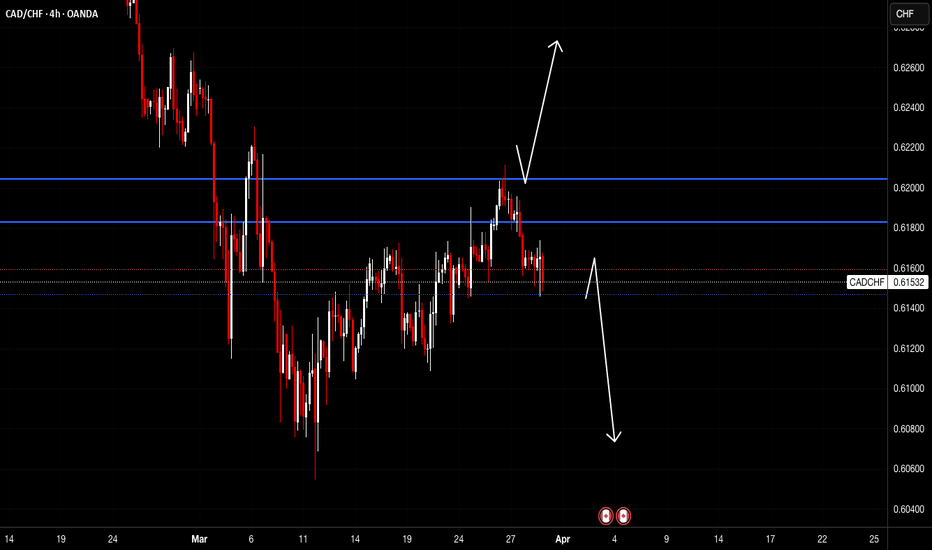

USDCHF Long off key level First publication after a very long time.

Just seen this inverted head and shoulders pattern forming with a key level being heavily respected as a key level of support.

I have seen that the last candle form on the daily chart was a bullish engulfing candle which has shown massive bullish pressure again and I will use this as my signal candle

I have my stop loss at the signal candle low wick with my target at a 1:3 reward but I am open to riding this out depending on how this idea goes ahead.

Best of luck on the charts !!!

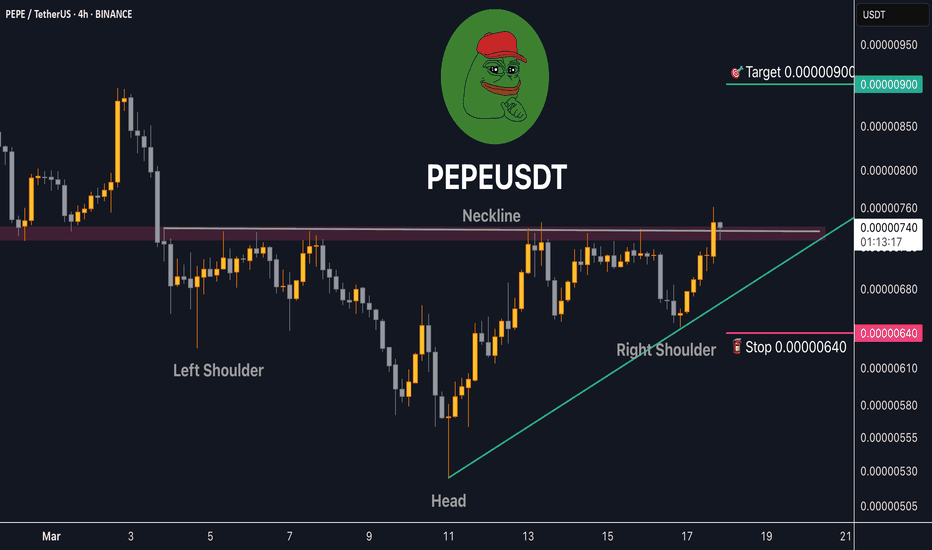

Head and Shoulders

MarketBreakdown | EURUSD, GBPUSD, USDJPY, AUDUSD

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURUSD daily time frame 🇪🇺🇺🇸

For the last 2 weeks, EURUSD shows a strong bearish momentum.

The price managed to break and close below a key daily support cluster.

A strong bearish reaction that followed after its retest confirms a strong

selling pressure.

I think that the pair has a potential to drop lower this week.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

In comparison to EURUSD, GBPUSD looks very stable.

The pair is consolidating within quite a wide range on a daily.

For now, probabilities are high that sideways movement will continue.

Consider trading the upper and lower boundary of the underlined channel.

Alternatively, a breakout of one of the underlined structures will give you a strong

bullish/breaish signal.

