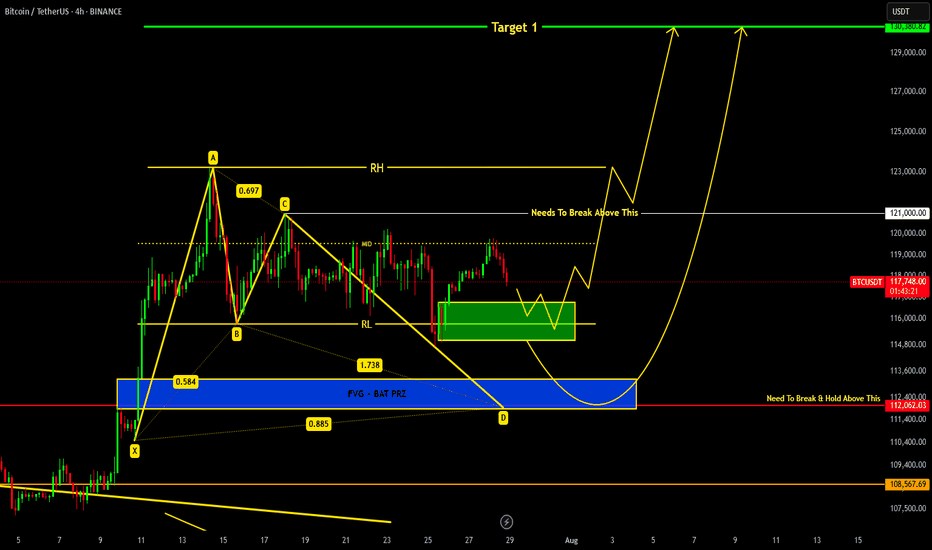

BITCOIN Current Update !!!we are heading towards support region around 116.8k-115k from where we can expect a reversal.

If price breaks down 115k level then a bat harmonic pattern is also forming which indicates it's PRZ at 113-112k region...

Remember 121k is key level which needs to be broken in order to remain bullish !!!

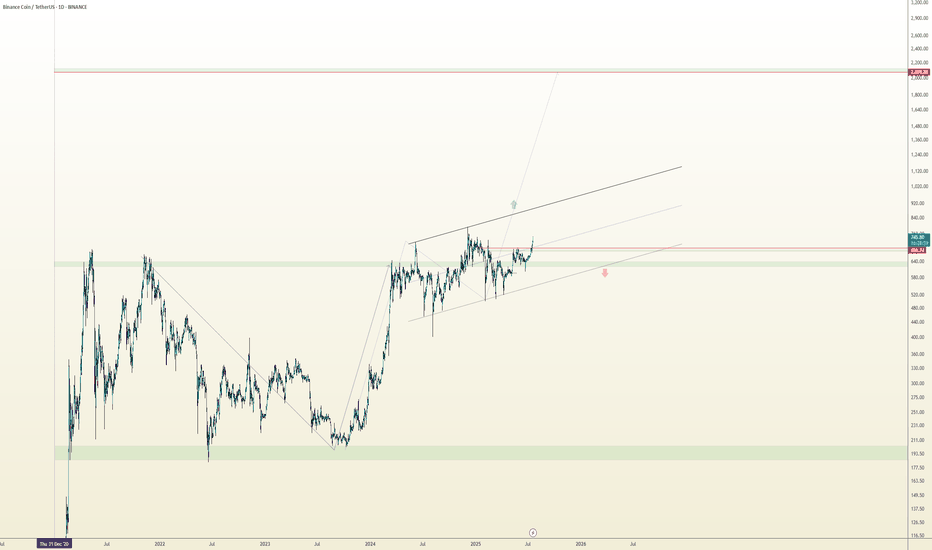

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.

EUR/USD Analysis: Potential Reversal at Key Support📉 Day 3 of 100: EUR/USD Breaks Structure!

Today’s market gave us a lesson! 📚

✅ SL Hit due to news

✅ 61% order block broken

✅ NY session may go bullish after Asia+London trap

.

Are you seeing the pattern unfold?

👇 Comment “Wave Watcher 🌊” if you use Elliott Wave!

Day 3/100 - EUR/USD Breakdown! | Forex Analysis | Elliott Wave | Order Block Strategy

In today’s update: 📌 SL hit due to major fundamental shift

📌 Break of 61% order block; heading to 78% zone

📌 Similar pattern in Tokyo/London sessions—bullish setup possible for NY session

.

