Boldly short gold, the bear has awakened!📌Bros, as mentioned in the previous article, Marvin invites you to grab a cup of coffee and quietly watch the dancing bears.

📍As I just said, if gold cannot break through the 3040-3050 area, it will build a head and shoulders structure in the short-term structure, and gold may accelerate downward to the 3020-3010 zone.

🔎Xauusd: @3040-3050 Sell

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

Head and Shoulders

Watch as the bears are about to dance!📍Bros, we must pay attention to the 3040-3050 area next. If gold cannot break through this area during the rebound, then the technical level may build a head and shoulders top structure, further stimulating the decline of gold. The market bullish factors for gold have all appeared. If there is no extra force to support the rise of gold, then the bears will fully wake up and may even go down to the 3020-3010 area.

📌So in terms of short-term trading, we can try to short gold in the 3040-3050 area.

🔎Xauusd:@3040-3050 Sell

📩Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

SILVER (#XAGUSD): Bearish Reversal ConfirmedSilver formed a classic head and shoulders pattern on the 4-hour chart.

Following the release of US fundamentals today, the price quickly dropped significant and broke below the pattern's neckline.

The price currently retesting the broken neckline, suggesting a potential continuation of the bearish reversal.

The next support levels to watch for are at 33.05.

MarketBreakdown | GOLD, GBPUSD, DOLLAR INDEX, EURAUD

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #GOLD XAUUSD 1H time frame 🥇

Earlier on Sunday, I shared a completed head & shoulders pattern on Gold.

Its neckline was respected and the price bounced from that, setting a new historic high.

That same neckline is now a perfect base for a new head & shoulders pattern.

The plan remains the same, if the price violates and closes below that

a correctional movement will be expected.

2️⃣ #GBPUSD daily time frame 🇬🇧🇺🇸

GBPUSD looks weak and shows a clear signs of a strong overbought state.

We see a breakout attempt of a rising parallel channel at the moment.

Daily candle close below that will trigger a correctional movement with a high probability.

3️⃣ DOLLAR INDEX #DXY daily time frame 💵

Dollar Index shows clear strength after 2 recent US fundamental releases.

The last obstacle for the bulls is the underlined blue resistance,

its breakout and a daily candle close above will trigger more growth.

4️⃣ #EURAUD daily time frame 🇪🇺🇦🇺

It feels like the pair is returning to a global bullish trend.

The price has recently retraced and perfectly respected the underlined support.

With a high probability, we will see a test of a current high soon.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

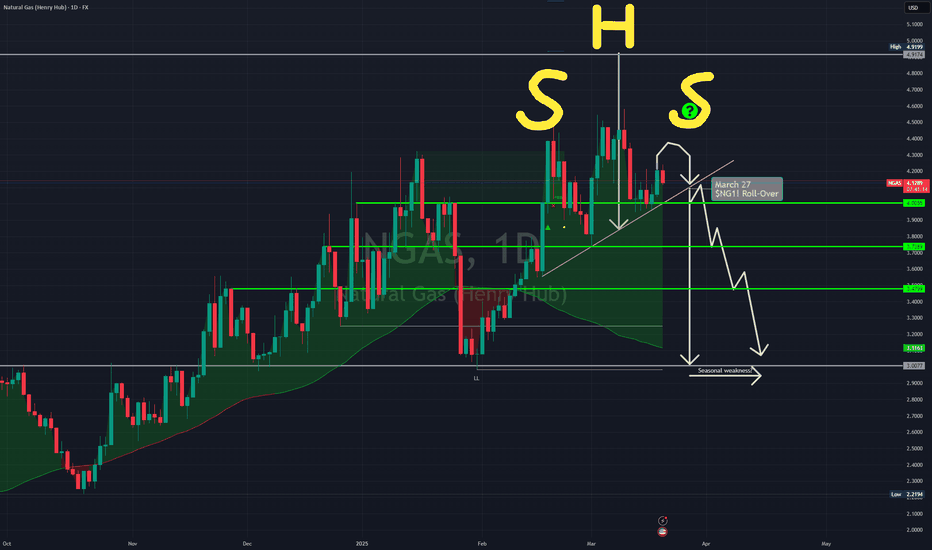

My Daily $NGAS / $NG1! Idea Because of Absent Seasonal WeaknessSeasonal weakness in FX:NGAS / NYMEX:NG1! is absent so far but it could come into play if war-related concerns are fading with Putin and Ukraine set under "friendly pressure" to end this war.

