Top 5 Cryptocurrencies This Month: July 2025 Leading PerformersBy Forbes Contributor

Despite ongoing regulatory turbulence and macroeconomic uncertainty, July 2025 has proven to be a month of notable gains across the cryptocurrency market. A mix of established leaders and rising altcoins have outperformed expectations, driven by ecosystem developments, market sentiment, and broader digital asset adoption. Based on performance metrics, trading volumes, and real-world developments, here are the top five crypto gainers of the month.

1. Toncoin (TON)

+67% (Month-to-Date)

Toncoin surged on the back of growing Telegram ecosystem integrations. With more mini-apps and wallets going live on the platform, TON is rapidly becoming a medium of exchange for users worldwide. Its alignment with a major messaging platform provides Toncoin with unique network effects that most cryptocurrencies can’t match.

Key driver: Telegram’s global user base crossing 1 billion, bringing TON into daily utility.

2. Render (RNDR)

+58%

The rise of AI and decentralized GPU rendering continues to benefit the Render Network. RNDR gained momentum as AI developers increasingly rely on decentralized GPU resources to train and deploy models, particularly in gaming and VR applications.

Key driver: Strategic partnerships with gaming studios and AI startups boosted investor confidence.

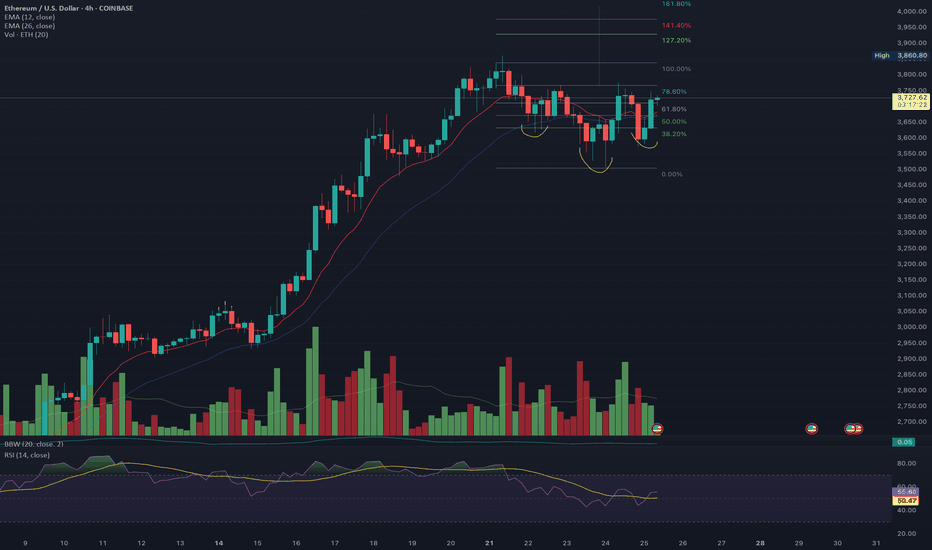

3. Ethereum (ETH)

+31%

Ethereum gained steadily following the approval of several ETH-based financial products in Europe and Asia. Additionally, increased staking activity and rollup adoption contributed to its bullish trajectory.

Key driver: Layer-2 activity and continued optimism surrounding Ethereum 2.0 upgrades.

4. Arbitrum (ARB)

+26%

Arbitrum benefited from significant ecosystem growth and DAO-funded initiatives. The implementation of new governance features and distribution of developer grants have brought more attention to the rollup-based network.

Key driver: Grant program rollout and cross-chain bridges attracting liquidity from competitors.

5. Worldcoin (WLD)

+24%

Despite controversy, Worldcoin’s biometric authentication project saw renewed adoption in emerging markets. With discussions around digital ID becoming central to Web3 identity, WLD attracted attention from institutional analysts.

Key driver: Integration into digital ID pilots in Latin America and Southeast Asia.

Final Thought

July's winners reflect a broader shift in investor preference: towards utility-driven, scalable projects. As we enter August, investors should monitor upcoming protocol upgrades, regulatory developments, and macroeconomic shifts — all of which could impact the next wave of top performers.

