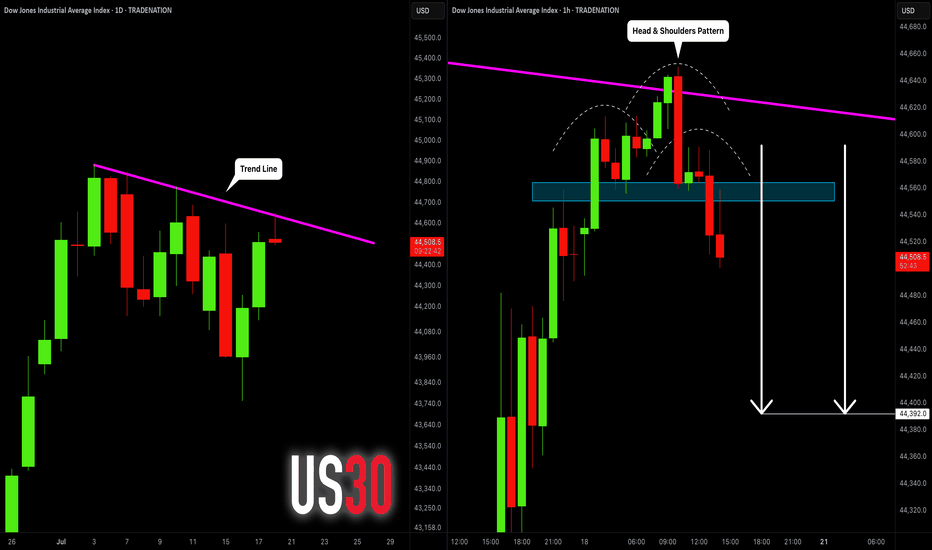

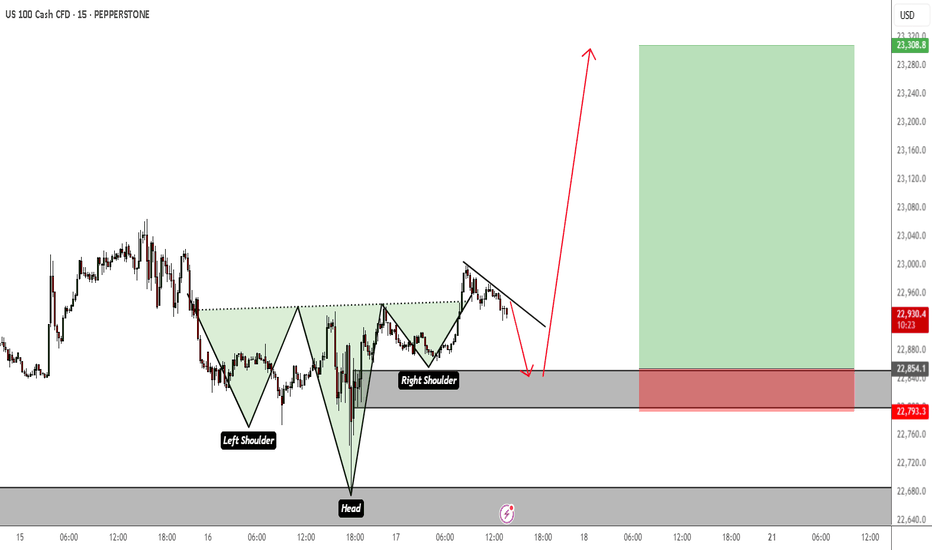

DOW JONES INDEX (US30): Bearish Move From Trend Line

I see a test of a strong trend line on US30.

The price formed a head & shoulders pattern on that

and a breakout of its neckline on an hourly time frame.