Still, the gap between ending heating period and beginning demand for cooling is big enough to see a seasonal weakness period, imo.

It's just an idea. As always, do your own research. You are solely responsible for your trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations

IKIO Lighting - Bullish Breakout!IKIO Lighting Ltd has given a strong breakout above the trendline resistance with a sharp move of +27.2% from recent lows. 🔥

Price has broken the downward trendline, signaling a potential reversal.

High volume on the breakout confirms strong buying interest. 📈

A successful retest of the trendline could provide a good buying opportunity.

If the momentum continues, price may rally towards ₹300+ in the coming sessions.

Disclaimer:

This is not financial advice. Please do your own research or consult with a financial advisor before making any investment decisions. Investments in stocks can be risky and may result in loss of capital.

BITCOIN (BTC/USD): Update & The Thing to WatchTake a look at the price movement of ⚠️BITCOIN, the market is consolidating around a significant daily support level.

Analyzing a 4-hour chart, I spotted a descending trend line and a potential inverted head and shoulders pattern.

The left shoulder and head have already formed, and the right shoulder is currently in progress.

The neckline for this pattern is between 83,600 and 84,488.

The trigger to buy BITCOIN will be its bullish breakout (4h candle close above), could signal a buying opportunity for BITCOIN with a target range of 88,000 to 90,000.

⚠️However, if the price drops to a new low, the pattern will no longer be valid.

GBPCAD: Bullish Price ActionThe 📈GBPCAD pair retested a horizontal structure that was previously broken on the 4-hour chart.

Following this retest, the price formed an inverse head and shoulders pattern and broke above a resistance line of a bullish flag pattern.

This suggests potential upward movement in the near future.

The next resistance level to watch is at 1.8692.

BEARISH MOVEMENTUSDCHF is on descending channel, an ascending channel is broken to the downside, which is now giving us pure bearish move. Also on daily timeframe i can see bearish head and shoulder pattern, which additional confirmation for my analysis. So i'm for a sell risking 1%. Lets see the see the outcome

XRPUSD breaking upward from invh&sTarget is $3. Very likely to hit the full target based on the bullish momentum from the sec ripple appeal being ofifcially dropped. Likely to continue upward from there as well but for this current idea I only wanna focus on the inv h&s target. *not financial advice*

Inverse Head & Shoulders in Play – Bitcoin’s Bullish Setup!!!Bitcoin ( BINANCE:BTCUSDT ) touched $84,500 as I expected in my previous post (even higher).

Right now it seems like Bitcoin has managed to break the Resistance zone($84,130_$81,500) and the 200_SMA(Daily) . The formation of the classic pattern , the Inverse Head and Shoulders Pattern , could be a sign that Bitcoin is preparing to break the Resistance zone($84,130_$81,500) .

Another Classic Pattern that we can see on the one-hour Bitcoin chart and hope for an increase in Bitcoin is the Fan Principle at the Bottom Pattern .

Educational tip : The Fan Principle at the Bottom is a bullish reversal pattern where the price forms a series of downward trendline breaks, signaling weakening bearish momentum. As each trendline is broken, buying pressure increases, leading to a potential uptrend.

According to Elliott Wave theory , with the resistance zone broken, we can expect Bitcoin to enter the next impulsive wave , which will likely continue to at least $86,300 .

Also, Today's U.S. economic data release could significantly impact financial markets, including Bitcoin :

UoM Consumer Sentiment : 57.9 (Forecast: 63.1 | Previous: 64.7) – A sharp decline, indicating consumer pessimism about the economy.

UoM Inflation Expectations : 4.9% (Previous: 4.3%) – A worrying increase, which could push the Fed toward a more hawkish stance.

Declining consumer sentiment may pressure the Fed to adopt a more accommodative stance, which is positive for risk assets like Bitcoin.

Rising inflation expectations could increase demand for inflation-hedge assets like Bitcoin.

However, if the Fed sees inflation rising as a concern, they may maintain a tighter policy, which could weigh on markets.

Today's data presents mixed signals, but falling consumer confidence and rising inflation expectations could ultimately fuel Bitcoin's next leg up.

Based on the above explanation , I expect Bitcoin to rise to at least the upper resistance zone($87,000_$85,820) after completing its pullback and complete the mission of filling the CME Gap($86,400_$85,595) . Of course, a CME Gap($80,760_$80,380) has also formed.