3️⃣ #USDJPY daily time frame 🇺🇸🇯🇵

Looks like the market is returning to a mid-term bearish trend.

The price is currently breaking a support line of a bearish flag pattern.

A daily candle close below its support will provide a strong bearish confirmation.

4️⃣ #AUDUSD daily time frame 🇦🇺🇺🇸

I see a completed head & shoulders pattern on a daily.

The price is currently breaking its neckline.

A daily candle close below that will provide a strong bearish confirmation

and suggest a highly probable bearish continuation.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Can we be optimistic that this will come true?( road to 300k )I might be wrong and this might never happen, but it might come true From a technical perspective!!!

Remmember

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

$BTC Death Cross Forming Inverse H & SAs expected, CRYPTOCAP:BTC is rolling over, hopefully to form that right shoulder for the inverse h & s patter to confirm the next leg up.

This dumped is fueled by the impending death cross, which historically marks big reversals, since the cross is already priced in.

HMR cup and handle pattern HMR stock is currently forming a promising cup and handle pattern, a bullish technical setup that signals potential for a significant upward move. This pattern, characterized by a rounded “cup” followed by a consolidating “handle,” suggests accumulation and growing momentum. With the stock approaching a breakout level around $4.79 a decisive move above this resistance could propel HMR toward a target of $8.15.

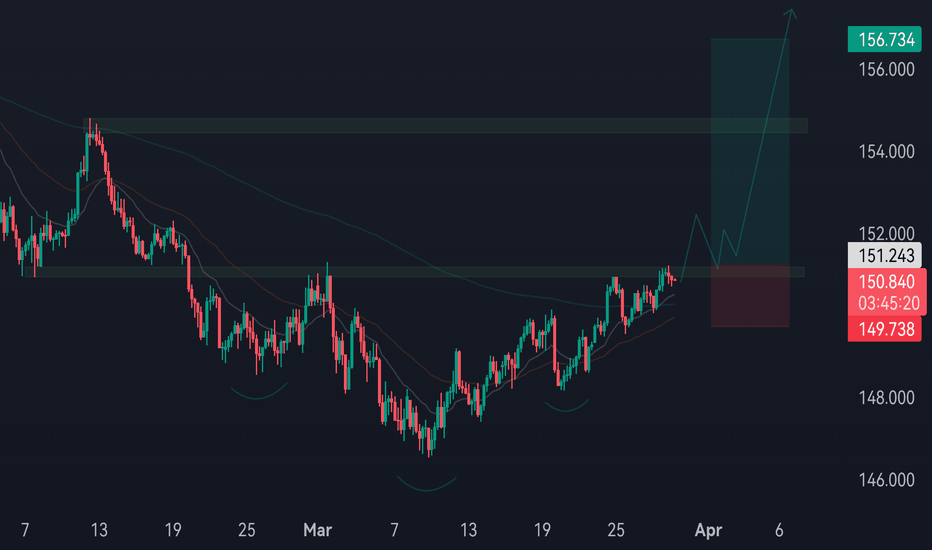

USDJPY has formed a head and shoulders bottom patternOn the 4-hour chart, USDJPY formed a head-and-shoulders bottom pattern and then stabilized upward, with a short-term bullish trend. Currently, the effective support below is around 149.5, and it is expected to continue to rise if it falls back and does not break. The upper resistance is around 152.3, and after breaking through, the upper resistance is around 154.5.

USDJPY Long BiasThe USDJPY pair on the 4H timeframe is forming a bullish structure, showing signs of continuation to the upside. The price is currently trading above key moving averages and consolidating near a resistance-turned-support zone, indicating potential bullish momentum.

Additionally, the formation resembles an inverse head and shoulders pattern, a strong bullish reversal signal. A successful break and retest of the 151.200 zone could confirm further upside movement, with the next key target around 156.700. However, failure to hold above the support zone may lead to a deeper retracement before resuming the uptrend.

Title: How to Spot Potential Price Reversals: Part 2A subject within technical analysis that many find difficult to apply to their day-to-day trading is the ability to spot reversals in price.

Yesterday we posted part 1 of this 2 part educational series, where we used GBPUSD as an example of how you could identify and trade a Head and Shoulders/Reversed Head and Shoulders pattern.

In today’s post we discuss a Double Top/Double Bottom, using a recent US 100 example.

Our intention is to help you understand why price activity is reversing and highlight how knowledge of this may be applied within your own individual trading strategies.

The Double Top Reversal:

The Double Top, is formed by 2 distinct price highs.

This pattern highlights the potential,

• reversal of a previous uptrend in price, into a phase of price weakness

• reversal of a previous downtrend in price into a more prolonged period of price strength.

