4-hour channel midlineThe price has reached the midline of the 4-hour channel, and buying volume has decreased in this area.

We need to see whether the price can break above the midline or not.

If it breaks to the upside, our first target will be the top of the channel.

If it gets rejected, our target will be the bottom of the channel.

Harmonic Patterns

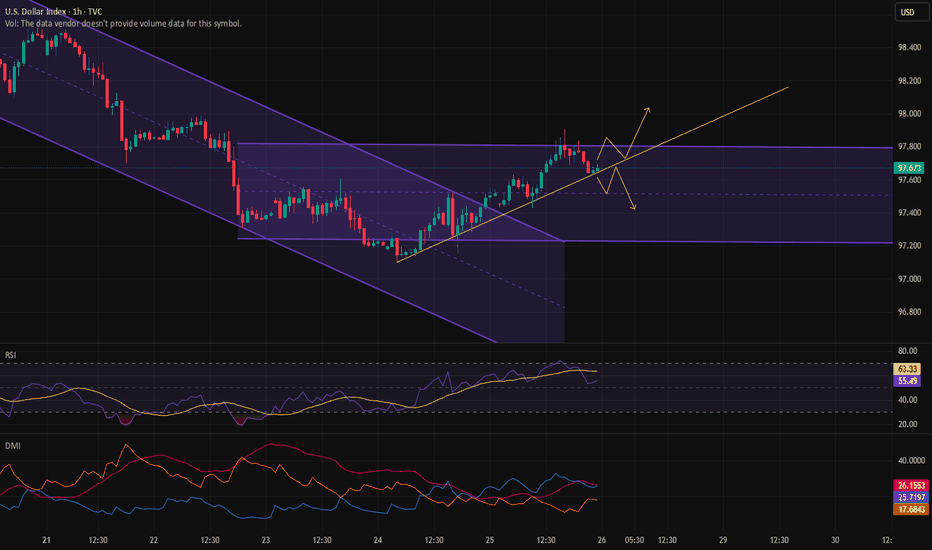

Breakout of the channelAfter the DXY broke out of the channel, it formed a range.

We can see a yellow trendline where the price is moving exactly along it.

If this trendline breaks to the downside, we can take a short position targeting the bottom of the channel.

Otherwise, it would mean the trend reversal in DXY is confirmed.

HARMONIC PATTERN on Daily for SOL ?I wonder if this pattern is the one which is highlighted by our friend and chart analyst @The_Alchemist_Trader_

Let's see if it need to test one last time the support of this channel or if it will break out for the long waited rally.

Level to keep an eye :

0.5 Fib support need to hold and clean breakout of the 0.382 Fib

Indicators : RSI, volume and volatility (liquidations)

Litecoin (LTC): Looking for Breakout + Targets to be ReachedLitecoin has done very well recently, where the current price is testing the branch of EMAs, where we are expecting to see a breakout, after which we will be looking for upward movement toward our first and second targets.

Swallowa Acaademy

Avalanche (AVAX): Waiting For Proper Breakout | 3 Step BreakAvalanche is slowly gaining some kind of bullish volume, where we are expecting to see smaller upward movement.

On bigger timeframes we are sitting just at the major neckline area so this is why we also considered the current zone to be a good bounce area, so let's wait for a proper breakout now.

Swallow Academy

Aave (AAVE): Aiming For $360-$400 Before Bigger Long SqueezeAave coin has had a good upward movement, and now we are inches away from a major resistance zone where we will be expecting to see some kind of big liquidity movement to lower zones.

RSI is overbought so we are already in dangerous zones, but we are pretty sure that before the big dump, we will reach the resistance zone so for now, this is our target area!

Swallow Academy

Chainlink (LINK): Looking For Target of 200EMA (Daily)Chainlink has done very well, and we have also opened one long position near the breakout area at $14. Now we are looking for the price to have a proper retest after what we expect to see some downward movement so eyes on the daily 200EMA line for now!

Swallow Academy

The Sandbox (SAND): Golden Buy Zone | Now or Never...Sand is one of the good long-term coins that caught our attention, where the price is at a local bottom...waiting for a proper breakout from EMAs, which would give us an easy 2.5x on the price.

There is not much to say but rather just wait patiently and enter at the right moment!. Very good R:R trade that we will not miss for sure!

Swallow Academy

Bitcoin SV (BSV): Possible Bounce Are | Eyes on 200EMABSV has filled the huge FVG that was formed during the bullish candle that we formed on the 25th of April.

As price has now cooled itself down, we are expecting another rally toward the 200EMA, where once we see the proper buyside dominance near $35, we will be going for the long position here!

Swallow Academy

SOL/USDT 1H Chart – Technical Analysis BreakdownTrend Reversal Structure: Price broke out of a descending trendline after sweeping prior lows (liquidity grab), indicating a possible bullish reversal setup.

Point of Control (POC): Price is currently retesting the POC area (high-volume node), aligning with the trendline and prior support — a potential bounce zone.

RSI Divergence: Bullish RSI divergence marked near the sweep confirms the loss of bearish momentum, strengthening the case for upward continuation.

GBP/USD Short Bias – Bearish Fundamentals + Smart Money StructurThe macro environment continues to favor USD strength and GBP weakness, setting up a clean short scenario both fundamentally and technically.

Fundamentals First:

Bank of England is expected to cut rates in the coming months as inflation falls and growth slows. June CPI came in lower than expected, and consumer spending remains weak.

UK GDP growth is flatlining, and PMI data continues to signal contraction in services and manufacturing.

IMF has warned the UK about fiscal imbalances and productivity issues, adding bearish pressure to GBP outlook.

Meanwhile, the Fed remains on hold, with strong U.S. labor data, robust consumer spending, and persistent core inflation — supporting the USD.

Institutional Outlook:

JPMorgan and Citi see GBP/USD downside risks as BoE policy shifts from restrictive to accommodative.

ING and BofA have noted bearish positioning building in GBP against the USD.

Technical Setup:

On the 4H chart, we’re watching a clean Head & Shoulders structure

A break and retest of the neckline confirms downside continuation.

Setup is backed by:

Institutional sentiment

Macro data divergence (UK vs U.S.)

Smart money structure + liquidity zones