💬 Drop a comment if you're also using Elliott Wave price action!

👍 Like | 🔁 Share | 🔔 Subscribe for more daily updates!

🚀 Join the 100-Day EUR/USD Challenge — Let’s decode the market together!

#forex #eurusd #elliottwave #orderblock #forextrader #forexeducation #smartmoneyconcepts #priceaction #forexchallenge #newyorksession #technicalanalysis #forexstrategy

---

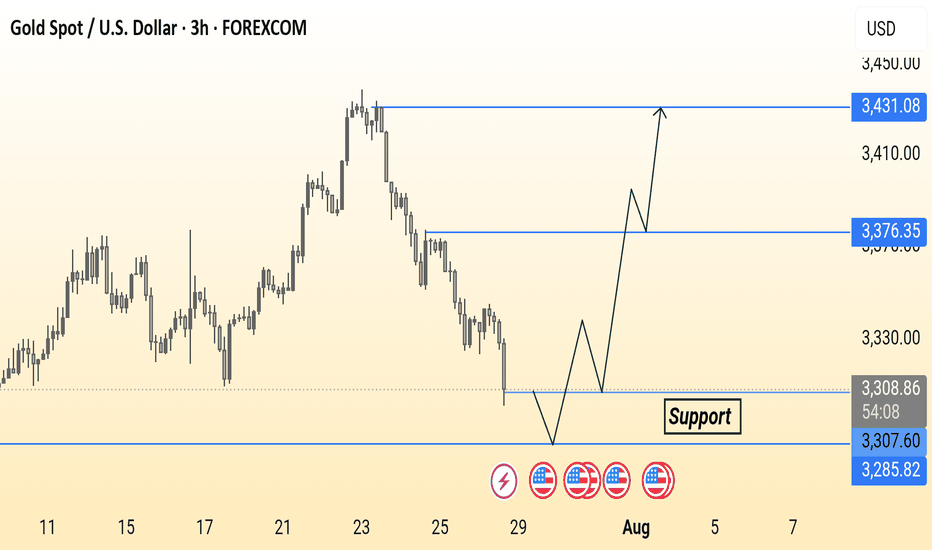

Analysis for the next week (XAUUSD) Hello Traders, Happy Weekend.

The market is going to open tonight, As you see the down trend is running, the price is falling like a waterfall.

Now the market is on the support area according to H1 & H4 TimeFrame.

The market is respecting the support area and there is a Trend line support according to D1 TimeFrame.

The market is respecting the Trend line and support area.

According to my analysis gold will drop till 3287 to 3271.

If gold fly, it can fly till 3350 then it will fall.

Stay tune for update.

Kindly share your views and leave positive comments here, Thanks.

Ethereum bigger pictureToday we are measuring the difference between Ethereum's current price and its average price over a specific period. We see how far the current price deviates from its statistical average. This helps traders identify potential overbought and oversold conditions. Even though institutions and etfs have bought up over 32x the supply of Ether since May, it has showed in the past 36 Days with ether running over 80%, we look at reducing exposure as the risk remains for a correction in the short term.

NASDAQ 100 LOOKING OVERBOUGHT RIPE FOR A CORRECTION?Hey Traders so today was looking at the Nasdaq 100 and it seems like it's approaching overbought territory at all time highs.

Of course no one knows what earnings season will bring and seasonally historically August is normally a good month for stocks.

So if we look at previous rallies market seems to correct eventually 3% or 4%. I think that is actually healthy for the market also.

So if your bullish watch for 3% correction and buy back in around 22,800-23,000 put a stop under support at around 22,000-22,500. Hopefully the market won't make it that far on a sell off so odds of getting stopped out are low I think.

However if you are Bearish I don't reccommend selling at All Time High. Best odds for stronger selloff I think is waiting until September as it is historically the weakest month of the year for stocks seasonally.