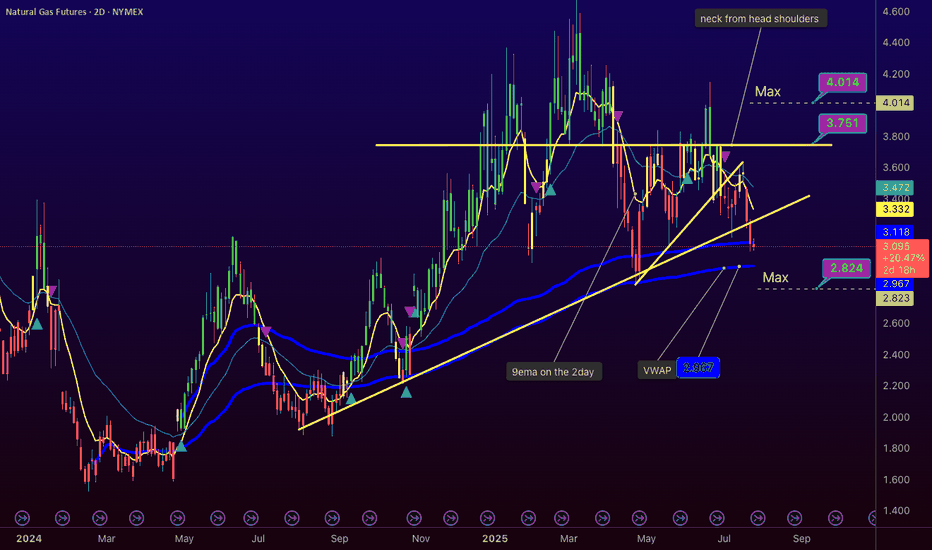

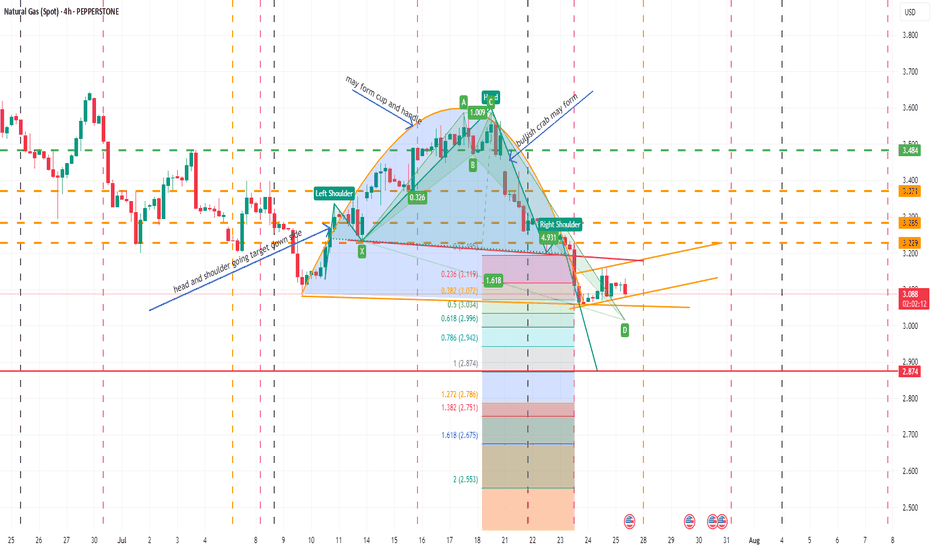

Head and Shoulders

NG1! Bearish Break to $3.00-$2.82 by Tuesday?www.tradingview.com NYMEX:NG1! Update - Bears Pushing, Turnaround Looms Short-Term Odds: ~60% pullback to $3.00-$2.99, ~40% chance to $2.82 - Key Signal: Low volume on 1000-tick chart, holding below VWAP ($3.134). Third test at $3.10 done—$3.00 next if support breaks. - Trend Hint: Bearish with high storage (3,075 Bcf). August heat (Dallas 104°F) looms but not flipping yet. Expect a potential dump Monday (July 28), turnaround Tuesday (July 29). lets see how it plays out - Enjoying these updates?