In this example, we are going to talk about a bearish reversal in price called a Double Top.

Points to Note: A Double Top

• An uptrend in price must be in place for the pattern to form.

• A Double Top pattern is made up of 2 clear highs and one low, forming a letter ‘M’ shape on a price chart.

• This pattern reflects an inability of buyers to push price activity above a previous peak in price, potentially highlighting a negative shift in sentiment and sellers gaining the upper hand. This is regarded as a ‘weak test’ of a previous price failure high and leaves 2 price peaks at, or very close to each other.

• A horizontal trendline is drawn at the low between the 2 peaks, which highlights the neckline of the pattern. If this is broken on a closing basis, the pattern is completed, reflecting a negative sentiment shift and the potential of further price weakness.

Point to Note: To understand a bullish reversal, known as a ‘Double Bottom’ please simply follow the opposite analysis of what is highlighted above.

US 100 Example:

In the chart below, we look at the US 100 index and the formation of a Double Top pattern from earlier in 2025.

As with any bearish reversal in price, a clear uptrend and extended price advance must have been seen for the reversal pattern to be valid. On the chart above, this was reflected by the advance from the August 5th 2024 low up into the December 16th price high.

The Double Top pattern is made up of 2 price highs close or at the same level as each other, with a low trade in the middle, which forms a letter ‘M’ on the chart (see below).

In this example above, the highs are marked by 22142, the December 16th and 22226, the February 18th highs, with the 20477 level posted on January 13th represents the low traded in the middle, which helps to form the ‘M’.

The Neckline of the pattern is drawn using a horizontal line at the 20477 January 13th low, with the Double Top pattern completed on closes below this level. Potential then turns towards a more extended phase of price weakness to reverse the previous uptrend, even opening the possibility a new downtrend in price being formed.

Does the Double Top Pattern Suggest a Potential Price Objective?

Yes, it does. This can be done by measuring the height of the 2nd peak in price down to the Neckline level at that time, this distance is projected lower from the point the neckline was broken, suggesting a possible minimum objective for any future price decline.

In the example above, the 2nd high was at 22226, posted on February 18th 2025, with the Neckline at 20477, meaning the height of the pattern was 1749 (points). On February 27th the Neckline of the pattern was broken on a closing basis.

This means… 20477 – 1749 = 18728 as a minimum potential price objective for the Double Top pattern.

Of course, as with any technical pattern, completion is not a guarantee of a significant phase of price movement, with much still dependent on future sentiment and price trends.

Therefore, if initiating a trade based on a Double Top pattern, you must ALWAYS place a stop loss to protect against any unforeseen event or price movement.

This stop loss should initially be placed just above the level of the 2nd price high, as any break negates the pattern, meaning we were wrong to class the pattern as we did.

Hopefully, as prices fall after completion of the pattern, you can consider moving your stop loss lower, keeping it just above lower resistance levels to protect your position and lock in potential gains.

While both the Head and Shoulders and Double Top/Bottom patterns can take a prolonged period to form and we must be patient to wait for completion, they reflect important signals indicating potential changes in price sentiment and direction.

By understanding how and why these patterns form can offer an important insight to potential price activity that can help to support day to day decision making when deciding on trading strategies.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

TON Forms Inverse Head & Shoulders – Breakout Imminent?CRYPTOCAP:TON is forming a textbook Inverse Head & Shoulders pattern, a strong bullish reversal signal. The price is currently testing the neckline around the $3.90–$4.00 zone. A successful breakout and daily close above this level could confirm the pattern and trigger a move toward the $4.80–$5.20 resistance area.

Bullish Confirmation: Neckline breakout with volume.

Invalidation : close below 3.5

DYOR, NFA

How to Spot Potential Price Reversals - Part 1: GBPUSD ExampleA subject within technical analysis that many traders find difficult to apply to their day-to-day trading is the ability to spot reversals in price.

The misreading of price activity when a reversal is materialising can often lead to incorrect decisions, such as entering a trade too early, which can result in being stopped out of a potentially successful trade before price activity moves in the intended direction.

In this piece today, and part 2 tomorrow, we want to look at 2 types of reversal in price – the Head and Shoulders/Reversed Head and Shoulders and the Double Top/Double Bottom.

The intention is to help you understand why price activity is reversing and highlight how knowledge of this may be applied within your own individual trading strategies.

The Head and Shoulders Pattern

This pattern highlights the potential,

• reversal of a previous downtrend in price into a more prolonged period of upside strength

• reversal of a previous uptrend in price into a phase of weakness

In this example, we are going to outline in more detail a bullish reversal in price, which is called a ‘Reversed Head and Shoulders’.

