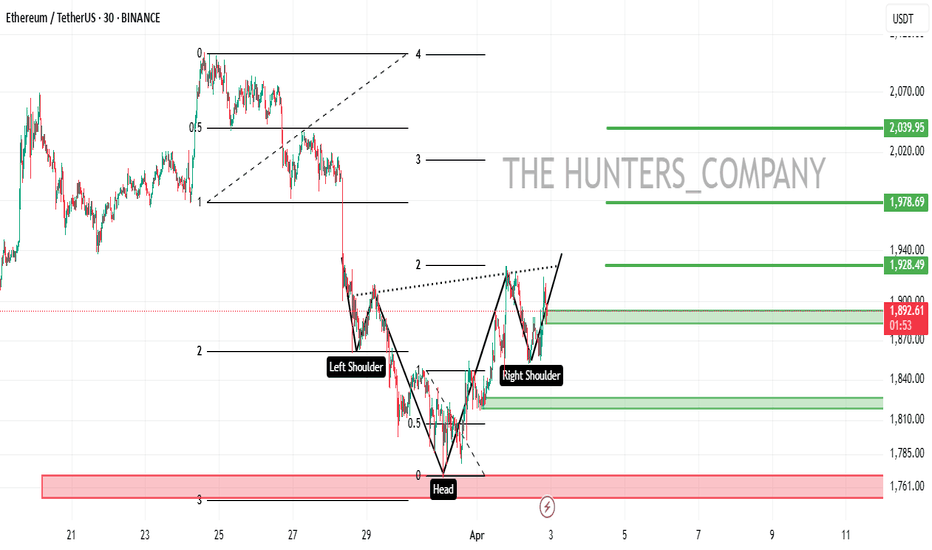

ETH/USDT:UPDATEHello dear friends

Given the price drop we had, a head and shoulders pattern has formed within the specified support range, indicating the entry of buyers.

Now, given the good support of buyers for the price, we can buy in steps with capital and risk management and move towards the specified targets.

*Trade safely with us*

Head and Shoulders

Trump Tariffs are Wrecking the MarketTrump’s disastrous right-wing policies continue to wreak havoc, with the latest victim being AMEX:XLC $XLC. His reckless tariff strategy is proving to be one of the greatest self-inflicted economic blunders in American history, harming industries, investors, and consumers alike. These tariffs have weakened the economy, disrupted markets, and imposed unnecessary burdens on businesses. The long-term consequences of these policies will be felt for years to come as the American economy struggles to recover from this avoidable crisis.

Head and shoulders top has been completed today, 4/3/25. The price objectives are 88.6 and 84.60

UPS looking DOWNSNice head and Shoulders on the United Parcel Service

#UPS and FEDEX are the new dow transport indicator.

An underlying determinant of how the consumer is faring

Since the US is a consumer economy and Online shopping is the majority of retail

if we see new highs on the Indicies, and the home delivery carriers continue to deteriorate

it would give your non confirmation Top

Similar to Dow theory of new High's in the Industrials , but the transports lagging and indeed falling.