Good hunting! #NaturalGas #Trading #NG1

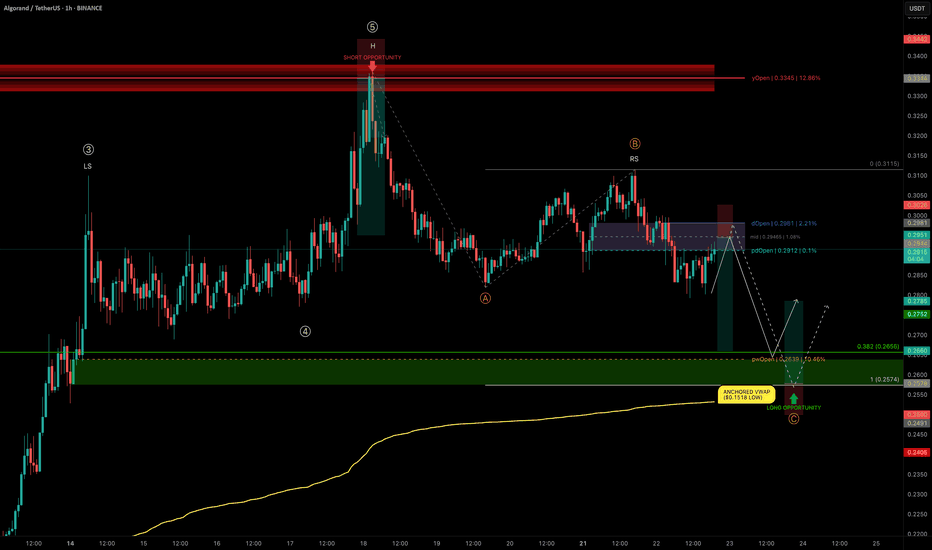

ALGO rejects at yOpen — Mapping High-Conviction Trade ZonesALGO has delivered an impressive +124% rally from $0.1518 to $0.336 in just 25 days, completing a 5-wave Elliott impulse right into the yearly open resistance.

We are now in a correction phase, and the current structure is showing a head and shoulders pattern, with the right shoulder currently forming.

Let’s break down the key levels and setups.

🧩 Technical Breakdown

➡️ ABC Corrective Structure:

Targeting wave C near the trend-based fib extension (TBFE) at $0.2574

➡️ Fib Retracement Confluence:

0.382 retracement of the entire 5-wave move → $0.2656

Previous weekly open (pwOpen) → $0.2639

Liquidity pocket likely to be swept

Anchored VWAP from the $0.1518 low (start of the bullish trend) → currently at $0.2532, acting as a major support layer

Conclusion: Long opportunity zone between $0.2656–$0.2574

Trade Setups

🔴 Short Setup:

Why? ALGO has lost dOpen and pdOpen — a bearish sign for downward continuation.

Entry Zone: Between dOpen and pdOpen

Stop-loss: Above dOpen

Target (TP): 0.382 fib retracement (~$0.2656)

R:R: ≈ 1:3.5

🟢 Long Setup:

Entry Zone: Laddered Entries between $0.2656–$0.2574

Stop-loss: Below anchored VWAP (~$0.2532)

Target (TP): ~$0.2785+

R:R: ≈ 1:2.65

🛠 Indicator Note

I’m using my own indicator called "DriftLine - Pivot Open Zones " for this analysis, which I recently published.

✅ Feel free to use it in your own analysis!

Just head over to my profile → “Scripts” tab → apply it directly to your charts.

💡 Educational Insight: Why Confluence Matters

High-probability trades aren’t based on just one tool or level — they come from confluence, where multiple signals align: fib levels, VWAP, liquidity pools, price structures , and key levels.

For example, in this ALGO setup, it’s not just the fib retracement or just the VWAP — it’s the stacking of all these elements together that creates a precise zone with a better statistical edge.

✍️ Lesson: Don’t chase trades off single signals; stack tools for confirmation.

Patience, confirmation, and confluence — as always, the keys to high-probability setups. 🚀