I expect a retracement to 48390

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Head and Shoulders

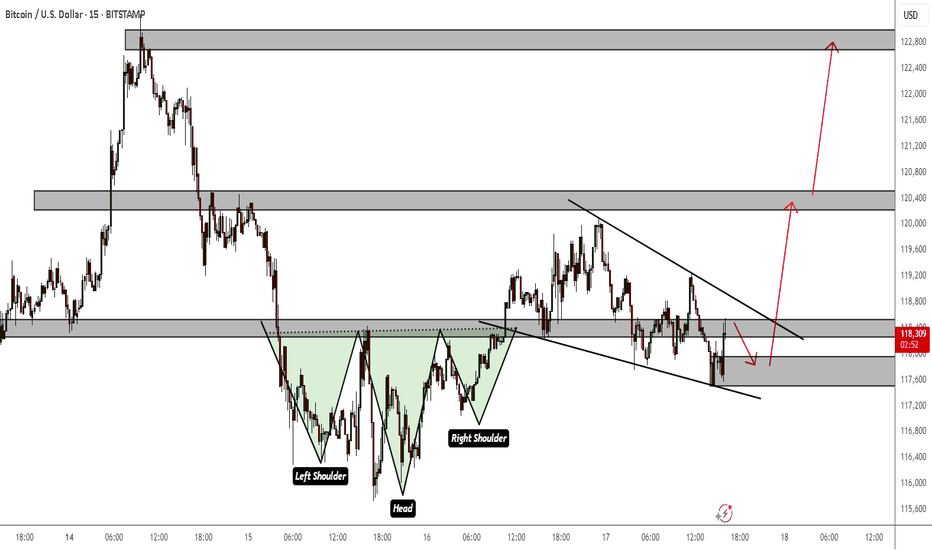

BTCUSD Bullish Continuation Patterns on LTFThe trend is still bullish and the daily bull flag I posted is still at play. This is just a lower TF perspective within the bigger overacharching view.

Inverse head and shoulders and a bullish flag all indicate continuation to the upside. You can use market structure to confirm your entries and your target profit zones if you do not plan on holding until $150k

ABT can potentially 4x in value reading up from the wedge its inThe smaller pink dotted measured move line is for the inv h&s pattern its formed inside the wedge with the top trendline of the wedge doubling as the invh&s pattern’s neckline. Hitting that smaller target is more or less a 2x from current price action. If we hit the full falling wedge target that’s a 4x from where it is currently. *not financial advice*

Total2 wants to inv h&s its way into completing its cup’s handleShould break above the neckline of this lemon lime colored inverse head and shoulder pattern in the upcoming 1-3 weekly candles here, and we are likely less than a week a way from the daily chart golden cross (not shown here). The breakout target from this inverse head and shoulder pattern will take price above the rimline of the larger cup and handle pattern and upon triggering the breakout from that we head to the light blue erasure move target which fro where price action currently is is about a 100% gain for the alt racket which should confirm alt season. *not financial advice*

The daily chart for total2 to look at the impending golden crossWanted to also post a daily chart tie frame of my previous idea. I first posted it in weekly to fit the entire cup and handle breakout target in the frame, but wanted to also post the daily time frame to provide both a close up of the inverse head and shoulders pattern as well as the impending golden cross on the daily time frame. Loos very likely that alt season may finally be approaching here. Gonna pay close attention to both this chart and the bitcoin dominance chart btc.d to know for sure. *not financial advice*

Btcusd breaking above cup and handle necklineIf it confirms the bullish breakout the target is 150k. Also by breaking above 116k and solidifying that level as strong support, we will trigger an even bigger inverse head and shoulders pattern (not shown here) with a breakout target around 208k! I will provide a link below to the chart I posted of that pattern. Thanks for reading, liking, and following. *not financial advice*