In your opinion, has Bitcoin finished its correction or created an opportunity for us to escape again?

Note: If Bitcoin falls below $81,300, we should expect further declines.

Note: If Bitcoin goes above $87,800, we should expect further increases.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

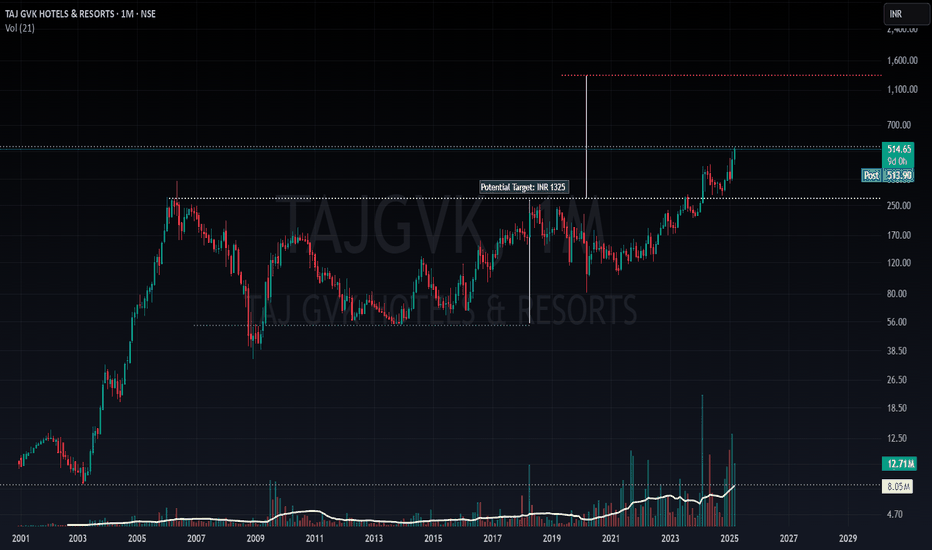

"Taj GVK Hotels & Resorts: Bullish Breakout with INR 1325 TargetTechnical Analysis

The chart shows a clear inverted Head and Shoulders / ascending triangle pattern. The breakout above the neckline confirms the pattern, suggesting a potential upward move. The target price of INR 1325 is derived by measuring the height from the head to the neckline and projecting it upwards from the breakout point. Additionally, the stock is trading above key moving averages, confirming bullish momentum.

Fundamental Analysis

Taj GVK Hotels & Resorts has demonstrated strong financial performance:

Revenue Growth: For H1 FY25, revenue grew by 10.8% YoY to ₹202.07 crore. EBITDA margins also improved, reflecting operational efficiency.

Profitability: PAT for Q2 FY25 rose by 76% YoY, indicating robust profitability.

Valuation Metrics: The stock is trading at a P/E ratio of 27.56, which is lower than the sector average of 85.06, suggesting relative undervaluation within its sector.

Expansion Plans: The company is constructing a new 253-room Taj hotel in Bengaluru, expected to open in FY26. This expansion could enhance revenue streams in the long term.

Cash Flow: Positive cash flow from operations (₹123.79 crore in FY24) indicates strong liquidity and financial health.

SWOT Analysis

Strengths:

Strong Brand and Market Position: Taj GVK benefits from its association with the Taj Group, a leading name in hospitality.

Consistent Financial Performance: Revenue and profit growth highlight operational efficiency and demand resilience.

Expansion Strategy: New projects like the Bengaluru hotel indicate forward-looking growth plans.

Weaknesses:

High Valuation Metrics: A P/B ratio of 5.41 and P/S ratio of 6.74 indicate that the stock is trading at a premium compared to intrinsic value.

Dividend Yield: At just 0.30%, the dividend yield is relatively low, which might not appeal to income-focused investors.

Opportunities:

Hospitality Sector Growth: The Indian hospitality industry is witnessing robust demand due to increasing tourism and business travel.

Upcoming Properties: The new hotel in Bengaluru could significantly boost revenues post-FY26.

Digital Transformation: Leveraging technology for better customer experiences can enhance brand loyalty.

Threats:

Economic Cycles: Hospitality demand is sensitive to economic downturns, which could impact revenue.

Competition: Intense competition from other luxury hotel chains may pressure margins.

Regulatory Risks: Changes in taxation or environmental regulations could increase costs.