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

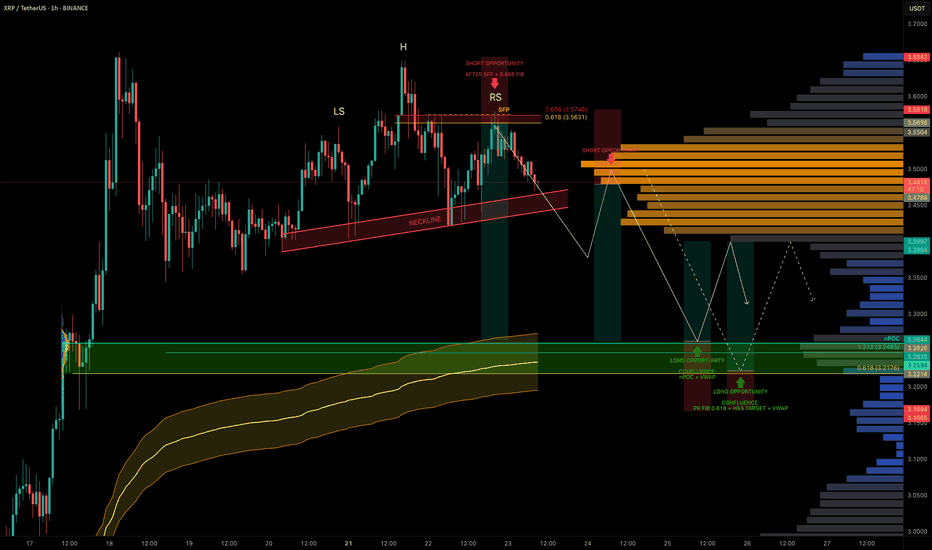

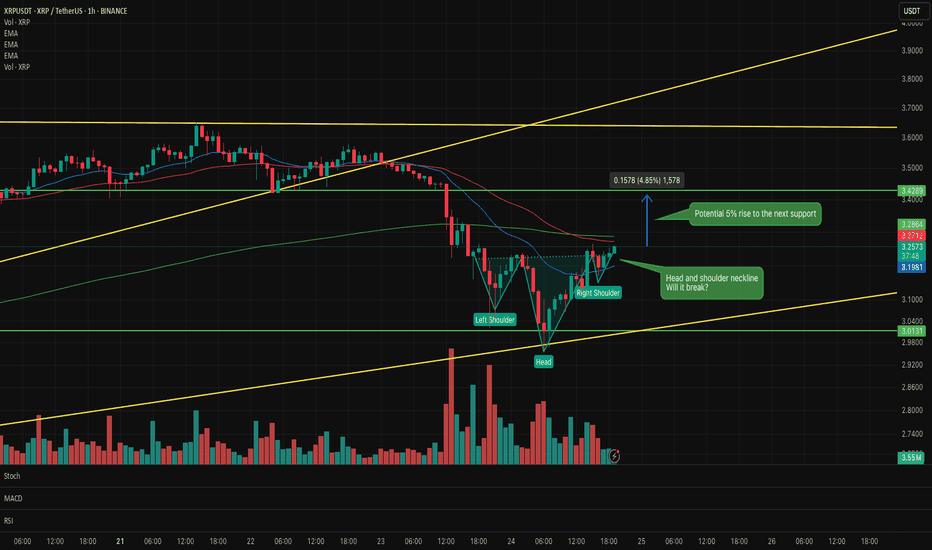

XRP Coiled in Range — Liquidity Below, Trade Setups AheadXRP has been stuck in a trading range around $3.50 for the past 5 days, offering multiple trade opportunities within the chop.

A notable short was triggered after a swing failure pattern (SFP) at the 0.666 fib retracement level near $3.563.

Now, with liquidity building to the downside, we’re watching closely for the next high-conviction setups.

🧩 Current Structure & Short Setup

🔴 Short Opportunity (Triggered):

SFP + 0.666 fib retracement at $3.563 led to rejection.

Market now shows a head & shoulders pattern forming.

Target: $3.2176 (0.618 fib retracement).

Trigger: Watch for a neckline break + retest for short confirmation.

Stop-loss: Above the right shoulder.

🟢 Long Setup:

Watching for a high-probability long around:

$3.26 → nPOC + 1.272 TBFE

$3.23 → anchored VWAP bands

This zone offers strong confluence and could act as the next launchpad.

Long Trade Plan:

Entry Zone: potential entries between $3.26–$3.22, price action needed for confirmation

Stop-loss: Below swing low at $3.1675

Target (TP): ~$3.40

✍️ Plan: Set alerts near the lows and react to price action at the zone — don’t front-run, let structure confirm.

💡 Pro Tip: Trade the Confluence, Not the Emotion

High-probability trades come from confluence, not guessing.

This setup combines nPOC, TBFE, VWAP, fib levels, and classical market structure (H&S) to map precise zones for both longs and shorts.

Let price come to you and wait for confirmation — especially in a rangebound environment where liquidity hunts are frequent.

Final Thoughts

We’re still rangebound, but liquidity is building below.

Keep an eye on the $3.26–$3.22 support zone for long entries and the H&S neckline for short breakdown confirmation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