Points to Note: Reversed Head and Shoulders

• A downtrend in price must have been in place.

• A Reversed Head and Shoulders is made up of 3 clear troughs on a price chart.

• The middle trough (called the Head) is lower than the 2 outer price troughs (called the

Left Hand Shoulder and the Right Hand Shoulder).

• The 3rd low in price (Right Hand Shoulder) being higher than the Head, reflects the

inability of sellers to be able to break under a previous low in price. This is regarded as a

‘weak test’ of a previous price extreme, suggesting buyers may be gaining the upper hand,

readying for a potential positive sentiment shift and price strength.

• A trendline connecting highs in price that mark the upper extremes of the Head is drawn.

This highlights the Neckline of the pattern, which if broken on a closing basis, completes

the reversal, to represent a positive shift in sentiment and the potential of further price strength.

Point to Note: To understand a bearish reversal, known as a ‘Head and Shoulders Top’ please simply follow the opposite analysis of what is highlighted above.

GBPUSD Example:

In the chart below, we look at the recent activity of GBPUSD, which formed a bullish Reversed Head and Shoulders Pattern between December 20th 2024 and February 13th 2025, when the pattern was completed.

As with any bullish reversal in price, a clear downtrend and extended price decline must have been seen previously, for the reversal pattern to be valid. On the chart above, this was reflected by the decline from the September 20th 2024 high at 1.3434, into the January 13th price low at 1.2100.

The Head and Shoulders pattern is made up of 3 troughs in price and in this example, these are marked by the period between December 30th 2024 to January 7th 2025 which forms the Left Hand Shoulder , between January 7th to February 5th 2025 which was the Head developing , and between February 5th to February 13th 2025, which then formed the Right Hand Shoulder .

The Neckline of the pattern is drawn connecting the December 30th 2024 high and the February 5th 2025 highs, which was broken on a closing basis on February 13th 2025. It was on this day, the Reversed Head and Shoulders Pattern was completed with potential then turning towards a more extended phase of price strength.

Does the Head and Shoulders offer an Insight into a Potential Price Objective?

Yes, it does, by measuring the height from the bottom of the Head to the level of the Neckline at the time that low was posted, we can project this distance higher from the point the neckline was broken. This suggests a possible minimum objective for any future price strength.

In the example above, a low of 1.2100 was registered on January 13th 2025, at which time the Neckline stood at 1.2576. This means the height of the Head was 0.0476 (476 pips). On February 13th when the Neckline was broken on a closing basis, the Neckline stood at 1.2529.

As such…

1.2529 + 0.0476 = 1.3005, which would be the minimum potential price objective for the Reversed Head and Shoulders. This level was in fact achieved on March 18th 2025.

Of course, while the Head and Shoulders pattern is regarded as one of the most reliable patterns within technical analysis, it is not a guarantee of a significant price movement, as much will still depend on future sentiment and price trends.

Therefore, if initiating a trade based on a Reversed Head and Shoulders pattern, you must ALWAYS place a stop loss to protect against any unforeseen event or price movement.

The stop loss should initially be placed just under the level of the Right Hand Shoulder, as any break of this point negates the pattern, meaning we were wrong to class the pattern as we did.

However, if prices rise after completion of the pattern, you can consider moving a stop loss higher, keeping it just under higher support levels to protect your position.

We highlighted the formation of the potential GBPUSD reversed Head and Shoulders pattern on February 13th 2025, so please take a look at our timeline for further details.

Remember to watch out for tomorrow’s Part 2 post

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

Shiba INU is repeating the history !!!!Trading patterns often tend to repeat themselves due to market psychology, investor behavior, and historical price movements. The current Shiba Inu chart appears to be mirroring past formations, reinforcing the cyclical nature of technical patterns.

Stage 1, a Falling Wedge, was completed , similar to previous corrections on September 24 before a breakout.

Stage 2, a Cup and Handle pattern, was confirmed , resembling earlier bullish continuation setups in August 2024.

Now, the market awaits, Stage 3, the formation of a W pattern , which historically signals strong upward momentum in September 2024.

Finally, Stage 4, an Inverted Head and Shoulders pattern expected, could mark a significant breakout, much like previous bullish reversals.

These recurring patterns highlight the importance of studying historical charts to anticipate future price movements.