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

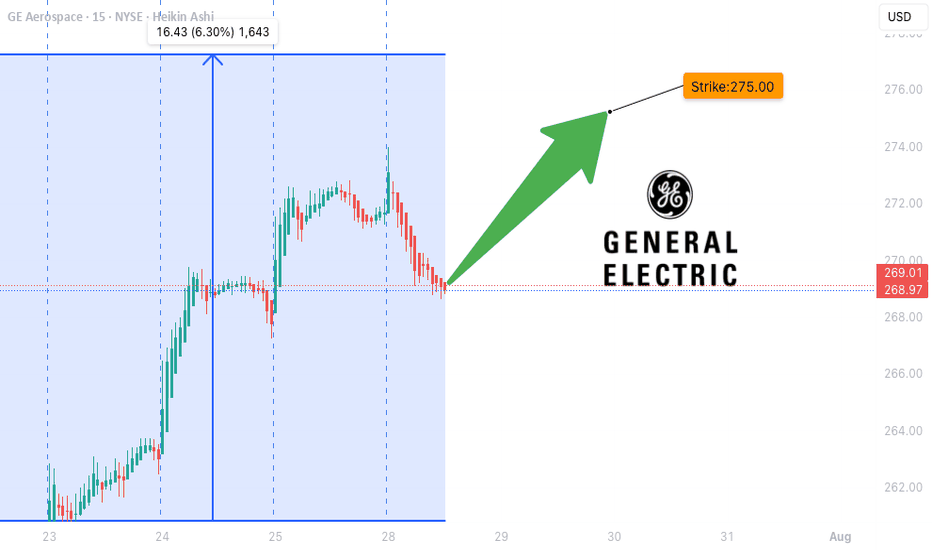

GE WEEKLY OPTIONS SETUP (2025-07-28)

### ⚙️ GE WEEKLY OPTIONS SETUP (2025-07-28)

**Mixed Signals, Bullish Flow – Can Calls Win This Tug-of-War?**

---

📊 **Momentum Breakdown:**

* **RSI:** Falling across models → ⚠️ *Momentum Weak*

* **Volume:** Weak 📉 = Low conviction from big players

* **Options Flow:** Call/Put ratio favors bulls 📈

* **Volatility (VIX):** Favorable for directional plays

🧠 Model Consensus:

> “Momentum weak, but bullish flow + low VIX = cautiously bullish.”

> Some models recommend **no trade**, others suggest **tight-risk long call**.

---

### ✅ WEEKLY SETUP AT A GLANCE

* 🔍 **Volume:** Weak (distribution risk)

* 📉 **Momentum:** RSI fading

* 💬 **Options Sentiment:** Bullish bias (calls > puts)

* ⚙️ **Volatility:** Favorable

**Overall Bias:** 🟡 *Moderate Bullish*

---

### 💥 TRADE IDEA: GE \$275C

* 🎯 **Strategy:** Long Weekly Call

* 🔵 **Strike:** 275.00

* 📆 **Expiry:** Aug 1, 2025

* 💸 **Entry:** \$1.10

* ✅ **Profit Target:** \$1.80

* 🛑 **Stop Loss:** \$0.55

* 📈 **Confidence Level:** 65%

* 🧮 **Risk Level:** Medium (momentum divergence = tread carefully)

* ⚠️ **Support Watch:** Monitor for drop below \$268–270 for potential exit.

---

### 📦 TRADE\_DETAILS (Algo/Backtest Ready JSON)

```json

{

"instrument": "GE",

"direction": "call",

"strike": 275.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.80,

"stop_loss": 0.55,

"size": 1,

"entry_price": 1.10,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 12:08:59 UTC-04:00"

}