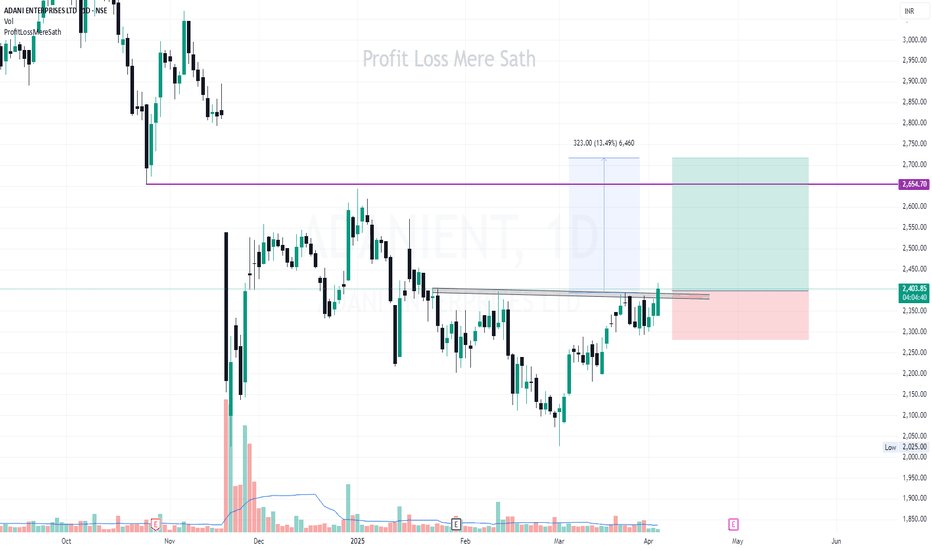

Adani Enterprises - Breakout in Progress?The stock has been consolidating below a resistance level for several weeks. Today, it has given a breakout above the trendline resistance with good volume. This breakout could trigger a potential uptrend.

🔹 Target & Resistance:

Target: ₹2,654.70 (+13.49%)

Resistance Level: ₹2,654.70 (marked in purple)

🔹 Volume Confirmation:

The breakout is supported by increasing volume, indicating strong buying interest. If the stock sustains above the breakout level, we might see a strong upward move.

🔹 Trading Plan:

✅ Entry: On breakout retest or sustained move above resistance

🎯 Target: ₹2,654.70

🛑 Stop Loss: Below breakout zone

📢 Conclusion:

A successful breakout and close above this level could confirm bullish momentum. However, traders should watch for retest and price action confirmation before entering.

GOLD: May fall below 3100So far, gold has continued to fluctuate in the 3110-3136 range. Although the candle chart has many long lower shadows, the high point is moving down. If this trend is not broken, the probability of falling below 3100 today is very high, so when trading, everyone must be cautious. Personally, I suggest selling as the main method.

Dow Jones Industrial Average (DJI) - Technical Analysis🧠 Dow Jones Industrial Average (DJI) - Technical Analysis

📅 Chart Date: April 2, 2025

🔍 Pattern Observations

Previous Uptrend (Left Section of Chart):

The chart shows a classic Head and Shoulders (H&S) pattern that formed after a strong uptrend.

Left Shoulder, Head, and Right Shoulder were clearly formed and confirmed.

The price reversed strongly after completing this H&S, indicating a bearish reversal.

Current Pattern Forming (Right Section of Chart):

A new H&S pattern is now forming, suggesting another potential bearish setup.

The Left Shoulder and Head are already in place.

The price is currently moving upward toward what may become the Right Shoulder.

Expected completion of Right Shoulder around the 40,000 level.

A trendline support from the prior lows aligns with this area, strengthening this level as a possible resistance zone.

📉 Bearish Breakdown Scenario (Pattern Confirmation)

If price reaches ~40,000, forms the Right Shoulder, and then starts to decline, the pattern will be complete.

A decisive breakdown below the neckline (drawn from the lows of Left Shoulder and Right Shoulder base) would confirm the bearish H&S pattern.

In that case, projected target zone would be calculated as:

Target=Neckline−(Head−Neckline)

Target=Neckline−(Head−Neckline)

Depending on exact neckline placement, target could be around 38,000 or lower.

🚫 Invalidation Scenario (Pattern Failure)

If price breaks above the Head region (~42,500 - 42,800), then the current H&S pattern gets nullified.

In this case, the structure becomes bullish again, potentially leading to new highs beyond 43,000+.

📌 Key Levels to Watch

Level Significance

42,500-42,800 Head Resistance / Pattern Invalidation

40,000 Expected Right Shoulder Peak

38,000 H&S Breakdown Target

41,000 Interim Support

39,500 Neckline (approx.)

⚠️ Risk Factors

H&S is a reliable reversal pattern, but like all technical patterns, confirmation is key.

Right Shoulder is still under formation; premature trading before confirmation could lead to false signals.

Market sentiment, macroeconomic news (like inflation data, Fed announcements), or geopolitical events could override technical patterns.

✅ Conclusion

DJI has already completed one H&S pattern post-uptrend and saw a bearish reversal.

Now, it's potentially forming another H&S, and 40,000 is a key level for the Right Shoulder.

If the price rejects at 40,000 and breaks below neckline, bearish trend may resume, targeting 38,000 or lower.