USDCHF Head & Shoulders: 400+ Pip Drop or Fakeout?USDCHF is showing a 131-day head and shoulders pattern, pointing to a possible 434-pip drop if it breaks below 0.8753. Even partial moves offer solid risk-reward, with setups ranging from 3.2 to 5.1. But be cautious—there’s also a chance of a failed pattern with upside potential. Fundamentals could decide the real breakout direction.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

LOKAUSDT // head and shoulders formationAlthough there is a reverse head and shoulders formation on the chart, the targets are drawn according to Fibonacci.Let's look for closures above the blue line.

Gold’s Bearish Setup – What’s Next for $XAUUSD?Gold ( OANDA:XAUUSD ) fell to $3,003 as I expected in my previous post . Of course, since this is a round number , we can expect good support .

In terms of Classic Technical Analysis , Gold appears to have succeeded in breaking the neckline of the two patterns , the Head and Shoulders Pattern and the Three Falling Peaks Pattern .

Educational Note : The Three Falling Peaks is a bearish reversal pattern that occurs after an uptrend, where the price forms three consecutive lower peaks. Each peak represents a failed attempt to continue the uptrend, signaling weakening bullish momentum. A breakdown below the support confirms the pattern and signals a potential downtrend.

In terms of Elliott Wave theory , it seems that Gold has completed 5 impulsive waves and we should wait for corrective waves .

I expect Gold to attack the $3,000 at least once more after completing the pullback , and the next target could be the Support zone($2,989-$2,976) .

Note: If Gold goes above $3,039, we should expect more pumps.

Gold Analyze ( XAUUSD ), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bull Trap Confirmed: HOOD's 8% Rally Faces ExhaustionHey Traders after the success of our last month trade on Tesla hitting all targets more than 35%+

With a Similar Trade setup I bring you today the NASDAQ:HOOD

Short opportunity on Hood

Based on Technical + Fundamental View

-Market structure

-Head and shoulder pattern

-Currently will be trading at supply zone which was a recent support and now an ideal place for a reversal to create the right shoulder of the bigger head and shoulder pattern - Daily time frame.

1. Declining User Growth and Transaction-Based Revenue

2. Regulatory and Legal Challenges

3. Rising Costs and Profitability Pressures

4. Intense Industry Competition

5. Macroeconomic and Market Volatility

Technical View

Head and shoulder pattern - Pretty visible. Right shoulder is yet to be formed, Which makes an ideal place to SELL with a great Risk Reward ratio.

Pro Tip

Wait for a bearish candle stick pattern to execute trades on end of the day keeping stop loss somewhere above the supply zone.

Target 1 - 35.52$

Target 2 - 30.81$

Target 3 - 26.26$

Stop Loss - 44.72$

Fundamental View

1. Declining User Growth and Transaction-Based Revenue

Robinhood’s revenue model relies heavily on Payment for Order Flow (PFOF), which makes it vulnerable to fluctuations in trading activity. After a pandemic-driven surge in 2020–2021, user growth stalled, with monthly active users dropping 34% YoY to 14 million by mid-2022. Transaction revenue fell 55% in Q2 2022, and while assets under custody grew to $140 billion by Q2 2024, the platform’s dependence on volatile crypto and meme-stock trading amplified revenue instability.

2. Regulatory and Legal Challenges

The SEC’s scrutiny of PFOF and proposed trading rule changes threaten Robinhood’s core revenue source. In 2022, New York regulators fined Robinhood’s crypto unit $30 million for anti-money laundering violations. Ongoing legal risks, including backlash from the 2021 GameStop trading restrictions, have further eroded institutional trust.

3. Rising Costs and Profitability Pressures

Operating expenses surged due to aggressive marketing, technology upgrades, and compliance investments. Despite workforce reductions (23% layoffs in 2022), profitability remains strained. The company’s shift toward diversified products like retirement accounts and credit cards has yet to offset these costs.

4. Intense Industry Competition

Traditional brokers like Fidelity and Charles Schwab adopted zero-commission trading, neutralizing Robinhood’s initial edge. Newer platforms like Webull and Public.com also captured younger investors with advanced features, while Robinhood’s limited product range (e.g., lack of wealth management services) hindered retention of high-net-worth clients.

5. Macroeconomic and Market Volatility

- Interest Rate Sensitivity: As a growth stock, HOOD declined amid rising rates in 2022–2023 and broader tech-sector sell-offs.

- Recent Market Turmoil: On March 10, 2025, HOOD dropped 18% alongside crypto-linked stocks like Coinbase due to Bitcoin’s price volatility and fears of inflationary tariffs under new U.S. policies.

- Retail Investor Pullback: Reduced discretionary investing and crypto crashes (e.g., Bitcoin’s 71% plunge in 2022) dampened trading activity.

NOT AN INVESTMENT ADVISE