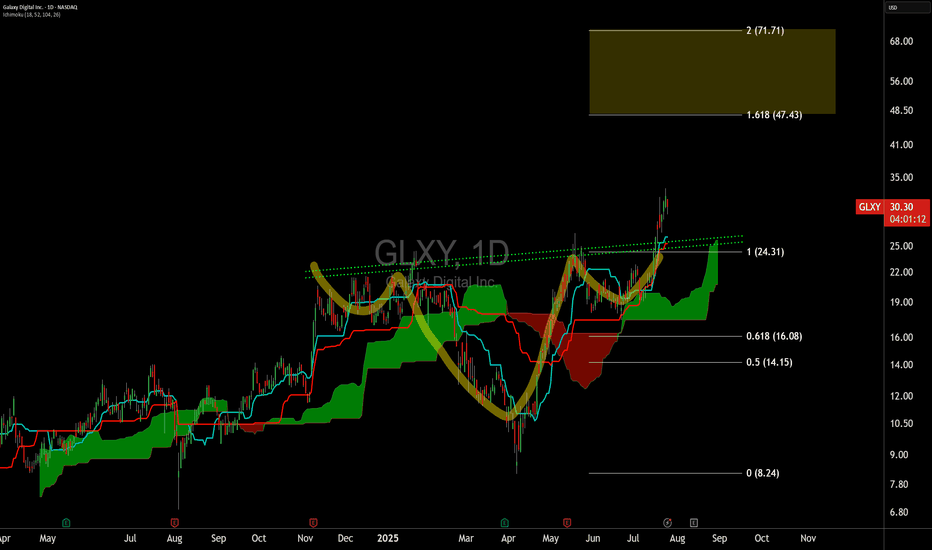

SG Approaching a Potential Trend ShiftPotential trend flip on the SweetGreen Chart for the first time since December 2024. I use a default doubled cloud on the daily timeframe 18/52/104/26. I find this to be superior to the default cloud on both backtesting and forward testing over the past decade on any chart.

Ideal bullish entry conditions occur on the cloud system when all four conditions are met:

Price above cloud

Bullish cloud

Bullish tenkan and kijun cross (TK)

Lagging span above price and above cloud (LS)

The doubled cloud settings are meant to decrease noise and increase signal, because of this I ignore the lagging span entirely and have never used the lagging span for entry criteria. We are approaching sufficient EARLY entry conditions was price enters the daily cloud.

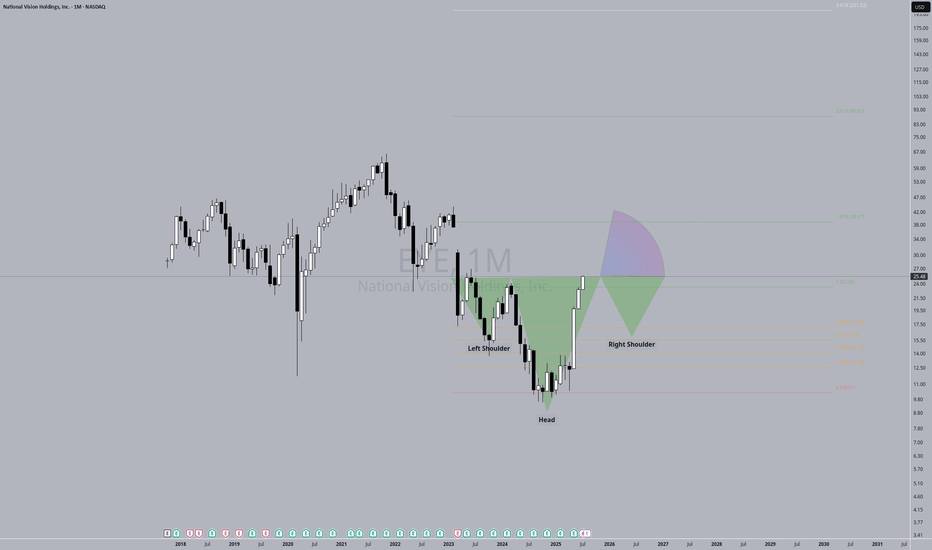

Additionally, SG has one of the cleanest active inverted head and shoulders patterns in the market at the moment.

The target zone is merely based on the 50% retracement of high to low of the multi-month down trend, see: Dow Theory. Additional upside can be seen if the trend remains intact. Trailing stop losses via Williams Fractals and keeping an eye out for bearish divergences are both key to position management for this strategy.

Stop loss considerations for this idea is a combination of price below cloud and new lower lows., in this case below 13. Be mindful of a poor earnings result on Aug 7th could easily trip this SL level.

NATURAL GAS SPOTMay form inverse cup and handle, bullish crab also about to form , after completing one head and shoulder pattern already posted earlier new head and shoulder going on. In daily and 4 hr chart below ichimoku cloud. In weekly within cloud. Moving averages showing weakness in daily and weekly, monthly candle also no bearish. May be in such scenario bullish crab pattern may fail but need to be careful as over sold territory. Let see how all works in future though so far all as per analysis. I am not SEBI registered analyst.