```

---

### 📌 NOTES FOR TRADERS

* 🤖 Models split between *no trade* vs *tight-risk long*

* 🚨 **Momentum divergence** is real – don’t oversize

* 🧭 **Watch Friday theta decay** — manage exits accordingly

* 🔍 Chart check: Watch price action near \$275 and \$268

---

**#GE #OptionsTrading #WeeklyPlay #CallFlow #UnusualOptionsActivity #GEcalls #AITrading #RiskManagement**

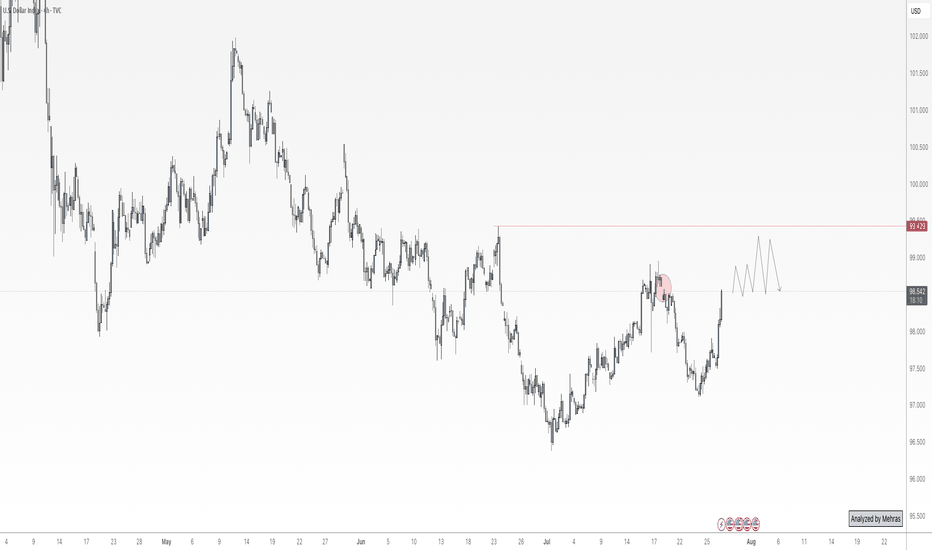

DXY at Its Most Critical Level of 2025 — Will the 100 Bank LevelThe Dollar Index (DXY), just like several other majors, is approaching a very important level. We’re now near the 100 mark, which is not only a psychological level — but also a key institutional (bank) level.

There’s also a gap zone left behind that price is about to fill. I believe the index will stay in a range over the next 1–2 days as it waits for critical data later this week — especially Wednesday’s announcements and Friday’s NFP report, which could set the tone for what’s next.

Based on current market sentiment, Trump’s remarks, Powell’s upcoming speech, and broader macro factors, I believe DXY has the potential to break above 100 and move toward 102–104, if that level is broken cleanly.

Let’s also not forget — price bounced from a monthly demand block near 96, and we’re seeing weak support across majors like EUR and Gold. That adds confluence for potential dollar strength.

📌 What do you think — is dollar strength just around the corner?

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

NQ : Scalping levelsHere's a very likely scenario on the NQ trade. Once the price grows back, you can take short pullbacks from these levels.

Be careful on trading on the news. It is better not to trade in them. Also, the levels are unlikely to work in illiquid times.

I will post the results of the levels and my trades in the comments if everything will be according to the scenario.

Gold fell below support. What will be the subsequent trend?The 1-hour moving average of gold continues to show a downward short position, indicating that the downward momentum is still sufficient; the wave pattern of gold's current decline remains intact, but the rebound strength is very weak, showing an obvious short trend of gold. Moreover, when gold rebounded in the short term, obvious resistance began to form above 3320, and the upward momentum was slightly insufficient.

From the daily chart, before 3300 fails to fall, it is likely to fluctuate around 3300-3350. On the contrary, if it falls below 3300, it is likely to reach the bottom of the 3385-3375 range.

This week is a super data week. The data of each day may affect the trend of gold on that day, but it will not form a unilateral strong trend. Therefore, the volatility before and after the data is released is likely to be large, so traders should focus on the following data:

1. US ADP employment report, US second quarter GDP preliminary value;

2. Federal Reserve interest rate decision;

3. US PCE annual rate, monthly rate;

4. The last trading day of this week will usher in non-agricultural data.

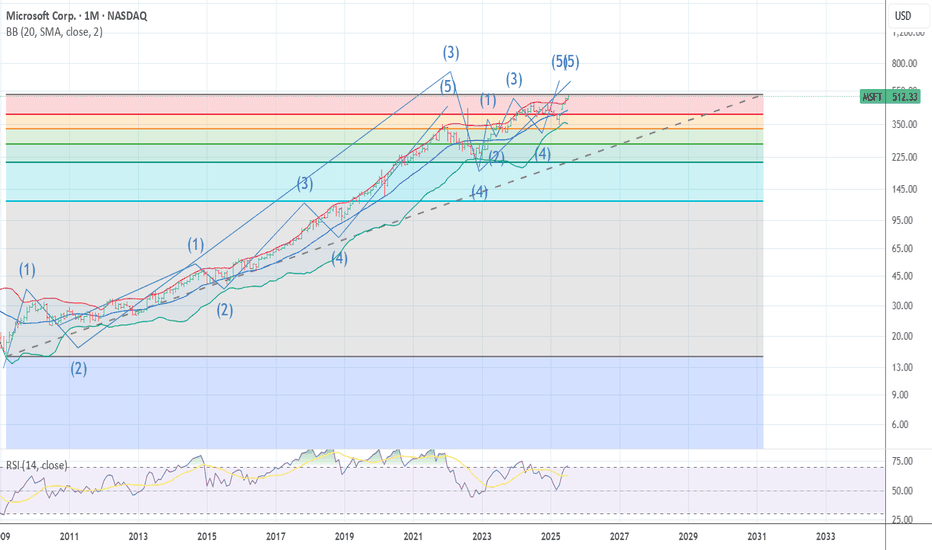

MSFT SUPER CYCLE WAVE 3 TOP MSFT The bell weather .Is now ending what looks to be the 5th wave for super cycle wave 3 top here from 518 to 525 from the 2009 low wave 2 . I am buying late 2027 525 puts Now the downside over the next 18 months is down near the previous wave 4 low 341 area I expect we will that at a min with odds as low as 222 . best of trades Wavetimer

Key fluctuation range of gold price: 3300-3345Key fluctuation range of gold price: 3300-3345

As shown in Figure 4h

It is expected that the gold price will still fluctuate widely in the range of 3280-3440.

However, the special thing is that the gold price trend has broken through the support of the long-term upward trend, and the triangular oscillation convergence structure has been destroyed.

The important ranges to pay attention to next:

Pressure zone: 3330-3345

Support zone: 3300

Through technical analysis: Obviously, intraday trading is mainly based on high-altitude thinking.

It should be noted that 3300 points is an important watershed between the bull market and the bear market, so there is definitely no shortage of bargain hunting chips.

Be cautious about bottom-fishing.

In the next few days, the trend of gold prices will focus on the fluctuation performance of the 3300-3345 range.

Operation strategy:

Buy: 3300-3310

Stop loss: 3295

Target: 3320-3345

Sell: 3330-3340

Stop loss: 3350

Target: 3300-3280

Buy cautiously at low prices, and try to short at high prices

TQQQ WEEKLY TRADE IDEA (07/28/2025)

**🚀 TQQQ WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Triple-Leveraged Momentum Play — But Watch the Volume Trap!**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 75.0 ⬆️

* **Weekly RSI:** 70.1 ⬆️

🔥 Bullish across **all timeframes** = strong trend confirmation

📊 **Options Flow:**

* **Call Volume:** 24,492

* **Put Volume:** 18,970

* **C/P Ratio:** **1.29** → Institutional bias = **Bullish**

📉 **Volume Concern:**

* Weekly volume = **0.8x** previous week

⚠️ Weak participation could limit breakout strength

🌪️ **Volatility Environment:**

* **VIX < 20** → ✅ Great for directional plays

---

🔍 **Model Consensus Recap:**

✅ All reports agree on bullish momentum

✅ Favorable volatility = cleaner setups

⚠️ Volume is the only red flag

📌 Final Take: **Bullish, but be tactical**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 75%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$93

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.79

* **Profit Target:** \$1.58 (🟢 2x Gain)

* **Stop Loss:** \$0.39 (🔻 50% Risk)

📆 Entry Timing: Market Open

📏 Position Size: 2–4% of account

---

⚠️ **Key Risks to Watch:**

* 🔍 **Volume Trap**: Weak volume = fragile follow-through

* ⚡ **Gamma Risk** into expiry → price may swing quickly

* 📉 Avoid chasing — stick to setup, use stop-loss

---

📌 **JSON FORMAT TRADE DETAILS (Automation-Ready):**

```json

{

"instrument": "TQQQ",

"direction": "call",

"strike": 93.0,

"expiry": "2025-08-01",

"confidence": 0.75,

"profit_target": 1.58,

"stop_loss": 0.39,

"size": 1,

"entry_price": 0.79,

"entry_timing": "open",

"signal_publish_time": "2025-07-31 09:29:00 UTC-04:00"

}

```

---

**TL;DR:**

✅ RSI momentum = 🔥

📈 Call flow = ✅

⚠️ Volume = 🟡 Caution

🎯 \ NASDAQ:TQQQ breakout play for the bold

💬 Are you riding the 3x bull, or waiting for confirmation?

\#TQQQ #OptionsTrading #MomentumSetup #UnusualOptionsFlow #TradingView #TechStocks #QQQ #LeveragedETF

#BTCUSDT: Minor Correction In Price Then $150,000?Hi everyone,

Hope you are doing great we are witnessing some minor bearish correction in the price and think this might be a sellers trap. We think $110,000 can be a good area to buy. Our target is at $150,000 area which look possible after looking at how price recently behaved.