WILL WE SEE AUDUSD BREAK THIS VITAL SUPPORT?Pair: AUDUSD

Timeframe: 4H, 1H

Analysis: Round number level, trend line, volume profile, support and resistance, descending triangle pattern

—————

Key Takeaway: Need a break of support, already seen a break of high volume level, we also need some strong bearish momentum

—————

Level needed: need a close by 0.68500

—————

Trade: Short

RISK:REWARD 1:7

SL: 21

TP: 146

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

Harmonictraders

USDJPY KEY LEVELS BREAK OUTPair: USDJPY

Timeframe: 4H, 1D

Analysis: Round number level, trend line, volume profile, support and resistance, pennant pattern

—————

Key Takeaway: Need a big push up with alot of bullish momentum as we have already broken key levels of resistance and using them now as support

—————

Level needed: need a close by 136.890(bullish)

—————

Trade: Long

RISK:REWARD 1:6

SL: 29

TP: 243

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

Possible Double Bottom, 22k StillPossible Double Bottom with good Buying.

Double Bottom pattern target is 1x above the neckline - this would be around 21,950-22k. The 0.886 fib X-D also meets here, which would create a potential bearish harmonic .

If this does happen, my profit target will be the 1.618 and 3.14 fibs - around 20k and 18.3k.

There is a descending triangle , but I won't be shorting here - I have a feeling it will break upwards.

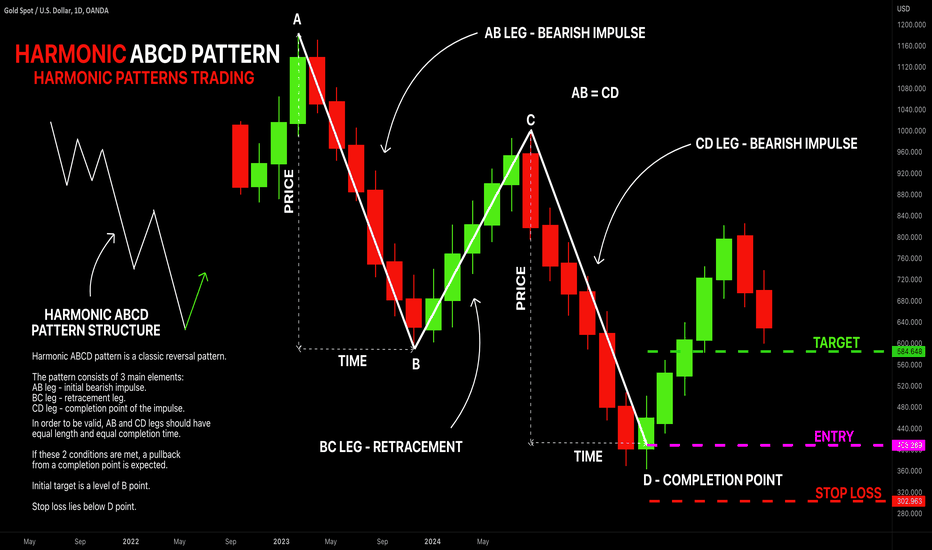

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

CADCHF BEARISH CONTINUATION TRADEPair: CADCHF

Timeframe: 4H

Analysis: Round number level, trend line, volume profile, support and resistance, descending triangle

—————

Key Takeaway: Need a break of support

—————

Level needed: need a close by 0.73760

—————

Trade: short

RISK:REWARD 1:6

SL: 13

TP: 79

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

EURCHF CONTINUATION TRADEPair: EURCHF

Timeframe: 4H

Analysis: Round number level, trend line, volume profile, support and resistance, descending triangle, Fib retracement

—————

Key Takeaway: Seen bounce off support turned resistance and fib 0.5 level

—————

Level needed: need a close by 0.96750

—————

Trade: short

RISK:REWARD 1:8

SL: 19

TP: 144

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

CHFJPY VITAL BREAKOUT BUT WHICH WAY?Pair: CHFJPY

Timeframe: 4H

Analysis: Round number level, trend line, volume profile, support and resistance, descending triangle, consolidation

—————

Key Takeaway: Need a break of support / break of resistance and trend line

—————

Level needed: need a close by 142.260(bullish) or 141.900(bearish)

—————

Trade: Neutral

RISK:REWARD —

SL: —

TP: —

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION

AUDUSD HUGE SUPPORT LEVELS BREAK OR BOUNCE?Pair: AUDUSD

Timeframe: 4H

Analysis: Round number level, trend line, volume profile, support and resistance, pennant pattern, ascending triangle

—————

Key Takeaway: Need to see a break of bottom pennant / support / high volume level / fib golden pocket

—————

Level needed: need a close by 0.69000

—————

Trade: Short

RISK:REWARD 1:13

SL: 20

TP: 250

—————

DO NOT ENTER OUR SETUPS WITHOUT CONFIRMATION