MARA: shoulders done, now walk toward the targetOn the daily chart, MARA completed a textbook inverse Head & Shoulders reversal with a clear breakout above the descending trendline. A corrective pullback followed, and the price is now heading into the key buy zone at 15.21–15.77 - aligning with the 0.72 and 0.79 Fibonacci retracements, and the upper boundary of the broken channel. This is the area to watch for a potential continuation of the bullish impulse.

Volume on the breakout was above average, confirming strong buyer interest. The EMAs are trending below the price, supporting the upward structure. The first target is located at 21.57 (previous resistance), with a potential extension to 28.77 (Fibonacci 1.618).

Fundamentally, MARA remains highly correlated with BTC and crypto sentiment. As interest returns to crypto-related assets due to ETF flows and possible Fed easing, mining stocks like MARA gain attention. Recent reports also show improved production efficiency and lowered costs - a tailwind for bulls.

Tactically, the best setup would be a confirmed reaction from the buy zone — whether a strong candlestick formation, volume surge, or reclaim of a key level. If that happens, aiming for 21.57 and 28.77 becomes a solid plan.

The pattern played out - now it's time for the market to walk the talk.

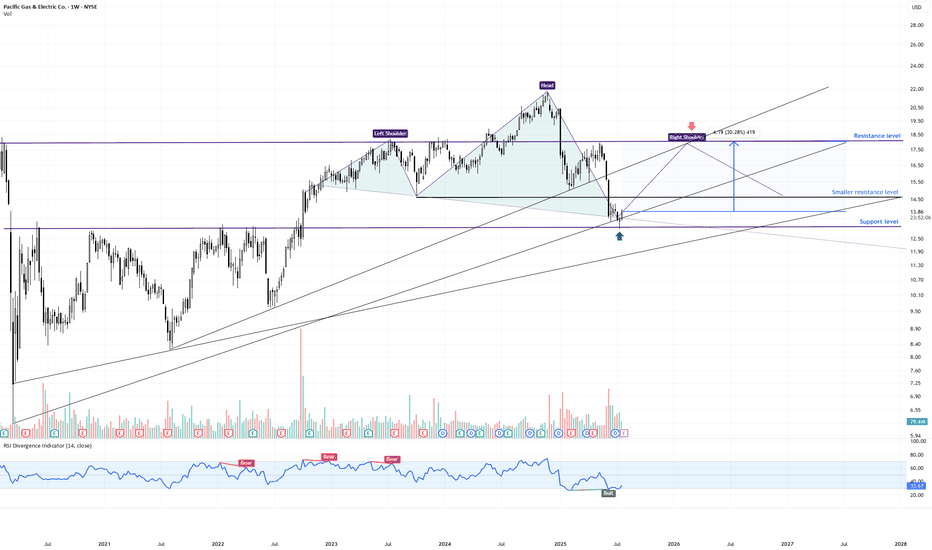

PCG Weekly Swing Trade | High-Probability Reversal Zone📍 Ticker: PCG (Pacific Gas & Electric Co.)

📆 Timeframe: 1W (Weekly)

💡 Pattern: Head & Shoulders Formation – Testing Neckline & Long-Term Support

📉 Price: $13.87 (current weekly level)

📊 Volume: 78M

📉 RSI: 33.7 → oversold zone brewing

🔍 What the Chart is Showing

PCG is in the late stages of a Head & Shoulders pattern, but the right shoulder is still developing. Price is now pressing into a critical confluence area where multiple factors intersect:

✅ Neckline zone from the potential H&S structure

✅ Multi-year ascending trendline support (2020 origin)

✅ Horizontal support cluster from 2022–2023 consolidation

✅ Weekly RSI hovering near oversold, hinting at possible bullish divergence

Importantly, the H&S is not yet confirmed – it would require a decisive weekly close below the neckline to trigger a textbook breakdown.

🧠 Swing Trade Scenarios

➡️ Bullish Reversal Scenario (Failed Breakdown)

🟢 Entry Zone: $13.60–$14.00

🎯 Target 1: $14.62 (initial resistance pivot) - close 30-70% of the position

🎯 Target 2: $17.80–$18.50 (major resistance) - close the another 30-70% of the position.

⛔️ Stop-Loss 1: Close below $13.20 (neckline break confirmation)

➡️ Bearish Breakdown Scenario (Pattern Confirmation)

❌ If PCG closes below $13.20 on the weekly, it confirms the H&S → opens downside toward $11.50 (the lowest trendline support)

⚠️ What Makes This Week Critical

📌 A hammer-like candle is forming – but needs a strong weekly close to indicate buyer absorption

📌 A close above $14.00 would weaken the H&S formation, hinting at a failed pattern

📌 A close below $13.20 would confirm the bearish continuation

This is a decision zone: either the right shoulder fails, triggering a deeper swing lower, or buyers defend and negate the pattern.