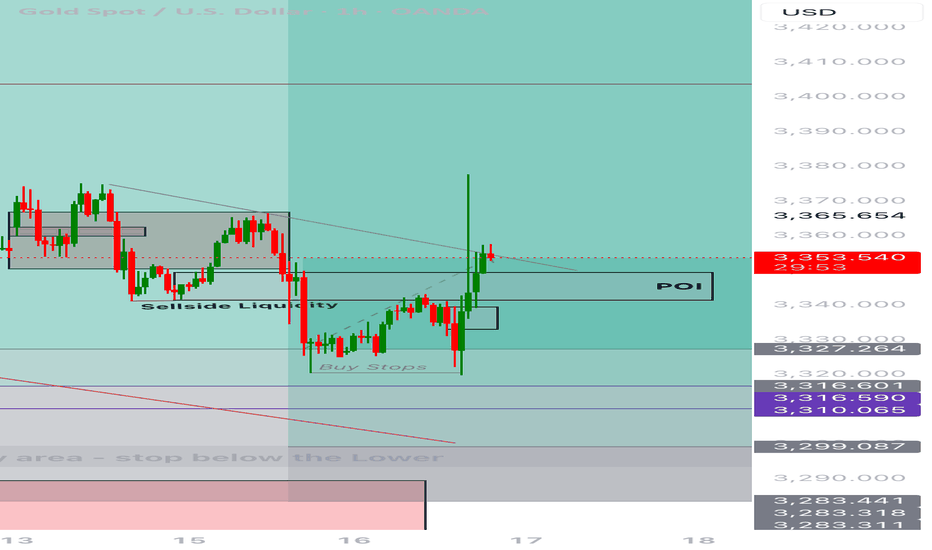

Current XAUUSD TradeDate: July 16, 2025

Platform: TradingView (Demo Account)

Timeframe: 15M (Entry), 4H (Bias/Context)

Direction: Long

Status: Entry zone identified, waiting for confirmation

Strategy Type: POI Re-entry after BOS (Break of Structure)

⸻

🔍 Market Context

• On the 4H, bullish BMS is confirmed after sweeping sell-side liquidity.

• Price has aggressively moved upward, showing intent to continue bullish.

• 15M structure now shows break of previous SND zone, shifting lower-timeframe flow to bullish.

• POI zone identified — price likely to return here for a mitigation tap before full continuation.

⸻

🧠 Trade Rationale

• POI marked as a mitigation zone for re-entry after BOS on 15M.

• Confirmation will be valid only after price closes above the wick (shows strength).

• Expecting return to POI to mitigate imbalance or unfilled orders.

⸻

📍 Entry Criteria

• POI zone: between ~3,327 and 3,316

• Watch for:

• Bullish SFP (swing failure pattern)

• Bullish engulfing candle

• 15M BOS + higher low confirmation inside POI

• Entry trigger: Price must close above the wick, then return to POI with bullish reaction

⸻

🧾 Management Plan

• Stop Loss: Below POI (~3,316 or slightly lower)

• Take Profit: 3,492 (upper 4H imbalance zone)

• Trail stop based on 15M structure if price accelerates

⸻

😌 Emotional Reflection

Comfortable identifying refined entry after HTF structure shift. No FOMO — POI must react cleanly and respect my conditions.

⸻

✅ Reflection Questions

• Did I wait for the proper 15M BOS before marking my POI?

• Did I define my confirmation model clearly?

• Will I enter only if the wick is closed above and POI is respected?

Western Carriers (WCIL) : Breakout Candidate#WCIL #patterntrading #breakout #breakoutstock #inverseheadandshoulder #swingtrading

WCIL : Swing Trade

>> Low PE Stock

>> Inverse Head & Shoulder pattern visible

>> Breakout & Retest Done

>> Ready for New Highs

>> Low Risk High Reward Trade

Swing Traders can lock profits at 10% & Keep Trailing

Pls Comment , Boost and Follow for more such Analysis

Disc : Charts shared are for Learning Purpose and not a Trade recommendation, Consult your Financial afvisor or a SEBI Registered Advisor before taking postion in it.