Conclusion

The technical analysis suggests a bullish outlook with a target of INR 1325 based on the inverted Head and Shoulders pattern. Fundamentally, Taj GVK is well-positioned for growth due to its strong financials and expansion plans but faces valuation concerns and external threats like competition and economic cycles. Investors should weigh these factors before making decisions.

AUDUSD Head and Shoulders bottom pattern, BUY 0.6330On the daily chart, AUDUSD formed a head and shoulders bottom pattern, with short-term bulls in the lead. Currently, attention can be paid to the support around 0.6330. If it falls back and stabilizes, you can consider buying. The upward target is around 0.6440, and the upper target is around 0.6550.

Nemetschek SE Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Nemetschek SE Stock Quote

- Double Formation

* 105.00 EUR | Area Of Value | Completed Survey

* Wave (3)) Extended | Feature & Entry Area | Subdivision 1

- Triple Formation

* 1.618 & 0.5 Retracement Suggestion | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 110.00 EUR

* Entry At 119.00 EUR

* Take Profit At 133.00 EUR

* (Uptrend Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

USDCAD 4H Chart Analysis1. Market Structure

The chart shows a bearish market structure, where price has broken a key trendline support.

The price previously made higher highs and higher lows, but recently failed to continue upward and broke below the ascending trendline.

This confirms a potential trend reversal to the downside.

2. Key Levels

Broken Support Zone (~1.4350 - 1.4400): This level previously acted as support, but price has now dropped below it.

Current Resistance (~1.4300 - 1.4320): Price attempted a pullback to this zone, but it is now acting as resistance.

Target Zone (~1.4165 - 1.4180): Marked as a potential take-profit area for short positions.

3. Bearish Setup Confirmation

The chart shows a short position setup, with:

Entry near the pullback area (~1.4300)

Stop-loss above the resistance zone (~1.4350 - 1.4400)

Take-profit near 1.4165 (previous key support)

The trade setup suggests a Risk-to-Reward Ratio (RRR) > 2:1, making it a favorable setup.

4. Trading Strategy

If Price Retests Resistance (1.4300 - 1.4320) and Rejects → Short (Sell) Entry

If Price Breaks Above 1.4350 → Invalidates Bearish Setup

If Price Drops Below 1.4260 → Bearish Momentum Confirmed

5. Additional Confirmation Factors

EMA 50: Price is below the 50 EMA, which supports the bearish outlook.

Break of Trendline: Strong signal for downside continuation.

Conclusion

Primary Bias: Bearish

Entry Zone: Near 1.4300 - 1.4320 resistance

Stop Loss: Above 1.4350

Take Profit: Around 1.4165

Trade Confirmation: Look for rejection candles at resistance.

PIUSDT : Head & Shoulders Signals a Major Drop Incoming!Yello, Paradisers! PIUSDT is flashing strong bearish signals! The price has formed a Head & Shoulders pattern right on the resistance trendline of a descending channel—this combination significantly increases the probability of a sharp move to the downside.

💎PIUSDT breaks below the neckline and closed a candle which validates the bearish setup, increasing the likelihood of further downside.

💎However, We have to wait for the proper retest of the neckline, patience is key for the right entry.

💎On the flip side, if PIUSDT breaks above the resistance zone and closes candle above it, the bearish setup will be invalidated.

Stay disciplined and wait for confirmation, Paradisers. A fakeout could trap impatient traders—don’t be one of them! 🎖

MyCryptoParadise

iFeel the success 🌴

XAUUSD 15MINTS CHART PATTERN. NEXT MOVE POSSIBLE.This chart is a 15-minute Gold (XAU/USD) price analysis with a technical pattern projection.

Key Observations:

1. Support & Resistance:

A strong horizontal support level is marked at $3,000.14.

Price recently peaked near $3,016.13 and is showing signs of a potential reversal.

2. Price Structure & Pattern:

The blue lines indicate wave-like price movements, possibly an Elliott Wave or price action structure.

The pattern suggests that the market previously experienced a strong bullish impulse, but now a retracement is expected.

3. Projected Movement:

The downward arrows suggest a bearish correction towards $3,000.14, which could act as a key support zone.

If price respects this support, a potential bounce-back might occur. Otherwise, a breakdown could lead to further declines.

Possible Trading Plan:

Short Setup: If price starts rejecting resistance near $3,016 and forms bearish confirmation (e.g., candlestick patterns like engulfing or pin bars).

Buy Opportunity: If price reaches $3,000.14 and shows strong support confirmation (like a bullish engulfing or double bottom).

Would you like a more detailed trading plan based on this setup?