If the price breaks above the Head (~42,800), the bearish structure is invalid, and we may see a bullish continuation.

📢 Disclaimer

This analysis is for educational and informational purposes only and does not constitute investment advice. Trading involves substantial risk and is not suitable for every investor. Please consult your financial advisor before making any investment decisions. The chart patterns discussed are based on historical price action and do not guarantee future performance.

NASDAQ INDEX (US100): Great Opportunity to Sell

NASDAQ Index formed a strong bearish pattern after a test of a key daily

resistance area.

I see a head & shoulders pattern on an hourly time frame

and a confirmed breakout of its horizontal neckline.

The index can continue decreasing.

Next support - 19240

❤️Please, support my work with like, thank you!❤️

MEW Looks Bullish (4H)From the point where we marked start on the chart, MEW appears to be forming a bullish QM.

As long as the green zone holds, it can move toward the targets.

A 4-hour candle closing below the invalidation level will invalidate this pattern.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

BTC.D Scenario 2: Potential USDT.D BreakdownBTC.D

In this scenario, if USDT.D fails to create a new high or even an equal high and starts melting down, it could indicate a bearish structure forming—specifically, a Head and Shoulders pattern. This pattern often signals a reversal, meaning USDT.D could continue dropping.

If this happens, it would likely lead to BTC dominance (BTC.D) rising, as capital flows out of stablecoins and into Bitcoin. This could fuel an upward movement for BTC, making it crucial to keep an eye on this development.

Stay prepared and plan accordingly. Hope this helps!

EURCAD - Inverse head and shoulder on a monthly timeframeJM-CAPITAL - My 2cents on EURCAD for the month of April 2025 - Still on the inverse Head and shoulder

After a 38.2% retracement from the previous month high, I see a continuing uptrend on EC to reach 1.595.

While doing some HH and HL, my entry will respect some QP and take profit as I see fit.

Managing your trades is the best option here and I am always trading with the trend.

Happy trading.

GBPJPY BULLISH OUTLOOK WITH DEFINED RISK *GBP/JPY Trade Opportunity: Bullish Outlook with Defined Risk*

A potential buying opportunity has emerged in the GBP/JPY currency pair, with a defined risk management strategy in place.

*Trade Setup:*

- *Buy*: 192

- *Take Profit (TP)*: 197

- *Stop Loss (SL)*: 190

This trade setup is based on a bullish outlook for the GBP/JPY pair, driven by both technical and fundamental factors.

*Fundamental Analysis:*

The British pound (GBP) has been gaining strength against the Japanese yen (JPY) due to:

1. *Interest Rate Divergence*: The Bank of England (BoE) has maintained a hawkish stance, while the Bank of Japan (BoJ) continues to pursue a dovish monetary policy. This divergence in interest rates has created an attractive carry trade opportunity.

2. *Economic Growth*: The UK economy has shown resilience despite Brexit uncertainties, while Japan's economic growth remains sluggish.

3. *Trade Tensions*: The ongoing trade tensions between the US and China have led to a decline in the value of the yen, making it an attractive currency to sell against the pound.

*Technical Analysis:*

From a technical perspective, the GBP/JPY pair has broken out of a consolidation range and is now trending upwards. The relative strength index (RSI) is below 70, indicating that the pair is not overbought yet.

*Risk Management:*

To manage risk, a stop loss has been set at 190, which is below the recent swing low. This will limit potential losses if the market moves against the position.

*Conclusion:*

The GBP/JPY trade setup offers a bullish opportunity with defined risk. The combination of interest rate divergence, economic growth, and trade tensions provides a solid fundamental basis for the trade.

Keep your best wishes to the Travis 👍

GBPJPY Sell idea/analysis On the 4-hour timeframe, we can see a downtrend forming by having a Lower high and a low that has been broken, and I can see a rejection off of the low that can be a confirmation for a downtrend to shape. The uptrend trendline is broken, and the downtrend trendline has been respected so far, so these are enough confirmations for me to take this trade.

EURCAD: Pullback Trade From Resistance 🇪🇺🇨🇦

EURCAD may drop from the strong daily resistance.

As a confirmation signal, I spotted a head and shoulders pattern

on that on an hourly time frame.

The price can fall at least to 1.552 support

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.