LTC Targets 400$ + 1900$ Litcoin LTC Targets for the next run are atm +290% is a realistic szenario. The addvanced targets at 1900$ are very impressiv but remember there are only 21 Mio. Coins too, like BTC because it is the fork and think about an alternative payment methode like btc, would be a reason for 1900$ pro LTC. So in Crypto is nothing unreal if you could imagine, but first of all approx. 400$ are a good direction. GM

SPORTKING INDIA LTD – Inverted Head & Shoulders Pattern

The weekly chart shows a classic **inverted head and shoulders** formation:

- 👈 **Left Shoulder**: Shallow trough

- 🔽 **Head**: Deep central low

- 👉 **Right Shoulder**: Higher trough mirroring the left

Price action around ₹132.48 suggests a potential **bullish reversal**, indicating that the prior downtrend may be bottoming out. A breakout above the neckline would typically confirm upward momentum—worth watching for volume confirmation and resistance levels.

Let me know if you’d like projected targets or neckline levels next!

Last resort buy’s concept ?Trade Journal Entry – XAUUSD (Gold Spot)

Date: July 15, 2025

Platform: TradingView (Demo Account)

Timeframe: 4H

Direction: Long

Status: Active trade under review / possible re-entry

Key Levels

- Sell-side liquidity tapped: ~3,340–3,345

- Support zone (mitigation block): ~3,316–3,310

- Last resort buy area: ~3,283

Market Context

Clear Break of Market Structure (BMS) confirming bullish bias.

Price swept recent sell-side liquidity above 3,360, failed to hold, and sharply pulled back.

Price is now entering a mitigation zone, sitting above the major buy-side liquidity zone and last resort demand.

Multiple liquidity layers marked below current price — good confluence for a reaction if structure holds.

Trade Rationale

Scenario A: If price respects ~3,316–3,310 zone and forms bullish engulfing/reversal, consider re-entry.

Scenario B: If price breaks deeper into 3,283 zone with SFP (swing failure pattern) or V-reversal, it's a last-chance long from premium demand.

Trade Plan

Watch for bullish reversal candle or lower timeframe BOS (M15) inside 3,316–3,310 zone.

If entered, SL below 3,283. TP remains at prior high ~3,492.

Manage risk carefully — only one more key demand zone below.

Emotional Reflection

Felt confident on initial entry, but market invalidated short-term structure. Now reassessing calmly — waiting for re-entry confirmation without chasing.

Reflection Questions

- Did I exit early enough once price showed failure to hold above 3,360?

- Will I maintain composure and wait for structure confirmation in the new zone?

- Is my risk sized properly for this secondary attempt?

Massive Head & Shoulders + Death Cross on Big 7A massive head and shoulders pattern is forming on the Big 7 tech stocks (AAPL, MSFT, NVDA, GOOGL, AMZN, META, TSLA). After a strong rally, a death cross (50 EMA crossing below 200 EMA) has appeared, pointing to possible weakness ahead.

Short-term concerns: right shoulder is forming now. If it holds, we could see a bounce. If the right shoulder fails, expect sharp drops and potential broader market reversals.

Long-term view: markets could still move higher over time, but short-term risks are rising. This setup resembles the 1999-2000 period before the dot-com crash. The AI bubble could be nearing its peak, with current leaders losing strength and new players stepping in.

Key to watch: neckline of the head and shoulders and how the market reacts to the death cross.

disclaimer: this is not financial advice. for informational purposes only. trading involves risk and past patterns do not predict future results. always do your own research and consult a licensed financial advisor before making decisions.

XAUUSD HEAD AND SHOULDER CHAAT PATTERN BEARISH ⏱ 4H Timeframe | Bearish Bias | Precision Setup

💡 Pattern Formed: Head & Shoulders

🔻 Market rejecting at right shoulder zone with bearish confirmation

---

🔽 Entry Level (Sell):

🟤 3,360 – 3,365 (Right shoulder rejection zone / supply area)

🛑 Stop-Loss (SL):

🔴 3,390 (Above the right shoulder + structure invalidation)

🎯 Take-Profit (TP):

🟢 3,210 – 3,200 (Measured move target + POI support zone)

📊 Risk:Reward Ratio:

✅ Approx. 1:4 — High probability setup

OndoBullish Reversal in Play – ONDO/USDT Weekly Chart

A clear Inverse Head and Shoulders pattern is forming on the weekly timeframe.