💬 Will PCG confirm the weekly H&S breakdown or trap bears with a failed pattern bounce?

✅ This week’s close will define the next major swing move!

LIKE & FOLLOW for more professional swing setups with clean risk/reward.

#PCG #SwingTrade #Utilities #TargetTraders #TechnicalAnalysis #HeadAndShoulders

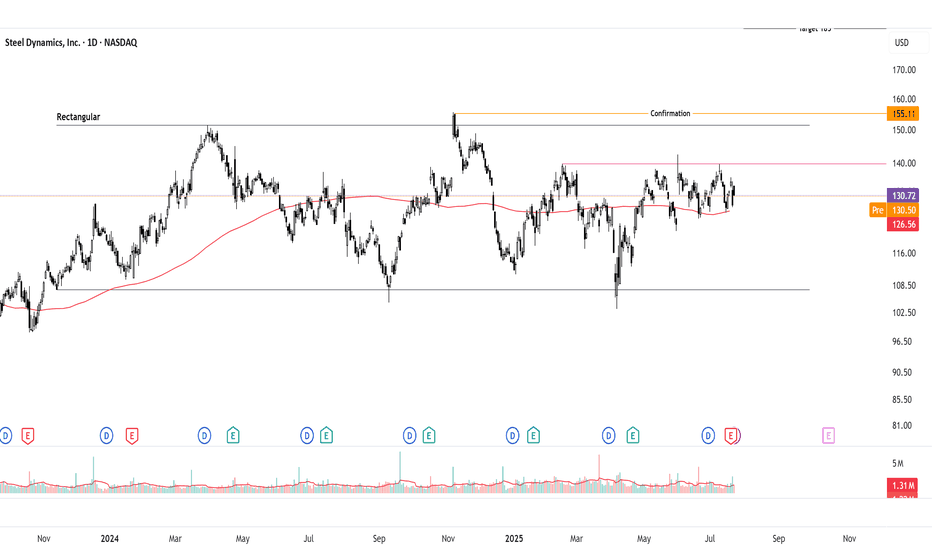

Bullish Breakout Watch on Inverted Head & ShouldersSteel Dynamics ( NASDAQ:STLD ) is consolidating on the daily chart but forming an inverted head and shoulders (IHS) pattern, signaling potential bullish reversal. Neutral until breakout above 140 pivot, but bias leans bullish with supportive steel fundamentals. Long idea on confirmation; current price ~132-135 (as of July 23, 2025). Upside targets offer strong risk-reward if triggered.

Thought Process Walkthrough:

Spotting the Setup: Scanned steel stocks amid sector rebound signals. STLD's daily chart shows a downtrend bottoming at 107, forming IHS: head at 107 support, shoulders higher, neckline ~140. Overlaid rectangular consolidation (107-151.5) adds confluence for breakout potential.

Technical Tools: Used trendlines (descending from highs, capping at 140-151.5), pivot points (140 key reaction level), and classic patterns. No indicators needed—price action clear: volume up on rallies, RSI neutral ~50. IHS target: measure 33-point head-to-neck, add to breakout → ~173 (adjusted to 185 for prior highs). Rectangular height ~44 points → 208 target.

Key Levels:

Support: 107 (IHS head, historical low—break invalidates bull case).

Resistance: 151.5 (rectangular top, past peaks—break above 155 confirms momentum).

These are significant due to repeated price reactions, providing high-probability zones.

Prediction: Consolidation now, but bullish breakout likely if 140 clears on volume, driven by pattern resolution and fundamentals. Without it, range-bound neutrality persists.

Fundamentals Supporting Thesis:

US steel outlook for 2025 shows moderate growth: CAGR ~2.4% through 2030, driven by automotive and construction demand. Economic moderation but robust drivers like infrastructure spending position the sector. For NASDAQ:STLD STLD, Q2 2025 EPS $2.01 missed estimates but operating income rose 39% despite challenges; revenue $4.57B, EBITDA $533M. Management eyes profitability acceleration into 2026 via efficiencies and demand While global capacity rises ~6.7%,US protections and STLD's strong balance sheet support upside.

BREAKING – US to Unveil Key Crypto Report: Crucial Moment for BiIn what could be a watershed moment for the digital asset industry, the U.S. government is expected to release a major crypto policy report in the coming days. Sources suggest the report will outline a framework for regulating digital assets, including Bitcoin, stablecoins, and DeFi—potentially defining how crypto will be governed in the world's largest economy.

Why This Report Matters Now

Amid rising political and economic pressure, the U.S. is being forced to take a firmer stance on crypto. With the 2024 elections behind and growing institutional participation, Washington is no longer able to delay key decisions.

Expected highlights of the report include:

Clarification on whether certain crypto assets are securities

Guidelines for stablecoin regulation

A potential roadmap for central bank digital currency (CBDC) development

Recommendations on DeFi and wallet service compliance

The report comes at a time when market volatility and fragmented oversight have led to investor uncertainty and inconsistent enforcement across states and agencies.

Possible Scenarios: Boom or Bust

Pro-Bitcoin Outlook

If the report favors clear rules, supports innovation, and endorses Bitcoin as a commodity (as the CFTC suggests), it could trigger a strong market rally. Institutional players sitting on the sidelines may finally enter.

Harsh Regulation

On the other hand, if the report leans toward heavy-handed enforcement—especially targeting self-custody, privacy, or DeFi—it could stifle innovation and lead to capital flight to offshore markets.

Neutral-but-Positive

A middle-ground report offering regulatory clarity without immediate enforcement could calm markets and lay the foundation for measured growth.

What’s at Stake for Bitcoin?

Bitcoin’s status in U.S. law remains technically undefined, though it’s generally viewed as a commodity. A clear statement reaffirming this status could fuel renewed institutional demand, ETF expansions, and deeper integration with traditional finance.

Conversely, if Bitcoin is lumped into broader regulatory restrictions, especially around AML or taxation, it could face new compliance burdens—dampening short-term momentum.

How the Market Is Reacting

Ahead of the report, Bitcoin has shown elevated volatility. Whales appear to be repositioning, with increased activity across derivatives markets and stablecoin inflows—indicating expectation of major movement.

Traders are watching key support at $56,000 and resistance near $60,000. A clear policy win could break this ceiling fast.

Conclusion

The upcoming U.S. crypto report could mark a historic regulatory pivot. For Bitcoin and the broader industry, the stakes are high: legitimacy, liquidity, and long-term growth—or repression and stagnation. One thing is certain—the days of regulatory limbo in the U.S. are numbered.

GRTHO - 3 months HEADS & SHOULDERS══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

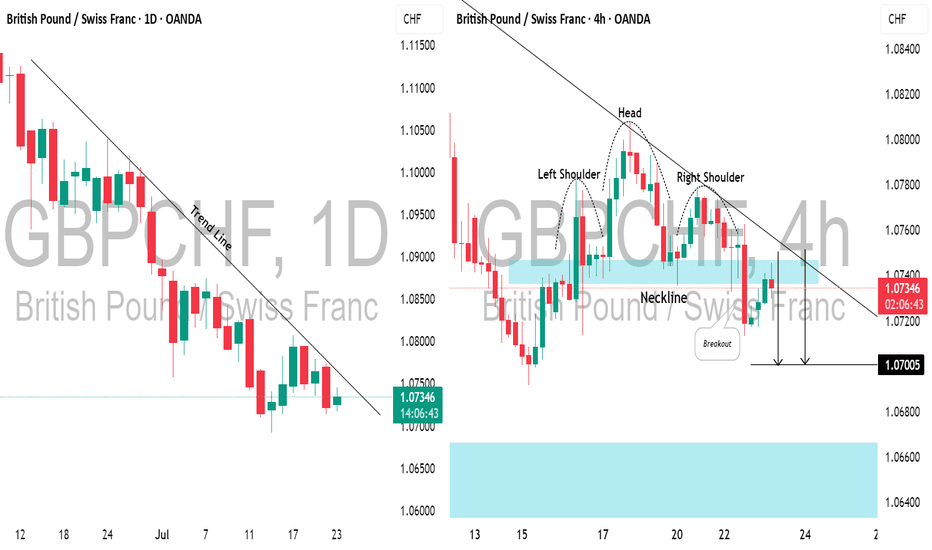

GBPCHF: Bearish Move From Trend LineI spotted a strong descending trend line on 📉GBPCHF, with the price rising to that last week on a daily.

As it tested this level, the pair formed an inverted head and shoulders pattern on a 4-hour time frame.

The neckline has recently been broken and retested.

I anticipate a bearish move towards the 1.0700 level now.