Price is currently breaking out of the neckline with strong momentum.

🔹 Left Shoulder: Formed with consistent volume support

🔹 Head: Deep correction followed by strong recovery

🔹 Right Shoulder: Higher low formation with bullish pressure

📈 Potential Target: $2.51 (+247%)

🛡️ Support Zone: ~$0.58

If this breakout confirms with weekly close above the neckline (~$0.90–$1.00),

we could be seeing the start of a major bull wave.

#ONDO #CryptoAnalysis #InverseHeadAndShoulders #Altseason #Breakout

End of trend with Head & Shoulders forming. On the monthly chart the pair has been ranging between 1.2 and 1.43 since 2016 with resistance established 2018. Currently on up leg of third cycle. Ignoring the Liz Truss blip.

Daily chart uptrend established Jan 25 and should continue up to resistance. However possible head & shoulders forming, which would indicate change of character, at most recent cycle but a good trade up to right shoulder still possible and then it will change to down trend to trend line

4H - Price at good quality demand with 4 basing candles. Ready for reversal and long to potential right shoulder at 1.355 or higher all the way to multiyear resistance.

COT Non-com and retail are increasing positions and commercials are reducing. Valuation is cheap.

Plan: waiting for US CPI data and confirmation of direction change and then long with stop at 1.33570 and TP at 1.355 to right shoulder. (I like these as worst that can happen, after up move is confirmed, is H&S doesnt form and it continues to upside increasing R:R). Followed by good short.

Let me know what you think

ANANT RAJ – Breakout From Rounded Base | ₹700+ Swing PossibleANANT RAJ has triggered a fresh breakout above the ₹580 zone – reclaiming its prior breakdown level from Feb 2025. This comes after a rounded base formation lasting 4+ months.

Breakout 1: June 2, on volume, cleared the March–May base

Breakout 2: Now taking out neckline of broader inverse H&S

Volume: Expanding again

RSI: Bullish, no divergence

Structure: Clean higher highs and lows post-Feb low

Measured Move Target: ₹700

Stop-Loss: ₹558

Fundamentals Support Swing Bias:

Low debt, strong solvency

Net profit margin ~21%

FY26 profit growth estimate ~32%

Valuation expensive (P/E ~46), but growth supports it short term

Not a long-term compounding candidate yet – monitor execution

Positioning:

Swing trade, not an investment. Ride momentum. Trail stops. No averaging up. Exit if ₹558 breaks on closing basis.

Disclaimer:

This analysis is for educational purposes only. It is not investment advice. Do your own due diligence. Trade at your own risk.

WIF/USDT: Dog back on track?WIF is building a "Cup And Handle" pattern alongside a (hopefully) last trendline, Trendline 1.

That breakout would lead back to the main keylevel, which is also the neckline of a H&S formation on a higher timeframe. To make it even more funny, that H&S is "the handle" of a even bigger cup n handle pattern on the next HTF.

So the break of trendline 1 might bring us to the keylevel, and that might start the H&S being "priced".

NZDUSD Pullback in Play – Head & Shoulders Signals More DownsideNZDUSD ( OANDA:NZDUSD ) is currently trading near the Resistance zone($0.612-$0.605) and has also managed to break the Support zone($0.604-$0.602) . We consider the Support zone as the neckline of the Head and Shoulders Pattern .

In terms of classic technical analysis , NZDUSD has managed to form a Head and Shoulders Pattern .

I expect NZDUSD to decline towards the Support zone($0.5968-$0.5946) after completing the pullback .

Note: Stop Loss(SL): $0.6062

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ U.S. Dollar Analyze (NZDUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.